Global Non-Medical Masks Market Synopsis

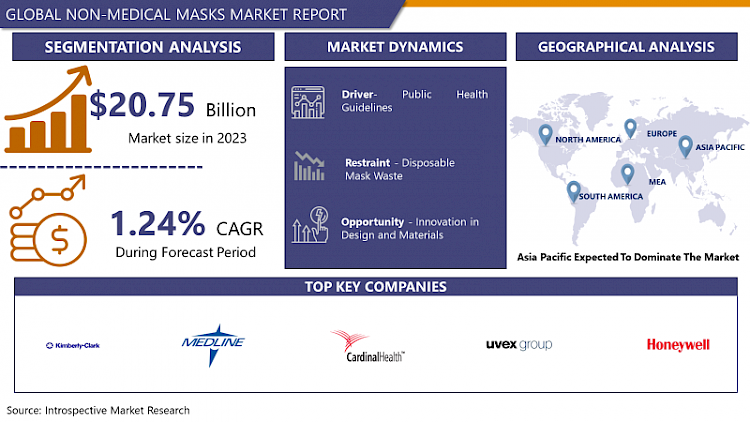

Non-Medical Masks Market Size Was Valued at USD 20.75 Billion in 2023 and is Projected to Reach USD 23.18 Billion by 2032, Growing at a CAGR of 1.24 % From 2024-2032.

The manufacturing and distribution of face masks used largely for non-medical purposes are included in the Non-Medical Masks Market. These masks, which can be referred to as cloth masks, fabric masks, or reusable masks, are constructed from a variety of materials, including cotton, polyester, or other fabric blends.

- While worn appropriately by individuals in regular situations, they are intended to act as a barrier to respiratory droplets and assist in reducing the spread of infectious particles. The non-medical mask market has witnessed significant growth and transformation over the past few years, driven primarily by global health crises, changing consumer behaviors, and advancements in materials and design.

- These masks, initially considered a niche product, have become an essential part of everyday life for people worldwide. This market overview provides insights into the key factors shaping the non-medical mask market and its future prospects. Non-medical masks have evolved from mere protective gear to fashion accessories. Consumers are increasingly looking for masks that not only protect but also reflect their style and personality.

Global Non-Medical Masks Market Trend Analysis

Public Health Guidelines

- Many governments and health authorities around the world have mandated mask-wearing in public spaces as a preventive measure during health crises, such as the COVID-19 pandemic. These mandates have created a massive demand for non-medical masks among the general population, making masks a daily necessity for millions.

- Public health campaigns and guidelines have raised awareness about the importance of mask-wearing in reducing the spread of infectious diseases. As a result, consumers are more conscious of their respiratory health and are more likely to purchase non-medical masks, even when not mandated by law.

- Public health guidelines often include recommendations or requirements for mask quality, filtration efficiency, and breathability. Manufacturers in the non-medical mask market have had to adapt their products to meet these standards, ensuring that their masks provide effective protection as recommended by health authorities.

- Guidelines that emphasize the importance of mask effectiveness have driven innovation in mask design and materials. Manufacturers are continually developing masks with improved filtration capabilities, better fit, and increased comfort to align with public health recommendations.

Innovation in Design and Materials

- Manufacturers have the chance to develop and provide non-medical masks with better designs, comfort, and breathability. Improved mask performance and customer satisfaction may result from research and development into cutting-edge textiles and materials.

- Branded non-medical masks are now commonly used by companies and organizations as part of their marketing and corporate identification initiatives. Businesses might look at options to produce custom-branded masks and meet client needs for branding and corporate identity.

- Developing masks with better filtration capabilities is a top priority. Innovative materials, such as nanofibers and electrostatic materials, can be incorporated to improve particle filtration while maintaining breathability. Masks that offer superior protection against airborne contaminants, including viruses and pollutants, are likely to gain popularity.

- Innovation in mask design can focus on improving comfort and fit. Ergonomically designed masks that provide a secure yet comfortable seal around the face is in high demand. Adjustable straps, nose bridges, and cushioning materials can enhance the overall user experience.

Global Non-Medical Masks Market Segment Analysis:

Global Non-Medical Masks Market Segmented on the basis of type, application, and end-users.

By Product, non-woven masks segment is expected to dominate the market during the forecast period

- Non-woven masks are made from synthetic fibers bonded together without weaving. This manufacturing process creates a material that is cost-effective and allows for mass production at a lower cost compared to woven or knitted fabrics. These masks offer excellent filtration properties, effectively capturing airborne particles and microorganisms due to the dense arrangement of fibers.

- Many non-woven masks are designed with multiple layers to enhance filtration without compromising breathability. Non-woven masks are generally lightweight and offer better breathability compared to some other materials. The porous structure of the non-woven fabric allows for adequate airflow, reducing discomfort for extended wear. Most non-woven masks are designed for single-use, making them convenient and hygienic. They are easily disposable after use, which is crucial in maintaining personal hygiene and preventing the spread of infections.

By Application, Industrial, segment held the largest share of 65% in 2022

Non-medical masks serve a crucial role in various non-healthcare settings, offering protection against dust, pollutants, and other particulate matter. These masks are specifically designed for use in industries such as construction, manufacturing, and agriculture, where workers are exposed to airborne hazards.

Industrial non-medical masks prioritize durability and robustness. They're engineered to withstand harsh working environments and prolonged use, often constructed with multiple layers of non-woven or woven materials to ensure enhanced filtration and resistance to particles, fumes, and chemicals present in industrial settings. these masks prioritize functionality without compromising on breathability. They are designed to maintain a balance between effective filtration and the ease of breathing, enabling workers to wear them comfortably for extended periods during their shifts without experiencing excessive discomfort.

Global Non-Medical Masks Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific, particularly countries like China, India, and Vietnam, has long been a global manufacturing hub for textiles and apparel. These countries have extensive manufacturing capabilities, including the production of non-medical masks. They have the infrastructure, skilled labor, and cost advantages to meet both domestic and international demand.

- Asia-Pacific was among the first regions to experience the COVID-19 pandemic, and governments in the region responded swiftly by implementing mask-wearing mandates and public health campaigns. This early response created a surge in demand for non-medical masks, stimulating local production and exports.

- The Asia-Pacific region is home to some of the world's most densely populated countries, such as China and India. High population density, coupled with urbanization, has contributed to increased mask usage for everyday protection and as a preventive measure during health crises.

- Mask-wearing has been a cultural norm in parts of Asia-Pacific, particularly in countries like Japan and South Korea, long before the pandemic. This cultural acceptance of mask-wearing translated into a ready market for non-medical masks when the need arose.

Global Non-Medical Masks Market Top Key Players:

- Cardinal Health (U.S.)

- Honeywell International Inc. (U.S.)

- 3M Company (U.S.)

- Moldex (US)

- DuPont (US)

- Uvex Group (Germany)

- Reckitt Benckiser (UK)

- Medline Industries (U.S.)

- Owens & Minor (U.S.)

- Alpha ProTech (Canada)

- Vogmask (Canada)

- Kimberly-Clark Corporation (US)

- The Medicom Group (Canada)

- Eclipse Automation Inc (Canada)

- Gildan Activewear (Canada)

- Huhtamaki Oyj (Finland)

- Decathlon (France)

- Zara (Spain)

- Unicharm (Japan)

- Hygiene Austria (Austria)

- Malwee (Brazil)

- Renner (Brazil)

Key Industry Developments in the Global Non-Medical Masks Market:

- In December 2023, 3M Launched the Aura 95 KN95 respirator with CoolFlow™ valve: This mask features a new valve technology designed to reduce heat and moisture buildup, making it more comfortable to wear for extended periods.

- In January 2023, LG introduces the "PuriCare Wearable Air Purifier," a smart mask with built-in air filtration and UV sanitization features.

|

Global Non-Medical Masks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.2% |

Market Size in 2032: |

USD 23.18 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NON-MEDICAL MASKS MARKET BY LIQUEFACTION PRODUCT (2017-2032)

- NON-MEDICAL MASKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NON-WOVEN MASKS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DUST MASKS

- PROTECTIVE MASKS

- NON-MEDICAL MASKS MARKET BY LIQUEFACTION APPLICATION (2017-2032)

- NON-MEDICAL MASKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDUSTRIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PERSONNEL

- NON-MEDICAL MASKS MARKET BY LIQUEFACTION DISTRIBUTION CHANNEL (2017-2032)

- NON-MEDICAL MASKS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFFLINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- NON-MEDICAL MASKS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SASOL (SOUTH AFRICA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SASOL (SOUTH AFRICA)

- SHENHUA GROUP (CHINA)

- SYNFUELS CHINA (CHINA)

- PETROSA (SOUTH AFRICA)

- YANKUANG GROUP (CHINA)

- DKRW ENERGY (USA)

- SHANXI LU'AN GROUP (CHINA)

- CINKARNA CELJE (SLOVENIA)

- TRANSGAS DEVELOPMENT SYSTEMS (USA)

- HUANENG GROUP (CHINA)

- BAOFENG ENERGY GROUP (CHINA)

- JINMEI GROUP (CHINA)

- GIGA WATT (USA)

- LINC ENERGY (AUSTRALIA)

- RENTECH (USA)

- SHANDONG ENERGY GROUP (CHINA)

- DKRW ADVANCED FUELS (USA)

- ANSHAN IRON AND STEEL GROUP (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL NON-MEDICAL MASKS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Non-Medical Masks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.75 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.2% |

Market Size in 2032: |

USD 23.18 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NON-MEDICAL MASKS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NON-MEDICAL MASKS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NON-MEDICAL MASKS MARKET COMPETITIVE RIVALRY

TABLE 005. NON-MEDICAL MASKS MARKET THREAT OF NEW ENTRANTS

TABLE 006. NON-MEDICAL MASKS MARKET THREAT OF SUBSTITUTES

TABLE 007. NON-MEDICAL MASKS MARKET BY PRODUCT

TABLE 008. NON-WOVEN MASKS MARKET OVERVIEW (2016-2030)

TABLE 009. DUST MASKS MARKET OVERVIEW (2016-2030)

TABLE 010. PROTECTIVE MASKS MARKET OVERVIEW (2016-2030)

TABLE 011. NON-MEDICAL MASKS MARKET BY APPLICATION

TABLE 012. INDUSTRIAL MARKET OVERVIEW (2016-2030)

TABLE 013. PERSONNEL MARKET OVERVIEW (2016-2030)

TABLE 014. NON-MEDICAL MASKS MARKET BY DISTRIBUTION CHANNEL

TABLE 015. ONLINE MARKET OVERVIEW (2016-2030)

TABLE 016. OFFLINE MARKET OVERVIEW (2016-2030)

TABLE 017. NORTH AMERICA NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 018. NORTH AMERICA NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 019. NORTH AMERICA NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 020. N NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 022. EASTERN EUROPE NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 023. EASTERN EUROPE NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 024. NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 025. WESTERN EUROPE NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 026. WESTERN EUROPE NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 027. WESTERN EUROPE NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 028. NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 029. ASIA PACIFIC NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 030. ASIA PACIFIC NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 031. ASIA PACIFIC NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 033. MIDDLE EAST & AFRICA NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 034. MIDDLE EAST & AFRICA NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 036. NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 037. SOUTH AMERICA NON-MEDICAL MASKS MARKET, BY PRODUCT (2016-2030)

TABLE 038. SOUTH AMERICA NON-MEDICAL MASKS MARKET, BY APPLICATION (2016-2030)

TABLE 039. SOUTH AMERICA NON-MEDICAL MASKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 040. NON-MEDICAL MASKS MARKET, BY COUNTRY (2016-2030)

TABLE 041. CARDINAL HEALTH (U.S.): SNAPSHOT

TABLE 042. CARDINAL HEALTH (U.S.): BUSINESS PERFORMANCE

TABLE 043. CARDINAL HEALTH (U.S.): PRODUCT PORTFOLIO

TABLE 044. CARDINAL HEALTH (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HONEYWELL INTERNATIONAL INC. (U.S.): SNAPSHOT

TABLE 045. HONEYWELL INTERNATIONAL INC. (U.S.): BUSINESS PERFORMANCE

TABLE 046. HONEYWELL INTERNATIONAL INC. (U.S.): PRODUCT PORTFOLIO

TABLE 047. HONEYWELL INTERNATIONAL INC. (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. 3M COMPANY (U.S.): SNAPSHOT

TABLE 048. 3M COMPANY (U.S.): BUSINESS PERFORMANCE

TABLE 049. 3M COMPANY (U.S.): PRODUCT PORTFOLIO

TABLE 050. 3M COMPANY (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. UVEX GROUP (GERMANY): SNAPSHOT

TABLE 051. UVEX GROUP (GERMANY): BUSINESS PERFORMANCE

TABLE 052. UVEX GROUP (GERMANY): PRODUCT PORTFOLIO

TABLE 053. UVEX GROUP (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. RECKITT BENCKISER (UK): SNAPSHOT

TABLE 054. RECKITT BENCKISER (UK): BUSINESS PERFORMANCE

TABLE 055. RECKITT BENCKISER (UK): PRODUCT PORTFOLIO

TABLE 056. RECKITT BENCKISER (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MEDLINE INDUSTRIES (U.S.): SNAPSHOT

TABLE 057. MEDLINE INDUSTRIES (U.S.): BUSINESS PERFORMANCE

TABLE 058. MEDLINE INDUSTRIES (U.S.): PRODUCT PORTFOLIO

TABLE 059. MEDLINE INDUSTRIES (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. OWENS & MINOR (U.S.): SNAPSHOT

TABLE 060. OWENS & MINOR (U.S.): BUSINESS PERFORMANCE

TABLE 061. OWENS & MINOR (U.S.): PRODUCT PORTFOLIO

TABLE 062. OWENS & MINOR (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ALPHA PROTECH (CANADA): SNAPSHOT

TABLE 063. ALPHA PROTECH (CANADA): BUSINESS PERFORMANCE

TABLE 064. ALPHA PROTECH (CANADA): PRODUCT PORTFOLIO

TABLE 065. ALPHA PROTECH (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DUPONT (US): SNAPSHOT

TABLE 066. DUPONT (US): BUSINESS PERFORMANCE

TABLE 067. DUPONT (US): PRODUCT PORTFOLIO

TABLE 068. DUPONT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. KIMBERLY-CLARK CORPORATION (US): SNAPSHOT

TABLE 069. KIMBERLY-CLARK CORPORATION (US): BUSINESS PERFORMANCE

TABLE 070. KIMBERLY-CLARK CORPORATION (US): PRODUCT PORTFOLIO

TABLE 071. KIMBERLY-CLARK CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. THE MEDICOM GROUP (CANADA): SNAPSHOT

TABLE 072. THE MEDICOM GROUP (CANADA): BUSINESS PERFORMANCE

TABLE 073. THE MEDICOM GROUP (CANADA): PRODUCT PORTFOLIO

TABLE 074. THE MEDICOM GROUP (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ECLIPSE AUTOMATION INC (CANADA): SNAPSHOT

TABLE 075. ECLIPSE AUTOMATION INC (CANADA): BUSINESS PERFORMANCE

TABLE 076. ECLIPSE AUTOMATION INC (CANADA): PRODUCT PORTFOLIO

TABLE 077. ECLIPSE AUTOMATION INC (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. GILDAN ACTIVEWEAR (CANADA): SNAPSHOT

TABLE 078. GILDAN ACTIVEWEAR (CANADA): BUSINESS PERFORMANCE

TABLE 079. GILDAN ACTIVEWEAR (CANADA): PRODUCT PORTFOLIO

TABLE 080. GILDAN ACTIVEWEAR (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. HUHTAMAKI OYJ (FINLAND): SNAPSHOT

TABLE 081. HUHTAMAKI OYJ (FINLAND): BUSINESS PERFORMANCE

TABLE 082. HUHTAMAKI OYJ (FINLAND): PRODUCT PORTFOLIO

TABLE 083. HUHTAMAKI OYJ (FINLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. DECATHLON (FRANCE): SNAPSHOT

TABLE 084. DECATHLON (FRANCE): BUSINESS PERFORMANCE

TABLE 085. DECATHLON (FRANCE): PRODUCT PORTFOLIO

TABLE 086. DECATHLON (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. ZARA (SPAIN): SNAPSHOT

TABLE 087. ZARA (SPAIN): BUSINESS PERFORMANCE

TABLE 088. ZARA (SPAIN): PRODUCT PORTFOLIO

TABLE 089. ZARA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. UNICHARM (JAPAN): SNAPSHOT

TABLE 090. UNICHARM (JAPAN): BUSINESS PERFORMANCE

TABLE 091. UNICHARM (JAPAN): PRODUCT PORTFOLIO

TABLE 092. UNICHARM (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. HYGIENE AUSTRIA (AUSTRIA): SNAPSHOT

TABLE 093. HYGIENE AUSTRIA (AUSTRIA): BUSINESS PERFORMANCE

TABLE 094. HYGIENE AUSTRIA (AUSTRIA): PRODUCT PORTFOLIO

TABLE 095. HYGIENE AUSTRIA (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. MALWEE (BRAZIL): SNAPSHOT

TABLE 096. MALWEE (BRAZIL): BUSINESS PERFORMANCE

TABLE 097. MALWEE (BRAZIL): PRODUCT PORTFOLIO

TABLE 098. MALWEE (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. RENNER (BRAZIL) AND OTHER MAJOR PLAYERS.: SNAPSHOT

TABLE 099. RENNER (BRAZIL) AND OTHER MAJOR PLAYERS.: BUSINESS PERFORMANCE

TABLE 100. RENNER (BRAZIL) AND OTHER MAJOR PLAYERS.: PRODUCT PORTFOLIO

TABLE 101. RENNER (BRAZIL) AND OTHER MAJOR PLAYERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NON-MEDICAL MASKS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NON-MEDICAL MASKS MARKET OVERVIEW BY PRODUCT

FIGURE 012. NON-WOVEN MASKS MARKET OVERVIEW (2016-2030)

FIGURE 013. DUST MASKS MARKET OVERVIEW (2016-2030)

FIGURE 014. PROTECTIVE MASKS MARKET OVERVIEW (2016-2030)

FIGURE 015. NON-MEDICAL MASKS MARKET OVERVIEW BY APPLICATION

FIGURE 016. INDUSTRIAL MARKET OVERVIEW (2016-2030)

FIGURE 017. PERSONNEL MARKET OVERVIEW (2016-2030)

FIGURE 018. NON-MEDICAL MASKS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 019. ONLINE MARKET OVERVIEW (2016-2030)

FIGURE 020. OFFLINE MARKET OVERVIEW (2016-2030)

FIGURE 021. NORTH AMERICA NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. EASTERN EUROPE NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. WESTERN EUROPE NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. ASIA PACIFIC NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. MIDDLE EAST & AFRICA NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. SOUTH AMERICA NON-MEDICAL MASKS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Global Non-Medical Masks Market research report is 2024-2032.

Cardinal Health (U.S.), Honeywell International Inc. (U.S.), 3M Company (U.S.), Uvex Group (Germany), Reckitt Benckiser (UK), Medline Industries (U.S.), Owens & Minor (U.S.), Alpha ProTech (Canada), DuPont (US), Kimberly-Clark Corporation (US), The Medicom Group (Canada), Eclipse Automation Inc (Canada), Gildan Activewear (Canada), Huhtamaki Oyj (Finland), Decathlon (France), Zara (Spain), Unicharm (Japan), Hygiene Austria (Austria), Malwee (Brazil), Renner (Brazil) and Other Major Players. and Other Major Players.

The Non-Medical Masks Market is segmented into Product, Application, Distribution Channel and region. By Product, the market is categorized into Non-woven Masks, Dust Masks, Protective Masks. By Application, the market is categorized into Industrial, Personnel. By Distribution Channel, the market is categorized into Online, Offline. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The manufacturing and distribution of face masks used largely for non-medical purposes are included in the Non-Medical Masks Market. These masks, which can be referred to as cloth masks, fabric masks, or reusable masks, are constructed from a variety of materials, including cotton, polyester, or other fabric blends.

Non-Medical Masks Market Size Was Valued at USD 20.75 Billion in 2023 and is Projected to Reach USD 23.18 Billion by 2032, Growing at a CAGR of 1.24 % From 2024-2032.