Neuropathic Ocular Pain Market Synopsis

The Neuropathic Ocular Pain Market size is expected to grow from USD 190.58 Million in 2022 to USD 249.41 Million by 2030, at a CAGR of 3.42% during the forecast period.

Ocular neuropathic pain is a diagnosis of exclusion that describes a pain threshold response to stimuli that are typically not painful. A variety of eye pain disorders that are brought on by nerve damage or disease are referred to as ocular neuropathic pain. Although damaged or dysfunctional corneal nerves are frequently linked to ocular neuropathic pain, the condition can also be brought on by peripheral or centralized sensitization. Ocular neuropathic pain is a crucial differential to consider because it frequently results in incorrect diagnoses for patients because of how much it overlaps with dry eye disease. Because of the discrepancy between the signs and symptoms, patients are frequently dismissed or viewed as malingering, hysterical, or psychosomatic.

The Neuropathic Ocular Pain Market Trend Analysis

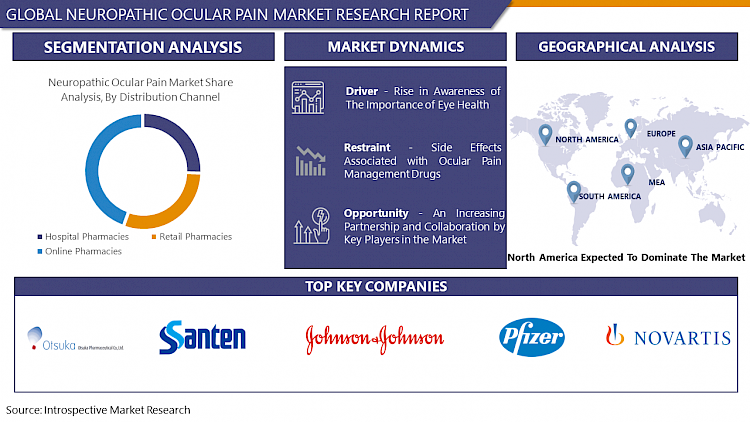

Rise in Awareness of the Importance of Eye Health

- The significance of eye health to overall well-being has increased awareness of the need for comprehensive eye care, which has resulted in a rise in demand. Due to its crippling effects on patients' quality of life, neuropathic ocular pain, among other eye conditions, has drawn a lot of attention.

- Neuropathic ocular pain is a chronic condition characterized by persistent, stabbing, or burning pain in the eye, resulting from damage or dysfunction of the nerves that transmit sensory signals. The condition can be caused by various factors, including ocular surgery, herpes zoster infection, dry eye syndrome, or nerve compression. Unlike other ocular pains, neuropathic ocular pain often does not respond to conventional treatments, making it a challenging condition to manage.

- Several factors have contributed to the increased awareness of the value of eye health. The aging population is one of the main causes. Age-related eye conditions like cataracts, glaucoma, and age-related macular degeneration become significantly more likely in older people. Due to this, more people are seeking routine eye exams and early detection of eye conditions, which may help identify cases of neuropathic ocular pain.

- The rise in awareness of eye health has catalyzed substantial investments in ocular research and the development of innovative diagnostic tools. Clinicians and researchers are increasingly focused on understanding the underlying mechanisms of neuropathic ocular pain, leading to more accurate and timely diagnoses.

An Increasing Partnership and Collaboration by Key Players in the Market

- Companies with a variety of skills and resources come together through partnerships and collaborations. This could entail the collaboration of pharmaceutical companies with academic institutions, businesses that produce medical equipment, or businesses that work in biotechnology in the context of neuropathic ocular pain. Through these partnerships, research and development efforts can be accelerated, a more thorough understanding of the condition can be gained, and resources can be pooled to tackle difficult problems.

- Companies that collaborate on research can pool their resources and share information to advance our understanding of neuropathic ocular pain's underlying mechanisms more quickly. Collaborative research initiatives may uncover new therapeutic targets, biomarkers, and therapeutic modalities, which may result in game-changing advancements in the treatment of the condition.

- The planning and execution of large-scale clinical trials for potential treatments can be facilitated by cooperation among key players. The recruitment process can be sped up and trials conducted more successfully with access to a larger patient pool and shared clinical expertise, resulting in quicker regulatory approvals and quicker access to new treatments.

Segmentation Analysis of the Neuropathic Ocular Pain Market

Neuropathic Ocular Pain market segments cover the Drug Class, and Distribution Channel, By Drug class, the steroids segment is Anticipated to Dominate the Market Over the Forecast period.

- Due to their success in controlling the underlying inflammatory component of the condition, steroids, a group of anti-inflammatory drugs, have become the market leader in the treatment of neuropathic ocular pain. Neuropathic ocular pain, which is characterized by chronic pain brought on by nerve damage, poses difficult treatment problems because traditional analgesics frequently only provide partial relief.

- Steroids are being explored for their potential in treating various new indications beyond their traditional uses. Research and clinical trials are investigating the efficacy of steroids in conditions like neurological disorders, certain cancers, and dermatological conditions, opening up new opportunities for market growth.

- Favorable government policies and regulations related to drug approvals, patent protection, and healthcare investments have facilitated market growth for steroid medications. Growing healthcare expenditure in many regions has allowed for increased access to medications, including the steroid market, for patients in need.

Regional Analysis of the Neuropathic Ocular Pain Market

North America is Expected to Dominate the Market Over the Forecast Period.

- The healthcare system in North America is highly advanced and sophisticated, with cutting-edge hospitals, research institutes, and specialized clinics. This makes it possible to diagnose neuropathic ocular pain early, to diagnose the disease accurately, and to access cutting-edge treatment options.

- Numerous pharmaceutical companies, biotechnology companies, and manufacturers of medical devices can be found in the area, all of which have strong research and development capacities. To address unmet needs in the treatment of neuropathic ocular pain, these organizations continuously invest in the development of novel therapeutics and cutting-edge medical technologies.

- Due to its sizable patient population, diverse demographics, and well-established regulatory frameworks, North America is a significant hub for clinical trials. The region's involvement in neuropathic ocular pain clinical trials speeds up the approval of new medications and improves patient access to care.

COVID-19 Impact Analysis on Neuropathic Ocular Pain Market

During the pandemic, many individuals with non-emergent medical conditions, including neuropathic ocular pain, may have postponed seeking medical attention or routine eye check-ups. This delay in diagnoses and treatment could lead to worsening symptoms and decreased treatment efficacy when patients eventually seek medical care. Similar to other healthcare industries, the neuropathic ocular pain market experienced supply chain disruptions as a result of international travel restrictions and lockdown procedures. This has made it more difficult to get the medicines and medical equipment needed to treat neuropathic ocular pain. The pandemic may have affected clinical trials for potential treatments for neuropathic ocular pain, causing delays or suspensions. Additionally, fewer patients visiting hospitals at the height of the pandemic might have made it harder to find volunteers for clinical trials. Telemedicine's acceptance as a method of providing healthcare remotely was accelerated by the pandemic. While telemedicine is convenient, it may not be the best option for treating complex eye conditions like neuropathic ocular pain. This is because these conditions require in-person evaluations and specialized diagnostic tests.

Top Key Players Covered in the Neuropathic Ocular Pain Market

- Johnson & Johnson (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Bausch Health Companies Inc. (Canada)

- Sun Pharmaceutical Industries Ltd. (India)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Mallinckrodt Pharmaceuticals (Ireland)

- Endo International plc (Ireland)

- Zydus Cadila (India) and Other Major Players

Key Industry Developments in the Neuropathic Ocular Pain Market

- In May 2023, Tonix Pharmaceuticals has reported encouraging outcomes from its Phase 2 clinical trial evaluating TNX-355, an investigational drug designed to address trigeminal neuralgia—a condition characterized by facial pain, occasionally impacting the eye. The trial results showcase TNX-355's potential as a treatment option for this challenging ailment. The positive findings underscore the drug's efficacy in alleviating facial pain associated with trigeminal neuralgia, marking a significant step forward in the pursuit of improved therapies for patients grappling with this complex and debilitating condition

- In October 2023, Shire In a groundbreaking initiative, Shire, under the umbrella of Takeda, has unveiled a collaborative effort with patient advocacy groups aimed at amplifying awareness and enhancing accessibility to treatment for neuropathic ocular pain. This strategic partnership signifies a pivotal step towards addressing the challenges faced by individuals enduring this debilitating condition, underscoring Shire's and Takeda's commitment to empowering patients and healthcare.

|

Global Neuropathic Ocular Pain Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 190.58 Mn. |

|

Forecast Period 2023-30 CAGR: |

3.42 % |

Market Size in 2030: |

USD 249.41 Mn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NEUROPATHIC OCULAR PAIN MARKET BY DRUG CLASS (2016-2030)

- NEUROPATHIC OCULAR PAIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STEROIDS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-STEROIDAL ANTI-INFLAMMATORY DRUGS

- ANTIDEPRESSANTS

- ANTICONVULSANTS

- OPIOIDS

- OTHERS

- NEUROPATHIC OCULAR PAIN MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- NEUROPATHIC OCULAR PAIN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITAL PHARMACIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL PHARMACIES

- ONLINE PHARMACIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- NEUROPATHIC OCULAR PAIN Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- JOHNSON & JOHNSON (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NOVARTIS AG (SWITZERLAND)

- PFIZER INC. (USA)

- SANTEN PHARMACEUTICAL CO., LTD. (JAPAN)

- BAUSCH HEALTH COMPANIES INC. (CANADA)

- SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

- OTSUKA PHARMACEUTICAL CO., LTD. (JAPAN)

- TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

- MALLINCKRODT PHARMACEUTICALS (IRELAND)

- ENDO INTERNATIONAL PLC (IRELAND)

- ZYDUS CADILA (INDIA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL NEUROPATHIC OCULAR PAIN MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By DRUG CLASS

- Historic And Forecasted Market Size By DISTRIBUTION CHANNEL

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Neuropathic Ocular Pain Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 190.58 Mn. |

|

Forecast Period 2023-30 CAGR: |

3.42 % |

Market Size in 2030: |

USD 249.41 Mn. |

|

Segments Covered: |

By Drug Class |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NEUROPATHIC OCULAR PAIN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NEUROPATHIC OCULAR PAIN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NEUROPATHIC OCULAR PAIN MARKET COMPETITIVE RIVALRY

TABLE 005. NEUROPATHIC OCULAR PAIN MARKET THREAT OF NEW ENTRANTS

TABLE 006. NEUROPATHIC OCULAR PAIN MARKET THREAT OF SUBSTITUTES

TABLE 007. NEUROPATHIC OCULAR PAIN MARKET BY DRUG CLASS

TABLE 008. STEROIDS MARKET OVERVIEW (2016-2030)

TABLE 009. NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET OVERVIEW (2016-2030)

TABLE 010. ANTIDEPRESSANTS MARKET OVERVIEW (2016-2030)

TABLE 011. ANTICONVULSANTS MARKET OVERVIEW (2016-2030)

TABLE 012. OPIOIDS MARKET OVERVIEW (2016-2030)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 014. NEUROPATHIC OCULAR PAIN MARKET BY DISTRIBUTION CHANNEL

TABLE 015. HOSPITAL PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 016. RETAIL PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 017. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 019. NORTH AMERICA NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 020. N NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 022. EASTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 023. NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 024. WESTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 025. WESTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 026. NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 027. ASIA PACIFIC NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 028. ASIA PACIFIC NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 029. NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 030. MIDDLE EAST & AFRICA NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 031. MIDDLE EAST & AFRICA NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 033. SOUTH AMERICA NEUROPATHIC OCULAR PAIN MARKET, BY DRUG CLASS (2016-2030)

TABLE 034. SOUTH AMERICA NEUROPATHIC OCULAR PAIN MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 035. NEUROPATHIC OCULAR PAIN MARKET, BY COUNTRY (2016-2030)

TABLE 036. JOHNSON & JOHNSON (USA): SNAPSHOT

TABLE 037. JOHNSON & JOHNSON (USA): BUSINESS PERFORMANCE

TABLE 038. JOHNSON & JOHNSON (USA): PRODUCT PORTFOLIO

TABLE 039. JOHNSON & JOHNSON (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. NOVARTIS AG (SWITZERLAND): SNAPSHOT

TABLE 040. NOVARTIS AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 041. NOVARTIS AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 042. NOVARTIS AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. PFIZER INC. (USA): SNAPSHOT

TABLE 043. PFIZER INC. (USA): BUSINESS PERFORMANCE

TABLE 044. PFIZER INC. (USA): PRODUCT PORTFOLIO

TABLE 045. PFIZER INC. (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SANTEN PHARMACEUTICAL CO.: SNAPSHOT

TABLE 046. SANTEN PHARMACEUTICAL CO.: BUSINESS PERFORMANCE

TABLE 047. SANTEN PHARMACEUTICAL CO.: PRODUCT PORTFOLIO

TABLE 048. SANTEN PHARMACEUTICAL CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LTD. (JAPAN): SNAPSHOT

TABLE 049. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 050. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 051. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BAUSCH HEALTH COMPANIES INC. (CANADA): SNAPSHOT

TABLE 052. BAUSCH HEALTH COMPANIES INC. (CANADA): BUSINESS PERFORMANCE

TABLE 053. BAUSCH HEALTH COMPANIES INC. (CANADA): PRODUCT PORTFOLIO

TABLE 054. BAUSCH HEALTH COMPANIES INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA): SNAPSHOT

TABLE 055. SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 056. SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 057. SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. OTSUKA PHARMACEUTICAL CO.: SNAPSHOT

TABLE 058. OTSUKA PHARMACEUTICAL CO.: BUSINESS PERFORMANCE

TABLE 059. OTSUKA PHARMACEUTICAL CO.: PRODUCT PORTFOLIO

TABLE 060. OTSUKA PHARMACEUTICAL CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. LTD. (JAPAN): SNAPSHOT

TABLE 061. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 062. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 063. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): SNAPSHOT

TABLE 064. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 065. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 066. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MALLINCKRODT PHARMACEUTICALS (IRELAND): SNAPSHOT

TABLE 067. MALLINCKRODT PHARMACEUTICALS (IRELAND): BUSINESS PERFORMANCE

TABLE 068. MALLINCKRODT PHARMACEUTICALS (IRELAND): PRODUCT PORTFOLIO

TABLE 069. MALLINCKRODT PHARMACEUTICALS (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. ENDO INTERNATIONAL PLC (IRELAND): SNAPSHOT

TABLE 070. ENDO INTERNATIONAL PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 071. ENDO INTERNATIONAL PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 072. ENDO INTERNATIONAL PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ZYDUS CADILA (INDIA): SNAPSHOT

TABLE 073. ZYDUS CADILA (INDIA): BUSINESS PERFORMANCE

TABLE 074. ZYDUS CADILA (INDIA): PRODUCT PORTFOLIO

TABLE 075. ZYDUS CADILA (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 076. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 077. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 078. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY DRUG CLASS

FIGURE 012. STEROIDS MARKET OVERVIEW (2016-2030)

FIGURE 013. NON-STEROIDAL ANTI-INFLAMMATORY DRUGS MARKET OVERVIEW (2016-2030)

FIGURE 014. ANTIDEPRESSANTS MARKET OVERVIEW (2016-2030)

FIGURE 015. ANTICONVULSANTS MARKET OVERVIEW (2016-2030)

FIGURE 016. OPIOIDS MARKET OVERVIEW (2016-2030)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 018. NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 019. HOSPITAL PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 020. RETAIL PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 021. ONLINE PHARMACIES MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA NEUROPATHIC OCULAR PAIN MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Neuropathic Ocular Pain Market research report is 2023-2030.

Johnson & Johnson (USA), Novartis AG (Switzerland), Pfizer Inc. (USA), Santen Pharmaceutical Co., Ltd. (Japan), Bausch Health Companies Inc. (Canada), Sun Pharmaceutical Industries Ltd. (India), Otsuka Pharmaceutical Co., Ltd. (Japan), Teva Pharmaceutical Industries Ltd. (Israel), Mallinckrodt Pharmaceuticals (Ireland), Endo International plc (Ireland), Zydus Cadila (India) and Other Major Players

The Neuropathic Ocular Pain Market is segmented into Drug Class, Distribution Channel, and Region. By Drug Class, the market is categorized as Steroids, Non-Steroidal Anti-Inflammatory Drugs, Antidepressants, Anticonvulsants, Opioids, and Others. By Distribution Channel, the market is categorized into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ocular neuropathic pain is a diagnosis of exclusion that describes a pain threshold response to stimuli that are typically not painful. A variety of eye pain disorders that are brought on by nerve damage or disease are referred to as ocular neuropathic pain. Although damaged or dysfunctional corneal nerves are frequently linked to ocular neuropathic pain, the condition can also be brought on by peripheral or centralized sensitization.

The Neuropathic Ocular Pain Market size is expected to grow from USD 190.58 Million in 2022 to USD 249.41 Million by 2030, at a CAGR of 3.42% during the forecast period.