Microencapsulated Pesticides Market Synopsis

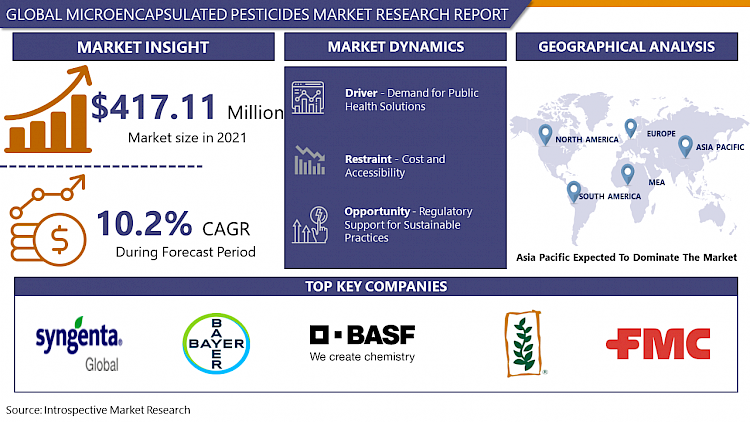

Global Microencapsulated Pesticides Market was valued at USD 417.11 billion in 2021 and is expected to reach USD 907.20 billion by the year 2028, at a CAGR of 10.2%.

Microencapsulated pesticides are formulations where active pesticide ingredients are enclosed within microscopic capsules. These capsules, typically made of polymers, protect the active ingredients from degradation due to environmental factors, prolonging their effectiveness. When applied, these capsules adhere to surfaces and gradually release the pesticide over time, offering controlled and sustained release.

- The applications of microencapsulated pesticides are diverse, spanning agriculture, public health, and consumer products. In agriculture, these formulations offer targeted and sustained pest control, reducing the need for frequent reapplication and minimizing pesticide runoff. In public health, they're used for vector control to combat diseases such as malaria and dengue fever by controlling mosquito populations. Additionally, microencapsulated pesticides find use in consumer products like pet collars, where they offer prolonged protection against fleas and ticks.

- In the market, the demand for microencapsulated pesticides has been steadily increasing due to their advantages over conventional formulations. Current trends focus on developing eco-friendly and biodegradable encapsulation materials to further reduce environmental impact. Moreover, research aims to improve the precision and specificity of pesticide delivery systems, ensuring targeted pest control while minimizing unintended effects on non-target organisms. The market growth is also influenced by regulatory changes emphasizing sustainability and safety, driving the development of innovative microencapsulation techniques and formulations in the pesticide industry.

Microencapsulated Pesticides Market Trend Analysis

Demand for Public Health Solutions

- Vector-borne diseases, such as malaria, dengue fever, Zika virus, and Lyme disease, pose significant health risks globally. Controlling the vectors responsible for these diseases, such as mosquitoes, ticks, and fleas, is crucial for public health. Microencapsulated pesticides offer a targeted and sustained approach to combat these disease-carrying organisms. They provide controlled release and longer-lasting effects, ensuring continuous protection against vectors while minimizing human and environmental exposure to chemicals.

- Governments and health organizations worldwide are increasingly focusing on preventative measures against these diseases. The use of microencapsulated pesticides in public health programs aligns with these initiatives by offering more effective and precise vector control. These formulations are designed to specifically target disease vectors while minimizing harm to non-target organisms and reducing the development of resistance among the targeted pests. As a result, there's a growing demand for these innovative formulations in various regions, especially in areas prone to vector-borne diseases, driving the market's growth.

- Furthermore, the effectiveness and safety profile of microencapsulated pesticides make them an attractive choice for integrated pest management strategies. They complement other control methods, such as biological control and habitat modification, contributing to a holistic approach in disease prevention. The market's expansion in the public health sector is propelled by the urgent need for efficient and sustainable solutions to combat vector-borne diseases, thus fostering the adoption of microencapsulated pesticides as a crucial component in disease control programs.

Regulatory Support for Sustainable Practices

- Governments and regulatory bodies worldwide are increasingly advocating for environmentally friendly and sustainable pest management solutions. Regulations that prioritize reduced chemical usage, minimize environmental impact, and promote targeted pest control methods create a conducive environment for the adoption of microencapsulated pesticides.

- Policies aimed at sustainable agriculture and integrated pest management encourage the development and use of innovative formulations like microencapsulated pesticides. Regulatory frameworks that incentivize or mandate the adoption of eco-friendly alternatives stimulate research and investment in these technologies. As a result, manufacturers are motivated to develop and introduce microencapsulated pesticides that align with these regulations, offering more precise and controlled methods of pest control while minimizing adverse effects on non-target organisms and ecosystems.

- Furthermore, regulatory support enhances market acceptance and consumer confidence in these formulations. Compliance with stringent environmental standards and safety regulations bolsters the credibility of microencapsulated pesticides, positioning them as viable, safe, and effective alternatives to conventional pesticides. This regulatory backing drives market expansion by fostering a supportive environment that encourages innovation, investment, and the adoption of sustainable pest management practices.

Microencapsulated Pesticides Market Segment Analysis:

Microencapsulated Pesticides Market Segmented on the basis of type, technology, application, and mode of application.

By Type, Insecticides segment is expected to dominate the market during the forecast period

- During the forecast period, the insecticides segment is anticipated to dominate the microencapsulated pesticides market. This dominance is primarily attributed to the persistent need for effective insect control measures across various sectors such as agriculture, public health, and household pest management. Microencapsulated insecticides offer a targeted and sustained approach in combating a wide array of insects, including agricultural pests, disease vectors such as mosquitoes and ticks, as well as household pests including ants, cockroaches, and fleas.

- The versatility and efficacy of microencapsulated insecticides make them a preferred choice for pest management strategies. These formulations provide controlled release mechanisms that prolong the effectiveness of the active ingredients, reducing the frequency of applications and enhancing overall pest control efficiency. Moreover, regulatory pressures to minimize environmental impact and the development of resistance against conventional insecticides further drive the demand for innovative pest control solutions like microencapsulation, solidifying the dominance of the insecticides segment in the microencapsulated pesticides market.

By Application, Agricultural segment held the largest market share of 65% in 2022

- The agricultural segment held the largest market share in the microencapsulated pesticides market based on application. This dominance is primarily due to the widespread adoption of microencapsulated pesticides in agricultural practices globally. Farmers and agricultural professionals increasingly rely on these formulations to protect crops from pests, insects, and diseases while minimizing environmental impact.

- Microencapsulated pesticides offer numerous advantages in agriculture, including targeted delivery, prolonged efficacy, and reduced chemical runoff. These formulations enable controlled release of active ingredients, ensuring more effective and sustained pest control while minimizing the adverse effects on non-target organisms and the surrounding ecosystem.

- Additionally, the need for higher crop yields to meet the growing global food demand, coupled with regulatory pressures to reduce chemical usage, has fueled the adoption of innovative and sustainable pest management practices, further driving the dominance of microencapsulated pesticides in the agricultural sector. As a result, the agricultural segment has maintained its leading position in the market owing to the significant demand for efficient and eco-friendly pest control solutions in farming practices.

Microencapsulated Pesticides Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Over the forecast period, the Asia Pacific region is anticipated to emerge as the dominant force in the microencapsulated pesticides market. Several factors contribute to this projection, including the region's vast agricultural landscape, increasing population, and rising demand for food production. As countries in Asia Pacific strive to meet the growing food requirements, there's a heightened emphasis on enhancing agricultural productivity while adhering to sustainable practices.

- The adoption of microencapsulated pesticides in the region's agriculture sector is gaining momentum due to their efficacy in pest control, reduced environmental impact, and compliance with stringent regulatory standards. Moreover, the prevalence of pests and diseases affecting crops in this region drives the need for more efficient and targeted pest management solutions, further propelling the demand for microencapsulated pesticides.

- Rapid industrialization and urbanization have also led to increased concerns regarding public health and the spread of vector-borne diseases, amplifying the use of microencapsulated pesticides in public health programs across the Asia Pacific. These factors collectively position the region to dominate the microencapsulated pesticides market during the forecast period.

Microencapsulated Pesticides Market Top Key Players:

- Adama Agricultural Solutions Ltd. (Israel)

- Arysta Lifescience(US)

- Basf Se (Germany)

- Bayer Cropscience Ag (Germany)

- Belchim Crop Protection (Belgium)

- Botanocap Ltd. (Israel)

- China National Chemical Corporation (China)

- Ecosafe Natural Products Inc. (Canada)

- Fmc Corporation (US)

- Gat Microencapsulation Gmbh (Austria)

- Israel Chemical Company (Israel)

- K + S Group (Germany)

- Mclaughlin Gormley King Company (US)

- Nufarm Limited (Australia)

- Reed Pacific Pty Limited (Australia)

- Sumitomo Chemicals (Japan)

- Syngenta Ag (Switzerland)

- The Dow Chemical Company (US)

- The Monsanto Company (US)

- Upl Corporation Ltd. (India)

- Yara International (Norway) and Other Major Players

Key Industry Developments in the Microencapsulated Pesticides Market:

- In November 2023, The PilarBio Strategic Upgrade and the Sixth National Strategic Customer Development Conference was held in Changsha, Hu’nan Province in China. During this event, PilarBio launched its microencapsulated formulation Pilarcore® and nano-formulation Pilarnano® brands, and officially introduced its brand mascot, ″Pilar OX″.

- In March 2023, The Syngenta Group has announced the launch of “Shoots by SyngentaTM,” a worldwide platform created to support innovation growth and the advancement of more sustainable agriculture while addressing some of agriculture’s most difficult problems. The platform will connect scientific discovery and creativity, bringing together academia, research centers, startups, and cross-industry sectors to work with Syngenta’s global network of 5,000+ scientists.

|

Global Microencapsulated Pesticides Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 417.11 Mn. |

|

Forecast Period 2023-30 CAGR: |

10.2 % |

Market Size in 2030: |

USD 907.20 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MICROENCAPSULATED PESTICIDES MARKET BY TYPE (2016-2030)

- MICROENCAPSULATED PESTICIDES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INSECTICIDES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FUNGICIDES

- HERBICIDES

- MICROENCAPSULATED PESTICIDES MARKET BY TECHNOLOGY (2016-2030)

- MICROENCAPSULATED PESTICIDES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHYSICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHYSICO-CHEMICAL

- CHEMICAL

- MICROENCAPSULATED PESTICIDES MARKET BY APPLICATION (2016-2030)

- MICROENCAPSULATED PESTICIDES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AGRICULTURAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NON-AGRICULTURAL

- MICROENCAPSULATED PESTICIDES MARKET BY MODE OF APPLICATION (2016-2030)

- MICROENCAPSULATED PESTICIDES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOLIAR SPRAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FERTIGATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- MICROENCAPSULATED PESTICIDES Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ADAMA AGRICULTURAL SOLUTIONS LTD. (ISRAEL)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ARYSTA LIFESCIENCE (US)

- BASF SE (GERMANY)

- BAYER CROPSCIENCE AG (GERMANY)

- BELCHIM CROP PROTECTION (BELGIUM)

- BOTANOCAP LTD. (ISRAEL)

- CHINA NATIONAL CHEMICAL CORPORATION (CHINA)

- ECOSAFE NATURAL PRODUCTS INC. (CANADA)

- FMC CORPORATION (US)

- GAT MICROENCAPSULATION GMBH (AUSTRIA)

- ISRAEL CHEMICAL COMPANY (ISRAEL)

- K + S GROUP (GERMANY)

- MCLAUGHLIN GORMLEY KING COMPANY (US)

- NUFARM LIMITED (AUSTRALIA)

- REED PACIFIC PTY LIMITED (AUSTRALIA)

- SUMITOMO CHEMICALS (JAPAN)

- SYNGENTA AG (SWITZERLAND)

- THE DOW CHEMICAL COMPANY (US)

- THE MONSANTO COMPANY (US)

- UPL CORPORATION LTD. (INDIA)

- YARA INTERNATIONAL (NORWAY)

- COMPETITIVE LANDSCAPE

- GLOBAL MICROENCAPSULATED PESTICIDES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By MODE OF APPLICATION

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Microencapsulated Pesticides Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 417.11 Mn. |

|

Forecast Period 2023-30 CAGR: |

10.2 % |

Market Size in 2030: |

USD 907.20 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Mode of Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MICROENCAPSULATED PESTICIDES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MICROENCAPSULATED PESTICIDES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MICROENCAPSULATED PESTICIDES MARKET COMPETITIVE RIVALRY

TABLE 005. MICROENCAPSULATED PESTICIDES MARKET THREAT OF NEW ENTRANTS

TABLE 006. MICROENCAPSULATED PESTICIDES MARKET THREAT OF SUBSTITUTES

TABLE 007. MICROENCAPSULATED PESTICIDES MARKET BY TYPE

TABLE 008. INSECTICIDES MARKET OVERVIEW (2016-2028)

TABLE 009. FUNGICIDES MARKET OVERVIEW (2016-2028)

TABLE 010. HERBICIDES MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. MICROENCAPSULATED PESTICIDES MARKET BY TECHNOLOGY

TABLE 013. PHYSICAL MARKET OVERVIEW (2016-2028)

TABLE 014. PHYSICO-CHEMICAL MARKET OVERVIEW (2016-2028)

TABLE 015. CHEMICAL MARKET OVERVIEW (2016-2028)

TABLE 016. MICROENCAPSULATED PESTICIDES MARKET BY APPLICATION

TABLE 017. AGRICULTURAL MARKET OVERVIEW (2016-2028)

TABLE 018. NON-AGRICULTURAL MARKET OVERVIEW (2016-2028)

TABLE 019. MICROENCAPSULATED PESTICIDES MARKET BY MODE OF APPLICATION

TABLE 020. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

TABLE 021. FERTIGATION MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 024. NORTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. NORTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY APPLICATION (2016-2028)

TABLE 026. NORTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 027. N MICROENCAPSULATED PESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE MICROENCAPSULATED PESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 029. EUROPE MICROENCAPSULATED PESTICIDES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. EUROPE MICROENCAPSULATED PESTICIDES MARKET, BY APPLICATION (2016-2028)

TABLE 031. EUROPE MICROENCAPSULATED PESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 032. MICROENCAPSULATED PESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC MICROENCAPSULATED PESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 034. ASIA PACIFIC MICROENCAPSULATED PESTICIDES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 035. ASIA PACIFIC MICROENCAPSULATED PESTICIDES MARKET, BY APPLICATION (2016-2028)

TABLE 036. ASIA PACIFIC MICROENCAPSULATED PESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 037. MICROENCAPSULATED PESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA MICROENCAPSULATED PESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA MICROENCAPSULATED PESTICIDES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA MICROENCAPSULATED PESTICIDES MARKET, BY APPLICATION (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA MICROENCAPSULATED PESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 042. MICROENCAPSULATED PESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 043. SOUTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY TYPE (2016-2028)

TABLE 044. SOUTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY TECHNOLOGY (2016-2028)

TABLE 045. SOUTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY APPLICATION (2016-2028)

TABLE 046. SOUTH AMERICA MICROENCAPSULATED PESTICIDES MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 047. MICROENCAPSULATED PESTICIDES MARKET, BY COUNTRY (2016-2028)

TABLE 048. SYNGENTA AG: SNAPSHOT

TABLE 049. SYNGENTA AG: BUSINESS PERFORMANCE

TABLE 050. SYNGENTA AG: PRODUCT PORTFOLIO

TABLE 051. SYNGENTA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. BAYER AG: SNAPSHOT

TABLE 052. BAYER AG: BUSINESS PERFORMANCE

TABLE 053. BAYER AG: PRODUCT PORTFOLIO

TABLE 054. BAYER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. BASF SE: SNAPSHOT

TABLE 055. BASF SE: BUSINESS PERFORMANCE

TABLE 056. BASF SE: PRODUCT PORTFOLIO

TABLE 057. BASF SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. MONSANTO COMPANY: SNAPSHOT

TABLE 058. MONSANTO COMPANY: BUSINESS PERFORMANCE

TABLE 059. MONSANTO COMPANY: PRODUCT PORTFOLIO

TABLE 060. MONSANTO COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FMC CORPORATION: SNAPSHOT

TABLE 061. FMC CORPORATION: BUSINESS PERFORMANCE

TABLE 062. FMC CORPORATION: PRODUCT PORTFOLIO

TABLE 063. FMC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ADAMA AGRICULTURAL SOLUTIONS LTD.: SNAPSHOT

TABLE 064. ADAMA AGRICULTURAL SOLUTIONS LTD.: BUSINESS PERFORMANCE

TABLE 065. ADAMA AGRICULTURAL SOLUTIONS LTD.: PRODUCT PORTFOLIO

TABLE 066. ADAMA AGRICULTURAL SOLUTIONS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ARYSTA LIFESCIENCE CORPORATION: SNAPSHOT

TABLE 067. ARYSTA LIFESCIENCE CORPORATION: BUSINESS PERFORMANCE

TABLE 068. ARYSTA LIFESCIENCE CORPORATION: PRODUCT PORTFOLIO

TABLE 069. ARYSTA LIFESCIENCE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BELCHIM CROP PROTECTION NV/SA: SNAPSHOT

TABLE 070. BELCHIM CROP PROTECTION NV/SA: BUSINESS PERFORMANCE

TABLE 071. BELCHIM CROP PROTECTION NV/SA: PRODUCT PORTFOLIO

TABLE 072. BELCHIM CROP PROTECTION NV/SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. MCLAUGHLIN GORMLEY KING COMPANY: SNAPSHOT

TABLE 073. MCLAUGHLIN GORMLEY KING COMPANY: BUSINESS PERFORMANCE

TABLE 074. MCLAUGHLIN GORMLEY KING COMPANY: PRODUCT PORTFOLIO

TABLE 075. MCLAUGHLIN GORMLEY KING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. REED PACIFIC PTY LIMITED: SNAPSHOT

TABLE 076. REED PACIFIC PTY LIMITED: BUSINESS PERFORMANCE

TABLE 077. REED PACIFIC PTY LIMITED: PRODUCT PORTFOLIO

TABLE 078. REED PACIFIC PTY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. BOTANOCAP: SNAPSHOT

TABLE 079. BOTANOCAP: BUSINESS PERFORMANCE

TABLE 080. BOTANOCAP: PRODUCT PORTFOLIO

TABLE 081. BOTANOCAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. GAT MICROENCAPSULATION: SNAPSHOT

TABLE 082. GAT MICROENCAPSULATION: BUSINESS PERFORMANCE

TABLE 083. GAT MICROENCAPSULATION: PRODUCT PORTFOLIO

TABLE 084. GAT MICROENCAPSULATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY TYPE

FIGURE 012. INSECTICIDES MARKET OVERVIEW (2016-2028)

FIGURE 013. FUNGICIDES MARKET OVERVIEW (2016-2028)

FIGURE 014. HERBICIDES MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY TECHNOLOGY

FIGURE 017. PHYSICAL MARKET OVERVIEW (2016-2028)

FIGURE 018. PHYSICO-CHEMICAL MARKET OVERVIEW (2016-2028)

FIGURE 019. CHEMICAL MARKET OVERVIEW (2016-2028)

FIGURE 020. MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY APPLICATION

FIGURE 021. AGRICULTURAL MARKET OVERVIEW (2016-2028)

FIGURE 022. NON-AGRICULTURAL MARKET OVERVIEW (2016-2028)

FIGURE 023. MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY MODE OF APPLICATION

FIGURE 024. FOLIAR SPRAY MARKET OVERVIEW (2016-2028)

FIGURE 025. FERTIGATION MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA MICROENCAPSULATED PESTICIDES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Microencapsulated Pesticides Market research report is 2023-2030.

ADAMA Agricultural Solutions Ltd. (Israel), Arysta LifeScience (US), BASF SE (Germany), Bayer CropScience AG (Germany), Belchim Crop Protection (Belgium), BotanoCap Ltd. (Israel), China National Chemical Corporation (China), EcoSafe Natural Products Inc. (Canada), FMC Corporation (US), GAT Microencapsulation Gmbh (Austria), Israel Chemical Company (Israel), K + S Group (Germany), McLaughlin Gormley King Company (US), Nufarm Limited (Australia), Reed Pacific Pty Limited (Australia), Sumitomo Chemicals (Japan), Syngenta AG (Switzerland), The DOW Chemical Company (US), The Monsanto Company (US), UPL Corporation Ltd. (India), Yara International (Norway) and Other Major Players.

The Microencapsulated Pesticides Market is segmented into Type, Technology, Application, Mode of Application and region. By Type, the market is categorized into Insecticides, Fungicides and Herbicides. By Technology, the market is categorized into Physical, Physico-Chemical and Chemical. By Application, the market is categorized into Agricultural and Non-agricultural. By Mode of Application, the market is categorized into Foliar Spray and Fertigation. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Microencapsulated pesticides are formulations where active pesticide ingredients are enclosed within microscopic capsules. These capsules, typically made of polymers, protect the active ingredients from degradation due to environmental factors, prolonging their effectiveness. When applied, these capsules adhere to surfaces and gradually release the pesticide over time, offering controlled and sustained release.

Global Microencapsulated Pesticides Market was valued at USD 417.11 billion in 2021 and is expected to reach USD 907.20 billion by the year 2028, at a CAGR of 10.2%.