Numerical Analysis Software Market Synopsis

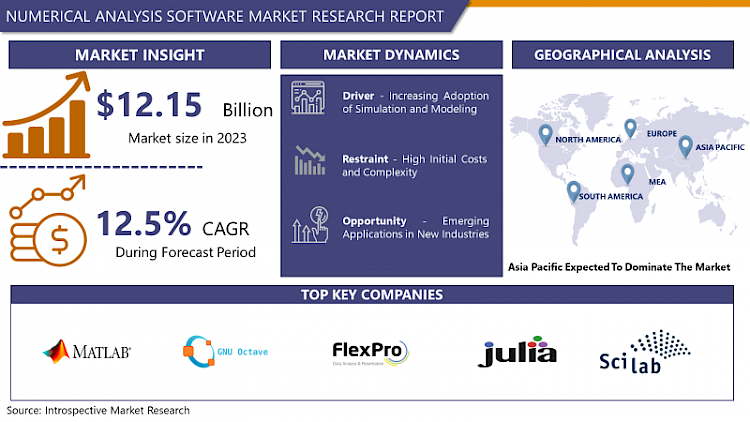

Numerical Analysis Software Market Size Was Valued at USD 12.15 Billion in 2023 and is Projected to Reach USD 35.07 Million by 2032, Growing at a CAGR of 12.5% From 2024-2032.

The Numerical Analysis Software Market refers to the sector encompassing software solutions designed to perform numerical computations and analyses across various fields such as engineering, science, finance, and research. These software tools facilitate complex mathematical modeling, simulations, and data analysis, utilizing algorithms and numerical methods to solve equations, optimize processes, and visualize results. Numerical analysis software often includes functionalities like linear algebra, differential equations solving, statistical analysis, and data visualization, catering to diverse industries and research domains. The market is characterized by a range of offerings from commercial vendors, open-source communities, and specialized niche providers, serving the evolving needs of professionals, researchers, and organizations seeking accurate and efficient numerical solutions for their computational challenges.

- The Numerical Analysis Software Market continues to witness robust growth driven by advancements in technology and the increasing demand for efficient computational tools across various industries. With the proliferation of data and the complexity of mathematical models, there's a growing need for sophisticated numerical analysis software to handle large datasets and perform complex calculations with precision and speed.

- Key players in the market are focusing on innovation and product development to stay competitive and cater to evolving customer requirements. Additionally, the adoption of cloud-based solutions and the integration of artificial intelligence and machine learning algorithms are reshaping the landscape, offering enhanced functionalities and scalability.

- Moreover, the rising emphasis on data-driven decision-making across sectors such as finance, engineering, healthcare, and research further propels the demand for advanced numerical analysis software.

- Geographically, North America and Europe dominate the market due to the presence of major players and the early adoption of technology, while Asia Pacific presents significant growth opportunities driven by rapid industrialization and increasing investments in research and development. However, challenges such as data security concerns and the complexity of implementing these solutions hinder market growth to some extent.

- Overall, the Numerical Analysis Software Market is poised for steady expansion as organizations seek to leverage advanced computational tools to gain insights, optimize processes, and drive innovation.

Numerical Analysis Software Market Trend Analysis

Transforming Computational Capabilities

- The surge in demand for cloud-based numerical analysis solutions reflects a fundamental shift in how organizations approach computational tasks. With the exponential growth of data and the escalating complexity of simulations and analyses, traditional on-premises infrastructure often falls short in meeting the evolving computational demands. Cloud-based solutions offer a compelling alternative by providing access to virtually unlimited computational resources on a pay-as-you-go basis. This scalability not only alleviates the burden of managing and maintaining costly hardware but also enables organizations to dynamically scale their computational capacity in response to fluctuating workloads. Additionally, cloud-based platforms facilitate seamless collaboration among geographically dispersed teams, allowing researchers and engineers to share data, models, and results in real-time, thereby fostering innovation and accelerating time-to-insight.

- Furthermore, the adoption of cloud-based numerical analysis solutions is driven by the imperative for agility and flexibility in today's fast-paced business environment. With cloud computing, organizations can rapidly deploy and configure computational resources without the constraints of physical infrastructure, enabling them to adapt quickly to changing market dynamics and emerging opportunities. Moreover, cloud-based platforms offer advanced capabilities such as auto-scaling, which automatically adjusts resource allocation based on workload demand, ensuring optimal performance and cost-efficiency. By leveraging cloud-based numerical analysis solutions, companies and research institutions can focus their resources on innovation and problem-solving rather than infrastructure management, thereby gaining a competitive edge in their respective fields while also embracing the scalability and flexibility demanded by modern computational challenges.

Enhancing Numerical Analysis Software Capabilities

- The integration of artificial intelligence (AI) and machine learning (ML) capabilities into numerical analysis software represents a significant advancement that is revolutionizing how data is analyzed and insights are derived. By leveraging AI and ML algorithms, numerical analysis software can unlock deeper insights from complex datasets, enabling more accurate predictive modeling and simulation. These algorithms have the capability to identify patterns, trends, and relationships within numerical data that may not be readily apparent to human analysts. As a result, users can make more informed decisions based on the insights generated by these advanced analytics techniques, leading to enhanced efficiency and effectiveness across a wide range of applications, from engineering design and optimization to financial forecasting and risk management.

- Moreover, the integration of AI and ML into numerical analysis software is driving innovation by automating repetitive tasks and streamlining workflows. Tasks that were once labor-intensive and time-consuming, such as data preprocessing, model parameter tuning, and result interpretation, can now be automated using AI-powered algorithms, freeing up valuable time for researchers and engineers to focus on higher-level analysis and problem-solving. Additionally, AI-driven optimization algorithms can help users identify the most promising design configurations or parameter settings, leading to more efficient and effective solutions. By harnessing the power of AI and ML, numerical analysis software is empowering users to extract actionable insights from their data more efficiently, driving innovation and enabling organizations to stay ahead in today's rapidly evolving competitive landscape.

Numerical Analysis Software Market Segment Analysis:

Numerical Analysis Software Market Segmented based on Type and By Applications

By Type, desktop-based software segment is expected to dominate the market during the forecast period

- In the domain of desktop-based software, applications tailored for engineering and scientific research stand out as the dominant share, significantly influencing how professionals in these fields operate. These software packages are meticulously crafted to address the complex and nuanced demands inherent in engineering and scientific endeavors. For engineering professionals, these applications serve as indispensable tools, providing a comprehensive suite of features for tasks ranging from conceptual design to intricate simulations. Whether it's civil engineers designing infrastructure, mechanical engineers optimizing machine components, or electrical engineers developing circuitry, desktop-based software offers specialized functionalities to streamline workflows and ensure precision in every stage of the project lifecycle. Similarly, in scientific research, desktop-based software plays a pivotal role in enabling researchers to analyze vast datasets, visualize complex phenomena, and simulate intricate systems. From molecular modeling in chemistry to computational fluid dynamics in physics, these applications empower scientists to explore hypotheses, validate theories, and push the boundaries of knowledge. The dominance of desktop-based software in these domains is underscored by its ability to deliver offline accessibility, robust features, and unmatched performance, catering to the specialized needs of engineering and scientific professionals with unparalleled efficiency and reliability.

- Moreover, the dominance of desktop-based software in engineering and scientific research is further cemented by its capacity to provide tailored solutions that align closely with the unique requirements of these industries. Unlike web-based alternatives, desktop-based applications offer a level of customization and control that is essential for addressing the diverse and intricate challenges faced by engineering and scientific professionals. Whether it's the need for high-fidelity simulations, seamless integration with specialized hardware, or stringent data privacy and security protocols, desktop-based software excels in meeting these demands with precision and reliability. Furthermore, the extensive feature sets offered by desktop-based applications surpass those of their web-based counterparts, providing users with a comprehensive toolkit to tackle multifaceted tasks effectively. This superiority in functionality and performance solidifies the position of desktop-based software as the dominant choice for engineering and scientific endeavors, serving as indispensable tools that empower professionals to innovate, analyze, and solve complex problems with unparalleled efficiency and accuracy.

By Applications, Financial Analysis segment held the largest share in 2023

- Financial analysis occupies a preeminent position in the contemporary economic landscape, wielding significant influence across diverse sectors. Its pivotal role stems from its capacity to provide invaluable insights into market trends, risks, and opportunities, thereby empowering stakeholders to make informed decisions. In investment banking, financial analysts play a crucial role in evaluating potential mergers and acquisitions, assessing market conditions, and structuring complex financial transactions. Their adeptness in analyzing financial data and leveraging advanced quantitative techniques enables them to mitigate risks and optimize returns for their clients. Similarly, in corporate finance, financial analysis guides strategic decision-making processes, ranging from capital budgeting to resource allocation. By employing sophisticated models and analytical tools, financial analysts facilitate the identification of growth opportunities, cost-saving measures, and optimal capital structures, thereby enhancing the overall efficiency and profitability of businesses. Moreover, in the realm of risk management, financial analysis serves as a linchpin for identifying, assessing, and mitigating various forms of financial risks, including market risk, credit risk, and operational risk. Through the application of statistical methods, scenario analysis, and stress testing, financial analysts help organizations safeguard their financial health and resilience in the face of uncertain market conditions.

- Furthermore, the advent of technology has revolutionized the landscape of financial analysis, ushering in an era of unprecedented innovation and efficiency. The integration of artificial intelligence, machine learning, and big data analytics has enabled financial analysts to extract actionable insights from vast troves of financial data with unprecedented speed and accuracy. Algorithmic trading algorithms, for instance, leverage complex mathematical models and real-time market data to execute trades autonomously, capitalizing on fleeting arbitrage opportunities and market inefficiencies. Similarly, in the realm of investment management, robo-advisors harness the power of data analytics and machine learning algorithms to offer personalized investment recommendations tailored to individual risk profiles and financial goals. Moreover, the proliferation of fintech startups and digital platforms has democratized access to financial analysis tools and services, empowering individuals and organizations alike to make more informed financial decisions. As such, the application of financial analysis continues to expand its footprint, driven by ongoing technological advancements and the growing demand for data-driven insights in an increasingly complex and interconnected global economy.

Numerical Analysis Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Within the Asia Pacific region, countries like China, Japan, and India are not only witnessing exponential growth in key sectors such as automotive, electronics, and construction but are also emerging as leaders in technological innovation and adoption. China, for instance, stands out as a global manufacturing powerhouse, with a rapidly evolving landscape that embraces advanced technologies like numerical analysis software to optimize production processes, improve product quality, and enhance competitiveness in the global market. The country's ambitious initiatives such as "Made in China 2025" underscore its commitment to technological advancement and industrial upgrading, driving significant demand for sophisticated engineering simulation and modeling solutions. Similarly, Japan's reputation for precision engineering and high-tech manufacturing makes it a natural market for numerical analysis software, particularly in industries like automotive, electronics, and robotics. With a strong emphasis on innovation and digital transformation, Japanese companies are increasingly turning to advanced computational tools to stay ahead of the curve and maintain their competitive edge in global markets. Likewise, India's rapidly expanding economy and burgeoning startup ecosystem offer fertile ground for the adoption of numerical analysis software across diverse industries. As the country strives to position itself as a global hub for technology and innovation, there is a growing recognition of the importance of leveraging advanced computational techniques to drive efficiency, productivity, and innovation across sectors ranging from automotive and aerospace to healthcare and infrastructure.

- Moreover, the presence of a large manufacturing base in the Asia Pacific region, coupled with government initiatives aimed at promoting innovation and technology adoption, further reinforces the dominance of numerical analysis software in the market. Governments across the region are increasingly recognizing the strategic importance of digitalization and technology-driven growth, investing heavily in research and development, infrastructure modernization, and skill development initiatives to foster a conducive environment for technological innovation. For instance, initiatives like China's "Internet Plus" and India's "Digital India" program are aimed at leveraging digital technologies to drive economic growth, create jobs, and enhance competitiveness. Additionally, the burgeoning startup ecosystem in countries like Singapore, South Korea, and Taiwan is fueling innovation and entrepreneurship in fields such as artificial intelligence, data analytics, and cloud computing, creating new opportunities for the adoption of numerical analysis software across a wide range of industries. As a result, the Asia Pacific region is poised to maintain its dominant share in the global market for numerical analysis software, driven by rapid industrialization, technological innovation, and proactive government policies aimed at fostering a conducive environment for digital transformation and economic growth.

Active Key Players in the Numerical Analysis Software Market

- Analytica

- Matlab

- GNU Octave

- Plotly

- FlexPro

- Julia

- Scilab

- LAPACK

- ScaLAPACK

- NAG Library

- FreeMat

- Calerga

- LabVIEW

- Other Key Players

|

Global Numerical Analysis Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 35.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NUMERICAL ANALYSIS SOFTWARE MARKET BY TYPE (2017-2032)

- NUMERICAL ANALYSIS SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DESKTOP-BASED SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DESKTOP-BASED SOFTWARE

- CLOUD-BASED SOFTWARE

- WEB-BASED SOFTWARE

- NUMERICAL ANALYSIS SOFTWARE MARKET BY APPLICATIONS (2017-2032)

- NUMERICAL ANALYSIS SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ENGINEERING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FINANCIAL ANALYSIS

- SCIENTIFIC RESEARCH

- ACADEMIC INSTITUTIONS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Numerical Analysis Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ANALYTICA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MATLAB

- GNU OCTAVE

- PLOTLY

- FLEXPRO

- JULIA

- SCILAB

- LAPACK

- SCALAPACK

- NAG LIBRARY

- FREEMAT

- CALERGA

- LABVIEW

- COMPETITIVE LANDSCAPE

- GLOBAL NUMERICAL ANALYSIS SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Applications

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Numerical Analysis Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.15 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.5% |

Market Size in 2032: |

USD 35.07 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NUMERICAL ANALYSIS SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NUMERICAL ANALYSIS SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NUMERICAL ANALYSIS SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. NUMERICAL ANALYSIS SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. NUMERICAL ANALYSIS SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. NUMERICAL ANALYSIS SOFTWARE MARKET BY TYPE

TABLE 008. CLOUD MARKET OVERVIEW (2016-2028)

TABLE 009. MARKET OVERVIEW (2016-2028)

TABLE 010. ON PREMISE MARKET OVERVIEW (2016-2028)

TABLE 011. NUMERICAL ANALYSIS SOFTWARE MARKET BY APPLICATION

TABLE 012. SCIENTIFIC RESEARCH MARKET OVERVIEW (2016-2028)

TABLE 013. MARKET OVERVIEW (2016-2028)

TABLE 014. FINANCIAL MARKET OVERVIEW (2016-2028)

TABLE 015. MARKET OVERVIEW (2016-2028)

TABLE 016. OTHER MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 019. N NUMERICAL ANALYSIS SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE NUMERICAL ANALYSIS SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE NUMERICAL ANALYSIS SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 022. NUMERICAL ANALYSIS SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC NUMERICAL ANALYSIS SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC NUMERICAL ANALYSIS SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 025. NUMERICAL ANALYSIS SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 028. NUMERICAL ANALYSIS SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 031. NUMERICAL ANALYSIS SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ANALYTICA: SNAPSHOT

TABLE 033. ANALYTICA: BUSINESS PERFORMANCE

TABLE 034. ANALYTICA: PRODUCT PORTFOLIO

TABLE 035. ANALYTICA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. MATLAB: SNAPSHOT

TABLE 036. MATLAB: BUSINESS PERFORMANCE

TABLE 037. MATLAB: PRODUCT PORTFOLIO

TABLE 038. MATLAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. GNU OCTAVE: SNAPSHOT

TABLE 039. GNU OCTAVE: BUSINESS PERFORMANCE

TABLE 040. GNU OCTAVE: PRODUCT PORTFOLIO

TABLE 041. GNU OCTAVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. PLOTLY: SNAPSHOT

TABLE 042. PLOTLY: BUSINESS PERFORMANCE

TABLE 043. PLOTLY: PRODUCT PORTFOLIO

TABLE 044. PLOTLY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. FLEXPRO: SNAPSHOT

TABLE 045. FLEXPRO: BUSINESS PERFORMANCE

TABLE 046. FLEXPRO: PRODUCT PORTFOLIO

TABLE 047. FLEXPRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. JULIA: SNAPSHOT

TABLE 048. JULIA: BUSINESS PERFORMANCE

TABLE 049. JULIA: PRODUCT PORTFOLIO

TABLE 050. JULIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. SCILAB: SNAPSHOT

TABLE 051. SCILAB: BUSINESS PERFORMANCE

TABLE 052. SCILAB: PRODUCT PORTFOLIO

TABLE 053. SCILAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. LAPACK: SNAPSHOT

TABLE 054. LAPACK: BUSINESS PERFORMANCE

TABLE 055. LAPACK: PRODUCT PORTFOLIO

TABLE 056. LAPACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SCALAPACK: SNAPSHOT

TABLE 057. SCALAPACK: BUSINESS PERFORMANCE

TABLE 058. SCALAPACK: PRODUCT PORTFOLIO

TABLE 059. SCALAPACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. NAG LIBRARY: SNAPSHOT

TABLE 060. NAG LIBRARY: BUSINESS PERFORMANCE

TABLE 061. NAG LIBRARY: PRODUCT PORTFOLIO

TABLE 062. NAG LIBRARY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. FREEMAT: SNAPSHOT

TABLE 063. FREEMAT: BUSINESS PERFORMANCE

TABLE 064. FREEMAT: PRODUCT PORTFOLIO

TABLE 065. FREEMAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. CALERGA: SNAPSHOT

TABLE 066. CALERGA: BUSINESS PERFORMANCE

TABLE 067. CALERGA: PRODUCT PORTFOLIO

TABLE 068. CALERGA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. LABVIEW: SNAPSHOT

TABLE 069. LABVIEW: BUSINESS PERFORMANCE

TABLE 070. LABVIEW: PRODUCT PORTFOLIO

TABLE 071. LABVIEW: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 013. MARKET OVERVIEW (2016-2028)

FIGURE 014. ON PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 015. NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 016. SCIENTIFIC RESEARCH MARKET OVERVIEW (2016-2028)

FIGURE 017. MARKET OVERVIEW (2016-2028)

FIGURE 018. FINANCIAL MARKET OVERVIEW (2016-2028)

FIGURE 019. MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA NUMERICAL ANALYSIS SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Numerical Analysis Software Market research report is 2024-2032.

Analytica, Matlab, GNU Octave, Plotly, FlexPro, Julia, Scilab, LAPACK, ScaLAPACK, NAG Library , FreeMat, Calerga, LabVIEW and Other Major Players.

The Numerical Analysis Software Market is segmented into By Type, By Applications and region.By Type, the market is categorized into Desktop-based Software, Cloud-based Software, Web-based Software.By Applications, the market is categorized into Engineering, Financial Analysis, Scientific Research, Academic Institutions and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Numerical Analysis Software Market refers to the sector encompassing software solutions designed to perform numerical computations and analyses across various fields such as engineering, science, finance, and research. These software tools facilitate complex mathematical modeling, simulations, and data analysis, utilizing algorithms and numerical methods to solve equations, optimize processes, and visualize results. Numerical analysis software often includes functionalities like linear algebra, differential equations solving, statistical analysis, and data visualization, catering to diverse industries and research domains. The market is characterized by a range of offerings from commercial vendors, open-source communities, and specialized niche providers, serving the evolving needs of professionals, researchers, and organizations seeking accurate and efficient numerical solutions for their computational challenges.

Numerical Analysis Software Market Size Was Valued at USD 12.15 Billion in 2023 and is Projected to Reach USD 35.07 Million by 2032, Growing at a CAGR of 12.5% From 2024-2032.