Milk Packaging Market Synopsis

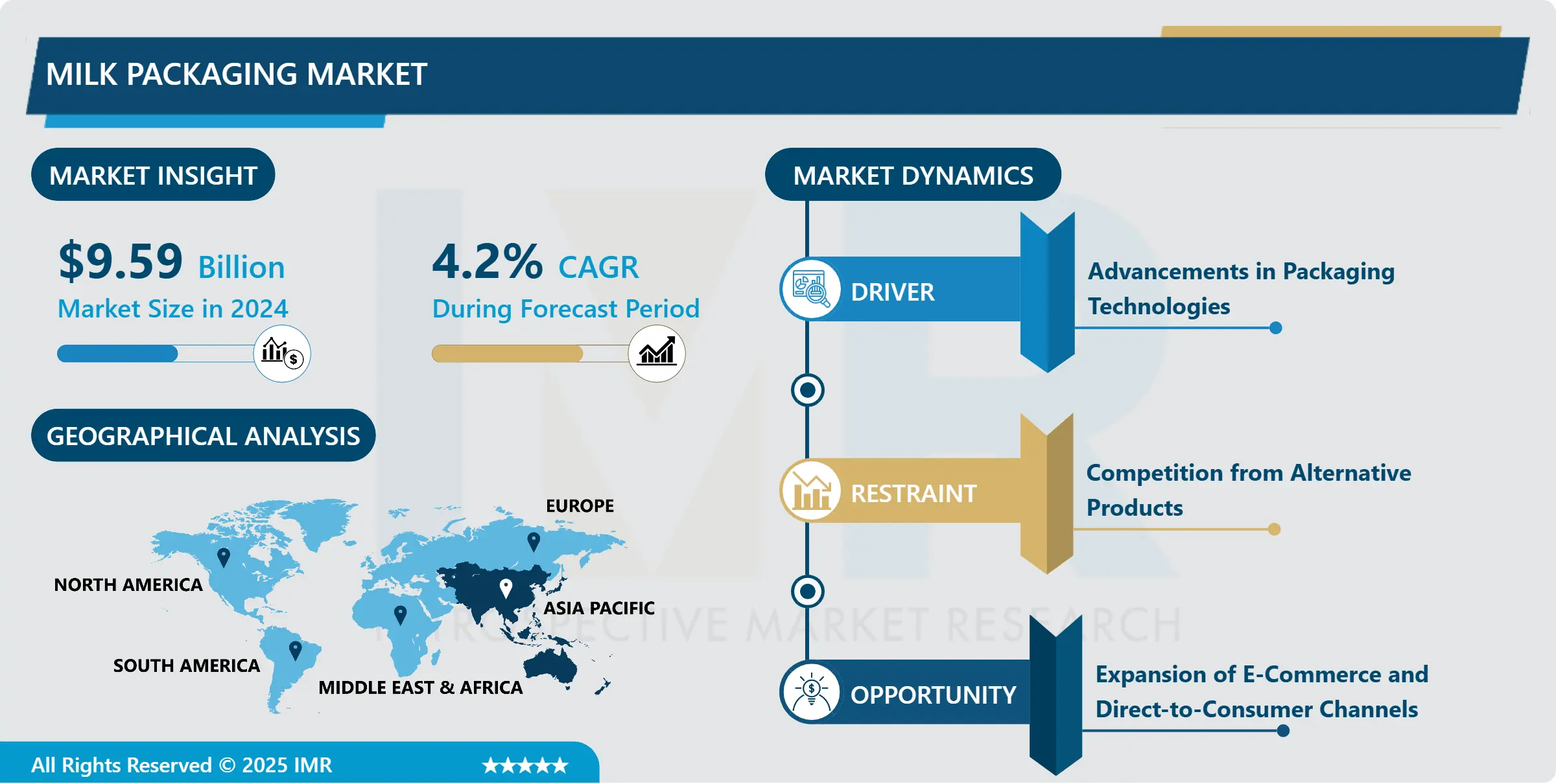

Milk Packaging Market Size Was Valued at USD 9.59 Billion in 2024, and is Projected to Reach USD 15.08 Billion by 2035, Growing at a CAGR of 4.2% From 2025-2035.

Milk packaging can therefore be defined as placing of milk into some sort of protective covering to prevent it from being contaminated, to preserve the shelf life of the milk, and to enable it to be transported safely. Some of the most prevalent choices for milk packaging are plastic, paperboard, and glass and its forms are cartons, bottles, and pouches. The packaging system is invented to ensure that the quality and freshness of milk are maintained with an added advantage to the consumer.

The Mandatory milk packaging market is growing dramatically because of the growing demand for dairy products all over the world, awareness of food hygiene and innovation in packaging. Interview With The Right Person: Packaging has a great role to play in maintaining the quality, freshness and nutritional adequacy of the most perishable commodity known to man, milk. On the basis of the type of packaging, the market can be divided into cartons, bottles, pouches, cans, and others; the cartons and bottles formats are popular in the global market. Carton structures including Tetra Pak cartons make the best choices based on the light weight, the relatively cheap cost and being environmentally friendly; Enhanced shelf life and reduced vulnerability to impurities. Glass bottles are also used frequently for the same reasons as the HDPE and PET bottles and even more so in the developed markets. Pouches used while not as prevalent in developed markets as emerging markets, enjoy the benefits of lower production cost and lesser material consumption hence are on the rise. In addition, they are using environmentally senitive materials including biodegradable or recyclable products, meeting the seemingly endless demands from consumers.

Technological advancements are also stimulating growth in the market through smart packaging solutions including the use of seal indicators, traceability through bar codes, and increased shelf life solutions. Regarding barrier properties, food packaging manufacturers of milk packaging are more and more concentrating on the barrier properties so as to provide a better oxygen and light barrier to prevent the spoilage and degradative changes in milk for an extended period. One of the innovation that have taken place is the development of aseptic packaging that enables raw milk to be sold at room temperature for a longer period without having to undergo processing and then being refrigerated during transportation. The market in geographical growth: While analyzing the geographical factors for the market growth, it has been observed that Asia Pacific region will have higher growth rate due to higher consumption of milk and more populated region with increased rate of urbanization. India and china are some of the dominating countries since they consist of bulky population who source milk and dairy products as their staple foods. North America and Europe also includes significant market due to increasing demand for good quality dairy products and well developed packaging system.

Although, the market has some setbacks which the following are discussed below. This is because cost of materials continues to increase and the problem of plastic waste continues to deteriorate the environment. This anticipation stems from the fact that plastic consumption has been on the decline while recyclable or biodegradable packaging materials are on the rise within the industry. By implementing legislation that seeks to control emission of carbon and reducing wastes especially in the European hemisphere, firms are now encouraging the use of paper based packages or those that can be recycled easily. Furthermore, specialty milks, flavored and fortified milk products are also a new trend affecting the packaging of milk, as milk brands incorporate more attractive, convenient and informative packaging that will be more appealing to customers who prefer to consume the milk on the go.

The milk packaging market is, therefore, shifting due to new trends, technologies, and consumer dynamics in maturity. The key areas of focus are innovative materials for packaging, new features for shelf life of milk and sustainable approaches, so the companies involved can dominate the market for a growing global product milk. The market in its progression, especially in the developing world, is expected to present innovation in smart and sustainable packaging in the future.

Milk Packaging Market Trend Analysis

Sustainable and Eco-Friendly Packaging Solutions

- The market of milk packaging is becoming increasingly greener due to increased awareness of consumers about the environmental impact as well as regulation pressures. Innovations around packaging materials, including biodegradable films, plant-based plastics, and recyclable cartons, are gaining acceptance. Firms are in quest of non-traditional plastic with derived materials from renewable resources, which not only reduce carbon footprints but also improve the overall sustainability of milk products. For instance, the brands are investing in packs made from post-consumer recycled material, thus reducing waste and establishing a circular economy. Such is not driven only by the pressure of a greener choice from consumers but also by cost savings in material sourcing and waste management.

- Beyond the material, sustainable packaging in milk is sometimes seen to go beyond material use. Companies adopt the concept of eco-design and opt for light packaging weights and shapes for their maximum transportation. This leads to lesser emissions in the greenhouse effect at the distribution level. Shelf-life extension, the paramount benefit of eco-coating and barrier technology, is another good impact of the integration of technology advancement. Loss and waste, as a result of spoilage, are

- reduced through them. Given the growing importance that retailers and consumers attach to sustainability, investments by milk producers in more environmentally friendly packaging both help the latter improve their position in the market and positively contribute to the conserved environment, ultimately contributing to more sustainable food supply chains.

Expansion of E-Commerce and Direct-to-Consumer Channels

- E-commerce and DTC channels have significantly altered the distribution pattern in the milk packaging market by enabling brands to bypass intermediaries and communicate and distribute their products directly to consumers. E-commerce is increasingly taking over, with companies investing more in e-commerce platforms and linear supply chains to reach consumers' backdoors. This, in turn, not only offers convenience to the customers but also enables brands to fetch crucial data on the pattern of preferences and buying behaviour of the consumers. Moreover, e-commerce channels offer scope to smaller, niche brands to compete against massive players with specialized products, such as organic or lactose-free milk, catering to changing demands of the consumer.

- In addition, with the proliferation of DTC channels, innovations are taking place in the packaging of the milk to ensure both product quality and sustainability. Companies have been trying to produce packaging solutions that will maintain freshness while reducing environmental issues. For instance, it has been discovered that lightweight and recyclable materials are currently in demand to coincide with the consumer's change to adopting sustainable practices. Organizations have incorporated additional packaging designs that have a feature of tamper-proof with user-friendly pour spouts to enhance the user experience and incorporate safety. It will be companies offering innovative and more sustainable packaging solutions for milk where they will have a fighting chance in the marketplace.

Milk Packaging Market Segment Analysis:

Milk Packaging Market Segmented based on Type, Material, and End User.

By Type, Pouch segment is expected to dominate the market during the forecast period

- Milk packaging market is the highly diverse and, as mentioned above, the major segments of milk packaging are the cans, bottles, pouches, and any other formats, which, in turn, meet the needs of its consumers. They are being preferred over plastic cans as the material is lightweight and recyclable and the cans have a relatively long shelf life. Bottles, especially the plastic and glass ones, have a very high market share because they’re easy to carry around, and many people perceive them to be of higher quality than other types of containers due to improvements in design, etc. Current popular formats include pouches that provide convenience, especially to consumers who are always on the move. Each type of packaging has its salience that meets different markets’ needs thus exerting pressure on packaging innovation and development.

- A shifting trend toward green or environmental conscious packaging is having a major impact on changes in the milk packaging market. The packaging segment is already gearing up to use material and having sustainable designs for the products since the environmental responsibility is a top concern, especially in bottles & pouches. Further, technology developments like the barrier coatings for packs and smart packaging solutions are improving product protection and safety and subsequently increasing shelf life. This is due to a growing consumer awareness on sustainable packaging resulting in packaging choices are anticipated to change and drive the market towards sustainable packaging. Bakery packaging type competition still influences milk packaging, as developments arise based on new consumer needs and global regulatory requirements.

By Material , Plastic segment held the largest share in 2024

- The Milk Packaging Market is under the unique influence of the materials such as glass, paper and paperboard, plastic, and others in which they all are contributing in different ways. One of the key features of glass packaging is the ability to maintain hygiene and quality of milk; another advantage – is the peculiar sensation. Not only this, it is recyclable and this quality will definitely win the hearts of the new generation buyers who are more conscious about the environment. But glass is heavier and more brittle than plastic; additional transportation costs may be incurred, and the use of glass can restrict certain markets. Each type is lightweight, easily printable and can serve branding needs especially when used to make cartons from paper and paperboards. They are also seen as being more sustainable than plastic, responding to the market need for ecological packaging materials.

- Plastic is thus the most utilized raw material in the milk packaging industry because of its flexibility and strength and relatively cheap in the market. Milk jugs and pouches are the examples of HDPE and LDPE products that offer consumers a number of conveniences and lightweight solutions. However, growing awareness of the environmental impact of plastic waste in recent years has created pressure for using other materials and recycling technologies in the production lines. Other materials like bioplastic and composites are developing as possible substitutes that create more sustainability and he needed property of protection milk product. The market dynamics are also therefore showing signs that they are moving to more sustainable practices due to the market itself, customer and regulatory requirements.

Milk Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The milk packaging industry in Asia pacific is expected to hold the highest growth rate during the forecast timeframe due to rising production of milk, enhancing consumer demand for packed milk products, and the increasing population’s urbanization. Over the last few years, countries like India and china have shifted their diets more towards diary products due to the increase in the middle class consumers. Continued consumer demand for easy to drink milk products has also urged manufacturers to come up with improved packaging hitherto observed in e.g. aseptic carton and flexible pouch. Additionally, factors like policies formulated by the government in order to enhance dairy farming and better supply chain of milk are aiding the growth of the market in the region.

- Besides the supply and demand factors the Asia Pacific milk packaging market also has growth factors such as technology and sustainability. Eco-friendly packaging materials have thus become the primary choice of manufacturers in their efforts to meet the market’s green trend. Sustainability solutions include biodegradable and recyclable solutions that are emerging to provide brands with differentiation. In addition, the growth of modern retail outlets such as electronics trading, cash and carry, supermarkets and hyper markets, has also contributed in improving the distribution of the packed milk products. Therefore, the demand for milk packaging, growth in technologies, and reformation towards sustainability make the Asia Pacific region significant for the milk packaging market over the forecast period.

Active Key Players in the Milk Packaging Market

- Amcor Limited (Australia)

- Indevco (Lebanon)

- Evergreen Packaging (USA)

- Stanpac Inc. (Canada)

- Elopak AS (Norway)

- Ball Corporation (USA)

- Graham Packaging Company Inc (USA)

- SF Holdings Group Inc. (China)

- RPC Group Plc (United Kingdom)

- Blue Ridge Paper Products (USA)

- Crown Holdings (USA)

- CkS Packaging (USA)

- Others Key Player

Key Industry Developments in the Milk Packaging Market

- May 2023: Elopak released a new film that examines the role of beverage cartons in ensuring a more sustainable future for the packaging sector. The film was created for Elopak as part of a Food for Thought series sponsored by FoodDrinkEurope and produced by BBC Storyworks Commercial Productions. The program focuses on environmentally friendly developments in the food and beverage sector that provide novel approaches to feeding future generations.

- April 2023: The Walt Disney Company and Tetra Pak are collaborating to bring Disney and MARVEL's enchantment to popular milk drink categories. In Switzerland, the Qualité & Prix brand of Coop's ambient white milk, fresh white milk, flavored milk, and protein drinks in beverage cartons will include eighty Disney and MARVEL-inspired graphics.

- May 2022: Elopak announced the market launch of the Pure-Pak eSense carton, a more ecologically friendly aseptic carton produced without an aluminum layer. The Pure-Pak eSense carton is manufactured with a polyolefin mix barrier rather than aluminum and was created utilizing technology from Fresh Portfolio and conventional environmentally produced paperboard. Due to this, the carbon footprint is up to 50% lower, and the aseptic carton is more fully recyclable than a typical Pure-Pak carton.

|

Global Milk Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 9.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.2% |

Market Size in 2035: |

USD 15.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Milk Packaging Market by Type (2018-2035)

4.1 Milk Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Can

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bottle

4.5 Pouch

4.6 Others

Chapter 5: Milk Packaging Market by Material (2018-2035)

5.1 Milk Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Glass

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Paper & Paper board

5.5 Plastic

5.6 Others

Chapter 6: Milk Packaging Market by End User (2018-2035)

6.1 Milk Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Butter

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Frozen Product

6.5 Milk

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Milk Packaging Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMCOR LIMITED (AUSTRALIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INDEVCO (LEBANON)

7.4 EVERGREEN PACKAGING (USA)

7.5 STANPAC INC. (CANADA)

7.6 ELOPAK AS (NORWAY)

7.7 BALL CORPORATION (USA)

7.8 GRAHAM PACKAGING COMPANY INC (USA)

7.9 SF HOLDINGS GROUP INC. (CHINA)

7.10 RPC GROUP PLC (UNITED KINGDOM)

7.11 BLUE RIDGE PAPER PRODUCTS (USA)

7.12 CROWN HOLDINGS (USA)

7.13 CKS PACKAGING (USA)

7.14 OTHERS KEY PLAYER

Chapter 8: Global Milk Packaging Market By Region

8.1 Overview

8.2. North America Milk Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Can

8.2.4.2 Bottle

8.2.4.3 Pouch

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Glass

8.2.5.2 Paper & Paper board

8.2.5.3 Plastic

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Butter

8.2.6.2 Frozen Product

8.2.6.3 Milk

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Milk Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Can

8.3.4.2 Bottle

8.3.4.3 Pouch

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Glass

8.3.5.2 Paper & Paper board

8.3.5.3 Plastic

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Butter

8.3.6.2 Frozen Product

8.3.6.3 Milk

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Milk Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Can

8.4.4.2 Bottle

8.4.4.3 Pouch

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Glass

8.4.5.2 Paper & Paper board

8.4.5.3 Plastic

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Butter

8.4.6.2 Frozen Product

8.4.6.3 Milk

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Milk Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Can

8.5.4.2 Bottle

8.5.4.3 Pouch

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Glass

8.5.5.2 Paper & Paper board

8.5.5.3 Plastic

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Butter

8.5.6.2 Frozen Product

8.5.6.3 Milk

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Milk Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Can

8.6.4.2 Bottle

8.6.4.3 Pouch

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Glass

8.6.5.2 Paper & Paper board

8.6.5.3 Plastic

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Butter

8.6.6.2 Frozen Product

8.6.6.3 Milk

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Milk Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Can

8.7.4.2 Bottle

8.7.4.3 Pouch

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Glass

8.7.5.2 Paper & Paper board

8.7.5.3 Plastic

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Butter

8.7.6.2 Frozen Product

8.7.6.3 Milk

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Milk Packaging Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 9.59 Bn. |

|

Forecast Period 2025-35 CAGR: |

4.2% |

Market Size in 2035: |

USD 15.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||