Nonylphenol Market Synopsis

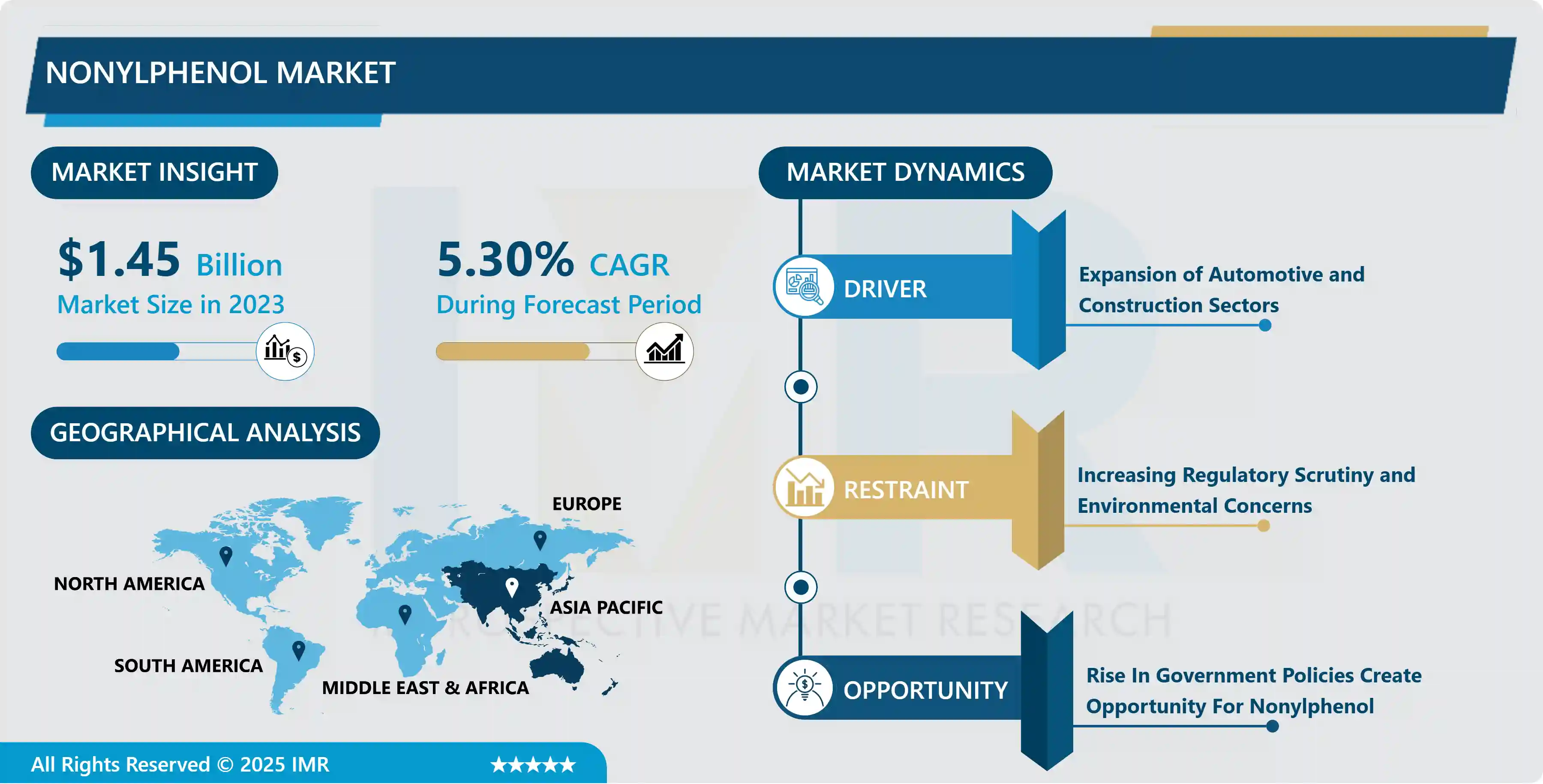

Nonylphenol Market Size is Valued at USD 1.45 Billion in 2023, and is Projected to Reach USD 2.31 Billion by 2032, Growing at a CAGR of 5.30% From 2024-2032.

Nonylphenol is an organic compound realized as a phenolic based on the branching of an alkyl radical containing 9 carbons. It is mainly synthesized through the alkylation of phenol with nonene. Nonylphenol is used principally as an intermediate in the production of nonylphenol ethoxylates, which are surfactants found to be used in detergents, emulsifiers and wetting agents. EP: As a result of its broad characteristics, nonylphenol is applied in a wide range of applications, for example in the agricultural, automotive, textile and in the manufacture of personal care products. But, it has greeted applause for its effect on the environment and health, leading to regulations in various parts.

The major uses of nonylphenol include in surfactants, and as the use of surfactants is rising along different industries, the market for the nonylphenol is also rising. Nonylphenol ethoxylates are widely used as wetting and emulsifying agents in cleaning compositions, detergents and in some industries. With the global cleaning products market increasing its pace due to an increasing awareness of cleanliness and hygiene amongst consumers, the usage of nonylphenol as a surfactant is also expected to rise. However, expansion of other product sectors particularly the personal care and cosmetics industry where nonylphenol is used in its products also fuels market growth.

Another factor is the increasing automobile and construction industries that use nonylphenol into adhesive, sealants and coating. The rise in the construction work globally with special reference to the emergent economies; the growth in the automobile industries also has a proportional influence towards the consumption of nonylphenol. In addition, a large use of nonylphenol in the manufacture of pesticides and herbicides that are used in the agrochemical industry is crucial in driving the market forward. Therefore, their increased growth is expected to enhance the demand for nonylphenol market in the near future.

Nonylphenol Market Trend Analysis

Shift towards environmentally friendly and sustainable alternatives

- One significant attribute that has been firmly demanded in the market is eco-friendly nonylphenol and those which are related to sustainability. As the environmental impacts of nonylphenol and products based there on becomes more apparent, many producers are turning to bio-degradable surfactants and natural solutions. This trend is as a result of the increased regulatory measures adopted by different governments and environmental organizations decreasing usage of dangerous materials. Consequently, firms are carrying out extensive R&D for the development of products that can satisfy the demands of customers and compliance with regulatory requirements.

- One trend is the acquisition of market niches by large firms that target the organizational growth of nonylphenol business through acquisition of other small firms with larger and diversified product profiles. This consolidation is mainly driven by the need to develop new business models to counter shifting customer demands and legal standards. To reinforce this argument, indicating that by acquiring companies that specialize in green surfactants or other products, large firms can help themselves to a more commanding position and also offer customers the necessary sustainable solutions that appeal to the growing green consumers.

Development of bio-based surfactants and eco-friendly formulations.

- This report indicates that there are vast opportunities to develop bio based nonylphenol and environment-friendly products in the global market. There is growing concern in the world over the use of natural and eco-friendly in the preparation of the surfactants. An implication for a firm that offers bio-based substitute for nonylphenol is that they should take advantage of existing markets where they can depict their products as eco-friendly to appease the increasing demand in the market. Further, relationships with the environmental organizations to advance the sustainable practices can also increase the brand image and helps to attract environment friendly consumers.

- In addition, in the global market, new opportunities for manufacturers supporting expansion of the nonylphenol market in developing countries are detected. The markets in the Asia-Pacific region, Latin America and the Middle East are quickly industrializing and urbanizing and the requirement for personal care and automotive and construction is expected to increase. These changes in consumption patterns will create the market for nonylphenol and its derivatives, and subsequently foster market growth. Companies need to develop their foothold within these quickly growing markets so that they can better compete for a greater portion of the nonylphenol market.

Nonylphenol Market Segment Analysis:

Nonylphenol Market Segmented on the basis of type, application, and end-users.

By Product Type, Nonylphenol Ethoxylates segment is expected to dominate the market during the forecast period

- To a large extent, the nonylphenol market can also be divided by product type into several categories all of which have their specific uses. Nonylphenol ethoxylates are employed commonly as surface active agents in detergents, in personal products and in industries basically because of their superb emulsifying and wetting capabilities. NFLP are used almost exclusively in adhesive systems, coatings, and molded products, key benefits being their toughness, heat stability. Nonylphenol sulfate on the other hand is used as a surfactant in formulations of agri chemicals and cleaning agents. Furthermore, in our analysis, there are other types of nonylphenol that include various derivatives and formulations that are used slightly in different industries owing to their flexibility in uses.

By Application, Surfactants segment held the largest share in 2024

- The market can also be classified according to the application of the nonylphenol in various industries. The largest and most important use is in surfactants, due to the ability of nonylphenol compounds to be used in detergents and cleaners and personal care products because of their good emulsifying and wetting traits. Nonylphenol is used in the plastics industry as a performance additive for boosting the efficiency and stability of the plastics. Many of its uses are quite direct: in the paints and coatings industry, NP enhances adhesion and stability; in adhesives and sealants, NP helps to create more bond. Also, it is used in textile chemicals such as dyeing and finish and in agrochemicals as a pesticide and herbicide active ingredient. In the “Others” category, there are different specific purposes that once again prove the applicability of the compound in industrial mixtures.

Nonylphenol Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is anticipated to dominate the nonylphenol market due to the tremendous industrial growth and afin seeking for the different end use sectors in the region. China and India, for instance, are absorbing huge amounts of industrialization and urbanization, and the subsequent demand for nonylphenol that would emanate from industries such as automobile, construction, and personal care would therefore be enormous. The existence of large and growing consumer markets and a locus of manufacturing in the region consequently influence the nonylphenol market positively. Besides, the raw materials and skilled labor cost in the Asia-Pacific region is comparatively low and thus the manufacturers can increase their production capacity, which supports nonylphenol to be the leading market.

- Furthermore, it is endowed with some crucial producers of nonylphenol; this strengthens its position further. These companies are investing in research and development in order to create new and additional products to meet the demand of society for green products. The support provided by the various governmental and non-governmental organizations, associations, and organisations to manage the industrial growth and sustainable development also support the nonylphenol market in Asia-Pacific. Therefore, industrial demand, investment in research & development of nonylphenol, as well as government policies are expected to drive the Asia-Pacific as the largest consumer region of nonylphenol.

Active Key Players in the Nonylphenol Market

- BASF (Germany)

- Dow Chemical Company (USA)

- Huntsman Corporation (USA)

- LG Chem (South Korea)

- Mitsui Chemicals (Japan)

- Eastman Chemical Company (USA)

- Solvay SA (Belgium)

- INEOS (UK)

- AkzoNobel (Netherlands)

- Reliance Industries Limited (India)

- othere

Nonylphenol Market Scope:

|

Global Nonylphenol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.30 % |

Market Size in 2032: |

USD 2.31 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Nonylphenol Market by Product Type (2018-2032)

4.1 Nonylphenol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nonylphenol Ethoxylates

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Nonylphenol Formaldehyde Resins

4.5 Nonylphenol Sulfate

4.6 Others

Chapter 5: Nonylphenol Market by Application (2018-2032)

5.1 Nonylphenol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Surfactants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastic Additives

5.5 Paints and Coatings

5.6 Adhesives and Sealants

5.7 Textile Chemicals

5.8 Agrochemicals

5.9 Others

Chapter 6: Nonylphenol Market by End User (2018-2032)

6.1 Nonylphenol Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Personal Care and Cosmetics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceuticals

6.5 Automotive

6.6 Construction

6.7 Agriculture

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Nonylphenol Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DOW CHEMICAL COMPANY (USA)

7.4 HUNTSMAN CORPORATION (USA)

7.5 LG CHEM (SOUTH KOREA)

7.6 MITSUI CHEMICALS (JAPAN)

7.7 EASTMAN CHEMICAL COMPANY (USA)

7.8 SOLVAY SA (BELGIUM)

7.9 INEOS (UK)

7.10 AKZONOBEL (NETHERLANDS)

7.11 RELIANCE INDUSTRIES LIMITED (INDIA)

7.12 OTHERE

7.13

7.14

Chapter 8: Global Nonylphenol Market By Region

8.1 Overview

8.2. North America Nonylphenol Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Nonylphenol Ethoxylates

8.2.4.2 Nonylphenol Formaldehyde Resins

8.2.4.3 Nonylphenol Sulfate

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Surfactants

8.2.5.2 Plastic Additives

8.2.5.3 Paints and Coatings

8.2.5.4 Adhesives and Sealants

8.2.5.5 Textile Chemicals

8.2.5.6 Agrochemicals

8.2.5.7 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Personal Care and Cosmetics

8.2.6.2 Pharmaceuticals

8.2.6.3 Automotive

8.2.6.4 Construction

8.2.6.5 Agriculture

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Nonylphenol Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Nonylphenol Ethoxylates

8.3.4.2 Nonylphenol Formaldehyde Resins

8.3.4.3 Nonylphenol Sulfate

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Surfactants

8.3.5.2 Plastic Additives

8.3.5.3 Paints and Coatings

8.3.5.4 Adhesives and Sealants

8.3.5.5 Textile Chemicals

8.3.5.6 Agrochemicals

8.3.5.7 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Personal Care and Cosmetics

8.3.6.2 Pharmaceuticals

8.3.6.3 Automotive

8.3.6.4 Construction

8.3.6.5 Agriculture

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Nonylphenol Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Nonylphenol Ethoxylates

8.4.4.2 Nonylphenol Formaldehyde Resins

8.4.4.3 Nonylphenol Sulfate

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Surfactants

8.4.5.2 Plastic Additives

8.4.5.3 Paints and Coatings

8.4.5.4 Adhesives and Sealants

8.4.5.5 Textile Chemicals

8.4.5.6 Agrochemicals

8.4.5.7 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Personal Care and Cosmetics

8.4.6.2 Pharmaceuticals

8.4.6.3 Automotive

8.4.6.4 Construction

8.4.6.5 Agriculture

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Nonylphenol Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Nonylphenol Ethoxylates

8.5.4.2 Nonylphenol Formaldehyde Resins

8.5.4.3 Nonylphenol Sulfate

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Surfactants

8.5.5.2 Plastic Additives

8.5.5.3 Paints and Coatings

8.5.5.4 Adhesives and Sealants

8.5.5.5 Textile Chemicals

8.5.5.6 Agrochemicals

8.5.5.7 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Personal Care and Cosmetics

8.5.6.2 Pharmaceuticals

8.5.6.3 Automotive

8.5.6.4 Construction

8.5.6.5 Agriculture

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Nonylphenol Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Nonylphenol Ethoxylates

8.6.4.2 Nonylphenol Formaldehyde Resins

8.6.4.3 Nonylphenol Sulfate

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Surfactants

8.6.5.2 Plastic Additives

8.6.5.3 Paints and Coatings

8.6.5.4 Adhesives and Sealants

8.6.5.5 Textile Chemicals

8.6.5.6 Agrochemicals

8.6.5.7 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Personal Care and Cosmetics

8.6.6.2 Pharmaceuticals

8.6.6.3 Automotive

8.6.6.4 Construction

8.6.6.5 Agriculture

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Nonylphenol Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Nonylphenol Ethoxylates

8.7.4.2 Nonylphenol Formaldehyde Resins

8.7.4.3 Nonylphenol Sulfate

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Surfactants

8.7.5.2 Plastic Additives

8.7.5.3 Paints and Coatings

8.7.5.4 Adhesives and Sealants

8.7.5.5 Textile Chemicals

8.7.5.6 Agrochemicals

8.7.5.7 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Personal Care and Cosmetics

8.7.6.2 Pharmaceuticals

8.7.6.3 Automotive

8.7.6.4 Construction

8.7.6.5 Agriculture

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Nonylphenol Market Scope:

|

Global Nonylphenol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.45 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.30 % |

Market Size in 2032: |

USD 2.31 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||