Mobile Payment Technologies Market Synopsis

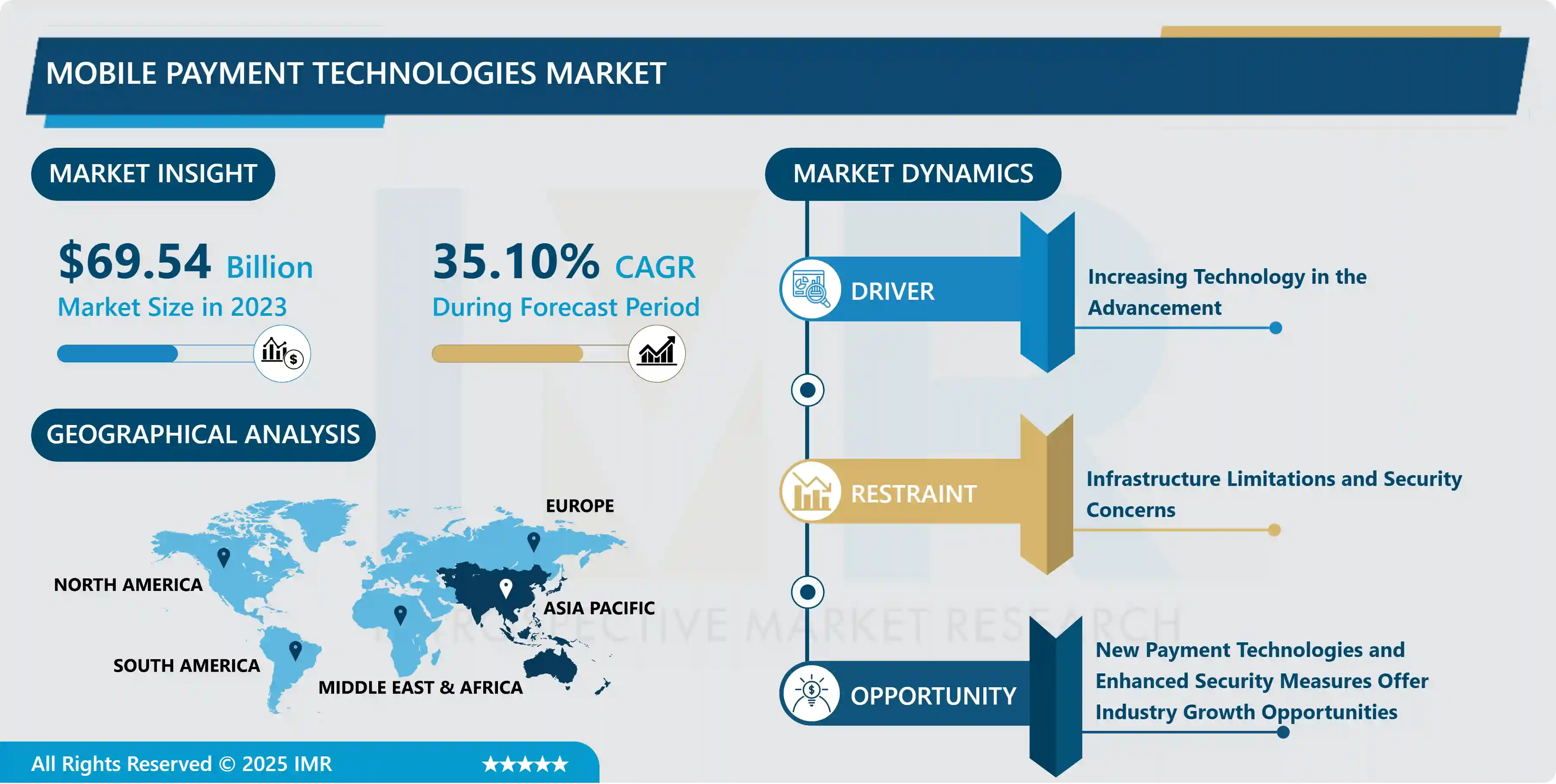

Mobile Payment Technologies Market Size Was Valued at USD 69.54 Billion in 2023 and is Projected to Reach USD 1048.63 Billion by 2032, Growing at a CAGR of 35.1% From 2024-2032.

According to the Mobile Payment Forum, mobile payments are transactions with a monetary value that are conducted through a mobile telecommunications network through diverse mobile user devices, such as cellular telephones, smartphones or PDAs, and mobile terminals. Mobile payment is a transfer of funds in return for goods or services in which a mobile device is functionally involved in executing and confirming payment. Doing financial transactions with mobile phones eliminates the need for auxiliary payment instruments (like POS devices) while using the security features of the SIM card (as a smart card) yields a great level of security and dependability. A mobile payment service comprises all technologies that are offered to the user as well as all tasks that the payment service provider(s) perform to commit payment transactions.

The International Finance Corporation of the World Bank Group has prepared mobile money scoping reports for a few countries in Asia and Africa. The reports assess the financial and telecom sectors and the policy and regulatory framework in place and evaluate existing mobile financial services to identify opportunities for support. In 2017, another focus group was created to discuss emerging questions about digital currency, especially digital fiat currency, like economic benefits, impact, interoperability, policy and regulation, and security and trust.38 The International Telecommunication Union also released a two-part Technology Watch report on mobile money in 2013 that focuses on NFC mobile payments and the financial inclusion aspect of such payments.

Mobile Payment Technologies Market Trend Analysis

Increasing Technological Advancement

- Consumer demand for quick and secure payment options is pushing the rise of contactless payments, especially through NFC and QR code methods. The trend has been sped up even more post-pandemic as individuals seek to limit in-person interactions. Mobile banking apps are now incorporating digital wallets to offer a comprehensive financial management platform with enhanced services.

- Facial recognition and fingerprint scanning are being adopted in mobile payment systems to enhance security and user convenience. Businesses are developing comprehensive payment ecosystems through a variety of methods and collaborations, improving user interaction and loyalty.

- Mobile wallets and payment platforms are incorporating digital currencies such as Bitcoin and Ethereum into their systems. The potential for improving payment security is being investigated through the exploration of blockchain technology. AI and machine learning are employed for detecting fraud and customizing payment experiences. The growing use of mobile payment solutions is playing a key role in improving financial inclusion in underserved regions of emerging markets such as Asia-Pacific, Latin America, and Africa, due to the rise in mobile penetration.

New Payment Technologies and Enhanced Security Measures Offer Industry Growth Opportunities

- Emerging payment technologies, such as biometric and voice-activated payments, provide chances for growth in the industry. Mobile payments can be combined with smart devices through the Internet of Things. Industry-specific implementations, such as in the fields of healthcare and education, have the potential to enhance effectiveness. The growth of digital content enables the use of mobile payment solutions for microtransactions.

- Using data analysis for tailored promotions can enhance customer satisfaction and trust. User experience can be improved by integrating seamlessly with POS systems and adhering to regulations like GDPR and PCI-DSS. Improvements in cross-border payments can be directed towards the worldwide e-commerce sector and customers from different countries.

- Utilizing digital wallets is essential for promoting financial inclusion among those without access to banking services. Combining mobile payments with microfinance can help people in underdeveloped areas. Forming alliances with banks, fintech firms, and technology providers can result in creative solutions and business growth.

Mobile Payment Technologies Market Segment Analysis:

The Mobile Payment Technologies Market is Segmented based on Payment Mode, Technology, Application, Security Type, Transaction Type, and End User.

By Technology, QR Code Segment Is Expected to Dominate the Market During the Forecast Period

- QR Code payments are utilized worldwide, notably in Asia, where users scan a code to conduct transactions. They are convenient, affordable, and can be used without any special equipment. QR codes have multiple uses, from different transactions to being able to enhance customer engagement by integrating with loyalty programs. QR codes are more appealing to small businesses due to their lower implementation costs compared to NFC technology. Both merchants and consumers find them attractive due to their simplicity and convenience.

- QR codes that utilize encryption and secure payment protocols provide increased security for transactions. Dynamic codes provide greater security in contrast to static codes. QR code payments in developing countries enhance financial inclusion by offering mobile payment options in areas with inadequate banking facilities, particularly in emerging markets.

- The rise in QR code usage is largely attributed to the quick rise of digital payments and the greater need for contactless choices amid the pandemic. Governments and financial institutions are also backing the use of QR code payments. Key players such as Alipay and WeChat Pay, as well as fintech startups, are putting resources into QR code solutions, incorporating them into different digital environments to promote broad acceptance and creativity.

By Application, Retail Segment Held the Largest Share

- Retailers control the mobile payment technologies market because of factors that are in line with the retail industry's requirements and current tendencies. Mobile payments are advantageous for high transaction volumes and small purchases due to their convenience. Incorporating loyalty programs improves customer satisfaction, while utilizing data from mobile payments enables personalized marketing and shopping experiences, leading to the prevalence of mobile payments in retail.

- Retailers have accepted NFC, QR codes, and mobile wallets for contactless payments to meet consumers' need for convenience. Mobile payments are a crucial component of omnichannel retailing, providing a smooth checkout process. After the pandemic, retailers are increasingly relying on contactless interactions, using technology to ensure fast and secure transactions at different stores.

- Retailers are using tokenization and biometric authentication to stop fraud and establish trust with consumers in mobile payments. Adherence to security regulations is essential when managing large transaction volumes. In countries such as China and India in Asia-Pacific, retailers are leading the way in embracing mobile payments through QR codes and mobile wallets. Emerging markets are using mobile payments to promote financial inclusion and access a broader customer demographic. The increase in contactless payments in retail has been driven by the COVID-19 pandemic, with mobile payments gaining popularity due to the growth of e-commerce. In general, mobile payment technologies are constantly changing the retail environment on a global scale.

Mobile Payment Technologies Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- China and India are at the forefront of utilizing mobile payments, experiencing swift expansion through the popular platforms Alipay, WeChat Pay, Paytm, Google Pay, and PhonePe. Countries in the Asia-Pacific region such as South Korea, Japan, and China have sophisticated telecommunications systems that enable smooth mobile payment transactions. The fintech ecosystem in the area is being advanced through NFC, QR codes, and blockchain, leading to a broad acceptance of mobile payment technologies.

- The sizeable population in nations such as China and India leads to a significant number of users of mobile payment technologies in the Asia-Pacific region. Government initiatives and regulations promoting digital payments are driving the quick adoption of new payment technologies by the tech-savvy younger population.

- In various regions of Asia-Pacific, there is a change in culture leaning towards digital payments instead of traditional methods because of convenience, security, and rewards. Super apps in China have incorporated mobile payments into a variety of services, increasing their popularity even more. The region saw a faster adoption of contactless payments during the COVID-19 pandemic as both consumers and businesses looked for safer ways to make transactions. This has further solidified the presence of mobile payments in the Asia-Pacific economy.

Mobile Payment Technologies Market Active Players

- Alipay (Ant Group) - (China)

- WeChat Pay (Tencent) - (China)

- PayPal Holdings, Inc. - (United States)

- Apple Pay (Apple Inc.) - (United States)

- Google Pay (Alphabet Inc.) - (United States)

- Samsung Pay (Samsung Electronics Co., Ltd.) - (South Korea)

- Visa Inc. - (United States)

- Mastercard Incorporated - (United States)

- Square, Inc. (Block, Inc.) - (United States)

- Paytm (One97 Communications) - (India)

- PhonePe (Walmart Inc.) - (India)

- Amazon Pay (Amazon.com, Inc.) - (United States)

- Stripe, Inc. - (United States)

- Rakuten Pay (Rakuten, Inc.) - (Japan)

- M-Pesa (Vodafone Group and Safaricom) - (United Kingdom/Kenya)

- Adyen N.V. - (Netherlands)

- Tencent Holdings Ltd. - (China)

- American Express Co. - (United States)

- Boku, Inc. - (United States)

- Kakao Pay (Kakao Corp.) - (South Korea)

- Barclays PLC (Barclays Mobile Banking) - (United Kingdom)

- Orange Money (Orange S.A.) - (France)

- Tencent Fintech - (China)

- Revolut Ltd. - (United Kingdom)

- Zelle (Early Warning Services, LLC) - (United States)

- Venmo (PayPal Holdings, Inc.) - (United States)

- BitPay, Inc. - (United States)

- Klarna Bank AB - (Sweden)

- Gojek (GoPay) - (Indonesia)

- Naver Pay (Naver Corporation) - (South Korea), and other Active Players.

Key Industry Developments in the Mobile Payment Technologies Market:

- In April 2023, Visa announced it's partnering with PayPal and Venmo to pilot Visa+. This innovative service aims to help individuals move money quickly and securely between different person-to-person (P2P) digital payment apps. Through this collaboration, Visa+ will expand its reach and enable more use cases, including gig, creator, and marketplace payouts. Participating digital wallets, neo-banks, and other payment apps reaching millions of US users will be able to enable interoperability through Visa.

Mobile Payment Technologies Market Scope:

|

Mobile Payment Technologies Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 69.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

35.1 % |

Market Size in 2032: |

USD 1048.63 Bn. |

|

Segments Covered: |

By Payment Mode |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Security Type |

|

||

|

By Transaction Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Mobile Payment Technologies Market by Payment Mode (2018-2032)

4.1 Mobile Payment Technologies Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Proximity Payments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Remote Payments

4.5 In-App Payments

Chapter 5: Mobile Payment Technologies Market by Technology (2018-2032)

5.1 Mobile Payment Technologies Market Snapshot and Growth Engine

5.2 Market Overview

5.3 NFC (Near Field Communication)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 QR Code

5.5 SMS Payments

5.6 SMS Payments

5.7 HCE (Host Card Emulation)

Chapter 6: Mobile Payment Technologies Market by Application (2018-2032)

6.1 Mobile Payment Technologies Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transportation

6.5 Healthcare

6.6 Hospitality

6.7 Utilities

Chapter 7: Mobile Payment Technologies Market by Security Type (2018-2032)

7.1 Mobile Payment Technologies Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Biometric Authentication

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 PIN-Based Authentication

7.5 Tokenization

Chapter 8: Mobile Payment Technologies Market by Transaction Type (2018-2032)

8.1 Mobile Payment Technologies Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Person-to-Person (P2P)

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Person-to-Merchant (P2M)

8.5 Business-to-Business (B2B)

Chapter 9: Mobile Payment Technologies Market by End User (2018-2032)

9.1 Mobile Payment Technologies Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Consumer

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Merchant

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Mobile Payment Technologies Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 ALIPAY (ANT GROUP) - (CHINA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 WECHAT PAY (TENCENT) - (CHINA)

10.4 PAYPAL HOLDINGS INC. - (UNITED STATES)

10.5 APPLE PAY (APPLE INC.) - (UNITED STATES)

10.6 GOOGLE PAY (ALPHABET INC.) - (UNITED STATES)

10.7 SAMSUNG PAY (SAMSUNG ELECTRONICS COLTD.) - (SOUTH KOREA)

10.8 VISA INC. - (UNITED STATES)

10.9 MASTERCARD INCORPORATED - (UNITED STATES)

10.10 SQUARE INC. (BLOCK INC.) - (UNITED STATES)

10.11 PAYTM (ONE97 COMMUNICATIONS) - (INDIA)

10.12 PHONEPE (WALMART INC.) - (INDIA)

10.13 AMAZON PAY (AMAZON.COM INC.) - (UNITED STATES)

10.14 STRIPE INC. - (UNITED STATES)

10.15 RAKUTEN PAY (RAKUTEN INC.) - (JAPAN)

10.16 M-PESA (VODAFONE GROUP AND SAFARICOM) - (UNITED KINGDOM/KENYA)

10.17 ADYEN N.V. - (NETHERLANDS)

10.18 TENCENT HOLDINGS LTD. - (CHINA)

10.19 AMERICAN EXPRESS CO. - (UNITED STATES)

10.20 BOKU INC. - (UNITED STATES)

10.21 KAKAO PAY (KAKAO CORP.) - (SOUTH KOREA)

10.22 BARCLAYS PLC (BARCLAYS MOBILE BANKING) - (UNITED KINGDOM)

10.23 ORANGE MONEY (ORANGE S.A.) - (FRANCE)

10.24 TENCENT FINTECH - (CHINA)

10.25 REVOLUT LTD. - (UNITED KINGDOM)

10.26 ZELLE (EARLY WARNING SERVICES

10.27 LLC) - (UNITED STATES)

10.28 VENMO (PAYPAL HOLDINGS INC.) - (UNITED STATES)

10.29 BITPAY INC. - (UNITED STATES)

10.30 KLARNA BANK AB - (SWEDEN)

10.31 GOJEK (GOPAY) - (INDONESIA)

10.32 NAVER PAY (NAVER CORPORATION) - (SOUTH KOREA)

10.33 AND

Chapter 11: Global Mobile Payment Technologies Market By Region

11.1 Overview

11.2. North America Mobile Payment Technologies Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Payment Mode

11.2.4.1 Proximity Payments

11.2.4.2 Remote Payments

11.2.4.3 In-App Payments

11.2.5 Historic and Forecasted Market Size by Technology

11.2.5.1 NFC (Near Field Communication)

11.2.5.2 QR Code

11.2.5.3 SMS Payments

11.2.5.4 SMS Payments

11.2.5.5 HCE (Host Card Emulation)

11.2.6 Historic and Forecasted Market Size by Application

11.2.6.1 Retail

11.2.6.2 Transportation

11.2.6.3 Healthcare

11.2.6.4 Hospitality

11.2.6.5 Utilities

11.2.7 Historic and Forecasted Market Size by Security Type

11.2.7.1 Biometric Authentication

11.2.7.2 PIN-Based Authentication

11.2.7.3 Tokenization

11.2.8 Historic and Forecasted Market Size by Transaction Type

11.2.8.1 Person-to-Person (P2P)

11.2.8.2 Person-to-Merchant (P2M)

11.2.8.3 Business-to-Business (B2B)

11.2.9 Historic and Forecasted Market Size by End User

11.2.9.1 Consumer

11.2.9.2 Merchant

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Mobile Payment Technologies Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Payment Mode

11.3.4.1 Proximity Payments

11.3.4.2 Remote Payments

11.3.4.3 In-App Payments

11.3.5 Historic and Forecasted Market Size by Technology

11.3.5.1 NFC (Near Field Communication)

11.3.5.2 QR Code

11.3.5.3 SMS Payments

11.3.5.4 SMS Payments

11.3.5.5 HCE (Host Card Emulation)

11.3.6 Historic and Forecasted Market Size by Application

11.3.6.1 Retail

11.3.6.2 Transportation

11.3.6.3 Healthcare

11.3.6.4 Hospitality

11.3.6.5 Utilities

11.3.7 Historic and Forecasted Market Size by Security Type

11.3.7.1 Biometric Authentication

11.3.7.2 PIN-Based Authentication

11.3.7.3 Tokenization

11.3.8 Historic and Forecasted Market Size by Transaction Type

11.3.8.1 Person-to-Person (P2P)

11.3.8.2 Person-to-Merchant (P2M)

11.3.8.3 Business-to-Business (B2B)

11.3.9 Historic and Forecasted Market Size by End User

11.3.9.1 Consumer

11.3.9.2 Merchant

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Mobile Payment Technologies Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Payment Mode

11.4.4.1 Proximity Payments

11.4.4.2 Remote Payments

11.4.4.3 In-App Payments

11.4.5 Historic and Forecasted Market Size by Technology

11.4.5.1 NFC (Near Field Communication)

11.4.5.2 QR Code

11.4.5.3 SMS Payments

11.4.5.4 SMS Payments

11.4.5.5 HCE (Host Card Emulation)

11.4.6 Historic and Forecasted Market Size by Application

11.4.6.1 Retail

11.4.6.2 Transportation

11.4.6.3 Healthcare

11.4.6.4 Hospitality

11.4.6.5 Utilities

11.4.7 Historic and Forecasted Market Size by Security Type

11.4.7.1 Biometric Authentication

11.4.7.2 PIN-Based Authentication

11.4.7.3 Tokenization

11.4.8 Historic and Forecasted Market Size by Transaction Type

11.4.8.1 Person-to-Person (P2P)

11.4.8.2 Person-to-Merchant (P2M)

11.4.8.3 Business-to-Business (B2B)

11.4.9 Historic and Forecasted Market Size by End User

11.4.9.1 Consumer

11.4.9.2 Merchant

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Mobile Payment Technologies Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Payment Mode

11.5.4.1 Proximity Payments

11.5.4.2 Remote Payments

11.5.4.3 In-App Payments

11.5.5 Historic and Forecasted Market Size by Technology

11.5.5.1 NFC (Near Field Communication)

11.5.5.2 QR Code

11.5.5.3 SMS Payments

11.5.5.4 SMS Payments

11.5.5.5 HCE (Host Card Emulation)

11.5.6 Historic and Forecasted Market Size by Application

11.5.6.1 Retail

11.5.6.2 Transportation

11.5.6.3 Healthcare

11.5.6.4 Hospitality

11.5.6.5 Utilities

11.5.7 Historic and Forecasted Market Size by Security Type

11.5.7.1 Biometric Authentication

11.5.7.2 PIN-Based Authentication

11.5.7.3 Tokenization

11.5.8 Historic and Forecasted Market Size by Transaction Type

11.5.8.1 Person-to-Person (P2P)

11.5.8.2 Person-to-Merchant (P2M)

11.5.8.3 Business-to-Business (B2B)

11.5.9 Historic and Forecasted Market Size by End User

11.5.9.1 Consumer

11.5.9.2 Merchant

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Mobile Payment Technologies Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Payment Mode

11.6.4.1 Proximity Payments

11.6.4.2 Remote Payments

11.6.4.3 In-App Payments

11.6.5 Historic and Forecasted Market Size by Technology

11.6.5.1 NFC (Near Field Communication)

11.6.5.2 QR Code

11.6.5.3 SMS Payments

11.6.5.4 SMS Payments

11.6.5.5 HCE (Host Card Emulation)

11.6.6 Historic and Forecasted Market Size by Application

11.6.6.1 Retail

11.6.6.2 Transportation

11.6.6.3 Healthcare

11.6.6.4 Hospitality

11.6.6.5 Utilities

11.6.7 Historic and Forecasted Market Size by Security Type

11.6.7.1 Biometric Authentication

11.6.7.2 PIN-Based Authentication

11.6.7.3 Tokenization

11.6.8 Historic and Forecasted Market Size by Transaction Type

11.6.8.1 Person-to-Person (P2P)

11.6.8.2 Person-to-Merchant (P2M)

11.6.8.3 Business-to-Business (B2B)

11.6.9 Historic and Forecasted Market Size by End User

11.6.9.1 Consumer

11.6.9.2 Merchant

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Mobile Payment Technologies Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Payment Mode

11.7.4.1 Proximity Payments

11.7.4.2 Remote Payments

11.7.4.3 In-App Payments

11.7.5 Historic and Forecasted Market Size by Technology

11.7.5.1 NFC (Near Field Communication)

11.7.5.2 QR Code

11.7.5.3 SMS Payments

11.7.5.4 SMS Payments

11.7.5.5 HCE (Host Card Emulation)

11.7.6 Historic and Forecasted Market Size by Application

11.7.6.1 Retail

11.7.6.2 Transportation

11.7.6.3 Healthcare

11.7.6.4 Hospitality

11.7.6.5 Utilities

11.7.7 Historic and Forecasted Market Size by Security Type

11.7.7.1 Biometric Authentication

11.7.7.2 PIN-Based Authentication

11.7.7.3 Tokenization

11.7.8 Historic and Forecasted Market Size by Transaction Type

11.7.8.1 Person-to-Person (P2P)

11.7.8.2 Person-to-Merchant (P2M)

11.7.8.3 Business-to-Business (B2B)

11.7.9 Historic and Forecasted Market Size by End User

11.7.9.1 Consumer

11.7.9.2 Merchant

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Mobile Payment Technologies Market Scope:

|

Mobile Payment Technologies Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 69.54 Bn. |

|

Forecast Period 2024-32 CAGR: |

35.1 % |

Market Size in 2032: |

USD 1048.63 Bn. |

|

Segments Covered: |

By Payment Mode |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Security Type |

|

||

|

By Transaction Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||