Power and Energy Monitoring System Market Synopsis

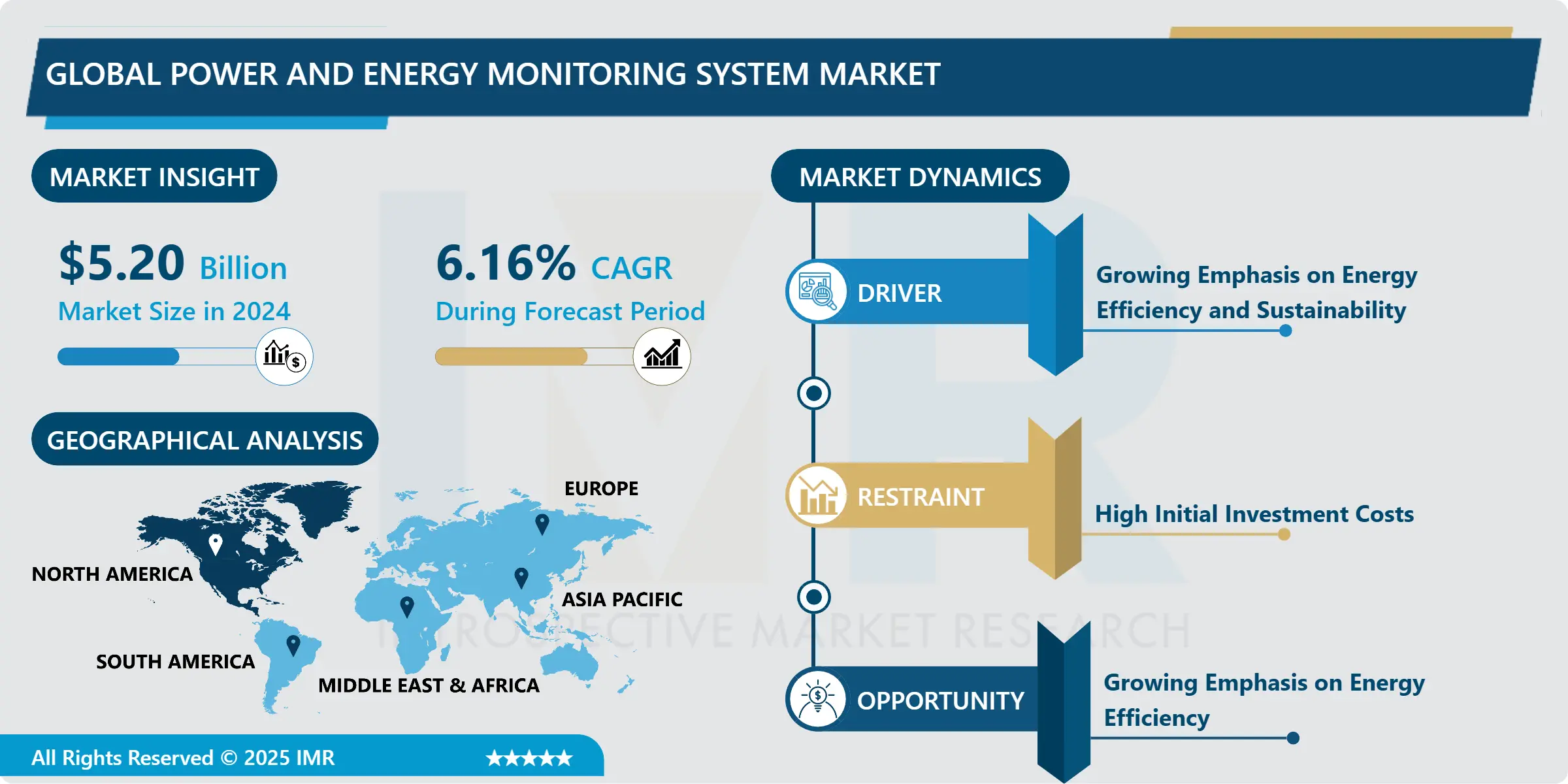

Power and Energy Monitoring System Market Size Was Valued at USD 5.20 Billion in 2024, and is Projected to Reach USD 8.39 Billion by 2032, Growing at a CAGR of 6.16% From 2025-2032

A Power and Energy Monitoring System is a technology used for monitoring, assessing, and controlling the processes of electricity use within a given system or system environment. It normally incorporates the input of sensors and meters as well as software technologies for the monitoring of real time information on power consumption voltage levels and energy use. This system delivers information on energy consumption, reveal points of excessive use, and support proactivity to manage energy saving and costs as well as the general level of energy efficiency. Power and energy monitoring system market: Recent development trends have been massive and this is due to increased concerns on conserving energy, high costs of electricity, and further tough government policies on energy conservation. These systems are essential in energy consumption monitoring and regulation and more specifically for residential, commercial, and industrial sectors. The most important factor a part of the Power and Energy Monitoring System Market is the increasing concentrate on sustainability and energy efficiency. As the issue of climate change and environmental conservation continues to gain prominence in the society, many organizations as well as individuals are looking for the best ways to mitigate carbon emissions and avoid wasting energy. Energy management and control systems provide the needed information concerning the use of energy at a given place for any specified interval of time so that the man may be able to know the precise areas in which the energy is wasted and take necessary steps to avoid that waste.

In addition, the increasing price of electricity has contributed to the growth of energy monitoring system use among businesses and consumers. The importance of this is that through tracking the consumed energy and the hours in which most energy is being utilized, the users can then opt to introduce new mechanisms that will ensure that energy-intensive tasks are being conducted during the hours in which the least energy is being consumed or even to start investing in the more energy efficient appliances and tools which in the long run will ensure that the overall energy expenses are reduced. Such key factors include government policies and incentives emphasizing energy conservation and efficiency have also fuelled the growth of power and energy monitoring systems. Some other countries mandate energy efficiency standards for commercial and industrial buildings and require enterprises to pass energy audits and this has increased the need for monitoring solutions that will assist an organization to meet these requirements and participate in energy conservation. A multitude of solutions target each of the end-user segments in the market for power and energy monitoring systems. The former includes simple features like energy consumption tracking and recording with the ability of the system to provide real-time data on how much energy is being used while the latter has more enhanced capabilities like the ability to use algorithms to predict energy demand with the aim of maximizing efficiency and cutting costs.

Power and Energy Monitoring System Market Trend Analysis

IoT Integration for Real-Time Data Analytics

- The integration of power and energy into monitoring and control systems in the IoT market is growing at an accelerated pace due to growing needs for real-time data and analysis capabilities across many industries. This integration helps to gather, identify, extract meaningful insights, and make sense of the data obtained from various sources like smart meters, sensors, and other smart devices to manage energy consumption more efficiently and reduce costs.

- Another argument is the urgency of the problem of climate change and the need for increased energy efficiency in power and energy consumption; so the demand for improving monitoring and energy management systems is one of the major incentives for the development of IoT integration in power and energy monitoring. Due to the current concerns for the environment and energy consumption, more organizations seek new technologies for measuring and managing the energy consumption. Smart monitoring ensures that any organization has a very detailed overview of energy consumption at individual levels and thus helps detect potential leaks in consumption and plan specific actions to minimize waste and optimize consumption.

- Advanced power and energy monitoring systems have been facilitated by increased use of the internet of things technologies as well as the emergence of better data analytic tools. These systems can now be designed to process huge volumes of data in real-time and accelerate information processing through the application of advanced algorithms to make decisions based on the generated information. For instance, predictive maintenance analytics assist in detecting any possible failures of equipment even before they happen and this allows for scheduled work rest to be done before any failure can actually occur.

- Apart from process efficiency, Io Thing integration in power and energy monitoring also helps with demand-side management and smart grid projects. These systems are designed to offer real-time insight into energy consumption activities and hence assist utilities in achieving better balancing of power supply and demand, peak shaving, and an overall improved stability of the grid. In addition, the introduction of smart household equipment, which are the IoT technology applications for households, allows consumers to participate in DSM programs and manage energy consumption themselves according to price or grid status signals.

Growing Emphasis on Energy Efficiency

- The necessity to reduce energy consumption has accelerated the market expansion of power and energy monitoring system. As the climate change continues to be a concern and the energy demand become great, there is a need for industries and buildings, both commercial and residential, to find ways to measure and control their energy use. Building energy management systems provide users with information on energy consumption at any given time and also help users to clearly demonstrate where they can save energy by efficiency measures.

- Rigorously imposed legislation and legal requirements for the efficiency of energy use also contribute to the increased application of these monitoring systems in different industries. The number of people and companies concerned with reducing their impact on the climate and their expenses on energy and maintenance is constantly growing, so the interest in further developing monitoring solutions with all the bells and whistles – from data analysis to remote control and predictive failure – is also increasing. All these factors will help in driving the market for power and energy monitoring system in the years to come and the change and development in technology will form an important part of this industry.

Power and Energy Monitoring System Market Segment Analysis:

Power and Energy Monitoring System Market is Segmented based on Type and Application.

By Type, Service segment is expected to dominate the market during the forecast period

- Hardware:Physical mechanical elements in power and energy supervising systems are sensors, meters, transducers, communication gadgets, and control units. To analyse this segment it is necessary to keep in mind recent changes in the sphere of sensor development, the use of IoT (Internet of Things) devices, and the introduction of smart meters. Some other factors, like precision, reproducibility, compatibility, and affordability, are vital for measuring the hardware segment’s effectiveness. Recent market trends also demonstrate a strong need for the advanced sensors designed to provide real-time data capture and processing capabilities.

- Software:The role of software in power and energy monitoring is essential for the visualization of the collected data as well as for the decision-making and analysis process. Analysis of this segment involves looking at some of the trends such as the rise of cloud-based platforms, data analytics algorithms, and predictive maintenance solutions. Considerable factors for the software segment are energy optimization and regulations compliance and management as well as operation and maintenance. In terms of trends in the market, there is likely to be greater emphasis on data security, data exchange, and usability of the energy monitoring software.

- Services:Services include engineering/consulting, installation, maintenance, and support provided by the vendor or third party. Analysis of this segment entails assessing the implementation of managed services, recurring billing, and outsourcing. Technical proficiency, service quality provisions, customer support provisions, and service-level agreements are some of the key competitive indicators used to measure the services segment’s strength. Trends in the market suggests that consumers are now more interested in purchasing more comprehensive products whose feature an integrated services model that includes the hardware, the software and the ongoing maintenance and support needed for complete energy management.

By Application, Manufacturing & Process Industry segment held the largest share in 2024

- Manufacturing & Process Industry: Energy management and control systems provide the most efficient energy usage, establish waste of energy and properly work of machines and equipments in the manufacturing and process industries. Application segment in this may involve the monitoring of the energy consumption in factories warehouses and production units.

- Data Center: Data centers are responsible for some of the highest energy usage in the world. The power and energy monitoring systems market in this application segment is aimed at assisting data center operators or owners in measuring PUE, enabling them to monitor the cooling system, and identify opportunities for energy efficiency improvements.

- Utilities & Renewables: Most of the utilities make use of the power and energy monitoring systems to control the energy distribution, analysis of performance of the grid system and integration of the renewable energies such as solar and wind into the grid. All these systems help the utilities in managing their supply and demand for the grid and also facilitate effective optimization of the grid as well as the transition to the low-carbon energy system.

- Public Infrastructure: Energy management and control systems function as tools for measuring energy consumption in public sector organizations which include government facilities, schools, hospitals, and transportation. These systems monitor the consumption of energy and inform the authorities about the need to undertake energy conserving strategies so as to reduce carbon footprints and also to cut the costs of operations.

- Electric Vehicle Charging Station: There is a future scope for the monitoring of energy consumption at EV charging points with the general use of EVs expanding. Monitoring systems for power and energy in this application segment are used to control the electricity load and delivery to market players and charging station operators to prevent energy supply disruptions and ensure the efficiency and reliability of charging services as the number of EVs on the road is constantly growing.

Power and Energy Monitoring System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Factors such as these have enabled North America to maintain dominance in the power and energy monitoring system market over the forecast period. First, the region has industrial and commercial infrastructure that is quite developed and requires complex supervision to maintain efficient energy use and adherence to prevailing laws. Further, the enhanced government regulations in the region to cut carbon footprint and efficient use of energy also accelerate the growth of monitoring systems systems in North America.

- Also, the trend toward integrating more renewable energy technologies, like wind or solar, into the power grid demands the use of further sophisticated monitoring tools to efficiently deal with the intermittent character of these systems. Also, the influx of the major industry players and the continuous innovations in technology means the region holds a strong position in the global power and energy monitoring system market. With well-developed market economy and favorable legal conditions North America is expected to remain a major power in this market.

Active Key Players in the Power and Energy Monitoring System Market

- Schneider Electric(France)

- Mitsubishi Electric(Japan)

- Siemens(Germany)

- ABB(Switzerland)

- Rockwell Automation(US)

- Eaton(Ireland)

- Yokogawa(Japan)

- Emerson(US)

- General Electric(US)

- Omron(Japan)

- Accuenergy(Canada)

- Littelfuse(US)

- Samsara(US)

- Fuji Electric Fa Components & Systems(Japan)

- Etap- Operation Technology(US)

- Albireo Energy(US)

- Fluke Corporation(US)

- Other Active Players

|

Global Power and Energy Monitoring System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 5.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.16% |

Market Size in 2032: |

USD 8.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power and Energy Monitoring System Market by Type (2018-2032)

4.1 Power and Energy Monitoring System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Services

Chapter 5: Power and Energy Monitoring System Market by Application (2018-2032)

5.1 Power and Energy Monitoring System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Manufacturing & Process Industry

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Data Center

5.5 Utilities & Renewables

5.6 Public Infrastructure

5.7 Electric Vehicle Charging Station

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Power and Energy Monitoring System Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 IGS GENERON(US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HOLTEC GAS SYSTEMS(US)

6.4 ATLAS COPCO(SWEDEN)

6.5 COMPRESSED GAS TECHNOLOGIES(US)

6.6 PARKER HANNIFIN(US)

6.7 PROTON(INDIA)

6.8 NOXERIOR S.R.L.(ITALY)

6.9 SAM GAS PROJECTS(INDIA)

6.10 AIR LIQUIDE(FRANCE)

6.11 OTHER KEY PLAYERS

Chapter 7: Global Power and Energy Monitoring System Market By Region

7.1 Overview

7.2. North America Power and Energy Monitoring System Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Hardware

7.2.4.2 Software

7.2.4.3 Services

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Manufacturing & Process Industry

7.2.5.2 Data Center

7.2.5.3 Utilities & Renewables

7.2.5.4 Public Infrastructure

7.2.5.5 Electric Vehicle Charging Station

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Power and Energy Monitoring System Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Hardware

7.3.4.2 Software

7.3.4.3 Services

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Manufacturing & Process Industry

7.3.5.2 Data Center

7.3.5.3 Utilities & Renewables

7.3.5.4 Public Infrastructure

7.3.5.5 Electric Vehicle Charging Station

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Power and Energy Monitoring System Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Hardware

7.4.4.2 Software

7.4.4.3 Services

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Manufacturing & Process Industry

7.4.5.2 Data Center

7.4.5.3 Utilities & Renewables

7.4.5.4 Public Infrastructure

7.4.5.5 Electric Vehicle Charging Station

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Power and Energy Monitoring System Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Hardware

7.5.4.2 Software

7.5.4.3 Services

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Manufacturing & Process Industry

7.5.5.2 Data Center

7.5.5.3 Utilities & Renewables

7.5.5.4 Public Infrastructure

7.5.5.5 Electric Vehicle Charging Station

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Power and Energy Monitoring System Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Hardware

7.6.4.2 Software

7.6.4.3 Services

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Manufacturing & Process Industry

7.6.5.2 Data Center

7.6.5.3 Utilities & Renewables

7.6.5.4 Public Infrastructure

7.6.5.5 Electric Vehicle Charging Station

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Power and Energy Monitoring System Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Hardware

7.7.4.2 Software

7.7.4.3 Services

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Manufacturing & Process Industry

7.7.5.2 Data Center

7.7.5.3 Utilities & Renewables

7.7.5.4 Public Infrastructure

7.7.5.5 Electric Vehicle Charging Station

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Power and Energy Monitoring System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 5.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.16% |

Market Size in 2032: |

USD 8.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||