Private Healthcare Market Synopsis

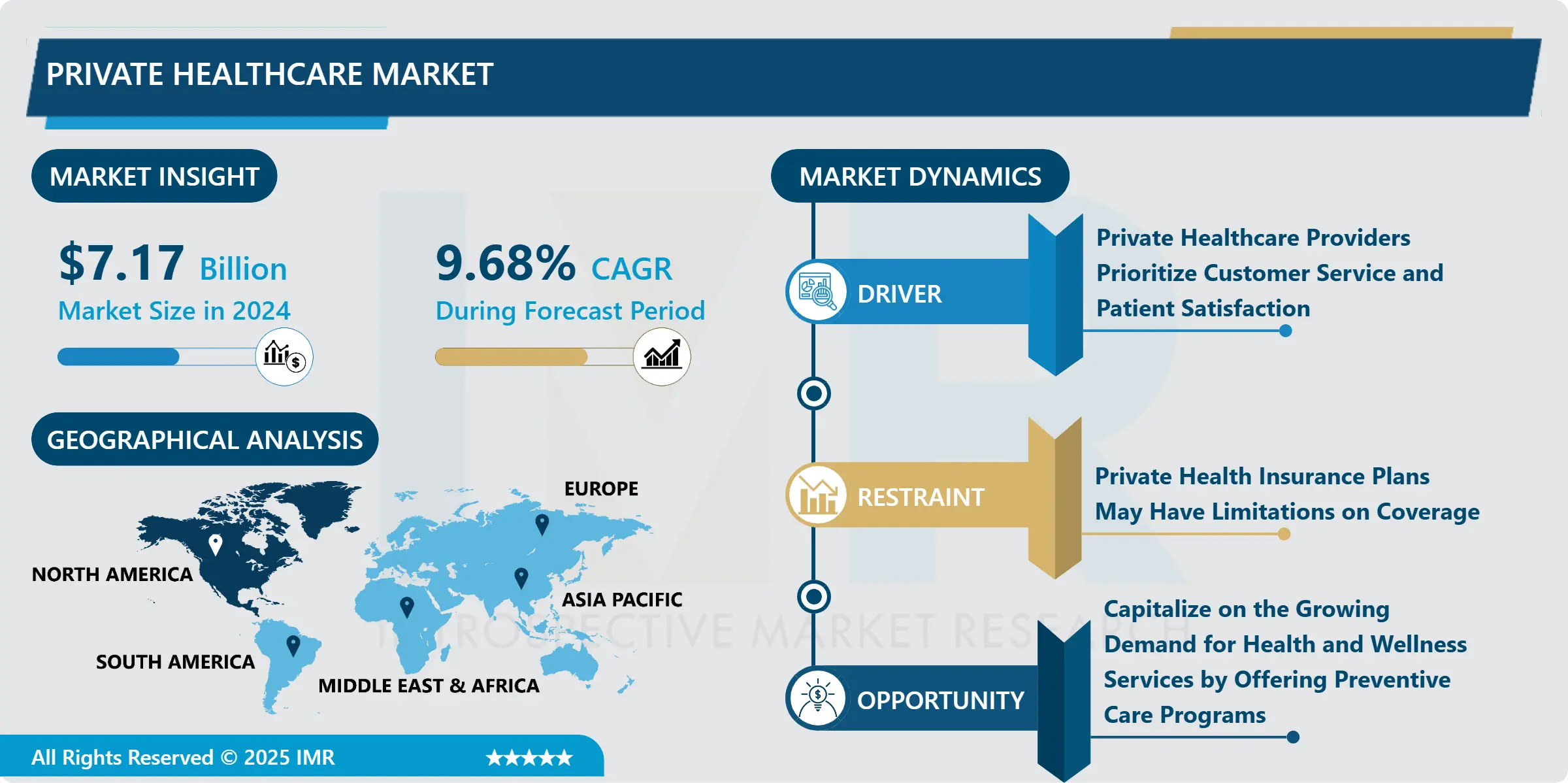

Private Healthcare Market Size Was Valued at USD 7.17 Billion in 2024, and is Projected to Reach USD 19.81 Billion by 2035, Growing at a CAGR of 9.68% From 2025-2035.

Private healthcare refers to medical services and facilities that are provided by privately-owned entities rather than by the government. It involves healthcare services offered by private hospitals, clinics, physicians, and other healthcare providers. Private healthcare is typically funded through out-of-pocket payments by individuals, employer-sponsored health insurance plans, or private health insurance policies. It often offers faster access to care, a wider range of services, and more amenities compared to public healthcare systems.

Private healthcare provides specialized medical services, personalized care, and expedited treatment options to individuals and organizations. Key applications include access to advanced diagnostics, specialized treatments, and procedures performed by highly trained specialists. Private healthcare facilities also offer shorter wait times for appointments, consultations, diagnostic tests, and elective surgeries, reducing waiting times. Enhanced patient experience is prioritized, with amenities like private rooms, personalized care plans, and attentive customer service. Individuals can choose their healthcare provider based on their preferences, needs, and priorities.

Private healthcare offers enhanced confidentiality and privacy protections, flexible scheduling options, and access to innovative treatments. Comprehensive health services include preventive care, wellness programs, chronic disease management, and rehabilitation services. Private healthcare also serves corporate clients by offering employee health programs, executive health screenings, occupational health services, and wellness initiatives. Medical tourism attracts patients worldwide seeking high-quality medical care at competitive prices, often combining healthcare with leisure travel.

Private healthcare facilities provide superior quality care with advanced medical technology, modern facilities, and specialized services, often perceived as superior to public healthcare. They offer shorter wait times for appointments, diagnostic tests, and elective procedures, allowing patients to choose their preferred provider based on reputation, convenience, and personal preferences. Private healthcare providers also offer additional services not covered by public systems, such as luxury amenities, personalized care plans, alternative medicine options, and wellness programs.

Confidentiality and privacy are also enhanced in private healthcare, catering to patients who prefer to keep their medical information private. Private health insurance coverage allows individuals to access services with minimal out-of-pocket expenses. Private healthcare providers prioritize customer service, offering personalized attention, shorter wait times, and responsive communication, enhancing patient satisfaction.

Private Healthcare Market Trend Analysis

Private Healthcare Providers Prioritize Customer Service and Patient Satisfaction

- Private healthcare providers prioritize customer service and patient satisfaction as a key driver in the sector. They focus on providing a positive patient experience through friendly staff, comfortable facilities, clear communication, and efficient processes. They also offer personalized care tailored to individual needs, building trust and confidence between patients and healthcare providers.

- Transparency in billing and pricing practices is a priority for private healthcare providers, ensuring patients can make informed decisions about their healthcare expenses. They regularly solicit patient feedback to identify areas for improvement and implement changes to enhance the patient experience. Private healthcare facilities offer multiple channels for communication, including phone, email, online portals, and in-person consultations, ensuring timely responses to patient needs.

- Investment in staff training and development is also a priority for private healthcare providers. This ensures healthcare professionals have the skills, knowledge, and empathy needed to deliver high-quality care with compassion and sensitivity to patients' needs.

- Measuring patient outcomes is another key aspect of private healthcare providers' approach. By tracking and measuring patient outcomes and satisfaction metrics, providers can evaluate the effectiveness of their services and identify areas for improvement, ultimately enhancing clinical results and patient satisfaction.

Restraint

Private Health Insurance Plans May Have Limitations on Coverage

- Private health insurance plans often exclude coverage for certain medical treatments, procedures, medications, or services that are considered experimental, cosmetic, or not medically necessary. These plans can restrict access to specific treatments or therapies for individuals with pre-existing conditions, waiting periods, network restrictions, cost-sharing requirements, annual and lifetime limits, and policy exclusions and limitations.

- Pre-existing conditions may also be excluded, causing difficulties in obtaining coverage or higher premiums. Network restrictions may limit coverage to healthcare providers, hospitals, or facilities within the network, resulting in reduced coverage or higher out-of-pocket costs. Cost-sharing requirements can result in significant out-of-pocket expenses, especially for high-cost medical treatments. Annual and lifetime limits may also limit coverage, causing financial burdens for individuals.

Opportunity

Capitalize on the Growing Demand for Health and Wellness Services by Offering Preventive Care Programs

- Private healthcare providers can capitalize on the growing demand for health and wellness services by offering preventive care programs. These programs can include comprehensive wellness programs, health education and awareness, preventive screenings and health assessments, population health management strategies, and integrating digital health and telemedicine solutions. These programs can be tailored to address specific health needs and goals of different patient populations.

- Promoting health education and awareness can involve conducting educational seminars, workshops, and online resources on topics such as healthy eating, physical activity, stress management, and disease prevention. Offering preventive screenings and health assessments can detect early signs of health problems and empower patients to take proactive steps to manage their health. Measuring and monitoring health outcomes related to preventive care initiatives can help evaluate the effectiveness of interventions and make data-driven improvements over time.

- Implementing population health management strategies can help identify at-risk patient populations and intervene early to prevent chronic disease progression. Digital health and telemedicine solutions can enable remote delivery of preventive care services. Collaborating with employers and insurers can help expand their reach and impact in promoting preventive care.

Challenge

Private Healthcare Providers may be Concentrated in Urban Areas

- Private healthcare providers are concentrated in urban areas, leading to uneven distribution of facilities and services. Rural and remote areas often have fewer providers, resulting in limited access to healthcare services. This can lead to delayed diagnoses, reduced treatment options, and poorer health outcomes.

- Rural areas may also lack private healthcare providers, creating healthcare deserts where residents must travel long distances to access medical care. Specialized services and expertise are often offered in urban areas, which can be limited in rural areas. Workforce recruitment and retention in rural areas can be challenging due to perceived isolation, limited career opportunities, and lower reimbursement rates.

- Limited infrastructure and resources in rural areas can also affect the capacity to deliver high-quality care. Telemedicine, while potentially improving access to healthcare in rural areas, may face limitations such as limited broadband internet access, technological literacy, and reimbursement policies.

Private Healthcare Market Segment Analysis:

Private Healthcare Market Segmented on the basis of service type, facilities, and consumer preferences.

By Service Type, Primary Care segment is expected to dominate the market during the forecast period

- Primary care services are crucial for individuals seeking healthcare, managing a wide range of medical conditions, addressing preventive care needs, and coordinating patient care across specialties. They are essential for promoting early disease detection, managing chronic conditions, and maintaining overall health and well-being. Primary care providers focus on preventive care, including routine health screenings, vaccinations, lifestyle counseling, and disease prevention strategies. This approach helps prevent chronic diseases, reduces healthcare costs, and improves patient outcomes over the long term.

- Primary care services are often accessible and convenient, facilitating timely access to healthcare, promoting early intervention for acute and chronic conditions, and reducing reliance on emergency departments for non-emergent care needs. Primary care providers offer comprehensive healthcare services, including diagnosis, treatment, and management of acute and chronic conditions, as well as ongoing health maintenance and follow-up care.

- Primary Care foster trust, communication, and collaboration between patients and providers, leading to improved patient satisfaction and health outcomes. Primary care providers also serve as gatekeepers within the healthcare system, coordinating referrals to specialty care services and ensuring appropriate utilization of healthcare resources. This optimizes healthcare delivery, reduces unnecessary utilization, and streamlines access to specialized services when needed.

By Facilities, Hospital segment held the largest share of 52.8% in 2024

- Hospitals provide a wide range of medical services, including emergency care, surgery, diagnostics, specialty care, and inpatient services. They have specialized departments staffed by highly trained professionals, offering advanced treatments for complex health conditions. Hospitals invest in advanced medical technology, such as diagnostic imaging systems and robotic surgery platforms, to enhance the precision and effectiveness of medical interventions.

- Hospitals provide acute and emergency care for patients with urgent medical needs, such as trauma, heart attacks, strokes, and severe illnesses. Inpatient services include medical, surgical, obstetric, pediatric, and psychiatric care. Hospitals have extensive infrastructure to accommodate a large volume of patients and provide around-the-clock care. They have established reputations for delivering high-quality healthcare services and achieving favorable patient outcomes, contributing to their dominance in the private healthcare market.

Private Healthcare Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the US, is a leading global region in healthcare spending per capita, resulting in a robust private healthcare market. The country's high expenditure on healthcare is fueled by technological advancements, strong private insurance coverage, and market competition. The region offers a diverse array of specialized healthcare services, including advanced treatments and personalized medicine options.

- The high disposable income of its population allows individuals to afford private healthcare services, including elective procedures and specialty treatments not covered by public systems. North America's healthcare systems, characterized by a mix of public and private providers, cater to diverse patient needs and preferences. The region's medical tourism industry attracts patients worldwide seeking high-quality healthcare services, with top-tier private healthcare facilities and expertise contributing to its dominance in the global private healthcare market.

Private Healthcare Market Top Key Players:

- UnitedHealth Group (US)

- HCA Healthcare (US)

- Anthem, Inc. (US)

- Tenet Healthcare Corporation (US)

- Ascension Health (US)

- Kaiser Permanente (US)

- Cardinal Health (US)

- Community Health Systems (US)

- DaVita Inc. (US)

- Cigna Corporation (US)

- Centene Corporation (US)

- CVS Health Corporation (US)

- Universal Health Services, Inc. (US)

- McKesson Corporation (US)

- LifePoint Health, Inc. (US)

- Encompass Health Corporation (US)

- Laboratory Corporation of America Holdings (US)

- Humana Inc. (US)

- AmerisourceBergen Corporation (US)

- Cardinal Health (US)

- Quest Diagnostics Incorporated (US)

- Molina Healthcare, Inc. (US)

- Express Scripts Holding Company (US)

- Aetna Inc. (US)

- Fresenius SE & Co. KGaA (Germany), and other major players

Key Industry Developments in the Private Healthcare Market:

- In August 2023, HCA Healthcare, Inc. one of the nation’s leading healthcare providers, and Google Cloud announced a new collaboration designed to use generative AI technology to improve workflows on time-consuming tasks, such as clinical documentation, so physicians and nurses can focus more on patient care.

- In March 2022, UnitedHealth Group health services division Optum has acquired burgeoning outpatient mental health provider Refresh Mental Health. Optum and Refresh Mental Health are excited to expand effective behavioral care to patients through a more coordinated health system, an Optum and BHB drive deeper integration between medical and behavioral health care and advance personalized care to patients through value-based care.

|

Global Private Healthcare Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

7.17 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.68% |

Market Size in 2035: |

19.81 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Facilities |

|

||

|

By Consumer Preferences |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Private Healthcare Market by Service Type (2018-2035)

4.1 Private Healthcare Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Primary Care

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Specialty Care

4.5 Diagnostic Services

4.6 Surgical Procedures

4.7 Wellness Services

Chapter 5: Private Healthcare Market by Facilities (2018-2035)

5.1 Private Healthcare Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diagnostic Centers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rehabilitation Centers

5.5 Hospital

5.6 Clinics

Chapter 6: Private Healthcare Market by Consumer Preferences (2018-2032)

6.1 Private Healthcare Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Complementary Medicine

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Personalized Medicine

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Private Healthcare Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CENTRIFY CORPORATION (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DELL TECHNOLOGIES INC (US)

7.4 FORGEROCK (US)

7.5 GLOBALSIGN (US)

7.6 HID GLOBAL (US)

7.7 IBM CORPORATION (US)

7.8 ORACLE (US)

7.9 PING IDENTITY (US)

7.10 ENTRUST DATACARD (US)

7.11 ONESPAN (US)

7.12 T-SYSTEMS (GERMANY)

7.13 VERIDOS IDENTITY SOLUTIONS (GERMANY)

7.14 SAP (GERMANY)

7.15 GEMALTO (FRANCE)

7.16 THALES GROUP (FRANCE)

7.17 MORPHO (FRANCE)

7.18 NEC CORPORATION (JAPAN)

7.19 WIPRO LIMITED (INDIA)

7.20

Chapter 8: Global Private Healthcare Market By Region

8.1 Overview

8.2. North America Private Healthcare Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Service Type

8.2.4.1 Primary Care

8.2.4.2 Specialty Care

8.2.4.3 Diagnostic Services

8.2.4.4 Surgical Procedures

8.2.4.5 Wellness Services

8.2.5 Historic and Forecasted Market Size by Facilities

8.2.5.1 Diagnostic Centers

8.2.5.2 Rehabilitation Centers

8.2.5.3 Hospital

8.2.5.4 Clinics

8.2.6 Historic and Forecasted Market Size by Consumer Preferences

8.2.6.1 Complementary Medicine

8.2.6.2 Personalized Medicine

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Private Healthcare Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Service Type

8.3.4.1 Primary Care

8.3.4.2 Specialty Care

8.3.4.3 Diagnostic Services

8.3.4.4 Surgical Procedures

8.3.4.5 Wellness Services

8.3.5 Historic and Forecasted Market Size by Facilities

8.3.5.1 Diagnostic Centers

8.3.5.2 Rehabilitation Centers

8.3.5.3 Hospital

8.3.5.4 Clinics

8.3.6 Historic and Forecasted Market Size by Consumer Preferences

8.3.6.1 Complementary Medicine

8.3.6.2 Personalized Medicine

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Private Healthcare Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Service Type

8.4.4.1 Primary Care

8.4.4.2 Specialty Care

8.4.4.3 Diagnostic Services

8.4.4.4 Surgical Procedures

8.4.4.5 Wellness Services

8.4.5 Historic and Forecasted Market Size by Facilities

8.4.5.1 Diagnostic Centers

8.4.5.2 Rehabilitation Centers

8.4.5.3 Hospital

8.4.5.4 Clinics

8.4.6 Historic and Forecasted Market Size by Consumer Preferences

8.4.6.1 Complementary Medicine

8.4.6.2 Personalized Medicine

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Private Healthcare Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Service Type

8.5.4.1 Primary Care

8.5.4.2 Specialty Care

8.5.4.3 Diagnostic Services

8.5.4.4 Surgical Procedures

8.5.4.5 Wellness Services

8.5.5 Historic and Forecasted Market Size by Facilities

8.5.5.1 Diagnostic Centers

8.5.5.2 Rehabilitation Centers

8.5.5.3 Hospital

8.5.5.4 Clinics

8.5.6 Historic and Forecasted Market Size by Consumer Preferences

8.5.6.1 Complementary Medicine

8.5.6.2 Personalized Medicine

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Private Healthcare Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Service Type

8.6.4.1 Primary Care

8.6.4.2 Specialty Care

8.6.4.3 Diagnostic Services

8.6.4.4 Surgical Procedures

8.6.4.5 Wellness Services

8.6.5 Historic and Forecasted Market Size by Facilities

8.6.5.1 Diagnostic Centers

8.6.5.2 Rehabilitation Centers

8.6.5.3 Hospital

8.6.5.4 Clinics

8.6.6 Historic and Forecasted Market Size by Consumer Preferences

8.6.6.1 Complementary Medicine

8.6.6.2 Personalized Medicine

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Private Healthcare Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Service Type

8.7.4.1 Primary Care

8.7.4.2 Specialty Care

8.7.4.3 Diagnostic Services

8.7.4.4 Surgical Procedures

8.7.4.5 Wellness Services

8.7.5 Historic and Forecasted Market Size by Facilities

8.7.5.1 Diagnostic Centers

8.7.5.2 Rehabilitation Centers

8.7.5.3 Hospital

8.7.5.4 Clinics

8.7.6 Historic and Forecasted Market Size by Consumer Preferences

8.7.6.1 Complementary Medicine

8.7.6.2 Personalized Medicine

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Private Healthcare Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

7.17 Bn. |

|

Forecast Period 2025-35 CAGR: |

9.68% |

Market Size in 2035: |

19.81 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By Facilities |

|

||

|

By Consumer Preferences |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||