Property Management Software Market Synopsis

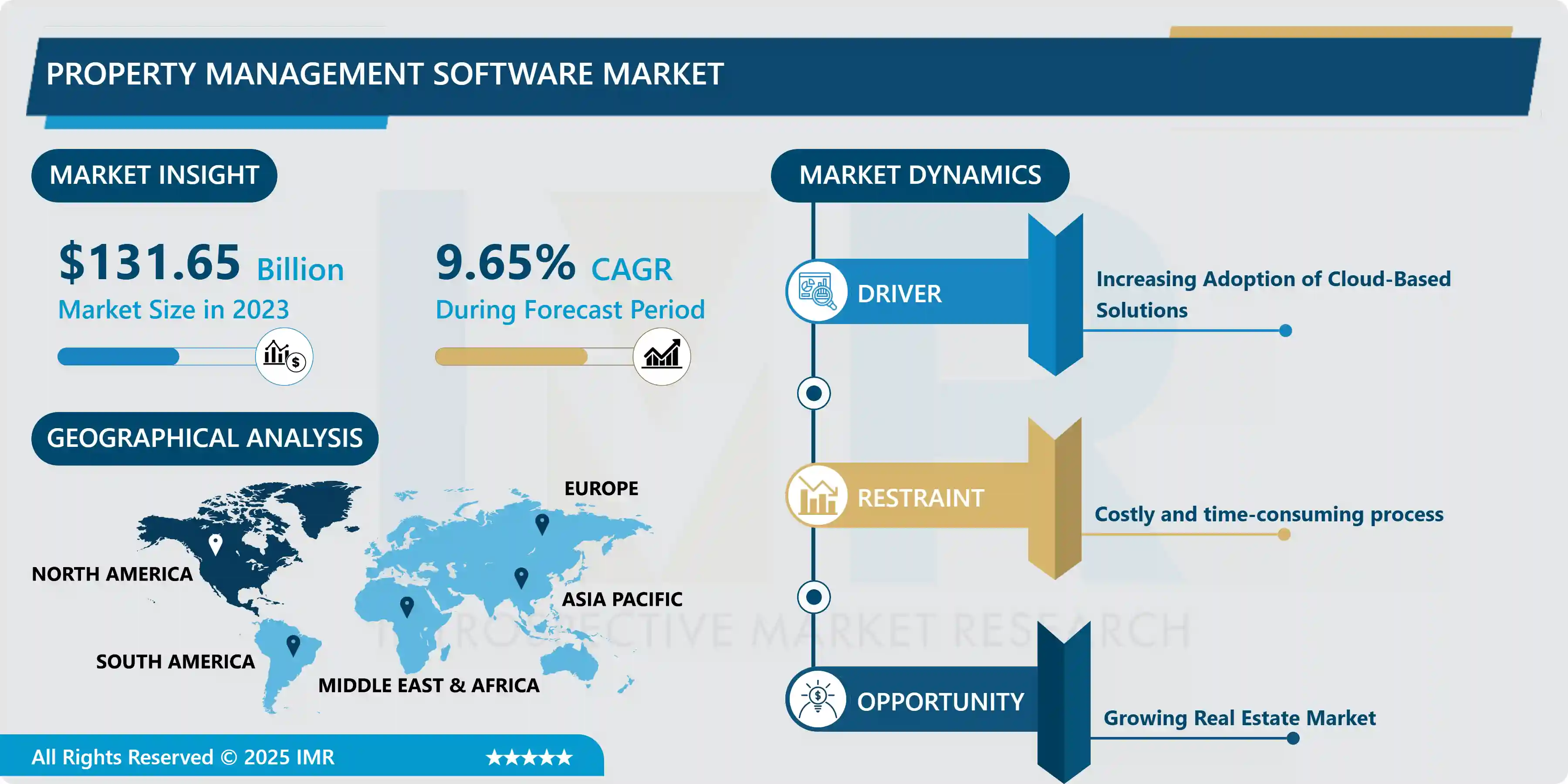

Property Management Software Market Size Was Valued at USD 131.65 Billion in 2023, and is Projected to Reach USD 301.65 Billion by 2032, Growing at a CAGR of 9.65% From 2024-2032.

The Property Management Software Market encompasses a range of digital solutions designed to aid in the efficient management of real estate properties, whether residential or commercial. These software systems offer functionalities like lease and tenancy management, accounting, maintenance scheduling, and tenant tracking, catering to various end-users such as property managers, owners, and housing associations.

The Property Management Software Market is a rapidly evolving sector that caters to the digital and operational needs of property management businesses and professionals. This market has gained significant traction due to the increasing demand for efficient management of real estate assets, both residential and commercial. Advancements in technology, property management software has become an indispensable tool, offering a range of functionalities from lease and tenancy management to financial accounting and reporting. This software aids in streamlining operations, enhancing tenant relations, and improving the financial performance of properties.

Property Management Software Market Trend Analysis

Increasing Adoption of Cloud-Based Solutions

- The increasing adoption of cloud-based solutions is a significant driver in the Global Property Management Software Market. Cloud-based property management software offers numerous advantages over traditional on-premises systems, such as scalability, accessibility, and cost-effectiveness. With cloud computing, property management companies can easily scale their operations up or down based on their current needs without significant upfront investments in IT infrastructure.

- This flexibility is particularly beneficial for managing fluctuating property portfolios. Additionally, cloud-based solutions allow for remote access to the software, enabling property managers and staff to access real-time data and perform their tasks from any location, which is especially valuable in today's increasingly mobile and remote working environments.

- The adoption of cloud-based property management software has been seeing a consistent upward trend, with more companies transitioning to these solutions each year. This growth is partly attributed to the lowering costs of cloud services and the increasing reliability and security offered by cloud providers. The trend is also driven by the growing awareness among property management firms of the benefits of cloud computing in terms of operational efficiency, data security, and competitive advantage.

Growing Real Estate Market

- The global real estate market has been witnessing robust growth, with forecasts projecting a continued upward trend. This expansion presents a significant opportunity for the property management software market. As more properties - residential, commercial, and industrial - come into existence, the demand for efficient property management increases. This surge in real estate activities necessitates advanced management solutions to handle complex tasks like tenant management, lease tracking, and financial operations.

- The integration of cutting-edge technologies like AI, IoT, and machine learning in property management software offers enhanced operational efficiency and data-driven decision-making. For instance, AI-driven analytics can predict maintenance needs and optimize energy usage, leading to cost savings. The increasing adoption of smart home technologies in residential properties and automation in commercial real estate also boosts the demand for sophisticated property management platforms.

Property Management Software Market Segment Analysis:

Property Management Software Market Segmented on the basis of Solution, application, and end-users.

By Type, Cloud property management software segment is expected to dominate the market during the forecast period

- The Cloud property management software segment is expected to dominate the market due to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions offer easy accessibility from any location, enabling property managers and owners to manage their properties remotely. This is particularly advantageous in today's mobile-centric world where real-time access to data is crucial. Furthermore, cloud solutions reduce the need for extensive hardware infrastructure and upfront investments, making them an attractive option for small and medium-sized enterprises (SMEs). The ability to pay as you go and scale services according to business needs also contributes to the popularity of cloud-based property management software.

- Software is the enhanced security and automatic software updates it offers. Data stored in cloud servers generally benefits from high-level encryption and robust security protocols, providing peace of mind for sensitive tenant and property data. Additionally, cloud-based software providers ensure that their systems are always up-to-date with the latest features and security measures, without requiring manual intervention from the users.

By End-User, Property Managers segment held the largest share of 37.8% in 2022

- The Property Managers segment holds the largest share in the Property Management Software Market, primarily due to the extensive responsibilities these professionals’ shoulder in managing multiple properties. Property managers often oversee a diverse portfolio of residential and commercial properties, requiring robust and multifaceted software solutions to efficiently handle tasks like lease administration, tenant communication, maintenance coordination, and financial management. The complexity and volume of these tasks make property management software an indispensable tool for them, driving high adoption rates.

- Property management software is vital for property managers in ensuring compliance with various regulatory requirements and industry standards. The software aids in maintaining accurate records, managing legal documents, and ensuring adherence to local property laws and regulations. Additionally, features like real-time reporting, performance analytics, and integrated accounting systems play a crucial role in financial management and decision-making.

Property Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to emerge as a dominant force in the property management software market, reflecting a robust and rapidly growing sector. The region's dominance is attributed to several key factors, including the increasing adoption of advanced technologies, a burgeoning real estate industry, and a growing awareness of the efficiency gains offered by property management software solutions.

- The United States and Canada, in particular, are witnessing a surge in demand for streamlined property management processes, driving the market's expansion. Property management software facilitates efficient management of tasks such as lease tracking, maintenance scheduling, and financial reporting, contributing to enhanced operational efficiency for real estate professionals.

- Moreover, the North American market benefits from a proactive approach to technology adoption and a well-established IT infrastructure, creating a conducive environment for the widespread implementation of property management software. The region's commitment to innovation and digital transformation further propels its leadership in the property management software domain. As businesses and property owners seek integrated solutions to optimize their operations, North America is poised to maintain its dominance in the property management software market, paving the way for sustained growth and technological advancements in the real estate sector.

Property Management Software Market Top Key Players:

- AppFolio (United States)

- CoreLogic (RESMan) (United States)

- Buildium (United States)

- Applaud (United States)

- RentCafe(United States)

- RealPage (AppFolio) (United States)

- Cozy.co (United States)

- Avail (United States)

- HouseCanary (United States)

- Jeeves (United States)

- Rentroll (United States)

- BuildQuick (United States)

- Property Solutions (United States)

- PropStream (United States)

- PropWay (United States)

- PropertyMinder (United States)

- Property Portals (United States)

- Cozy.co (United States)

- Rentroll (United States)

- BuildQuick (United States)

- Appway (United Kingdom)

- Propertybase (United Kingdom)

Key Industry Developments in the Property Management Software Market:

- In March 2023, AppFolio, a leading cloud-based property management platform, announced it has acquired Buildium, a provider of property management software for single- and multi-family rental properties. The acquisition will combine AppFolio's strengths in tenant experience, property operations, and finance with Buildium's expertise in compliance, reporting, and communication. The combined company will serve over 400,000 properties and 1.2 million units across North America.

- In April 2023, RentCafe, a leading real estate platform, has launched a new property management app that allows property managers to streamline their day-to-day operations. The app includes features such as tenant communication, maintenance management, and rent collection. RentCafe is targeting the growing market of smaller property managers who are looking for more affordable and user-friendly property management software solutions.

|

Property Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 131.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.65 % |

Market Size in 2032: |

USD 301.65 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Property Management Software Market by Solution (2018-2032)

4.1 Property Management Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 On-Premise Property Management Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cloud Property Management Software

Chapter 5: Property Management Software Market by Application (2018-2032)

5.1 Property Management Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Commercial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

Chapter 6: Property Management Software Market by End-User (2018-2032)

6.1 Property Management Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Property Managers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Property Owners

6.5 Housing Associations

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Property Management Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CASPER SLEEP INC (NEW YORK

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 UNITED STATES)

7.4 CORSICANA BEDDING INC (DALLAS

7.5 UNITED STATES)

7.6 INNOCOR INC (RED BANK

7.7 UNITED STATES)

7.8 KING KOIL (WILLOWBROOK

7.9 UNITED STATES)

7.10 KINGSDOWN INC (MEBANE

7.11 UNITED STATES)

7.12 PARAMOUNT BED CO. LTD (TOKYO

7.13 JAPAN)

7.14 RELYON LIMITED (WELLINGTON

7.15 UNITED KINGDOM)

7.16 RESTONIC MATTRESS CORPORATION (BUFFALO

7.17 UNITED STATES)

7.18 SERTA SIMMONS BEDDING LLC (ATLANTA

7.19 UNITED STATES)

7.20 SILENTNIGHT GROUP LTD (PRESTON

7.21 UNITED KINGDOM)

7.22 SLEEP NUMBER CORPORATION (MINNEAPOLIS

7.23 UNITED STATES)

7.24 SPRING AIR INTERNATIONAL (WOBURN UNITED STATES)

7.25 TEMPUR SEALY INTERNATIONAL INC (LEXINGTON

7.26 UNITED STATES)

Chapter 8: Global Property Management Software Market By Region

8.1 Overview

8.2. North America Property Management Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Solution

8.2.4.1 On-Premise Property Management Software

8.2.4.2 Cloud Property Management Software

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Commercial

8.2.5.2 Residential

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Property Managers

8.2.6.2 Property Owners

8.2.6.3 Housing Associations

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Property Management Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Solution

8.3.4.1 On-Premise Property Management Software

8.3.4.2 Cloud Property Management Software

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Commercial

8.3.5.2 Residential

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Property Managers

8.3.6.2 Property Owners

8.3.6.3 Housing Associations

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Property Management Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Solution

8.4.4.1 On-Premise Property Management Software

8.4.4.2 Cloud Property Management Software

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Commercial

8.4.5.2 Residential

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Property Managers

8.4.6.2 Property Owners

8.4.6.3 Housing Associations

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Property Management Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Solution

8.5.4.1 On-Premise Property Management Software

8.5.4.2 Cloud Property Management Software

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Commercial

8.5.5.2 Residential

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Property Managers

8.5.6.2 Property Owners

8.5.6.3 Housing Associations

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Property Management Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Solution

8.6.4.1 On-Premise Property Management Software

8.6.4.2 Cloud Property Management Software

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Commercial

8.6.5.2 Residential

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Property Managers

8.6.6.2 Property Owners

8.6.6.3 Housing Associations

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Property Management Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Solution

8.7.4.1 On-Premise Property Management Software

8.7.4.2 Cloud Property Management Software

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Commercial

8.7.5.2 Residential

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Property Managers

8.7.6.2 Property Owners

8.7.6.3 Housing Associations

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Property Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 131.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.65 % |

Market Size in 2032: |

USD 301.65 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||