Proactive Service Market Synopsis

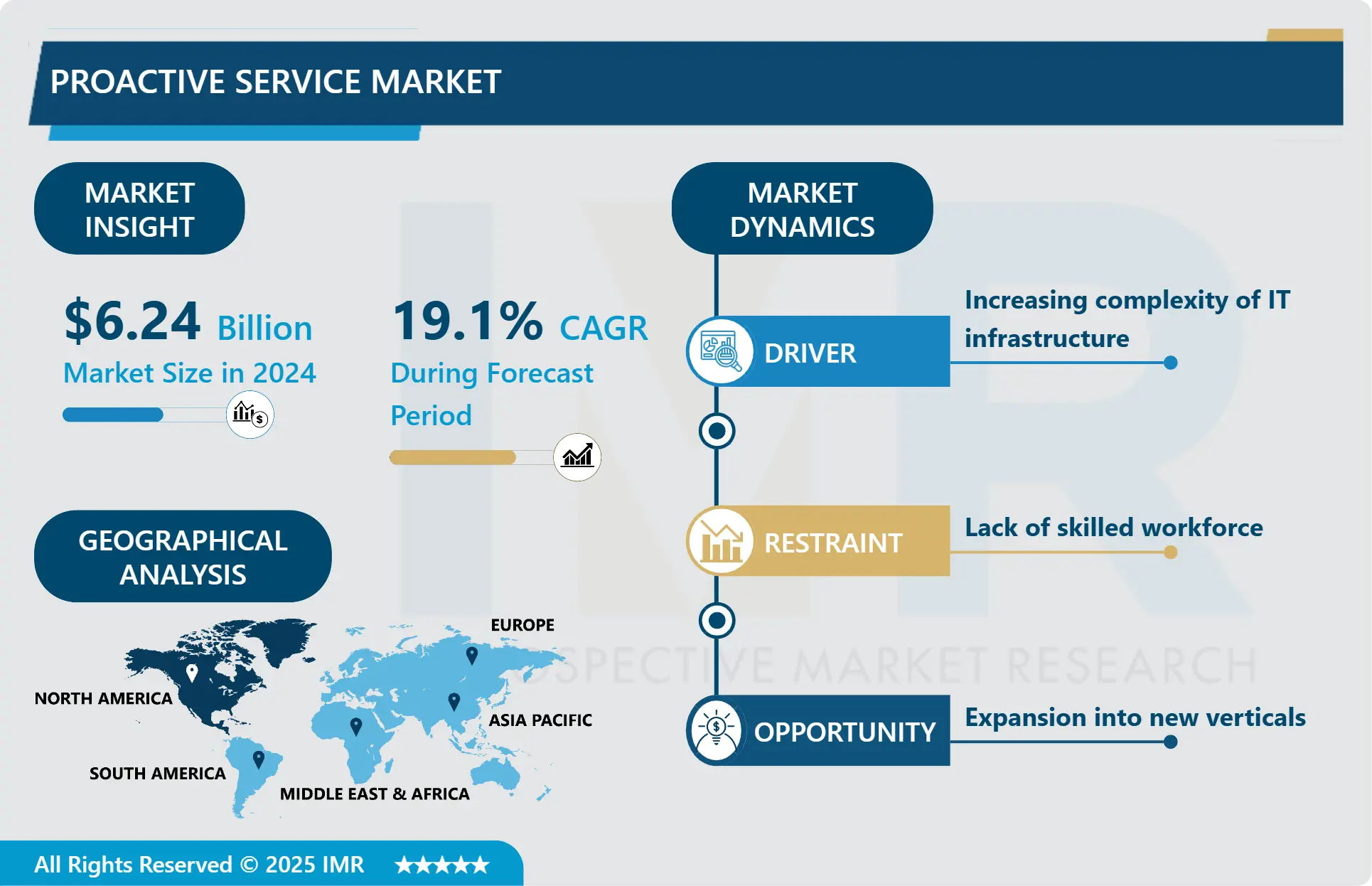

Proactive Service Market Size Was Valued at USD 6.24 Billion in 2024 and is Projected to Reach USD 25.27 Billion by 2032, Growing at a CAGR of 19.1 % From 2025-2032.

Preventive services comprise the measures that the business and other organizations take to deal with the future possibilities of threats opportunities, or needs of their customers. As opposed to the kinds of services that counter the issues that consumers might face and complain about, proactive services seek to prevent issues from arising and, accordingly, strive to improve customer satisfaction and optimize operations. This approach usually entails the use of technology, analysis of information, and business planning with the intent of preventing concerns.

Protective services are gradually becoming an unbeatable factor in the running and management of business organizations. Thus, being able to look into the future and consider good or bad what can happen will help prevent or enhance the buying process for the benefit of the customers. They also come in handy in conversational marketing used in business sectors that require high customer satisfaction standards; for instance, telecommunication, health, and financial sectors. For example, a telecommunications firm can employ big data analysis to know when a client is likely to encounter a service interruption and correct it before the client realizes there is a problem. Effectively it not only preserves and avoids dissatisfaction on the side of customers but also generates trust and loyalty with them.

There are possibilities to cut considerable expenses for businesses with the help of proactive services. If the company anticipates potential problems and immediately begins to work on them, companies can avoid having to pay tidal wave amounts to rectify the issue or having to handle customers’ complaints. It also enhances efficiency in managing resources since businesses can focus their resource on activities with high ROA and are most likely to return high value to the business. For instance, in manufacturing, it is possible to predict when equipment is likely to fail and schedule for repair at times when production is low to reduce losses.

This paper has demonstrated that technology has a central role in the provision of proactive services. AI and ML have come to a point where it is feasible to gather large amounts of data and seek out the means to utilize the data. Such technologies can provide results that might not be easily noticed during simple analysis of characteristics. Also, through IoT, equipment, and systems can be monitored and while they are functioning, data that can be used to predict failure and facilitate preventions is collected. For instance, in the sector of healthcare technologies, wearable devices can measure the patient’s vital signs and notify the physicians of the need to see the patient or attend to him/her before developing severe conditions.

It is pertinent to note that proactive services need to be properly managed, which entails changing organizational culture and perceptions. An organization requires the ability to be forward-looking in its management and have employees who are always anticipating problems. This involves sensible training and development which would enhance the employees in terms of skills and knowledge. Besides, the communication between the different departments and the coordination of the proactive activities must take place to correspond to the overall business plan. Therefore, through the implementation of such strategies, customers’ satisfaction and loyalty and long-term operational efficiency and profitability are likely to increase.

Proactive Service Market Trend Analysis

Proactive Service Market Growth Driver- Integration with IoT and AI

- Proactive services market of connected products plus devices and smart services are being highly impacted by IoT and AI integration as the market moves towards the application of intelligence within the materials, objects, and devices of the product layer. IoT devices gather Goliath info from multiple sources including; sensors, smart appliances, and industrial equipment. When this information is passed through AI techniques and tools, then it is possible to get almost real-time information about system utilization, user patterns, and problems. For instance, in smart homes, AI can use information gathered from the IoT devices to anticipate when maintenance is required, how energy can be conserved, and even improvements on the security aspect of the homes, meaning users of the service will be pre-emptively catered for intelligently.

- In industries and business, enterprises, IoT and AI work hand in hand for the smooth running and prognosis of machine and system failures. IoT technology can be used in the real-time tracking of various machinery and equipment and these can feed real-time data to the AI systems. The above AI systems could also forecast when a given machine is likely to break down or when it will need a service, thus enabling companies to solve problems before they result in large losses. It minimizes the occurrence of emergencies that would require expensive repair and overhaul of the equipment, while, increasing the durability of the equipment to enhance the performance’s efficiency.

- Besides, the collaboration between IoT and AI fuels the creation of novel customer service and support solutions. Integration of AI in chatbots or virtual assistants with IoT devices will enable organizations to preventively reach out to customers with solutions even when the customers themselves have not identified there is a problem. For instance, an AI system can predict some changes in the smart device that a user is using and notify the customer support department to start solving the issue. Implementing a proactive strategy entails offering customers more help before they begin to search for such assistance, thus increasing their level of satisfaction. In summary, the combination of IoT technology with force AI influences proactive services within different spheres to be more intelligent, efficient, and customer-oriented.

Proactive Service Market Opportunity- Development of new service models

- The development of new service models presents a significant opportunity for the Proactive Services Market by enhancing customer satisfaction and operational efficiency. Traditional reactive service models, which respond to issues as they arise, often result in customer dissatisfaction due to delays and unpredictability in service resolution. In contrast, proactive service models anticipate customer needs and potential issues before they occur, allowing for timely interventions and solutions. This shift from a reactive to a proactive approach not only improves the customer experience by reducing downtime and inconvenience but also builds customer trust and loyalty, essential for long-term business success.

- New service models leverage advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to monitor, analyze, and predict service needs. AI and ML algorithms can analyze vast amounts of data to identify patterns and predict potential failures or service requirements. IoT devices can continuously monitor the condition and performance of equipment, providing real-time data that can be used to preemptively address issues. By integrating these technologies into service models, companies can offer more personalized and efficient services, minimizing disruptions and enhancing overall service quality.

- The financial benefits of proactive service models are also substantial. By preventing issues before they escalate, companies can reduce maintenance costs and avoid expensive repairs or replacements. Additionally, the efficiency gained from predictive maintenance and timely interventions can lead to significant cost savings and resource optimization. This not only improves the profitability of service providers but also provides a competitive edge in the market. As businesses continue to adopt and refine these advanced service models, the Proactive Services Market is poised for robust growth, driven by the dual advantages of enhanced customer satisfaction and operational efficiency.

Proactive Service Market Segment Analysis:

Proactive Service Market Segmented based on Service, Technology, Organization Size, and Application.

By Service, Managed Services segment is expected to dominate the market during the forecast period

- In the Proactive Services Market, the Managed Services segment is traditionally regarded as the segment with the largest potential. Managed services cut across a broad solution that entails total outsourcing of an organization’s IT environment and end-user computing systems. This segment has risen in relevance in the recent past because organizations are becoming more complex in their IT aspects and most of them are not willing or are inadequately equipped to build the required in-house capabilities to guarantee the efficient running of their IT systems. MSPs include monitoring, maintenance, security, and support services to facilitate businesses to concentrate on their core business operations. Another benefit of managed services is received regarding the predictability of costs and the scalability of the services.

- Technical Support is yet another important segment of the proactive services category which aims at helping customers to address technical problems and achieve the best performance of the acquired IT goods or services. This segment is important because its outcome reflects customers’ loyalty and their willingness to do business with the company again. Technical support is not only about solving the problems that have been reported but it also encompasses checking up on the systems constantly, patching, and optimizing to prevent system faults. Although technical support is crucial to the market, it exists as a part of a wide range of managed services more often than not, thus playing a role in managed services’ market domination.

- Proactive services encompass Design and Consulting services that are critical in providing core consulting and strategic advice to organizations on how to assimilate effective IT solutions and frameworks. They include the following; such as System design, architecture planning for the services, risk assessment, as well as business process optimization. Since design and consulting skills are relevant for the overall development of intricate and elaborate strategies for an organization and effective IT system, their impact is usually most pronounced in a project’s beginning phases. Hence, though this segment has a significant impact on the formation of the IT environment, the constant impact they bring is less than with the numerous managed services that contribute to the continuous operation support. These two apart further and consolidate managed services as the leading segment in the proactive services market.

By Technology, Analytics segment held the largest share in 2024

- In the Proactive Services Market, a segment that is most often considered to be leading is Analytics. There is another step in the definition of proactive services and one more group of technologies in this context – analytics. Through analyzing a great amount of data, organizations can find trends or undiscovered issues that can become the root of a current problem or, vice versa, the path to further optimization. This predictive capability enables organizations to solve problems before they become severe, improve their functioning, and improve the service provision to customers. This is evident since there is an increase in analytics tools in various industries to advance proactive services.

- Another major category of proactive services, Artificial Intelligence (AI) one that aims at using new technologies in decision-making, automating processes, and offering efficient analysis. ML and NLP become crucial in helping the organization to minimize and even anticipate various problems that may arise. By using AI people can perform simple mundane duties and control different processes while reviewing data for inconsistencies and coming up with ways to improve different processes. AI is indispensable for the enhancement of proactive services; however, its implementation presupposes the existence of solid analytics platforms that provide the algorithms with proper data. That relationship discloses the synergy that is in AI and analytics; where analytics gives the fundamental data used in the implementation of AI.

- Others comprise various other technologies that feed the concept of proactive services such as cloud computing, IoT, or the internship of things and highly developed cybersecurity. These technologies support the concept of proactive services since they give the necessary foundation, links, and protection of IT environments. Nevertheless, it is crucial, and its effect is less comprehensive than the analytics’, as a rule, which manifests in considerable differences. Since analytics entails generating solutions across multiple sectors, this function alone places it ahead of the other segments as the leading proactive services market. Analytics acts as the support system for anticipatory strategies because they can help organizations to foresee problems and venture where there is potential, thus, fuelling the overall market.

Proactive Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America's dominance in the Proactive Services Market can be attributed to its advanced technological infrastructure and high adoption rates of emerging technologies. The region boasts a well-established network of tech-savvy companies and consumers, which creates a fertile ground for proactive service solutions. Companies in North America are quick to adopt new technologies like AI, machine learning, and IoT, all of which play crucial roles in the development and implementation of proactive services. This readiness to embrace innovation gives North American firms a significant edge in offering and utilizing proactive services, leading to higher market penetration and growth

- Another critical factor is the strong presence of key industry players and the availability of substantial investment resources. North America is home to many leading technology firms, including major players in the proactive services market. These companies not only drive the market through their product offerings and innovations but also set industry standards that others follow. Moreover, the robust venture capital ecosystem in North America provides the necessary funding for startups and established companies to develop and scale proactive service solutions. This financial backing facilitates continuous research, development, and expansion, further cementing the region's dominance in the market.

- The regulatory and business environment in North America is conducive to the growth of the proactive services market. Regulatory frameworks in the United States and Canada, for example, are generally supportive of technological advancements and business innovation. This supportive environment encourages companies to invest in and deploy proactive services without facing significant legal or regulatory hurdles. Additionally, the high level of competition in the North American market pushes companies to innovate continuously and offer superior proactive service solutions to maintain a competitive edge. This dynamic environment fosters a culture of excellence and rapid advancement, ensuring that North America remains at the forefront of the proactive services market.

Active Key Players in the Proactive Service Market

- Amdocs Limited (United States)

- Atos SE (France)

- Capgemini SE (France)

- Cisco Systems, Inc. (United States)

- Cognizant Technology Solutions (United States)

- DXC Technology (United States)

- Fortinet, Inc. (United States)

- Fujitsu Limited (Japan)

- HCL Technologies (India)

- Hewlett Packard Enterprise (United States)

- IBM Corporation (United States)

- Infosys Limited (India)

- McAfee, LLC (United States)

- Microsoft Corporation (United States)

- Oracle Corporation (United States)

- SAP SE (Germany)

- Symantec Corporation (United States)

- Tata Consultancy Services (India)

- Tech Mahindra Limited (India)

- Wipro Limited (India)

- Other Active Players

|

Global Proactive Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.24 Bn. |

|

Forecast Period 2025-32 CAGR: |

19.1 % |

Market Size in 2032: |

USD 25.27 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Technology |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Proactive Service Market by Service (2018-2032)

4.1 Proactive Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Managed Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Technical Support

4.5 Design and Consulting

Chapter 5: Proactive Service Market by Technology (2018-2032)

5.1 Proactive Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Analytics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Artificial Intelligence

5.5 Others

Chapter 6: Proactive Service Market by Organization Size (2018-2032)

6.1 Proactive Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium-sized Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large enterprises

Chapter 7: Proactive Service Market by Application (2018-2032)

7.1 Proactive Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Network Management

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Customer Experience Management

7.5 Data Center Management

7.6 Cloud Management

7.7 Application Management

7.8 Device / Endpoint Management

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Proactive Service Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NOVARTIS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ALLERGAN

8.4 VALEANT PHARMACEUTICALS

8.5 SANTEN PHARMACEUTICAL

8.6 LUPIN PHARMACEUTICALS

8.7 APOTEX

8.8 AKORN

8.9 OTHER MAJOR PLAYERS

Chapter 9: Global Proactive Service Market By Region

9.1 Overview

9.2. North America Proactive Service Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Service

9.2.4.1 Managed Services

9.2.4.2 Technical Support

9.2.4.3 Design and Consulting

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Analytics

9.2.5.2 Artificial Intelligence

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by Organization Size

9.2.6.1 Small and Medium-sized Enterprises (SMEs)

9.2.6.2 Large enterprises

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Network Management

9.2.7.2 Customer Experience Management

9.2.7.3 Data Center Management

9.2.7.4 Cloud Management

9.2.7.5 Application Management

9.2.7.6 Device / Endpoint Management

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Proactive Service Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Service

9.3.4.1 Managed Services

9.3.4.2 Technical Support

9.3.4.3 Design and Consulting

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Analytics

9.3.5.2 Artificial Intelligence

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by Organization Size

9.3.6.1 Small and Medium-sized Enterprises (SMEs)

9.3.6.2 Large enterprises

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Network Management

9.3.7.2 Customer Experience Management

9.3.7.3 Data Center Management

9.3.7.4 Cloud Management

9.3.7.5 Application Management

9.3.7.6 Device / Endpoint Management

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Proactive Service Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Service

9.4.4.1 Managed Services

9.4.4.2 Technical Support

9.4.4.3 Design and Consulting

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Analytics

9.4.5.2 Artificial Intelligence

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by Organization Size

9.4.6.1 Small and Medium-sized Enterprises (SMEs)

9.4.6.2 Large enterprises

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Network Management

9.4.7.2 Customer Experience Management

9.4.7.3 Data Center Management

9.4.7.4 Cloud Management

9.4.7.5 Application Management

9.4.7.6 Device / Endpoint Management

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Proactive Service Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Service

9.5.4.1 Managed Services

9.5.4.2 Technical Support

9.5.4.3 Design and Consulting

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Analytics

9.5.5.2 Artificial Intelligence

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by Organization Size

9.5.6.1 Small and Medium-sized Enterprises (SMEs)

9.5.6.2 Large enterprises

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Network Management

9.5.7.2 Customer Experience Management

9.5.7.3 Data Center Management

9.5.7.4 Cloud Management

9.5.7.5 Application Management

9.5.7.6 Device / Endpoint Management

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Proactive Service Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Service

9.6.4.1 Managed Services

9.6.4.2 Technical Support

9.6.4.3 Design and Consulting

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Analytics

9.6.5.2 Artificial Intelligence

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by Organization Size

9.6.6.1 Small and Medium-sized Enterprises (SMEs)

9.6.6.2 Large enterprises

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Network Management

9.6.7.2 Customer Experience Management

9.6.7.3 Data Center Management

9.6.7.4 Cloud Management

9.6.7.5 Application Management

9.6.7.6 Device / Endpoint Management

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Proactive Service Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Service

9.7.4.1 Managed Services

9.7.4.2 Technical Support

9.7.4.3 Design and Consulting

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Analytics

9.7.5.2 Artificial Intelligence

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by Organization Size

9.7.6.1 Small and Medium-sized Enterprises (SMEs)

9.7.6.2 Large enterprises

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Network Management

9.7.7.2 Customer Experience Management

9.7.7.3 Data Center Management

9.7.7.4 Cloud Management

9.7.7.5 Application Management

9.7.7.6 Device / Endpoint Management

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Proactive Service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.24 Bn. |

|

Forecast Period 2025-32 CAGR: |

19.1 % |

Market Size in 2032: |

USD 25.27 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Technology |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||