Key Market Highlights

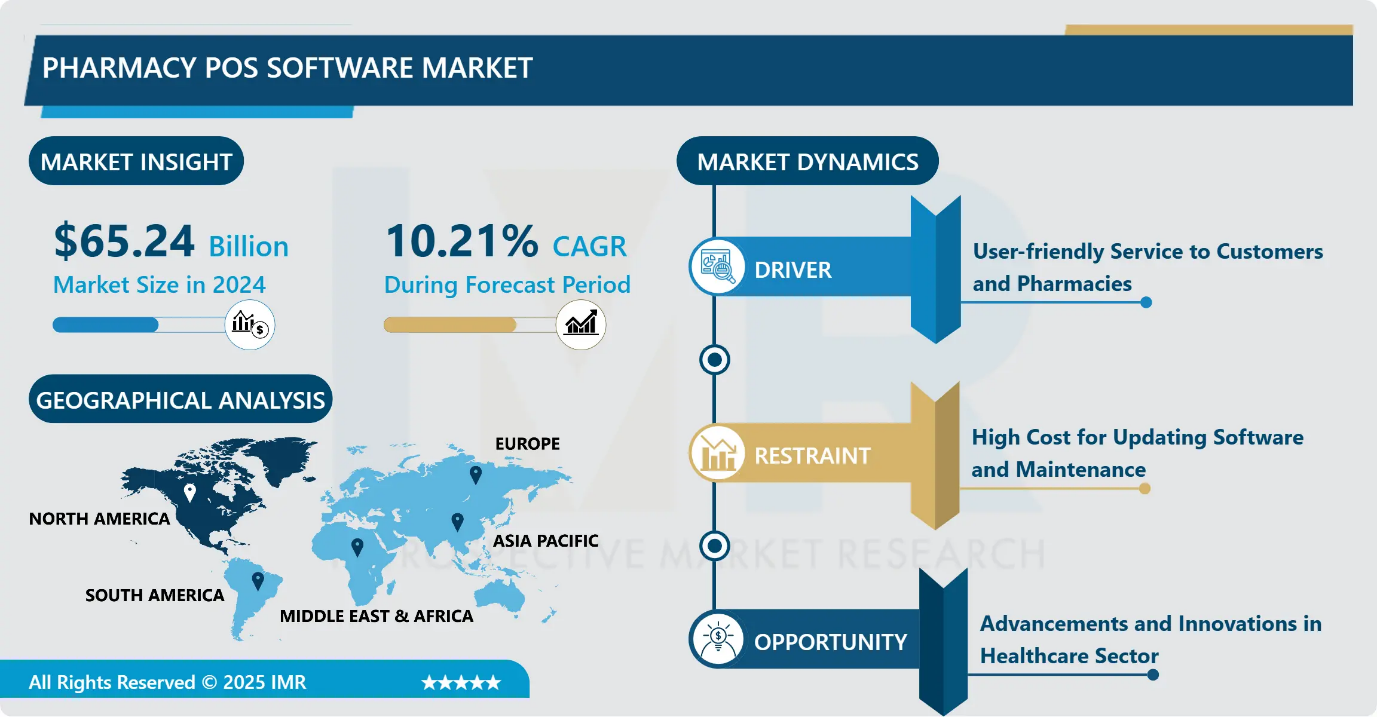

Pharmacy POS Software Market Size Was Valued at USD 65.24 Billion in 2024, and is Projected to Reach USD 190.22 Billion by 2035, Growing at a CAGR of 10.21% from 2025-2035.

- Market Size in 2024: USD 65.24 Billion

- Projected Market Size by 2035: USD 190.22 Billion

- CAGR (2025–2035): 10.21%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Deployment Type: The Cloud Based deployment segment is anticipated to lead the market by accounting for 36.44% of the market share throughout the forecast period.

- By Size: The Small and Medium Sized Pharmacies segment is expected to capture 58.33% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 32.54% of the market share during the forecast period.

- Active Players: LS Retail (Iceland), BZQ Abacus (Australia), Cashier Live LLC. (US), Nuchange (India), AdvancedRx (US), and Other major players.

Pharmacy POS Software Market Synopsis:

A Pharmacy POS or a point-of-sale is software that helps pharmacies and pharmacists in organizing and managing the drugs, medicines, and syrups inventory, managing customers, and approving an electronic or digital transaction. It also helps in collecting data and enables functionality. Pharmacy POS software acts as a central component where everything such as customer management, sales, and inventory management integrates. Moreover, the initial POS system consists of the technology utilization to complete and record sales transactions on the sales floor. Usually, it includes barcoded items, scanning devices, a checkout interface or terminal, and additional qualities.

A Pharmacy POS software utilizes a scanner that scans the product and looks up the inventory for its selling price then, it updates the inventory to show the product as sold and calculates the final price with taxes, discounts. Then it interacts with the customer relations management system and transacts with a merchant services account for credit cards/checks and then a sales receipt is printed. Furthermore, this information is recorded and stored in a database which is either a company server or a cloud-based server. The flexibility and automation that a Pharmacy POS software offers over manual processes is the main factor promoting pharmacy stores owners for upgrading systems thus stimulating the growth of the Pharmacy POS Software market growth in the period of forecast. The collected data can be analysed for a variety of sale reports such as daily reports with historical data, six-week history reports, top margin categories, top-selling items, top margin customers, top margin items, customer rank by sales, top-selling categories, and sales by time of day.

Pharmacy POS Software Market Dynamics and Trend Analysis:

Pharmacy POS Software Market Growth Driver- User-friendly Service to Customers and Pharmacies

-

The pharmacy POS software makes working easier and enables the user for the digital record of transactions and quick retrieval of information. Moreover, pharmacies come across numerous patients every day. The data generated is collected and stored within the pharmacy POS Software system. Also, the stored data can be utilized later for improving business operations. The data reports can be analyzed to stock medicines appropriately and to create marketing strategies to tailor the needs thus, driving the growth of the pharmacy POS software market in the forecast period. Furthermore, prescription is an important characteristic in the Pharmacy POS Software. It eradicates the threat of errors and offers a user-friendly service for patients. This feature also aids pharmacies to manage refills.

- The pharmacy POS software is an excellent and ideal way to manage transactions as it doesn't generate bills for products that are of no use. In addition, it also notifies the staff about expired medicines and assists the owner to purchase new products. Moreover, a separate folder that contains the details of medicines, syrups, and drugs stored can be maintained by the pharmacist. It is a great quality of the POS system that keeps pharmacists updated about the composition of substitutes and medicine thus, propelling the growth of the Pharmacy POS Software Market in the forecast period.

Pharmacy POS Software Market Limiting Factor- Hidden Costs and Security Threats

-

The adoption of software technology comes with a hidden cost required for software updating and maintenance. Moreover, to the complications and costs that accompany these software updates, consumers also have to invest in hardware updates that are required for scanning. Furthermore, these updates may result in significant recurrent costs for maintenance thus, hampering the growth of the Pharmacy POS Software Market.

- Customers who use debit or credit cards at POS stations increase the threat of revealing their PINs to other customers. Most pharmacy stores make sure that the keypad is covered, but none of those efforts are perfect. Additionally, Pharmacy POS software running on a web-based system have chances of security and privacy risks as the company is doing business on the web. The cloud-based data storage can be hacked by anonymous intruders as well the system needs to have continuous and reliable internet connectivity. For users in remote areas having electricity outages, internet connectivity can be lost in this region thus, restraining the Pharmacy POS Software Market expansion in the forecast period.

Pharmacy POS Software Market Expansion Opportunity- Digital Transformation in Pharmacies

-

The Pharmacy POS Software market has significant growth potential driven by the accelerating shift toward digital dispensing workflows, e-prescriptions, and automated billing systems. Increasing medication volumes, rising footfall in independent pharmacies, and demand for integrated payment systems create strong incentives for modern POS adoption. Cloud-based models enable low-cost deployment, faster scalability, and subscription revenues, positioning vendors to capture expanding SME pharmacy segments globally.

- Expanding healthcare infrastructure in emerging regions, hospital digital transformation initiatives, and the integration of analytics and inventory automation provide major opportunities for POS vendors. Advanced features like real-time stock visibility, controlled drug tracking, and interoperability with EHR/ERP platforms support improved efficiency and compliance. Partnerships with pharmacy chains, telehealth providers, and insurance platforms will unlock multi-channel retailing and cross-selling potential through unified digital ecosystems.

Pharmacy POS Software Market Challenge and Risk- High Customization Requirements and Limited System Standardization

-

The Pharmacy POS Software market struggles with limited standardization across pharmacy workflows, insurance processes, and regional billing policies, creating a need for extensive system customization. Vendors must tailor solutions to varied prescription handling practices, taxation rules, and integration protocols, increasing development time and implementation complexity for both providers and end-users.

- Such high customization requirements significantly elevate deployment costs and lengthen configuration cycles, making rapid scalability difficult. Smaller pharmacies often find these tailored solutions financially and operationally overwhelming, resulting in delayed decision-making and slower transition from manual to digital platforms. The lack of uniform standards ultimately restricts widespread adoption and market acceleration.

Pharmacy POS Software Market Trend- Growing Integration of Omnichannel Pharmacy Services and Digital Health Platforms

-

A key trend transforming the Pharmacy POS Software market is the integration of omnichannel retail capabilities, allowing pharmacies to connect in-store operations with online prescription ordering, home-delivery services, and telehealth platforms. As patient expectations shift toward convenience and real-time accessibility, pharmacies increasingly rely on POS systems that unify digital and physical touchpoints.

- Modern POS solutions now support synchronized order tracking, digital payment options, loyalty programs, and automated communication with customers through mobile apps. This seamless ecosystem improves patient engagement, boosts sales conversion, and enhances service personalization. The rise of hybrid pharmacy models is accelerating demand for POS solutions capable of managing cross-platform transactions and integrated healthcare interactions.

Pharmacy POS Software Market Segment Analysis:

Pharmacy POS Software Market by Deployment Type, Size, Application and Region

By Deployment Type, Cloud Based Deployment system segment is expected to dominate the market with around 36.44% share during the forecast period.

-

Cloud-Based deployment is the most common and rapidly growing segment in the Pharmacy POS Software market. Its popularity is driven by lower upfront cost, subscription-based pricing, easy scalability, remote access, automatic updates, and faster implementation compared to on-premise models. Growing adoption among small and mid-sized pharmacies and increased digital transformation initiatives strongly accelerate cloud-based POS demand global

- Cloud-based POS solutions are also gaining momentum due to their seamless integration with digital payment gateways, e-prescription platforms, and inventory automation systems. Enhanced data security frameworks and real-time analytics capabilities further strengthen adoption. As pharmacies prioritize mobility and centralized multi-store management, cloud deployment continues to outpace on-premise and hybrid models in growth rate.

By Size, Small and Medium-Size Pharmacies represent the fastest-growing segment is expected to dominate with close to 58.33% market share during the forecast period.

-

Pharmacy POS Software market. Increasing digital adoption among independent pharmacies, rising customer volumes, and the need for automated billing and inventory tracking are driving demand. Cost-effective cloud POS solutions, flexible subscription models, and simplified deployment accelerate uptake compared to large chain pharmacies reliant on legacy systems.

- Growth in small and mid-size pharmacies is fuelled by expanding healthcare access in Tier-2 and Tier-3 regions, rising prescription loads, and competitive pressure to improve service speed and compliance accuracy. These pharmacies seek modern POS platforms to enhance operational efficiency, integrate digital payments, and strengthen patient engagement, making them the most dynamic adoption segment globally.

Pharmacy POS Software Market Regional Insights:

North America region is estimated to lead the market with around 32.54% share during the forecast period.

-

The North America region is anticipated to dominate the Pharmacy POS Software Market during the forecast period. Technological advancements have transformed the healthcare industry, and the incorporation of new rules and regulations is supporting the growth of the Pharmacy POS Software Market in this region.

- Moreover, to provide customers with effective treatment plans, the healthcare sector is evolving from insurance coverage to healthcare data analytics. The rise in spending on the healthcare sector is fuelling the development of the Pharmacy POS Software Market in this region throughout the forecast period.

Pharmacy POS Software Market Active Players:

- AdvancedRx (US)

- Best Pos (Pty) Ltd.

- BZQ Abacus (Australia)

- Cashier Live LLC. (US)

- Emporos POS (US)

- LS Retail (Iceland)

- Micro Merchant Systems Inc. (US)

- Nuchange (India)

- Prime Commerce (Vietnam)

- Transaction Data Systems Inc. (US)

- VIP Computer Systems Inc. (US), and Other Active Players

Key Industry Developments in the Pharmacy POS Software Market:

- In December 2024, AdvancedRx (US) Completed a strategic consolidation when Automated HealthCare Solutions (AHCS) rebranded/merged into AdvancedRx, expanding its pharmacy services and technology capabilities

- In July 2023, Transaction Data Systems (TDS), a portfolio company of BlackRock Long Term Private Capital and GTCR, is pleased to announce the closing of the previously announced transaction with Cardinal Health (NYSE: CAH) to merge with Outcomes. This merger brings together a full suite of patient engagement, clinical and pharmacy workflow solutions to the nation’s largest network of retail, chain, and grocery pharmacies

Technological Evolution and Strategic Importance of Pharmacy POS Software in Modern Healthcare Retail

-

Pharmacy POS (Point-of-Sale) Software is an advanced, technology-driven platform designed to manage end-to-end pharmacy operations, integrating billing, prescription processing, inventory tracking, and secure patient data management within a single interface. Unlike traditional cash registers or generic retail POS systems, pharmacy specific POS platforms connect seamlessly with pharmacy management software, e-prescription networks, and insurance billing portals. This enables automated claim submissions, barcode-based dispensing accuracy, and real-time stock visibility across multiple pharmacy locations.

- The need for specialized Pharmacy POS Software is increasing rapidly as pharmacies experience rising prescription volumes, stringent regulatory requirements, and demand for faster, error-free service. Manual operations often result in incorrect dosage issuing, expired medication sales, financial discrepancies, and inventory shrinkage, making digital transformation essential for patient safety and operational efficiency.

- Technological advancements have significantly enhanced modern POS capabilities, including cloud-based accessibility, AI-driven demand forecasting, IoT-enabled automated stock count systems, integrated digital payments, loyalty program execution, and high-level data encryption. These systems function by capturing prescription or OTC product data through barcode or QR scanning, processing payment or insurance details, automatically updating inventory in real time, and synchronizing with EHR or ERP platforms. Encrypted data storage either on-premise or cloud-based enables secure multi-user access and advanced analytics for better decision-making.

- Looking ahead, the future of the Pharmacy POS Software market is highly promising, driven by the evolution of omnichannel healthcare retail. Increasing adoption of tele pharmacy, home-delivery models, and personalized medication services is accelerating demand for intelligent, AI-powered POS systems capable of seamless integration across digital health ecosystems. As pharmacies expand into community healthcare hubs, next-generation POS platforms will play a crucial role in supporting scalable, compliant, and patient-centric operations worldwide.

|

Pharmacy POS Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 65.24 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.21% |

Market Size in 2035: |

USD 190.22 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Pharmacy POS Software Market by Deployment Type (2018-2035)

4.1 Pharmacy POS Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-Premise

4.5 Hybrid

Chapter 5: Pharmacy POS Software Market by Size (2018-2035)

5.1 Pharmacy POS Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small & Medium-Size Pharmacy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Pharmacy

Chapter 6: Pharmacy POS Software Market by Application (2018-2035)

6.1 Pharmacy POS Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Health Care Systems

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Pharmacy POS Software Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ADVANCEDRX (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BEST POS (PTY) LTD.

7.4 BZQ ABACUS (AUSTRALIA)

7.5 CASHIER LIVE LLC. (US)

7.6 EMPOROS POS (US)

7.7 LS RETAIL (ICELAND)

7.8 MICRO MERCHANT SYSTEMS INC. (US)

7.9 NUCHANGE (INDIA)

7.10 PRIME COMMERCE (VIETNAM)

7.11 TRANSACTION DATA SYSTEMS INC. (US)

7.12 VIP COMPUTER SYSTEMS INC. (US)

7.13 OTHER ACTIVE PLAYERS

Chapter 8: Global Pharmacy POS Software Market By Region

8.1 Overview

8.2. North America Pharmacy POS Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Pharmacy POS Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Pharmacy POS Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Pharmacy POS Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Pharmacy POS Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Pharmacy POS Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

10.1 Sources

10.2 List of Tables and figures

10.3 Short Forms and Citations

10.4 Assumption and Conversion

10.5 Disclaimer

|

Pharmacy POS Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 65.24 Bn. |

|

Forecast Period 2025-35 CAGR: |

10.21% |

Market Size in 2035: |

USD 190.22 Bn. |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and risk |

|

||

|

Companies Covered in the Report: |

|

||