North America Floor Coatings Market Overview

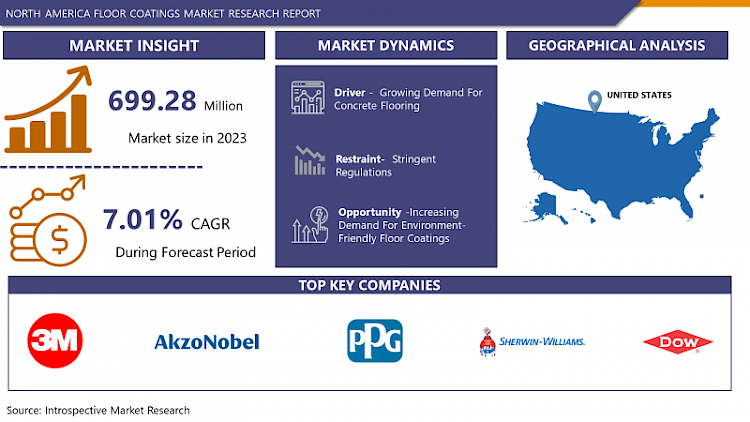

The North America Floor Coatings Market size was valued at USD 699.28 Million in 2023 and is projected to reach USD 1286.68 Million by 2028, growing at a CAGR of 7.01 % from 2024 to 2032.

- Floor coatings are essential for protecting concrete surfaces in demanding environments such as warehouses, chemical plants, and manufacturing facilities. These coatings provide a robust layer of defense against abrasion, stains, chemicals, and the effects of freeze-thaw cycles. They not only extend the lifespan of concrete floors but also enhance their appearance and functionality.

- Various types of floor coatings are available, each offering specific advantages. Acrylic coatings are known for their affordability and ease of application, making them suitable for light to moderate traffic areas. Epoxies are highly durable and resistant to chemicals, making them ideal for industrial settings where heavy machinery and corrosive substances are present. Polyurethanes offer excellent abrasion resistance and UV stability, making them suitable for outdoor and high-traffic indoor areas.

- Polyaspartic polyurea coatings are fast-curing and provide exceptional durability and chemical resistance, making them ideal for environments where downtime must be minimized. Specialized elastomeric coatings offer flexibility and crack-bridging capabilities, making them suitable for environments prone to substrate movement or expansion.

- Overall, selecting the right floor coating depends on the specific requirements of the environment, including traffic levels, exposure to chemicals, and aesthetic preferences, ensuring both protection and longevity for concrete surfaces.

Market Dynamics And Growth Factors For North America Floor Coatings Market

Drivers:

Growing Demand For Concrete Flooring

- Concrete has been used as a flooring material for basements, garages, patios, and utility areas for many years. However, like with other flooring materials, the techniques of installing and decorating concrete floors have evolved over the years, making it a versatile material that adapts to almost any design or budget. Concrete combines durability for heavy use, high-traffic areas with endless customization options. These two factors combine to make it a perfect choice for retail stores, restaurants and bars, offices, churches, schools, medical institutions, and industrial buildings. Moreover, the design options of concrete flooring are remarkably diverse. Nowadays, stained concrete floors often replace natural stone or ceramic tiles mainly in residential buildings. The demand for concrete flooring is increasing rapidly as more commercial, industrial, and residential customers opt for polished concrete. The increase in demand for polished concrete is associated with its benefits such as more resistance to high foot traffic and industrial machinery while displaying a high-quality and aesthetically pleasing, polished finish. Concrete floors are a great alternative to linoleum, carpet, wood, tile, stone, or marble flooring, which is driving its demand and the growth of overall North America floor coatings market.

Restraint:

Stringent Regulations

- Growing concerns about the depleting ozone layer, increasing smog, and reduced outdoor air quality are prompting government bodies to pass more stringent regulations regarding the emissions and VOC content in coatings. The floor coatings market is affected by the potential changes in the regulations, as it creates uncertainty throughout the entire value chain. Raw material producers, formulators, channel partners, and end users are proportionately affected by different regulatory changes in different countries and their operations in different regions. These changes have led to a tremendous shift from low-solid, solvent-based coating to high solid-water borne technologies and have resulted in increased capital costs for upgrading technologies, leading to high-cost coatings. Additionally, the switch to environmentally-friendly floor coatings has also created innovation opportunities for manufacturers. Thus, manufacturers need to comply with the changing regulatory policies in the floor coatings market, which is likely to create uncertainty in the market over the next few years. Thus, stringent government regulations act as a restraint for the players operating in the North America floor coatings market during the forecast period.

Opportunity:

Increasing Demand For Environment-Friendly Floor Coatings

- With the increasing environmental concerns, several governments and end users are increasingly using green and environmental-friendly floor coatings. End users are more inclined toward eco-friendly floor coatings due to the growing focus on health, safety, and environmental regulations within the application areas of floor coatings. Thus, the demand for environmental-friendly products by the end users has prompted manufacturers to reduce the use of volatile organic compounds (VOCs) in floor coatings and opt for solvent-free coating products. Waterborne coatings contain less than 5% of the solvents and are eco-friendly because water is used as a diluent to disperse a resin instead of organic solvents, which are considered as VOCs. Thus, the shifting preferences of end users towards eco-friendly floor coatings are expected to increase the traction of the floor coatings market in North America.

Segmentation Analysis of North America Floor Coatings Market

- By Technology, Water-borne segments is expected to have the maximum market share over the forecast period. Floor coatings that are water-borne solutions require a clean environment and surface. To ensure good results, the applicators need to be more precise, accurate, and clean throughout the process. The solid content in water-borne floor coatings is generally lower than in solvent-borne variants.

- Solvent-based floor coatings include liquefying agents that evaporate via a chemical reaction with oxygen. Moving air surrounding a solvent-based floor coating helps speed up the reaction and resulting in reducing drying times. Also, application of a single layer of solvent-borne coatings directly to a rough surface offers an even surface. Solvent-borne segment is predicted to have the second-highest share of the North America Floor Coatings Market. The others segment includes technologies, such as powder coatings, high solids coating, and radiation curable coatings.

- By Application, the Concrete segment accounted for the largest market share over the forecast period. Concrete is a construction material which is used in civil engineering structures for its strength and durability. For buildings, concrete enhances the aesthetics and make the building look more colourful. Protective coating systems are used to increase the durability of the concrete by preventing water ingress and to seal and accommodate surface cracks. The Wood segment accounted for the second-largest market share in near future. The coating of wooden floorings protects the wood and enhances its natural appeal. Outdoor wooden floors are prone to constant threat of warping, rotting, splintering, and fading due to weather. Terrazzo segment floors are made of marble or granite chips mixed with Portland cement, poured in place, and smoothened. Epoxy binders have become very common in synthetic terrazzo floors due to its lower cost of original installation. The others segment includes application surfaces, such as carpets, vinyl sheets, and basic tiling.

Regional Analysis of North America Floor Coatings Market

- The North America market for floor coatings is projected to witness healthy growth during the forecast period, owing to the growth of the construction industry. The demand for concrete flooring is increasing on account of its durability, economic, easy maintenance, versatility, weatherproof, etc. The industry’s growth is expected to increase over the forecast period by boosting economic growth in the region. The region is witnessing a rapid increase in construction growth across the US and Canada, with the residential sector a key driver of the pick-up, with improved economic conditions. Demand for construction services has been bolstered during most of the period by favourable macroeconomic conditions, including rising disposable income, relatively low interest rates, and increased access to credit.

Top Key Players Covered In North America Floor Coatings Market

- 3M

- AKZO NOBEL N.V.

- PPG INDUSTRIES, INC.

- THE SHERWIN-WILLIAMS COMPANY

- MBCC GROUP

- DOW

- FLOROCK

- ASIAN PAINTS PPG PVT. LIMITED

- AXALTA COATING SYSTEMS LTD

- DSM

- RPM INTERNATIONAL INC

- THE LUBRIZOL CORPORATION

- OTHER MAJOR PLAYERS

Recent Industry Developments In North America Floor Coatings Market

- In September 2020, PPG Industries announced the launch of PPG flooring coatings, which is a comprehensive line of coating systems that include prime coats, base coats, and topcoats and are tailored to provide optimum performance based on the specific work environment. Users can choose from four flooring coating systems – general purpose, wear resistant, chemical resistant, and urethane cement – with additional customization options.

- In March 2024, Jon-Don expanded its selection of resinous floor coatings for concrete flooring by partnering with PPG. The collaboration saw Jon-Don, a prominent supplier of commercial supplies and equipment to specialty contractors, enhancing its offerings. PPG FLOORING™ introduced a variety of high-performance flooring systems, encompassing general-purpose epoxy flooring and specialized options tailored for extreme environments. This partnership aimed to provide customers with expanded choices in durable and versatile flooring solutions, catering to diverse commercial and industrial needs across different sectors.

|

North America Floor Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 699.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.01% |

Market Size in 2032: |

USD 1286.68 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Technology

3.2 By Product Type

3.3 By Component

3.4 By Application

3.5 By End Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: North America Floor Coatings Market by Technology

5.1 North America Floor Coatings Market Overview Snapshot and Growth Engine

5.2 North America Floor Coatings Market Overview

5.3 Water-Borne

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Water-Borne: Geographic Segmentation

5.4 Solvent-Borne

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solvent-Borne: Geographic Segmentation

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Geographic Segmentation

Chapter 6: North America Floor Coatings Market by Product Type

6.1 North America Floor Coatings Market Overview Snapshot and Growth Engine

6.2 North America Floor Coatings Market Overview

6.3 Epoxy

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Epoxy: Geographic Segmentation

6.4 Polyurethane

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Polyurethane: Geographic Segmentation

6.5 Acrylic

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Acrylic: Geographic Segmentation

6.6 Polyaspartic

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Polyaspartic: Geographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Geographic Segmentation

Chapter 7: North America Floor Coatings Market by Component

7.1 North America Floor Coatings Market Overview Snapshot and Growth Engine

7.2 North America Floor Coatings Market Overview

7.3 One-Component

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 One-Component: Geographic Segmentation

7.4 Two-Component

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Two-Component: Geographic Segmentation

7.5 Three-Component

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Three-Component: Geographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Geographic Segmentation

Chapter 8: North America Floor Coatings Market by Application

8.1 North America Floor Coatings Market Overview Snapshot and Growth Engine

8.2 North America Floor Coatings Market Overview

8.3 Concrete

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Concrete: Geographic Segmentation

8.4 Wood

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Wood: Geographic Segmentation

8.5 Terrazzo

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017-2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Terrazzo: Geographic Segmentation

8.6 Others

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017-2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Others: Geographic Segmentation

Chapter 9: North America Floor Coatings Market by End Use

9.1 North America Floor Coatings Market Overview Snapshot and Growth Engine

9.2 North America Floor Coatings Market Overview

9.3 Residential

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size (2017-2032F)

9.3.3 Key Market Trends, Growth Factors and Opportunities

9.3.4 Residential: Geographic Segmentation

9.4 Commercial

9.4.1 Introduction and Market Overview

9.4.2 Historic and Forecasted Market Size (2017-2032F)

9.4.3 Key Market Trends, Growth Factors and Opportunities

9.4.4 Commercial: Geographic Segmentation

9.5 Industrial

9.5.1 Introduction and Market Overview

9.5.2 Historic and Forecasted Market Size (2017-2032F)

9.5.3 Key Market Trends, Growth Factors and Opportunities

9.5.4 Industrial: Geographic Segmentation

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Positioning

10.1.2 North America Floor Coatings Sales and Market Share By Players

10.1.3 Industry BCG Matrix

10.1.4 Ansoff Matrix

10.1.5 North America Floor Coatings Industry Concentration Ratio (CR5 and HHI)

10.1.6 Top 5 North America Floor Coatings Players Market Share

10.1.7 Mergers and Acquisitions

10.1.8 Business Strategies By Top Players

10.2 3M

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Operating Business Segments

10.2.5 Product Portfolio

10.2.6 Business Performance

10.2.7 Key Strategic Moves and Recent Developments

10.2.8 SWOT Analysis

10.3 AKZO NOBEL N.V.

10.4 PPG INDUSTRIES

10.5 INC.

10.6 THE SHERWIN-WILLIAMS COMPANY

10.7 MBCC GROUP

10.8 DOW

10.9 FLOROCK

10.10 ASIAN PAINTS PPG PVT. LIMITED

10.11 AXALTA COATING SYSTEMS LTD

10.12 DSM

10.13 RPM INTERNATIONAL INC

10.14 THE LUBRIZOL CORPORATION

10.15 OTHER MAJOR PLAYERS

Chapter 11:North America Floor Coatings Market Analysis, Insights and Forecast, 2017-2032

11.1 Market Overview

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Technology

11.4.1 Water-Borne

11.4.2 Solvent-Borne

11.4.3 Others

11.5 Historic and Forecasted Market Size By Product Type

11.5.1 Epoxy

11.5.2 Polyurethane

11.5.3 Acrylic

11.5.4 Polyaspartic

11.5.5 Others

11.6 Historic and Forecasted Market Size By Component

11.6.1 One-Component

11.6.2 Two-Component

11.6.3 Three-Component

11.6.4 Others

11.7 Historic and Forecasted Market Size By Application

11.7.1 Concrete

11.7.2 Wood

11.7.3 Terrazzo

11.7.4 Others

11.8 Historic and Forecasted Market Size By End Use

11.8.1 Residential

11.8.2 Commercial

11.8.3 Industrial

11.9 Historic and Forecast Market Size by Country

11.9.1 US

11.9.2 Canada

11.9.3 Mexico

Chapter 12 Investment Analysis

Chapter 13 Analyst Viewpoint and Conclusion

|

North America Floor Coatings Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 699.28 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.01% |

Market Size in 2032: |

USD 1286.68 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NORTH AMERICA FLOOR COATINGS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NORTH AMERICA FLOOR COATINGS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NORTH AMERICA FLOOR COATINGS MARKET COMPETITIVE RIVALRY

TABLE 005. NORTH AMERICA FLOOR COATINGS MARKET THREAT OF NEW ENTRANTS

TABLE 006. NORTH AMERICA FLOOR COATINGS MARKET THREAT OF SUBSTITUTES

TABLE 007. NORTH AMERICA FLOOR COATINGS MARKET BY TECHNOLOGY

TABLE 008. WATER-BORNE MARKET OVERVIEW (2016-2028)

TABLE 009. SOLVENT-BORNE MARKET OVERVIEW (2016-2028)

TABLE 010. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 011. NORTH AMERICA FLOOR COATINGS MARKET BY PRODUCT TYPE

TABLE 012. EPOXY MARKET OVERVIEW (2016-2028)

TABLE 013. POLYURETHANE MARKET OVERVIEW (2016-2028)

TABLE 014. ACRYLIC MARKET OVERVIEW (2016-2028)

TABLE 015. POLYASPARTIC MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA FLOOR COATINGS MARKET BY COMPONENT

TABLE 018. ONE-COMPONENT MARKET OVERVIEW (2016-2028)

TABLE 019. TWO-COMPONENT MARKET OVERVIEW (2016-2028)

TABLE 020. THREE-COMPONENT MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA FLOOR COATINGS MARKET BY APPLICATION

TABLE 023. CONCRETE MARKET OVERVIEW (2016-2028)

TABLE 024. WOOD MARKET OVERVIEW (2016-2028)

TABLE 025. TERRAZZO MARKET OVERVIEW (2016-2028)

TABLE 026. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA FLOOR COATINGS MARKET BY END USE

TABLE 028. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 029. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 030. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 031. NORTH AMERICA FLOOR COATINGS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. NORTH AMERICA FLOOR COATINGS MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. NORTH AMERICA FLOOR COATINGS MARKET, BY COMPONENT (2016-2028)

TABLE 034. NORTH AMERICA FLOOR COATINGS MARKET, BY APPLICATION (2016-2028)

TABLE 035. NORTH AMERICA FLOOR COATINGS MARKET, BY END USE (2016-2028)

TABLE 036. NORTH AMERICA FLOOR COATINGS MARKET, BY COUNTRY (2016-2028)

TABLE 037. 3M: SNAPSHOT

TABLE 038. 3M: BUSINESS PERFORMANCE

TABLE 039. 3M: PRODUCT PORTFOLIO

TABLE 040. 3M: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. AKZO NOBEL N.V.: SNAPSHOT

TABLE 041. AKZO NOBEL N.V.: BUSINESS PERFORMANCE

TABLE 042. AKZO NOBEL N.V.: PRODUCT PORTFOLIO

TABLE 043. AKZO NOBEL N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. PPG INDUSTRIES: SNAPSHOT

TABLE 044. PPG INDUSTRIES: BUSINESS PERFORMANCE

TABLE 045. PPG INDUSTRIES: PRODUCT PORTFOLIO

TABLE 046. PPG INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. INC.: SNAPSHOT

TABLE 047. INC.: BUSINESS PERFORMANCE

TABLE 048. INC.: PRODUCT PORTFOLIO

TABLE 049. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. THE SHERWIN-WILLIAMS COMPANY: SNAPSHOT

TABLE 050. THE SHERWIN-WILLIAMS COMPANY: BUSINESS PERFORMANCE

TABLE 051. THE SHERWIN-WILLIAMS COMPANY: PRODUCT PORTFOLIO

TABLE 052. THE SHERWIN-WILLIAMS COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MBCC GROUP: SNAPSHOT

TABLE 053. MBCC GROUP: BUSINESS PERFORMANCE

TABLE 054. MBCC GROUP: PRODUCT PORTFOLIO

TABLE 055. MBCC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DOW: SNAPSHOT

TABLE 056. DOW: BUSINESS PERFORMANCE

TABLE 057. DOW: PRODUCT PORTFOLIO

TABLE 058. DOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. FLOROCK: SNAPSHOT

TABLE 059. FLOROCK: BUSINESS PERFORMANCE

TABLE 060. FLOROCK: PRODUCT PORTFOLIO

TABLE 061. FLOROCK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ASIAN PAINTS PPG PVT. LIMITED: SNAPSHOT

TABLE 062. ASIAN PAINTS PPG PVT. LIMITED: BUSINESS PERFORMANCE

TABLE 063. ASIAN PAINTS PPG PVT. LIMITED: PRODUCT PORTFOLIO

TABLE 064. ASIAN PAINTS PPG PVT. LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. AXALTA COATING SYSTEMS LTD: SNAPSHOT

TABLE 065. AXALTA COATING SYSTEMS LTD: BUSINESS PERFORMANCE

TABLE 066. AXALTA COATING SYSTEMS LTD: PRODUCT PORTFOLIO

TABLE 067. AXALTA COATING SYSTEMS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. DSM: SNAPSHOT

TABLE 068. DSM: BUSINESS PERFORMANCE

TABLE 069. DSM: PRODUCT PORTFOLIO

TABLE 070. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. RPM INTERNATIONAL INC: SNAPSHOT

TABLE 071. RPM INTERNATIONAL INC: BUSINESS PERFORMANCE

TABLE 072. RPM INTERNATIONAL INC: PRODUCT PORTFOLIO

TABLE 073. RPM INTERNATIONAL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. THE LUBRIZOL CORPORATION: SNAPSHOT

TABLE 074. THE LUBRIZOL CORPORATION: BUSINESS PERFORMANCE

TABLE 075. THE LUBRIZOL CORPORATION: PRODUCT PORTFOLIO

TABLE 076. THE LUBRIZOL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. WATER-BORNE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOLVENT-BORNE MARKET OVERVIEW (2016-2028)

FIGURE 014. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 015. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 016. EPOXY MARKET OVERVIEW (2016-2028)

FIGURE 017. POLYURETHANE MARKET OVERVIEW (2016-2028)

FIGURE 018. ACRYLIC MARKET OVERVIEW (2016-2028)

FIGURE 019. POLYASPARTIC MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY COMPONENT

FIGURE 022. ONE-COMPONENT MARKET OVERVIEW (2016-2028)

FIGURE 023. TWO-COMPONENT MARKET OVERVIEW (2016-2028)

FIGURE 024. THREE-COMPONENT MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY APPLICATION

FIGURE 027. CONCRETE MARKET OVERVIEW (2016-2028)

FIGURE 028. WOOD MARKET OVERVIEW (2016-2028)

FIGURE 029. TERRAZZO MARKET OVERVIEW (2016-2028)

FIGURE 030. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY END USE

FIGURE 032. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 033. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 034. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 035. NORTH AMERICA FLOOR COATINGS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the North America Floor Coatings Market research report is 2024-2032.

3M, AKZO NOBEL N.V., PPG INDUSTRIES, INC., THE SHERWIN-WILLIAMS COMPANY, MBCC GROUP, DOW, FLOROCK, ASIAN PAINTS PPG PVT. LIMITED, AXALTA COATING SYSTEMS LTD, DSM, RPM INTERNATIONAL INC, THE LUBRIZOL CORPORATION, OTHER MAJOR PLAYERS

The North America Floor Coatings Market is segmented into Technology, Product Type, Component, Application, End Use Industry and Region. By Technology, the market is categorized into Water-Borne, Solvent-Borne, Others. By Product Type, the market is categorized into Epoxy, Polyurethane, Acrylic, Polyaspartic, Others. By Component, the market is categorized into One-Component, Two-Component, Three-Component, Others. By Application, the market is categorized into Concrete, Wood, Terrazzo, Others. By End Use Industry, the market is categorized into Residential, Commercial, Industrial. By region, it is analyzed across North America (U.S.; Canada; Mexico).

Floor coatings are tough, protective layers used in applications where heavy surface wear or corrosion is expected. The end-use areas include residential, commercial, and industrial applications. Some of the major application areas in industrial and commercial floor coatings include pharmaceutical manufacturing, research and laboratories facilities, hospitals and medical offices, food manufacturing and bottling facilities, restaurants and breweries, and warehousing and distribution facilities.

The North America Floor Coatings Market size was valued at USD 699.28 Million in 2023 and is projected to reach USD 1286.68 Million by 2028, growing at a CAGR of 7.01 % from 2024 to 2032.