Orthopedic Devices Market Synopsis

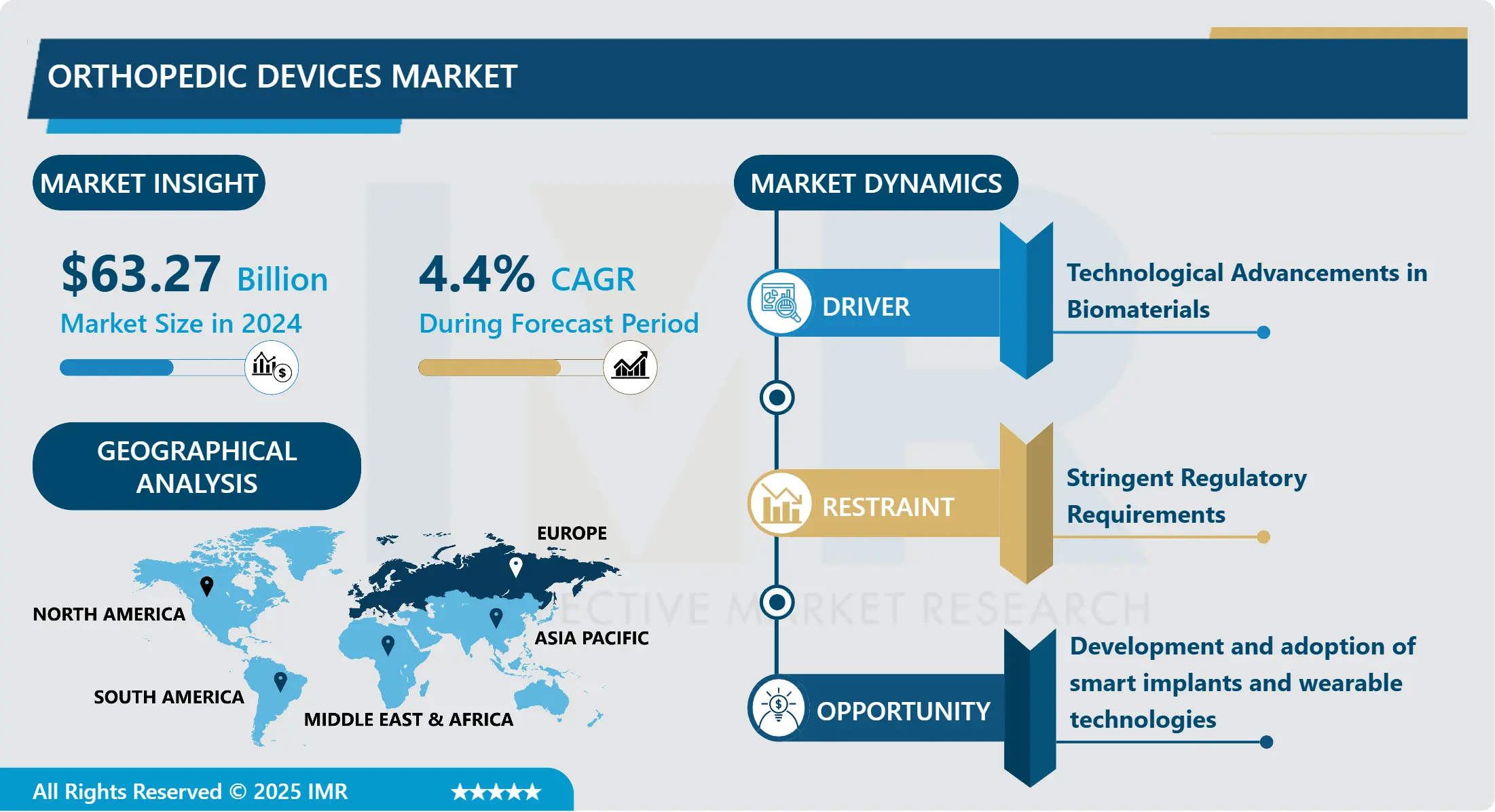

Orthopedic Devices Market Size Was Valued at USD 63.27 Billion in 2024 and is Projected to Reach USD 89.29 Billion by 2032, Growing at a CAGR of 4.4% From 2025-2032.

This can be broadly defined as a category of medical instruments and implants that fixes and restores the skeleton and its connections together with joints,iligaments and musculature. These devices are used in orthopedic surgery and rehabilitation procedures so to improve the range of motions and afford relief from the pain and discomfort and improve the functioning of bones, joints, muscles, ligaments and tendons. Or they are implants that mostly consist of joint replacements, plates, screws, rods used when fixing a fracture besides braces, splints, and prosthetics. Orthopedic devices are important when assisting with fractures, spinal deformities, and post-injury or chronic diseases in the musculoskeletal system. Their development and use go on, with technology and medical growing constantly on account of developments in IT and biomedical science for the benefit of patients and the disabled.

Market for orthopedic devices is one of the most active segments which belongs to a wider group of medical devices, targeted at treatment of different disorders and traumas of musculoskeletal system. It covers almost every type of implant, including joint replacement implants, fixation devices and systems, orthobiologic products, and orthotic braces. It is propelled by attributes like the growing number of elder population, evolving musculoskeletal diseases such as osteoarthritis and osteoporosis, and increased cases of sporting disorders across the world.

Some of the significant factors that have influenced the orthopedic devices market are: technological innovation that has resulted in better biomaterial and implant devices that are more long-lasting and compatible with the body as well as having higher levels of effectiveness. Variations in surgical procedures are also expected to propel the growth in this industry due to the use of minimally invasive surgeries as they allow for faster patient recovery and fewer post-surgery side effects. On the same note, it is imperative to state that advances in technology such as robotic assisted surgeries and 3D printing is still changing the shape of orthopedics through offering ideal and accurate treatments based on the patient’s need.

Orthopedic Devices Market Trend Analysis

Orthopedic Devices Market Growth Driver- Trend Shift towards personalized and customized orthopedic solutions

- One marked characteristic that has been witnessed in the market for orthopedic devices is the rise of personalized and customized orthopedic products. Conventional orthopedic devices such as implants and prosthetics on the other hand used to be generic and manufactured in the ordinary course. Nevertheless, one must also understand that due to the aforementioned advancements in technology the possibility of making implants and devices more consistent with the recipient anatomy through the use of 3D printing and digital imaging is possible.

- This trend shows personalized orthopedics that are far more effective in providing exact results in the surgery, patients can recover quickly, and they are happier with the outcomes. In the case where a physician needs to perform a surgery that requires the use of implants, a surgeon can now obtain these implants from exact replicas of the patient’s scans which may include either a CT scan or an MRI scan. This modification is functional and tuning of the PDA devices not only helps to improve functional capabilities of the devices but at the same time, minimizes the probability of experiences such as implant looseness or pain after surgery.

Orthopedic Devices Market Expansion Opportunity- Trend Development and adoption of smart implants and wearable technologies

- Another major opportunity identified in the orthopedic devices market is the concept or integration of smart implants and technology wear. I believe that all these innovations have possibilities to change the way patient is monitored and treated, and make a significant impact on the general health care sphere.

- In this regard, patients with smart implants which have built-in sensors can have regular output on issues such as implant stability, load distribution and healing. This information can prevent healthcare providers from only relying on the status updates from the patients and allow timely medical intervention in case of deterioration or adjustment of the rehabilitation schedule according to a patient’s status. For instance, smart knee implants can log the use of the joint and give feedback to the patients or doctors which can be used to enhance the right exercises for the knee.

- In the same way, objects like smart braces or even exoskeletons could play a key role within rehab in terms of support and health tracking and real-time feedback regarding the wearer’s posture and gait, for instance. Apart from helping the clients that succumb to musculoskeletal injuries, these devices have probable uses in chronic injuries like osteoarthritis.

Orthopedic Devices Market Segment Analysis:

Orthopedic Devices Market Segmented on the basis of Product, End use, and Region.

By Product, Joint Replacement/ Orthopedic Implants segment is expected to dominate the market during the forecast period

- Among all the products in the orthopedic devices market, the joint replacement/orthopedic implants segment will bypass the others and lead the market throughout the forecast period and for the following reasons. It comprises of numerous implants that involve joint arthroplasty which is the surgical operation that entails replacement of one or more joints including; hips, knees, shoulders, and other joints. Osteoarthritis and other degenerative joint diseases have been growing in popularity across the aging population, and increase the demand for a solution, compelling growth in the market. With population growth concerns in mind and changes in life styles that are expected in the future, demand for joint replacement surgeries will continue to increase. In addition, technological advancements and innovations in implant materials, designs, and surgical methods have increased the strength, biocompatibility, and functionality of joint replacement procedures, which in turn are raising the demand for joint replacements.

- Also, increased emerging markets through optimizing the healthcare system and increased healthcare spending in the developed and developing nations to potent orthopedic treatments for the patients make this segment dominant. In sum, the joint replacement / orthopedic implants segment is well placed to lead the way to growth in the market by continuing to innovate, by responding to demography, and by responding to higher surgical activity internationally.

By End Use, Hospitals segment expected to held the largest share

- But when it comes to the orthopedic devices, market, then the highest market share is attributed to the hospitals segment for various reasons. Hospitals are the specialized units that mainly cater the needs of orthopedic surgeries, wherein regular surgeries include joint replacements, fracture fixations, and spine surgeries. These facilities have provided specialized orthopedic departments with better surgical tools, diagnostic equipments or x-rays and other post-operative care facilities that are essential for managing complext and severe musculoskeletal diseases and disabilities.

- Additionally, most hospitals encounter a population of patients with a wide spectrum of orthopedic problems including those that may require emergency intervention due to trauma or those who present with orthopedic illnesses that may require elective interventions such as joint replacements for arthritis. The fact that patients are not of the same age and do not all have the same problem helps in maintaining a constant and steady market for orthopedic devices like the implants, prosthetics and instruments for surgery. Also, a large-scale hospital acquires low-priced orthopedic devices and favorable procurement terms due to economy scale effect on the orthopedic devices required for treatment.

Orthopedic Devices Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- The following section will explain how the orthopedic devices market is likely to be controlled by Europe over the course of the forecast period due to several factors. This suggests the health authorities in the region invested significantly in healthcare , have high healthcare costs, and the population is aging with increased incidence of musculoskeletal disorders like osteoarthritis and fractures. Also, the technology improves over and over again, and Europe also has a reliable legal framework that supports the use of orthopedic devices. This is driven mainly by a rise in surgical operations such as joint replacements and surgical operations due to traumas, facilitated by experienced medical staff and well-equipped health facilities. However, the outstanding availability of substantial orthopedic device manufacturers in conjunction with the scientific researches heading further in efforts to improve device performance and patient satisfaction make Europe one of the most favored markets in the global orthopedic devices market.

Active Key Players in the Orthopedic Devices Market

- Aesculap, Inc. (Germany)

- Arthrex (USA)

- Conmed Corporation (USA)

- DJO Global (USA)

- Exactech (USA)

- Integra LifeSciences (USA)

- Johnson & Johnson (USA)

- Medtronic (Ireland)

- NuVasive (USA)

- Orthofix Medical Inc. (USA)

- Össur (Iceland)

- Smith & Nephew (UK)

- Stryker Corporation (USA)

- Wright Medical Group N.V. (USA)

- Zimmer Biomet (USA)

- Other Active Players.

Key Industry Developments in the Orthopedic Devices Market:

- In February 2024, Tyber Medical LLC, an orthopedic device manufacturer, has received approval for its anatomical plating system in Canada. Health Canada has now granted approval to this extensive product line, which had previously been granted FDA 510(k) certification in the United States.

|

Global Orthopedic Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 63.27 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 89.29 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Orthopedic Devices Market by Product (2018-2032)

4.1 Orthopedic Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Joint Replacement/ Orthopedic Implants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Trauma

4.5 Sports Medicine

4.6 Orthobiologics

4.7 Others

Chapter 5: Orthopedic Devices Market by End Use (2018-2032)

5.1 Orthopedic Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Outpatient Facilities

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Orthopedic Devices Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AESCULAP INC (GERMANY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARTHREX (USA)

6.4 CONMED CORPORATION (USA)

6.5 DJO GLOBAL (USA)

6.6 EXACTECH (USA)

6.7 INTEGRA LIFESCIENCES (USA)

6.8 JOHNSON & JOHNSON (USA)

6.9 MEDTRONIC (IRELAND)

6.10 NUVASIVE (USA)

6.11 ORTHOFIX MEDICAL INC (USA)

6.12 ÖSSUR (ICELAND)

6.13 SMITH & NEPHEW (UK)

6.14 STRYKER CORPORATION (USA)

6.15 WRIGHT MEDICAL GROUP N.V (USA)

6.16 ZIMMER BIOMET (USA)

6.17 OTHER KEY PLAYERS

Chapter 7: Global Orthopedic Devices Market By Region

7.1 Overview

7.2. North America Orthopedic Devices Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Joint Replacement/ Orthopedic Implants

7.2.4.2 Trauma

7.2.4.3 Sports Medicine

7.2.4.4 Orthobiologics

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by End Use

7.2.5.1 Hospitals

7.2.5.2 Outpatient Facilities

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Orthopedic Devices Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Joint Replacement/ Orthopedic Implants

7.3.4.2 Trauma

7.3.4.3 Sports Medicine

7.3.4.4 Orthobiologics

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by End Use

7.3.5.1 Hospitals

7.3.5.2 Outpatient Facilities

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Orthopedic Devices Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Joint Replacement/ Orthopedic Implants

7.4.4.2 Trauma

7.4.4.3 Sports Medicine

7.4.4.4 Orthobiologics

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by End Use

7.4.5.1 Hospitals

7.4.5.2 Outpatient Facilities

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Orthopedic Devices Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Joint Replacement/ Orthopedic Implants

7.5.4.2 Trauma

7.5.4.3 Sports Medicine

7.5.4.4 Orthobiologics

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by End Use

7.5.5.1 Hospitals

7.5.5.2 Outpatient Facilities

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Orthopedic Devices Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Joint Replacement/ Orthopedic Implants

7.6.4.2 Trauma

7.6.4.3 Sports Medicine

7.6.4.4 Orthobiologics

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by End Use

7.6.5.1 Hospitals

7.6.5.2 Outpatient Facilities

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Orthopedic Devices Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Joint Replacement/ Orthopedic Implants

7.7.4.2 Trauma

7.7.4.3 Sports Medicine

7.7.4.4 Orthobiologics

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by End Use

7.7.5.1 Hospitals

7.7.5.2 Outpatient Facilities

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Orthopedic Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 63.27 Bn. |

|

Forecast Period 2025-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 89.29 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||