Global Non-Alcoholic Wine and Beer Market Overview

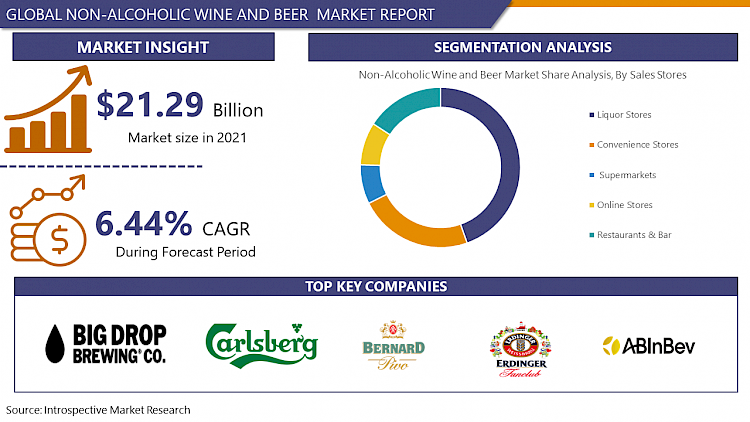

The Non-Alcoholic Wine and Beer market estimated at USD 22.65 Billion in the year 2022, is projected to reach a revised size of USD 37.21 Billion by 2030, growing at a CAGR of 6.4% over the analysis period 2023-2030

Low and reduced alcohol beverages become gaining popularity in many regions with key factors such as rising health awareness, promotional strategies, perception towards non-alcoholic beverages and others. According to research, low alcohol beverages such as light beer and reduced alcohol wine have become more welcomed in the marketplace and expected to stimulate the growth in non-alcoholic wine and beer market during forecast period. For instance, according to MDPI, increased the global consumption for light beer from 2006-2011 by 47.2 % in volume. Furthermore, the production of beers with light alcohol content is a booming segment in the global beer market. Over the last few decades, various beer and wine-based products have been developed globally, using different brewing process, technologies, and raw ingredients.

For instance, in Germany, a country with a huge tradition in beer production, according to the Reinheitsgebot, the single ingredients used for obtaining beer and wine are water, malted barley, grapes, hops and yeast. In addition, wheat, rice, rye, oats, maize, unmalted barley, and to a lower range sorghum, millet, and cassava are used in brewing process. According to MDPI, nonalcoholic and low alcoholic beers market growth in 2020 were 20% and it is expected to grow at 24% by 2021.

Report Coverage:

The global market report of Non-alcoholic Wine and Beer Market by the Introspective Market Research includes qualitative and quantitative insights. The company also offers a detailed analysis of the market size and growth rate of the possible segments. Different key insights presented in the report are an overview of that related of the market, also competitive rivalry, recent developments, collaboration and mergers.

COVID-19 Impact:

The COVID-19 pandemic and its related government measures to limit mobility impacted pattern and places for alcohol consumption. People have significantly the drinking habits towards non-alcoholic beer and wine owing to health concern which helps to grow the market during projected period. However, shutdowns in some region effect on sales of non-alcoholic brands and poor home delivery distribution channel hindering the market growth.

Market Dynamics and Factor:

Drivers:

Low and non-alcoholic beverages are gaining more popularity with compared to traditional alcoholic beverages due to rising consumer awareness regarding health risks related with alcohol. For instance, in 2007, according to World Cancer Research Fund reported that a reduce in alcohol content from 14.2% to 10% would reduce the risk of breast and bowel cancer by 7%.

Rising the purchasing power along with switching spending pattern of millennials worldwide is expected to create significant demand for non-alcoholic beer over the forecast period.

Furthermore, significant investments in innovative technology such as cutting edge to produce low ABV beers are supplemental benefiting the strong growth of the alcohol-free beer market which is expected to grow in projected period. For instance, the production of NAB (including malt beverages) expanded in Germany from 5.4% in 2012 to 7.3% in 2018, while in Netherlands it went from 1.5% in 2012 to 5.2% in 2018

Restraints:

More flavor loss due to usage of temperature sensitive ingredients in brewing process in order to application of high temperature process might be hindering market growth during forecast period.

Opportunities:

Supportive government policies and standards, regarding the promotional activities of alcohol substitutes drinks will stimulate the masses opportunities for existing key players. For instance, in European region, branding of the product as 0% alcohol free will boost the market growth as non-alcoholic beer is not disposed to excise duty.

Furthermore, home delivery of non-alcoholic beer and wine by food delivery services is creates new opportunity in non-alcoholic beer and wine market.

Market Segmentation

Type Insights

Based on product type beer is dominating the market during forecast period. For instance, according to the Distilled Spirits Council of the United States, beer is the dominant segment in the alcoholic beverage sector with a 47.8% market share of the total supplier revenue figures for 2014. Based on material type, according to lumen learning, yeasts are the main fermenter and applied in production of wine, beer and other alcoholic drinks. Based on type, alcohol free wine and beer dominating the market in projected period. Based on technology, according to Science Direct Journal, dealcoholization dominating the market in nonalcoholic wine and beer market during forecast period. Based on distribution channel, restaurants and bars dominating the market owing to 70% margin on wine and beer, according to BinWise Inventory Management.

Regional Analysis

Europe region is the dominating the nonalcoholic wine and beer market owing to Germany is the one of the biggest markets globally in low alcoholic beer and wine industry. Furthermore, changing consumer preferences, well established distribution channels, large number of key players, and variety of products availability are factors driving the market during forecast period.

North America witnessing the highest market growth due to rapid growth in R&D activities, consistent innovation in products and rising consumer preferences towards the nonalcoholic and low alcoholic beer which leads the market growth in projected period.

In Asia Pacific, China has the largest demand for alcohol free beer and wine. An increasing health awareness gaining popularity for non-alcoholic beer and wine in India, Japan, and China helps to fueled the market growth. In addition, rising the demand for free liquor content products in Muslim countries instead of Islamic liquor is anticipated to trigger the market growth over forecast period.

In Latin America, rising spending on non-alcoholic beverages, shifting consumer awareness regarding health and alcohol-free products, and growing population leads to market growth over forecast period. The growing demand for alcohol free beer and wine in Middle East and Africa attributed to growth in market. In addition, rising the food and beverages industry helps to boost the market in the region and expected to continue in upcoming years.

Key Industry Developments:

In March 2018, Heineken and Infor announced their collaboration to grow the production capacity and efficiency, with Infor’s cloud-based solution, and Heineken would be benefited with smart integration technology for proper operations.

In October 2020, in the period of COVID-19 pandemic to control spreading, RIKEN, Suntory Liquors Ltd and Toppan Printing Co. Ltd. Have decided to merge their expertise to innovate face shield developed especially for eating and drinking, thereby creating a safer environment in restaurants and bars.

Players Covered in Non-Alcoholic Wine and Beer Market are :

- Big Drop Brewing

- Carlsberg

- Bernard Brewery

- Erdinger Weibbrau

- Suntory Beer

- Anheuser-Bush InBev

- Moscow Brewing Company

- Heineken N.V.

- Behnoush Iran

- Pierre Chavin and other major players.

|

Global Non-Alcoholic Wine and Beer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 22.65 Bn. |

|

Forecast Period 2022-30 CAGR: |

6.4% |

Market Size in 2030: |

USD 37.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Technology |

|

||

|

By Sales Stores |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By Technology

3.4 By Sales Stores

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Non-Alcoholic Wine and Beer Market by Type

5.1 Non-Alcoholic Wine and Beer Market Overview Snapshot and Growth Engine

5.2 Non-Alcoholic Wine and Beer Market Overview

5.3 Alcohol Free

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Alcohol Free: Grographic Segmentation

5.4 Lower Alcohol

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Lower Alcohol: Grographic Segmentation

Chapter 6: Non-Alcoholic Wine and Beer Market by Source

6.1 Non-Alcoholic Wine and Beer Market Overview Snapshot and Growth Engine

6.2 Non-Alcoholic Wine and Beer Market Overview

6.3 Grapes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Grapes: Grographic Segmentation

6.4 Apples

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Apples: Grographic Segmentation

6.5 Malted Grains

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Malted Grains: Grographic Segmentation

6.6 Hops

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Hops: Grographic Segmentation

6.7 Yeast

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Yeast: Grographic Segmentation

6.8 Enzymes

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Enzymes: Grographic Segmentation

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2016-2028F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Grographic Segmentation

Chapter 7: Non-Alcoholic Wine and Beer Market by Technology

7.1 Non-Alcoholic Wine and Beer Market Overview Snapshot and Growth Engine

7.2 Non-Alcoholic Wine and Beer Market Overview

7.3 Restricted Fermentation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Restricted Fermentation: Grographic Segmentation

7.4 Dealcoholization

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Dealcoholization: Grographic Segmentation

Chapter 8: Non-Alcoholic Wine and Beer Market by Sales Stores

8.1 Non-Alcoholic Wine and Beer Market Overview Snapshot and Growth Engine

8.2 Non-Alcoholic Wine and Beer Market Overview

8.3 Liquor Stores

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Liquor Stores: Grographic Segmentation

8.4 Convenience Stores

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Convenience Stores: Grographic Segmentation

8.5 Supermarkets

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Supermarkets: Grographic Segmentation

8.6 Online Stores

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Online Stores: Grographic Segmentation

8.7 Restaurants & Bar

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Restaurants & Bar: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Non-Alcoholic Wine and Beer Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Non-Alcoholic Wine and Beer Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Non-Alcoholic Wine and Beer Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 BIG DROP BREWING

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 CARLSBERG

9.4 BERNARD BREWERY

9.5 ERDINGER WEIBBRAU

9.6 SUNTORY BEER

9.7 ANHEUSER-BUSH INBEV

9.8 MOSCOW BREWING COMPANY

9.9 HEINEKEN N.V.

9.10 BEHNOUSH IRAN

9.11 PIERRE CHAVIN

9.12 OTHER MAJOR PLAYERS

Chapter 10: Global Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Alcohol Free

10.2.2 Lower Alcohol

10.3 Historic and Forecasted Market Size By Source

10.3.1 Grapes

10.3.2 Apples

10.3.3 Malted Grains

10.3.4 Hops

10.3.5 Yeast

10.3.6 Enzymes

10.3.7 Others

10.4 Historic and Forecasted Market Size By Technology

10.4.1 Restricted Fermentation

10.4.2 Dealcoholization

10.5 Historic and Forecasted Market Size By Sales Stores

10.5.1 Liquor Stores

10.5.2 Convenience Stores

10.5.3 Supermarkets

10.5.4 Online Stores

10.5.5 Restaurants & Bar

Chapter 11: North America Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Alcohol Free

11.4.2 Lower Alcohol

11.5 Historic and Forecasted Market Size By Source

11.5.1 Grapes

11.5.2 Apples

11.5.3 Malted Grains

11.5.4 Hops

11.5.5 Yeast

11.5.6 Enzymes

11.5.7 Others

11.6 Historic and Forecasted Market Size By Technology

11.6.1 Restricted Fermentation

11.6.2 Dealcoholization

11.7 Historic and Forecasted Market Size By Sales Stores

11.7.1 Liquor Stores

11.7.2 Convenience Stores

11.7.3 Supermarkets

11.7.4 Online Stores

11.7.5 Restaurants & Bar

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Alcohol Free

12.4.2 Lower Alcohol

12.5 Historic and Forecasted Market Size By Source

12.5.1 Grapes

12.5.2 Apples

12.5.3 Malted Grains

12.5.4 Hops

12.5.5 Yeast

12.5.6 Enzymes

12.5.7 Others

12.6 Historic and Forecasted Market Size By Technology

12.6.1 Restricted Fermentation

12.6.2 Dealcoholization

12.7 Historic and Forecasted Market Size By Sales Stores

12.7.1 Liquor Stores

12.7.2 Convenience Stores

12.7.3 Supermarkets

12.7.4 Online Stores

12.7.5 Restaurants & Bar

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Alcohol Free

13.4.2 Lower Alcohol

13.5 Historic and Forecasted Market Size By Source

13.5.1 Grapes

13.5.2 Apples

13.5.3 Malted Grains

13.5.4 Hops

13.5.5 Yeast

13.5.6 Enzymes

13.5.7 Others

13.6 Historic and Forecasted Market Size By Technology

13.6.1 Restricted Fermentation

13.6.2 Dealcoholization

13.7 Historic and Forecasted Market Size By Sales Stores

13.7.1 Liquor Stores

13.7.2 Convenience Stores

13.7.3 Supermarkets

13.7.4 Online Stores

13.7.5 Restaurants & Bar

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Alcohol Free

14.4.2 Lower Alcohol

14.5 Historic and Forecasted Market Size By Source

14.5.1 Grapes

14.5.2 Apples

14.5.3 Malted Grains

14.5.4 Hops

14.5.5 Yeast

14.5.6 Enzymes

14.5.7 Others

14.6 Historic and Forecasted Market Size By Technology

14.6.1 Restricted Fermentation

14.6.2 Dealcoholization

14.7 Historic and Forecasted Market Size By Sales Stores

14.7.1 Liquor Stores

14.7.2 Convenience Stores

14.7.3 Supermarkets

14.7.4 Online Stores

14.7.5 Restaurants & Bar

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Non-Alcoholic Wine and Beer Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Alcohol Free

15.4.2 Lower Alcohol

15.5 Historic and Forecasted Market Size By Source

15.5.1 Grapes

15.5.2 Apples

15.5.3 Malted Grains

15.5.4 Hops

15.5.5 Yeast

15.5.6 Enzymes

15.5.7 Others

15.6 Historic and Forecasted Market Size By Technology

15.6.1 Restricted Fermentation

15.6.2 Dealcoholization

15.7 Historic and Forecasted Market Size By Sales Stores

15.7.1 Liquor Stores

15.7.2 Convenience Stores

15.7.3 Supermarkets

15.7.4 Online Stores

15.7.5 Restaurants & Bar

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Non-Alcoholic Wine and Beer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2016 to 2021 |

Market Size in 2022: |

USD 22.65 Bn. |

|

Forecast Period 2022-30 CAGR: |

6.4% |

Market Size in 2030: |

USD 37.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Technology |

|

||

|

By Sales Stores |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NON-ALCOHOLIC WINE AND BEER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NON-ALCOHOLIC WINE AND BEER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NON-ALCOHOLIC WINE AND BEER MARKET COMPETITIVE RIVALRY

TABLE 005. NON-ALCOHOLIC WINE AND BEER MARKET THREAT OF NEW ENTRANTS

TABLE 006. NON-ALCOHOLIC WINE AND BEER MARKET THREAT OF SUBSTITUTES

TABLE 007. NON-ALCOHOLIC WINE AND BEER MARKET BY TYPE

TABLE 008. ALCOHOL FREE MARKET OVERVIEW (2016-2028)

TABLE 009. LOWER ALCOHOL MARKET OVERVIEW (2016-2028)

TABLE 010. NON-ALCOHOLIC WINE AND BEER MARKET BY SOURCE

TABLE 011. GRAPES MARKET OVERVIEW (2016-2028)

TABLE 012. APPLES MARKET OVERVIEW (2016-2028)

TABLE 013. MALTED GRAINS MARKET OVERVIEW (2016-2028)

TABLE 014. HOPS MARKET OVERVIEW (2016-2028)

TABLE 015. YEAST MARKET OVERVIEW (2016-2028)

TABLE 016. ENZYMES MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. NON-ALCOHOLIC WINE AND BEER MARKET BY TECHNOLOGY

TABLE 019. RESTRICTED FERMENTATION MARKET OVERVIEW (2016-2028)

TABLE 020. DEALCOHOLIZATION MARKET OVERVIEW (2016-2028)

TABLE 021. NON-ALCOHOLIC WINE AND BEER MARKET BY SALES STORES

TABLE 022. LIQUOR STORES MARKET OVERVIEW (2016-2028)

TABLE 023. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

TABLE 024. SUPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 025. ONLINE STORES MARKET OVERVIEW (2016-2028)

TABLE 026. RESTAURANTS & BAR MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TYPE (2016-2028)

TABLE 028. NORTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SOURCE (2016-2028)

TABLE 029. NORTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. NORTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SALES STORES (2016-2028)

TABLE 031. N NON-ALCOHOLIC WINE AND BEER MARKET, BY COUNTRY (2016-2028)

TABLE 032. EUROPE NON-ALCOHOLIC WINE AND BEER MARKET, BY TYPE (2016-2028)

TABLE 033. EUROPE NON-ALCOHOLIC WINE AND BEER MARKET, BY SOURCE (2016-2028)

TABLE 034. EUROPE NON-ALCOHOLIC WINE AND BEER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 035. EUROPE NON-ALCOHOLIC WINE AND BEER MARKET, BY SALES STORES (2016-2028)

TABLE 036. NON-ALCOHOLIC WINE AND BEER MARKET, BY COUNTRY (2016-2028)

TABLE 037. ASIA PACIFIC NON-ALCOHOLIC WINE AND BEER MARKET, BY TYPE (2016-2028)

TABLE 038. ASIA PACIFIC NON-ALCOHOLIC WINE AND BEER MARKET, BY SOURCE (2016-2028)

TABLE 039. ASIA PACIFIC NON-ALCOHOLIC WINE AND BEER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. ASIA PACIFIC NON-ALCOHOLIC WINE AND BEER MARKET, BY SALES STORES (2016-2028)

TABLE 041. NON-ALCOHOLIC WINE AND BEER MARKET, BY COUNTRY (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SOURCE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SALES STORES (2016-2028)

TABLE 046. NON-ALCOHOLIC WINE AND BEER MARKET, BY COUNTRY (2016-2028)

TABLE 047. SOUTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TYPE (2016-2028)

TABLE 048. SOUTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SOURCE (2016-2028)

TABLE 049. SOUTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY TECHNOLOGY (2016-2028)

TABLE 050. SOUTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET, BY SALES STORES (2016-2028)

TABLE 051. NON-ALCOHOLIC WINE AND BEER MARKET, BY COUNTRY (2016-2028)

TABLE 052. BIG DROP BREWING: SNAPSHOT

TABLE 053. BIG DROP BREWING: BUSINESS PERFORMANCE

TABLE 054. BIG DROP BREWING: PRODUCT PORTFOLIO

TABLE 055. BIG DROP BREWING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. CARLSBERG: SNAPSHOT

TABLE 056. CARLSBERG: BUSINESS PERFORMANCE

TABLE 057. CARLSBERG: PRODUCT PORTFOLIO

TABLE 058. CARLSBERG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BERNARD BREWERY: SNAPSHOT

TABLE 059. BERNARD BREWERY: BUSINESS PERFORMANCE

TABLE 060. BERNARD BREWERY: PRODUCT PORTFOLIO

TABLE 061. BERNARD BREWERY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ERDINGER WEIBBRAU: SNAPSHOT

TABLE 062. ERDINGER WEIBBRAU: BUSINESS PERFORMANCE

TABLE 063. ERDINGER WEIBBRAU: PRODUCT PORTFOLIO

TABLE 064. ERDINGER WEIBBRAU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SUNTORY BEER: SNAPSHOT

TABLE 065. SUNTORY BEER: BUSINESS PERFORMANCE

TABLE 066. SUNTORY BEER: PRODUCT PORTFOLIO

TABLE 067. SUNTORY BEER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ANHEUSER-BUSH INBEV: SNAPSHOT

TABLE 068. ANHEUSER-BUSH INBEV: BUSINESS PERFORMANCE

TABLE 069. ANHEUSER-BUSH INBEV: PRODUCT PORTFOLIO

TABLE 070. ANHEUSER-BUSH INBEV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. MOSCOW BREWING COMPANY: SNAPSHOT

TABLE 071. MOSCOW BREWING COMPANY: BUSINESS PERFORMANCE

TABLE 072. MOSCOW BREWING COMPANY: PRODUCT PORTFOLIO

TABLE 073. MOSCOW BREWING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. HEINEKEN N.V.: SNAPSHOT

TABLE 074. HEINEKEN N.V.: BUSINESS PERFORMANCE

TABLE 075. HEINEKEN N.V.: PRODUCT PORTFOLIO

TABLE 076. HEINEKEN N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. BEHNOUSH IRAN: SNAPSHOT

TABLE 077. BEHNOUSH IRAN: BUSINESS PERFORMANCE

TABLE 078. BEHNOUSH IRAN: PRODUCT PORTFOLIO

TABLE 079. BEHNOUSH IRAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. PIERRE CHAVIN: SNAPSHOT

TABLE 080. PIERRE CHAVIN: BUSINESS PERFORMANCE

TABLE 081. PIERRE CHAVIN: PRODUCT PORTFOLIO

TABLE 082. PIERRE CHAVIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY TYPE

FIGURE 012. ALCOHOL FREE MARKET OVERVIEW (2016-2028)

FIGURE 013. LOWER ALCOHOL MARKET OVERVIEW (2016-2028)

FIGURE 014. NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY SOURCE

FIGURE 015. GRAPES MARKET OVERVIEW (2016-2028)

FIGURE 016. APPLES MARKET OVERVIEW (2016-2028)

FIGURE 017. MALTED GRAINS MARKET OVERVIEW (2016-2028)

FIGURE 018. HOPS MARKET OVERVIEW (2016-2028)

FIGURE 019. YEAST MARKET OVERVIEW (2016-2028)

FIGURE 020. ENZYMES MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY TECHNOLOGY

FIGURE 023. RESTRICTED FERMENTATION MARKET OVERVIEW (2016-2028)

FIGURE 024. DEALCOHOLIZATION MARKET OVERVIEW (2016-2028)

FIGURE 025. NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY SALES STORES

FIGURE 026. LIQUOR STORES MARKET OVERVIEW (2016-2028)

FIGURE 027. CONVENIENCE STORES MARKET OVERVIEW (2016-2028)

FIGURE 028. SUPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 029. ONLINE STORES MARKET OVERVIEW (2016-2028)

FIGURE 030. RESTAURANTS & BAR MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA NON-ALCOHOLIC WINE AND BEER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Non-Alcoholic Wine and Beer Market research report is 2023-2030.

Big Drop Brewing, Carlsberg, Bernard Brewery, Erdinger Weibbrau, Suntory Beer, Anheuser, Bush InBev, Moscow Brewing Company, Heineken N.V., Behnoush Iran, Pierre Chavin and other major players.

The Non-Alcoholic Wine and Beer Market is segmented into Type, Source, Technology, Sales Stores and region. By Type, the market is categorized into Alcohol Free, Lower Alcohol. By Source the market is categorized into Grapes, Apples, Malted Grains, Hops, Yeast, Enzymes, Others. By Technology the market is categorized into Restricted Fermentation, Dealcoholization. By Sales Stores the market is categorized into Liquor Stores, Convenience Stores, Supermarkets, Online Stores, Restaurants & Bar. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The non-alcoholic beer market consists of sales of non-alcoholic beer by entities (organizations, sole traders, and partnerships) that manufacture non-alcoholic beer. Non-alcoholic beer contains 0% to 1.2% of alcohol and it is generally manufactured by removing alcohol from the finished product or by boiling beer to evaporate the alcohol.

The Non-Alcoholic Wine and Beer market estimated at USD 22.65 Billion in the year 2022, is projected to reach a revised size of USD 37.21 Billion by 2030, growing at a CAGR of 6.4% over the analysis period 2023-2030.