Global Power Distribution Unit (PDU) Market Overview

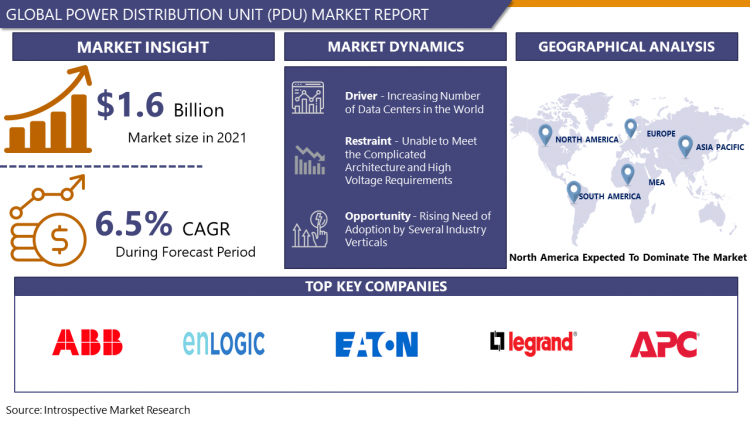

Global Power Distribution Unit (PDU)Market Size Was Valued at USD 1.70 Billion In 2022 And Is Projected to Reach USD 2.82 Billion By 2030, Growing at A CAGR of 6.5% From 2023 To 2030.

PDUs are power distribution units that provide electricity to computers and other networking equipment in data centers. They have many outputs and can measure and control the quantity of electricity that is distributed. Multiple low amperage outlets are available from high amperage outlets on PDU models with high amperage plugs. They are typically used to ensure that power from a UPS (uninterruptible power supply), generator, or utility source is distributed reliably to various devices. Carbon emissions and power usage are predicted to rise dramatically as the number of data centers grows. Constant monitoring of electricity consumption is projected to become a requirement to comply with environmental requirements. In such cases, modern power distribution units with unique features are expected to assist data centers. Intelligent PDUs, for example, provide increased uptime, capacity planning, reduced power consumption, real-time data collection, and remote monitoring, all while lowering expenses. The expansion of the worldwide power distribution unit market is aided by an increase in data volume, which leads to an increased need for data centers. Intelligent PDUs, for example, provide increased uptime, capacity planning, reduced power consumption, real-time data collection, and remote monitoring, all while lowering expenses. The expansion of the worldwide power distribution unit market is aided by an increase in data volume, which leads to an increased need for data centers.

Covid-19 Impact On Power Distribution Unit (PDU) Market

The COVID-19 pandemic has had devastating effects on several industry verticals globally. To constrain the number of cases and slow the coronavirus spread, various public health guidelines were implemented in different countries across the globe. COVID-19 protocols range from declaring national emergency states, enforcing stay-at-home orders, closing nonessential business operations and schools, banning public gatherings, imposing curfews, distributing digital passes, and allowing police to restrict citizen movements within a country, as well as closing international borders. With the growing vaccination rate, governments are uplifting the protocols to give a boost to the stagnant economy. Furthermore, because of the current COVID-19 outbreak, people are being recommended to stay at home as a precaution. Several companies have implemented a work-from-home policy to protect their employees and better serve their customers. As a result, digital traffic has increased, as has the use of online communication services. Data centers are playing a key role in securing and sustaining secure digital infrastructure during this uncertain time. The importance of enhanced digital infrastructure, as well as data centers, is expected to be highlighted as a result of this crisis, paving the way for market expansion. Like other industries, the Power Distribution Unit (PDU) Market has experienced a slow down the growth; however, the market is expected to bounce back as restrictions are being lifted by governments across the globe.

Market Dynamics And Factors For Power Distribution Unit (PDU) Market

Drivers:

In the future years, it is expected that the growing number of data centers in all parts of the world would fuel significant expansion prospects in the global power distribution unit market. A power distribution unit is a stationary device with many outputs that distributes electric power to racks of networking equipment and PCs in a data center. These devices can measure and control the quantity of power that will be distributed. Models of power distribution units with a high number of amperage plugs can produce multiple low-amperage outlets from a single high-amperage outlet. The major goal of installing these models is to ensure that power from a generator, utility source, or uninterruptible power source is distributed reliably to a large number of devices (UPS). While the number of data centers is projected to grow in the next years, so will the prospect of increased power consumption and carbon emissions. As a result, the requirement to constantly monitor power use and adhere to environmental rules will increase. As a result, demand for advanced power distribution units with current characteristics is likely to raise from data centers all over the world.

Restraints:

Current PDUs are unable to meet the complicated architecture and high voltage requirements needed to develop reliable data center management systems. Customers seeking stable and uninterrupted electrical supply solutions for their high-end data center businesses will be discouraged by these constraints. Even after these Units have been thoroughly tested and installed, issues such as overhead line sag, circuit breaker failure, overloading and failure of high voltage transformers, and subterranean cable treeing are unavoidable and can result in significant downtime and power outages in data centers. As a result, these factors will have an impact on the market's growth over the forecast period.

Challenges:

The rising complexity of data center designs is the primary problem facing the PDU market. High investment prices and interoperability concerns may also be stumbling blocks to the PDU market's expansion.

Opportunities:

With potential in telecom & IT, banking, healthcare, and other industries, the future of the power distribution unit market is bright. Because digital transformation and consumer needs are always changing, the power distribution unit must adapt to these changes. The need for PDU is expected to rise as the number of high-power IT devices, high-density, and high-capability applications in data centers grow, regardless of quality, capability, or dependability. To remain competitive in the future PDU market, intelligent power distribution unit solutions with extra features such as remote monitoring and management and real-time digital monitoring will expand during the anticipated period.

Market Segmentation

Segmentation Analysis of Power Distribution Unit (PDU) Market:

By Type, metered power type segment is anticipated to dominate the power distribution unit (PDU) market over the forecast period. Metered power distribution units deliver local visual monitoring capability through an in-built LED screen that displays real-time power consumption data. The metered power distribution units are categorized into inlet and outlet metered power distribution units. Inlet metered power distribution units determine the available capacity of the racks, whereas the outlet metered power distribution units permit end users to understand the actual power consumption at the device or server level. This enables the optimum management of power used for powering specific business units of customers and increases the efficiency of data centers. The real-time data consumption for power along with comparatively low costs drives the metered power distribution unit market.

By Phase, the three-phase segment is anticipated to grow at a faster rate over the forecast period. Three-phase power distribution units at the cabinets and data centers help in minimizing losses and simplifying the load balance at all input and output power points. The advantages of installing three-phase power distribution units are that the cost of cabling for three phases is very low as compared to a single-phase; also, the total installation time is less. These power distribution units are suitable for heavy industries that require continuous power. With hyper-scale data centers and increasing cloud-based operations across the end-user industries, the demand for three-phase power distribution units is projected to increase during the forecast period.

By End-User, Telecom & IT sector is expected to register the maximum power distribution unit market share over the forecast period. Various IT organizations and telecommunication companies, such as mobile number operators and wireless service providers, are included in IT and Telecom. For both IT businesses and telecom providers, data centers have become a more significant asset. Furthermore, the universal power distribution unit market is primarily driven by the increasing amount of data generated globally. Global population growth is increasing the amount of data collected across several business segments, such as the telecommunications and information technology industries. PDUs are required by these businesses to efficiently distribute power, and so are projected to be in high demand in the coming years.

Regional Analysis of Power Distribution Unit (PDU) Market:

Over the forecast period, the Americas is expected to be the largest market, owing to increased demand for data centers in the United States and Canada. Due to advancements in IT infrastructure, demand for PDU is increasing in the telecom and IT sectors. Similarly, the healthcare industry presents growth potential for the PDU market, owing to a surge in demand for lifesaving equipment that requires a continuous power supply for crucial activities. The region is seeing a significant increase in the number of colocation data centers, which presents the lucrative potential for companies in the power distribution sector in the Americas.

Increased corporate infrastructure in developing countries, as well as government measures to improve the IT infrastructure environment, will support market developments in the Asia Pacific area. Continuous substantial increases in IT establishment, as well as the inclusion of automation and cloud-based operations have emphasized the critical relevance of reliable power and data center and server room operation. In addition, a noteworthy increase in the sales and application of novel and advanced laboratory equipment and healthcare machines, which require a fast and constant power supply to perform vital operations and procedures, boosts market demand in the mentioned region.

Increased expenditures from the cloud, internet, co-location, and telecommunication service providers are driving up demand for power distribution units in the European data center development market. EdgeConnex, a European data center provider, is increasing its footprint in Amsterdam, Dublin, and Munich, for example, to better manage power consumption across Europe. In addition, Google has revealed plans to build a data center in Belgium costing around USD 300 million, with all of these initiatives boosting market expansion in Europe.

Players Covered in Power Distribution Unit (PDU) Market are:

- ABB

- Legrand North America LLC

- APC

- Cyber Power Systems (USA) Inc.

- Eaton

- Emerson Electric Co.

- Enlogic

- Geist

- Hewlett Packard Enterprise Development LP

- Cisco Systems

- Raritan Inc.

- Schneider Electric.

- Server Technology Inc.

- Tripp Lite.

- Siemon

- RackOm System

- NOVA ELECTRIC

- Vertiv Group Corp

- Elcom International Private Limited

- Panduit

- Chatsworth Products and others major players.

Key Industry Developments In Power Distribution Unit (PDU) Market

- In April 2021, Sensata Technologies, a manufacturer of industrial technology and power management solutions based in the United States has signed a deal with a major electric truck manufacturer. Sensata Technologies will produce and provide distribution units for DC fast charging power outlets as part of the arrangement.

- In September 2020, Schneider Electric, a leader in energy management and automation digital transformation, has announced the debut of the APC Easy Rack PDU line, which offers connected loads an easy-to-install, easy-to-use, and customized power distribution unit. The new APC Easy Rack PDU series from a globally known brand and pioneer in battery backup power provides reliable power distribution at an affordable price. APC Easy Rack PDUs provide a reliable power continuity solution for end-users in network closets, edge computing settings, and small and medium data centers.

|

Global Power Distribution Unit (PDU) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.70 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5% |

Market Size in 2030: |

USD 2.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Phase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By End User

3.3 By Phase

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Power Distribution Unit (PDU) Market by Type

5.1 Power Distribution Unit (PDU) Market Overview Snapshot and Growth Engine

5.2 Power Distribution Unit (PDU) Market Overview

5.3 Basic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Basic: Grographic Segmentation

5.4 Metered

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Metered: Grographic Segmentation

5.5 Monitored

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Monitored: Grographic Segmentation

5.6 Switched

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Switched: Grographic Segmentation

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Grographic Segmentation

Chapter 6: Power Distribution Unit (PDU) Market by End User

6.1 Power Distribution Unit (PDU) Market Overview Snapshot and Growth Engine

6.2 Power Distribution Unit (PDU) Market Overview

6.3 Telecom & IT

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Telecom & IT: Grographic Segmentation

6.4 Banking

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Banking: Grographic Segmentation

6.5 Financial Services

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Financial Services: Grographic Segmentation

6.6 Insurance (BFSI)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Insurance (BFSI): Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Power Distribution Unit (PDU) Market by Phase

7.1 Power Distribution Unit (PDU) Market Overview Snapshot and Growth Engine

7.2 Power Distribution Unit (PDU) Market Overview

7.3 Single Phase

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Single Phase: Grographic Segmentation

7.4 Three Phase

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Three Phase: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Power Distribution Unit (PDU) Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Power Distribution Unit (PDU) Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Power Distribution Unit (PDU) Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ABB

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 LEGRAND NORTH AMERICA LLC

8.4 APC

8.5 CYBER POWER SYSTEMS (USA) INC.

8.6 EATON

8.7 EMERSON ELECTRIC CO.

8.8 ENLOGIC

8.9 GEIST

8.10 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

8.11 CISCO SYSTEMS

8.12 RARITAN INC.

8.13 SCHNEIDER ELECTRIC.

8.14 SERVER TECHNOLOGY INC.

8.15 TRIPP LITE.

8.16 SIEMON

8.17 RACKOM SYSTEM

8.18 NOVA ELECTRIC

8.19 VERTIV GROUP CORP

8.20 ELCOM INTERNATIONAL PRIVATE LIMITED

8.21 PANDUIT

8.22 CHATSWORTH PRODUCTS

8.23 OTHERS MAJOR PLAYERS

Chapter 9: Global Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Basic

9.2.2 Metered

9.2.3 Monitored

9.2.4 Switched

9.2.5 Others

9.3 Historic and Forecasted Market Size By End User

9.3.1 Telecom & IT

9.3.2 Banking

9.3.3 Financial Services

9.3.4 Insurance (BFSI)

9.3.5 Others

9.4 Historic and Forecasted Market Size By Phase

9.4.1 Single Phase

9.4.2 Three Phase

Chapter 10: North America Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Basic

10.4.2 Metered

10.4.3 Monitored

10.4.4 Switched

10.4.5 Others

10.5 Historic and Forecasted Market Size By End User

10.5.1 Telecom & IT

10.5.2 Banking

10.5.3 Financial Services

10.5.4 Insurance (BFSI)

10.5.5 Others

10.6 Historic and Forecasted Market Size By Phase

10.6.1 Single Phase

10.6.2 Three Phase

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Basic

11.4.2 Metered

11.4.3 Monitored

11.4.4 Switched

11.4.5 Others

11.5 Historic and Forecasted Market Size By End User

11.5.1 Telecom & IT

11.5.2 Banking

11.5.3 Financial Services

11.5.4 Insurance (BFSI)

11.5.5 Others

11.6 Historic and Forecasted Market Size By Phase

11.6.1 Single Phase

11.6.2 Three Phase

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Basic

12.4.2 Metered

12.4.3 Monitored

12.4.4 Switched

12.4.5 Others

12.5 Historic and Forecasted Market Size By End User

12.5.1 Telecom & IT

12.5.2 Banking

12.5.3 Financial Services

12.5.4 Insurance (BFSI)

12.5.5 Others

12.6 Historic and Forecasted Market Size By Phase

12.6.1 Single Phase

12.6.2 Three Phase

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Basic

13.4.2 Metered

13.4.3 Monitored

13.4.4 Switched

13.4.5 Others

13.5 Historic and Forecasted Market Size By End User

13.5.1 Telecom & IT

13.5.2 Banking

13.5.3 Financial Services

13.5.4 Insurance (BFSI)

13.5.5 Others

13.6 Historic and Forecasted Market Size By Phase

13.6.1 Single Phase

13.6.2 Three Phase

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Power Distribution Unit (PDU) Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Basic

14.4.2 Metered

14.4.3 Monitored

14.4.4 Switched

14.4.5 Others

14.5 Historic and Forecasted Market Size By End User

14.5.1 Telecom & IT

14.5.2 Banking

14.5.3 Financial Services

14.5.4 Insurance (BFSI)

14.5.5 Others

14.6 Historic and Forecasted Market Size By Phase

14.6.1 Single Phase

14.6.2 Three Phase

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Power Distribution Unit (PDU) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.70 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5% |

Market Size in 2030: |

USD 2.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By End User |

|

||

|

By Phase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. POWER DISTRIBUTION UNIT (PDU) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. POWER DISTRIBUTION UNIT (PDU) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. POWER DISTRIBUTION UNIT (PDU) MARKET COMPETITIVE RIVALRY

TABLE 005. POWER DISTRIBUTION UNIT (PDU) MARKET THREAT OF NEW ENTRANTS

TABLE 006. POWER DISTRIBUTION UNIT (PDU) MARKET THREAT OF SUBSTITUTES

TABLE 007. POWER DISTRIBUTION UNIT (PDU) MARKET BY TYPE

TABLE 008. BASIC MARKET OVERVIEW (2016-2028)

TABLE 009. METERED MARKET OVERVIEW (2016-2028)

TABLE 010. MONITORED MARKET OVERVIEW (2016-2028)

TABLE 011. SWITCHED MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. POWER DISTRIBUTION UNIT (PDU) MARKET BY END USER

TABLE 014. TELECOM & IT MARKET OVERVIEW (2016-2028)

TABLE 015. BANKING MARKET OVERVIEW (2016-2028)

TABLE 016. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 017. INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. POWER DISTRIBUTION UNIT (PDU) MARKET BY PHASE

TABLE 020. SINGLE PHASE MARKET OVERVIEW (2016-2028)

TABLE 021. THREE PHASE MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY END USER (2016-2028)

TABLE 024. NORTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY PHASE (2016-2028)

TABLE 025. N POWER DISTRIBUTION UNIT (PDU) MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE POWER DISTRIBUTION UNIT (PDU) MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE POWER DISTRIBUTION UNIT (PDU) MARKET, BY END USER (2016-2028)

TABLE 028. EUROPE POWER DISTRIBUTION UNIT (PDU) MARKET, BY PHASE (2016-2028)

TABLE 029. POWER DISTRIBUTION UNIT (PDU) MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC POWER DISTRIBUTION UNIT (PDU) MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC POWER DISTRIBUTION UNIT (PDU) MARKET, BY END USER (2016-2028)

TABLE 032. ASIA PACIFIC POWER DISTRIBUTION UNIT (PDU) MARKET, BY PHASE (2016-2028)

TABLE 033. POWER DISTRIBUTION UNIT (PDU) MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY END USER (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY PHASE (2016-2028)

TABLE 037. POWER DISTRIBUTION UNIT (PDU) MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY END USER (2016-2028)

TABLE 040. SOUTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET, BY PHASE (2016-2028)

TABLE 041. POWER DISTRIBUTION UNIT (PDU) MARKET, BY COUNTRY (2016-2028)

TABLE 042. ABB: SNAPSHOT

TABLE 043. ABB: BUSINESS PERFORMANCE

TABLE 044. ABB: PRODUCT PORTFOLIO

TABLE 045. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. LEGRAND NORTH AMERICA LLC: SNAPSHOT

TABLE 046. LEGRAND NORTH AMERICA LLC: BUSINESS PERFORMANCE

TABLE 047. LEGRAND NORTH AMERICA LLC: PRODUCT PORTFOLIO

TABLE 048. LEGRAND NORTH AMERICA LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. APC: SNAPSHOT

TABLE 049. APC: BUSINESS PERFORMANCE

TABLE 050. APC: PRODUCT PORTFOLIO

TABLE 051. APC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CYBER POWER SYSTEMS (USA) INC.: SNAPSHOT

TABLE 052. CYBER POWER SYSTEMS (USA) INC.: BUSINESS PERFORMANCE

TABLE 053. CYBER POWER SYSTEMS (USA) INC.: PRODUCT PORTFOLIO

TABLE 054. CYBER POWER SYSTEMS (USA) INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. EATON: SNAPSHOT

TABLE 055. EATON: BUSINESS PERFORMANCE

TABLE 056. EATON: PRODUCT PORTFOLIO

TABLE 057. EATON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EMERSON ELECTRIC CO.: SNAPSHOT

TABLE 058. EMERSON ELECTRIC CO.: BUSINESS PERFORMANCE

TABLE 059. EMERSON ELECTRIC CO.: PRODUCT PORTFOLIO

TABLE 060. EMERSON ELECTRIC CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ENLOGIC: SNAPSHOT

TABLE 061. ENLOGIC: BUSINESS PERFORMANCE

TABLE 062. ENLOGIC: PRODUCT PORTFOLIO

TABLE 063. ENLOGIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GEIST: SNAPSHOT

TABLE 064. GEIST: BUSINESS PERFORMANCE

TABLE 065. GEIST: PRODUCT PORTFOLIO

TABLE 066. GEIST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: SNAPSHOT

TABLE 067. HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: BUSINESS PERFORMANCE

TABLE 068. HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCT PORTFOLIO

TABLE 069. HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. CISCO SYSTEMS: SNAPSHOT

TABLE 070. CISCO SYSTEMS: BUSINESS PERFORMANCE

TABLE 071. CISCO SYSTEMS: PRODUCT PORTFOLIO

TABLE 072. CISCO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. RARITAN INC.: SNAPSHOT

TABLE 073. RARITAN INC.: BUSINESS PERFORMANCE

TABLE 074. RARITAN INC.: PRODUCT PORTFOLIO

TABLE 075. RARITAN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SCHNEIDER ELECTRIC.: SNAPSHOT

TABLE 076. SCHNEIDER ELECTRIC.: BUSINESS PERFORMANCE

TABLE 077. SCHNEIDER ELECTRIC.: PRODUCT PORTFOLIO

TABLE 078. SCHNEIDER ELECTRIC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SERVER TECHNOLOGY INC.: SNAPSHOT

TABLE 079. SERVER TECHNOLOGY INC.: BUSINESS PERFORMANCE

TABLE 080. SERVER TECHNOLOGY INC.: PRODUCT PORTFOLIO

TABLE 081. SERVER TECHNOLOGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TRIPP LITE.: SNAPSHOT

TABLE 082. TRIPP LITE.: BUSINESS PERFORMANCE

TABLE 083. TRIPP LITE.: PRODUCT PORTFOLIO

TABLE 084. TRIPP LITE.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SIEMON: SNAPSHOT

TABLE 085. SIEMON: BUSINESS PERFORMANCE

TABLE 086. SIEMON: PRODUCT PORTFOLIO

TABLE 087. SIEMON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. RACKOM SYSTEM: SNAPSHOT

TABLE 088. RACKOM SYSTEM: BUSINESS PERFORMANCE

TABLE 089. RACKOM SYSTEM: PRODUCT PORTFOLIO

TABLE 090. RACKOM SYSTEM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. NOVA ELECTRIC: SNAPSHOT

TABLE 091. NOVA ELECTRIC: BUSINESS PERFORMANCE

TABLE 092. NOVA ELECTRIC: PRODUCT PORTFOLIO

TABLE 093. NOVA ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. VERTIV GROUP CORP: SNAPSHOT

TABLE 094. VERTIV GROUP CORP: BUSINESS PERFORMANCE

TABLE 095. VERTIV GROUP CORP: PRODUCT PORTFOLIO

TABLE 096. VERTIV GROUP CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ELCOM INTERNATIONAL PRIVATE LIMITED: SNAPSHOT

TABLE 097. ELCOM INTERNATIONAL PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 098. ELCOM INTERNATIONAL PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 099. ELCOM INTERNATIONAL PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. PANDUIT: SNAPSHOT

TABLE 100. PANDUIT: BUSINESS PERFORMANCE

TABLE 101. PANDUIT: PRODUCT PORTFOLIO

TABLE 102. PANDUIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. CHATSWORTH PRODUCTS: SNAPSHOT

TABLE 103. CHATSWORTH PRODUCTS: BUSINESS PERFORMANCE

TABLE 104. CHATSWORTH PRODUCTS: PRODUCT PORTFOLIO

TABLE 105. CHATSWORTH PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. OTHERS MAJOR PLAYERS: SNAPSHOT

TABLE 106. OTHERS MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 107. OTHERS MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 108. OTHERS MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY TYPE

FIGURE 012. BASIC MARKET OVERVIEW (2016-2028)

FIGURE 013. METERED MARKET OVERVIEW (2016-2028)

FIGURE 014. MONITORED MARKET OVERVIEW (2016-2028)

FIGURE 015. SWITCHED MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY END USER

FIGURE 018. TELECOM & IT MARKET OVERVIEW (2016-2028)

FIGURE 019. BANKING MARKET OVERVIEW (2016-2028)

FIGURE 020. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 021. INSURANCE (BFSI) MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY PHASE

FIGURE 024. SINGLE PHASE MARKET OVERVIEW (2016-2028)

FIGURE 025. THREE PHASE MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA POWER DISTRIBUTION UNIT (PDU) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Power Distribution Unit (PDU) Market research report is 2023-2030.

ABB, Legrand North America LLC, APC, Cyber Power Systems (USA) Inc., Eaton, Emerson Electric Co., Enlogic, Geist, Hewlett Packard Enterprise Development LP, Cisco Systems, Raritan Inc., Schneider Electric., Server Technology Inc., Tripp Lite., Siemon, RackOm System, NOVA ELECTRIC, Vertiv Group Corp, Elcom International Private Limited, Panduit, Chatsworth Products, and Other Major Players.

Power Distribution Unit (PDU) Market is segmented into Type, End User, Phase and region. By Type, the market is categorized into Basic, Metered, Monitored, Switched, Others. By End User, the market is categorized into Telecom & IT, Banking, Financial Services, Insurance (BFSI), Others. By Phase, the market is categorized into Single Phase, Three Phase. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

PDUs are power distribution units that provide electricity to computers and other networking equipment in data centers. They have many outputs and can measure and control the quantity of electricity that is distributed.

Global Power Distribution Unit (PDU)Market Size Was Valued at USD 1.70 Billion In 2022 And Is Projected to Reach USD 2.82 Billion By 2030, Growing at A CAGR of 6.5% From 2023 To 2030.