Mobile Phone Insurance Market Synopsis

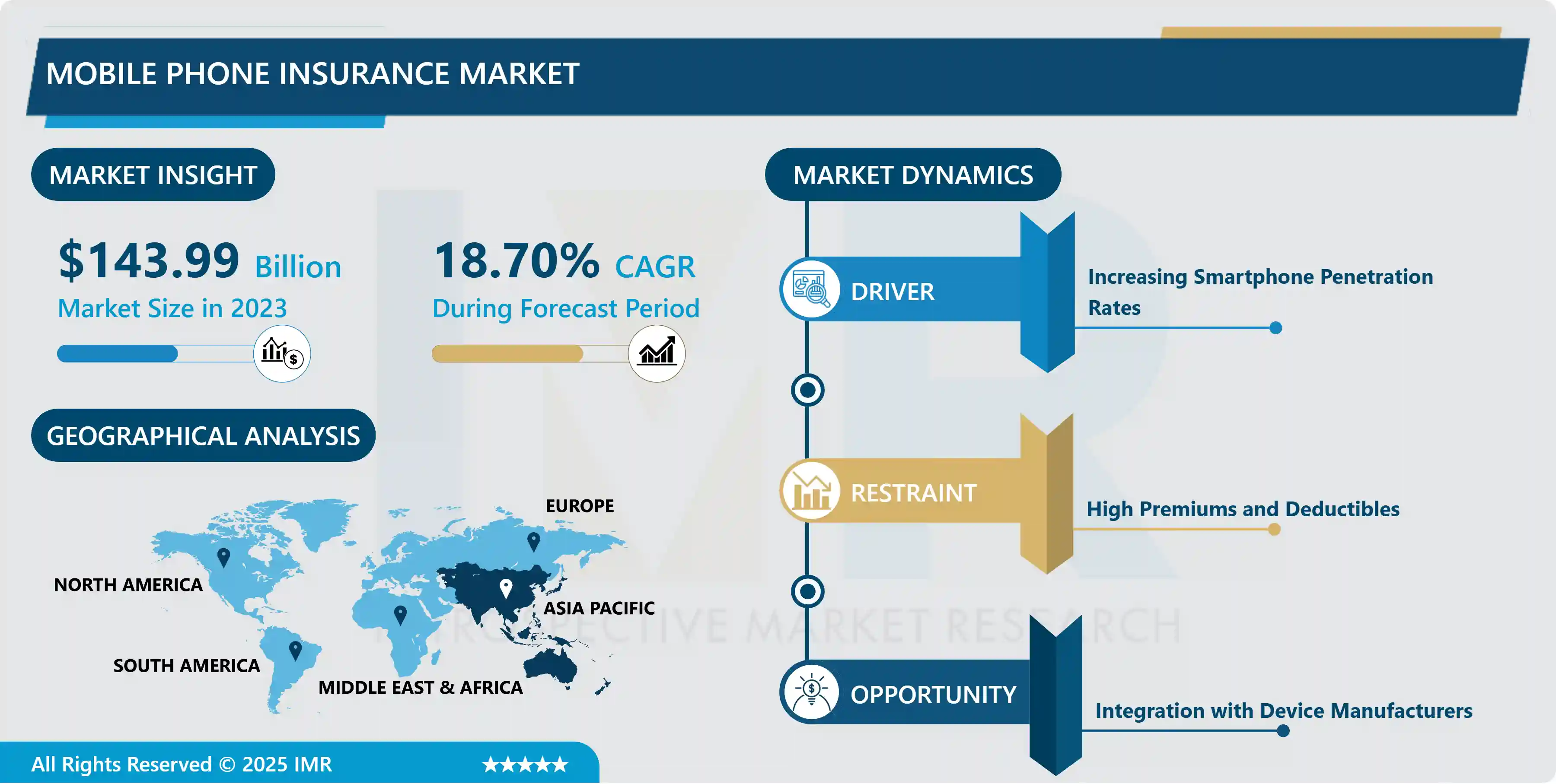

Mobile Phone Insurance Market Size Was Valued at USD 1,43.99 Billion in 2023, and is Projected to Reach USD 205.77 Billion by 2032, Growing at a CAGR of 18.7 % From 2024-2032.

Mobile phone insurance refers to the type of insurance plan that you obtain to see to it that your smartphone is safe from different challenges and abuses. Usually mobile phone insurance policies are offered by insurance companies (mobile network providers not excluded) could be different in coverage but normally they provide protection against damage, due to the breaking, theft and loss, and malfunction of the device extending beyond the manufacturer's warranty period. As compensation for being paid the premium, they get financial compensation or a replacement phone in case the original phone is damaged, lost or stolen if the latter happens based on the terms and conditions of the policy.

Owners of mobile phones who are insured against any damage or unexpected loss have experienced a boom of significant growth lately by the influence of several major factors that have brought about this growth. In the first place electrons, the powerful spread of smartphones contributed to the increasing demand for insurances to make sure these already expensive machines. Smartphones are paramount to the lives of many people, so when phones get damaged, lost, or stolen the outcomes that affect their finances and emotions became more evident over time and consumers have to force them to find policies to insure their phones.

Adopting smartphones continues to be the more affordable choice as more people insure themselves. At this point, budget flagship phones are commonly sold for hundreds of dollars and more; the idea of having to buy a functioning one in a short time is already quite a concern. The consumers can be relieved of the worry and uncertainty of hefty repair or phone replacement costs by signing onto a mobile phone insurance policy that covers such events.

The complexity of smartphone devices which takes place from time to time results in the fact that the mobile phone insurance market became broader. Modern phones, albeit high technology devices, are nevertheless made of the same components as classical phones, but hardware and software components produce even more complex devices vulnerable to malfunctions. The outcome is actually the demand to be supplied with the insurance that is all-rounded, from the protection against physical damage and theft, extend to reflex of technical faults and the software malfunctions as well.

Despite their specific characteristics, a sign of market development is the appearance of innovative insurance models and distribution channels that fuel demand, and provide greater coverage of the population. The traditional insurance companies plus technology businesses and cellular operators start selling mobile phone insurance typically as a part of the bundled service packages or independent items. This multiple distribution channel empower consumers to be able to possess their insurance policy at the same time as they buying a new device by online platform and mobile application.

The specialisation of phone insurance products to the market and inclusion of additional products has made them stand out among competing products. While further to standard protection from crashes, loss, and theft, insurance providers are incorporating in their coverage extra services such as extended warranty insurance, identity theft help, and loss of data solution. The improved features customize to different consumers' likes, which results in high customer adoption and interest rates.

The coronavirus pandemic has revealed the need for mobile phone insurance in a very effective way since remote work and internet communication have become really widespread. As more people across the globe are depending on their smart devices to work, communicate and entertain they need to safeguard it against unpredictable events and this need is more urgent than before. the mobile phone insurance industry stays in-demand with consumers interested in securing their valuable assets among the lack of dependable protection options.

Mobile Phone Insurance Market Trend Analysis

Rise of Comprehensive Coverage Plans

- The of the insurance plans on the mobile phones sector has witnessed a major spike and it's derived from the elasticity of the phones with the consumers and continual advance of the smart phone technology.

- Such all-encompassing plans will be a whole new insurance concept with coverage that goes beyond regular coverage and includes damage and theft cases, extended warranty, technical support and even the protection against software malfunctions.

- This trend to an extent signifies a change in trend where customers feel the option of convenience and peace of mind as services are developed to cater to all possible risks facing the modern smart phone users.

- With mobile devices being more salient to daily life as time passes, it can be expected that the emergence of comprehensive coverage plans are to continue as well. Thus, it can also be expected that the insurance landscapes will be reshaped and a new standard for protection in the digital age is going to be set.

- Besides that, another important factor fueling the development of inclusive insurance plans for mobile devices is the endless competition between phone manufacturers and carriers.

- Differentiation in a competitive market has forced companies to explore the bundled packages which not only enrol the device insurance policy but also include other add-ons such as upgrade features, device backup services, access to exclusive content or discounts on accessories.

- Such merger of insurance with value added services not only gives the customers more attractive price but also builds relationships at levels of brand loyalty. available plans including all in one prtoect plans are now central strategy for industry players to stay ahead of the competition, which in turn has made innovations and upped the bar for mobile phone protection ecosystem (industry players).

Integration with Device Manufacturers

- Device producers are a key partners the insurance product must really work with in mobile phone insurance market. Working hand in hand with manufacturers, insurance carriers are able to provide insurance products that are custom made for devices and have them integrated naturally with the cloths.

- The insurers can promote convenience for consumers by offering insurance options during or after sales activities of manufacturers. This is accomplished through the incorporation of insurance into the purchase process or any post sales services. These measures improve the chances of insurance uptake.

- The combined effect of this integration provides the insurers with access to important information from the devices such as patterns of damage, claims trends, and behavior of the customers, and ultimately leads to the development of better models for risk models and personalized insurance product offerings.

- Further more partnerships among device manufacturers help in creation of innovative products and services which can be customized by the insurance companies to have a strong market share in the mobile insurance market.

- Closer collaboration with suppliers will improve services with unique value propositions, for instance, augmented warranties, device upgrade programs, and bundled insurance solutions.

- Partnerships of this type not only develop a stronger market position for the insurance provider and the device manufacturer but also help to meet the customers' needs better which results in increasing brand loyalty for both.

- Furthermore, linking insurance providers to customers' support channels of manufacturing companies will enable customers to make claims faster and resolve customer controversies as more speedily as can be.

Mobile Phone Insurance Market Segment Analysis:

Mobile Phone Insurance Market is segmented based on PhoneType, Coverage Type, Sales Channel and End User.

By Phone Type, Mid & High-End Phones segment is expected to dominate the market during the forecast period

- The mobile phone insurance industry is diverse and is thus able to meet different customer's needs by marketing products to different phone types. What features insurance plans for budget phones often have in common is that they are focused on affordability and essential coverage.

- This leaves having the essential elements that are necessary for protection against common damaging accidents such as accidental damage, theft or when there is a malfunction of the phone. These plans are structured merely in a way that both parties made an understanding, peace the mind at a discounted cost.

- While this group of smartphones directly implicates insurance covers, the respective value determines how they are provided. Keeping in mind the fact that these devices command a higher price and have some advanced features, the plans of these insurance providers give more robust coverage, including the protect against physical and liquid damage and coverage for lost or damaged gadgets.

- While some consumer are focused on devices durability and overall quality, many others tend to prioritize their financial interests. The best example when it comes to coverage against both foreseeable and unpredictable risks is the protection offered by a reliable insurance company.

- Consequently, premium smartphones fitted with the leading technology and crafted with wealthy brands' brands, generally comes with customized insurance packages that consists of quicker claims processing, concierge support, and even upgrade options, all in a bid to attend to the exclusive customer experience expected from these devices.

- The insurance market for premium smartphones therefore met the desire of attentive consumers who had special needs for their, already, high priced phones.

By Coverage Type, Physical Damage segment held the largest share in 2023

- Cell phone insurance as a counteracting mechanism of ease of mind is a critical type of coverage that shields the user from potential risks. Among all the insurance types, physical damage is perhaps the one that stands out most, and it secures against such things as unintentional dropping, spilling or any accident that may happen to the device’s outside structure.

- The extent of the coverage often embraces fixing the cracked screen, water damage or any other physical impairment that may develop ensuring, therefore, that people use the device without necessarily being part of the financial burden.

- During performances in the area, a local coffee shop, or a drama party, students will be immersed in different cultural traditions related to literature, music, theatre, and dance. From motherboard failures to battery issues and to the software malfunctions as well, this cover type shall remedy any issue that might occur deep into a cracked phone.

- Furthermore, theft, and loss protection in addition offer a wide range of other services that help users recover the device if it ends up being stolen or lost. This coverage frequently comes with terms set for replacements or reimbursements as situations, in which the physical device itself is not available, could be anxiety-provoking.

- Collectively, these types of coverage arrangements make a complete safety net for gadgets users in order to ensure they have all the safer and secure features with which they may navigate the diverse uses of devices.

Mobile Phone Insurance Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Poor developing Asia will tackle developed world together to become the leading mobile phone insurance market in the outlook period.

- The fast-growing middle class across countries including China, India, and the Southeast Asian nations ALREADY carry a lot of mobile phone insurance demand due to the wide use of smartphones.

- This tendency is rather engrossed by the region's booming digital world where smartphones play the vital role of communication, commerce, and entertainment tools.

- Not only that, growing concern about financial hazards linked with the damage, loss, or steal of the smartphones is encouraging the consumers to protected insurance schemes in a same process which in turn expedites the market growth of the Asia Pacific region.

- Besides that, there is a fierce fighting global mobile phone insurance market which is among the Asia Pacific local and international insurers.

- They try to capture a piece of this lucrative market that is on the wire. By virtue of companies branching out with precise insurance offerings such as accidental damage, theft, and software malfunction, consumers have lines of insurance diversity to choose on. strategic alliances such as collaboration with mobile device manufacturers and telecom enterprises are providing more and more distribution channels all over the world and increasing product visibility through the market.

- As the region registers a surging smartphone user base heavily wired on digitalization, Asia Pacific region appears ready to outlast others in mobile phone insurance sector for obvious reasons.

Active Key Players in the Mobile Phone Insurance Market

- Apple Inc.(US)

- American International Group, Inc. .(US)

- Assurant, Inc.(US)

- Asurion.(US)

- AT&T Intellectual Property. .(US)

- AmTrust Financial.(US)

- Brightstar Corp. .(US)

- GoCare Warranty Group.(US)

- SquareTrade, Inc. .(US)

- Taurus Insurance Services Limited.(US)

- Other Key Players .(Uk)

|

Global Mobile Phone Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1,43.99 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.7% |

Market Size in 2032: |

USD 205.77 Bn. |

|

Segments Covered: |

By Phone Type |

|

|

|

By Coverage Type |

|

||

|

By Sales Channel |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mobile Phone Insurance Market by Phone Type (2018-2032)

4.1 Mobile Phone Insurance Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Budget Phones

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mid & High-End Phones

4.5 Premium Smartphones

Chapter 5: Mobile Phone Insurance Market by Coverage Type (2018-2032)

5.1 Mobile Phone Insurance Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Physical Damage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Internal Component Failure

5.5 Theft & Loss Protection

Chapter 6: Mobile Phone Insurance Market by Sales Channel (2018-2032)

6.1 Mobile Phone Insurance Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online

Chapter 7: Mobile Phone Insurance Market by End users (2018-2032)

7.1 Mobile Phone Insurance Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Business

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Individual

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Mobile Phone Insurance Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 APPLE (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 GOOGLE (US)

8.4 AMERICAN EXPRESS COMPANY (US)

8.5 MASTERCARD (US)

8.6 PAYPAL (US)

8.7 ISIS MOBILE WALLET (US)

8.8 VISA (US)

8.9 MERCHANT CUSTOMER EXCHANGE (US)

8.10 ALIBABA GROUP HOLDINGS LIMITE (CHINA)

8.11 AMAZON.COM INC. (US)

8.12 M PESA (AFRICA)

8.13 MONEY GRAM INTERNATIONAL (US)

8.14 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

8.15 WECHAT (TENCENT HOLDINGS LIMITED) (CHINA)

8.16

Chapter 9: Global Mobile Phone Insurance Market By Region

9.1 Overview

9.2. North America Mobile Phone Insurance Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Phone Type

9.2.4.1 Budget Phones

9.2.4.2 Mid & High-End Phones

9.2.4.3 Premium Smartphones

9.2.5 Historic and Forecasted Market Size by Coverage Type

9.2.5.1 Physical Damage

9.2.5.2 Internal Component Failure

9.2.5.3 Theft & Loss Protection

9.2.6 Historic and Forecasted Market Size by Sales Channel

9.2.6.1 Retail

9.2.6.2 Online

9.2.7 Historic and Forecasted Market Size by End users

9.2.7.1 Business

9.2.7.2 Individual

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Mobile Phone Insurance Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Phone Type

9.3.4.1 Budget Phones

9.3.4.2 Mid & High-End Phones

9.3.4.3 Premium Smartphones

9.3.5 Historic and Forecasted Market Size by Coverage Type

9.3.5.1 Physical Damage

9.3.5.2 Internal Component Failure

9.3.5.3 Theft & Loss Protection

9.3.6 Historic and Forecasted Market Size by Sales Channel

9.3.6.1 Retail

9.3.6.2 Online

9.3.7 Historic and Forecasted Market Size by End users

9.3.7.1 Business

9.3.7.2 Individual

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Mobile Phone Insurance Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Phone Type

9.4.4.1 Budget Phones

9.4.4.2 Mid & High-End Phones

9.4.4.3 Premium Smartphones

9.4.5 Historic and Forecasted Market Size by Coverage Type

9.4.5.1 Physical Damage

9.4.5.2 Internal Component Failure

9.4.5.3 Theft & Loss Protection

9.4.6 Historic and Forecasted Market Size by Sales Channel

9.4.6.1 Retail

9.4.6.2 Online

9.4.7 Historic and Forecasted Market Size by End users

9.4.7.1 Business

9.4.7.2 Individual

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Mobile Phone Insurance Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Phone Type

9.5.4.1 Budget Phones

9.5.4.2 Mid & High-End Phones

9.5.4.3 Premium Smartphones

9.5.5 Historic and Forecasted Market Size by Coverage Type

9.5.5.1 Physical Damage

9.5.5.2 Internal Component Failure

9.5.5.3 Theft & Loss Protection

9.5.6 Historic and Forecasted Market Size by Sales Channel

9.5.6.1 Retail

9.5.6.2 Online

9.5.7 Historic and Forecasted Market Size by End users

9.5.7.1 Business

9.5.7.2 Individual

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Mobile Phone Insurance Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Phone Type

9.6.4.1 Budget Phones

9.6.4.2 Mid & High-End Phones

9.6.4.3 Premium Smartphones

9.6.5 Historic and Forecasted Market Size by Coverage Type

9.6.5.1 Physical Damage

9.6.5.2 Internal Component Failure

9.6.5.3 Theft & Loss Protection

9.6.6 Historic and Forecasted Market Size by Sales Channel

9.6.6.1 Retail

9.6.6.2 Online

9.6.7 Historic and Forecasted Market Size by End users

9.6.7.1 Business

9.6.7.2 Individual

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Mobile Phone Insurance Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Phone Type

9.7.4.1 Budget Phones

9.7.4.2 Mid & High-End Phones

9.7.4.3 Premium Smartphones

9.7.5 Historic and Forecasted Market Size by Coverage Type

9.7.5.1 Physical Damage

9.7.5.2 Internal Component Failure

9.7.5.3 Theft & Loss Protection

9.7.6 Historic and Forecasted Market Size by Sales Channel

9.7.6.1 Retail

9.7.6.2 Online

9.7.7 Historic and Forecasted Market Size by End users

9.7.7.1 Business

9.7.7.2 Individual

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Mobile Phone Insurance Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1,43.99 Bn. |

|

Forecast Period 2024-32 CAGR: |

18.7% |

Market Size in 2032: |

USD 205.77 Bn. |

|

Segments Covered: |

By Phone Type |

|

|

|

By Coverage Type |

|

||

|

By Sales Channel |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||