Microirrigation Systems Market Synopsis

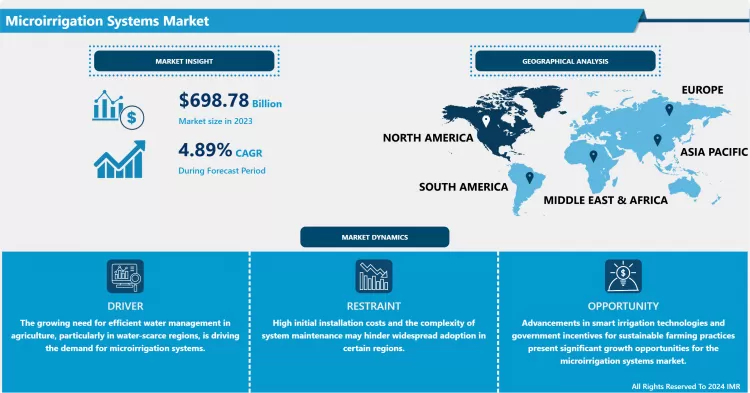

Microirrigation Systems Market Size is Valued at USD 698.78 Billion in 2023, and is Projected to Reach USD 1024.15 Billion by 2032, Growing at a CAGR of 4.89 % From 2024-2032.

In particular, microirrigation systems market has had rather remarkable growth as the use of advanced technologies allowing for a rational use of water in agriculture constantly increases. Micro irrigation is best described as a group of techniques that involves the application of water at the plant root zone either from pipes, valves or through emitters. This method does not allow water to evaporate nor run off to the nearby drainage systems; making it more preferable in an area of water shortages. Because food production demands rise globally, thanks to population size and climate change, farmers increasingly deploy micro irrigation systems to boost crop productivity while minimizing water use.

- Technological innovations are additional strengths of micro irrigation system, new technologies like smart controller, sensor technology, automatic systems etc has added further strength to the market. These technologies help farmers in the implementation of more efficient and accurate irrigation schedules they wish to have. Further, the application of microirrigation system coupled with precision agriculture that lies in the adoption of modern farming techniques is fast taking root allowing the farmer to properly fertilize and spray crops to reduce incidences of diseases and pest attacks, making crops healthier and all this at a cheaper price. Consequently, the market is registering incremental traction from a broad cross-section of small-scale and big-scale agricultural enterprises.

- Hence the market of micro irrigation systems is likely to move up in the future due to growing consciousness about environment friendly farming techniques and policies framed by different governments to use water optimally. North America, Europe as well as Asia-Pacific are expected to lead the market particularly due to increased funding of agricultural technology as well as infrastructure. Yet, problem like high initial installation cost and lack of technical skills in the particular zone can act as barriers to the broad implementation of the smart grids. On the whole, the market offering microirrigation systems remains rather promising for development, as well as for innovations and more effective water use in agriculture.

Microirrigation Systems Market Trend Analysis

Increased Adoption of Smart Irrigation Technologies

- Smart irrigation technology is one of the rapidly growing trends in the micro irrigation systems market. These sophisticated systems use sensors, weather information and controller equipment to decide when and for how long watering should take place. Smart irrigation technologies thus not only improve the efficiency with which water is supplied to crops and valued added but also boost output and cut operating expenses among farmers who use the systems. Internet of Things (IoT) devices extend this trend, which gives an ability to control and monitor to irrigation systems through a smartphone or a computer. Due to the current situation, farmers are trying to exploit resources and accommodate themselves with the altering climate hence there will be a high demand for the smart microirrigation solutions.

- However, this trend is further supported by the growth of practices in data-intensive farming, as analytics become more prevalent among farmers. With data on moisture and humidity that the soil requires for growth and crops the farmers can adjust the use of water and apply it correctly. This has seen the shift to precision agriculture not only saves water, but also encourages sustainable farming practices making smart irrigation technologies an important element of the modern agricultural business. With market development of microirrigation on the way, the focus on the smart systems is probably going to change how farmers use smar irrigation to achieve efficient and sustainable results.

Growing Emphasis on Sustainable Agriculture

- One more factor that defines the current tendencies in the microirrigation systems market is the constantly increasing focus on the sustainable agriculture. As global concerns on water crisis, climate change, and environmental pollution intensify, farmers and all players in the agricultural sector are looking forward to productive methods of conserving resources and the environment. Microirrigation systems which are well appreciated for their efficiency in the use of water are central to the change by allowing direct application of water to the drip line around plant root systems. This method has no issue with water evaporation as well as water running down slopes hence it can be used for water conservation by farmers who want to embrace ecological conservation practices.

- Using campaigns and programmes, governmental and non-governmental organisations all through the world are also encouraging sustainable measures such as water conservation in agriculture. These efforts promote use of microirrigation equipment by farmers especially in areas experiencing water deficits. Also, the consumers are insisting on food that was produced sustainably, and this has continued to exert pressure on the farmers to adopt efficient methods of irrigation as one of the methods for doing this. As awareness of the fundamentals of sustainability increases in the farming community, the microirrigation systems market should demonstrate sustained improvement and gradual adoption of microirrigation systems. This trend also has added advantages of being an environmentally friendly approach in farming besides enhancing the chances of farmer’s resource base productivity.

Microirrigation Systems Market Segment Analysis:

Microirrigation Systems Market Segmented on the basis of By Crops, By Mechanism, By Component ,By Cultivation Technology, By End-User

By Crops, Vineyards segment is expected to dominate the market during the forecast period

- Due to the different types of crops grown globally such as vineyards, vegetables, plantation crops, fields, and orchards, the microirrigation systems market receives a massive influence. Its importance is felt on vineyards where micro irrigation has the responsibility of applying water with high accuracy to enhance grapes quality and increases production. The method assists in the conservation of water at defining stages of vine development, allowing vintners to bring the grape to optimal maturity. As in the case of vegetable farming, where status of moisture is significantly important in evaluating the quality growth of crops, microirrigation has been of great benefits in providing means of delivering water to crops in the right quality and quantity, thus avoiding wastage of water for enhancing growth of crops. The customized approach to irrigation opened up the opportunity to leave conservation and efficiency of resources generally paralleled by the positive impact of irrigation to the overall global agriculture, particularly proving to be appealing to growers of diverse crops and planting categories.

- Aside from vineyards and vegetables, microirrigation systems are gradually being applied in plantations and orchards besides improving fruit and nut yield by applying water in targeted ways. Micro irrigation is beneficial to crops like coffee, rubber where water distribution to the root zone is very important for growth and yield improvement. The microirrigation systems can be versatile to allow correct dissemination of water in relation to the various fruit trees planted in the orchards for efficient control of water usage as well as the soil moisture regimes. Since climate change affects the ways in which farmers approach crop cultivation, the use of microirrigation in these diverse crop segments will increase over time, resulting in improved water management with benefits for economic and environmental sustainability of the agricultural industry.

By End-User, Farmers segment held the largest share in 2024

- The major segments that of the micro irrigation systems market are farmers, industrial users and other sectors. Farmers, especially in agricultural segment, are heavy users of micro irrigation technologies. Such systems enable them to control water supply and demand enabling crops to be supplied with a correct amount of water needed for growth to occur. This is more important given that some parts of the world experience water scarcity problems, or worse, droughts, making conventional methods of irrigation extremely inefficient. Drip irrigation and sprinkler irrigation are part of microirrigating practices that when used by farmers can increase production of their crops, control growth of soil borne diseases, and minimize operational expenses. As consumer reliance on organic produce grows and demand for increased yields due to a growing world population, such advancements enhance adoption by farmers all over the world.

- Industrial users are also now starting to come up as key active players in the microirrigation system market. These systems are widely adopted in horticulture industries and landscapers, and greenhouses need water delivery to plants to be consistent and efficient. Micro irrigation enables it to control the moisture level to the needed optimum levels especially for ornamental plants and crops grown under greenhouse. Moreover other sectors such as parks and other recreational areas are now coming to appreciate the efficacy of microirrigation systems in maintaining green areas using water conservatively. The situation becomes even clearer bearing in mind that people are becoming more aware of environmentally friendly ways of practicing irrigation across industries therefore increasing the market potential for micro irrigation solutions and the need to explore this further for opportunities.

Microirrigation Systems Market Regional Insights:

North America is anticipated to be the fastest growing region

- The regional outlook for microirrigation systems market is analyzed across North America, Europe, Asia-Pacific, South America, and Africa; North America is projected to exhibit the fastest growth rate in the overall market, primarily due to the enriching necessity of water management techniques in agriculture. Given the fact that much of the region’s cultivated land is in areas of low and actual rainfall the farmers are already in the process of searching for solutions to enhance the efficiency of the use of water and increase crop yields. Sprinkler and drip irrigation systems can be used as micro irrigation since they enable the farmer to water only the root area minimizing wastage. The move towards microirrigation is therefore increasingly strategic for the region when water scarcity become more acute due to climate change.

- Furthermore, increasing use of subsidies and government funding for ecological and efficient farming also helps to enhance the growth of the capacity in the North American microirrigation market. There are, however, different federal and state initiatives that have increased farmers’ investment in advanced irrigation technologies due to subsidies and grants, which also contributed to market growth. The IoT and precision agriculture in microirrigation techniques are also been adopted by North American farmers to monitor the efficient use of this facility. The general increase in consciousness towards environmental sustainability and scarcity of water resources gives North America, more focus on better and innovation in farming a sheer potential in the microirrigation system market.

Active Key Players in the Microirrigation Systems Market

- Jain Irrigation Systems Ltd. (India)

- The Toro Company (U.S.)

- Rain Bird Corporation (U.S.)

- HUNTER INDUSTRIES (U.S.)

- Lindsay Corporation (U.S.)

- Mahindra (India)

- NETAFIM (Israel)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Rivulis (Israel)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Deere & Company. (U.S.)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Antelco (en-AU). (Australia)

- Kothari Agritech Private Limited (India)

- others

|

Global Microirrigation Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 698.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.89% |

Market Size in 2032: |

USD 1024.15 Bn. |

|

Segments Covered: |

By Crops |

|

|

|

By Mechanism |

|

||

|

By Component |

|

||

|

By Cultivation Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Microirrigation Systems Market by Crops (2018-2032)

4.1 Microirrigation Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vineyards

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vegetables

4.5 Plantation

4.6 Field and Orchard

Chapter 5: Microirrigation Systems Market by Mechanism (2018-2032)

5.1 Microirrigation Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Drip

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Sprinkler

5.5 Other Systems

Chapter 6: Microirrigation Systems Market by Component (2018-2032)

6.1 Microirrigation Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Drippers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Polyethylene Tubing

6.5 Irrigation Valve

6.6 Filters

Chapter 7: Microirrigation Systems Market by Cultivation Technology (2018-2032)

7.1 Microirrigation Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Open Field

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Protected Cultivation

Chapter 8: Microirrigation Systems Market by End-User (2018-2032)

8.1 Microirrigation Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Farmers

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Industrial users

8.5 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Microirrigation Systems Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 JAIN IRRIGATION SYSTEMS LTD. (INDIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 THE TORO COMPANY (U.S.)

9.4 RAIN BIRD CORPORATION (U.S.)

9.5 HUNTER INDUSTRIES (U.S.)

9.6 LINDSAY CORPORATION (U.S.)

9.7 MAHINDRA (INDIA)

9.8 NETAFIM (ISRAEL)

9.9 CHINADRIP IRRIGATION EQUIPMENT COLTD. (CHINA)

9.10 RIVULIS (ISRAEL)

9.11 HARVEL AGUA INDIA PRIVATE LIMITED (INDIA)

9.12 DEERE & COMPANY. (U.S.)

9.13 HARVEL AGUA INDIA PRIVATE LIMITED (INDIA)

9.14 ANTELCO (EN-AU). (AUSTRALIA)

9.15 KOTHARI AGRITECH PRIVATE LIMITED (INDIA)

9.16 OTHERS

9.17

Chapter 10: Global Microirrigation Systems Market By Region

10.1 Overview

10.2. North America Microirrigation Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Crops

10.2.4.1 Vineyards

10.2.4.2 Vegetables

10.2.4.3 Plantation

10.2.4.4 Field and Orchard

10.2.5 Historic and Forecasted Market Size by Mechanism

10.2.5.1 Drip

10.2.5.2 Sprinkler

10.2.5.3 Other Systems

10.2.6 Historic and Forecasted Market Size by Component

10.2.6.1 Drippers

10.2.6.2 Polyethylene Tubing

10.2.6.3 Irrigation Valve

10.2.6.4 Filters

10.2.7 Historic and Forecasted Market Size by Cultivation Technology

10.2.7.1 Open Field

10.2.7.2 Protected Cultivation

10.2.8 Historic and Forecasted Market Size by End-User

10.2.8.1 Farmers

10.2.8.2 Industrial users

10.2.8.3 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Microirrigation Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Crops

10.3.4.1 Vineyards

10.3.4.2 Vegetables

10.3.4.3 Plantation

10.3.4.4 Field and Orchard

10.3.5 Historic and Forecasted Market Size by Mechanism

10.3.5.1 Drip

10.3.5.2 Sprinkler

10.3.5.3 Other Systems

10.3.6 Historic and Forecasted Market Size by Component

10.3.6.1 Drippers

10.3.6.2 Polyethylene Tubing

10.3.6.3 Irrigation Valve

10.3.6.4 Filters

10.3.7 Historic and Forecasted Market Size by Cultivation Technology

10.3.7.1 Open Field

10.3.7.2 Protected Cultivation

10.3.8 Historic and Forecasted Market Size by End-User

10.3.8.1 Farmers

10.3.8.2 Industrial users

10.3.8.3 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Microirrigation Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Crops

10.4.4.1 Vineyards

10.4.4.2 Vegetables

10.4.4.3 Plantation

10.4.4.4 Field and Orchard

10.4.5 Historic and Forecasted Market Size by Mechanism

10.4.5.1 Drip

10.4.5.2 Sprinkler

10.4.5.3 Other Systems

10.4.6 Historic and Forecasted Market Size by Component

10.4.6.1 Drippers

10.4.6.2 Polyethylene Tubing

10.4.6.3 Irrigation Valve

10.4.6.4 Filters

10.4.7 Historic and Forecasted Market Size by Cultivation Technology

10.4.7.1 Open Field

10.4.7.2 Protected Cultivation

10.4.8 Historic and Forecasted Market Size by End-User

10.4.8.1 Farmers

10.4.8.2 Industrial users

10.4.8.3 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Microirrigation Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Crops

10.5.4.1 Vineyards

10.5.4.2 Vegetables

10.5.4.3 Plantation

10.5.4.4 Field and Orchard

10.5.5 Historic and Forecasted Market Size by Mechanism

10.5.5.1 Drip

10.5.5.2 Sprinkler

10.5.5.3 Other Systems

10.5.6 Historic and Forecasted Market Size by Component

10.5.6.1 Drippers

10.5.6.2 Polyethylene Tubing

10.5.6.3 Irrigation Valve

10.5.6.4 Filters

10.5.7 Historic and Forecasted Market Size by Cultivation Technology

10.5.7.1 Open Field

10.5.7.2 Protected Cultivation

10.5.8 Historic and Forecasted Market Size by End-User

10.5.8.1 Farmers

10.5.8.2 Industrial users

10.5.8.3 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Microirrigation Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Crops

10.6.4.1 Vineyards

10.6.4.2 Vegetables

10.6.4.3 Plantation

10.6.4.4 Field and Orchard

10.6.5 Historic and Forecasted Market Size by Mechanism

10.6.5.1 Drip

10.6.5.2 Sprinkler

10.6.5.3 Other Systems

10.6.6 Historic and Forecasted Market Size by Component

10.6.6.1 Drippers

10.6.6.2 Polyethylene Tubing

10.6.6.3 Irrigation Valve

10.6.6.4 Filters

10.6.7 Historic and Forecasted Market Size by Cultivation Technology

10.6.7.1 Open Field

10.6.7.2 Protected Cultivation

10.6.8 Historic and Forecasted Market Size by End-User

10.6.8.1 Farmers

10.6.8.2 Industrial users

10.6.8.3 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Microirrigation Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Crops

10.7.4.1 Vineyards

10.7.4.2 Vegetables

10.7.4.3 Plantation

10.7.4.4 Field and Orchard

10.7.5 Historic and Forecasted Market Size by Mechanism

10.7.5.1 Drip

10.7.5.2 Sprinkler

10.7.5.3 Other Systems

10.7.6 Historic and Forecasted Market Size by Component

10.7.6.1 Drippers

10.7.6.2 Polyethylene Tubing

10.7.6.3 Irrigation Valve

10.7.6.4 Filters

10.7.7 Historic and Forecasted Market Size by Cultivation Technology

10.7.7.1 Open Field

10.7.7.2 Protected Cultivation

10.7.8 Historic and Forecasted Market Size by End-User

10.7.8.1 Farmers

10.7.8.2 Industrial users

10.7.8.3 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Microirrigation Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 698.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.89% |

Market Size in 2032: |

USD 1024.15 Bn. |

|

Segments Covered: |

By Crops |

|

|

|

By Mechanism |

|

||

|

By Component |

|

||

|

By Cultivation Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Microirrigation Systems Market research report is 2024-2032.

Jain Irrigation Systems Ltd. (India), The Toro Company (U.S.), Rain Bird Corporation (U.S.), HUNTER INDUSTRIES (U.S.), Lindsay Corporation (U.S.), Mahindra (India), NETAFIM (Israel), Chinadrip Irrigation Equipment Co., Ltd. (China), Rivulis (Israel), HARVEL AGUA INDIA PRIVATE LIMITED (India), Deere & Company (U.S.), Antelco (Australia), Kothari Agritech Private Limited (India), others.

The Microirrigation Systems Market is segmented into By Crops (Vineyards, Vegetables, Plantation, Field and Orchard), Mechanism (Drip, Sprinkler and Other Systems), Component (Drippers, Polyethylene Tubing, Irrigation Valve, Filters), Cultivation Technology (Open Field and Protected Cultivation), End-User (Farmers, Industrial users, Others).By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Micro irrigation is defined as the techniques of applying water through a system of pipes and heads and sprinklers to the plant root areas. This method comprises of what can be referred to as low-flow methods of applying water that comprise of drip Irrigation and micro sprinklers. Microirrigation is different from the other methods of irrigation as clearly explained below in the following ways: These systems do not only increase water productivity, but also a healthier plant growth through well timed water and nutrient provision. Micro irrigation has been earning more importance in the latest years with a growing concern about water availability and sustainable agriculture.

Microirrigation Systems Market Size is Valued at USD 698.78 Billion in 2023, and is Projected to Reach USD 1024.15 Billion by 2032, Growing at a CAGR of 4.89 % From 2024-2032.