Online Event Ticketing Market Synopsis

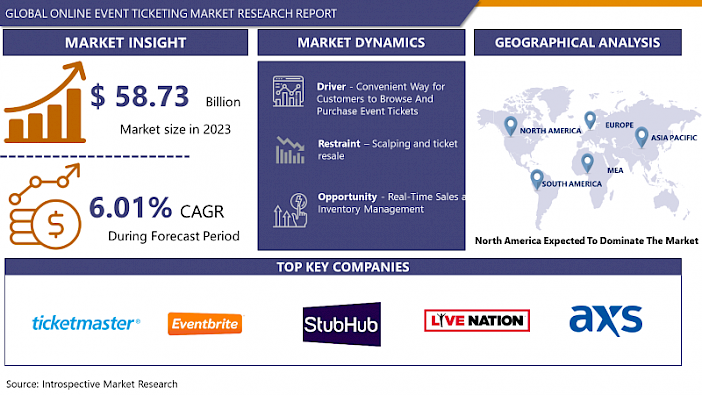

Online Event Ticketing Market Size Was Valued at USD 58.73 Billion in 2023, and is Projected to Reach USD 99.31 Billion by 2032, Growing at a CAGR of 6.01% From 2024-2032.

Online event ticketing refers to the process of purchasing tickets for various events, such as concerts, sports games, theater performances, and conferences, through internet-based platforms. These platforms enable users to browse upcoming events, select seats or ticket types, make payments securely online, and receive digital tickets via email or mobile apps. Online event ticketing has revolutionized the way people buy tickets, offering convenience, accessibility, and often discounts compared to traditional box office sales. It also allows event organizers to efficiently manage ticket sales, seating arrangements, and attendee data.

- Online event ticketing platforms have become a crucial part of the event industry, offering convenience for both organizers and attendees. They facilitate ticket sales for various events, allowing attendees to purchase tickets from their homes. Organizers can easily set up events, manage ticket inventory, and track sales, while attendees can browse events, select seats, and make purchases at any time. Online ticketing platforms also integrate marketing and promotional tools, allowing organizers to reach a wider audience and share event details with friends and networks.

- Ticket customization allows organizers to enhance the event experience by branding, seating charts, and additional information. Access control tools, such as scanning digital tickets or QR codes, enhance security and reduce fraud risk. Data analytics help organizers understand attendee demographics, purchasing behavior, and preferences, which inform future planning and pricing decisions. Online ticketing platforms also enable revenue generation through upselling opportunities and enhancing attendee engagement through reminders, updates, and post-event surveys.

- Online ticketing offers customers the convenience of purchasing tickets from their homes or on the go, without the need to visit physical outlets. It provides accessibility, variety, transparency, speed, and security. Platforms offer a wide range of events and tickets, catering to diverse interests. They also offer transparency about availability, pricing, and seating options, allowing customers to make informed decisions. Reputable platforms also offer secure payment options, protecting customer information and reducing fraud risks.

Online Event Ticketing Market Trend Analysis

Convenient Way for Customers To Browse And Purchase Event Tickets

- Online event ticketing platforms offer customers the convenience of browsing through a wide array of events from their homes, offices, or on the go, eliminating geographical barriers and time constraints. These platforms prioritize user experience by offering intuitive interfaces, advanced search functionalities, personalized recommendations, and interactive seating maps. They operate round the clock, allowing customers to purchase tickets at their convenience, regardless of opening hours or holiday schedules.

- One of the key conveniences of online ticketing is instant confirmation of purchases, which can be received via email or mobile app, eliminating the need for physical tickets or waiting in line. Many platforms also offer electronic tickets (e-tickets), which can be easily accessible and presented using smartphones. Online ticketing platforms offer a wide range of payment options, including credit/debit cards, digital wallets, and alternative payment methods.

- Real-time updates and notifications regarding event changes, ticket availability, or special offers further enhance the convenience of online ticketing platforms. Customers can choose from various delivery options, such as standard mail, e-ticket delivery, or mobile ticketing. These notifications help customers stay informed and engaged throughout the ticketing process, ensuring a seamless experience from browsing to attending the event.

Restraint

Scalping and Ticket Resale

- Scalpers use automated bots or buy tickets in bulk from primary sellers during the initial release. They mark up prices, often several times the face value, to capitalize on high demand for popular events. Tickets are then listed on resale platforms like eBay or Craigslist. Consumers who missed out on the initial sale may turn to secondary markets, willing to pay higher prices to secure their attendance. The price of tickets on the resale market fluctuates based on factors like demand, proximity to the event date, and availability of primary sellers. Some jurisdictions have implemented regulations to combat scalping and ticket resale, including price caps, bot restrictions, and ticket disclosure requirements.

- Anti-scalping laws prohibit or limit the resale of tickets above face value, such as restrictions on resale price, license requirements, or outright bans on ticket scalping. Ticket purchase limits prevent bulk purchases by scalpers, distributing tickets more fairly among genuine fans. Digital or mobile ticketing platforms use technology to verify ticket holders' identities and prevent unauthorized resale. Dynamic pricing strategies adjust ticket prices based on demand and other factors to discourage scalpers from buying tickets in bulk.

Opportunity

Real-Time Sales and Inventory Management

- Online event ticketing offers numerous benefits, including convenience for attendees, real-time sales tracking, accurate inventory management, data insights, promotional tools, enhanced security, and seamless integration with event management software, marketing tools, and CRM systems. Attendees can purchase tickets anytime, anywhere, reducing the need to visit physical box offices.

- Real-time sales tracking allows organizers to monitor sales, enabling dynamic pricing strategies and timely marketing efforts. Inventory management ensures accurate tracking of available tickets, preventing overselling and minimizing fraud risk. Online ticketing platforms provide valuable data insights into attendee demographics, purchasing behavior, and preferences, which can inform future planning, marketing strategies, and pricing decisions.

- Built-in promotional tools like discount codes and social media integration help attract more attendees and boost ticket sales. Secure payment processing and fraud detection mechanisms protect both organizers and attendees from unauthorized transactions and counterfeit tickets. Overall, online event ticketing streamlines the event planning and management process, saving time and resources for organizers.

Challenge

Ticketing Platforms Must Handle Fluctuations in Demand

- Online event ticketing platforms face a significant challenge in managing demand fluctuations. They must quickly scale their infrastructure to accommodate increased traffic and transactions during peak periods, ensuring servers, databases, and other systems can handle high volumes of concurrent users without experiencing slowdowns or crashes.

- Performance optimization is crucial for managing demand fluctuations, involving efficient caching mechanisms, database queries, and content delivery networks. Load balancing ensures efficient resource allocation to handle fluctuations and maintain system stability. Predictive analytics can help forecast demand for upcoming events more accurately, identifying trends and factors influencing ticket sales.

- Dynamic pricing strategies allow ticketing platforms to adjust prices in real-time based on demand levels, inventory availability, and other factors. Offering flexible ticketing options, such as pre-sales, timed releases, and tiered pricing, can distribute demand more evenly and reduce congestion during peak periods.

Online Event Ticketing Market Segment Analysis:

Online Event Ticketing Market Segmented on the basis of platform, event type, and payment method.

By Type, Concerts segment is expected to dominate the market during the forecast period

- The Concerts category in the Online Event Ticketing segment is expected to dominate the market due to its popularity, convenience, and wide reach. Concerts attract a large global audience and feature a diverse range of artists and genres, catering to various tastes and preferences.

- Online ticketing platforms offer unparalleled accessibility, allowing users to browse upcoming concerts, compare ticket prices, select preferred seats, and complete their purchases from the comfort of their homes or on the go. This convenience factor encourages more people to buy tickets online, boosting the market for online event ticketing platforms.

- The vast reach of online ticketing platforms allows users to discover new artists, explore different music genres, and attend concerts they may not have been aware of otherwise. Furthermore, many online event ticketing platforms integrate with social media, enhancing the visibility of concerts and ticketing options, driving ticket sales, and solidifying the concert segment's dominance in the online event ticketing market.

By Platform, Mobile segment held the largest share of 53.8% in 2023

- The mobile segment of online event ticketing platforms holds the largest share percentage due to accessibility, convenience, enhanced user experience, and integration with social media networks. Mobile devices, such as smartphones and tablets, are widely available to a large portion of the population, allowing users to conveniently purchase tickets anytime and anywhere.

- Mobile ticketing platforms offer unparalleled convenience, allowing users to browse events, select seats, and complete transactions within a few taps. They also offer intuitive interfaces, personalized recommendations, and seamless integration with mobile payment methods, making the ticket-purchasing process more enjoyable and efficient.

- Many mobile ticketing platforms integrate with social media networks, enhancing user engagement and extending the reach of events. Mobile devices cater to the on-the-go lifestyle of modern consumers, offering flexibility and accessibility wherever they are. Online event ticketing platforms that prioritize mobile access effectively target younger demographics, who heavily rely on mobile devices for their daily activities.

Online Event Ticketing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's high internet penetration and early adoption of technology, such as smartphones and tablets, make it an ideal location for online ticketing. The North American region is home to a rich tapestry of events spanning various categories, which includes concerts, sports games, theater performances, and festivals. Each of these categories caters to diverse interests and preferences, contributing to the vibrant cultural landscape of the region.

- The region's strong economy allows consumers to spend on entertainment activities, contributing to a robust market for online event ticketing. Major players like Ticketmaster, Eventbrite, and StubHub have established a strong presence in the region. Cities like New York, Los Angeles, and Toronto are renowned for their vibrant cultural and entertainment hubs, driving significant demand for event tickets and online ticketing services.

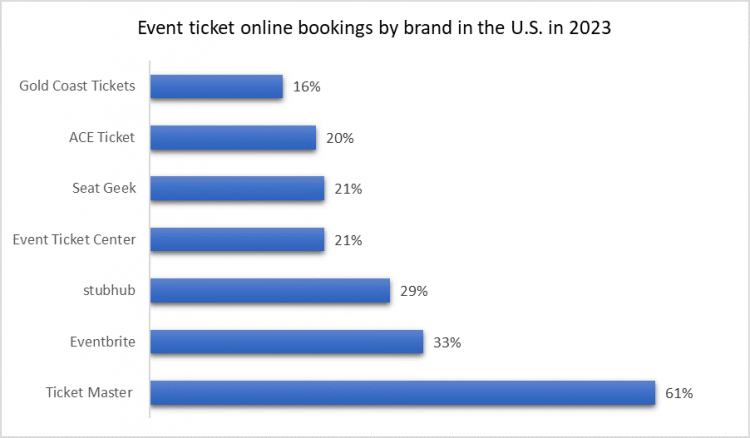

- In 2023, online ticket booking in the U.S. showcased Ticketmaster leading the market with 61% of event ticket sales. Following closely behind was Eventbrite with 33%, while StubHub secured 29%. Other notable players included Event Ticket Center and SeatGeek, each capturing 21%, followed by ACE Ticket at 20% and Gold Coast Tickets at 16%. The dominance of North America in online ticket booking systems was evident, with these brands collectively driving the majority of event ticket sales, indicating a strong preference for online platforms among consumers in the region.

Online Event Ticketing Market Top Key Players:

- Ticketmaster (US)

- Eventbrite (US)

- StubHub (US)

- Live Nation Entertainment (US)

- AXS (US)

- TicketNetwork (US)

- Tixr (US)

- TicketWeb (US)

- Ticketmaster Resale (US)

- Ticketfly (US)

- SeatGeek (US)

- Universe (Canada)

- Ticketpro (Czech Republic)

- CTS Eventim (Germany)

- MyTicket (Germany)

- See Tickets (UK)

- Ticket Tailor (UK)

- Paylogic (Netherlands)

- TicketOne (Italy)

- Ticketcorner (Switzerland)

- Ticketek (Australia)

- Ticketek New Zealand (New Zealand), and other major players

Key Industry Developments in the Online Event Ticketing Market:

- In January 2024, Eventbrite announced the introduction of two new features, Instant Payouts and Tap to Pay, aimed at providing event organizers with enhanced financial flexibility and operational efficiency. These features are currently rolling out to eligible organizers in the US and are expected to be fully available nationwide in the next few weeks, with global availability slated by the end of the year.

- In May 2023, The Athletic and StubHub announced the launch of a multi-year, exclusive ticketing deal, which aims to give a larger audience of passionate sports fans further access to live sporting events. The collaboration with StubHub marks an exciting milestone for The Athletic, and continues to fulfill promise to subscribers to bring them increased value in their overall reader experience.

|

Global Online Event Ticketing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

58.73 Bn |

|

Forecast Period 2024-32 CAGR: |

6.01 % |

Market Size in 2032: |

99.31 Bn |

|

Segments Covered: |

By Event Type |

|

|

|

By Platform |

|

||

|

By Payment Method |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ONLINE EVENT TICKETING MARKET BY EVENT TYPE (2017-2032)

- ONLINE EVENT TICKETING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONCERTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPORTS EVENTS

- THEATER AND PERFORMING ARTS

- CONFERENCES AND EXPOS

- FESTIVALS AND FAIRS

- ONLINE EVENT TICKETING MARKET BY PLATFORM (2017-2032)

- ONLINE EVENT TICKETING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DESKTOP

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOBILE

- ONLINE EVENT TICKETING MARKET BY PAYMENT METHOD (2017-2032)

- ONLINE EVENT TICKETING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CREDIT/DEBIT CARDS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOBILE WALLETS

- BANK TRANSFERS

- CASH ON DELIVERY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Online Event Ticketing Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- TICKETMASTER (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- EVENTBRITE (US)

- STUBHUB (US)

- LIVE NATION ENTERTAINMENT (US)

- AXS (US)

- TICKETNETWORK (US)

- TIXR (US)

- TICKETWEB (US)

- TICKETMASTER RESALE (US)

- TICKETFLY (US)

- SEATGEEK (US)

- UNIVERSE (CANADA)

- TICKETPRO (CZECH REPUBLIC)

- CTS EVENTIM (GERMANY)

- MYTICKET (GERMANY)

- SEE TICKETS (UK)

- TICKET TAILOR (UK)

- PAYLOGIC (NETHERLANDS)

- TICKETONE (ITALY)

- TICKETCORNER (SWITZERLAND)

- TICKETEK (AUSTRALIA)

- TICKETEK NEW ZEALAND (NEW ZEALAND),

- COMPETITIVE LANDSCAPE

- GLOBAL ONLINE EVENT TICKETING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Event Type

- Historic And Forecasted Market Size By Platform

- Historic And Forecasted Market Size By Payment Method

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Online Event Ticketing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

58.73 Bn |

|

Forecast Period 2024-32 CAGR: |

6.01 % |

Market Size in 2032: |

99.31 Bn |

|

Segments Covered: |

By Event Type |

|

|

|

By Platform |

|

||

|

By Payment Method |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ONLINE EVENT TICKETING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ONLINE EVENT TICKETING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ONLINE EVENT TICKETING MARKET COMPETITIVE RIVALRY

TABLE 005. ONLINE EVENT TICKETING MARKET THREAT OF NEW ENTRANTS

TABLE 006. ONLINE EVENT TICKETING MARKET THREAT OF SUBSTITUTES

TABLE 007. ONLINE EVENT TICKETING MARKET BY EVENT TYPE

TABLE 008. MOVIE MARKET OVERVIEW (2016-2028)

TABLE 009. SPORT MARKET OVERVIEW (2016-2028)

TABLE 010. LIVE SHOW MARKET OVERVIEW (2016-2028)

TABLE 011. STAND-UP COMEDY MARKET OVERVIEW (2016-2028)

TABLE 012. LIVE CONCERTS MARKET OVERVIEW (2016-2028)

TABLE 013. DRAMA MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER SHOWS MARKET OVERVIEW (2016-2028)

TABLE 015. ONLINE EVENT TICKETING MARKET BY PLATFORM

TABLE 016. DESKTOP MARKET OVERVIEW (2016-2028)

TABLE 017. MOBILE MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA ONLINE EVENT TICKETING MARKET, BY EVENT TYPE (2016-2028)

TABLE 019. NORTH AMERICA ONLINE EVENT TICKETING MARKET, BY PLATFORM (2016-2028)

TABLE 020. N ONLINE EVENT TICKETING MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE ONLINE EVENT TICKETING MARKET, BY EVENT TYPE (2016-2028)

TABLE 022. EUROPE ONLINE EVENT TICKETING MARKET, BY PLATFORM (2016-2028)

TABLE 023. ONLINE EVENT TICKETING MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC ONLINE EVENT TICKETING MARKET, BY EVENT TYPE (2016-2028)

TABLE 025. ASIA PACIFIC ONLINE EVENT TICKETING MARKET, BY PLATFORM (2016-2028)

TABLE 026. ONLINE EVENT TICKETING MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA ONLINE EVENT TICKETING MARKET, BY EVENT TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA ONLINE EVENT TICKETING MARKET, BY PLATFORM (2016-2028)

TABLE 029. ONLINE EVENT TICKETING MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA ONLINE EVENT TICKETING MARKET, BY EVENT TYPE (2016-2028)

TABLE 031. SOUTH AMERICA ONLINE EVENT TICKETING MARKET, BY PLATFORM (2016-2028)

TABLE 032. ONLINE EVENT TICKETING MARKET, BY COUNTRY (2016-2028)

TABLE 033. BROWN PAPER TICKETS: SNAPSHOT

TABLE 034. BROWN PAPER TICKETS: BUSINESS PERFORMANCE

TABLE 035. BROWN PAPER TICKETS: PRODUCT PORTFOLIO

TABLE 036. BROWN PAPER TICKETS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. CVENT INC: SNAPSHOT

TABLE 037. CVENT INC: BUSINESS PERFORMANCE

TABLE 038. CVENT INC: PRODUCT PORTFOLIO

TABLE 039. CVENT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. EVENTBEE INC.: SNAPSHOT

TABLE 040. EVENTBEE INC.: BUSINESS PERFORMANCE

TABLE 041. EVENTBEE INC.: PRODUCT PORTFOLIO

TABLE 042. EVENTBEE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. EVENTBRITE INC.: SNAPSHOT

TABLE 043. EVENTBRITE INC.: BUSINESS PERFORMANCE

TABLE 044. EVENTBRITE INC.: PRODUCT PORTFOLIO

TABLE 045. EVENTBRITE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. EVENTZILLA: SNAPSHOT

TABLE 046. EVENTZILLA: BUSINESS PERFORMANCE

TABLE 047. EVENTZILLA: PRODUCT PORTFOLIO

TABLE 048. EVENTZILLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. MOSHTIX PTY LTD: SNAPSHOT

TABLE 049. MOSHTIX PTY LTD: BUSINESS PERFORMANCE

TABLE 050. MOSHTIX PTY LTD: PRODUCT PORTFOLIO

TABLE 051. MOSHTIX PTY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. RAZORGATOR LLC: SNAPSHOT

TABLE 052. RAZORGATOR LLC: BUSINESS PERFORMANCE

TABLE 053. RAZORGATOR LLC: PRODUCT PORTFOLIO

TABLE 054. RAZORGATOR LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. STUBHUB INC.: SNAPSHOT

TABLE 055. STUBHUB INC.: BUSINESS PERFORMANCE

TABLE 056. STUBHUB INC.: PRODUCT PORTFOLIO

TABLE 057. STUBHUB INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. THUNDEX TIX: SNAPSHOT

TABLE 058. THUNDEX TIX: BUSINESS PERFORMANCE

TABLE 059. THUNDEX TIX: PRODUCT PORTFOLIO

TABLE 060. THUNDEX TIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. TICKETEK PTY LTD: SNAPSHOT

TABLE 061. TICKETEK PTY LTD: BUSINESS PERFORMANCE

TABLE 062. TICKETEK PTY LTD: PRODUCT PORTFOLIO

TABLE 063. TICKETEK PTY LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ONLINE EVENT TICKETING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ONLINE EVENT TICKETING MARKET OVERVIEW BY EVENT TYPE

FIGURE 012. MOVIE MARKET OVERVIEW (2016-2028)

FIGURE 013. SPORT MARKET OVERVIEW (2016-2028)

FIGURE 014. LIVE SHOW MARKET OVERVIEW (2016-2028)

FIGURE 015. STAND-UP COMEDY MARKET OVERVIEW (2016-2028)

FIGURE 016. LIVE CONCERTS MARKET OVERVIEW (2016-2028)

FIGURE 017. DRAMA MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER SHOWS MARKET OVERVIEW (2016-2028)

FIGURE 019. ONLINE EVENT TICKETING MARKET OVERVIEW BY PLATFORM

FIGURE 020. DESKTOP MARKET OVERVIEW (2016-2028)

FIGURE 021. MOBILE MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA ONLINE EVENT TICKETING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE ONLINE EVENT TICKETING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC ONLINE EVENT TICKETING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA ONLINE EVENT TICKETING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA ONLINE EVENT TICKETING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Online Event Ticketing Market research report is 2024-2032.

Ticketmaster (US), Eventbrite (US), StubHub (US), Live Nation Entertainment (US), AXS (US), TicketNetwork (US), Tixr (US), TicketWeb (US), Ticketmaster Resale (US), Ticketfly (US), SeatGeek (US), Universe (Canada), Ticketpro (Czech Republic), CTS Eventim (Germany), MyTicket (Germany), See Tickets (UK), Ticket Tailor (UK), Paylogic (Netherlands), TicketOne (Italy), Ticket corner (Switzerland), Ticketek (Australia), Ticketek New Zealand (New Zealand), and Other Major Players.

The Online Event Ticketing Market is segmented into Event Type, Platform, Payment Method, and Region. By Event Type, the market is categorized into Concerts, Sports Events, Theater and Performing Arts, Conferences and Expos, Festivals and Fairs, and Others. By Platform, the market is categorized into Desktop and mobile. By Payment Method, the market is categorized into Credit/Debit Cards, Mobile Wallets, Bank Transfers, and Cash on Delivery. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Online Event Ticketing Market refers to the industry involved in facilitating the purchase and sale of tickets for various events, such as concerts, sports games, theater performances, and festivals, through online platforms. These platforms provide users with convenient access to event information, ticket purchasing, seat selection, and sometimes even exclusive deals or discounts. The market is driven by factors like increasing internet penetration, growing demand for live entertainment, and the convenience offered by online ticketing platforms.

Online Event Ticketing Market Size Was Valued at USD 58.73 Billion in 2023, and is Projected to Reach USD 99.31 Billion by 2032, Growing at a CAGR of 6.01% From 2024-2032.