Premix Feed Market Synopsis

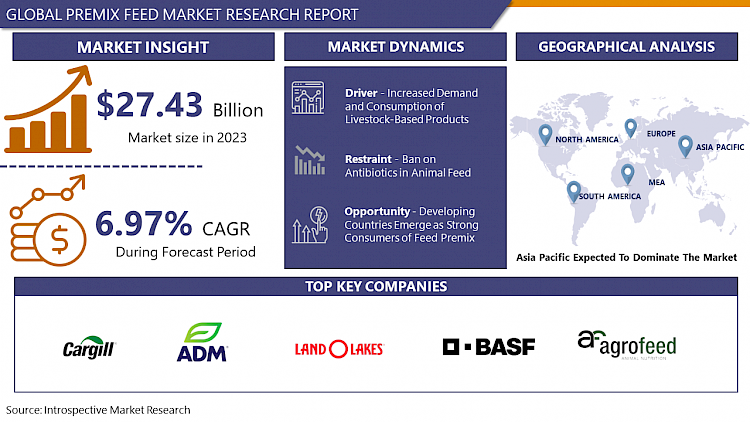

Global Premix Feed Market Size Was Valued at USD 27.43 Billion in 2023, and is Projected to Reach USD 50.3 Billion by 2032, Growing at a CAGR of 6.97 % From 2024-2032.

Premix feed comprises a unique mixture of vitamins, minerals, and vital nutrients incorporated into animal feed to maintain nutritional equilibrium. These premixed supplements are customized to fulfill the distinct dietary needs of various livestock species, thereby enhancing their well-being, development, and overall efficiency.

- Premix feed is widely utilized in livestock farming to rectify nutritional deficiencies and ensure the optimal health and development of animals. It comprises a precise amalgamation of vitamins, minerals, amino acids, and other vital nutrients, complementing the base feed to fulfill the specific dietary requirements of diverse livestock species. This customized nutritional strategy is pivotal in maximizing animal perDrynce, bolstering reproductive efficiency, and fortifying resistance against diseases, thereby augmenting overall farm productivity and profitability.

- A significant advantage of premix feed lies in its capacity to heighten feed efficiency and nutrient utilization in livestock. By providing a well-balanced diet, premix feed facilitates superior absorption and utilization of nutrients by animals, resulting in enhanced growth rates, improved feed conversion efficiency, and superior meat quality. Additionally, premix feed enables meticulous regulation of nutrient intake, empowering farmers to rectify deficiencies and fulfill the nutritional prerequisites of animals at various growth stages and production phases.

- The demand for premix feed is poised for substantial growth as the global livestock industry evolves and expands. With escalating consumer preferences for premium-quality animal products and heightened awareness regarding the significance of animal nutrition, there is a growing acknowledgment of the pivotal role played by premix feed in optimizing animal health and perdurance. Furthermore, advancements in feed technology and formulation are anticipated to foster innovation in premix feed products, offering refined nutritional solutions tailored to meet the evolving requisites of contemporary livestock production systems.

Premix Feed Market Trend Analysis

Increased Demand and Consumption of Livestock-Based Products

- The surging demand and consumption of livestock-based products emerge as primary catalysts driving the expansion of the premix feed market. As the global population escalates and dietary preferences shift towards protein-rich foods, there's a notable upsurge in the utilization of livestock-derived items. This heightened demand underscores the need to optimize animal health and productivity to meet the burgeoning requirements of the food industry.

- Premix feed assumes a pivotal role in meeting this demand by ensuring the delivery of balanced nutrition to livestock. By providing a precise blend of essential vitamins, minerals, amino acids, and other nutrients, premix feed complements the base diet, catering to the specific nutritional needs of diverse livestock species. This customized nutritional approach significantly enhances animal performance, reproductive efficiency, and disease resilience, thereby boosting overall farm productivity and profitability.

- Moreover, with the continuous rise in demand for livestock-based products, the reliance on premix feed as a fundamental element in livestock nutrition is expected to amplify. As consumers increasingly prioritize top-quality animal products, there's a growing acknowledgment of the pivotal role of optimal animal nutrition in ensuring product excellence and safety. The premix feed market is poised for substantial expansion as the livestock industry strives to meet evolving consumer demands while upholding sustainable and efficient production practices.

Developing Countries Emerge as Strong Consumers of Feed Premix

- Developing nations are emerging as significant consumers of feed premix, creating a substantial growth opportunity for the premix feed market. These countries are experiencing rapid urbanization, economic expansion, and dietary shifts, leading to increased demand for livestock-based goods to satisfy the dietary preferences of their expanding populations. This uptick in demand necessitates the adoption of effective and economical approaches to improve animal health and productivity, consequently boosting the consumption of feed premix.

- The utilization of feed premix in developing countries offers several benefits, including enhanced animal nutrition, improved growth rates, and heightened disease resistance. Through the provision of a precise combination of essential nutrients, premix feed supplements the basic diet, addressing potential nutritional deficiencies and optimizing animal well-being. Moreover, premix feed enables tailored nutritional solutions to meet the specific needs of diverse livestock species, empowering farmers to maximize productivity and profitability.

- The rising consumption of feed premix in developing nations is poised to drive market expansion and innovation within the premix feed sector. With continued investments in agriculture, livestock farming, and food security initiatives, these countries are anticipated to emerge as key drivers of demand for premix feed products. Additionally, as awareness regarding the significance of animal nutrition grows and regulatory frameworks evolve, there is an increasing acknowledgment of the role played by premix feed in advancing sustainable and efficient livestock production practices in developing economies.

Premix Feed Market Segment Analysis:

Premix Feed Market Segmented on the basis of Ingredient Type, Form, and Application.

By Application, Poultry segment is expected to dominate the market during the forecast period

- The poultry segment is poised to lead the expansion of the premix feed market. Poultry farming heavily depends on premix feed to ensure optimal health and nutrition for poultry flocks. With the rising global demand for poultry products like meat and eggs, there's an increasing need for top-notch premix feed to bolster the health and productivity of poultry.

- One of the primary factors driving the dominance of the poultry segment is the intensive nature of poultry farming and the specific nutritional demands of poultry species. Premix feed offers a convenient and efficient way to deliver vital vitamins, minerals, amino acids, and other nutrients essential for poultry growth, development, and disease prevention. Moreover, as consumers seek poultry products raised sustainably and with animal welfare in mind, the demand for premix feed formulated with high-quality ingredients is on the rise. The poultry segment is anticipated to maintain its dominance in the premix feed market, propelling notable growth and innovation in the sector.

By Ingredient Type, Amino Acids segment held the largest share of 56.12% in 2022

- The amino acids segment is the primary driver of growth in the premix feed market, holding the largest share. Amino acids are crucial for animal nutrition, as they are essential for protein synthesis, growth, and overall metabolic functions. The increasing recognition of the importance of balanced nutrition in livestock farming has led to a rising demand for premix feed fortified with amino acids to enhance animal health and perdurance.

- The prominence of the amino acids segment stems from their vital role in supporting various physiological processes in animals. Essential amino acids, which animals cannot produce on their own and must obtain from their diet, are particularly critical for livestock growth and development. Premix feed supplemented with essential amino acids ensures that animals receive the necessary nutrition to meet their metabolic needs, resulting in improved feed conversion efficiency, growth rates, and productivity, the amino acids segment is expected to continue leading the premix feed market, fostering significant growth and innovation in the livestock nutrition industry.

Premix Feed Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is expected to lead the regional expansion of the premix feed market. The region's rapid population growth and escalating demand for animal protein, particularly in emerging economies such as China and India, offer significant opportunities for the premix feed industry. The intensive nature of livestock farming in Asia Pacific, combined with prevalent nutritional deficiencies in animal diets, propels the need for premix feed to ensure optimal livestock health and productivity.

- Furthermore, the increasing adoption of modern farming techniques and growing awareness among farmers about the advantages of premix feed contribute to market growth in the region. Additionally, government and regulatory bodies' augmented investments in agriculture, livestock farming, and food security initiatives across the Asia Pacific are expected to spur the widespread adoption of premix feed. Consequently, Asia Pacific is poised to uphold its dominance in the premix feed market, fostering substantial growth and innovation in the livestock nutrition sector across the region.

Premix Feed Market Top Key Players:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Land O'Lakes, Inc (U.S.)

- Watson Foods Co., Inc (U.S.)

- Farbest-Tallman Foods Corporation (U.S.)

- Wright Enrichment Inc. (U.S.)

- BASF SE (Germany)

- SternVitamin GmbH & Co. KG (Germany)

- Koninklijke DSM N.V (Netherlands)

- Corbion N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- AB Agri Ltd. (UK)

- Devenish Nutrition LLC. (UK)

- Agrofeed Ltd. (Greece)

- Vitablend Nederland BV (NetherLands)

- Dansk Landbrugs Grovvareselskab A.M.B.A. (DLG) (Denmark)

- Glanbia plc (Ireland)

- Zagro Asia Ltd (Singapore)

- Charoen Pokphand Foods PCL (Thailand)

- Godrej Agrovet (India), and Other Major Players

Key Industry Developments in the Premix Feed Market:

- In December 2023, ADM reached an agreement to acquire premix manufacturer, PT Trouw Nutrition Indonesia, a subsidiary of Nutreco. The acquisition encompasses two premix production facilities—known as the Pasuruan site in Surabaya and the Cibitung site in Jakarta—as well as laboratories, warehouses, and offices across Indonesia.

- In July 2023, Adare Pharma Solutions, a global technology-driven CDMO focused on oral dosage forms, announced the completion of the divestiture of its Adare Biome business unit, a pioneer in the development and manufacturing of postbiotics, to dsm-firmenich, innovators in nutrition, health, and beauty.

|

Global Premix Feed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.97% |

Market Size in 2032: |

USD 50.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PREMIX FEED MARKET BY INGREDIENT TYPE (2017-2032)

- PREMIX FEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- VITAMINS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MINERALS

- AMINO ACIDS

- ANTIOXIDANTS

- ANTIBIOTICS

- OTHERS

- PREMIX FEED MARKET BY FORM (2017-2032)

- PREMIX FEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LIQUID

- PREMIX FEED MARKET BY APPLICATION (2017-2032)

- PREMIX FEED MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POULTRY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F))

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RUMINANTS

- AQUATIC ANIMALS

- EQUINE

- PETS

- SWINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Premix Feed Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CARGILL, INCORPORATED (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business PerDrynce (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ADM (U.S.)

- LAND O'LAKES, INC (U.S.)

- WATSON FOODS CO., INC (U.S.)

- FARBEST-TALLMAN FOODS CORPORATION (U.S.)

- WRIGHT ENRICHMENT INC. (U.S.)

- BASF SE (GERMANY)

- STERNVITAMIN GMBH & CO. KG (GERMANY)

- KONINKLIJKE DSM N.V (NETHERLANDS)

- CORBION N.V. (NETHERLANDS)

- NUTRECO N.V. (NETHERLANDS)

- AB AGRI LTD. (UK)

- DEVENISH NUTRITION LLC. (UK)

- AGROFEED LTD. (GREECE)

- VITABLEND NEDERLAND BV (NETHERLANDS)

- DANSK LANDBRUGS GROVVARESELSKAB A.M.B.A. (DLG) (DENMARK)

- GLANBIA PLC (IRELAND)

- ZAGRO ASIA LTD (SINGAPORE)

- CHAROEN POKPHAND FOODS PCL (THAILAND)

- GODREJ AGROVET (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL PREMIX FEED MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Ingredient Type

- Historic And Forecasted Market Size By Form

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Premix Feed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.97% |

Market Size in 2032: |

USD 50.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Form |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PREMIX FEED MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PREMIX FEED MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PREMIX FEED MARKET COMPETITIVE RIVALRY

TABLE 005. PREMIX FEED MARKET THREAT OF NEW ENTRANTS

TABLE 006. PREMIX FEED MARKET THREAT OF SUBSTITUTES

TABLE 007. PREMIX FEED MARKET BY TYPE

TABLE 008. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

TABLE 009. VITAMINS MARKET OVERVIEW (2016-2028)

TABLE 010. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

TABLE 011. AMINO ACIDS MARKET OVERVIEW (2016-2028)

TABLE 012. MINERALS MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. PREMIX FEED MARKET BY APPLICATION

TABLE 015. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 016. RUMINANTS MARKET OVERVIEW (2016-2028)

TABLE 017. SWINE MARKET OVERVIEW (2016-2028)

TABLE 018. AQUATIC ANIMALS MARKET OVERVIEW (2016-2028)

TABLE 019. OTHER MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA PREMIX FEED MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA PREMIX FEED MARKET, BY APPLICATION (2016-2028)

TABLE 022. N PREMIX FEED MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE PREMIX FEED MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE PREMIX FEED MARKET, BY APPLICATION (2016-2028)

TABLE 025. PREMIX FEED MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC PREMIX FEED MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC PREMIX FEED MARKET, BY APPLICATION (2016-2028)

TABLE 028. PREMIX FEED MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA PREMIX FEED MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA PREMIX FEED MARKET, BY APPLICATION (2016-2028)

TABLE 031. PREMIX FEED MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA PREMIX FEED MARKET, BY TYPE (2016-2028)

TABLE 033. SOUTH AMERICA PREMIX FEED MARKET, BY APPLICATION (2016-2028)

TABLE 034. PREMIX FEED MARKET, BY COUNTRY (2016-2028)

TABLE 035. GODREJ AGROVET: SNAPSHOT

TABLE 036. GODREJ AGROVET: BUSINESS PERFORMANCE

TABLE 037. GODREJ AGROVET: PRODUCT PORTFOLIO

TABLE 038. GODREJ AGROVET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. LAND O' LAKES FEED: SNAPSHOT

TABLE 039. LAND O' LAKES FEED: BUSINESS PERFORMANCE

TABLE 040. LAND O' LAKES FEED: PRODUCT PORTFOLIO

TABLE 041. LAND O' LAKES FEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. DBN GROUP: SNAPSHOT

TABLE 042. DBN GROUP: BUSINESS PERFORMANCE

TABLE 043. DBN GROUP: PRODUCT PORTFOLIO

TABLE 044. DBN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. FORFARMERS: SNAPSHOT

TABLE 045. FORFARMERS: BUSINESS PERFORMANCE

TABLE 046. FORFARMERS: PRODUCT PORTFOLIO

TABLE 047. FORFARMERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. DLG GROUP: SNAPSHOT

TABLE 048. DLG GROUP: BUSINESS PERFORMANCE

TABLE 049. DLG GROUP: PRODUCT PORTFOLIO

TABLE 050. DLG GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. NIPPAI: SNAPSHOT

TABLE 051. NIPPAI: BUSINESS PERFORMANCE

TABLE 052. NIPPAI: PRODUCT PORTFOLIO

TABLE 053. NIPPAI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. DE HEUS: SNAPSHOT

TABLE 054. DE HEUS: BUSINESS PERFORMANCE

TABLE 055. DE HEUS: PRODUCT PORTFOLIO

TABLE 056. DE HEUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. LALLEMAND ANIMAL NUTRITION: SNAPSHOT

TABLE 057. LALLEMAND ANIMAL NUTRITION: BUSINESS PERFORMANCE

TABLE 058. LALLEMAND ANIMAL NUTRITION: PRODUCT PORTFOLIO

TABLE 059. LALLEMAND ANIMAL NUTRITION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. BIOMIN: SNAPSHOT

TABLE 060. BIOMIN: BUSINESS PERFORMANCE

TABLE 061. BIOMIN: PRODUCT PORTFOLIO

TABLE 062. BIOMIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. INVIVO NSA: SNAPSHOT

TABLE 063. INVIVO NSA: BUSINESS PERFORMANCE

TABLE 064. INVIVO NSA: PRODUCT PORTFOLIO

TABLE 065. INVIVO NSA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BEC FEED SOLUTIONS: SNAPSHOT

TABLE 066. BEC FEED SOLUTIONS: BUSINESS PERFORMANCE

TABLE 067. BEC FEED SOLUTIONS: PRODUCT PORTFOLIO

TABLE 068. BEC FEED SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. NUTRECO NV: SNAPSHOT

TABLE 069. NUTRECO NV: BUSINESS PERFORMANCE

TABLE 070. NUTRECO NV: PRODUCT PORTFOLIO

TABLE 071. NUTRECO NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. CARGILL: SNAPSHOT

TABLE 072. CARGILL: BUSINESS PERFORMANCE

TABLE 073. CARGILL: PRODUCT PORTFOLIO

TABLE 074. CARGILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ARCHER DANIELS MIDLAND: SNAPSHOT

TABLE 075. ARCHER DANIELS MIDLAND: BUSINESS PERFORMANCE

TABLE 076. ARCHER DANIELS MIDLAND: PRODUCT PORTFOLIO

TABLE 077. ARCHER DANIELS MIDLAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PREMIX FEED MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PREMIX FEED MARKET OVERVIEW BY TYPE

FIGURE 012. ANTIBIOTICS MARKET OVERVIEW (2016-2028)

FIGURE 013. VITAMINS MARKET OVERVIEW (2016-2028)

FIGURE 014. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

FIGURE 015. AMINO ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 016. MINERALS MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. PREMIX FEED MARKET OVERVIEW BY APPLICATION

FIGURE 019. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 020. RUMINANTS MARKET OVERVIEW (2016-2028)

FIGURE 021. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 022. AQUATIC ANIMALS MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA PREMIX FEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE PREMIX FEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC PREMIX FEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA PREMIX FEED MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA PREMIX FEED MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Premix Feed Market research report is 2024-2032.

Cargill, Incorporated (U.S.), ADM (U.S.), Land O'Lakes, Inc (U.S.), Watson Foods Co., Inc (U.S.), Farbest-Tallman Foods Corporation (U.S.), Wright Enrichment Inc. (U.S.), BASF SE (Germany), SternVitamin GmbH & Co. KG (Germany), Koninklijke DSM N.V (Netherlands), Corbion N.V. (Netherlands), Nutreco N.V. (Netherlands), AB Agri Ltd. (UK), Devenish Nutrition LLC. (UK), Agrofeed Ltd. (Greece), Vitablend Nederland BV (NetherLands), Dansk Landbrugs Grovvareselskab A.M.B.A. (DLG) (Denmark), Glanbia plc (Ireland), Zagro Asia Ltd (Singapore), Charoen Pokphand Foods PCL (Thailand), Godrej Agrovet (India), and Other Major Players.

The Premix Feed Market is segmented into Ingredient Type, Nature, Application, and region. By Ingredient Type, the market is categorized into Vitamins, Minerals, Amino acids, Antibiotics, Antibiotics, and Others. By Form, the market is categorized into Dry and Liquid. By Application, the market is categorized into Poultry, Ruminants, Aquatic animals, Equine, Pets, and Swine. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Premix feed comprises a unique mixture of vitamins, minerals, and vital nutrients incorporated into animal feed to maintain nutritional equilibrium. These premixed supplements are customized to fulfill the distinct dietary needs of various livestock species, thereby enhancing their well-being, development, and overall efficiency.

Global Premix Feed Market Size Was Valued at USD 27.43 Billion in 2023, and is Projected to Reach USD 50.3 Billion by 2032, Growing at a CAGR of 6.97 % From 2024-2032.