Phenolic Resin Market Synopsis

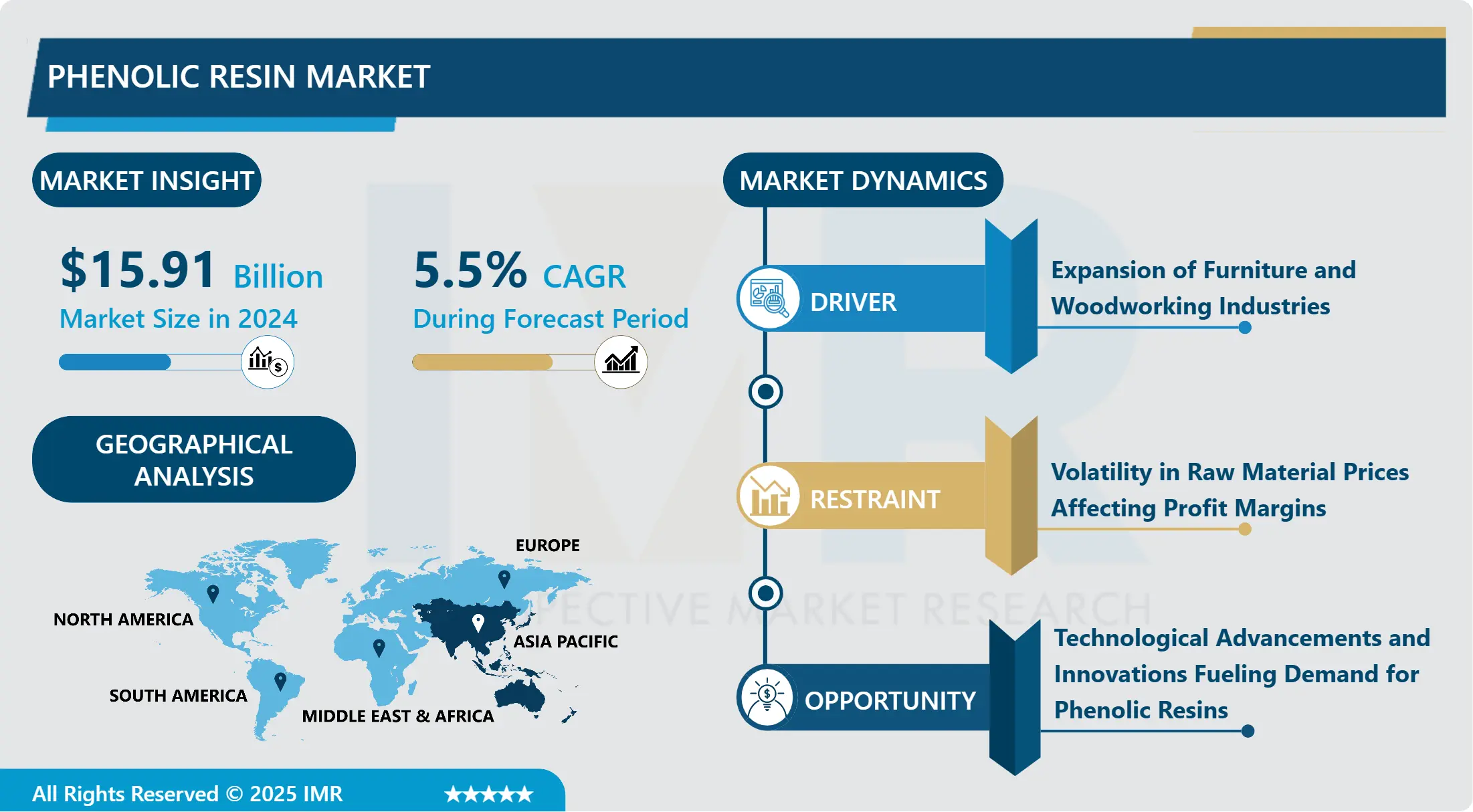

Phenolic Resin Market Size is Valued at USD 15.91 Billion in 2024, and is Projected to Reach USD 24.42 Billion by 2032, Growing at a CAGR of 5.50% From 2025-2032.

The Phenolic Resin Market actually covers the worldwide business and market related to production, sales, and use of phenolic resins, an artificial material created from phenol and formaldehyde. The above resins have found wide uses in many fields like wood glue, molding, laminates, coatings, and insulating materials because of their inherent resistances to heat, mechanical strength and chemical inappropriateness. The major application areas are automotive, construction, electronics, and industrial segments. New markets are also being developed to respond to the massive growth in industrial applications, development in resin technologies and an ever-rising global demand for lightweight products across all sectors.

The major driving factor for phenolic resin market is its wide applicability across many industries because of its excellent characteristics such as good heat stability, excellent mechanical strength, and chemical resistance. Phenolic resins also have a large usage in the automotive industry particularly in the brake linings, clutch facings, and other friction items because of obligatory safety standards as well as the ever-increasing use of lightweight materials. The construction industry widely employs phenolic resins in laminates, ply, and insulating materials because of their sturdiness and fire-retardant nature, which work together to drive the market forward.

Furthermore, the electrical and electronics industries also play a role in the market growth using phenolic resins as a material applied in circuit boards, electrical parts and insulating material since they possess insulating properties that are electrical. More and more infrastructure advancement across the globe increases the use phenolic resins in the coatings, adhesive and composite materials hence highlighting constant market growth. Further, the development of new generations of the phenolic resin and the growing R & D investments are jointly believed to be broadening the application segments for phenolic resins, to drive the market ahead in the projected period.

Phenolic Resin Market Trend Analysis

Phenolic Resin Market Growth Driver-Evolving Strategies, Market Shifts and Developments in Phenolic Resin

- The phenolic resin market is consuming a constant growth rate and is expected to grow further in the global market because it has varieties of applications in many sectors like automotive, construction, electricals, etc. Phenolic resins are used extensively due to their high thermal stability, mechanical strength and chemical and moisture resistance they display, and for their uses in adhesives, coatings laminates and insulating material. At present, there is a growing trend towards phenolic resin formulations for the market with great concern towards environment and consumption of eco-friendly products.

- Besides, innovation of product is identified as one of the main trends in the development of the market characterized by research activities of manufacturers aimed at improving the properties of resins, primarily their flame retardance and low smoke emission. Technological developments in the manufacturing techniques are also entrenched in enhancing productivity and cost reduction which is an added advantage to the market progression. Regionally, Asia-Pacific continues to be the largest consumer of phenolic resin owing to the growing industrialization level, infrastructure developments, and growing automotive industry in countries such as China and India. North America and Europe also remain major markets due to high demand of resins from construction and automotive industries and focus on improving the technologies used in the production of resins.

Phenolic Resin Market Expansion Opportunity- From Automotive Innovations to Electronics Advancements, Phenolic Resin Market Insights

- The prospects in the phenolic resin market are numerous because of its uses in numerous sectors of the economy. Phenolic resins find substantial application in composite materials wherein the automotive and aerospace industries experience steady demand for lightweight, durable materials to improve fuel efficiency by decreasing vehicles’ overall weights. Furthermore, the construction industry’s focus on energy efficient structures providing demand for phenolic foam insulation, which has superior fire and thermal benefits.

- Besides these basic uses, increasing electronics manufacturing in Asia-Pacific region would create a greater want for phenolic resin in uses related to the manufacturing of circuit boards and electronic elements since it possesses desirable electrical properties and heat endurance superior to some other products. At the same time, there are improvements in the formulations of resin material, technological improvements in the manufacturing process to increase sustainability and improve the environmental balance of resin-based materials as the world today shifts towards environmentally friendly products. All these factors in one way or the other place the phenolic resin market for growth prospects especially in the regions experiencing industrialization and infrastructure advancements.

Phenolic Resin Market Segment Analysis:

Phenolic Resin Market Segmented on the basis of Type, Application, End-users, and Region.

By Type, Resol Resin segment is expected to dominate the market during the forecast period

- Phenolic resins are of two types – Resol Resin and Novolac Resin, with Other as the third category. Resol Resins have good heat stability and they are used in applications where mechanical strength is important as automotive brake pads and friction goods. While Novolac Resins have better chemical tolerance and mostly used in anchoring applications for coatings and adhesives. The Other phenolic resins sub-category describes specific types of phenolic resins designed for particular uses so that this raw material uses are as diverse as electronics, construction, and aerospace industries.

By Application, Wood Adhesives segment held the largest share in 2024

- Phenolic resins have find their utility in numerous field of application Industry. It is widely applied to wood adhesive due to its good adhesive properties and heat and moisture resistance for plywood and laminated woods. Phenolic resins are widely used as binders in foundry processes because they do produce moulds having good dimensional accuracy and acceptable surface finish. They occur in molding applications offering high heat resistance, and dimensional stability necessary in the creation of automobile parts and electrical equipment. They are also applied in laminates due to their good mechanical characteristics, high chemical and heat resistance, and flame retardancy which is evidenced in countertops and aesthetically designed fascias.

- Also, they excellent adhesion and durability properties they posses make them ideal for use in coatings especially where the coating is required to offer corrosion and chemical resistance such as in the industrial applications. In insulation, phenolic resins are for low thermal conductivity and fire resistance important in building and construction materials. They are also employed in paper saturation to improve the characteristics of papers utilized in electrical insulation and decorative laminates. Specialty items fall under the others classification and signify the endless uses of phenolic resins as a component in the manufacturing of different products and structures.

Phenolic Resin Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region, specifically phenolic resin market, is rapidly growing mainly due to the increasing industrialization all across the region. China is the most crucial country in this context, as it not only consumes a large amount of styrene monohalides, but also produces them aggressively because of its robust automotive construction, and electronics sectors. These sectors extensively employ phenolic resins in laminates, coatings and molding compounds and drive their usage due to the growing rates of urbanization and industrialization.

- The two major contributors to this market are Japan and South Korea as phenolic resins are use in electronic devices and automotive parts due to their good electrical insulation and high thermal stability. India is one of the markets where laminates and coatings are growing at a fast pace because of the growing construction bases and furniture requirements. In sum, Asia-Pacific phenolic resin market is expected to continue a healthy growth trajectory over the forecast period due to the growing industrialization and technological progress in the relevant industries.

Active Key Players in the Phenolic Resin Market

- DIC CORPORATION (Japan)

- Kolon Industries, Inc. (South Korea)

- Sumitomo Bakelite Co., Ltd. (Japan)

- Hexcel Corporation (United States)

- Georgia-Pacific Chemicals (United States)

- KRATON CORPORATION (United States)

- Hexion (United States)

- Bostik, Inc. (France)

- SI Group, Inc. (United States)

- Other Active Players

|

Phenolic Resin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.91 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 24.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Phenolic Resin Market by Type (2018-2032)

4.1 Phenolic Resin Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Resol Resin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Novolac Resin

4.5 Others

Chapter 5: Phenolic Resin Market by Application (2018-2032)

5.1 Phenolic Resin Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wood Adhesives

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Foundry

5.5 Molding

5.6 Laminates

5.7 Coatings

5.8 Insulation

5.9 Paper Impregnation

5.10 Others

Chapter 6: Phenolic Resin Market by End User (2018-2032)

6.1 Phenolic Resin Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Building & Construction

6.5 Furniture

6.6 Electrical & Electronics

6.7 Industrial

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Phenolic Resin Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DIC CORPORATION (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KOLON INDUSTRIES INC. (SOUTH KOREA)

7.4 SUMITOMO BAKELITE COLTD. (JAPAN)

7.5 HEXCEL CORPORATION (UNITED STATES)

7.6 GEORGIA-PACIFIC CHEMICALS (UNITED STATES)

7.7 KRATON CORPORATION (UNITED STATES)

7.8 HEXION (UNITED STATES)

7.9 BOSTIK INC. (FRANCE)

7.10 SI GROUP INC. (UNITED STATES)

Chapter 8: Global Phenolic Resin Market By Region

8.1 Overview

8.2. North America Phenolic Resin Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Resol Resin

8.2.4.2 Novolac Resin

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Wood Adhesives

8.2.5.2 Foundry

8.2.5.3 Molding

8.2.5.4 Laminates

8.2.5.5 Coatings

8.2.5.6 Insulation

8.2.5.7 Paper Impregnation

8.2.5.8 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Automotive

8.2.6.2 Building & Construction

8.2.6.3 Furniture

8.2.6.4 Electrical & Electronics

8.2.6.5 Industrial

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Phenolic Resin Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Resol Resin

8.3.4.2 Novolac Resin

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Wood Adhesives

8.3.5.2 Foundry

8.3.5.3 Molding

8.3.5.4 Laminates

8.3.5.5 Coatings

8.3.5.6 Insulation

8.3.5.7 Paper Impregnation

8.3.5.8 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Automotive

8.3.6.2 Building & Construction

8.3.6.3 Furniture

8.3.6.4 Electrical & Electronics

8.3.6.5 Industrial

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Phenolic Resin Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Resol Resin

8.4.4.2 Novolac Resin

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Wood Adhesives

8.4.5.2 Foundry

8.4.5.3 Molding

8.4.5.4 Laminates

8.4.5.5 Coatings

8.4.5.6 Insulation

8.4.5.7 Paper Impregnation

8.4.5.8 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Automotive

8.4.6.2 Building & Construction

8.4.6.3 Furniture

8.4.6.4 Electrical & Electronics

8.4.6.5 Industrial

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Phenolic Resin Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Resol Resin

8.5.4.2 Novolac Resin

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Wood Adhesives

8.5.5.2 Foundry

8.5.5.3 Molding

8.5.5.4 Laminates

8.5.5.5 Coatings

8.5.5.6 Insulation

8.5.5.7 Paper Impregnation

8.5.5.8 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Automotive

8.5.6.2 Building & Construction

8.5.6.3 Furniture

8.5.6.4 Electrical & Electronics

8.5.6.5 Industrial

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Phenolic Resin Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Resol Resin

8.6.4.2 Novolac Resin

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Wood Adhesives

8.6.5.2 Foundry

8.6.5.3 Molding

8.6.5.4 Laminates

8.6.5.5 Coatings

8.6.5.6 Insulation

8.6.5.7 Paper Impregnation

8.6.5.8 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Automotive

8.6.6.2 Building & Construction

8.6.6.3 Furniture

8.6.6.4 Electrical & Electronics

8.6.6.5 Industrial

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Phenolic Resin Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Resol Resin

8.7.4.2 Novolac Resin

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Wood Adhesives

8.7.5.2 Foundry

8.7.5.3 Molding

8.7.5.4 Laminates

8.7.5.5 Coatings

8.7.5.6 Insulation

8.7.5.7 Paper Impregnation

8.7.5.8 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Automotive

8.7.6.2 Building & Construction

8.7.6.3 Furniture

8.7.6.4 Electrical & Electronics

8.7.6.5 Industrial

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Phenolic Resin Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 15.91 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 24.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||