Paint Thinners Market Synopsis

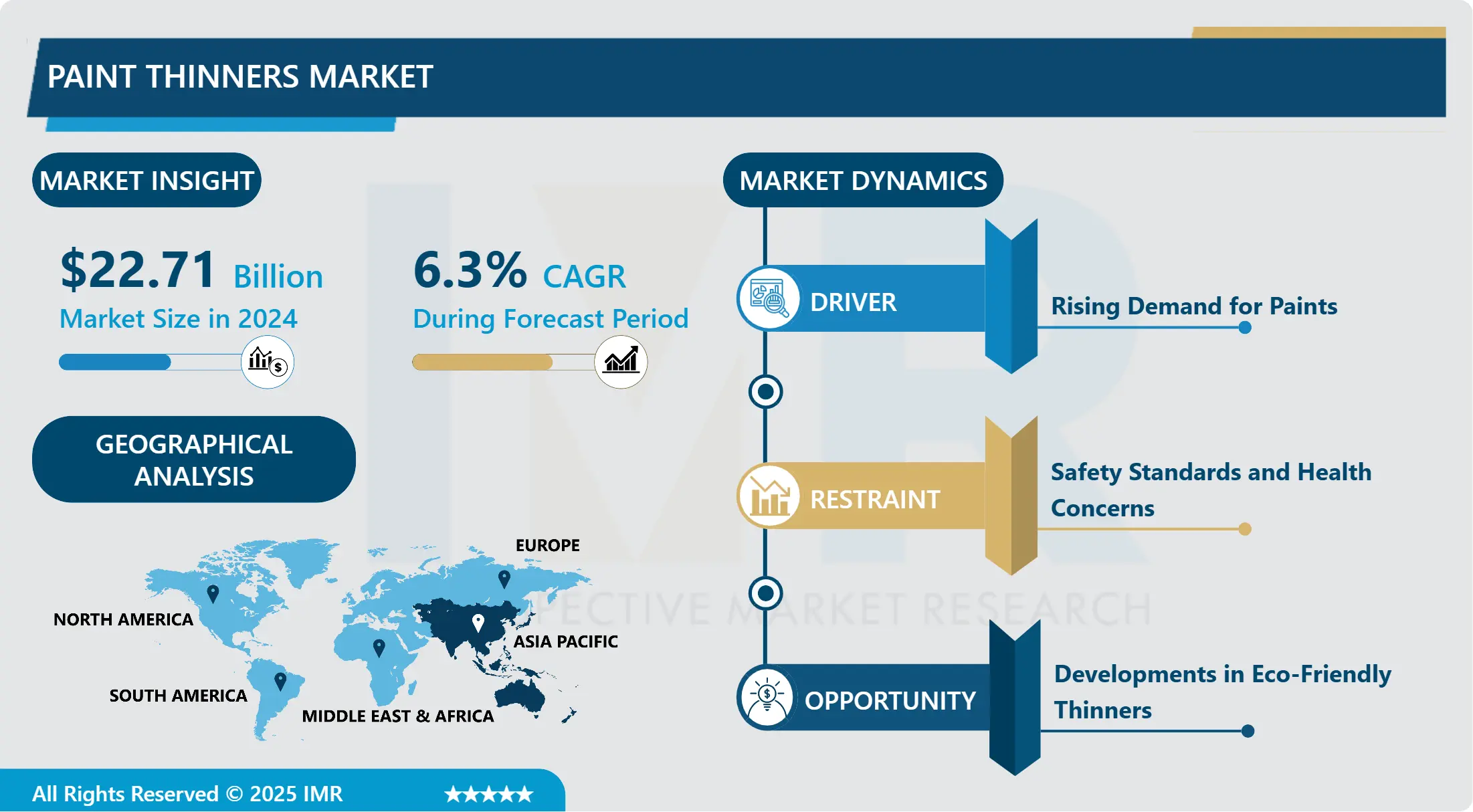

Paint Thinners Market Size Was Valued at USD 22.71 Billion in 2024, and is Projected to Reach USD 37.02 Billion by 2032, Growing at a CAGR of 6.3% From 2025-2032.

Paint thinner is both widely used and highly versatile in industrial settings. Paint thinner can also be used for various industrial cleaning tasks, such as eliminating stains, grease, and other substances from specific surfaces, in addition to thinning and cleaning paint products. You have a variety of choices for particular substances that can be utilized for thinning and cleaning your paint.

The global paint thinner market encompasses a diverse array of solvents designed to dissolve thin paints, varnishes, and other coatings. These products find extensive application across various industries and sectors, including automotive, construction, furniture manufacturing, and home improvement. Paint thinners are utilized for tasks such as cleaning surfaces before painting, thinning paint for proper application consistency, and removing paint or varnish from brushes, rollers, and other equipment.

In the automotive industry, paint thinners play a crucial role in surface preparation, paint mixing, and cleanup processes. They aid in removing old paint layers, degreasing surfaces, and ensuring proper viscosity for spray application. Similarly, in construction and home improvement, paint thinners are indispensable for preparing surfaces like wood, metal, or concrete before applying fresh coats of paint or varnish. They help in achieving smooth finishes and enhancing the durability of coatings.

Paint thinners are utilized in industrial settings for cleaning and maintenance purposes. They efficiently dissolve stubborn residues, grease, and grime from machinery, equipment, and surfaces. Additionally, these solvents are employed in artistic endeavors, facilitating the blending of oil-based paints and cleaning of brushes and palettes. Despite their widespread applications, it's essential to handle paint thinners with care due to their volatile nature and potential health hazards, emphasizing the importance of proper ventilation and safety protocols in their use.

Paint Thinners Market Trend Analysis

Paint Thinners Market Growth Driver- Rising Demand for Paints

- The worldwide market for paint thinners is seeing substantial expansion, mainly due to the increasing need for paints in different sectors. The surge is greatly driven by urbanization and infrastructure development, with the construction sector playing a significant role in it. With the construction of new buildings, bridges, and roads on the rise, there is a growing demand for paints and coatings to safeguard and enhance these structures. This results in an increased need for paint thinners, which are necessary for thinning paints, cleaning tools, and preserving coatings.

- The paint thinners market is significantly driven by the automotive industry. As the number of vehicles being manufactured and sold globally continues to rise, so does the need for automotive paints and coatings. Paint thinners are essential in automotive paint shops for a variety of tasks such as cleaning spray guns, mixing paints, and eliminating overspray.

- The manufacturing industry depends greatly on paints and coatings for a variety of uses, including machinery, equipment, and consumer products. With manufacturing activities growing on a global scale due to factors such as technological advancements and consumer demand, the need for paint thinners also increases. Manufacturers need paint thinners to clean and upkeep industrial coatings, guaranteeing the durability and excellence of their products.

Paint Thinners Market Opportunity- Developments in Eco-Friendly Thinners

- As environmental awareness grows, manufacturers have a growing chance to create new eco-friendly paint thinners, especially those with lower Volatile Organic Compound (VOC) levels. Volatile organic compounds (VOCs) released from different products, such as conventional paint thinners, are damaging pollutants that lead to air pollution and negative health impacts. With regulations becoming stricter and consumer preferences changing towards sustainable options, the need for environmentally friendly paint thinners is increasing.

- Creating environmentally friendly paint solvent offers a major chance in the worldwide market. Companies can take advantage of this trend by putting resources into research and development to create thinner products that have reduced VOC levels while still maintaining their effectiveness. By utilizing different ingredients and cutting-edge technology, they are able to develop products that align with environmental regulations and meet the needs of the industry.

- Promoting these environmentally friendly solvents has numerous benefits. First and foremost, it supports corporate sustainability objectives and boosts brand image, attracting eco-minded customers and companies. Secondly, it focuses on complying with regulatory standards to ensure adherence to strict environmental regulations on a global scale. In addition, it encourages creativity and uniqueness, establishing companies as frontrunners in eco-friendly technology in the competitive industry of paint thinners.

Paint Thinners Market Segment Analysis:

Paint Thinners Market is Segmented based on Material Type, Type, Application, and Region.

By Material, Mineral Spirits segment holds 34.8% market share in 2024

- Mineral Spirits' leading position in the worldwide paint thinners market is a result of various important factors that have helped it become a key player in the industry. Its long history and good reputation in the market have made it a trusted and reliable supplier of paint thinning solutions. Throughout time, Mineral Spirits has established a powerful brand reputation linked with excellence and reliability, gaining the confidence of customers and professionals in the field.

- Mineral Spirits has made a large investment in research and development, constantly creating new products to satisfy the changing requirements of the market. By being at the forefront of product development, the company has been able to provide advanced solutions that surpass rivals, thus strengthening its dominance in the market.

- Mineral Spirits has strategically grown its international presence, creating a strong distribution network to guarantee widespread product availability in different areas. The company's broad reach allows it to serve a variety of customers and gives it a competitive advantage in market entry and availability.

By Application, Architectural Coatings segment held the largest share in 2024

- Several key factors can be credited with the dominance of architectural coatings in the paint thinners market. The considerable size and magnitude of the construction and renovation sector play a major role in driving the need for architectural coatings. Architectural coatings are used in a variety of projects, including residential, commercial, and industrial, unlike other sectors like automotive or wood finishing that target specific niches, contributing to the growth of a larger industry.

- Architectural endeavors frequently require covering vast surface areas, whether it be painting walls, ceilings, or exteriors of structures. This results in more paint being used compared to automotive or furniture painting, leading to a significant need for paint thinners for proper application and cleanup.

- The increasing use of DIY applications strengthens the leading position of architectural coatings in the paint thinners market. Several homeowners and individuals who are passionate about painting choose to tackle painting projects on their own, whether it's touching up a room or refurbishing a property. In DIY projects, paint thinners are essential for diluting paints and cleaning tools, increasing the need for these products in the architectural coatings industry.

Paint Thinners Market Regional Insights:

Asia Pacific Dominate the Market and holds 49.6% market share

- Quick industrial development and urban growth in nations such as China and India have driven significant expansion in industries like manufacturing and construction. The rise in economic activity has caused a higher need for paints in different applications, increasing the usage of paint thinners.

- The APAC region has a thriving construction sector, with continuous infrastructure development projects in residential and commercial areas. The demand for architectural coatings and paint thinners is high in these projects, reinforcing the region's market dominance.

- Apart from the construction sector, the growing automotive and manufacturing industries in APAC also significantly contribute to the increasing need for paint thinners. The rising production and use of cars and products have led to an increased requirement for coatings and finishes, consequently driving up the demand for paint thinners in the area.

- The availability of raw materials for making paint thinner could potentially provide the APAC region with a competitive edge. Improved availability of essential ingredients and chemicals for making paint thinners could affect cost and availability, potentially making the area a desirable market for manufacturing and distributing.

Paint Thinners Market Top Key Players:

- PPG Industries (USA)

- Sherwin-Williams (USA)

- Nippon Paint (Japan)

- RPM International (USA)

- Axalta (USA)

- Masco (USA)

- Benjamin Moore (USA)

- ICP Group (USA)

- Rust-Oleum Corporation (USA)

- Hempel A/S (Denmark)

- Jotun (Norway)

- BASF (Germany)

- DAW (Germany)

- MIPA SE (Germany)

- Beckers Group (Sweden)

- AkzoNobel (Netherlands)

- SKSHU Paints (China)

- Asian Paints (India)

- Berger Paints (India)

- DIC Corporation (Japan)

- Kansai Paint (Japan)

- Nippon Paint Holdings Co. Ltd (Japan)

- KCC Corp. (South Korea)

- Noroo Paint (South Korea)

- Other Active Players

Key Industry Developments in the Paint Thinners Market:

- In February 2024, KANSAI HELIOS signed a share purchase agreement with GREBE Holding in Weilburg, Germany to acquire its entire industrial coatings business (WEILBURGER Coatings), an industrial coatings producer, especially in the fields of non-stick, high temperature, railway, and other industrial specialty coatings. WEILBURGER had a turnover of approximately €150 million.

- In January 2024, MIPA SE took over the industrial coating’s division of HAERING GmbH from Unterheinriet (near Heilbronn) with a retroactive effect. Production of the acquired products was to be relocated to Mipa Group sites during the first quarter, and customer support was to be gradually taken over by MIPA SE. The HAERING GmbH sites and the HAERING brand and its product names were not part of the takeover. Terms were not disclosed.

|

Global Paint Thinners Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.71 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 37.02 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Paint Thinners Market by Material (2018-2032)

4.1 Paint Thinners Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mineral Spirits

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Acetone

4.5 Turpentine

4.6 Naphtha

4.7 Others

Chapter 5: Paint Thinners Market by Type (2018-2032)

5.1 Paint Thinners Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Traditional Paint Thinners

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Water-Based Paint Thinners

5.5 Bio-Based Paint Thinners

5.6 Low-VOC Paint Thinners

Chapter 6: Paint Thinners Market by Application (2018-2032)

6.1 Paint Thinners Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Architectural Coatings

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive Coatings

6.5 Industrial Coatings

6.6 Wood Coatings

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Paint Thinners Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PPG INDUSTRIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SHERWIN-WILLIAMS (USA)

7.4 NIPPON PAINT (JAPAN)

7.5 RPM INTERNATIONAL (USA)

7.6 AXALTA (USA)

7.7 MASCO (USA)

7.8 BENJAMIN MOORE (USA)

7.9 ICP GROUP (USA)

7.10 RUST-OLEUM CORPORATION (USA)

7.11 HEMPEL A/S (DENMARK)

7.12 JOTUN (NORWAY)

7.13 BASF (GERMANY)

7.14 DAW (GERMANY)

7.15 MIPA SE (GERMANY)

7.16 BECKERS GROUP (SWEDEN)

7.17 AKZONOBEL (NETHERLANDS)

7.18 SKSHU PAINTS (CHINA)

7.19 ASIAN PAINTS (INDIA)

7.20 BERGER PAINTS (INDIA)

7.21 DIC CORPORATION (JAPAN)

7.22 KANSAI PAINT (JAPAN)

7.23 NIPPON PAINT HOLDINGS CO. LTD (JAPAN)

7.24 KCC CORP. (SOUTH KOREA)

7.25 NOROO PAINT (SOUTH KOREA)

7.26 AND

Chapter 8: Global Paint Thinners Market By Region

8.1 Overview

8.2. North America Paint Thinners Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Material

8.2.4.1 Mineral Spirits

8.2.4.2 Acetone

8.2.4.3 Turpentine

8.2.4.4 Naphtha

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size by Type

8.2.5.1 Traditional Paint Thinners

8.2.5.2 Water-Based Paint Thinners

8.2.5.3 Bio-Based Paint Thinners

8.2.5.4 Low-VOC Paint Thinners

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Architectural Coatings

8.2.6.2 Automotive Coatings

8.2.6.3 Industrial Coatings

8.2.6.4 Wood Coatings

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Paint Thinners Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Material

8.3.4.1 Mineral Spirits

8.3.4.2 Acetone

8.3.4.3 Turpentine

8.3.4.4 Naphtha

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size by Type

8.3.5.1 Traditional Paint Thinners

8.3.5.2 Water-Based Paint Thinners

8.3.5.3 Bio-Based Paint Thinners

8.3.5.4 Low-VOC Paint Thinners

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Architectural Coatings

8.3.6.2 Automotive Coatings

8.3.6.3 Industrial Coatings

8.3.6.4 Wood Coatings

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Paint Thinners Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Material

8.4.4.1 Mineral Spirits

8.4.4.2 Acetone

8.4.4.3 Turpentine

8.4.4.4 Naphtha

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size by Type

8.4.5.1 Traditional Paint Thinners

8.4.5.2 Water-Based Paint Thinners

8.4.5.3 Bio-Based Paint Thinners

8.4.5.4 Low-VOC Paint Thinners

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Architectural Coatings

8.4.6.2 Automotive Coatings

8.4.6.3 Industrial Coatings

8.4.6.4 Wood Coatings

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Paint Thinners Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Material

8.5.4.1 Mineral Spirits

8.5.4.2 Acetone

8.5.4.3 Turpentine

8.5.4.4 Naphtha

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size by Type

8.5.5.1 Traditional Paint Thinners

8.5.5.2 Water-Based Paint Thinners

8.5.5.3 Bio-Based Paint Thinners

8.5.5.4 Low-VOC Paint Thinners

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Architectural Coatings

8.5.6.2 Automotive Coatings

8.5.6.3 Industrial Coatings

8.5.6.4 Wood Coatings

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Paint Thinners Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Material

8.6.4.1 Mineral Spirits

8.6.4.2 Acetone

8.6.4.3 Turpentine

8.6.4.4 Naphtha

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size by Type

8.6.5.1 Traditional Paint Thinners

8.6.5.2 Water-Based Paint Thinners

8.6.5.3 Bio-Based Paint Thinners

8.6.5.4 Low-VOC Paint Thinners

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Architectural Coatings

8.6.6.2 Automotive Coatings

8.6.6.3 Industrial Coatings

8.6.6.4 Wood Coatings

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Paint Thinners Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Material

8.7.4.1 Mineral Spirits

8.7.4.2 Acetone

8.7.4.3 Turpentine

8.7.4.4 Naphtha

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size by Type

8.7.5.1 Traditional Paint Thinners

8.7.5.2 Water-Based Paint Thinners

8.7.5.3 Bio-Based Paint Thinners

8.7.5.4 Low-VOC Paint Thinners

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Architectural Coatings

8.7.6.2 Automotive Coatings

8.7.6.3 Industrial Coatings

8.7.6.4 Wood Coatings

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Paint Thinners Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 22.71 Bn. |

|

Forecast Period 2025-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 37.02 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||