Photography Studio Software Market Synopsis

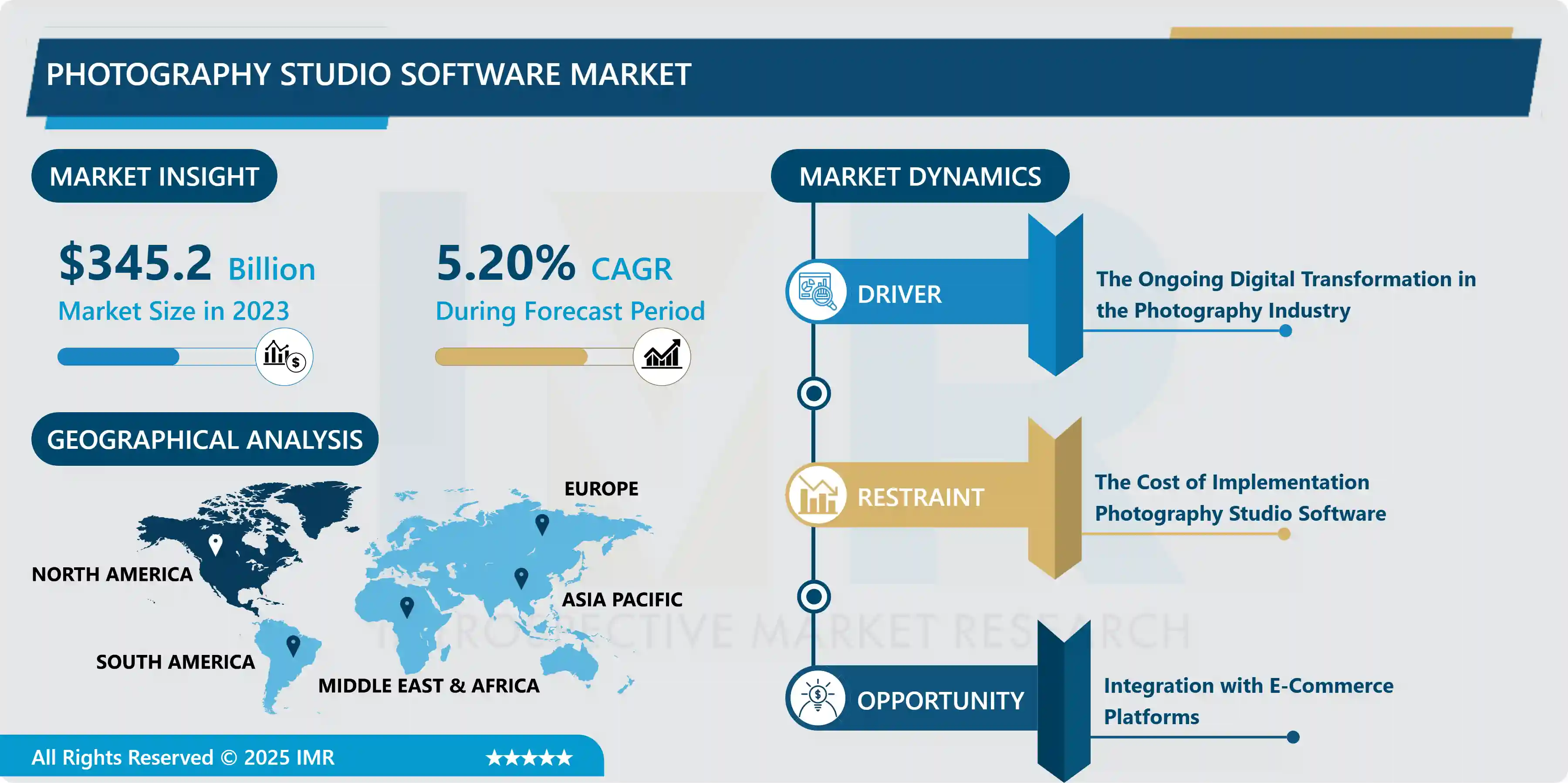

Photography Studio Software Market Size Was Valued at USD 345.2 million in 2023 and is Projected to Reach USD 580.3 million by 2032, Growing at a CAGR of 5.2% From 2024-2032.

Photography Studio Software is a specialized category of computer programs designed to support the operations of a photography studio. These software solutions encompass a range of features tailored to the unique needs of professional photographers and studio managers.

Photography Studio Software refers to specialized programs designed to streamline and enhance various aspects of managing and operating a photography studio. However, these software solutions often incorporate tools for photo editing, cataloging, and storage to facilitate seamless post-production workflows. Some platforms may also integrate with online galleries or client portals, allowing photographers to easily share proofs and final images with their clients. Photography Studio Software plays a crucial role in optimizing studio operations, improving client communication, and enhancing the overall efficiency of the photography business.

Photography Studio Software serves a multifaceted role in streamlining and optimizing various aspects of a photography studio's operations. The basic use is appointment scheduling and client management, allowing photographers to efficiently organize bookings, track appointments, and maintain a comprehensive database of clients. These software solutions often integrate invoicing and payment processing features, simplifying financial transactions and helping studios manage their finances effectively. However, Photography Studio Software frequently includes tools for photo editing, cataloging, and storage, enhancing post-production workflows and ensuring a seamless and organized archive of images.

The growth of Photography Studio Software can be attributed to evolving needs and challenges faced by modern photography businesses. As the photography industry becomes increasingly digital, there is a growing demand for tools that can streamline administrative tasks. Moreover, the integration of photo editing and organizing features within Photography Studio Software addresses the demand for more comprehensive and efficient post-production workflows.

The rise of online platforms and digital communication has led to a greater emphasis on client engagement and interaction. Photography Studio Software includes features like online galleries and client portals, enabling photographers to easily share proofs and final images with clients, thereby enhancing the overall client experience. Furthermore, the competitive nature of the photography industry necessitates staying up-to-date with technological advancements. Photography Studio Software provides a technological edge, allowing studios to operate more efficiently, deliver high-quality services, and ultimately stay competitive in the market.

Photography Studio Software Market Trend Analysis

The Ongoing Digital Transformation in the Photography Industry

- The ongoing digital transformation in the photography industry serves as a significant driver for the adoption of Photography Studio Software. This transformation involves the shift from traditional film-based photography to digital processes, impacting the entire workflow from image capture to post-production and client delivery.

- Digital transformation brings about a range of technological advancements, including high-resolution digital cameras, sophisticated editing software, and online platforms for image sharing. As photographers embrace these advancements, the need for comprehensive tools to manage the digital workflow becomes essential. The shift to digital processes aligns with the broader trend of automation and integration in the industry.

- Photography Studio Software is designed to accommodate the digital nature of modern photography. It enables photographers to seamlessly organize, edit, and store digital images, fostering a more efficient post-production process. These software solutions often come with features like batch editing, metadata management, and digital asset organization, allowing photographers to handle the increased volume and complexity of digital content.

- As the photography industry continues to undergo digital transformation, Photography Studio Software becomes an indispensable companion for professionals seeking to stay competitive, deliver high-quality services, and adapt to the changing landscape of modern photography. It not only facilitates a smoother transition to digital workflows but also ensures that photographers can harness the full potential of digital technology to meet the evolving needs of their clients and the industry as a whole.

Restraints

The Cost of Implementation Photography Studio Software

- The cost of implementing Photography Studio Software represents a significant restraint for many photography studios. This restraint includes various financial considerations associated with adopting and integrating the software into the existing workflow of the studio. The initial cost involves purchasing the software licenses, which can be relatively high for feature-rich and specialized solutions. also, there are expenses related to hardware upgrades or requirements, ensuring that the studio's equipment is compatible with the software.

- Photography Studio Software often comes with a learning curve, and staff members need training to effectively use the new tools and features. This training can result in downtime as employees familiarize themselves with the software, impacting overall productivity. For smaller studios, the upfront investment required for Photography Studio Software may be a substantial barrier. Moreover, ongoing costs, such as subscription fees and potential maintenance expenses, contribute to the overall cost of ownership.

Opportunity

Integration with E-Commerce Platforms

- Photography Studio Software is rooted in the growing trend of photography studios seeking additional revenue streams beyond traditional services. By seamlessly connecting with e-commerce platforms, Photography Studio Software can empower photographers to monetize their work in various ways. This integration allows studios to sell prints, digital downloads, or other photography-related products directly through their online presence.

- Another significant aspect of this opportunity lies in the potential for studios to reach a broader audience. Through e-commerce integration, photographers can showcase and sell their work to a global customer base, breaking down geographical barriers and expanding their market reach.

- Moreover, integration with e-commerce platforms provides a streamlined and centralized system for managing product listings, transactions, and order fulfillment. This efficiency is particularly valuable for photography studios, as it enables them to focus on their creative work while automating the logistics of selling products. e-commerce integration enhances the overall client experience.

- With the use of e-commerce clients can conveniently browse and purchase prints or digital files of their photos, creating a seamless and user-friendly process. This feature adds convenience for clients and also contributes to client satisfaction and loyalty, as it reflects a studio's commitment to providing comprehensive services.

Challenges

Customization and Flexibility

- The challenge of customization and flexibility in Photography Studio Software lies in the delicate balance between providing a rich set of features and maintaining a user-friendly and adaptable interface. Photography studios vary significantly in their workflows, business models, and specific needs. Striking the right balance becomes crucial offering enough flexibility to cater to different studio types and photography niches without overwhelming users with unnecessary features.

- The challenge is to create software that is intuitive for beginners yet robust enough for seasoned professionals. It requires a nuanced understanding of the industry's nuances and a user-centric approach to the software development process. Successful Photography Studio Software addresses this challenge by allowing users to tailor the software to their unique workflows while maintaining simplicity and ease of use. Regular feedback from users, continuous updates, and a commitment to user-centric design principles are key elements in overcoming the customization and flexibility challenge in this dynamic and diverse industry.

Photography Studio Software Market Segment Analysis:

Photography Studio Software Market Segmented based on type, platform, and end-users.

By Type, Prosumer Level segment is expected to dominate the market during the forecast period

- The Prosumer Level segment may have certain characteristics that make it attractive to a broad range of users. Prosumer-level software typically offers a balance between advanced features and user-friendly interfaces, making it suitable for both enthusiasts and professional photographers. Prosumer level software tends to strike a balance between advanced features and ease of use.

- This appeals to users who want more functionality than entry-level software but may not require the extensive capabilities of professional-grade tools. Prosumer-level software is designed to cater to a broad range of users, from enthusiasts to small businesses. The versatility can contribute to its popularity in the market. As technology evolves, the Prosumer Level segment is often quick to adapt to new trends and user preferences, making it appealing to a dynamic and evolving market.

By Platform, Windows segment held the largest share of 43.65% in 2023

- Windows is a prevalent operating system in photography studios. Many studios and businesses use Windows-based computers for their operations. Windows is known for its versatility and compatibility with a wide range of software applications. Photography studios often use a variety of applications, and the flexibility offered by Windows can contribute to its popularity.

- Windows-based computers, especially high-end workstations, are known for their graphics capabilities and performance. This can be crucial for tasks such as photo editing and rendering in photography studios.

Photography Studio Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the United States, has a robust and expansive creative industry, including photography. With a large number of professional photographers, studios, and creative agencies, there is a substantial market for photography-related software solutions. The region has advanced technological infrastructure and widespread access to high-speed internet, facilitating the adoption of digital tools and software in various industries, including photography studios.

- North American photography studios often emphasize professionalism and efficient business practices. Photography Studio Software, which helps in client management, scheduling, and other business-related tasks, aligns well with the industry standards in the region. North America is often a hub for technological innovation, and businesses in the region are more prone to early adoption of new tools and technologies, contributing to the growth of the Photography Studio Software market.

Photography Studio Software Market Top Key Players:

- Macphun (US)

- ON1(US)

- Blinkbid (US)

- Acuity Scheduling (US)

- Time Exposure (US)

- Iris Works (US)

- Darkroom (US)

- Pixifi (US)

- Sprout Studio (Canada)

- Zoner (Czech Republic)

- Magix Software GmbH (Germany)

- Serif Ltd. (UK)

- Lyncpix (France)

- ShootZilla (Netherlands)

- Studio Ninja (Australia)

- Bookeo (Australia) and other major players

Key Industry Developments in the Photography Studio Software Market:

- In October 2023, Darkroom Software, announced a significant update to its products, including Darkroom Core, Darkroom Pro, Darkroom Assembly, and Darkroom Booth. The update is designed to advance the event photography and phototainment industry by introducing enhanced features and capabilities. This development aims to cater to the diverse needs of photographers globally.

- In May 2023, Serif announced an update for its software suite, including Affinity Photo, Affinity Designer, and Affinity Publisher. This software update promises a better workflow and user experience. The release introduces new features and hundreds of incremental improvements to enhance the functionality of Affinity's tools.

|

Global Photography Studio Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

345.2 Mn |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

580.3 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Photography Studio Software Market by Type (2018-2032)

4.1 Photography Studio Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Entry Level

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Prosumer Level

4.5 Professional Level

Chapter 5: Photography Studio Software Market by Platform (2018-2032)

5.1 Photography Studio Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Android /IOS

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Windows

5.5 Mac

Chapter 6: Photography Studio Software Market by End User (2018-2032)

6.1 Photography Studio Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Professional

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Freelancer

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Photography Studio Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 LG ELECTRONICS INC.( SOUTH KOREA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SIEMENS AG(GERMANY)

7.4 AMAZON.COM INC(US)GOOGLE NEST (GOOGLE LLC)(US)

7.5 SAMSUNG ELECTRONICS COLTD.( SOUTH KOREA)

7.6 SCHNEIDER ELECTRIC SE(FRANCE)

7.7 LEGRAND S.A.( FRANCE)

7.8 ROBERT BOSCH GMBH(GERMANY)

7.9 ASSA ABLOY AB(SWEDEN)

7.10 SONY GROUP CORP.( JAPAN)

7.11 ABB LTD.( SWITZERLAND)

7.12 PHILIPS LIGHTING B.V.( NETHERLANDS)

7.13 HONEYWELL INTERNATIONAL INC.(US)

7.14 OTHER KEY PLAYERS

Chapter 8: Global Photography Studio Software Market By Region

8.1 Overview

8.2. North America Photography Studio Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Entry Level

8.2.4.2 Prosumer Level

8.2.4.3 Professional Level

8.2.5 Historic and Forecasted Market Size by Platform

8.2.5.1 Android /IOS

8.2.5.2 Windows

8.2.5.3 Mac

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Professional

8.2.6.2 Freelancer

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Photography Studio Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Entry Level

8.3.4.2 Prosumer Level

8.3.4.3 Professional Level

8.3.5 Historic and Forecasted Market Size by Platform

8.3.5.1 Android /IOS

8.3.5.2 Windows

8.3.5.3 Mac

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Professional

8.3.6.2 Freelancer

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Photography Studio Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Entry Level

8.4.4.2 Prosumer Level

8.4.4.3 Professional Level

8.4.5 Historic and Forecasted Market Size by Platform

8.4.5.1 Android /IOS

8.4.5.2 Windows

8.4.5.3 Mac

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Professional

8.4.6.2 Freelancer

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Photography Studio Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Entry Level

8.5.4.2 Prosumer Level

8.5.4.3 Professional Level

8.5.5 Historic and Forecasted Market Size by Platform

8.5.5.1 Android /IOS

8.5.5.2 Windows

8.5.5.3 Mac

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Professional

8.5.6.2 Freelancer

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Photography Studio Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Entry Level

8.6.4.2 Prosumer Level

8.6.4.3 Professional Level

8.6.5 Historic and Forecasted Market Size by Platform

8.6.5.1 Android /IOS

8.6.5.2 Windows

8.6.5.3 Mac

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Professional

8.6.6.2 Freelancer

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Photography Studio Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Entry Level

8.7.4.2 Prosumer Level

8.7.4.3 Professional Level

8.7.5 Historic and Forecasted Market Size by Platform

8.7.5.1 Android /IOS

8.7.5.2 Windows

8.7.5.3 Mac

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Professional

8.7.6.2 Freelancer

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Photography Studio Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

345.2 Mn |

|

Forecast Period 2024-32 CAGR: |

5.2% |

Market Size in 2032: |

580.3 Mn |

|

Segments Covered: |

By Type |

|

|

|

By Platform |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||