Physical Therapy Equipment Market Synopsis

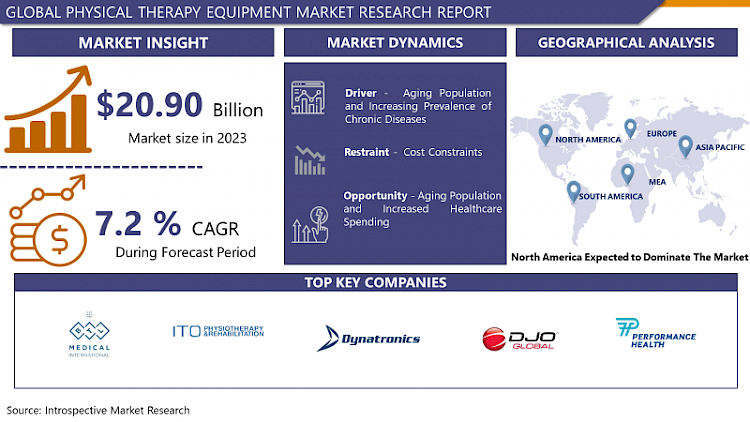

Physical Therapy Equipment Market Size Was Valued at USD 20.90 Billion in 2023, and is Projected to Reach USD 39.08 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.

Physical therapy equipment, also known as physical rehabilitation, means all tools, devices, machines, or aids that facilitate the physical therapist to help patients with rehabilitation, gain or regain their strength, movements, sensations, functions, or abilities. Special equipment that can be provided includes exercise bands, weights, balance boards, treatment tables, ultrasound machines, and so on, and other ones that are designed to address particular regions of the body or particular types of movement.

- There has been significant growth in the PT equipment market over the recent past due to factors like; a. aging population b. growing incidence of chronic diseases and c. understanding of the effectiveness of physical therapy. This market covers a broad category of apparatus and instruments utilized in physical therapy to help patients who have been immobilized, injured, disabled, or having some health complications.

- One of the major factors that can be identified at present is the incorporation of new technologies in physical therapy equipment. Some of the advancements that have emerged include the implementation of robotic-assisted therapy, technology like virtual reality (VR), and wearable devices to facilitate the administration of physical therapy. Not only do these technologies make the therapy more effective, but they also offer the patient more appealing and exciting opportunities in addition to the outcomes, which are already good enough if a sufficient therapy plan is chosen and implemented. Also, the enhanced biomedical technology in the equipment’s fabrication has allowed the emergence of durable and lightweight equipment; this means that patients can be in comfortable positions as they undergo physical therapy sessions.

- Likewise, there has been a rise in awareness for preventive care and health and wellness centres hence boosting the physical therapy equipment market. Individual service providers and healthcare centers have embraced early intervention and rehabilitation as essential measures that can help prevent recurrent or worsening healthcare conditions. Therefore, people now search for physical therapy equipment for home use that helps the patients continue with their rehabilitation activities at home. Devices including resistance bands, balance boards, and exercise balls can be easily carried around and provide easier usage in the improvement of patient’s health.

- Moreover, the role of telehealth as well as the remote monitoring services in the PT sector has also increased due to the current pandemic or COVID-19. Due to current restrictions implemented to slow the spread of the infection and minimize the number of face-to-face appointments, more clients now avail of telemedicine and remote counseling sessions. This shift in focus has posed several new opportunities for the companies that are in the software or tile support with connected devices and any type of products that allow real-time tracking of patients’ progress and their compliance with the treatment plan.

- Thus, this physical therapy equipment market can be analyzed in terms of market segmentation by product type, end-user, and region. Oxygen and aerosol equipment, wheelchairs, walkers, therapeutic equipment including physiotherapy equipment like ultrasound, electric stimulation, traction instruments, and treatment couches are other types of equipment. The target patient audience of physical therapy equipment includes hospitals, rehabilitation centers, and clinics, outpatient centers, home care organizations or settings, and sports institutions. Regionally, North America and Europe hold the largest market share due to the accessibility of efficient and advanced healthcare sectors along with consistently increasing new healthcare spending. However, Asian-Pacific and Latin American economies are experiencing considerable growth due to the enhancement of healthcare facilities, increased customers’ purchasing capacity, and an actual realization of the need to attend to patients’ physical therapy necessities.

- It is also important for the stakeholders to understand that the market for physical therapy equipment will continue expanding in the future due to the development of new technologies, changes in the healthcare system, and the rise in the need for rehabilitation for patients with physical disabilities. Therefore, borne out of the increased population, advanced age, and the continuously rising incidence of chronic diseases, the physical therapy solutions market will continue to be a growing one, full of profit opportunities for the companies involved.

Physical Therapy Equipment Market Trend Analysis

Shift Towards Home-Based Rehabilitation Solutions

- It has been observed over the years that there is a trend of leaning towards home-based care or rehabilitation equipment which has triggered the changes in the physical therapy equipment market. This development is the result of different factors like; innovation, the transformation in the people’s choice in terms of treatment, and the existence of the COVID-19 virus that forced the use of telehealth/ home-based treatment. The advancement in portable technology and the growing need for efficient self-care for health issues has made the human demand for portable and easily operable physical therapy equipment highly demanded.

- Scientists on their side start producing equipment, that is smaller, simpler, and can be used in a home setting. These solutions comprise wearable rehabilitation equipment, virtual reality systems, and digital monitoring devices allowing patients to undergo therapy sessions at their homes with the assistance of professionals. This is not only better for the patient but also for clinic-based rehabilitation but also provides cost-effective solutions to clinic-based physical therapy equipment hence promoting the growth of the home physical therapy equipment market.

Aging Population and Increased Healthcare Spending

- Aging society and excessive spending on the healthcare system are two factors raising concerns and inseparable phenomena that have impacts on all societies. Since people are living longer due to factors such as better genetics, improved healthcare, and policies on childbirth, the populations’ health requirements rise, especially for diseases affecting the elderly and persons with chronic ailments. Policies are needed as this demographic shift increases spending pressures on healthcare systems in various ways. Secondly, elderly people are more likely to seek healthcare such as hospital care, long-term care, and drugs than the young and hence, any economic indicator that involves medical services is likely to be greater among elderly people. Additionally, aging persons utilize the health systems more often than youths due to their multitude of interacting chronic diseases that require expensive treatment.

- More to the point, as the number of employees increases in age, there may be less active contribution to the healthcare funding either through taxes or insurance contributions thus putting immense pressure on the financial impacts. To overcome these issues, the policymakers need to consider the sources of funding health care most sustainably, shift focus on the care provided before diseases develop into complications, and ensure that money is directed towards increasing access to efficient technologies and practices in caring for the elderly population.

Physical Therapy Equipment Market Segment Analysis:

Physical Therapy Equipment Market Segmented Based on By Type, By Application, and By End User.

By Type, the Ultrasound segment is expected to dominate the market during the forecast period

- In the existing grater, different kinds of equipment serve as significant tools in the course of therapy and treatment of patients that undergo PT. Lasers are also widely used today due to their benefits in the stimulation of the recovery of tissues and the alleviation of pain as a result of light. Ultrasound machines are another critical feature, which uses frequencies above the normal audible range to produce images of tissues within the body, increase blood flow, and speed up various treatment procedures. Apparatus used in cryotherapy includes a cryogenic apparatus/or cryogen: this equipment provides cold therapy at the designated area hence minimizing inflammation and the effects of numbness on the affected part. TENS units, transcutaneous electrical nerve stimulation units, and muscle stimulators are electrotherapy stimulating equipment that applies electrical currents to muscles and nerves that control pain and facilitate muscle strengthening exercises.

- Moreover, that is why the main forms of work, namely, massage, hydrotherapy, physiotherapy, Electrophysical agents, and Manual therapy have accessories that comprise braces, supports, and exercise equipment that enhance this general support during rehabilitation. These include a variety of equipment important for the professional physical therapist to adopt a wide-ranging and complex treatment plan aimed at improving the general well-being of their patients.

By Application, the Musculoskeletal segment held the largest share in 2023

- Currently, the market for physical therapy equipment is undergoing tangible growth in terms of applicability across various domains such as musculoskeletal, gynecology, pediatric, and cardiovascular fields. Physical therapy equipment has a high demand in musculoskeletal which is a result of aging people, increasing cases of sports injuries, and Musculoskeletal disorders all over the globe. Gynecology employs the equipment in physical therapy for conditions like perinatal care, pelvic disorders, and UI among pregnant and postnatal mothers. For children with developmental delays, cerebral palsy, and other childhood conditions, physical therapy equipment enhances treatment strategies with an emphasis on early intervention and rehabilitation.

- In the cardiovascular aspect, facilities such as treadmills, stationary bikes, and resistance bands are essentials in cardiac rehab where patients need physical fitness to recover from surgeries or to manage chronic ailments. Incorporating these findings, trends such as the adoption of advanced technologies, increase in total health care spending, influx for preventive care needs, and advancements in physical therapy techniques are positively impacting the global physical therapy equipment market for these multiple applications.

Physical Therapy Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Bolstered by factors such as a rising geriatric population, increased awareness of rehabilitation, and improved accessibility to healthcare, North America is anticipated to emerge as the leading region in the physical therapy equipment market over the forecast period. Several factors could be attributed to this region being among the leading regions in terms of health facility investment; they include better healthcare technology, improved healthcare facilities, rising cases of chronic diseases, and the growing population of people within the geriatric era. Further, the increased focus on hospital infrastructure and modernization by governments and healthcare authorities also enhances the tendency for attractive reimbursements and greater healthcare spending. Thirdly, increased technological development and the incorporation of advanced treatment technologies push for the increased use of physical therapy equipment in North America. Focused on rehabilitation and other early intervention approaches and procedures in healthcare, the region is likely to experience steady growth in market size in the future, strengthening its position in the global market of physical therapy equipment.

Active Key Players in the Physical Therapy Equipment Market

- BTL Industries Inc. (US)

- ITO Co.Ltd. (Japan)

- Dynatronics Corporation (US)

- DJO Global (US)

- Performance Health (US)

- Whitehall Manufacturing (US)

- Zimmer MedizinSysteme GmbH (Germany)

- Enraf-Nonius B.V. (Netherlands)

- Mectronic Medicale (Italy)

- Zinex Inc. (US)

- STORZ Medical AG (Switzerland)

- EMS Physio Ltd. (UK)

- Life Care Systems (India)

- Mettler Electronics Corp. (US)

- Other Key Players

Key Industry Developments in the Physical Therapy Equipment Market

- In November 2023, Siemens Healthineers launched ACUSON Maple Ultrasound System which is designed to incorporate 25 advanced features and accommodate 15 transducers that improve user experience and simplify operational processes. The system’s AI-powered tools, combined with an integrated battery providing up to 75 minutes of unplugged scanning, empower clinicians to enhance efficiency through improved consistency in repetitive tasks.

- In March 2023, the physiotherapy unit at District Hospital in Chhattisgarh, India, was equipped with modern devices such as a TENS machine, IFT muscle stimulator, traction machine, SWD, static bicycle, and cordysafe chair to treat severe cases of chronic back pain and stiffness.

- In January 2023, Hydro Physio joined the ABHI UK Pavilion at Arab Health 2023 to launch a hypnotherapy system in the Middle East. The new Active Hydrotherapy Trainer by Hydro Physio aims to transform the rehabilitation process for patients recovering from injuries or surgeries. This innovative system offers a dedicated and hygienic aquatic therapy space with a treadmill chamber, entrance foyer, and integrated water management equipment.

Global Physical Therapy Equipment Market Scope :

|

Global Physical Therapy Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.90 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 39.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PHYSICAL THERAPY MARKET BY LASER TYPE (2017-2032)

- PHYSICAL THERAPY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LASER THERAPY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ULTRASOUND

- CRYOTHERAPY

- ELECTROTHERAPY

- ACCESSORIES

- PHYSICAL THERAPY MARKET BY APPLICATION (2017-2032)

- PHYSICAL THERAPY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MUSCULOSKELETAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GYNECOLOGY

- PEDIATRICS

- CARDIOVASCULAR

- PHYSICAL THERAPY MARKET BY END USERS (2017-2032)

- PHYSICAL THERAPY MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHYSIOTHERAPY & REHABILITATION CENTERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HOSPITALS

- HOME CARE SETTINGS

- PHYSICIAN OFFICES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- PHYSICAL THERAPY Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BTL INDUSTRIES INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ITO CO.LTD. (JAPAN)

- DYNATRONICS CORPORATION (US)

- DJO GLOBAL (US)

- PERFORMANCE HEALTH (US)

- WHITEHALL MANUFACTURING (US)

- ZIMMER MEDIZINSYSTEME GMBH (GERMANY)

- ENRAF-NONIUS B.V. (NETHERLANDS)

- MECTRONIC MEDICALE (ITALY)

- ZINEX INC. (US)

- STORZ MEDICAL AG (SWITZERLAND)

- EMS PHYSIO LTD. (UK)

- LIFE CARE SYSTEMS (INDIA)

- METTLER ELECTRONICS CORP. (US)

- COMPETITIVE LANDSCAPE

- GLOBAL PHYSICAL THERAPY MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

Global Physical Therapy Equipment Market Scope :

|

Global Physical Therapy Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.90 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.2% |

Market Size in 2032: |

USD 39.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PHYSICAL THERAPY EQUIPMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PHYSICAL THERAPY EQUIPMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PHYSICAL THERAPY EQUIPMENT MARKET COMPETITIVE RIVALRY

TABLE 005. PHYSICAL THERAPY EQUIPMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. PHYSICAL THERAPY EQUIPMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. PHYSICAL THERAPY EQUIPMENT MARKET BY PRODUCT

TABLE 008. LASER THERAPY MARKET OVERVIEW (2016-2028)

TABLE 009. ULTRASOUND MARKET OVERVIEW (2016-2028)

TABLE 010. CRYOTHERAPY MARKET OVERVIEW (2016-2028)

TABLE 011. ELECTROTHERAPY MARKET OVERVIEW (2016-2028)

TABLE 012. ACCESSORIES MARKET OVERVIEW (2016-2028)

TABLE 013. PHYSICAL THERAPY EQUIPMENT MARKET BY APPLICATION

TABLE 014. MUSCULOSKELETAL MARKET OVERVIEW (2016-2028)

TABLE 015. GYNECOLOGY MARKET OVERVIEW (2016-2028)

TABLE 016. PEDIATRICS MARKET OVERVIEW (2016-2028)

TABLE 017. CARDIOVASCULAR MARKET OVERVIEW (2016-2028)

TABLE 018. PHYSICAL THERAPY EQUIPMENT MARKET BY END USERS

TABLE 019. PHYSIOTHERAPY & REHABILITATION CENTERS MARKET OVERVIEW (2016-2028)

TABLE 020. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 021. HOME CARE SETTINGS MARKET OVERVIEW (2016-2028)

TABLE 022. PHYSICIAN OFFICES MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 025. NORTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY END USERS (2016-2028)

TABLE 027. N PHYSICAL THERAPY EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE PHYSICAL THERAPY EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 029. EUROPE PHYSICAL THERAPY EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 030. EUROPE PHYSICAL THERAPY EQUIPMENT MARKET, BY END USERS (2016-2028)

TABLE 031. PHYSICAL THERAPY EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC PHYSICAL THERAPY EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 033. ASIA PACIFIC PHYSICAL THERAPY EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 034. ASIA PACIFIC PHYSICAL THERAPY EQUIPMENT MARKET, BY END USERS (2016-2028)

TABLE 035. PHYSICAL THERAPY EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA PHYSICAL THERAPY EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA PHYSICAL THERAPY EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA PHYSICAL THERAPY EQUIPMENT MARKET, BY END USERS (2016-2028)

TABLE 039. PHYSICAL THERAPY EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY PRODUCT (2016-2028)

TABLE 041. SOUTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 042. SOUTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET, BY END USERS (2016-2028)

TABLE 043. PHYSICAL THERAPY EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 044. BTL INDUSTRIES INC. (US): SNAPSHOT

TABLE 045. BTL INDUSTRIES INC. (US): BUSINESS PERFORMANCE

TABLE 046. BTL INDUSTRIES INC. (US): PRODUCT PORTFOLIO

TABLE 047. BTL INDUSTRIES INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ITO CO.: SNAPSHOT

TABLE 048. ITO CO.: BUSINESS PERFORMANCE

TABLE 049. ITO CO.: PRODUCT PORTFOLIO

TABLE 050. ITO CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. LTD. (JAPAN): SNAPSHOT

TABLE 051. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 052. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 053. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. DYNATRONICS CORPORATION (US): SNAPSHOT

TABLE 054. DYNATRONICS CORPORATION (US): BUSINESS PERFORMANCE

TABLE 055. DYNATRONICS CORPORATION (US): PRODUCT PORTFOLIO

TABLE 056. DYNATRONICS CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DJO GLOBAL (US): SNAPSHOT

TABLE 057. DJO GLOBAL (US): BUSINESS PERFORMANCE

TABLE 058. DJO GLOBAL (US): PRODUCT PORTFOLIO

TABLE 059. DJO GLOBAL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. PERFORMANCE HEALTH (US): SNAPSHOT

TABLE 060. PERFORMANCE HEALTH (US): BUSINESS PERFORMANCE

TABLE 061. PERFORMANCE HEALTH (US): PRODUCT PORTFOLIO

TABLE 062. PERFORMANCE HEALTH (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. WHITEHALL MANUFACTURING (US): SNAPSHOT

TABLE 063. WHITEHALL MANUFACTURING (US): BUSINESS PERFORMANCE

TABLE 064. WHITEHALL MANUFACTURING (US): PRODUCT PORTFOLIO

TABLE 065. WHITEHALL MANUFACTURING (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. ZIMMER MEDIZINSYSTEME GMBH (GERMANY): SNAPSHOT

TABLE 066. ZIMMER MEDIZINSYSTEME GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 067. ZIMMER MEDIZINSYSTEME GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 068. ZIMMER MEDIZINSYSTEME GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ENRAF-NONIUS B.V. (NETHERLANDS): SNAPSHOT

TABLE 069. ENRAF-NONIUS B.V. (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 070. ENRAF-NONIUS B.V. (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 071. ENRAF-NONIUS B.V. (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. MECTRONIC MEDICALE (ITALY): SNAPSHOT

TABLE 072. MECTRONIC MEDICALE (ITALY): BUSINESS PERFORMANCE

TABLE 073. MECTRONIC MEDICALE (ITALY): PRODUCT PORTFOLIO

TABLE 074. MECTRONIC MEDICALE (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ZINEX INC. (US): SNAPSHOT

TABLE 075. ZINEX INC. (US): BUSINESS PERFORMANCE

TABLE 076. ZINEX INC. (US): PRODUCT PORTFOLIO

TABLE 077. ZINEX INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. STORZ MEDICAL AG (SWITZERLAND): SNAPSHOT

TABLE 078. STORZ MEDICAL AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 079. STORZ MEDICAL AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 080. STORZ MEDICAL AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. EMS PHYSIO LTD. (UK): SNAPSHOT

TABLE 081. EMS PHYSIO LTD. (UK): BUSINESS PERFORMANCE

TABLE 082. EMS PHYSIO LTD. (UK): PRODUCT PORTFOLIO

TABLE 083. EMS PHYSIO LTD. (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. LIFE CARE SYSTEMS (INDIA): SNAPSHOT

TABLE 084. LIFE CARE SYSTEMS (INDIA): BUSINESS PERFORMANCE

TABLE 085. LIFE CARE SYSTEMS (INDIA): PRODUCT PORTFOLIO

TABLE 086. LIFE CARE SYSTEMS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. METTLER ELECTRONICS CORP. (US): SNAPSHOT

TABLE 087. METTLER ELECTRONICS CORP. (US): BUSINESS PERFORMANCE

TABLE 088. METTLER ELECTRONICS CORP. (US): PRODUCT PORTFOLIO

TABLE 089. METTLER ELECTRONICS CORP. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY PRODUCT

FIGURE 012. LASER THERAPY MARKET OVERVIEW (2016-2028)

FIGURE 013. ULTRASOUND MARKET OVERVIEW (2016-2028)

FIGURE 014. CRYOTHERAPY MARKET OVERVIEW (2016-2028)

FIGURE 015. ELECTROTHERAPY MARKET OVERVIEW (2016-2028)

FIGURE 016. ACCESSORIES MARKET OVERVIEW (2016-2028)

FIGURE 017. PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY APPLICATION

FIGURE 018. MUSCULOSKELETAL MARKET OVERVIEW (2016-2028)

FIGURE 019. GYNECOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 020. PEDIATRICS MARKET OVERVIEW (2016-2028)

FIGURE 021. CARDIOVASCULAR MARKET OVERVIEW (2016-2028)

FIGURE 022. PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY END USERS

FIGURE 023. PHYSIOTHERAPY & REHABILITATION CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 024. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 025. HOME CARE SETTINGS MARKET OVERVIEW (2016-2028)

FIGURE 026. PHYSICIAN OFFICES MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA PHYSICAL THERAPY EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Physical Therapy Equipment Market research report is 2024-2032.

BTL Industries Inc. (US), ITO Co.Ltd. (Japan), Dynatronics Corporation (US), DJO Global (US), Performance Health (US), Whitehall Manufacturing (US), Zimmer MedizinSysteme GmbH (Germany), Enraf-Nonius B.V. (Netherlands), and Other Major Players.

The Physical Therapy Equipment Market is segmented into Type, Application, and End-use By Sales Channel and Region. By Type, the market is categorized into Laser Therapy, ultrasound, Cryotherapy, Electrotherapy, and Accessories. By Application, the market is categorized into Musculoskeletal, Gynecology, Pediatrics, and Cardiovascular. By End User, the market is categorized into Physiotherapy & Rehabilitation Centers, Hospitals, Home Care Settings, Physician Offices, and Others End Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Physical therapy equipment, also known as physical rehabilitation, means all tools, devices, machines, or aids that facilitate the physical therapist to help patients with rehabilitation, gain or regain their strength, movements, sensations, functions, or abilities. Special equipment that can be provided includes exercise bands, weights, balance boards, treatment tables, ultrasound machines, and so on, and other ones that are designed to address particular regions of the body or particular types of movement.

Physical Therapy Equipment Market Size Was Valued at USD 20.90 Billion in 2023, and is Projected to Reach USD 39.08 Billion by 2032, Growing at a CAGR of 7.2% From 2024-2032.