Global Phytosterols Market Overview

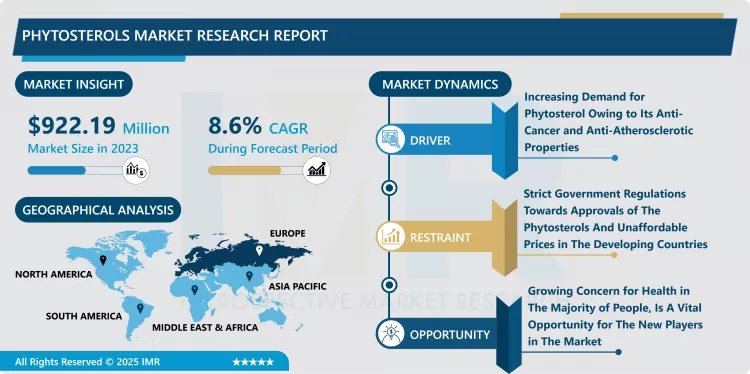

Phytosterols Market Size Was Valued at USD 922.19 Million in 2023, and is Projected to Reach USD 1,937.71 Million by 2032, Growing at a CAGR of 8.6% From 2024-2032.

- The global phytosterols industry is experiencing significant growth driven by increasing consumer awareness of health benefits and the incorporation of these plant-based compounds into various products. Phytosterols, naturally occurring plant sterols, are gaining traction due to their cholesterol-lowering properties, making them attractive ingredients in food and beverage, pharmaceutical, and cosmetic applications. Leading players in the industry are focusing on product innovation and diversification to meet evolving consumer preferences and tap into new market segments. Strategic partnerships and collaborations between industry players and research institutions are also contributing to the development of novel phytosterol-based products.

- Despite the promising growth prospects, the phytosterols market faces certain challenges, such as regulatory hurdles, fluctuations in raw material prices, and concerns regarding the long-term sustainability of phytosterol sources.

Market Dynamics and Factors of Phytosterols Market:

Drivers:

- Recently, the Chinese diet has changed from being rich in plant-sourced foods to being rich in animal-derived foods. This dietary change has given rise to a decrease in phytosterol intake and an increase in cholesterol intake. Moreover, the high cholesterol intake will aggravate cardiovascular diseases in a population having underlying health conditions like diabetes and blood pressure. This is driving the phytosterol market in the Asia region. Moreover, recent studies have shown that phytosterols are effective in lowering cancer risks by 20%. The bleeding edge is that phytosterol has shown properties that directly inhibit plant growth, apoptosis induction, reduced cell cycle progression, and tumor metastasis inhibition. Moreover, there is research going on the antiatherosclerosis efficacy of phytosterols.

- Moreover, there is a growing demand for phytosterol because of its anti-cancer and anti-atherosclerotic properties. The significance they have shown in lowering the absorption of low-density lipoprotein i.e., bad cholesterol is remarkable. It has overturned the non-veg consumers to a vegetarian diet, this shift in population is driving the phytosterols market. The increasing prevalence of diseases is one of the key factors driving the phytosterol market. According to science direct, UK is the leading country in Europe, in terms of purchase of phytosterol, they consumed around 736 kg of phytosterol per year, followed by France, Belgium, Netherlands, Germany, and Greece with a consumption rate of 228.4kg, 129.6kg, 114.2kg, 78.7kg, 64.7kg respectively.

Restraints

- Even, though studies have shown the capability of phytosterols in lowering cardiovascular diseases, some scientists have reported that higher intakes of phytosterols can cause an increase in heart-related problems. Cooking at higher temperatures and for a longer duration of time is influencing the retention of phytosterols in oils, thus hampering the growth of the phytosterol market in the forecast period. However, strict government regulations of the U.S food & drug administration (FDA) towards approvals of the phytosterols and unaffordable prices in the developing countries, are key factors that can hamper the phytosterol market growth. Moreover, unawareness of the phytosterol applications, in illiterate individuals can impact the phytosterol market negatively.

Opportunities

- The growing concern for health in the majority of people, is a vital opportunity for the new players in the market, to introduce their products and make them available to consumers at affordable prices as compared to the high price of reputed companies. The growing pharmaceutical industry and the use of phytosterol in anti-cancer and anti-atherosclerotic therapeutics, is an opportunity for pharmaceutical companies to thrive in the market and extend their reach towards the consumers as a significant amount of people are having these health-related problems. Due to stationary lifestyle, in the IT sector population, the majority of people are deprived of sunlight which causes vitamin D deficiency, phytosterols specifically stigmasterol and its derivatives (stigmasterol glucoside, Spinasterol, fucosterol, and others), play a vital intermediate role in the synthesis of vitamin D3. Vitamin D3 is used to prevent the bone disorders like rickets and osteomalacia, these factors make stigmasterol ideal for the pharmaceutical industry.

Market Segmentation

- Based on the type, the beta-sitosterol segment registered the maximum market share during the forecast period. Beta-Sitosterol, which can be blended from plant woods and vegetable oils, is significantly used in beverages, dairy products, and as an additive in dietary supplements. Also, a significant number of overweight individuals consume 1.5g to 5g of beta-sitosterol daily for body fat reduction. The rising tendency of consumers associated with health and nutritional intake has positively influenced the demand for beta-sitosterol. Therefore, beta-sitosterol is anticipated to be one of the prime segments in the market for phytosterols.

- Based on the application, pharmaceutical, cosmetics, and food ingredients are the well-known applications of all phytosterol products. The pharmaceutical segment includes tablets, creams, and medicinal products. Factors such as increased cholesterol levels among the geriatric population along with the universality of lifestyle diseases and other health conditions have fostered the demand for phytosterols in pharmaceutical applications. In the cosmetics industry, phytosterols derivatives/formulations find application in oral care products, skincare, sun care, creams, and hair care. In the food industry, phytosterols are utilized in the form of an ingredient in products such as mayonnaise, spread, cheese, oatmeal, turkey liver sausage, chicken balls, soymilk, yogurt, buttermilk, and cream.

Players Covered in Phytosterols market are :

- Archer Daniels Midlands (U.S)

- Cargill Incorporated (U.S)

- Pharmachem Laboratories INC. (U.S)

- BASF SE (Germany)

- E.I. DuPont de Nemours INC. (U.S)

- Raisio PLC (Finland)

- Arboris LLC (U.S)

- Unilever (U.K)

- Gustav Parmentier GmbH (Germany)

- Bunge Limited (U.S)

- Nikko Chemicals Co. Ltd (India)

- Pioneer Enterprise (India)

- Herbo Nutra (India)

- Berkshire Hathaway Inc. (U.S)

- Merck KGaA (Germany) and other major key players.

Regional Analysis of Phytosterols Market:

- Europe is expected to be the dominant market for phytosterols due to the rising consumer demand for functional foods and dietary supplements that offer cholesterol-lowering benefits. The region's growing health consciousness, especially in countries like Germany, the UK, and France, has fueled the adoption of phytosterols in food products such as margarine, yogurt, and fortified drinks. Regulatory approval from authorities like the European Food Safety Authority (EFSA) for the use of phytosterols in food products further boosts market growth, ensuring safety and efficacy for consumers.

- Additionally, the increasing focus on heart health, driven by a rise in cardiovascular diseases and obesity, is likely to contribute to the demand for phytosterols in Europe. The region's well-developed food and beverage industry, coupled with strong research and innovation, is anticipated to drive market expansion at a significant rate. With major players investing in product development and marketing campaigns, the European phytosterols market is poised for sustained growth in the coming years.

Key Industry Development of Phytosterols Market:

- In July 2021, ADM (Archer Daniels Midlands), a global nutrition leader has declared that it has reached an agreement to acquire Sojaprotein, a leading ingredient provider of soy ingredients. Soy is an excellent source of ?-sitosterol, as it helps in reducing cholesterol levels and reduce the risk of some cancers.

- In June 2019, Finland-based company, Raisio Group has financed USD 55 million in the growth of healthy foods along with plant-based added-value products. Through this investment, the company has built up its market position in the European Market.

|

Global Phytosterols Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 922.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 1,937.71 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Phytosterols Market by Type (2018-2032)

4.1 Phytosterols Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Beta-sitosterol

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Campesterol

4.5 Stigmasterol

4.6 Other Types

Chapter 5: Phytosterols Market by Application (2018-2032)

5.1 Phytosterols Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food Ingredients

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceuticals

5.5 Cosmetics

5.6 Feed

5.7 Other Application

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Phytosterols Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ARCHER DANIELS MIDLANDS (U.S)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CARGILL INCORPORATED (U.S)

6.4 PHARMACHEM LABORATORIES INC. (U.S)

6.5 BASF SE (GERMANY)

6.6 E.I. DUPONT DE NEMOURS INC. (U.S)

6.7 RAISIO PLC (FINLAND)

6.8 ARBORIS LLC (U.S)

6.9 UNILEVER (U.K)

6.10 GUSTAV PARMENTIER GMBH (GERMANY)

6.11 BUNGE LIMITED (U.S)

6.12 NIKKO CHEMICALS CO. LTD (INDIA)

6.13 PIONEER ENTERPRISE (INDIA)

6.14 HERBO NUTRA (INDIA)

6.15 BERKSHIRE HATHAWAY INC. (U.S)

6.16 MERCK KGAA (GERMANY) OTHER MAJORKEY PLAYERS

Chapter 7: Global Phytosterols Market By Region

7.1 Overview

7.2. North America Phytosterols Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Beta-sitosterol

7.2.4.2 Campesterol

7.2.4.3 Stigmasterol

7.2.4.4 Other Types

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food Ingredients

7.2.5.2 Pharmaceuticals

7.2.5.3 Cosmetics

7.2.5.4 Feed

7.2.5.5 Other Application

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Phytosterols Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Beta-sitosterol

7.3.4.2 Campesterol

7.3.4.3 Stigmasterol

7.3.4.4 Other Types

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food Ingredients

7.3.5.2 Pharmaceuticals

7.3.5.3 Cosmetics

7.3.5.4 Feed

7.3.5.5 Other Application

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Phytosterols Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Beta-sitosterol

7.4.4.2 Campesterol

7.4.4.3 Stigmasterol

7.4.4.4 Other Types

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food Ingredients

7.4.5.2 Pharmaceuticals

7.4.5.3 Cosmetics

7.4.5.4 Feed

7.4.5.5 Other Application

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Phytosterols Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Beta-sitosterol

7.5.4.2 Campesterol

7.5.4.3 Stigmasterol

7.5.4.4 Other Types

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food Ingredients

7.5.5.2 Pharmaceuticals

7.5.5.3 Cosmetics

7.5.5.4 Feed

7.5.5.5 Other Application

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Phytosterols Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Beta-sitosterol

7.6.4.2 Campesterol

7.6.4.3 Stigmasterol

7.6.4.4 Other Types

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food Ingredients

7.6.5.2 Pharmaceuticals

7.6.5.3 Cosmetics

7.6.5.4 Feed

7.6.5.5 Other Application

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Phytosterols Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Beta-sitosterol

7.7.4.2 Campesterol

7.7.4.3 Stigmasterol

7.7.4.4 Other Types

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food Ingredients

7.7.5.2 Pharmaceuticals

7.7.5.3 Cosmetics

7.7.5.4 Feed

7.7.5.5 Other Application

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Phytosterols Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 922.19 Mn. |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 1,937.71 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Phytosterols Market research report is 2022-2028.

Archer Daniels Midlands (U.S), Cargill Incorporated (U.S), Pharmachem Laboratories INC. (U.S), BASF SE (Germany), E.I. DuPont de Nemours INC. (U.S), Raisio PLC (Finland), Arboris LLC (U.S), Unilever (U.K), Gustav Parmentier GmbH (Germany), Bunge Limited (U.S), Nikko Chemicals Co. Ltd (India), Pioneer Enterprise (India), Herbo Nutra (India), Berkshire Hathaway Inc. (U.S), Merck KGaA (Germany) and other major players.

The Phytosterols Market is segmented into Type, Application, and region. By Type, the market is categorized into Beta-sitosterol, Campesterol, Stigmasterol, Other Types. By Application, the market is categorized into Food Ingredients, Pharmaceuticals, Cosmetics, Feed, Other Application. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Phytosterols or plant sterols are a family of steroid molecules closely related to the cholesterol molecules found in animal cells. They play a vital role in the human body by lowering the absorption of bad cholesterol and thus preventing many hearts related diseases.

Phytosterols Market Size Was Valued at USD 922.19 Million in 2023, and is Projected to Reach USD 1,937.71 Million by 2032, Growing at a CAGR of 8.6% From 2024-2032.