Prepaid Card Market Synopsis

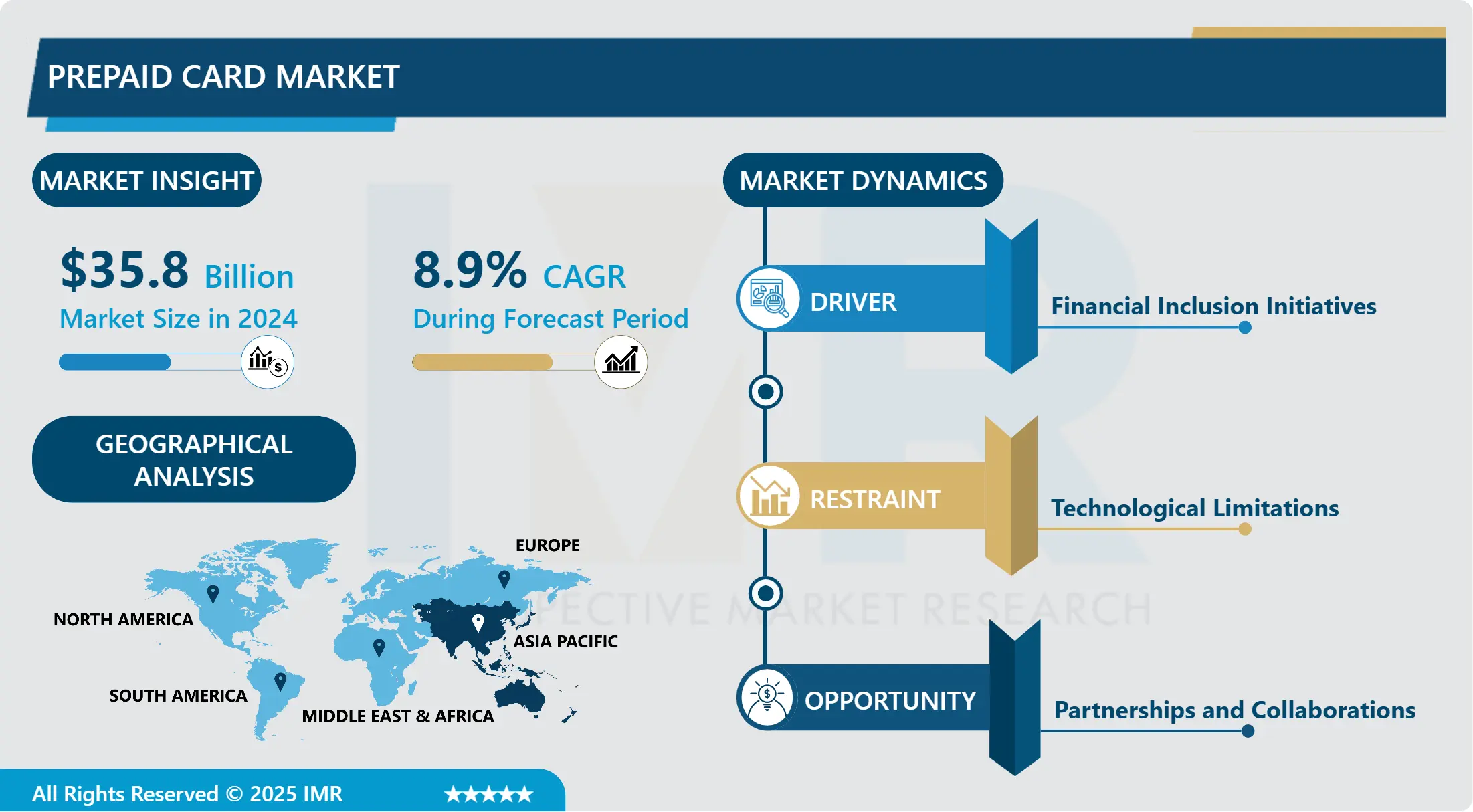

Prepaid Card Market Size Was Valued at USD 35.8 Billion in 2024 and is Projected to Reach USD 70.81 Billion by 2032, Growing at a CAGR of 8.90% From 2025-2032.

The financial services industry when payment cards are pre-issued by banks or payment service providers is known as the "prepaid card market." These cards may be used for purchases at different retailers or online platforms up until the balance is exhausted. The money are usually put into the card by the cardholder or a third party. For consumers who wish to budget and manage their expenditure or who might not have access to regular banking services, prepaid cards provide flexibility and convenience. They greatly contribute to financial inclusion and the widespread acceptance of electronic payments as they are frequently used for things like salary disbursement, the delivery of government benefits, travel expenditures, and regular consumer shopping.

Prepaid card demand is rising sharply worldwide, mostly due to consumers' growing need for safe and easy payment options. Prepaid cards, which come in both closed- and open-loop varieties, appeal to a broad range of consumers, from elders to millennials, by providing flexibility and financial control. The growth of e-commerce, the acceptance of digital payments, and the unbanked population's desire for financial inclusion are important factors propelling the market's progress.

Prepaid card sales are dominated by North America and Europe due to their sophisticated banking systems and welcoming regulatory frameworks. On the other hand, significant market possibilities are being created by the fast urbanization and technological development in the developing economies of Asia Pacific and Latin America. Initiatives by the government to increase financial inclusion and literacy support market expansion in these areas.

The prepaid card market is changing as a result of technological advancements like contactless payments and mobile wallet integration, which improve consumer convenience and security. Collaborations among financial institutions, fintech startups, and major retailers are promoting product innovation and broadening the reach of available channels.

Notwithstanding these advantages, there are still obstacles to overcome, including cybersecurity risks, regulatory compliance, and competition from other payment options. In order to benefit on the changing prepaid card industry and maintain growth in the upcoming years, stakeholders will need to engage in strategic collaborations, keep up with continual technical improvements, and prioritize improving the user experience.

Prepaid Card Market Trend Analysis

Prepaid Card Market Growth Driver- Evolution of Prepaid Cards Convenience, Security, and Technological Advancements

- The main reasons prepaid cards are becoming more and more popular with customers are their convenience and security features. Prepaid cards, in contrast to conventional credit cards, enable users load a predetermined amount of money onto the card ahead of time, which may then be used for purchases up until the balance is exhausted. People who wish to have more control over their finances and are wary about overspending may find this option appealing. Prepaid cards provide a risk-free option for controlling daily costs and creating a budget as they remove the chance of debt accumulation.

- Prepaid cards now perform much better thanks to technological improvements, which also increase their acceptability and versatility on a variety of platforms. With cutting-edge security features like EMV chips and encryption technology, modern prepaid cards guarantee safe transactions both online and off. Customers are now more comfortable utilizing prepaid cards for a variety of financial operations, including as online purchases, bill payments, and overseas vacation costs, thanks to the increased security.

- Furthermore, the usefulness of prepaid cards has increased even more with the integration of digital and mobile platforms. These days, a lot of issuers include mobile applications that let customers check their spending in real time, manage their prepaid card accounts, and get transaction notifications. Prepaid cards are now more accessible and handy because to their seamless integration with digital banking services. This meets the needs of tech-savvy customers who value having rapid access to and control over their financial operations. Prepaid card sales therefore keep growing as a consequence of innovation and customer desire for adaptable, safe payment options.

Prepaid Card Market Expansion Opportunity- Integration of Prepaid Cards in Corporate Expense Management

- Prepaid cards are becoming more and more popular in the corporate world as businesses realize how useful they are for effectively managing employee perks, incentives, and costs. The improved administration that prepaid solutions provide over traditional ways is one important benefit. Prepaid cards make it easier to give money to staff members for a variety of applications, such bonuses, per diems, and travel expenditures. This lessens the workload for administrative staff while also improving the organization's financial transactions' transparency.

- Prepaid card acceptance in business contexts is also strongly influenced by cost-effectiveness. Prepaid cards offer a rapid and straightforward way to disburse payments, in contrast to traditional reimbursement procedures that could incur delays and administrative expenses. Businesses may preload cards with quantities that are relevant to each customer's needs, guaranteeing exact budget management and lowering the possibility of overpaying. Furthermore, prepaid cards frequently include capabilities that give businesses real-time expenditure tracking and monitoring, giving them more insight into the spending habits of their company.

- Prepaid cards also give employees freedom when it comes to making purchases or withdrawals when working remotely or on business vacations. Because the cards are widely recognized across the world, accessing funds is made simple and hassle-free, with no need to worry about foreign transaction fees or currency exchange. Because of their ease of use, prepaid cards are the go-to option for large companies looking for effective and adaptable payment options that fit the needs of their contemporary workforce. Prepaid card integration is thus expected to continue expanding as long as businesses place a high priority on productivity, cost reduction, and employee happiness.

Prepaid Card Market Segment Analysis:

Prepaid Card Market Segmented based on Offering, Card Type, End User, and Region.

By Offering, Government Benefit/Disbursement Card segment is expected to dominate the market during the forecast period

- Government benefit/disbursement cards are vital to contemporary welfare systems because they make it easier for qualifying recipients to get necessary financial help in an efficient manner. These cards are made especially to manage many kinds of benefits, such as social security, unemployment, and welfare payments. The main user of these cards is the public sector/government because of how difficult and massively expansive it is to provide rewards to such a big number of people.

- Compared to more conventional methods like cheques or cash disbursements, government benefit/disbursement cards have the advantage of streamlining payment procedures and lowering administrative expenses. Governments may minimize delays and potential mistakes by ensuring the prompt and safe distribution of payments to beneficiaries through electronic loading of monies into these prepaid cards. Because transactions can be traced and audited more successfully using this system, it also improves financial transaction transparency and accountability.

- Additionally, these cards provide recipients with increased financial inclusion and convenience. Beneficiaries' overall financial management is enhanced by being able to access their cash via ATMs, make purchases at approved retailers, and often get text or email alerts of deposits. Adopting these cards by governments enhances their capacity to respond rapidly to catastrophes or economic problems by providing relief to individuals in need while also modernizing benefit distribution processes. Government benefit/disbursement cards, therefore, constitute a major breakthrough in public sector financial management, fusing efficiency with better service delivery to boost community welfare and economic stability.

By Card Type, Closed Loop Prepaid Card segment held the largest share in 2024

- Prepaid cards with closed loops are a unique type of payment that are widely used in retail settings, especially in certain brands or chains of stores. These cards are intended to be used only within the network of the issuing store or a specific set of participating merchants. They are used for a number of things, like as loyalty programs, gift cards, and special incentives meant to improve client retention tactics.

- For retail businesses, one of the main benefits of closed loop prepaid cards is their capacity to increase sales through focused marketing campaigns. For example, gift cards incentivize recipients to visit businesses and make purchases, which frequently leads to spending more than the card's initial value. In addition to generating income right away, this encourages customer loyalty and return business because customers frequently use the cards as presents or to redeem their balances.

- Closed loop prepaid cards are very useful for raising brand awareness and engagement. Retailers may reinforce brand identification and build consumer affinity by personalizing these cards with their logos, colors, and promotional messaging. These cards come with loyalty programs that encourage regular shopping and may be customized to honor particular acts like high-value transactions or referrals. All things considered, closed loop prepaid cards give merchants the ability to forge closer bonds with their clientele, increase revenue through focused marketing campaigns, and set themselves apart in crowded marketplaces by providing easy, branded payment options that improve the shopping experience.

Prepaid Card Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The prepaid card market in Asia Pacific is undergoing rapid expansion, driven by several key factors that are reshaping consumer payment habits and financial inclusion efforts across the region. With rising disposable incomes and rapid urbanization, there is a growing demand for convenient, secure, and accessible payment solutions. Prepaid cards, offering flexibility and ease of use, have emerged as popular alternatives to traditional banking services, especially in countries like China, India, and various Southeast Asian nations.

- In China, for instance, the prevalence of mobile payment platforms like Alipay and WeChat Pay has laid a strong foundation for digital financial services, including prepaid cards. These platforms leverage extensive internet penetration and smartphone usage to offer seamless transactions, attracting a broad demographic from urban centers to rural areas. Government initiatives in China and other Asian countries are also pivotal, promoting financial inclusion and driving adoption through subsidies, incentives, and regulatory support that foster a competitive market landscape.

- Southeast Asian nations such as Indonesia, Thailand, and Vietnam are experiencing a surge in prepaid card usage, spurred by the region's growing middle class and the expansion of digital infrastructure. Mobile-based payment solutions are particularly favored among tech-savvy consumers who value convenience and accessibility. Companies are innovating with tailored prepaid card offerings, integrating rewards programs, and enhancing security features to capture market share in this dynamic landscape.

- Overall, the prepaid card market in Asia Pacific is not only benefiting from technological advancements and increasing internet connectivity but also from proactive government policies aimed at expanding financial access. As digitalization continues to reshape consumer behaviors and economic landscapes, prepaid cards are poised to play a crucial role in the region's evolving payment ecosystem, catering to a diverse and expanding customer base seeking flexible and secure financial solutions.

Active Key Players in the Prepaid Card Market

- American Express Company

- Green Dot Corporation

- JPMorgan Chase And Co

- Kaiku Finance LLC

- Mango Financial, Inc.

- Mastercard

- NetSpend Corporation

- PayPal Holdings, Inc.

- Travelex Foreign Coin Services Limited

- Visa Inc.

- Other Active Players.

|

Global Prepaid Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 35.8 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.90% |

Market Size in 2032: |

USD 70.81 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Card Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Prepaid Card Market by Offering (2018-2032)

4.1 Prepaid Card Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gift Cards

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Government Benefit/Disbursement Card

4.5 Incentive/Payroll Card

4.6 General Purpose Reloadable Card

4.7 Others

Chapter 5: Prepaid Card Market by Card Type (2018-2032)

5.1 Prepaid Card Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Closed Loop Prepaid Card

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Open Loop Prepaid Card

Chapter 6: Prepaid Card Market by End User (2018-2032)

6.1 Prepaid Card Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Establishments

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Corporate

6.5 Government/Public sector

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Prepaid Card Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMERICAN EXPRESS COMPANY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GREEN DOT CORPORATION

7.4 JPMORGAN CHASE AND CO

7.5 KAIKU FINANCE LLC

7.6 MANGO FINANCIAL INCMASTERCARD

7.7 NETSPEND CORPORATION

7.8 PAYPAL HOLDINGS INCTRAVELEX FOREIGN COIN SERVICES LIMITED

7.9 VISA INCOTHER KEY PLAYERS

Chapter 8: Global Prepaid Card Market By Region

8.1 Overview

8.2. North America Prepaid Card Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Offering

8.2.4.1 Gift Cards

8.2.4.2 Government Benefit/Disbursement Card

8.2.4.3 Incentive/Payroll Card

8.2.4.4 General Purpose Reloadable Card

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Card Type

8.2.5.1 Closed Loop Prepaid Card

8.2.5.2 Open Loop Prepaid Card

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Retail Establishments

8.2.6.2 Corporate

8.2.6.3 Government/Public sector

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Prepaid Card Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Offering

8.3.4.1 Gift Cards

8.3.4.2 Government Benefit/Disbursement Card

8.3.4.3 Incentive/Payroll Card

8.3.4.4 General Purpose Reloadable Card

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Card Type

8.3.5.1 Closed Loop Prepaid Card

8.3.5.2 Open Loop Prepaid Card

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Retail Establishments

8.3.6.2 Corporate

8.3.6.3 Government/Public sector

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Prepaid Card Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Offering

8.4.4.1 Gift Cards

8.4.4.2 Government Benefit/Disbursement Card

8.4.4.3 Incentive/Payroll Card

8.4.4.4 General Purpose Reloadable Card

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Card Type

8.4.5.1 Closed Loop Prepaid Card

8.4.5.2 Open Loop Prepaid Card

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Retail Establishments

8.4.6.2 Corporate

8.4.6.3 Government/Public sector

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Prepaid Card Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Offering

8.5.4.1 Gift Cards

8.5.4.2 Government Benefit/Disbursement Card

8.5.4.3 Incentive/Payroll Card

8.5.4.4 General Purpose Reloadable Card

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Card Type

8.5.5.1 Closed Loop Prepaid Card

8.5.5.2 Open Loop Prepaid Card

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Retail Establishments

8.5.6.2 Corporate

8.5.6.3 Government/Public sector

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Prepaid Card Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Offering

8.6.4.1 Gift Cards

8.6.4.2 Government Benefit/Disbursement Card

8.6.4.3 Incentive/Payroll Card

8.6.4.4 General Purpose Reloadable Card

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Card Type

8.6.5.1 Closed Loop Prepaid Card

8.6.5.2 Open Loop Prepaid Card

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Retail Establishments

8.6.6.2 Corporate

8.6.6.3 Government/Public sector

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Prepaid Card Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Offering

8.7.4.1 Gift Cards

8.7.4.2 Government Benefit/Disbursement Card

8.7.4.3 Incentive/Payroll Card

8.7.4.4 General Purpose Reloadable Card

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Card Type

8.7.5.1 Closed Loop Prepaid Card

8.7.5.2 Open Loop Prepaid Card

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Retail Establishments

8.7.6.2 Corporate

8.7.6.3 Government/Public sector

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Prepaid Card Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 35.8 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.90% |

Market Size in 2032: |

USD 70.81 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Card Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||