Global Power-over-Ethernet (PoE) Chipsets Market Overview

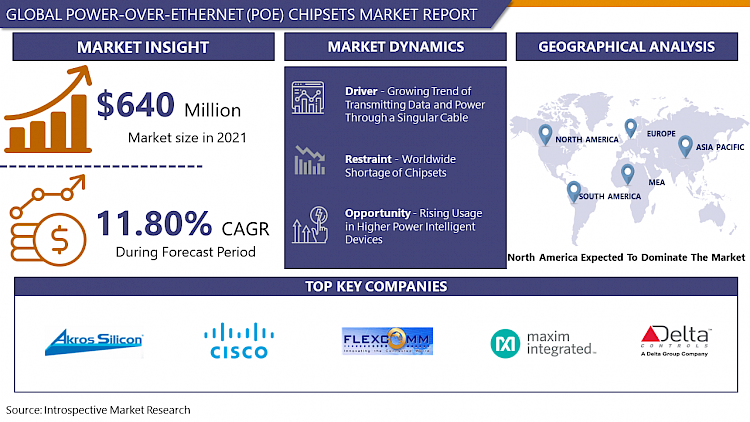

Power-over-Ethernet (PoE) Chipsets Market to reach 1400 million USD in 2028 from an estimated 640 million USD in 2021, growing at CAGR of 11.80%.

Power over Ethernet is considered as an innovative technology that allows delivery of power over standard Ethernet infrastructure to facilitate quick and easy connection of Wireless Local Area Network access points which are generally used in surveillance cameras, telephones, and various IP-based devices. The production of Ethernet-connected devices such as security cameras, and access points, LED luminaires, and Internet of Things appliances has created an extraordinary demand for more power. PoE is the primary factor to connect the access points efficiently, cost-effectively, and reliably power network devices. One of the key features of PoE is to transmit the power supply and network connectivity in a single cable makes it convenient and allows it to use in various applications. PoE chipsets are being sued as a junction to connect and supply power and network cables and a variety of access point standards such as 802.11ac and 802.11ax.

Growing IT Sector and high usage of internet and network connectivity as well as security solutions in commercial and residential applications and also smart meter adoption to save the energy slippage due to network and power disability which boost the demand for seamless connections and minimum disruptions created a demand for PoE chipsets in the global market.

Market Dynamics and Factors:

Drivers

POE is a technology that allows the transmission of the electric indications with data over connected Ethernet cables and enables the transfer of electric power with data through the same power cable to the power over Ethernet-enabled devices.The POE market is projected to witness significant growth over the forecast period due to various factors impacting the growing use of IP technologies and their usage in various applications and the growing trend of transmitting data and power through a singular cable covering large distances with POE injectors and switches. With large adoption of fiber cables for communication is expected to provide an upthrust to the market. Increasing energy costs and implementation of POE in the commercial sector have caused a major upsurge in the growth of the global PoE chipset market.

Increase in demand of VoIP Deployments Shoots Market Opportunities for PoE Chipsets as major workforce around the world is working from home creating demand in setup for residential internet connection and broadband setups makes lucrative opportunity for PoE chipset market. LED lighting and digital signage is the new emerging trend replacing old-style billboard advertisement practices and large user and installation of PoE cables and network lines capturing vast area caused the major demand for top-quality PoE chipset globally.

Restraints

To meet the high global demand and limited manufacturers creates an unproportionate demand-supply ratio. There is high demand in North America and the Asia Pacific creating pressure on the manufacturer to meet the global demand. The scarcity of raw materials like copper and steel creates a worldwide shortage of chipsets and hampers manufacturing. 2020-2021 global chip and chipset shortage due to unavailability of raw material is the most recent event and major restraining factor to the global PoE chipset market.

Opportunities

Currently, PoE Chipsets are being used in various applications to Higher Power Intelligent Devices such as smart solar power solutions and power storage devices and also growing popularity in the internet of things and smart building infrastructure has the major application of PoE chipsets making a crucial link in vast applications. Security and defense sectors have a massive opportunity for PoE chipset as high-power data cables and connections which required high tolerance junction ports which need to sustain in a tough environment. Durable PoE chipsets have a massive opportunity in the defense and security sector globally.

Market Segmentation Analysis

By Type, Powered devices are the dominating segment in the PoE Chipsets market. PoE chipsets are used in the devices which are powered through LAN cable avoiding two different cable connections or power sources. LAN cables can securely provide power and data for IoT devices without connecting long power cables. PoE-powered devices are being used in various applications such as lighting and digital signage, Computer displays and video conferencing systems, Telephones and phone charging stations, Internet access points, PoS (point of sale) systems, and Door access, security cameras, and fire alarm systems. Hence the PoE-powered devices have boosted the demand for PoE chipsets globally. Power Sourcing devices contain network switches, injectors, repeaters, and extenders that offer data, electricity which has relatively less demand in the global market.

By Standard, 802.3bt Standard chipsets are leading in the standard segment of the PoE Chipsets market. 802.3bt is the newly introduced and widely adopted standard chipset due to Working over four pairs and providing low standby power support, automatic class functionality, and improved mutual identification process which is the key reasons for growth in the demand in the telecom and internet sector in the residential and commercial sector. A microchip is a leading manufacturer and innovator in PoE technology and a major developer of 802.3af, 802.3at, 802.3bt IEEE standards.

By Device, Ethernet switch and injector dominating the segment in PoE chipset market. Ethernet switch and injector used in large applications such as internet and broadband connections also it is used in security camera and connections which has domestic and commercial applications globally making a large market for PoE chipsets to utilized in various devices as well. PoE chipset also used in wireless radio access points and VoIP phones which in security and defense sector. Seamless and uninterrupted connections make it a preferred option in such a sector.

By Application, Connectivity dominates the application segment in the PoE Chipset market as it is used heavily in ethernet connections, internet, and Wi-Fi router and also used as a junction to the power transmitting cables. Commercial buildings and offices require complex wired connections in all points to function smoothly in daily tasks especially in the IT sector which requires uninterrupted internet and internal device connections make it most widely applied. Security camera and wired and power connection is the second leading application of PoE Chipset globally.

By End User, the Residential segment has seen the major growth in the use of PoE chipset as the internet connectivity boom has boosted the market due to the covid19 pandemic and the repercussions on the working and education culture. Lockdown, work from home and online schooling has boosted the demand for home internet connectivity which eventually reflected in the global demand for PoE Chipsets. Commercial utilization of in-office connectivity and also security camera connection required a PoE chipset in various designs and applications. Security companies with generic equipment opt for the high-quality chipset into integrated security solutions is also one of the reasons for the growth of the PoE chipset market globally.

Regional Analysis of PoE Chipsets Market

North America is the dominating region in the global PoE chipset market accounting for the largest share in the market. The high installation rate of internet and ethernet connections in the domestic and commercial sector and the highest security systems operated and being installed making the growth of the PoE chipset market in the North America Region. The defense sector is one foe the major contributor of growth in PoE chipset demand as major surveillance and security connections required high-class PoE chipsets in the applications like wireless radio access points, proximity sensors, VoIP phones, and security systems.

The Asia Pacific is the second leading region and is anticipated to witness significant growth in demand for high-speed internet amenities and automation in various industries. Moreover, Japan, China, India, Singapore, and Hong Kong are predicted to be the major contributors to the growth of the newly launched 802.3bt standard in the region.

Players Covered in PoE Chipsets Market are :

- Akros Silicon Inc.

- Cisco Systems Inc

- Flexcomm Technology Limited

- Maxim Integrated Products Inc

- Microsemi Corporation

- Texas Instruments Incorporated

- Linear Technology Corporation

- ON Semiconductor

- Silicon Laboratories

- STMicroelectronics

- Broadcom Ltd.

- Delta Controls Inc.

- Monolithic Power Systems

- NXP Semiconductors N.V.

- Semtech Corporation

- Shenzhen Lianrui Electronics Co. Ltd. and other major players.

Key Developments of PoE Chipsets Market

March 2020, New Generation 802.3bt PoE chipsets deployment is the new opting standard practice in various sectors creating demand for 802.3bt standard chipset due to its key features like Working over four pairs and providing low standby power support, the automatic class functionality.

Covid19 Impact Analysis on PoE Chipsets Market

The covid19 pandemic has been a serious factor for major manufacturing countries like China, India, and United States. Many leading manufacturers had stopped the manufacturing process and halted the export disrupted global supply chain. In 2020, global chip and chipset shortage due to scarcity of raw material had caused a major setback for the PoE chipset market. However, Demand for PoE chipset has seen a significant boom as demand in the network connectivity sector has increased due to imposition of lockdown and work from home- and home-schooling norms boosted the large residential connectivity demand ultimately reflected on the PoE Chipset market.

|

Global Power-over-Ethernet (PoE) Chipsets Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 640 Mn. |

|

Forecast Period 2022-28 CAGR: |

11.80% |

Market Size in 2028: |

USD 1400 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Device |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Device

3.4 By End Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Power-over-Ethernet (PoE) Chipsets Market by Type

5.1 Power-over-Ethernet (PoE) Chipsets Market Overview Snapshot and Growth Engine

5.2 Power-over-Ethernet (PoE) Chipsets Market Overview

5.3 Power Sourcing Chipsets

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Power Sourcing Chipsets: Grographic Segmentation

5.4 Powered Devices Chipsets

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Powered Devices Chipsets: Grographic Segmentation

Chapter 6: Power-over-Ethernet (PoE) Chipsets Market by Application

6.1 Power-over-Ethernet (PoE) Chipsets Market Overview Snapshot and Growth Engine

6.2 Power-over-Ethernet (PoE) Chipsets Market Overview

6.3 Connectivity

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Connectivity: Grographic Segmentation

6.4 Infotainment

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Infotainment: Grographic Segmentation

6.5 LED Lighting

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 LED Lighting: Grographic Segmentation

6.6 Security

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Security: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Power-over-Ethernet (PoE) Chipsets Market by Device

7.1 Power-over-Ethernet (PoE) Chipsets Market Overview Snapshot and Growth Engine

7.2 Power-over-Ethernet (PoE) Chipsets Market Overview

7.3 Network Cameras

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Network Cameras: Grographic Segmentation

7.4 VoIP Phone

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 VoIP Phone: Grographic Segmentation

7.5 Ethernet Switch & Injector

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Ethernet Switch & Injector: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Power-over-Ethernet (PoE) Chipsets Market by End Users

8.1 Power-over-Ethernet (PoE) Chipsets Market Overview Snapshot and Growth Engine

8.2 Power-over-Ethernet (PoE) Chipsets Market Overview

8.3 Commercial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Commercial: Grographic Segmentation

8.4 Industrial

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Industrial: Grographic Segmentation

8.5 Residential

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Residential: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Power-over-Ethernet (PoE) Chipsets Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Power-over-Ethernet (PoE) Chipsets Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Power-over-Ethernet (PoE) Chipsets Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 AKROS SILICON INC.

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 CISCO SYSTEMS INC

9.4 FLEXCOMM TECHNOLOGY LIMITED

9.5 MAXIM INTEGRATED PRODUCTS INC

9.6 MICROSEMI CORPORATION

9.7 TEXAS INSTRUMENTS INCORPORATED

9.8 LINEAR TECHNOLOGY CORPORATION

9.9 ON SEMICONDUCTOR

9.10 SILICON LABORATORIES

9.11 STMICROELECTRONICS

9.12 BROADCOM LTD.

9.13 DELTA CONTROLS INC.

9.14 MONOLITHIC POWER SYSTEMS

9.15 NXP SEMICONDUCTORS N.V.

9.16 SEMTECH CORPORATION

9.17 SHENZHEN LIANRUI ELECTRONICS CO. LTD.

9.18 OTHER MAJOR PLAYERS

Chapter 10: Global Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Power Sourcing Chipsets

10.2.2 Powered Devices Chipsets

10.3 Historic and Forecasted Market Size By Application

10.3.1 Connectivity

10.3.2 Infotainment

10.3.3 LED Lighting

10.3.4 Security

10.3.5 Others

10.4 Historic and Forecasted Market Size By Device

10.4.1 Network Cameras

10.4.2 VoIP Phone

10.4.3 Ethernet Switch & Injector

10.4.4 Others

10.5 Historic and Forecasted Market Size By End Users

10.5.1 Commercial

10.5.2 Industrial

10.5.3 Residential

Chapter 11: North America Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Power Sourcing Chipsets

11.4.2 Powered Devices Chipsets

11.5 Historic and Forecasted Market Size By Application

11.5.1 Connectivity

11.5.2 Infotainment

11.5.3 LED Lighting

11.5.4 Security

11.5.5 Others

11.6 Historic and Forecasted Market Size By Device

11.6.1 Network Cameras

11.6.2 VoIP Phone

11.6.3 Ethernet Switch & Injector

11.6.4 Others

11.7 Historic and Forecasted Market Size By End Users

11.7.1 Commercial

11.7.2 Industrial

11.7.3 Residential

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Power Sourcing Chipsets

12.4.2 Powered Devices Chipsets

12.5 Historic and Forecasted Market Size By Application

12.5.1 Connectivity

12.5.2 Infotainment

12.5.3 LED Lighting

12.5.4 Security

12.5.5 Others

12.6 Historic and Forecasted Market Size By Device

12.6.1 Network Cameras

12.6.2 VoIP Phone

12.6.3 Ethernet Switch & Injector

12.6.4 Others

12.7 Historic and Forecasted Market Size By End Users

12.7.1 Commercial

12.7.2 Industrial

12.7.3 Residential

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Power Sourcing Chipsets

13.4.2 Powered Devices Chipsets

13.5 Historic and Forecasted Market Size By Application

13.5.1 Connectivity

13.5.2 Infotainment

13.5.3 LED Lighting

13.5.4 Security

13.5.5 Others

13.6 Historic and Forecasted Market Size By Device

13.6.1 Network Cameras

13.6.2 VoIP Phone

13.6.3 Ethernet Switch & Injector

13.6.4 Others

13.7 Historic and Forecasted Market Size By End Users

13.7.1 Commercial

13.7.2 Industrial

13.7.3 Residential

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Power Sourcing Chipsets

14.4.2 Powered Devices Chipsets

14.5 Historic and Forecasted Market Size By Application

14.5.1 Connectivity

14.5.2 Infotainment

14.5.3 LED Lighting

14.5.4 Security

14.5.5 Others

14.6 Historic and Forecasted Market Size By Device

14.6.1 Network Cameras

14.6.2 VoIP Phone

14.6.3 Ethernet Switch & Injector

14.6.4 Others

14.7 Historic and Forecasted Market Size By End Users

14.7.1 Commercial

14.7.2 Industrial

14.7.3 Residential

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Power-over-Ethernet (PoE) Chipsets Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Power Sourcing Chipsets

15.4.2 Powered Devices Chipsets

15.5 Historic and Forecasted Market Size By Application

15.5.1 Connectivity

15.5.2 Infotainment

15.5.3 LED Lighting

15.5.4 Security

15.5.5 Others

15.6 Historic and Forecasted Market Size By Device

15.6.1 Network Cameras

15.6.2 VoIP Phone

15.6.3 Ethernet Switch & Injector

15.6.4 Others

15.7 Historic and Forecasted Market Size By End Users

15.7.1 Commercial

15.7.2 Industrial

15.7.3 Residential

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Power-over-Ethernet (PoE) Chipsets Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 640 Mn. |

|

Forecast Period 2022-28 CAGR: |

11.80% |

Market Size in 2028: |

USD 1400 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Device |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET COMPETITIVE RIVALRY

TABLE 005. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET THREAT OF NEW ENTRANTS

TABLE 006. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET THREAT OF SUBSTITUTES

TABLE 007. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BY TYPE

TABLE 008. POWER SOURCING CHIPSETS MARKET OVERVIEW (2016-2028)

TABLE 009. POWERED DEVICES CHIPSETS MARKET OVERVIEW (2016-2028)

TABLE 010. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BY APPLICATION

TABLE 011. CONNECTIVITY MARKET OVERVIEW (2016-2028)

TABLE 012. INFOTAINMENT MARKET OVERVIEW (2016-2028)

TABLE 013. LED LIGHTING MARKET OVERVIEW (2016-2028)

TABLE 014. SECURITY MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BY DEVICE

TABLE 017. NETWORK CAMERAS MARKET OVERVIEW (2016-2028)

TABLE 018. VOIP PHONE MARKET OVERVIEW (2016-2028)

TABLE 019. ETHERNET SWITCH & INJECTOR MARKET OVERVIEW (2016-2028)

TABLE 020. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 021. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET BY END USERS

TABLE 022. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 023. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 024. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY TYPE (2016-2028)

TABLE 026. NORTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY APPLICATION (2016-2028)

TABLE 027. NORTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY DEVICE (2016-2028)

TABLE 028. NORTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY END USERS (2016-2028)

TABLE 029. N POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY TYPE (2016-2028)

TABLE 031. EUROPE POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY APPLICATION (2016-2028)

TABLE 032. EUROPE POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY DEVICE (2016-2028)

TABLE 033. EUROPE POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY END USERS (2016-2028)

TABLE 034. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY COUNTRY (2016-2028)

TABLE 035. ASIA PACIFIC POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY TYPE (2016-2028)

TABLE 036. ASIA PACIFIC POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY APPLICATION (2016-2028)

TABLE 037. ASIA PACIFIC POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY DEVICE (2016-2028)

TABLE 038. ASIA PACIFIC POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY END USERS (2016-2028)

TABLE 039. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY COUNTRY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY TYPE (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY APPLICATION (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY DEVICE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY END USERS (2016-2028)

TABLE 044. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY COUNTRY (2016-2028)

TABLE 045. SOUTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY TYPE (2016-2028)

TABLE 046. SOUTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY APPLICATION (2016-2028)

TABLE 047. SOUTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY DEVICE (2016-2028)

TABLE 048. SOUTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY END USERS (2016-2028)

TABLE 049. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET, BY COUNTRY (2016-2028)

TABLE 050. AKROS SILICON INC.: SNAPSHOT

TABLE 051. AKROS SILICON INC.: BUSINESS PERFORMANCE

TABLE 052. AKROS SILICON INC.: PRODUCT PORTFOLIO

TABLE 053. AKROS SILICON INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. CISCO SYSTEMS INC: SNAPSHOT

TABLE 054. CISCO SYSTEMS INC: BUSINESS PERFORMANCE

TABLE 055. CISCO SYSTEMS INC: PRODUCT PORTFOLIO

TABLE 056. CISCO SYSTEMS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. FLEXCOMM TECHNOLOGY LIMITED: SNAPSHOT

TABLE 057. FLEXCOMM TECHNOLOGY LIMITED: BUSINESS PERFORMANCE

TABLE 058. FLEXCOMM TECHNOLOGY LIMITED: PRODUCT PORTFOLIO

TABLE 059. FLEXCOMM TECHNOLOGY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. MAXIM INTEGRATED PRODUCTS INC: SNAPSHOT

TABLE 060. MAXIM INTEGRATED PRODUCTS INC: BUSINESS PERFORMANCE

TABLE 061. MAXIM INTEGRATED PRODUCTS INC: PRODUCT PORTFOLIO

TABLE 062. MAXIM INTEGRATED PRODUCTS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. MICROSEMI CORPORATION: SNAPSHOT

TABLE 063. MICROSEMI CORPORATION: BUSINESS PERFORMANCE

TABLE 064. MICROSEMI CORPORATION: PRODUCT PORTFOLIO

TABLE 065. MICROSEMI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. TEXAS INSTRUMENTS INCORPORATED: SNAPSHOT

TABLE 066. TEXAS INSTRUMENTS INCORPORATED: BUSINESS PERFORMANCE

TABLE 067. TEXAS INSTRUMENTS INCORPORATED: PRODUCT PORTFOLIO

TABLE 068. TEXAS INSTRUMENTS INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LINEAR TECHNOLOGY CORPORATION: SNAPSHOT

TABLE 069. LINEAR TECHNOLOGY CORPORATION: BUSINESS PERFORMANCE

TABLE 070. LINEAR TECHNOLOGY CORPORATION: PRODUCT PORTFOLIO

TABLE 071. LINEAR TECHNOLOGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. ON SEMICONDUCTOR: SNAPSHOT

TABLE 072. ON SEMICONDUCTOR: BUSINESS PERFORMANCE

TABLE 073. ON SEMICONDUCTOR: PRODUCT PORTFOLIO

TABLE 074. ON SEMICONDUCTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SILICON LABORATORIES: SNAPSHOT

TABLE 075. SILICON LABORATORIES: BUSINESS PERFORMANCE

TABLE 076. SILICON LABORATORIES: PRODUCT PORTFOLIO

TABLE 077. SILICON LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. STMICROELECTRONICS: SNAPSHOT

TABLE 078. STMICROELECTRONICS: BUSINESS PERFORMANCE

TABLE 079. STMICROELECTRONICS: PRODUCT PORTFOLIO

TABLE 080. STMICROELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. BROADCOM LTD.: SNAPSHOT

TABLE 081. BROADCOM LTD.: BUSINESS PERFORMANCE

TABLE 082. BROADCOM LTD.: PRODUCT PORTFOLIO

TABLE 083. BROADCOM LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. DELTA CONTROLS INC.: SNAPSHOT

TABLE 084. DELTA CONTROLS INC.: BUSINESS PERFORMANCE

TABLE 085. DELTA CONTROLS INC.: PRODUCT PORTFOLIO

TABLE 086. DELTA CONTROLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. MONOLITHIC POWER SYSTEMS: SNAPSHOT

TABLE 087. MONOLITHIC POWER SYSTEMS: BUSINESS PERFORMANCE

TABLE 088. MONOLITHIC POWER SYSTEMS: PRODUCT PORTFOLIO

TABLE 089. MONOLITHIC POWER SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. NXP SEMICONDUCTORS N.V.: SNAPSHOT

TABLE 090. NXP SEMICONDUCTORS N.V.: BUSINESS PERFORMANCE

TABLE 091. NXP SEMICONDUCTORS N.V.: PRODUCT PORTFOLIO

TABLE 092. NXP SEMICONDUCTORS N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. SEMTECH CORPORATION: SNAPSHOT

TABLE 093. SEMTECH CORPORATION: BUSINESS PERFORMANCE

TABLE 094. SEMTECH CORPORATION: PRODUCT PORTFOLIO

TABLE 095. SEMTECH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. SHENZHEN LIANRUI ELECTRONICS CO. LTD.: SNAPSHOT

TABLE 096. SHENZHEN LIANRUI ELECTRONICS CO. LTD.: BUSINESS PERFORMANCE

TABLE 097. SHENZHEN LIANRUI ELECTRONICS CO. LTD.: PRODUCT PORTFOLIO

TABLE 098. SHENZHEN LIANRUI ELECTRONICS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 099. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 100. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 101. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY TYPE

FIGURE 012. POWER SOURCING CHIPSETS MARKET OVERVIEW (2016-2028)

FIGURE 013. POWERED DEVICES CHIPSETS MARKET OVERVIEW (2016-2028)

FIGURE 014. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY APPLICATION

FIGURE 015. CONNECTIVITY MARKET OVERVIEW (2016-2028)

FIGURE 016. INFOTAINMENT MARKET OVERVIEW (2016-2028)

FIGURE 017. LED LIGHTING MARKET OVERVIEW (2016-2028)

FIGURE 018. SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY DEVICE

FIGURE 021. NETWORK CAMERAS MARKET OVERVIEW (2016-2028)

FIGURE 022. VOIP PHONE MARKET OVERVIEW (2016-2028)

FIGURE 023. ETHERNET SWITCH & INJECTOR MARKET OVERVIEW (2016-2028)

FIGURE 024. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 025. POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY END USERS

FIGURE 026. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 027. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 028. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA POWER-OVER-ETHERNET (POE) CHIPSETS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Power-over-Ethernet (PoE) Chipsets Market research report is 2022-2028.

Akros Silicon Inc., Cisco Systems Inc, Flexcomm Technology Limited, Maxim Integrated Products Inc, Microsemi Corporation, Texas Instruments Incorporated, Linear Technology Corporation, ON Semiconductor, Silicon Laboratories, STMicroelectronics, Broadcom Ltd., Delta Controls Inc., Monolithic Power Systems, NXP Semiconductors N.V., Semtech Corporation, Shenzhen Lianrui Electronics Co. Ltd., and other major players.

The Power-over-Ethernet (PoE) Chipsets Market is segmented into type, application, device, end users, and region. By Type, the market is categorized into Power Sourcing Chipsets and Powered Devices Chipsets. By Application, the market is categorized into Connectivity, Infotainment, LED Lighting, Security, and Others. By Device, the market is categorized into Network Cameras, VoIP Phone, Ethernet Switch & Injector, and Others. By End Users, the market is categorized into Commercial, Industrial, and Residential. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Power over Ethernet is considered as an innovative technology that allows delivery of power over standard Ethernet infrastructure to facilitate quick and easy connection of Wireless Local Area Network access points which are generally used in surveillance cameras, telephones, and various IP-based devices.

The Power-over-Ethernet (PoE) Chipsets Market was valued at USD 640 Million in 2021 and is projected to reach USD 1400 Billion by 2028, growing at a CAGR of 11.80% from 2022 to 2028.