Global Plastic Rigid IBC Market Overview

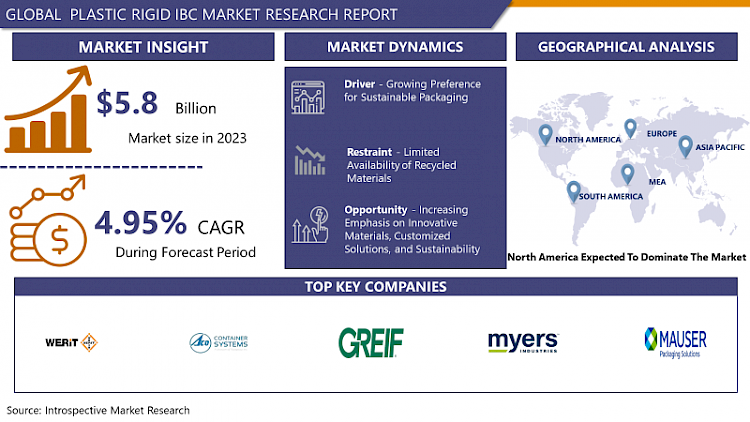

Plastic Rigid IBC Market Size Was Valued at USD 5.8 Billion in 2023, and is Projected to Reach USD 8.96 Billion by 2032, Growing at a CAGR of 4.95 % From 2024-2032.

A plastic rigid IBC, also known as an Intermediate Bulk Container, is a large, industrial-grade container used for storing, transporting, and handling various liquids and solids. They are typically made from high-density polyethylene (HDPE), a strong, durable, and chemically resistant material that can withstand the rigors of industrial environments. Plastic rigid IBCs are reusable and come in a variety of sizes and capacities to meet the specific needs of different industries.

Plastic rigid IBCs are durable and impact-resistant, made of HDPE, and compatible with a wide range of liquids and solids, including chemicals, solvents, and hazardous materials. They are reusable, reducing waste and environmental impact, and stackable, saving space during storage and transportation. These cost-effective options are commonly used in various industries, such as chemicals, food and beverage, pharmaceuticals, agriculture, and manufacturing.

- The benefits of using plastic rigid IBCs include improved safety, reduced costs, reduced environmental impact, and increased efficiency. The durable and leak-proof design prevents spills and accidents, while the reusable nature reduces material handling costs. The reusability of plastic rigid IBCs also helps reduce waste and environmental impact. The stackable design also saves space, improving efficiency. Overall, plastic rigid IBCs are a versatile and cost-effective solution for storing, transporting, and handling various materials, making them a valuable asset for businesses in various industries.

Plastic Rigid IBC Market Trend Analysis:

Growing Preference for Sustainable Packaging

- This suggests that tastes in the business and among consumers are shifting in favour of ecologically friendly packaging options. Packaging that is considered sustainable usually uses resources that are renewable, recyclable, or biodegradable, among other practices that have a lower negative influence on the environment. Large, reusable industrial containers called plastic rigid intermediate bulk containers, or IBCs, are used for bulk and liquid material storage and transportation. Usually constructed of sturdy plastic, these containers support environmental objectives and are recyclable.

- The implies that the market for plastic rigid IBCs is expanding due in large part to consumers' increasing inclination toward sustainable packaging. The result is that, as part of their sustainable packaging plans, companies and industries are increasingly using plastic rigid IBCs. The claimed environmental benefits and compatibility with sustainability programs of plastic rigid IBCs may be driving greater demand for them. Businesses looking for environmentally friendly packaging solutions might discover greater opportunities in the plastic rigid IBC market. As sustainability continues to be a significant focus across various industries, the Plastic Rigid IBC Market stands to benefit from its alignment with the growing preference for sustainable packaging solutions.

Increasing Emphasis on Innovative Materials, Customized Solutions, and Sustainability

- Sustainability is gaining prominence in consumer preferences and corporate strategies, with businesses recognizing the importance of eco-friendly practices. This shift aligns with ethical considerations, opens new market segments, and enhances brand reputation, as there is a rising demand for sustainable products and services. Advanced materials are driving innovation and reshaping industries, with lightweight, high-strength, and environmentally friendly materials influencing manufacturing processes and product design. Companies investing in research and development to incorporate these materials gain a competitive edge by delivering improved performance, durability, and reduced environmental impact.

- The demand for customized solutions is transforming the market, as consumers seek products and services that cater to their unique needs across various sectors like technology, healthcare, and manufacturing. Offering tailored solutions enhances customer satisfaction and creates a competitive market niche for businesses. The increasing emphasis on sustainability, advanced materials, and customized solutions is not just a trend but a fundamental shift in business operations. Companies that integrate these principles into their strategies can capitalize on this market opportunity, addressing consumer expectations and fostering long-term resilience in an evolving economic landscape where sustainable and innovative practices are becoming synonymous with market leadership.

Plastic Rigid IBC Market Segment Analysis:

Plastic Rigid IBC Market Segmented on the basis of type, Capacity, and end-users.

By Type, HDPE Rigid IBC segment is expected to dominate the market during the forecast period

- High-density polyethylene intermediate bulk containers are popular due to their high melting temperature of 120-140 degrees Celsius, making them ideal for durability and temperature resistance, ensuring safe storage and transport of various materials in applications requiring temperature resistance. High-density polyethylene (HDPE IBCs) are popular due to their high density, enhancing their structural integrity and durability. HDPE IBCs offer superior tensile strength, making them suitable for handling substantial loads and providing reliable containment for a variety of products, making them suitable for handling diverse loads. High-density polyethylene intermediate bulk containers are known for their chemical resistance, making them ideal for storing and transporting various substances, ensuring material integrity and protecting against potential chemical interactions.

Plastic Rigid IBC Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is driving the growth of the Plastic Rigid Intermediate Bulk Container (IBC) Market due to its economic strength, technological advancements, and robust industrial landscape. Industries like chemicals, pharmaceuticals, and manufacturing demand IBCs for efficient bulk material storage and transportation. Advanced infrastructure and stringent quality standards in these sectors make durable and reliable packaging solutions a preferred choice. The region's regulatory environment prioritizes safety and environmental sustainability, promoting high-quality IBCs like Plastic Rigid IBCs for durability, reusability, and compliance with stringent safety regulations. North America's commitment to sustainability is driving growth in the market for Plastic Rigid IBCs, driven by the preference for eco-friendly packaging solutions and the preference for recyclable materials, shaping the future of sustainable industrial packaging.

Key Players Covered in Plastic Rigid IBC Market:

- Hoover Ferguson Group (United States)

- Greif (United States)

- Mauser Packaging Solutions (United States)

- Myers Industries (United States)

- Snyder Industries (United States)

- ACO Container Systems (Canada)

- SCHUTZ (Germany)

- Mauser Group (Germany)

- WERIT AG (Switzerland)

- MaschioPack GmbH (Italy)

- Pyramid Technoplast (Italy)

- Sotralentz (France)

- FACH-PAK Sp. z o.o. (Poland)

- Shijiheng (China)

- ZhenJiang JinShan Packing Factory (China)

- Shanghai Fujiang Plastic Industry Group (China)

- Jielin (China)

- NOVAX (China)

- Time Technoplast Limited (Hong Kong)

- Chuang Xiang (Taiwan)

- Sintex (India), and Other Major Players

Key Industry Developments in the Plastic Rigid IBC Market:

- In March 2024, Greif, Inc. completed its acquisition of Ipackchem Group SAS, a move anticipated to bolster its position as a global leader in industrial packaging. With a transaction value totaling $538 million plus additional fees, Greif now aims to leverage synergies and new market opportunities. The acquisition, funded through existing credit facilities, is expected to immediately enhance EBITDA margins.

- In November 2023, Mauser Packaging Solutions announced its definitive agreement to acquire Taenza, S.A. de C.V., a Mexico-based manufacturer specializing in tin-steel aerosol cans and steel pails. The acquisition aims to broaden Mauser's capabilities in rigid metal packaging. With Taenza's five manufacturing facilities across Mexico and over 850 employees, the deal positions Mauser to better serve customers in industries such as paint, coatings, and chemicals. Mark Burgess, CEO of Mauser, highlighted the alignment of values between the two companies.

|

Global Plastic Rigid IBC Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 5.08 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.95% |

Market Size in 2032 : |

USD 8.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Capacity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PLASTIC RIGID IBC MARKET BY TYPE (2016-2030)

- PLASTIC RIGID IBC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HDPE RIGID IBC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LLDPE RIGID IBC

- LDPE RIGID IBC

- PLASTIC RIGID IBC MARKET BY CAPACITY (2016-2030)

- PLASTIC RIGID IBC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- UP TO 500 LITERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 501 TO 1000 LITERS

- 1001 TO 2000 LITERS

- ABOVE 2000 LITERS

- PLASTIC RIGID IBC MARKET BY END-USER (2016-2030)

- PLASTIC RIGID IBC MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDUSTRIAL CHEMICALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PETROLEUM & LUBRICANTS

- PAINTS INKS & DYES

- FOOD & BEVERAGES

- BUILDING & CONSTRUCTION

- PHARMACEUTICALS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Plastic Rigid IBC Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HOOVER FERGUSON GROUP

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GREIF (UNITED STATES)

- MAUSER PACKAGING SOLUTIONS (UNITED STATES)

- MYERS INDUSTRIES (UNITED STATES)

- SNYDER INDUSTRIES (UNITED STATES)

- ACO CONTAINER SYSTEMS (CANADA)

- SCHUTZ (GERMANY)

- MAUSER GROUP (GERMANY)

- WERIT AG (SWITZERLAND)

- MASCHIOPACK GMBH (ITALY)

- PYRAMID TECHNOPLAST (ITALY)

- SOTRALENTZ (FRANCE)

- FACH-PAK SP. Z O.O. (POLAND)

- SHIJIHENG (CHINA)

- ZHENJIANG JINSHAN PACKING FACTORY (CHINA)

- SHANGHAI FUJIANG PLASTIC INDUSTRY GROUP (CHINA)

- JIELIN (CHINA)

- NOVAX (CHINA)

- TIME TECHNOPLAST LIMITED (HONG KONG)

- CHUANG XIANG (TAIWAN)

- SINTEX (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL PLASTIC RIGID IBC MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Capacity

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Plastic Rigid IBC Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 5.08 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.95% |

Market Size in 2032 : |

USD 8.96 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Capacity |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PLASTIC RIGID IBC MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PLASTIC RIGID IBC MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PLASTIC RIGID IBC MARKET COMPETITIVE RIVALRY

TABLE 005. PLASTIC RIGID IBC MARKET THREAT OF NEW ENTRANTS

TABLE 006. PLASTIC RIGID IBC MARKET THREAT OF SUBSTITUTES

TABLE 007. PLASTIC RIGID IBC MARKET BY TYPE

TABLE 008. HDPE RIGID IBC MARKET OVERVIEW (2016-2028)

TABLE 009. LLDPE RIGID IBC MARKET OVERVIEW (2016-2028)

TABLE 010. LDPE RIGID IBC MARKET OVERVIEW (2016-2028)

TABLE 011. PLASTIC RIGID IBC MARKET BY APPLICATION

TABLE 012. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 013. FOOD MARKET OVERVIEW (2016-2028)

TABLE 014. CHEMICAL INDUSTRIES MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA PLASTIC RIGID IBC MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA PLASTIC RIGID IBC MARKET, BY APPLICATION (2016-2028)

TABLE 017. N PLASTIC RIGID IBC MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE PLASTIC RIGID IBC MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE PLASTIC RIGID IBC MARKET, BY APPLICATION (2016-2028)

TABLE 020. PLASTIC RIGID IBC MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC PLASTIC RIGID IBC MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC PLASTIC RIGID IBC MARKET, BY APPLICATION (2016-2028)

TABLE 023. PLASTIC RIGID IBC MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA PLASTIC RIGID IBC MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA PLASTIC RIGID IBC MARKET, BY APPLICATION (2016-2028)

TABLE 026. PLASTIC RIGID IBC MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA PLASTIC RIGID IBC MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA PLASTIC RIGID IBC MARKET, BY APPLICATION (2016-2028)

TABLE 029. PLASTIC RIGID IBC MARKET, BY COUNTRY (2016-2028)

TABLE 030. SCHUTZ: SNAPSHOT

TABLE 031. SCHUTZ: BUSINESS PERFORMANCE

TABLE 032. SCHUTZ: PRODUCT PORTFOLIO

TABLE 033. SCHUTZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. MAUSER GROUP: SNAPSHOT

TABLE 034. MAUSER GROUP: BUSINESS PERFORMANCE

TABLE 035. MAUSER GROUP: PRODUCT PORTFOLIO

TABLE 036. MAUSER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. SHIJIHENG: SNAPSHOT

TABLE 037. SHIJIHENG: BUSINESS PERFORMANCE

TABLE 038. SHIJIHENG: PRODUCT PORTFOLIO

TABLE 039. SHIJIHENG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. SNYDER INDUSTRIES: SNAPSHOT

TABLE 040. SNYDER INDUSTRIES: BUSINESS PERFORMANCE

TABLE 041. SNYDER INDUSTRIES: PRODUCT PORTFOLIO

TABLE 042. SNYDER INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ZHENJIANG JINSHAN PACKING FACTORY: SNAPSHOT

TABLE 043. ZHENJIANG JINSHAN PACKING FACTORY: BUSINESS PERFORMANCE

TABLE 044. ZHENJIANG JINSHAN PACKING FACTORY: PRODUCT PORTFOLIO

TABLE 045. ZHENJIANG JINSHAN PACKING FACTORY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. TIME TECHNOPLAST LIMITED: SNAPSHOT

TABLE 046. TIME TECHNOPLAST LIMITED: BUSINESS PERFORMANCE

TABLE 047. TIME TECHNOPLAST LIMITED: PRODUCT PORTFOLIO

TABLE 048. TIME TECHNOPLAST LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CHUANG XIANG: SNAPSHOT

TABLE 049. CHUANG XIANG: BUSINESS PERFORMANCE

TABLE 050. CHUANG XIANG: PRODUCT PORTFOLIO

TABLE 051. CHUANG XIANG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MYERS INDUSTRIES: SNAPSHOT

TABLE 052. MYERS INDUSTRIES: BUSINESS PERFORMANCE

TABLE 053. MYERS INDUSTRIES: PRODUCT PORTFOLIO

TABLE 054. MYERS INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. HOOVER FERGUSON GROUP: SNAPSHOT

TABLE 055. HOOVER FERGUSON GROUP: BUSINESS PERFORMANCE

TABLE 056. HOOVER FERGUSON GROUP: PRODUCT PORTFOLIO

TABLE 057. HOOVER FERGUSON GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. GREIF: SNAPSHOT

TABLE 058. GREIF: BUSINESS PERFORMANCE

TABLE 059. GREIF: PRODUCT PORTFOLIO

TABLE 060. GREIF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. WERIT: SNAPSHOT

TABLE 061. WERIT: BUSINESS PERFORMANCE

TABLE 062. WERIT: PRODUCT PORTFOLIO

TABLE 063. WERIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MASCHIOPACK: SNAPSHOT

TABLE 064. MASCHIOPACK: BUSINESS PERFORMANCE

TABLE 065. MASCHIOPACK: PRODUCT PORTFOLIO

TABLE 066. MASCHIOPACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. PYRAMID TECHNOPLAST: SNAPSHOT

TABLE 067. PYRAMID TECHNOPLAST: BUSINESS PERFORMANCE

TABLE 068. PYRAMID TECHNOPLAST: PRODUCT PORTFOLIO

TABLE 069. PYRAMID TECHNOPLAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. SOTRALENTZ: SNAPSHOT

TABLE 070. SOTRALENTZ: BUSINESS PERFORMANCE

TABLE 071. SOTRALENTZ: PRODUCT PORTFOLIO

TABLE 072. SOTRALENTZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SINTEX: SNAPSHOT

TABLE 073. SINTEX: BUSINESS PERFORMANCE

TABLE 074. SINTEX: PRODUCT PORTFOLIO

TABLE 075. SINTEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SHANGHAI FUJIANG PLASTIC INDUSTRY GROUP: SNAPSHOT

TABLE 076. SHANGHAI FUJIANG PLASTIC INDUSTRY GROUP: BUSINESS PERFORMANCE

TABLE 077. SHANGHAI FUJIANG PLASTIC INDUSTRY GROUP: PRODUCT PORTFOLIO

TABLE 078. SHANGHAI FUJIANG PLASTIC INDUSTRY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. JIELIN: SNAPSHOT

TABLE 079. JIELIN: BUSINESS PERFORMANCE

TABLE 080. JIELIN: PRODUCT PORTFOLIO

TABLE 081. JIELIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NOVAX: SNAPSHOT

TABLE 082. NOVAX: BUSINESS PERFORMANCE

TABLE 083. NOVAX: PRODUCT PORTFOLIO

TABLE 084. NOVAX: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PLASTIC RIGID IBC MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PLASTIC RIGID IBC MARKET OVERVIEW BY TYPE

FIGURE 012. HDPE RIGID IBC MARKET OVERVIEW (2016-2028)

FIGURE 013. LLDPE RIGID IBC MARKET OVERVIEW (2016-2028)

FIGURE 014. LDPE RIGID IBC MARKET OVERVIEW (2016-2028)

FIGURE 015. PLASTIC RIGID IBC MARKET OVERVIEW BY APPLICATION

FIGURE 016. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 017. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 018. CHEMICAL INDUSTRIES MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA PLASTIC RIGID IBC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE PLASTIC RIGID IBC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC PLASTIC RIGID IBC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA PLASTIC RIGID IBC MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA PLASTIC RIGID IBC MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024–2032.

Hoover Ferguson Group (United States), Greif (United States), Mauser Packaging Solutions (United States), Myers Industries (United States), Snyder Industries (United States), ACO Container Systems (Canada), SCHUTZ (Germany), Mauser Group (Germany), WERIT AG (Switzerland), MaschioPack GmbH (Italy), Pyramid Technoplast (Italy), Sotralentz (France), FACH-PAK Sp. z o.o. (Poland),Shijiheng (China), ZhenJiang JinShan Packing Factory (China), Shanghai Fujiang Plastic Industry Group (China),Jilin (China), NOVAX (China), Time Technoplast Limited (Hong Kong), Chuang Xiang (Taiwan), Sintex (India), and Other Major Players

The Plastic Rigid IBC Market is segmented into Type, Capacity, End-User, and region. By Type, the market is categorized into HDPE Rigid IBC, LLDPE Rigid IBC, and LDPE Rigid IBC. By Capacity, the market is categorized into Up To 500 Liters, 501 To 1000 Liters, 1001 To 2000 Liters, and Above 2000 Liters. By End-User, the market is categorized into Industrial Chemicals, Petroleum & Lubricants, Paints Inks & Dyes, Food & Beverages, Building & Construction, Pharmaceuticals, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A plastic rigid IBC, also known as an Intermediate Bulk Container, is a large, industrial-grade container used for storing, transporting, and handling various liquids and solids. They are typically made from high-density polyethylene (HDPE), a strong, durable, and chemically resistant material that can withstand the rigors of industrial environments. Plastic rigid IBCs are reusable and come in a variety of sizes and capacities to meet the specific needs of different industries.

Plastic Rigid IBC Market Size Was Valued at USD 5.8 Billion in 2023, and is Projected to Reach USD 8.96 Billion by 2032, Growing at a CAGR of 4.95 % From 2024-2032.