Metal Cans Market Synopsis

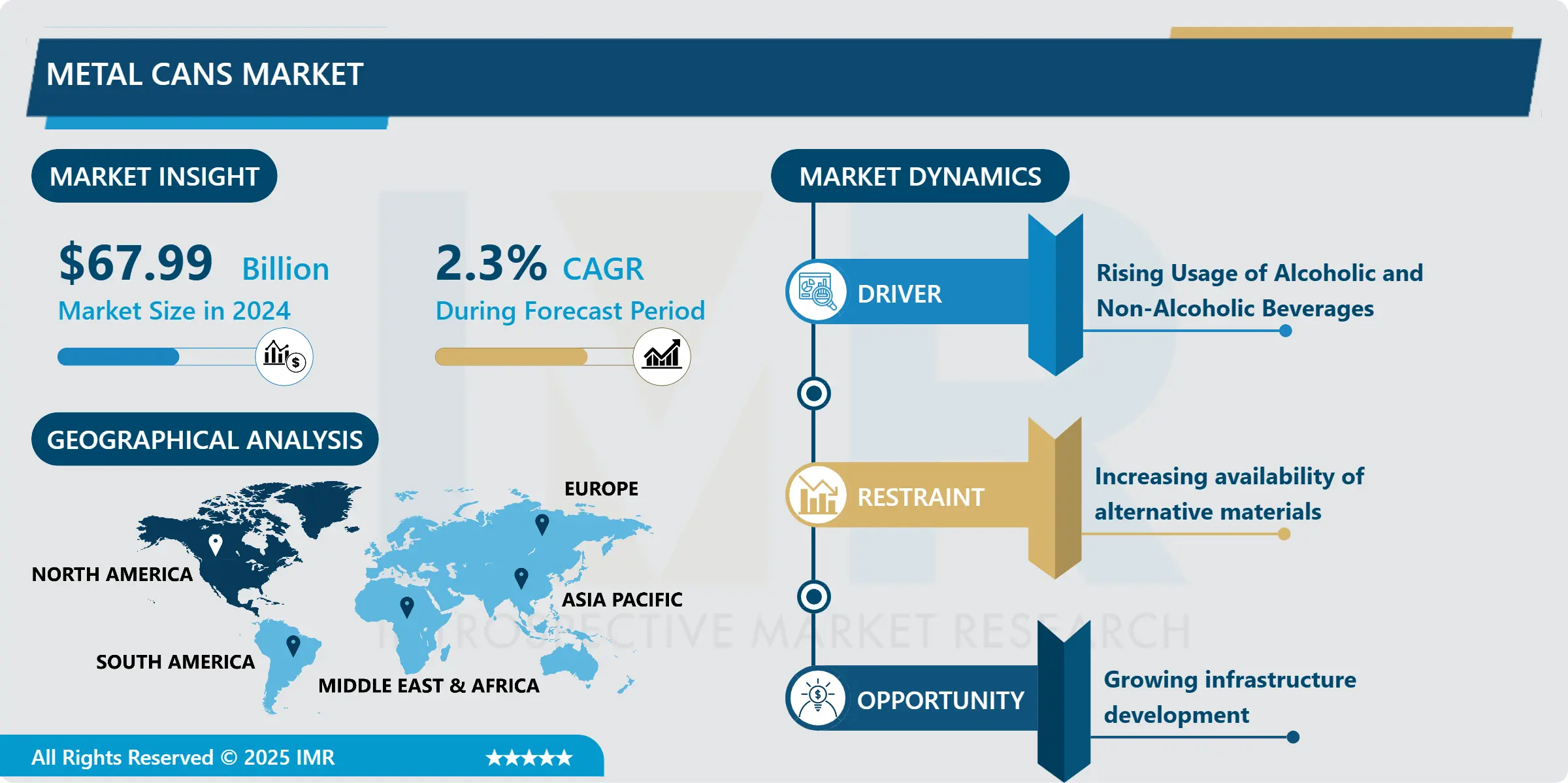

Metal Cans Market Size Was Valued at USD 67.99 Billion in 2024, and is Projected to Reach USD 88.26 Billion by 2035, Growing at a CAGR of 2.3% From 2025-2035.

Metal Cans are the most utilized type of packaging in the food & beverage industry to prolong storage life, gain the best defense against external contaminants and have high recyclability. These cans can be recycled and reused an infinite number of times and can also be molded in any shape one wants to. Some of the most common contaminants include moisture, oxygen, bacteria etc which can spoil the food and beverages and other valuable products and that is why metal cans are a very effective barrier for these contaminants hence its high adoption in storing perishable goods for long durations.

Metal Cans have been widely employed in industrial packaging since the early 1800s. The initial development of metal cans started in England in the year 1813. Some of the early uses of this technology included storing of food products like meat, fruits, oysters among others in the metal cans. Subsequently the use of these metal cans have extended to different end use industries to contain a range of products such as beverages. Modern steel containers are employed in various purposes in storing important and sensitive healthcare products, edible oil, cosmetics, industrial solvents, dyes, paints, etc.

Higher demand on packaged and processed Food & Beverages is the major factor contributing to the rise in the market. Another factor which is also influential in the market growth of metal cans is that the concerned packaging technologies are the scales expected to be developed and innovated smoothly by the major participants operating in various global areas. Also, creating structure for the recycling of used metallic packaging material is at the same time boosting the need for metal cans across the world.

In addition, the tendency towards recycling of the metal cans due to sustainability benefits, as well as the aspect of this kind of containers being recyclable infinitely without a negative impact on the quality, is another factor that speaks in favor of employing metal cans across the application industry. Furthermore, the increase in awareness level from littering the packaging waste material across the world and which in turn contributed to the negative impacts on the environment and the living organisms dependent on this environment is also driving the metal cans usage and recycling within the end user sectors such as food and beverage.

Consumers’ desire for convenience and easy-to-consume products, especially in thefinished beverage industry, including canned coffee, tea, and energy drinks, are also likely to fuel the demand for metal cans in the foreseeable future. Also, the expansion of the craft beer segments, as well as the rising sales of canned wines, would contribute to the elevation of metal cans’ demand. Therefore the factors associated with Metal Cans have increase in Metal Cans market CAGR in the recent years globally.

Metal Cans Market Trend Analysis

Growing Demand for Packaged and Processed Food

- One of the major trends driving the metal cans market is the increasing consumption of packaged and processed food products as these items are more convenient for consumers especially in the modern world where people have busy schedules. For instance, a recent study conducted on the food processing industry in India revealed that this sector contributes about 13 percent of the total GDP of that nation, as revealed by the United States Department of Agriculture (USDA).

- Furthermore, it will create seven new ministries and provide the necessary structure to the Prime Minister of India and Union Cabinet, including the Production-Linked Incentive (PLI) scheme in the food product manufacturing to boost the manufacturing capacity and improve the exports. Since metal cans are chemically inert and produce a non-reactive environment, our canned foods are suitable for various processed foods like fruits, vegetables, soups, sauces, and ready to cook foods. They offer retail convenience; the need for hermetical seal, convenient minimal portions; and shelf stability. Furthermore, metal cans act as a safe, and clean packaging system for processed foods out acting as a barrier against contamination and outsider interference with products at the time of storage and even during the transportation. Apart from this, the surge in demand for beverages is seen as a factor that is favoring the metal cans market share. For instance, one of the key players in the industry, a manufacturer of beverages such as coke, recorded 7% increase in the Revenue in the fourth Quarter of 2023.

Increasing Focus on Recycling

- The rising environmental concerns associated with the metal cans along with increasing consciousness among the consumers to minimize disposal into the landfills are fostering the growth of metal cans market. Amongst the modern trends in the metal cans market , one should mention the significant advancement in the recycling structures and systems. In addition, governmental and non-governmental organization playing their part in increasing efforts and setting up higher policies and targets regarding recycling and waste management. For example, in October 2023, Budweiser Brewing Co APAC Ltd, the biggest beer producing company in Asia Pacific has started ‘Can-to-Can’ recycling program in China. It was a program that sought to increase the percentage of Aluminium Cans that were being recycled. It is now also increasingly common for many firms to declare their sustainability goals that also include targets regarding recycling in the packaging material to be used. It has thus resulted to a growing demand for recycled metal in the market.

Metal Cans Market Segment Analysis:

Metal Cans Market Segmented based on Material Type, Fabrication, and Can Type.

By Material Type, Aluminium segment is expected to dominate the market with around 37.72% share during the forecast period.

- This segmentation has been growing due to the investment by these players to establish new manufacturing structures to meet the growing orders and suffice the scarcity of aluminum cans. For instance, in September 2021, Ball Corporation embarked on a new aluminum beverage packaging plant in Nevada, United States. The production of this multi-line factory was initiated at the end of the year 2022. Besides this, the increasing consumer knowledge and consciousness about the benefits of aluminum packaging in relation to the environment and its recyclability without a compromise to the quality and energy conservation aspects will remain a metal cans market opportunity for the industry players.

By Can Type, Beverages segment is expected to dominate the market with around 32.92% share during the forecast period.

- The enhanced capability of metal cans in preserving the beverages so as not to leak, spoil, or even contaminate them is mainly driving the market growth of this segmentation. However, based on the metal cans market trends highlighted in the metal cans market report the increasing consumption of carbonated beverages especially among young people is also another factor that is reciprocate in the growth of the market. Furthermore, the segmentation of the beverage market is done in two categories: alcoholic and non-alcoholic. The expanding number of millennial, increasing demand of alcoholic beverages and the rising disposable income levels are expected to further enhance the growth of the global market in this segmentation in the foreseeable future.

Metal Cans Market Regional Insights:

By Region, North America is anticipated to remain the leading regional market with close to 33.72% share during the upcoming years.

- In North America metal cans market there several drivers such as developed infrastructure and recycling industry which is mandatory. It is also assisted by the expansion of huge markets in the region due to the presence of research-oriented key players. The growth in the revenues from sales in the packaging segment is also attributed to the strategic inclinations of these manufacturers to create environmentally friendly packaging materials in the region. Also, the increased consumption of canned food across the global region and especially in countries such as the USA and Canada will also help fuel the North America metal cans market over the forecasted period.

- Further, major manufacturers like Crown Holdings Inc. , Bail Corporation, and BWAY Corporation, among others are also helping the market make headway. The packaging manufacturers have been making strategic efforts to come up with sustainable packaging especially with their enhanced profitability hence driving market progress.

Active Key Players in the Metal Cans Market

- Amcor plc

- Ardagh Group S.A.

- Ball Corporation

- CPMC Holdings Limited

- Crown Holdings Inc.

- Hindustan Tin Works Ltd.

- Independent Can Company

- Kian Joo Can Factory Berhad (Can-One Berhad)

- Mauser Packaging Solutions

- Silgan Containers LLC (Silgan Holdings Inc.)

- Sonoco Products Company and Toyo Seikan Group Holdings Ltd and Other Active Players

Key Industry Developments in the Metal Cans Market:

- In February 2024, Crown and CANPACK, two companies that manufacture beverage cans, have both partnered with Emirates Global Aluminium to launch Every Can Counts, which is a marketing idea for the recycling of used aluminum container cans. This program announced at COP28 is an excellent initiation that is taken by the United Arab Emirates towards making the country ready for creating circular economy.

- In November 4, 2024, Ball Corporation announced the acquisition of Alucan to expand its sustainable extruded-aluminum packaging business and strengthen its metal can portfolio globally.

(Source:https://www.ball.com/)

|

Global Metal Cans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 67.99 Bn. |

|

Forecast Period 2025-35 CAGR: |

2.3 % |

Market Size in 2035: |

USD 88.26 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Fabrication |

|

||

|

By Can Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Metal Cans Market by Material Type (2018-2032)

4.1 Metal Cans Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aluminium

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Steel

4.5 Tin

Chapter 5: Metal Cans Market by Fabrication (2018-2032)

5.1 Metal Cans Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Two Piece Metal Can

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Three Piece Metal Can

Chapter 6: Metal Cans Market by Can Type (2018-2032)

6.1 Metal Cans Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Food

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Vegetable

6.5 Fruits

6.6 Pet Food

6.7 Others

6.8 Beverages

6.9 Alcoholic Beverage

6.10 Non-Alcoholic Beverage

6.11 Aerosols

6.12 Paints and Varnishes

6.13 Cosmetic and Personal Care

6.14 Pharmaceuticals

6.15 Others

6.16 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Metal Cans Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMCOR PLC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARDAGH GROUP S.ABALL CORPORATION

7.4 CPMC HOLDINGS LIMITED

7.5 CROWN HOLDINGS INCHINDUSTAN TIN WORKS LTDINDEPENDENT CAN COMPANY

7.6 KIAN JOO CAN FACTORY BERHAD (CAN-ONE BERHAD)

7.7 MAUSER PACKAGING SOLUTIONS

7.8 SILGAN CONTAINERS LLC (SILGAN HOLDINGS INC.)

7.9 SONOCO PRODUCTS COMPANY AND TOYO SEIKAN GROUP HOLDINGS LTD AND

Chapter 8: Global Metal Cans Market By Region

8.1 Overview

8.2. North America Metal Cans Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Material Type

8.2.4.1 Aluminium

8.2.4.2 Steel

8.2.4.3 Tin

8.2.5 Historic and Forecasted Market Size by Fabrication

8.2.5.1 Two Piece Metal Can

8.2.5.2 Three Piece Metal Can

8.2.6 Historic and Forecasted Market Size by Can Type

8.2.6.1 Food

8.2.6.2 Vegetable

8.2.6.3 Fruits

8.2.6.4 Pet Food

8.2.6.5 Others

8.2.6.6 Beverages

8.2.6.7 Alcoholic Beverage

8.2.6.8 Non-Alcoholic Beverage

8.2.6.9 Aerosols

8.2.6.10 Paints and Varnishes

8.2.6.11 Cosmetic and Personal Care

8.2.6.12 Pharmaceuticals

8.2.6.13 Others

8.2.6.14 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Metal Cans Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Material Type

8.3.4.1 Aluminium

8.3.4.2 Steel

8.3.4.3 Tin

8.3.5 Historic and Forecasted Market Size by Fabrication

8.3.5.1 Two Piece Metal Can

8.3.5.2 Three Piece Metal Can

8.3.6 Historic and Forecasted Market Size by Can Type

8.3.6.1 Food

8.3.6.2 Vegetable

8.3.6.3 Fruits

8.3.6.4 Pet Food

8.3.6.5 Others

8.3.6.6 Beverages

8.3.6.7 Alcoholic Beverage

8.3.6.8 Non-Alcoholic Beverage

8.3.6.9 Aerosols

8.3.6.10 Paints and Varnishes

8.3.6.11 Cosmetic and Personal Care

8.3.6.12 Pharmaceuticals

8.3.6.13 Others

8.3.6.14 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Metal Cans Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Material Type

8.4.4.1 Aluminium

8.4.4.2 Steel

8.4.4.3 Tin

8.4.5 Historic and Forecasted Market Size by Fabrication

8.4.5.1 Two Piece Metal Can

8.4.5.2 Three Piece Metal Can

8.4.6 Historic and Forecasted Market Size by Can Type

8.4.6.1 Food

8.4.6.2 Vegetable

8.4.6.3 Fruits

8.4.6.4 Pet Food

8.4.6.5 Others

8.4.6.6 Beverages

8.4.6.7 Alcoholic Beverage

8.4.6.8 Non-Alcoholic Beverage

8.4.6.9 Aerosols

8.4.6.10 Paints and Varnishes

8.4.6.11 Cosmetic and Personal Care

8.4.6.12 Pharmaceuticals

8.4.6.13 Others

8.4.6.14 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Metal Cans Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Material Type

8.5.4.1 Aluminium

8.5.4.2 Steel

8.5.4.3 Tin

8.5.5 Historic and Forecasted Market Size by Fabrication

8.5.5.1 Two Piece Metal Can

8.5.5.2 Three Piece Metal Can

8.5.6 Historic and Forecasted Market Size by Can Type

8.5.6.1 Food

8.5.6.2 Vegetable

8.5.6.3 Fruits

8.5.6.4 Pet Food

8.5.6.5 Others

8.5.6.6 Beverages

8.5.6.7 Alcoholic Beverage

8.5.6.8 Non-Alcoholic Beverage

8.5.6.9 Aerosols

8.5.6.10 Paints and Varnishes

8.5.6.11 Cosmetic and Personal Care

8.5.6.12 Pharmaceuticals

8.5.6.13 Others

8.5.6.14 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Metal Cans Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Material Type

8.6.4.1 Aluminium

8.6.4.2 Steel

8.6.4.3 Tin

8.6.5 Historic and Forecasted Market Size by Fabrication

8.6.5.1 Two Piece Metal Can

8.6.5.2 Three Piece Metal Can

8.6.6 Historic and Forecasted Market Size by Can Type

8.6.6.1 Food

8.6.6.2 Vegetable

8.6.6.3 Fruits

8.6.6.4 Pet Food

8.6.6.5 Others

8.6.6.6 Beverages

8.6.6.7 Alcoholic Beverage

8.6.6.8 Non-Alcoholic Beverage

8.6.6.9 Aerosols

8.6.6.10 Paints and Varnishes

8.6.6.11 Cosmetic and Personal Care

8.6.6.12 Pharmaceuticals

8.6.6.13 Others

8.6.6.14 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Metal Cans Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Material Type

8.7.4.1 Aluminium

8.7.4.2 Steel

8.7.4.3 Tin

8.7.5 Historic and Forecasted Market Size by Fabrication

8.7.5.1 Two Piece Metal Can

8.7.5.2 Three Piece Metal Can

8.7.6 Historic and Forecasted Market Size by Can Type

8.7.6.1 Food

8.7.6.2 Vegetable

8.7.6.3 Fruits

8.7.6.4 Pet Food

8.7.6.5 Others

8.7.6.6 Beverages

8.7.6.7 Alcoholic Beverage

8.7.6.8 Non-Alcoholic Beverage

8.7.6.9 Aerosols

8.7.6.10 Paints and Varnishes

8.7.6.11 Cosmetic and Personal Care

8.7.6.12 Pharmaceuticals

8.7.6.13 Others

8.7.6.14 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Metal Cans Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 67.99 Bn. |

|

Forecast Period 2025-35 CAGR: |

2.3 % |

Market Size in 2035: |

USD 88.26 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Fabrication |

|

||

|

By Can Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||