Plastic Pill Bottle Market Synopsis

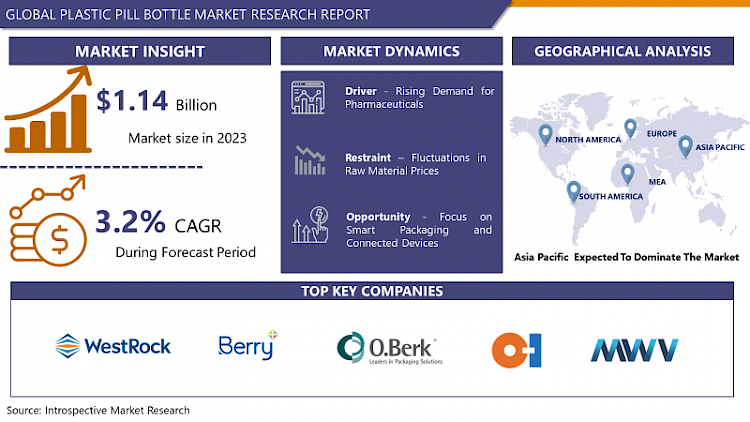

Global Plastic Pill Bottle Market Size Was Valued at USD 1.14 Billion in 2023 and is Projected to Reach USD 1.51 Billion by 2032, Growing at a CAGR of 3.2% From 2024-2032.

Plastic pill bottle is a receptacle crafted from plastic with the explicit purpose of storing and dispensing medications. These containers are characterized by being lightweight, resilient, and frequently equipped with child-resistant closures. They play an essential role in the realm of pharmaceutical packaging, guaranteeing the secure storage of diverse types of medication, all the while providing convenience for both patients and healthcare providers.

- Plastic pill bottles, designed to store and dispense medications, see extensive use in the pharmaceutical sector. These bottles are characterized by their lightweight, durable nature and feature secure closures, ensuring the safety and integrity of various medications. Widely employed for both prescription and over-the-counter drugs, plastic pill bottles offer a convenient and dependable packaging solution.

- The advantages of plastic pill bottles go beyond their practicality. They are cost-effective to manufacture, contributing to overall efficiency in pharmaceutical packaging. The lightweight quality of plastic bottles reduces transportation expenses, making them a cost-efficient choice for pharmaceutical companies. Furthermore, their transparent design facilitates easy identification of medications by both patients and healthcare providers. With the global demand for pharmaceuticals on the rise, the plastic pill bottle market is poised for future expansion. Given the increasing emphasis on patient safety, convenience, and cost-effectiveness, the demand for these bottles is expected to remain strong, establishing them as a crucial element in the pharmaceutical packaging landscape.

Plastic Pill Bottle Market Trend Analysis:

Rising Demand for Pharmaceuticals

- The primary driver behind the growth of the plastic pill bottle market is the increasing demand for pharmaceuticals. The robust expansion of the pharmaceutical industry, fueled by growing healthcare needs worldwide, significantly impacts the need for secure and efficient packaging solutions. Plastic pill bottles, being a crucial component in pharmaceutical packaging, provide a reliable and cost-effective means of storing and dispensing medications. The upsurge in pharmaceutical production, coupled with a heightened focus on patient safety, establishes plastic pill bottles as essential in meeting the packaging requirements for an expanding range of medications.

- Furthermore, the escalating prevalence of chronic diseases and the subsequent increase in prescription medications contribute significantly to the growing demand for plastic pill bottles. With healthcare providers prescribing a higher volume of medications to manage chronic conditions, there is a crucial need for secure, tamper-evident, and user-friendly packaging.

- This aligns with the pharmaceutical industry's commitment to providing safe and effective medications, driving the ongoing growth of the plastic pill bottle market. The increasing demand for pharmaceuticals, driven by global healthcare needs and the rise of chronic diseases, emerges as the primary catalyst propelling the growth of the plastic pill bottle market.

Focus on Smart Packaging and Connected Devices

- The substantial growth opportunity for the plastic pill bottle market is opportunity by an increased emphasis on smart packaging and connected devices within the pharmaceutical sector. As technology continues to progress, there is a rising interest in incorporating smart features into pharmaceutical packaging, including plastic pill bottles. These advancements involve the integration of sensors, RFID tags, or other connected devices that enable real-time monitoring of medication USge. This, in turn, provides patients with reminders for timely doses and enhances overall medication adherence.

- The adoption of smart packaging brings various benefits, such as improved patient engagement and better healthcare outcomes. Plastic pill bottles equipped with smart features empower patients to manage their medication routines more effectively and enable healthcare providers to remotely monitor patient compliance. This interconnected approach enhances the overall efficiency of medication management, especially for individuals with complex treatment regimens.

- Moreover, the integration of smart packaging aligns with the broader trend of digital health and patient-centric care. The incorporation of technology into plastic pill bottles not only addresses challenges related to medication adherence but also opens avenues for data-driven insights into patient behavior. As healthcare becomes more personalized and digitally integrated, the plastic pill bottle market is poised to benefit significantly from the opportunities presented by smart packaging solutions and connected devices, contributing to the advancement of healthcare delivery and patient well-being.

Plastic Pill Bottle Market Segment Analysis:

Plastic Pill Bottle Market Segmented on the basis of Type, Raw Material, Capacity, and Application

By Application, Pharmaceuticals segment is expected to dominate the market during the forecast period

- The pharmaceuticals segment's supremacy in the plastic pill bottle market is propelled by the persistent and expanding demand for secure and efficient medication packaging. As the pharmaceutical industry undergoes global expansion, the need for dependable packaging solutions has witnessed a significant increase. Plastic pill bottles, playing a fundamental role in pharmaceutical packaging, offer characteristics such as durability, tamper resistance, and user-friendliness. These bottles ensure the safety and integrity of medications, making them the preferred choice for pharmaceutical companies committed to delivering high-quality products to consumers.

- Furthermore, the growing prevalence of chronic diseases and the surge in prescription medications contribute substantially to the prominence of the pharmaceuticals segment in the plastic pill bottle market. As the demand for medications continues to rise, the pharmaceutical sector relies on plastic pill bottles to provide a pragmatic and protective packaging solution. The pharmaceuticals' dependence on plastic pill bottles underscores their crucial role in meeting the packaging requirements for a diverse range of medications, solidifying their dominance in the market.

By Raw Material, Polyethylene Terephthalate (PET) segment held the largest share of 59% in 2022

- The Polyethylene Terephthalate (PET) segment has captured the largest share in the plastic pill bottle market, propelled by its versatile properties and extensive applicability. PET, renowned for its clarity, lightweight nature, and recyclability, has emerged as a favored material for pharmaceutical packaging. Its transparent characteristics facilitate easy identification of contents for patients, and its lightweight design adds convenience to handling. Furthermore, the recyclable nature of PET aligns with the growing emphasis on sustainable practices in packaging, further contributing to its dominance in the market.

- PET plastic pill bottles are esteemed for their durability and ability to protect medications from external elements. These bottles offer a secure and tamper-evident packaging solution, ensuring the integrity of pharmaceutical products. The prominence of the PET segment is reinforced by its capacity to meet the essential requirements of pharmaceutical packaging, establishing it as the material of choice for a significant majority of plastic pill bottle applications in the market.

Plastic Pill Bottle Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is expected to lead the plastic pill bottle market due to the region's thriving pharmaceutical industry, fueled by a large and diverse population, significantly contributes to the demand for plastic pill bottles. As healthcare infrastructure expands and access to medications increases, the requirement for secure and efficient packaging solutions expands, positioning Asia Pacific as a key player in the market.

- The growing emphasis on cost-effective manufacturing in countries such as China and India further drive Asia Pacific's dominance. These nations play substantial roles in the global pharmaceutical supply chain, and the presence of skilled labor and cost-effective production facilities makes them significant contributors to the plastic pill bottle market. The region's economic growth, combined with its strategic position in the pharmaceutical industry, positions Asia Pacific as a front-runner in the plastic pill bottle market, expected to maintain its dominance in the foreseeable future.

Plastic Pill Bottle Market Top Key Players:

- WestRock (US)

- Berry Global (US)

- O.Berk Company LLC (US)

- Owens-Illinois (US)

- MeadWestvaco (US)

- Berlin Packaging (US)

- Innocap Corporation (US)

- CCL Industries (Canada)

- Gerresheimer (Germany)

- Huhtamaki (Finland)

- SGD Pharma (France)

- Plastipharm (France)

- Aptar Pharma (Switzerland)

- Alpla Group (Austria)

- DS Smith (UK)

- Tricor Packaging (Hong Kong)

- Amcor (Australia)

- BioPak (Australia)

- Teijin Pharma (Japan)

- Shunmei Industrial Co., Ltd. (Taiwan)

Key Industry Developments in the Plastic Pill Bottle Market:

- In January 2024, PillSafe® is proud to announced the launch of its innovative, patented pill distribution control system, a disruptive technology designed to revolutionize prescription drug safety and compliance. This groundbreaking economical "smart" pill bottle is the brainchild of leading medical professionals, aimed at tackling the growing problem of prescription drug misuse, particularly in the context of the national opioid epidemic.

- In September 2023, Atlanta-based WestRock has agreed to a $20 billion merger with Ireland's Smurfit Kappa, forming the world's largest packaging and materials company.The deal creates the world's largest packaging company, to be named Smurfit WestRock.

|

Global Plastic Pill Bottle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.2 % |

Market Size in 2032: |

USD 1.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PLASTIC PILL BOTTLE MARKET BY TYPE (2017-2032)

- PLASTIC PILL BOTTLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- (SOLID CONTAINERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DROPPER BOTTLES

- LIQUID BOTTLES

- NASAL SPRAY BOTTLES

- CHILD-RESISTANT CLOSURES

- PLASTIC PILL BOTTLE MARKET BY RAW MATERIAL (2017-2030)

- PLASTIC PILL BOTTLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYETHYLENE TEREPHTHALATE (PET)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HIGH-DENSITY POLYETHYLENE (HDPE)

- LOW-DENSITY POLYETHYLENE (LDPE)

- POLYPROPYLENE (PP)

- PLASTIC PILL BOTTLE MARKET BY CAPACITY (2017-2032)

- PLASTIC PILL BOTTLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BELOW 100 ML

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 100 ML TO 500 ML

- ABOVE 500 ML

- PLASTIC PILL BOTTLE MARKET BY APPLICATION (2017-2032)

- PLASTIC PILL BOTTLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHARMACEUTICALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OVER-THE-COUNTER (OTC) MEDICATIONS

- NUTRACEUTICALS AND DIETARY SUPPLEMENTS

- VETERINARY MEDICINES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Plastic Pill Bottle Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- WESTROCK (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BERRY GLOBAL (US)

- O.BERK COMPANY LLC (US)

- OWENS-ILLINOIS (US)

- MEADWESTVACO (US)

- BERLIN PACKAGING (US)

- INNOCAP CORPORATION (US)

- CCL INDUSTRIES (CANADA)

- GERRESHEIMER (GERMANY)

- HUHTAMAKI (FINLAND)

- SGD PHARMA (FRANCE)

- PLASTIPHARM (FRANCE)

- APTAR PHARMA (SWITZERLAND)

- ALPLA GROUP (AUSTRIA)

- DS SMITH (UK)

- TRICOR PACKAGING (HONG KONG)

- AMCOR (AUSTRALIA)

- BIOPAK (AUSTRALIA)

- TEIJIN PHARMA (JAPAN)

- SHUNMEI INDUSTRIAL CO., LTD. (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL PLASTIC PILL BOTTLE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Raw Material

- Historic And Forecasted Market Size By Capacity

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Plastic Pill Bottle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.14 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.2 % |

Market Size in 2032: |

USD 1.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Raw Material |

|

||

|

By Capacity |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PLASTIC PILL BOTTLE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PLASTIC PILL BOTTLE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PLASTIC PILL BOTTLE MARKET COMPETITIVE RIVALRY

TABLE 005. PLASTIC PILL BOTTLE MARKET THREAT OF NEW ENTRANTS

TABLE 006. PLASTIC PILL BOTTLE MARKET THREAT OF SUBSTITUTES

TABLE 007. PLASTIC PILL BOTTLE MARKET BY TYPE

TABLE 008. PET MARKET OVERVIEW (2016-2028)

TABLE 009. HDPE MARKET OVERVIEW (2016-2028)

TABLE 010. PLASTIC PILL BOTTLE MARKET BY APPLICATION

TABLE 011. HOSPITAL MARKET OVERVIEW (2016-2028)

TABLE 012. CLINIC MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA PLASTIC PILL BOTTLE MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA PLASTIC PILL BOTTLE MARKET, BY APPLICATION (2016-2028)

TABLE 015. N PLASTIC PILL BOTTLE MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE PLASTIC PILL BOTTLE MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE PLASTIC PILL BOTTLE MARKET, BY APPLICATION (2016-2028)

TABLE 018. PLASTIC PILL BOTTLE MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC PLASTIC PILL BOTTLE MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC PLASTIC PILL BOTTLE MARKET, BY APPLICATION (2016-2028)

TABLE 021. PLASTIC PILL BOTTLE MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA PLASTIC PILL BOTTLE MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA PLASTIC PILL BOTTLE MARKET, BY APPLICATION (2016-2028)

TABLE 024. PLASTIC PILL BOTTLE MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA PLASTIC PILL BOTTLE MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA PLASTIC PILL BOTTLE MARKET, BY APPLICATION (2016-2028)

TABLE 027. PLASTIC PILL BOTTLE MARKET, BY COUNTRY (2016-2028)

TABLE 028. DRUG PLASTICS: SNAPSHOT

TABLE 029. DRUG PLASTICS: BUSINESS PERFORMANCE

TABLE 030. DRUG PLASTICS: PRODUCT PORTFOLIO

TABLE 031. DRUG PLASTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. BERLIN PACKAGING: SNAPSHOT

TABLE 032. BERLIN PACKAGING: BUSINESS PERFORMANCE

TABLE 033. BERLIN PACKAGING: PRODUCT PORTFOLIO

TABLE 034. BERLIN PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. THORNTON PLASTICS COMPANY: SNAPSHOT

TABLE 035. THORNTON PLASTICS COMPANY: BUSINESS PERFORMANCE

TABLE 036. THORNTON PLASTICS COMPANY: PRODUCT PORTFOLIO

TABLE 037. THORNTON PLASTICS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. GLASS & PLASTIC PACKAGING: SNAPSHOT

TABLE 038. GLASS & PLASTIC PACKAGING: BUSINESS PERFORMANCE

TABLE 039. GLASS & PLASTIC PACKAGING: PRODUCT PORTFOLIO

TABLE 040. GLASS & PLASTIC PACKAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. GERRESHEIMER: SNAPSHOT

TABLE 041. GERRESHEIMER: BUSINESS PERFORMANCE

TABLE 042. GERRESHEIMER: PRODUCT PORTFOLIO

TABLE 043. GERRESHEIMER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. COMAR: SNAPSHOT

TABLE 044. COMAR: BUSINESS PERFORMANCE

TABLE 045. COMAR: PRODUCT PORTFOLIO

TABLE 046. COMAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. GUANGDONG HONGRUNFA HARDWARE PLASTICS INDUSTRY: SNAPSHOT

TABLE 047. GUANGDONG HONGRUNFA HARDWARE PLASTICS INDUSTRY: BUSINESS PERFORMANCE

TABLE 048. GUANGDONG HONGRUNFA HARDWARE PLASTICS INDUSTRY: PRODUCT PORTFOLIO

TABLE 049. GUANGDONG HONGRUNFA HARDWARE PLASTICS INDUSTRY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DONGGUAN FU KANG PLASTIC PRODUCTS: SNAPSHOT

TABLE 050. DONGGUAN FU KANG PLASTIC PRODUCTS: BUSINESS PERFORMANCE

TABLE 051. DONGGUAN FU KANG PLASTIC PRODUCTS: PRODUCT PORTFOLIO

TABLE 052. DONGGUAN FU KANG PLASTIC PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ZHONGSHAN XINRUN PLASTIC PRODUCTS: SNAPSHOT

TABLE 053. ZHONGSHAN XINRUN PLASTIC PRODUCTS: BUSINESS PERFORMANCE

TABLE 054. ZHONGSHAN XINRUN PLASTIC PRODUCTS: PRODUCT PORTFOLIO

TABLE 055. ZHONGSHAN XINRUN PLASTIC PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PLASTIC PILL BOTTLE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PLASTIC PILL BOTTLE MARKET OVERVIEW BY TYPE

FIGURE 012. PET MARKET OVERVIEW (2016-2028)

FIGURE 013. HDPE MARKET OVERVIEW (2016-2028)

FIGURE 014. PLASTIC PILL BOTTLE MARKET OVERVIEW BY APPLICATION

FIGURE 015. HOSPITAL MARKET OVERVIEW (2016-2028)

FIGURE 016. CLINIC MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA PLASTIC PILL BOTTLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE PLASTIC PILL BOTTLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC PLASTIC PILL BOTTLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA PLASTIC PILL BOTTLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA PLASTIC PILL BOTTLE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Plastic Pill Bottle Market research report is 2024-2032.

WestRock (US), Berry Global (US), O.Berk Company LLC (US), Owens-Illinois (US), MeadWestvaco (US), Berlin Packaging (US), Innocap Corporation (US), CCL Industries (Canada), Gerresheimer (Germany), Huhtamaki (Finland), SGD Pharma (France), Plastipharm (France), Aptar Pharma (Switzerland), Alpla Group (Austria), DS Smith (UK), Tricor Packaging (Hong Kong), Amcor (Australia), BioPak (Australia), Teijin Pharma (Japan), Shunmei Industrial Co., Ltd. (Taiwan)

The Plastic Pill Bottle Market is segmented into Type, Raw Material, Capacity, Application, and region. By Type, the market is categorized into Solid Containers, Dropper Bottles, Liquid Bottles, Nasal Spray Bottles and Child-Resistant Closures. By Raw Material, the market is categorized into Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE) and Polypropylene (PP). By Capacity Below 100 ml, 100 ml to 500 ml and Above 500 ml. By Application, the market is categorized into Pharmaceuticals, Over-the-Counter (OTC) Medications, Nutraceuticals and Dietary Supplements and Veterinary Medicines. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Plastic pill bottle is a receptacle crafted from plastic with the explicit purpose of storing and dispensing medications. These containers are characterized by being lightweight, resilient, and frequently equipped with child-resistant closures. They play an essential role in the realm of pharmaceutical packaging, guaranteeing the secure storage of diverse types of medication, all the while providing convenience for both patients and healthcare providers.

Global Plastic Pill Bottle Market Size Was Valued at USD 1.14 Billion in 2023 and is Projected to Reach USD 1.51 Billion by 2032, Growing at a CAGR of 3.2% From 2024-2032.