Potting Compound Market Synopsis

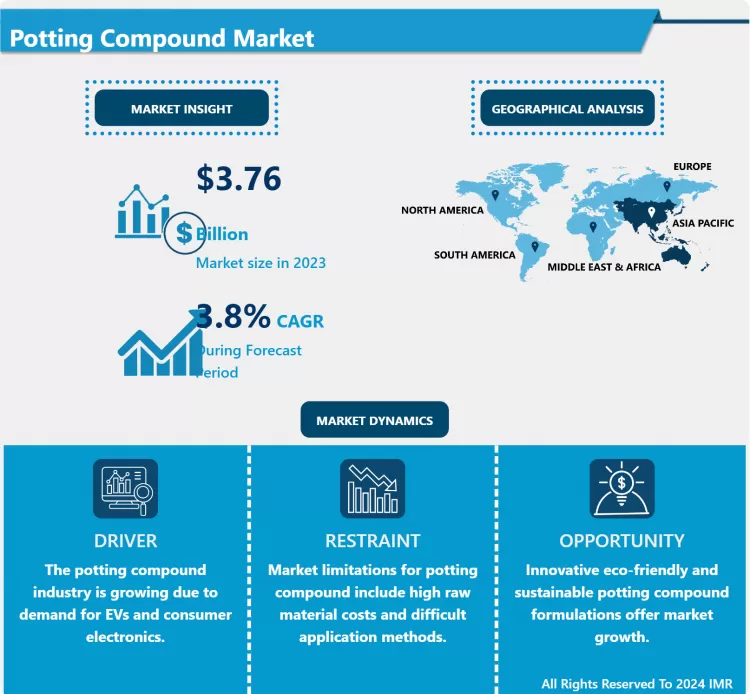

Potting Compound Market Size is Valued at USD 3.76 Billion in 2023, and is Projected to Reach USD 5.07 Billion by 2032, Growing at a CAGR of 3.80% From 2024-2032.

Over the years, the potting compound market has posted impressive growth as the electronics industry’s need for components that will shield equipment from factors such as moisture, dust, and temperature variations increases. Potting compounds used in housing electronic components hold enormous reliability and durability since they offer insulation and mechanical protection. An increase in renewable energy technologies, automotive electronics, and consumer electronics has also helped to increase demand for these shielding materials, thereby emphasizing their roles in current production methods.

- The potting compound market has majorly focused on North America and Europe earlier because of the strong electronics and automotive sectors. This is a regional one. The United States stands at the top regarding the number it contributes with focus on technology and more so electronics technology. However, the Asia-Pacific region is gradually emerging as an important area of growth, due to factors such as, increased consumption of electronics, capacity addition in the production and speeded up industrialization. In the forthcoming years, potential potting compounds may experience increased consumer traffic resulting from the heavy investment in electronics production in countries like China, Japan, and India.

- Epoxies, silicones, polyurethanes and several forms of acrylics are widely available potting compounds.. All of them offer properties that other do not – chemical stability, thermal stability and amongst them flexibility that is advantageous in different applications. For instance epoxy potting compounds possess good thermal stability and have high bond strength and hence are more desirable for high performance application. However, silicone potting compounds are used in regions characterized by high temperature fluctuations as identified by their high TCR and flexibility.

Potting Compound Market Trend Analysis

Increasing Demand for Electric and Electronic Applications

- A SPONSORING comparable to 35% of the potting compound market up until an enormous trend based principally on the electric and electronic applications.. The require Ments for strong protective solutions have therefore become rather crucial with expansion of industries like automotive, consumer electronics as well as renewable energy. Protecting delicate electronic parts from moisture, dirt, movement and temperature changes depends on potting materials. The growing use of electronics in virtually every sector including new age electric automobiles known as electric vehicles (EVs) and sophisticated consumer appliances has risen demand for great performance potting materials that assure reliability of these parts in harsh conditions.

- Beside the conventional uses, the advancement of smart technologies most especially the Internet of Things (Iot) has increased the market for new styles of potting compounds. These compound not only provide protection to various electronic assemblies but they also enhance the operating characteristics and capabilities of the assembly by providing thermal conductivity and dielectric strength. Manufacturer are putting more effort into research and development to come up with formulations that should meet different application requirements some of the characteristics that the manufacturers are trying to achieve include: shorter curing time and better thermal conductivity. As a result, the potting compound market is gradually shifting to overcome the challenges arising from the increasing electrical and electronics industry that forms part of the growth of technology based industries today.

Sustainability and Eco-Friendly Formulations

- The dual-use property of a product, sustainable, and eco-friendly formulation has become an innovative factor in the potting compound market. The use of environment friendly potting compounds have however taken precedence over performance and reliability with manufacturers now seeking to provide environmentally friendly potting compounds that offer the highest performance ever. With electronics, renewable energy and automotive consumers now seeking to reduce emissions, bio-based and non-toxic materials are also in high demand. A sustainable potting compound material is more convenient in disposal because the liberation end-of-life threats and emissions are not significantly hazardous compared to other potting compounds that would also lead to discouragement of waste production in line with international sustainability strategies. This tendency is particularly distressing in areas where environmental regulation is stringent, which forces the company to look for new ways of meaningful product release.

- In addition, this pressure has been motivated by consumers’ increasing concern for the environmental impact of their buying decisions, especially in sectors like electric vehicle (EV), which have sustainability targets partly in terms of the use of environmentally friendly components. Some companies are undertaking research to find out the possibilities of using biodegradable or recyclable potting material that has potentiality to produce low environmental effects but which is equally strong and effective. With this trend likely to gather pace over the years, manufacturers are expected to invest a great deal of capital into research and development in a bid to produce potting compounds that meet both technical and environmental requirements. This will put them in a vantage point, especially given the current markets trends which are increasingly being impacted on by issues to do with sustainability.

Potting Compound Market Segment Analysis:

Potting Compound Market Segmented on the basis of By Resin Type, Function, Curing Techniques , Application, End-Users

By Resin Type, Polyurethane segment is expected to dominate the market during the forecast period

- Epoxy, polyurethane, silicone, polyester, polyamide, polyolefin, and acrylics are considered as materials which are used often and presented in potting compound market. Of all these, epoxy resins are by far the most common due to their thermal stability, chemical and mechanical properties. industrial application, the automotive and electronics industries mainly utilize them to shield components from environmental impacts. Polyurethane stowing compounds are preferred for application, where flexibility and impact are required, making it perfect for the renewable energy and transport industries. Silicon polymers are emerging as an industry favourite because of factors like high thermal stability and electrical insulation making it perfect for applications that require high temperature, for instance medical and aerospace applications.

- Another classification of such resins includes polyester and polyamide resins which also dominate the market due to the high efficiency coupled with moderate cost in low performance applications. Polyolefin and acrylics are widely preferred by consumer electronics and lightweight automotive parts for components owing to the lightweight and versatile nature of the two polymers. It is also forecasted that all resins kind will be in high demand stemming from the growing application of encapsulation in new generation electronics and electrical vehicles. The industry in particular optimizes each resin type with regard to its properties. It thus allows manufacturers to fulfill various requirements of consumer which in turn creates the market growth.

By Application, Electronics segment held the largest share in 2023

- Electronical and electrical industry is one of the biggest consumer of potting compounds due to a rising need to protect delicate parts from the effects of weather, heat, moisture and chemicals. Potting compounds are commonly used on many electronic assemblies and circuits to shield and protect these circuits from voltage, shocks, impacts, and heat. There has been a growing call for potting compounds due to the growth in consumer electronics, telecommunication, automobile electronics, and industrial instrumentation. The application has expanded with evolvement of internet of things (IoT) devices, renewable energy systems, and electric vehicles (EVs) where potting compounds enhance the performance and durability of the electronic parts.

- In addition, the trend for the miniaturization of electronic components has accelerated the need for more complex and effective potting systems. For this reason, manufacturers in the potting compound market are developing new and improved potting compounds such as silicone based, epoxy based and polyurethane based compounds that offer superior thermal conductivity and electrical insulation. This particular rise in its application in sectors like automotive electronics, power supplies and renewable energy underlines its role in meeting the safety and reliability standards of the modern electrical and electronic-needed devices.

Potting Compound Market Regional Insights:

Asia-Pacific is expected to dominate the potting compound market

- On this basis, we expect that the Asia-Pacific region will continue to lead the potting compound market as the demand for electric vehicle (EVs) has steadily rises and electronics manufacturing industry expands constantly. Consumer electronics and automotive industries are majorly led by countries like China, Japan, South Korea, demanding more of potting compounds to safeguard delicate and complex parts from unfavorable conditions. The increasing investments made in the region by countries across the globe in renewable energy, for instance photovoltaic solar systems advanced the use of potting compounds in energy storage and electrical insulation.

- Besides, the region is another global production hub thanks to well developed supply chain and affordable manufacturing industry. The governments of various countries in the Asia-Pacific region often launch programs of technological development of industries and manufacturing, which in turn fuels the potting compound market. As electronics industry and automotive industry develops the demand of encapsulation solutions, including potting compounds, will grow up and the leadership of the region in the word market will strengthen up.

Active Key Players in the Potting Compound Market

- ELANTAS GmbH (Germany)

- Henkel AG & Co. KGaA (Germany)

- Master Bond Inc. (U.S.)

- Dymax (U.S.)

- Electrolube (U.K.)

- CHT Germany GmbH (Germany)

- EFI POLYMERS (U.S.)

- CHT Germany GmbH (Germany)

- INTERTRONICS (U.K.)

- MG Chemicals (Canada)

- Others

Global Potting compound Market Scope:

|

Global Potting compound Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.76 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 5.07 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Function |

|

||

|

By Curing Techniques |

|

||

|

By Application |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Potting Compound Market by Resin Type (2018-2032)

4.1 Potting Compound Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Epoxy

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polyurethane

4.5 Silicone

4.6 Polyester

4.7 Polyamide

4.8 Polyolefin

4.9 Acrylics

Chapter 5: Potting Compound Market by Function (2018-2032)

5.1 Potting Compound Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Corrosion Resistance

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Insulation

Chapter 6: Potting Compound Market by Curing Techniques (2018-2032)

6.1 Potting Compound Market Snapshot and Growth Engine

6.2 Market Overview

6.3 UV Curing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Thermal Curing

6.5 Room Temperature Curing

Chapter 7: Potting Compound Market by Application (2018-2032)

7.1 Potting Compound Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Electrical

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Electronics

Chapter 8: Potting Compound Market by End-Users (2018-2032)

8.1 Potting Compound Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Electronics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Transportation

8.5 Energy and Power

8.6 Industrial

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Potting Compound Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ELANTAS GMBH (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 HENKEL AG & CO. KGAA (GERMANY)

9.4 MASTER BOND INC. (U.S.)

9.5 DYMAX (U.S.)

9.6 ELECTROLUBE (U.K.)

9.7 CHT GERMANY GMBH (GERMANY)

9.8 EFI POLYMERS (U.S.)

9.9 CHT GERMANY GMBH (GERMANY)

9.10 INTERTRONICS (U.K.)

9.11 MG CHEMICALS (CANADA)

9.12 OTHERS

9.13

Chapter 10: Global Potting Compound Market By Region

10.1 Overview

10.2. North America Potting Compound Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Resin Type

10.2.4.1 Epoxy

10.2.4.2 Polyurethane

10.2.4.3 Silicone

10.2.4.4 Polyester

10.2.4.5 Polyamide

10.2.4.6 Polyolefin

10.2.4.7 Acrylics

10.2.5 Historic and Forecasted Market Size by Function

10.2.5.1 Corrosion Resistance

10.2.5.2 Insulation

10.2.6 Historic and Forecasted Market Size by Curing Techniques

10.2.6.1 UV Curing

10.2.6.2 Thermal Curing

10.2.6.3 Room Temperature Curing

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Electrical

10.2.7.2 Electronics

10.2.8 Historic and Forecasted Market Size by End-Users

10.2.8.1 Electronics

10.2.8.2 Transportation

10.2.8.3 Energy and Power

10.2.8.4 Industrial

10.2.8.5 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Potting Compound Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Resin Type

10.3.4.1 Epoxy

10.3.4.2 Polyurethane

10.3.4.3 Silicone

10.3.4.4 Polyester

10.3.4.5 Polyamide

10.3.4.6 Polyolefin

10.3.4.7 Acrylics

10.3.5 Historic and Forecasted Market Size by Function

10.3.5.1 Corrosion Resistance

10.3.5.2 Insulation

10.3.6 Historic and Forecasted Market Size by Curing Techniques

10.3.6.1 UV Curing

10.3.6.2 Thermal Curing

10.3.6.3 Room Temperature Curing

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Electrical

10.3.7.2 Electronics

10.3.8 Historic and Forecasted Market Size by End-Users

10.3.8.1 Electronics

10.3.8.2 Transportation

10.3.8.3 Energy and Power

10.3.8.4 Industrial

10.3.8.5 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Potting Compound Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Resin Type

10.4.4.1 Epoxy

10.4.4.2 Polyurethane

10.4.4.3 Silicone

10.4.4.4 Polyester

10.4.4.5 Polyamide

10.4.4.6 Polyolefin

10.4.4.7 Acrylics

10.4.5 Historic and Forecasted Market Size by Function

10.4.5.1 Corrosion Resistance

10.4.5.2 Insulation

10.4.6 Historic and Forecasted Market Size by Curing Techniques

10.4.6.1 UV Curing

10.4.6.2 Thermal Curing

10.4.6.3 Room Temperature Curing

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Electrical

10.4.7.2 Electronics

10.4.8 Historic and Forecasted Market Size by End-Users

10.4.8.1 Electronics

10.4.8.2 Transportation

10.4.8.3 Energy and Power

10.4.8.4 Industrial

10.4.8.5 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Potting Compound Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Resin Type

10.5.4.1 Epoxy

10.5.4.2 Polyurethane

10.5.4.3 Silicone

10.5.4.4 Polyester

10.5.4.5 Polyamide

10.5.4.6 Polyolefin

10.5.4.7 Acrylics

10.5.5 Historic and Forecasted Market Size by Function

10.5.5.1 Corrosion Resistance

10.5.5.2 Insulation

10.5.6 Historic and Forecasted Market Size by Curing Techniques

10.5.6.1 UV Curing

10.5.6.2 Thermal Curing

10.5.6.3 Room Temperature Curing

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Electrical

10.5.7.2 Electronics

10.5.8 Historic and Forecasted Market Size by End-Users

10.5.8.1 Electronics

10.5.8.2 Transportation

10.5.8.3 Energy and Power

10.5.8.4 Industrial

10.5.8.5 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Potting Compound Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Resin Type

10.6.4.1 Epoxy

10.6.4.2 Polyurethane

10.6.4.3 Silicone

10.6.4.4 Polyester

10.6.4.5 Polyamide

10.6.4.6 Polyolefin

10.6.4.7 Acrylics

10.6.5 Historic and Forecasted Market Size by Function

10.6.5.1 Corrosion Resistance

10.6.5.2 Insulation

10.6.6 Historic and Forecasted Market Size by Curing Techniques

10.6.6.1 UV Curing

10.6.6.2 Thermal Curing

10.6.6.3 Room Temperature Curing

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Electrical

10.6.7.2 Electronics

10.6.8 Historic and Forecasted Market Size by End-Users

10.6.8.1 Electronics

10.6.8.2 Transportation

10.6.8.3 Energy and Power

10.6.8.4 Industrial

10.6.8.5 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Potting Compound Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Resin Type

10.7.4.1 Epoxy

10.7.4.2 Polyurethane

10.7.4.3 Silicone

10.7.4.4 Polyester

10.7.4.5 Polyamide

10.7.4.6 Polyolefin

10.7.4.7 Acrylics

10.7.5 Historic and Forecasted Market Size by Function

10.7.5.1 Corrosion Resistance

10.7.5.2 Insulation

10.7.6 Historic and Forecasted Market Size by Curing Techniques

10.7.6.1 UV Curing

10.7.6.2 Thermal Curing

10.7.6.3 Room Temperature Curing

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Electrical

10.7.7.2 Electronics

10.7.8 Historic and Forecasted Market Size by End-Users

10.7.8.1 Electronics

10.7.8.2 Transportation

10.7.8.3 Energy and Power

10.7.8.4 Industrial

10.7.8.5 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Global Potting compound Market Scope:

|

Global Potting compound Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.76 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.80% |

Market Size in 2032: |

USD 5.07 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Function |

|

||

|

By Curing Techniques |

|

||

|

By Application |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Potting compound Market research report is 2024-2032.

ELANTAS GmbH (Germany) , Henkel AG & Co. KGaA (Germany) , Master Bond Inc. (U.S.) , Dymax (U.S.) , Electrolube (U.K.) , CHT Germany GmbH (Germany) , EFI POLYMERS (U.S.), CHT Germany GmbH (Germany) , INTERTRONICS (U.K.) , MG Chemicals (Canada) , Others

The Potting compound Market is segmented into By Resin Type (Epoxy, Polyurethane, Silicone, Polyester, Polyamide, Polyolefin, and Acrylics), Function (Corrosion Resistance, and Insulation), Curing Techniques (UV Curing, Thermal Curing, and Room Temperature Curing), Application (Electrical and Electronics), End-Users (Electronics, Transportation, Energy and Power, Industrial, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Potting compounds are substances that are employed to encase electronic components, thereby safeguarding them from environmental factors such as moisture, grime, chemicals, and mechanical stress. Typically, these compounds are poured into an enclosure or mold, where they congeal, forming a protective barrier around sensitive circuitry or devices. Potting compounds are frequently employed in applications such as automotive electronics, renewable energy systems, and consumer devices to improve the durability, insulation, and performance of electronic components, thereby ensuring their reliability and longevity in challenging operational environments.

Potting Compound Market Size is Valued at USD 3.76 Billion in 2023, and is Projected to Reach USD 5.07 Billion by 2032, Growing at a CAGR of 3.80% From 2024-2032.