Paint & Coatings Market Synopsis

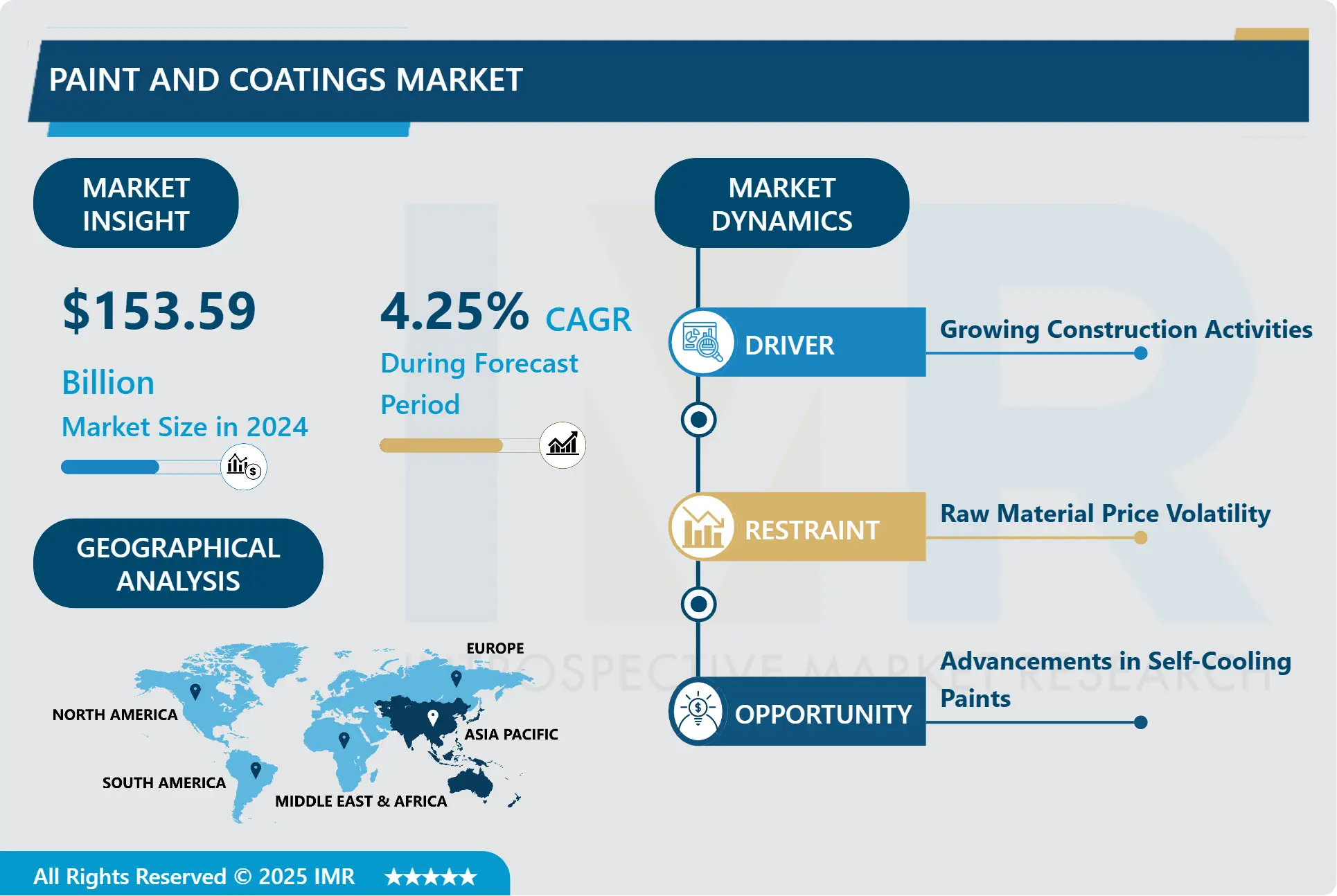

Paints and Coatings Market size is estimated at USD 153.59 billion in 2024 and is expected to reach USD 214.27 billion by 2032, growing at a CAGR of 4.25% during the forecast period (2025-2032).

Paint is defined as an opaque pigment or powder combination or dispersion in a liquid or medium. Coatings include other substances like varnishes and inorganic binders that have purposes comparable to paint.

Beyond aesthetics, the paint industry plays a critical role in protecting and maintaining a variety of surfaces. Buildings are protected from inclement weather, including rain, sun, and temperature changes, by exterior coatings.

Paints and lacquers are often used for both decorative and protective reasons on substrates. Industrial paints, like as red for firefighting control and blue for process water, can be used to identify huge pipes, although some artist paints are only ornamental.

In addition to improving durability and resisting abrasion, coatings are perfect for giving a high-gloss, eye-catching appearance. Their lifetime and efficacy are further enhanced by their strong UV and environmental resistance.

Paints and coatings offer long-lasting performance in both aesthetic and practical applications, protecting buildings from environmental elements and providing functional identification for industrial applications.

Paint & Coatings Market Trend Analysis- Growing Construction Activities

- An important factor propelling the paints and coatings market's expansion is the expanding building sector. Protective coatings are in high demand as building projects grow in number, from large-scale commercial parking lots to residential driveways. These coatings serve a variety of purposes by protecting surfaces from a wide range of outside aggressors, including insects, rain, sunlight, and chemical exposure from vehicle leaks.

- Adoption of industrial coatings is further fueled by the attractiveness of easier maintenance and improved aesthetic appeal. When surfaces are effectively sealed against weather-induced degradation, abrasion, and corrosion, property owners may expect longer-lasting materials and less maintenance. In addition to ensuring parking lots last a long time; this revolutionary protection makes architectural landscapes seem better overall.

- As the building industry continues to grow, the need for strong protective coatings is increasingly important. These coatings operate as steadfast protectors, strengthening surfaces against the effects of time, climate, and traffic. This preserves investments and improves the lifetime and aesthetic appeal of constructed surroundings.

Advancements in Self-Cooling Paints

- Self-cooling paint provides a passive way to reduce surface temperatures considerably without using power, so exemplifying a cooling technological achievement. This novel covering offers respite from searing heat by reaching sub-ambient temperatures by reflecting heat out rather than absorbing it.

- Its adaptability and simplicity of use make it a sensible option for a wide range of outside applications, including infrastructure, cars, and buildings. Furthermore, its low VOC, water-based composition and lack of PFAS chemicals make it environmentally friendly and meet the rising need for sustainable solutions.

- In hot areas, self-cooling paint becomes an essential tool for decreasing heat stress and energy consumption as society struggles with the effects of climate change. In conclusion, self-cooling paint offers a workable and environmentally friendly way to cool outside surfaces by fusing technology innovation with environmental awareness.

- Its eco-friendliness, ease of use, and passive cooling qualities make it an appealing option for dealing with heat-related issues in a variety of contexts. Self-cooling paint has the potential to completely change the way we think about cooling infrastructure as its use spreads, opening the door to a greener, cooler future.

Paint & Coatings Market Segment Analysis:

Paint & Coatings Market is segmented based on Resin Type, Technology, and End-users.

By Resin Type, Acrylic resins segment is expected to dominate the market during the forecast period

- In the field of environmentally friendly coating solutions, acrylic resins have become a leader thanks to their combination of beneficial qualities that meet a variety of industrial requirements. They are composed mostly of monomeric components that are finely woven into a polymeric chain, which gives them remarkable weatherability, mechanical resilience, and durability over time.

- There are several main classifications of acrylic resins, each with unique forms that are suited to certain uses. These groups include a range of uses, from solvent-based versions that are well-known for their durability in harsh conditions to aqueous acrylics that are perfect for applications that respect the environment.

- For instance, applications requiring heightened chemical resistance might necessitate the selection of cross-linked acrylic resins, while those prioritizing low VOC emissions would benefit from waterborne formulations. By meticulously assessing these variables, formulators can pinpoint the acrylic resin best suited to meet their performance and sustainability objectives.

- Moreover, acrylic resins offer an excess of desirable attributes that further elevate their appeal across industries. Beyond mechanical robustness and durability, these resins exhibit flexibility, gloss retention, and increased hardness, ensuring coatings maintain their integrity and aesthetics over extended periods.

By End-User, the Marine Industry segment held the largest share of 45.83% in 2024

- There is a lot of potential ahead for the paint and coatings business, especially in the maritime sector. Many different types of ships depend on coating technologies that are enhanced with ADI chemistry, thus there is an increasing need for products that provide exceptional endurance and performance.

- A mainstay in this field, polyurethane coatings provide not only the best possible color and gloss preservation but also the best possible weather protection, which is essential for boats that travel through a variety of climates. In addition, its remarkable ability to withstand water, chemicals, and abrasion acts as a barrier against corrosion, prolonging the life of marine equipment.

- Applications that need more chemical resistance, for example, may require the use of cross-linked acrylic resins; on the other hand, aqueous formulations would be more advantageous for those that prioritize low volatile organic compound emissions. Formulators can identify the acrylic resin that best fits their performance and sustainability goals by carefully evaluating these factors.

- Furthermore, acrylic resins have an abundance of attractive qualities that increase their popularity in a variety of sectors. In addition to their mechanical strength and endurance, these resins also have improved hardness, flexibility, and gloss retention, which helps coatings keep their integrity and appearance for longer.

- China dominated in 2023 with 8839 boats, a testament to the strength of its maritime sector. Greece demonstrated its great maritime heritage by coming in second with 4936 boats. With 4023 boats, Japan demonstrated its substantial marine presence. Singapore's critical maritime location was highlighted by its 2813 vessels. Indonesia's increasing marine activity was evidenced by its 2458 vessels. Germany's noteworthy maritime sector was demonstrated by its 2156 boats. Norway demonstrated its naval tradition and competence with its 1918 boats. The significant number of fleets owned by various countries indicates a sizable market for paints and coatings, which are essential for maintaining vessels and preventing corrosion. This highlights the industry's critical position in marine operations worldwide.

Paint & Coatings Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- China's unquestionable supremacy in the paint and coatings business is driven by several reasons that are advancing the sector. First of all, China's vast infrastructure development initiatives and industrial capability offer a strong basis for the growth of its coatings sector.

- Chinese coatings producers have many opportunities to demonstrate their skills and satisfy a wide range of needs due to their large local market and ambitious global programs such as the Belt and Road Initiative.

- China's competitive advantage is largely sustained by its unrelenting pursuit of technical innovation. Chinese firms consistently improve their coating formulas and production methods via heavy investment in research and development, leading to greater product performance, durability, and application efficiency.

- China's strategy emphasis on sustainability fits in very well with consumer tastes and current global trends. Chinese coatings producers are in the forefront of creating low-VOC, eco-friendly formulas as environmental concerns gain attention globally.

Active Key Players in the Paint & Coatings Market

- The Sherwin-Williams Company (United States)

- Ppg Industries Inc. (United States)

- Rpm International Inc (United States)

- Cardolite Corporation (United States)

- Reichhold Llc 2 (United States)

- Alberdingk Boley (United States)

- Masco Corporation (United States)

- Arkema (France)

- Basf Se (Germany)

- Evonik Industries Ag (Germany)

- Wacker Chemie Ag (Germany)

- Sika Ag (Switzerland)

- Clariant Ag (Switzerland)

- Tikkurila Oyj (Finland)

- Akzonobel Nv (Netherlands)

- Dsm (Netherlands)

- Hempel A/S (Denmark)

- Jotun A/S (Norway)

- Dic Corporation (Japan)

- Nippon Paint Holdings Co. Ltd (Japan)

- Kansai Paint Co., Ltd. (Japan)

- Nipsea Group (Japan)

- Arakawa Chemical Industries, Ltd. (Japan)

- Eternal Materials Co., Ltd. (Taiwan)

- Qualipoly Chemical Corp. (Taiwan) and Other Active Players

Key Industry Developments in the Paint & Coatings Market:

- In February 2024, BASF Coatings signed a Global Preferred Partnership agreement with INEOS Automotive for its Global Body and Paint Program. INEOS Automotive and BASF’s Coatings division had agreed with a global automotive refinish body and paint development. The partners committed to a long-term strategic collaboration that enabled them to exceed the industry standard in vehicle body repair and paint refinish. The partnership included the supply of sustainable refinish solutions, expertise, and the latest digital color-smatching solutions and training.

- In February 2024, PPG announced a long-term partnership between its JOHNSTONE’S PAINT brand and the World Snooker Tour (WST). The collaboration saw the Johnstone’s Paint brand serving as the Lead Partner for the Players Championship and Tour Championship – the second and third events of the 2024 Players Series. This strategic alliance aimed to enhance the profile of both parties involved while offering mutual benefits. Through this venture, PPG aimed to leverage the popularity of snooker events to further strengthen the JOHNSTONE’S PAINT brand's presence and engage with a wider audience within the sports community.

|

Global Paint & Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 153.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.25% |

Market Size in 2032: |

USD 214.27 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Paint & Coatings Market by Resin Type (2018-2032)

4.1 Paint & Coatings Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Acrylic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Alkyd

4.5 Polyurethane

4.6 Epoxy

4.7 Polyester

4.8 Other

Chapter 5: Paint & Coatings Market by Technology (2018-2032)

5.1 Paint & Coatings Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Water-borne

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solvent-borne

5.5 Powder Coating

5.6 UV-cured Coating

Chapter 6: Paint & Coatings Market by End-User (2018-2032)

6.1 Paint & Coatings Market Snapshot and Growth Engine

6.2 Market Overview

6.3 End-user Industry

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Architectural

6.5 Automotive

6.6 Marine Industry

6.7 General Industrial

6.8 Transportation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Paint & Coatings Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 THE SHERWIN-WILLIAMS COMPANY (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PPG INDUSTRIES INC. (UNITED STATES)

7.4 RPM INTERNATIONAL INC (UNITED STATES)

7.5 CARDOLITE CORPORATION (UNITED STATES)

7.6 REICHHOLD LLC 2 (UNITED STATES)

7.7 ALBERDINGK BOLEY (UNITED STATES)

7.8 MASCO CORPORATION (UNITED STATES)

7.9 ARKEMA (FRANCE)

7.10 BASF SE (GERMANY)

7.11 EVONIK INDUSTRIES AG (GERMANY)

7.12 WACKER CHEMIE AG (GERMANY)

7.13 SIKA AG (SWITZERLAND)

7.14 CLARIANT AG (SWITZERLAND)

7.15 TIKKURILA OYJ (FINLAND)

7.16 AKZONOBEL NV (NETHERLANDS)

7.17 DSM (NETHERLANDS)

7.18 HEMPEL A/S (DENMARK)

7.19 JOTUN A/S (NORWAY)

7.20 DIC CORPORATION (JAPAN)

7.21 NIPPON PAINT HOLDINGS CO. LTD (JAPAN)

7.22 KANSAI PAINT COLTD. (JAPAN)

7.23 NIPSEA GROUP (JAPAN)

7.24 ARAKAWA CHEMICAL INDUSTRIES LTD. (JAPAN)

7.25 ETERNAL MATERIALS COLTD. (TAIWAN)

7.26 QUALIPOLY CHEMICAL CORP. (TAIWAN)

Chapter 8: Global Paint & Coatings Market By Region

8.1 Overview

8.2. North America Paint & Coatings Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Resin Type

8.2.4.1 Acrylic

8.2.4.2 Alkyd

8.2.4.3 Polyurethane

8.2.4.4 Epoxy

8.2.4.5 Polyester

8.2.4.6 Other

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Water-borne

8.2.5.2 Solvent-borne

8.2.5.3 Powder Coating

8.2.5.4 UV-cured Coating

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 End-user Industry

8.2.6.2 Architectural

8.2.6.3 Automotive

8.2.6.4 Marine Industry

8.2.6.5 General Industrial

8.2.6.6 Transportation

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Paint & Coatings Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Resin Type

8.3.4.1 Acrylic

8.3.4.2 Alkyd

8.3.4.3 Polyurethane

8.3.4.4 Epoxy

8.3.4.5 Polyester

8.3.4.6 Other

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Water-borne

8.3.5.2 Solvent-borne

8.3.5.3 Powder Coating

8.3.5.4 UV-cured Coating

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 End-user Industry

8.3.6.2 Architectural

8.3.6.3 Automotive

8.3.6.4 Marine Industry

8.3.6.5 General Industrial

8.3.6.6 Transportation

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Paint & Coatings Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Resin Type

8.4.4.1 Acrylic

8.4.4.2 Alkyd

8.4.4.3 Polyurethane

8.4.4.4 Epoxy

8.4.4.5 Polyester

8.4.4.6 Other

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Water-borne

8.4.5.2 Solvent-borne

8.4.5.3 Powder Coating

8.4.5.4 UV-cured Coating

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 End-user Industry

8.4.6.2 Architectural

8.4.6.3 Automotive

8.4.6.4 Marine Industry

8.4.6.5 General Industrial

8.4.6.6 Transportation

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Paint & Coatings Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Resin Type

8.5.4.1 Acrylic

8.5.4.2 Alkyd

8.5.4.3 Polyurethane

8.5.4.4 Epoxy

8.5.4.5 Polyester

8.5.4.6 Other

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Water-borne

8.5.5.2 Solvent-borne

8.5.5.3 Powder Coating

8.5.5.4 UV-cured Coating

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 End-user Industry

8.5.6.2 Architectural

8.5.6.3 Automotive

8.5.6.4 Marine Industry

8.5.6.5 General Industrial

8.5.6.6 Transportation

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Paint & Coatings Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Resin Type

8.6.4.1 Acrylic

8.6.4.2 Alkyd

8.6.4.3 Polyurethane

8.6.4.4 Epoxy

8.6.4.5 Polyester

8.6.4.6 Other

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Water-borne

8.6.5.2 Solvent-borne

8.6.5.3 Powder Coating

8.6.5.4 UV-cured Coating

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 End-user Industry

8.6.6.2 Architectural

8.6.6.3 Automotive

8.6.6.4 Marine Industry

8.6.6.5 General Industrial

8.6.6.6 Transportation

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Paint & Coatings Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Resin Type

8.7.4.1 Acrylic

8.7.4.2 Alkyd

8.7.4.3 Polyurethane

8.7.4.4 Epoxy

8.7.4.5 Polyester

8.7.4.6 Other

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Water-borne

8.7.5.2 Solvent-borne

8.7.5.3 Powder Coating

8.7.5.4 UV-cured Coating

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 End-user Industry

8.7.6.2 Architectural

8.7.6.3 Automotive

8.7.6.4 Marine Industry

8.7.6.5 General Industrial

8.7.6.6 Transportation

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Paint & Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 153.59 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.25% |

Market Size in 2032: |

USD 214.27 Bn. |

|

Segments Covered: |

By Resin Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||