Global Organic Seeds Market Overview

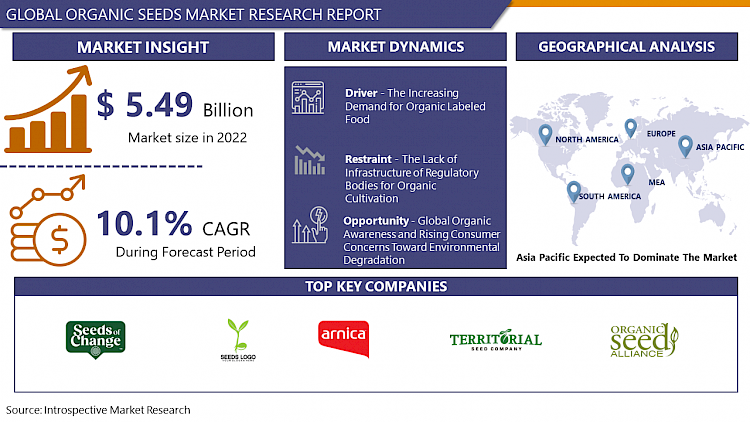

The Organic Seeds market estimated at USD 5.49 Billion in the year 2022, is projected to reach a revised size of USD 11.86 Billion by 2030, growing at a CAGR of 10.1% over the analysis period 2023-2030.

Organic seeds refer to those seeds that come from plants cultivate wisely without the use of synthetic fertilizers and pesticides. The application of sewage sludge, irradiation, and genetic engineering is also interdict in organic seed harvesting. In addition, when seeds are labeled as organic, it means the seed has a recognizable legal meaning. In order to certify a batch of seeds as organic seeds, the seeds should stick to all of the USDA’s National Organic Program’s rules and specifications. Furthermore, organic seeds give assurance to farmers or customers that toxic and inorganic chemical pesticides, fertilizers, and genetically modified organisms are not used while the seed cultivation process.

The rising consumer concerns toward environmental degradation owing to the increasing usage of chemicals has fueled organic seed production globally. This provides growth opportunities for the organic seed industry in projected period. For instance, the organic seed industry has grown significantly and were valued about US$ 80 Bn dollars in 2015, while global agricultural land for organic farming increased from 11 million hectors in 1999 to 50.9 million hectors in 2015 which indicates that increases the consumer demand for organic based products globally.

Market Dynamics And Factor

Drivers:

An increasing the demand for organic labeled food over the past few years is anticipated to drive the global organic seed market expansion over forecast period. Gaining popularity for organic trend owing to rising awareness among consumers associated with negative health impacts of hazardous chemicals used in the conventional agriculture system. In addition, research studies suggest that high use of inorganic agrochemicals in conventional agriculture system have negative effects on neurological & cardiovascular health, respiratory system, and may also lead cancer.

Favorable government initiatives to support organic farming may boost organic seed market growth. In addition, the implementation of government schemes in India such as Paramparagat Krishi Vikas Yojana, National Food Security Mission, and National Food Security Mission is projected to boost organic production in the region. This leads to market growth during forecast period.

Furthermore, the demand for vegetables market in urban areas are increased due to health and healthy diet pattern which leads to lucrative market growth for organic vegetables seeds. Consumers are shifted towards the organic based vegetables, plant-based product and veganism leads the global organic seed market growth in projected period.

Restraints:

The lack of infrastructure of regulatory bodies for organic cultivation regarding the association of different agricultural practices such as organic, conventional and genetically engineered, which may yield a contaminated crop is expected to hamper the growth of organic seeds market in the upcoming years.

Opportunities:

In developing countries, lack infrastructure and global organic awareness, create the opportunities for leading key players to penetrate their product and services by the significant promotional activities. Government support in the form of various agricultural schemes and financial assistance to the framers are create the lucrative growth opportunities in the organic seed industry in upcoming years.

Market Segmentation

Regional Analysis:

North America has largest organic seeds market. In addition, some key factors such as the growing trend of home gardening, an increasing demand for healthy food, and supportive government regulations, augmenting the sales of organic seed in North America. Being presence of major key players such as High Mowing Organic Seeds, Johnny's Selected Seeds, and Southern Exposure Seed Exchange are hastening the market growth during projected period.

Asia Pacific dominates the global organic seed market owing to largest arable land for farming and high percentage of occupation as farming, adequate availability of raw materials, and rising the demand for organic and plant-based products. In addition, existing agricultural government schemes also helps to farmers to organic farming, which leads the growth during forecast period.

In Europe, growing environmental concerns about conventional agricultural practices in food and beverage industry, negative health impact caused by usage of inorganic agrochemicals and favorable regulatory framework with respect to organic produce and cultivation which boost the market growth during forecast period.

In Latin America, growing population and consumer preference towards organic farming leads to fueled the market growth over forecast period. In Middle East and Africa, lack of environmental condition especially in Middle East leads to effect on organic agriculture farming but positive government support, and rising consumer preference towards organic based and plant-based product is expected to growth in upcoming years.

Players Covered in Organic Seeds Market are:

- Seeds of Change

- Wild Garden Seeds

- Arnica Kwekerij

- Territorial Seed Company

- Fleuren

- Organic Seed Alliance

- Fedco Seeds Inc.

- Wild Garden Seed

- Johnny Selected Seed

- High Mowing Organic Seeds

- Renee’s Garden

- Southern Exposure Seed Exchange

- De Bolster Organic Seeds

- Rijk Zwaan Zaadteelt EN Zaadhandel B.V.

- Navdanya

- HILD Samen GmbH

- Vitalis Organic Seeds

- Mass Plant and other major players.

Key Industry Developments

- In May 2021, Above Food Co., acquired the Farmer Direct Organic Foods Ltd, which provides organic certified cereals and pulses. The collaboration will support to the company during the growth period.

|

Global Organic Seeds Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 5.49 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.1% |

Market Size in 2030: |

USD 11.86Bn. |

|

Segments Covered: |

By Crop Type |

|

|

|

By Farm Type |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ORGANIC SEEDS MARKET BY CROP TYPE (2017-2030)

- ORGANIC SEEDS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRUIT & VEGETABLE CROP SEEDS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FIELD CROP SEEDS

- OILSEED CROP

- CASH CROP

- ORGANIC SEEDS MARKET BY FARM TYPE (2017-2030)

- ORGANIC SEEDS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDOOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OUTDOOR

- ORGANIC SEEDS MARKET BY DISTRIBUTION CHANNEL (2017-2030)

- ORGANIC SEEDS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WHOLESALERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAILERS

- AGRICULTURAL SERVICE CENTERS

- COOPERATIVES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Organic Seeds Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SEEDS OF CHANGE

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- WILD GARDEN SEEDS

- ARNICA KWEKERIJ

- TERRITORIAL SEED COMPANY

- FLEUREN

- ORGANIC SEED ALLIANCE

- FEDCO SEEDS INC.

- WILD GARDEN SEED

- JOHNNY SELECTED SEED

- HIGH MOWING ORGANIC SEEDS

- RENEE’S GARDEN

- SOUTHERN EXPOSURE SEED EXCHANGE

- DE BOLSTER ORGANIC SEEDS

- RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.

- NAVDANYA

- HILD SAMEN GMBH

- VITALIS ORGANIC SEEDS

- MASS PLANT

- COMPETITIVE LANDSCAPE

- GLOBAL ORGANIC SEEDS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Crop Type

- Historic And Forecasted Market Size By Farm Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Organic Seeds Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 5.49 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.1% |

Market Size in 2030: |

USD 11.86Bn. |

|

Segments Covered: |

By Crop Type |

|

|

|

By Farm Type |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ORGANIC SEEDS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ORGANIC SEEDS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ORGANIC SEEDS MARKET COMPETITIVE RIVALRY

TABLE 005. ORGANIC SEEDS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ORGANIC SEEDS MARKET THREAT OF SUBSTITUTES

TABLE 007. ORGANIC SEEDS MARKET BY CROP TYPE

TABLE 008. FRUIT & VEGETABLE CROP SEEDS MARKET OVERVIEW (2016-2028)

TABLE 009. FIELD CROP SEEDS MARKET OVERVIEW (2016-2028)

TABLE 010. OILSEED CROP MARKET OVERVIEW (2016-2028)

TABLE 011. CASH CROP MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. ORGANIC SEEDS MARKET BY FARM TYPE

TABLE 014. INDOOR MARKET OVERVIEW (2016-2028)

TABLE 015. OUTDOOR MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. ORGANIC SEEDS MARKET BY DISTRIBUTION CHANNELS

TABLE 018. WHOLESALERS MARKET OVERVIEW (2016-2028)

TABLE 019. RETAILERS MARKET OVERVIEW (2016-2028)

TABLE 020. AGRICULTURAL SERVICE CENTERS MARKET OVERVIEW (2016-2028)

TABLE 021. COOPERATIVES MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA ORGANIC SEEDS MARKET, BY CROP TYPE (2016-2028)

TABLE 024. NORTH AMERICA ORGANIC SEEDS MARKET, BY FARM TYPE (2016-2028)

TABLE 025. NORTH AMERICA ORGANIC SEEDS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 026. N ORGANIC SEEDS MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE ORGANIC SEEDS MARKET, BY CROP TYPE (2016-2028)

TABLE 028. EUROPE ORGANIC SEEDS MARKET, BY FARM TYPE (2016-2028)

TABLE 029. EUROPE ORGANIC SEEDS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 030. ORGANIC SEEDS MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC ORGANIC SEEDS MARKET, BY CROP TYPE (2016-2028)

TABLE 032. ASIA PACIFIC ORGANIC SEEDS MARKET, BY FARM TYPE (2016-2028)

TABLE 033. ASIA PACIFIC ORGANIC SEEDS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 034. ORGANIC SEEDS MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA ORGANIC SEEDS MARKET, BY CROP TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA ORGANIC SEEDS MARKET, BY FARM TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA ORGANIC SEEDS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 038. ORGANIC SEEDS MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA ORGANIC SEEDS MARKET, BY CROP TYPE (2016-2028)

TABLE 040. SOUTH AMERICA ORGANIC SEEDS MARKET, BY FARM TYPE (2016-2028)

TABLE 041. SOUTH AMERICA ORGANIC SEEDS MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 042. ORGANIC SEEDS MARKET, BY COUNTRY (2016-2028)

TABLE 043. SEEDS OF CHANGE: SNAPSHOT

TABLE 044. SEEDS OF CHANGE: BUSINESS PERFORMANCE

TABLE 045. SEEDS OF CHANGE: PRODUCT PORTFOLIO

TABLE 046. SEEDS OF CHANGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. WILD GARDEN SEEDS: SNAPSHOT

TABLE 047. WILD GARDEN SEEDS: BUSINESS PERFORMANCE

TABLE 048. WILD GARDEN SEEDS: PRODUCT PORTFOLIO

TABLE 049. WILD GARDEN SEEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ARNICA KWEKERIJ: SNAPSHOT

TABLE 050. ARNICA KWEKERIJ: BUSINESS PERFORMANCE

TABLE 051. ARNICA KWEKERIJ: PRODUCT PORTFOLIO

TABLE 052. ARNICA KWEKERIJ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TERRITORIAL SEED COMPANY: SNAPSHOT

TABLE 053. TERRITORIAL SEED COMPANY: BUSINESS PERFORMANCE

TABLE 054. TERRITORIAL SEED COMPANY: PRODUCT PORTFOLIO

TABLE 055. TERRITORIAL SEED COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. FLEUREN: SNAPSHOT

TABLE 056. FLEUREN: BUSINESS PERFORMANCE

TABLE 057. FLEUREN: PRODUCT PORTFOLIO

TABLE 058. FLEUREN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. ORGANIC SEED ALLIANCE: SNAPSHOT

TABLE 059. ORGANIC SEED ALLIANCE: BUSINESS PERFORMANCE

TABLE 060. ORGANIC SEED ALLIANCE: PRODUCT PORTFOLIO

TABLE 061. ORGANIC SEED ALLIANCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. FEDCO SEEDS INC.: SNAPSHOT

TABLE 062. FEDCO SEEDS INC.: BUSINESS PERFORMANCE

TABLE 063. FEDCO SEEDS INC.: PRODUCT PORTFOLIO

TABLE 064. FEDCO SEEDS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. WILD GARDEN SEED: SNAPSHOT

TABLE 065. WILD GARDEN SEED: BUSINESS PERFORMANCE

TABLE 066. WILD GARDEN SEED: PRODUCT PORTFOLIO

TABLE 067. WILD GARDEN SEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. JOHNNY SELECTED SEED: SNAPSHOT

TABLE 068. JOHNNY SELECTED SEED: BUSINESS PERFORMANCE

TABLE 069. JOHNNY SELECTED SEED: PRODUCT PORTFOLIO

TABLE 070. JOHNNY SELECTED SEED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. HIGH MOWING ORGANIC SEEDS: SNAPSHOT

TABLE 071. HIGH MOWING ORGANIC SEEDS: BUSINESS PERFORMANCE

TABLE 072. HIGH MOWING ORGANIC SEEDS: PRODUCT PORTFOLIO

TABLE 073. HIGH MOWING ORGANIC SEEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. RENEE’S GARDEN: SNAPSHOT

TABLE 074. RENEE’S GARDEN: BUSINESS PERFORMANCE

TABLE 075. RENEE’S GARDEN: PRODUCT PORTFOLIO

TABLE 076. RENEE’S GARDEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SOUTHERN EXPOSURE SEED EXCHANGE: SNAPSHOT

TABLE 077. SOUTHERN EXPOSURE SEED EXCHANGE: BUSINESS PERFORMANCE

TABLE 078. SOUTHERN EXPOSURE SEED EXCHANGE: PRODUCT PORTFOLIO

TABLE 079. SOUTHERN EXPOSURE SEED EXCHANGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. DE BOLSTER ORGANIC SEEDS: SNAPSHOT

TABLE 080. DE BOLSTER ORGANIC SEEDS: BUSINESS PERFORMANCE

TABLE 081. DE BOLSTER ORGANIC SEEDS: PRODUCT PORTFOLIO

TABLE 082. DE BOLSTER ORGANIC SEEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: SNAPSHOT

TABLE 083. RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: BUSINESS PERFORMANCE

TABLE 084. RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: PRODUCT PORTFOLIO

TABLE 085. RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. NAVDANYA: SNAPSHOT

TABLE 086. NAVDANYA: BUSINESS PERFORMANCE

TABLE 087. NAVDANYA: PRODUCT PORTFOLIO

TABLE 088. NAVDANYA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. HILD SAMEN GMBH: SNAPSHOT

TABLE 089. HILD SAMEN GMBH: BUSINESS PERFORMANCE

TABLE 090. HILD SAMEN GMBH: PRODUCT PORTFOLIO

TABLE 091. HILD SAMEN GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. VITALIS ORGANIC SEEDS: SNAPSHOT

TABLE 092. VITALIS ORGANIC SEEDS: BUSINESS PERFORMANCE

TABLE 093. VITALIS ORGANIC SEEDS: PRODUCT PORTFOLIO

TABLE 094. VITALIS ORGANIC SEEDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. MASS PLANT: SNAPSHOT

TABLE 095. MASS PLANT: BUSINESS PERFORMANCE

TABLE 096. MASS PLANT: PRODUCT PORTFOLIO

TABLE 097. MASS PLANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 098. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 099. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 100. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ORGANIC SEEDS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ORGANIC SEEDS MARKET OVERVIEW BY CROP TYPE

FIGURE 012. FRUIT & VEGETABLE CROP SEEDS MARKET OVERVIEW (2016-2028)

FIGURE 013. FIELD CROP SEEDS MARKET OVERVIEW (2016-2028)

FIGURE 014. OILSEED CROP MARKET OVERVIEW (2016-2028)

FIGURE 015. CASH CROP MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. ORGANIC SEEDS MARKET OVERVIEW BY FARM TYPE

FIGURE 018. INDOOR MARKET OVERVIEW (2016-2028)

FIGURE 019. OUTDOOR MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. ORGANIC SEEDS MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 022. WHOLESALERS MARKET OVERVIEW (2016-2028)

FIGURE 023. RETAILERS MARKET OVERVIEW (2016-2028)

FIGURE 024. AGRICULTURAL SERVICE CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 025. COOPERATIVES MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA ORGANIC SEEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE ORGANIC SEEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC ORGANIC SEEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA ORGANIC SEEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA ORGANIC SEEDS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Organic Seeds Market research report is 2023-2030

Seeds of Change, Wild Garden Seeds, Arnica Kwekerij, Territorial Seed Company, Fleuren, Organic Seed Alliance, and Other Major Players.

Organic Seeds Market is segmented into Crop Type, Farm Type, Distribution Channels and region. By Crop Type, the market is categorized into Fruit and Vegetable Crop Seeds, Field Crop Seeds, Oilseed Crop, Cash Crop, Others. By Farm Type, the market is categorized into Indoor, Outdoor, Others. By Distribution Channels the market is categorized into Wholesalers, Retailers, Agricultural Service Centers, Cooperatives, Others By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Organic seeds refer to those seeds that come from plants cultivate wisely without the use of synthetic fertilizers and pesticides. The application of sewage sludge, irradiation, and genetic engineering is also interdict in organic seed harvesting.

The Organic Seeds market estimated at USD 5.49 Billion in the year 2022, is projected to reach a revised size of USD 11.86 Billion by 2030, growing at a CAGR of 10.1% over the analysis period 2023-2030.