Micromachining Market Synopsis

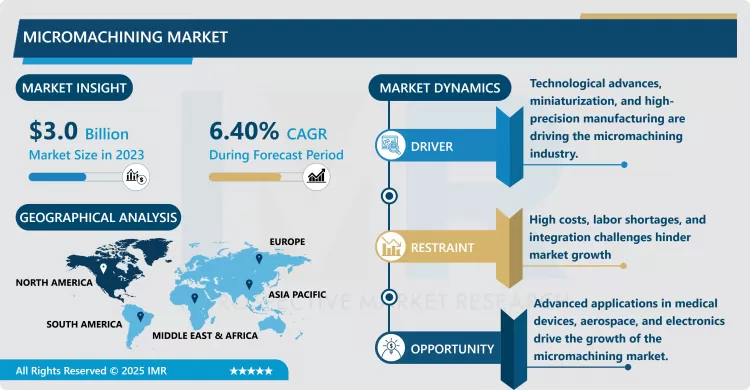

Micromachining Market Size Was Valued at USD 3.0 Billion in 2023, and is Projected to Reach USD 5.3 Billion by 2032, Growing at a CAGR of 6.40% from 2024-2032.

Micromaching is a relatively new subfield of manufacturing engineering that deals with operations that deal with materials on a microscopic scale. This process employs high-projection equipment’s like lasers, EDM and FIBs to provide micro patterns and shapes on different materials with close to micrometres thickness. Micromachining is widely used across the electronics industries, medical devices, aerospace industries, automotive, and microelectronics industries because it enables the manufacturer to produce highly precise and small components for intricate use.

The market is witnessing great demand due to the penetration of high density in electronic devices and circuits including semiconductors, micro sensors and micro actuators. Technological inventions such as 3D printing, advanced lasers and nanotechnology have fostered more effective as well as accurate micromachining technologies fuelling this market’s growth. Also, applications in the medical device sector enrich from micromachining services since such a level of detail is required in the production of parts used in implantation, surgical tools, and diagnostic tools.

Region wise, Asia pacific dominates the micromachining market followed by America at present due to its manufacturing strength in china, Japan and South Korea. These regions include areas that have electronics production and automobile industries both of which require precision micromachining. North America and Europe are the other key markets due to their buoyant industrial needs for equipment that integrates mechanics systems with high-accuracy elements such as aerospace and medical device industries. Continuous development of micromachining technologies is driven by advancements in precision engineering and a rise in more and diverse applications in global market.

Micromachining Market Trend Analysis:

Increased Adoption of Laser-Based Micromachining

- Of the laser micro-machining techniques, the technique has rapidly grown in the market, mainly because it is versatile and the ability to machine various materials, such as metals, plastics, ceramics, and composites. Femtosecond and picosecond lasers are exact technologies as that exactness is critical for producing increasingly smaller parts for electronics, medical devices, and aerospace, among others. Another aspect influencing the trend towards laser-based micromachining is the contactless nature of the process which means that there is little material deformation and wear – a significant advantage in the field of production with high demand for precision and speed.

Integration of AI and Automation in Micromachining Processes

- Another rising trend is what is in the micromachining processes where the use of artificial intelligence (AI) and automation is becoming popular for smarter manufacturing processes. In cutting path, maintenance of micromachining operations, the AI-powered systems are applied to solve and enhance the entire operations with great efficiency. Moreover, automated systems can perform complex tasks with very little human interaction hence there is a guarantee of high accuracy which is very important for industries that need very close tolerances. This trend is hoped to extent the effeciency of the micromachining even further as well as bringing down the overall expenses.

Micromachining Market Segment Analysis:

Micromachining Market is Segmented based on type, process, axis, end use industry, and region

By Type, Traditional segment is expected to dominate the market during the forecast period

- There is micro-level division of micromachining market on the basis of type into Traditional, Non-traditional and Hybrid. Conventional micromachining methods include milling and turning that permit high accuracy in machining of material to micro scale, but they are inefficient for complex shapes or hard materials. Other techniques of micromachining are laser ablation, EDM and AWJC which are widely accepted because they offer solution to processing of hard and brittle materials without using much mechanical force. Micromachining with the aid of traditional/nontraditional methods results in flexible manufacturing functionality to provide optimum production of micro components requirements of advanced sectors like electronics automotive and medical devices. Such a segmentation provides a broad range of opportunities for achieving precision manufacturing and development and is in the process of refinement as new technologies are created.

By End Use Industry, Automotive segment expected to held the largest share

- Micromachining’s area of application means that the end-use industrial segment has different requirements of miniature and precision. Within the Auto industry, micromachining has its application within manufacturing areas such as in sensors and fuel injectors since precision is a virtue. The manufacture of her small electronic entities requiring micromachining which it uses in call the semiconductors/ electronics industry to manufacture the tiny pieces of electronic equipment like the microchips and the circuit boards to meet the increased demands of size and efficiency. Micromachining is essential in aerospace and defense industries to manufacture light weight high performance part like the turbine blades and connectors. In healthcare industry, micromachining applies in applications such as precision in medical devices and implants, miniature instruments and tools used in surgeries. Telecommunications reduce their dependence on conventional machining through their application of micromachining in the manufacture of small parts utilized in sophisticated communication systems. In power and energy, new products such as turbines and generators rely on micromachining to make high precision parts while plastics and polymers sectors also use micromachining for intricate molding and fabrication. It is in these sectors and others that the increasing requirement for better micromachining technologies is being realized as companies demand increasingly miniature, yet high precision, components.

Micromachining Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- There is a growing focus of key players such as Boeing, Airbus, Ford, and GE in adopting advanced technologies including micromachining and therefore North America is expected to lead the market during the given time period. The above-discussed region has few vendors who are prominent players in the field of micromachining; laser-based and automatic micromachining solutions are widely used in products that are seen in various applications. Further, continuous research and development activities, and large number of investments to smart manufacturing technologies are the factors which are fueling the growth of the market. A wide spread industrial base and the technological drift towards miniaturization of electronics also bolster North America’s lead in the market.

Active Key Players in the Micromachining Market

- Amada Co. Ltd. (Japan)

- Coherent Inc. (USA)

- Mks Instruments Inc. (USA)

- Georg Fischer AG (Switzerland)

- Han’s Laser Technology Industry Group Co. Ltd. (China)

- IPG Photonics Corporation (USA)

- Makino Milling Machine Co. Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd (Japan)

- OpTek Systems (Safety Technology Holdings Inc.) (UK)

- Oxford Lasers Limited (UK), and Others Active Players.

Key Industry Development in the Micromachining Market

- In October 2024, UNITED GRINDING Group announced its agreement to acquire GF Machining Solutions Division from Georg Fischer AG for CHF 630–650 million. Expected to close in the first half of 2025, this acquisition aimed to enhance UNITED GRINDING's global leadership in ultra-precision machining by integrating GFMS's expertise and expanding advanced solutions for diverse customer needs.

- In April 2023, Mitsubishi Electric India CNC partnered with SolidCAM, a global CAM software leader, at CNC eXPerience Park, Bengaluru. This collaboration aimed to deliver advanced CNC solutions with Digital Twin Technology and CAD/CAM integration, enhancing productivity, reducing costs, and offering cutting-edge training methods for industries like Die & Mold, Medical, and Aerospace.

|

Micromachining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40% |

Market Size in 2032: |

USD 5.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

Process |

|

||

|

Axis |

|

||

|

End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Micromachining Market by Type (2018-2032)

4.1 Micromachining Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Traditional

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-traditional

4.5 Hybrid

4.6 Process

4.7 Additive

4.8 Subtractive

4.9 Others

Chapter 5: Micromachining Market by Axis (2018-2032)

5.1 Micromachining Market Snapshot and Growth Engine

5.2 Market Overview

5.3 3-axis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 4-axis

5.5 5-axis

Chapter 6: Micromachining Market by End Use Industry (2018-2032)

6.1 Micromachining Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Semiconductors and Electronics

6.5 Aerospace and Defense

6.6 Healthcare

6.7 Telecommunications

6.8 Power and Energy

6.9 Plastics and Polymers

6.10 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Micromachining Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMADA CO. LTD. (JAPAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 COHERENT INC. (USA)

7.4 MKS INSTRUMENTS INC. (USA)

7.5 GEORG FISCHER AG (SWITZERLAND)

7.6 HAN’S LASER TECHNOLOGY INDUSTRY GROUP CO. LTD. (CHINA)

7.7 IPG PHOTONICS CORPORATION (USA)

7.8 MAKINO MILLING MACHINE CO. LTD. (JAPAN)

7.9 MITSUBISHI HEAVY INDUSTRIES LTD (JAPAN)

7.10 OPTEK SYSTEMS (SAFETY TECHNOLOGY HOLDINGS INC.) (UK)

7.11 OXFORD LASERS LIMITED (UK)

7.12 OTHER ACTIVE PLAYERS.

Chapter 8: Global Micromachining Market By Region

8.1 Overview

8.2. North America Micromachining Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Traditional

8.2.4.2 Non-traditional

8.2.4.3 Hybrid

8.2.4.4 Process

8.2.4.5 Additive

8.2.4.6 Subtractive

8.2.4.7 Others

8.2.5 Historic and Forecasted Market Size By Axis

8.2.5.1 3-axis

8.2.5.2 4-axis

8.2.5.3 5-axis

8.2.6 Historic and Forecasted Market Size By End Use Industry

8.2.6.1 Automotive

8.2.6.2 Semiconductors and Electronics

8.2.6.3 Aerospace and Defense

8.2.6.4 Healthcare

8.2.6.5 Telecommunications

8.2.6.6 Power and Energy

8.2.6.7 Plastics and Polymers

8.2.6.8 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Micromachining Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Traditional

8.3.4.2 Non-traditional

8.3.4.3 Hybrid

8.3.4.4 Process

8.3.4.5 Additive

8.3.4.6 Subtractive

8.3.4.7 Others

8.3.5 Historic and Forecasted Market Size By Axis

8.3.5.1 3-axis

8.3.5.2 4-axis

8.3.5.3 5-axis

8.3.6 Historic and Forecasted Market Size By End Use Industry

8.3.6.1 Automotive

8.3.6.2 Semiconductors and Electronics

8.3.6.3 Aerospace and Defense

8.3.6.4 Healthcare

8.3.6.5 Telecommunications

8.3.6.6 Power and Energy

8.3.6.7 Plastics and Polymers

8.3.6.8 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Micromachining Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Traditional

8.4.4.2 Non-traditional

8.4.4.3 Hybrid

8.4.4.4 Process

8.4.4.5 Additive

8.4.4.6 Subtractive

8.4.4.7 Others

8.4.5 Historic and Forecasted Market Size By Axis

8.4.5.1 3-axis

8.4.5.2 4-axis

8.4.5.3 5-axis

8.4.6 Historic and Forecasted Market Size By End Use Industry

8.4.6.1 Automotive

8.4.6.2 Semiconductors and Electronics

8.4.6.3 Aerospace and Defense

8.4.6.4 Healthcare

8.4.6.5 Telecommunications

8.4.6.6 Power and Energy

8.4.6.7 Plastics and Polymers

8.4.6.8 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Micromachining Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Traditional

8.5.4.2 Non-traditional

8.5.4.3 Hybrid

8.5.4.4 Process

8.5.4.5 Additive

8.5.4.6 Subtractive

8.5.4.7 Others

8.5.5 Historic and Forecasted Market Size By Axis

8.5.5.1 3-axis

8.5.5.2 4-axis

8.5.5.3 5-axis

8.5.6 Historic and Forecasted Market Size By End Use Industry

8.5.6.1 Automotive

8.5.6.2 Semiconductors and Electronics

8.5.6.3 Aerospace and Defense

8.5.6.4 Healthcare

8.5.6.5 Telecommunications

8.5.6.6 Power and Energy

8.5.6.7 Plastics and Polymers

8.5.6.8 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Micromachining Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Traditional

8.6.4.2 Non-traditional

8.6.4.3 Hybrid

8.6.4.4 Process

8.6.4.5 Additive

8.6.4.6 Subtractive

8.6.4.7 Others

8.6.5 Historic and Forecasted Market Size By Axis

8.6.5.1 3-axis

8.6.5.2 4-axis

8.6.5.3 5-axis

8.6.6 Historic and Forecasted Market Size By End Use Industry

8.6.6.1 Automotive

8.6.6.2 Semiconductors and Electronics

8.6.6.3 Aerospace and Defense

8.6.6.4 Healthcare

8.6.6.5 Telecommunications

8.6.6.6 Power and Energy

8.6.6.7 Plastics and Polymers

8.6.6.8 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Micromachining Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Traditional

8.7.4.2 Non-traditional

8.7.4.3 Hybrid

8.7.4.4 Process

8.7.4.5 Additive

8.7.4.6 Subtractive

8.7.4.7 Others

8.7.5 Historic and Forecasted Market Size By Axis

8.7.5.1 3-axis

8.7.5.2 4-axis

8.7.5.3 5-axis

8.7.6 Historic and Forecasted Market Size By End Use Industry

8.7.6.1 Automotive

8.7.6.2 Semiconductors and Electronics

8.7.6.3 Aerospace and Defense

8.7.6.4 Healthcare

8.7.6.5 Telecommunications

8.7.6.6 Power and Energy

8.7.6.7 Plastics and Polymers

8.7.6.8 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Micromachining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.0 Billion |

|

Forecast Period 2024-32 CAGR: |

6.40% |

Market Size in 2032: |

USD 5.3 Billion |

|

Segments Covered: |

By Type |

|

|

|

Process |

|

||

|

Axis |

|

||

|

End Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Micromachining Market research report is 2024-2032.

Amada Co. Ltd. (Japan), Coherent Inc. (USA), Mks Instruments Inc. (USA), Georg Fischer AG (Switzerland), Han’s Laser Technology Industry Group Co. Ltd. (China), IPG Photonics Corporation (USA), Makino Milling Machine Co. Ltd. (Japan), Mitsubishi Heavy Industries Ltd (Japan), OpTek Systems (Safety Technology Holdings Inc.) (UK), Oxford Lasers Limited (UK), and others Active Players.

The Micromachining Market is segmented into Type, Process, Axis, End Use Industry and region. by Type (Traditional, Non-traditional, Hybrid), Process (Additive, Subtractive, and Others), Axis (3-axis, 4-axis, 5-axis), End Use Industry (Automotive, Semiconductors and Electronics, Aerospace and Defense, Healthcare, Telecommunications, Power and Energy, Plastics and Polymers, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Micromachining is a precision manufacturing process used to create extremely small, intricate features and components, typically on the micron or sub-micron scale. It involves various techniques, including laser machining, electrical discharge machining (EDM), and mechanical cutting, to fabricate parts with high precision and fine detail. Micromachining is commonly used in industries such as electronics, aerospace, medical devices, and automotive for producing miniature parts like microchips, sensors, and thin-walled components. The technology enables the production of high-performance parts with tight tolerances and complex geometries, which are essential for modern engineering and manufacturing applications.

Micromachining Market Size Was Valued at USD 3.0 Billion in 2023 and is Projected to Reach USD 5.3 Billion by 2032, Growing at a CAGR of 6.40% from 2024-2032.