Pro Headphones Market Synopsis

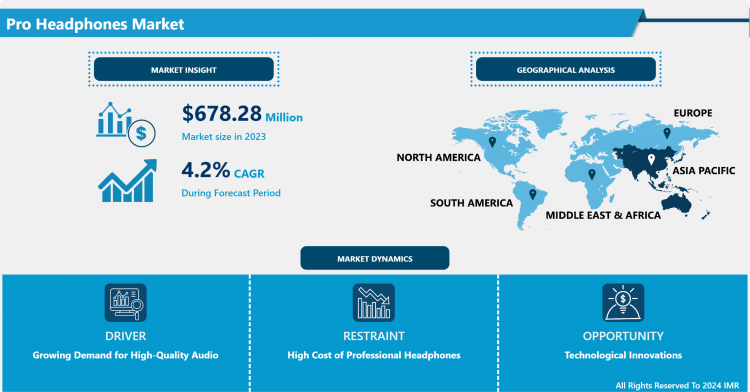

Pro Headphones Market Size Was Valued at USD 678.28 Million in 2023 and is Projected to Reach USD 982.24 Million by 2032, Growing at a CAGR of 4.2% From 2024-2032

- The pro headphones market encompasses high-quality, professional-grade headphones designed for use in various industries such as music production, broadcasting, film, and gaming. These headphones are engineered to deliver superior sound accuracy, durability, and comfort to meet the rigorous demands of professionals. They often feature advanced technologies such as noise cancellation, high-fidelity audio reproduction, and adjustable components, catering to users who require precise audio monitoring and extended usage periods. This market includes a diverse range of products, from studio monitors to closed-back designs, each tailored to specific professional needs and preferences.

- The global pro headphones market has experienced substantial growth driven by advancements in audio technology and rising consumer demand for high-quality sound experiences. Professional headphones, designed to offer superior audio performance and comfort, are increasingly sought after by audio professionals, musicians, and enthusiasts. This market encompasses a broad range of products, including studio monitors, noise-cancelling headphones, and wireless models, catering to diverse professional needs.

- The pro headphones market is witnessing robust growth due to the increasing adoption of advanced audio technologies such as active noise cancellation (ANC) and high-definition audio. The proliferation of digital audio workstations (DAWs) and the expansion of the music production industry are contributing significantly to market expansion. Additionally, the growing trend of remote work and online content creation has further boosted the demand for high-quality audio equipment.

- Regionally, North America and Europe are leading the pro headphones market, driven by well-established music and entertainment industries. However, the Asia-Pacific region is emerging as a significant growth area due to rapid urbanization, rising disposable incomes, and increasing investments in entertainment and media sectors. Emerging economies in this region are showing a growing preference for high-quality audio equipment, which is likely to drive market growth further.

- Key drivers of the pro headphones market include technological innovations, rising demand for high-fidelity audio experiences, and the expanding influence of social media platforms. The continuous evolution of wireless technologies and improvements in battery life are also enhancing the appeal of pro headphones, making them more convenient and versatile for professional use.

- Despite the positive growth outlook, the pro headphones market faces challenges such as high competition and price sensitivity among consumers. The rapid pace of technological advancements necessitates continuous innovation, which can be costly for manufacturers. Additionally, the market is also impacted by fluctuating raw material prices and supply chain disruptions.

- Looking ahead, the pro headphones market is poised for continued growth, supported by ongoing advancements in audio technology and the expanding global entertainment and media industries. Companies are expected to focus on developing innovative products with enhanced features and superior audio quality to cater to the evolving needs of professionals and consumers alike. With a strong emphasis on research and development, the market is likely to witness further advancements and opportunities in the coming years.

Pro Headphones Market Trend Analysis

Increased Demand for Professional-Grade Features in Headphones

- The increased demand for professional-grade features in headphones is a direct response to the evolving needs of users in various fields such as music production, broadcasting, and gaming. Professionals in these areas require headphones that deliver precise audio reproduction to ensure accurate sound monitoring and mixing. In music production, for instance, engineers and producers need headphones that can faithfully reproduce every nuance of a recording, from the subtlest low frequencies to the highest treble notes. This has led manufacturers to focus on creating headphones with extended frequency ranges and high-resolution audio capabilities. For broadcasters, headphones with excellent isolation and clear sound are essential for monitoring live audio and ensuring that broadcasts are of the highest quality. Gamers, on the other hand, benefit from headphones with immersive soundscapes and accurate spatial audio to enhance their gaming experience and provide a competitive edge.

- To meet these professional demands, manufacturers are increasingly incorporating features that offer greater control and customization. Adjustable EQ settings allow users to tailor the sound profile to their specific needs, whether it’s emphasizing certain frequencies for critical listening or adjusting the balance for a more immersive experience. Removable cables are becoming a standard feature, providing flexibility and convenience for users who need to replace or upgrade their cables without discarding the entire headset. Modular designs are also gaining traction, enabling users to customize their headphones with different components such as earpads, cables, and connectors. This modularity not only extends the lifespan of the headphones but also allows for a personalized fit and performance that aligns with individual preferences and professional requirements.

Growing Popularity of Wireless and Smart Headphones

- The growing popularity of wireless and smart headphones is reshaping the audio equipment market, driven by advancements in connectivity and smart technology. Wireless headphones, utilizing Bluetooth and other wireless protocols, offer unparalleled convenience by eliminating the constraints of cables. This mobility is especially advantageous in professional settings, where users may need to move freely without being tethered to a device. For instance, audio engineers and broadcasters benefit from the freedom to maneuver while managing equipment, and gamers appreciate the lack of cable clutter in their gaming setups. The seamless integration of wireless technology enhances the overall user experience, making it a preferred choice for both professional and casual users.

- In addition to wireless connectivity, the rise of smart headphones is further fueling market growth. These headphones often come equipped with advanced features such as voice assistants, touch controls, and built-in sensors that provide a more interactive and personalized experience. Voice assistants enable hands-free control of music, calls, and other functions, while touch controls offer intuitive and responsive operation. Built-in sensors can adjust sound settings based on environmental conditions or user activity, enhancing the listening experience. The combination of wireless convenience and smart functionality addresses the needs of modern users who seek a blend of practicality and innovation in their audio equipment.

Pro Headphones Market Segment Analysis:

Pro Headphones Market Segmented based on By Product, By Connectivity and By Distribution Channel.

By Distribution Channel, Online segment is expected to dominate the market during the forecast period

- Online distribution channels have emerged as the leading force in the pro headphones market, driven by the rapid expansion of e-commerce platforms and digital marketplaces. These platforms provide a vast array of options for consumers, allowing them to explore a wide range of pro headphones from various brands and models without the constraints of physical store inventories. The convenience of browsing, comparing prices, and accessing detailed product reviews from the comfort of one's home significantly enhances the shopping experience. This ease of access not only facilitates informed purchasing decisions but also helps consumers find competitive prices and exclusive deals, which further contributes to the growing dominance of online sales.

- The rise of online shopping has been particularly transformative for the pro headphones market as it aligns with the needs of a tech-savvy and global customer base. The digital nature of e-commerce platforms allows for seamless transactions and faster delivery options, catering to professionals who require quick access to high-quality audio equipment. Additionally, online channels often provide detailed product information, user reviews, and expert ratings, which empower buyers to make well-informed choices. As more consumers and professionals embrace the convenience of online shopping, the segment continues to expand, reflecting a broader shift toward digital retail and the increasing preference for accessible, efficient purchasing processes in the pro audio industry.

By Product, Over-Ear segment held the largest share in 2023

- Over-ear headphones are renowned for their dominance in the professional headphones market due to their exceptional sound quality and comfort. Their design, which features larger ear cups that completely enclose the ears, allows for the inclusion of larger drivers that produce richer and more detailed sound. This design also contributes to superior noise isolation, which is crucial for professionals working in noisy environments or requiring precise sound monitoring. For audiophiles and musicians, the ability to hear every nuance in their audio production without external interference is essential, making over-ear headphones the preferred choice. The extended comfort provided by their plush ear padding also enables extended listening sessions without discomfort, which is a significant advantage in professional settings where prolonged use is common.

- Moreover, the larger size of over-ear headphones facilitates advanced acoustic engineering, allowing manufacturers to include features like larger soundstage and better bass response, which are highly valued in studio and live performance contexts. This segment's dominance is further reinforced by the high demand from audio engineers, recording artists, and studio professionals who need equipment that can deliver precise and accurate sound reproduction. The substantial market share held by over-ear headphones reflects their critical role in achieving the high standards of audio quality demanded by the professional audio industry, solidifying their position as the leading choice for serious audio work.

Pro Headphones Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- In the Asia-Pacific region, the pro headphones market is experiencing a notable surge, fueled by a dynamic entertainment industry that spans music, gaming, and digital media. Countries like China and India are significant contributors to this growth due to their vast populations and burgeoning middle class. As these economies continue to develop, there is an increasing appetite for high-quality audio experiences across various applications, from professional audio engineering to personal leisure. The region's entertainment sector is expanding rapidly, with a growing number of music festivals, live performances, and digital content creation activities, all of which drive demand for advanced pro headphones that offer superior sound quality and durability.

- Japan and South Korea also play a crucial role in this market expansion, driven by their technological advancements and strong consumer electronics industries. The presence of numerous local and international manufacturers in these countries not only fosters competitive pricing but also accelerates innovation, as companies strive to meet the evolving preferences of both professionals and enthusiasts. Additionally, the increasing accessibility of premium audio technology in these markets is further supported by rising disposable incomes and a shift towards more sophisticated audio solutions. This regional growth is marked by a blend of technological innovation and a vibrant cultural landscape, creating a robust market for pro headphones in the Asia-Pacific region.

Active Key Players in the Pro Headphones Market

- Sennheiser Electronic Corporation,

- AKG Acoustics GmbH,

- Audio-Technica Corp,

- Sony Corporation,

- Shure Inc.,

- Beyerdynamic GmbH & Co. KG,

- Ultrasone of America LLC,

- Koninklijke Philips N.V.,

- Beats Electronics LLC,

- Beyerdynamic GmbH & Co.,

- Bose Corporation,

- Harman International,

- Panasonic Corporation,

- Samsung Group, Other Key Players

|

Global Pro Headphones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 678.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.2% |

Market Size in 2032: |

USD 982.24 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Connectivity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pro Headphones Market by Product

4.1 Pro Headphones Market Snapshot and Growth Engine

4.2 Pro Headphones Market Overview

4.3 Over-Ear

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Over-Ear: Geographic Segmentation Analysis

4.4 In-Ear

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 In-Ear: Geographic Segmentation Analysis

4.5 On-Ear

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 On-Ear: Geographic Segmentation Analysis

Chapter 5: Pro Headphones Market by Connectivity

5.1 Pro Headphones Market Snapshot and Growth Engine

5.2 Pro Headphones Market Overview

5.3 Wired

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Wired: Geographic Segmentation Analysis

5.4 Wireless

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Wireless: Geographic Segmentation Analysis

Chapter 6: Pro Headphones Market by Distribution Channel

6.1 Pro Headphones Market Snapshot and Growth Engine

6.2 Pro Headphones Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online: Geographic Segmentation Analysis

6.4 Offline

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Offline: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pro Headphones Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SENNHEISER ELECTRONIC CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AKG ACOUSTICS GMBH

7.4 AUDIO-TECHNICA CORP

7.5 SONY CORPORATION

7.6 SHURE INC

7.7 BEYERDYNAMIC GMBH & CO KG

7.8 ULTRASONE OF AMERICA LLC

7.9 KONINKLIJKE PHILIPS N.V

7.10 BEATS ELECTRONICS LLC

7.11 BEYERDYNAMIC GMBH & CO

7.12 BOSE CORPORATION

7.13 HARMAN INTERNATIONAL

7.14 PANASONIC CORPORATION

7.15 SAMSUNG GROUP

7.16 OTHER KEY PLAYERS

Chapter 8: Global Pro Headphones Market By Region

8.1 Overview

8.2. North America Pro Headphones Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product

8.2.4.1 Over-Ear

8.2.4.2 In-Ear

8.2.4.3 On-Ear

8.2.5 Historic and Forecasted Market Size By Connectivity

8.2.5.1 Wired

8.2.5.2 Wireless

8.2.6 Historic and Forecasted Market Size By Distribution Channel

8.2.6.1 Online

8.2.6.2 Offline

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Pro Headphones Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product

8.3.4.1 Over-Ear

8.3.4.2 In-Ear

8.3.4.3 On-Ear

8.3.5 Historic and Forecasted Market Size By Connectivity

8.3.5.1 Wired

8.3.5.2 Wireless

8.3.6 Historic and Forecasted Market Size By Distribution Channel

8.3.6.1 Online

8.3.6.2 Offline

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Pro Headphones Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product

8.4.4.1 Over-Ear

8.4.4.2 In-Ear

8.4.4.3 On-Ear

8.4.5 Historic and Forecasted Market Size By Connectivity

8.4.5.1 Wired

8.4.5.2 Wireless

8.4.6 Historic and Forecasted Market Size By Distribution Channel

8.4.6.1 Online

8.4.6.2 Offline

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Pro Headphones Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product

8.5.4.1 Over-Ear

8.5.4.2 In-Ear

8.5.4.3 On-Ear

8.5.5 Historic and Forecasted Market Size By Connectivity

8.5.5.1 Wired

8.5.5.2 Wireless

8.5.6 Historic and Forecasted Market Size By Distribution Channel

8.5.6.1 Online

8.5.6.2 Offline

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Pro Headphones Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product

8.6.4.1 Over-Ear

8.6.4.2 In-Ear

8.6.4.3 On-Ear

8.6.5 Historic and Forecasted Market Size By Connectivity

8.6.5.1 Wired

8.6.5.2 Wireless

8.6.6 Historic and Forecasted Market Size By Distribution Channel

8.6.6.1 Online

8.6.6.2 Offline

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Pro Headphones Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product

8.7.4.1 Over-Ear

8.7.4.2 In-Ear

8.7.4.3 On-Ear

8.7.5 Historic and Forecasted Market Size By Connectivity

8.7.5.1 Wired

8.7.5.2 Wireless

8.7.6 Historic and Forecasted Market Size By Distribution Channel

8.7.6.1 Online

8.7.6.2 Offline

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Pro Headphones Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 678.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.2% |

Market Size in 2032: |

USD 982.24 Mn. |

|

Segments Covered: |

By Product |

|

|

|

By Connectivity |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Pro Headphones Market research report is 2024-2032.

Sennheiser Electronic Corporation, AKG Acoustics GmbH, Audio-Technica Corp, Sony Corporation,Shure Inc., Beyerdynamic GmbH & Co. KG, Ultrasone of America LLC, Koninklijke Philips N.V., Beats Electronics LLC, Beyerdynamic GmbH & Co., Bose Corporation, Harman International, Panasonic Corporation, Samsung Groupand and Other Major Players.

The Pro Headphones Market is segmented into By Product, By Connectivity, By Distribution Channel, and region. By Product, the market is categorized into Over-Ear, In-Ear and On-Ear. By Connectivity, the market is categorized into Wired and Wireless. By Distribution Channel, the market is categorized into Online and Offline.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The pro headphones market encompasses high-quality, professional-grade headphones designed for use in various industries such as music production, broadcasting, film, and gaming. These headphones are engineered to deliver superior sound accuracy, durability, and comfort to meet the rigorous demands of professionals. They often feature advanced technologies such as noise cancellation, high-fidelity audio reproduction, and adjustable components, catering to users who require precise audio monitoring and extended usage periods. This market includes a diverse range of products, from studio monitors to closed-back designs, each tailored to specific professional needs and preferences.