Medical Billing Software Market Overview

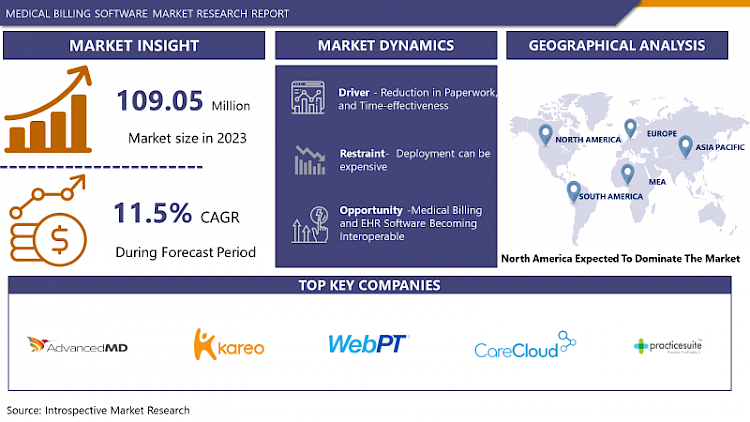

The global market for Medical Billing Software was estimated at USD 109.05 Million in 2023 and is projected to reach USD 290.47 Million by 2024, growing at a CAGR of 11.5% over the analysis period.

Customer payments are the fuel that keeps any firm running. Healthcare providers are no exception; yet, getting paid is a lengthy multi-step process with multiple regulations and players involved. While hospitals cannot make this journey any shorter, they may make it more efficient by automating billing operations. Medical billing is an important aspect of the healthcare revenue cycle since it involves getting paid for the services provided by a healthcare provider. This procedure begins before the services are even provided and includes numerous important steps. Medical billing software automates practically every aspect of the healthcare billing cycle, from scheduling a doctor's appointment to processing electronic payments. Medical software can perform a variety of functions, including appointment scheduling and management, remittance management, payment reminders, BI & reporting, patient pre-registration, medical coding support, and electronic medical claim management. The rise in the number of patients, and the growing need for effective management of health records and claims, is the major driving factor for the development of the medical billing software market in the forecasted period.

Market Dynamics And Factors For Medical Billing Software Market

Drivers:

Reduction In Paperwork, And Time-Effectiveness

All billing processes that were previously done, sent, and processed on paper can now be completed electronically. As a result, there are fewer errors and less rework. Furthermore, medical billing software significantly streamlines treatment and medication operations since most solutions allow for the filing and processing of hundreds of claims through a single interface. Switching to electronic transactions has been calculated to save healthcare providers around 1.1 million work hours each week. Purchasing and implementing medical billing software might be expensive, but the investment is worthwhile. A manual transaction costs a medical provider $6 more than an electronic transaction. The automation of billing procedures can decrease operational expenses by more than 55 percent while increasing revenue, propelling the medical billing software market to grow throughout the forecasted timeframe.

Streamline Coding

ICD (International Classification of Diseases) coding is in its tenth revision (ICD-10), and it is slowly becoming the standard, shared coding system for physicians and medical professionals. A uniform set of medical codes facilitates coding and maintains efficiencies in individual practices. On a larger scale, this classification system enables the development of a comprehensive database of codes that represent specific diseases or courses of therapy. While it is still in its initial stages, artificial intelligence (AI) technology is being utilized to streamline and automate coding and charting. AI can scan medical documents and extract key information for coding and billing. Automating the coding process saves time and reduces data entry errors, allowing records to be updated accurately thus, strengthening the development of the medical billing software market over the projected timeframe.

Restraints:

Deployment Can Be Expensive

Computerized patient billing systems may run on standard off-the-shelf hardware, but the software that powers their database-reliant structures is an investment in proprietary technology that comes at a cost. Obtaining the underlying data may involve scanning a printed document or entering in and verifying data. The combination of a server, workstations, document scanners, and networking, as well as the integration of insurance information, payment processing, and collections capabilities, can drive up the cost of a billing system to the point where it is too expensive for small practices. Moreover, the consistent cost of updating cloud-based software is also high which can also harm the adoption of medical billing software. The cloud-based billing software is also prone to cyber-attacks which can result in the loss of critical patient data thereby, hampering the adoption rate of the medical billing software market over the analysis period.

Opportunities:

Medical Billing And EHR Software Becoming Interoperable

The integration of medical billing with electronic health records (EHR) is the latest trend that offers plenty of excellent benefits for healthcare providers of all sizes. One of the main advantages is that data entry requires much less time. Manually entering data into electronic systems is both time-consuming and tedious, but when medical billing and EHR software become interoperable, users can reduce this work by eliminating the need to double enter patient data. Higher reimbursement rates are another advantage, as it allows users to enhance their first pass claim rate. When the data entry burden and the potential for typographic errors are reduced, errors that can lead to costly denials are reduced. Integrating these technologies also provides users with a centralized management solution that will take care of all practice management needs rather than bouncing back and forth between multiple platforms. Integrated and interoperable systems also facilitate communication between internal practice systems. It makes it simple to swipe or find information across all systems, eliminating the risk of human error. All the above-mentioned factors are expected to create lucrative opportunities for market players over the forecasted timeframe as more hospitals & clinics will adopt medical billing software.

Market Segmentation Analysis of Medical Billing Software Market

By System Type, the open segment is expected to lead the growth of the medical billing software market in the projected period. Unlike the closed system, an open medical billing system demonstrates the importance of a synergetic design. The patient's complete health data is transferred to more than one practice via Electronic Health Record (EHRs). This type of billing system allows providers, patients, key stakeholders, insurance payers, medical billing teams, and even third-party vendors and multiple healthcare organizations to easily access information. When viewed by several healthcare providers, EHRs contain more information than an EMR and enable editing. Open medical billing is widely opted, owing to the flexibility provided, for excellent Healthcare consisting of numerous departments.

By Deployment Type, the cloud-based segment is anticipated to have the highest share of the medical billing software market during the analysis period. Using a billing software system that operates on a cloud-based server eliminates the possibility of a loss of data. Information on cloud-based servers is securely encrypted across numerous servers, with multiple backups. Users do not have to worry about losing files due to a fire or other natural disaster, and they can deliver services offline while the Internet is down and then immediately upload saved billing information when the connection is restored.

By Functions, the claim management segment is expected to have the highest share of the medical billing software market over the analysis period. Electronic claims processing provides less room for error and allows for more efficient and faster claim submission. Resubmitting a claim takes a long time, but a solid medical billing system can accelerate the process. The best systems validate claims and claim codes before submission, alerting users to potential issues before filing the claim. AMA has indicated that by using electronic claim processing, the cost of processing can be cut from 14 % of revenue to 1 %, thereby supporting the segment's growth.

By End Users, the hospital segment is forecasted to dominate in the projected period. During the forecast period, the segment is expected to maintain its dominance. This is primarily due to the growing demand for hospital finance services. Furthermore, hospital consolidation affects the reimbursement and billing process. Hospitals in developing as well as in underdeveloped countries act as primary healthcare sources thus, the registration of patients in hospitals is more thus, supporting the expansion of the segment.

Regional Analysis of Medical Billing Software Market

The North American region is anticipated to lead the development of the medical billing software market over the forecasted timeframe. The dominance of this region is attributed to the presence of prominent key players, such as Kareo, TheraBill - WebPT, TherapyNotes, LLC, Athena Health, and Practice Fusion. Several studies conducted over the last two decades have found that administrative expenses account for approximately 15% to 25% of total the United States health care expenditures, an amount that represents an estimated $600 billion to $1 trillion per year of total national health expenditures of $3.8 trillion in 2019. The key drivers of these expenses are billing and coding fees, physician administrative activities, and insurance administrative costs. Medical billing software can help in reducing these costs and thereby decreasing the cost incurred by patients, and administration thus, boosting the adoption rate of medical billing software in this region.

The European region is expected to have the second highest share of the medical billing software market in the analysis period. The growth in this market can be attributed to the rising geriatric population and the increasing prevalence of chronic diseases. According to Eurostat, more than one in every three EU citizens aged 16 and up reported having a long-standing disease or health problem in 2019. The growing prevalence of chronic diseases is expected to increase the number of visits of individuals to healthcare facilities for a routine health checkups. This in turn will create a large amount of database and increase the number of filings for healthcare claims. Thus, to regulate healthcare claims, there has been a significant rise in the adoption rate of medical billing software in this region.

The medical billing software market in the APAC region is forecasted to develop at the highest CAGR. India, China, Australia, Japan, South Korea, and Australia are the prominent countries responsible for the growth of the market in this region. Governments in this region are investing in the medical sector to digitize the healthcare sector. For instance, the Indian government has increased its spending by 73% on public healthcare for 2021-2022. This funding will be utilized to digitize the healthcare sector as well as for other initiations started by the government. Similar initiatives by other governments are expected to attract key players to start their operations in this region thus, consolidating the expansion of the medical billing software market in the projected period.

Key Players of the Medical Billing Software Market

- AdvancedMD, Inc.

- Kareo

- WebPT

- CareCloud

- PracticeSuit

- Docpulse

- CentralReach

- AllMeds

- GE Centricity

- McKesson

- CureMD

- EverCommerce Inc.

- Other Major Players

Key Industry Development In The Medical Billing Software Market

- In February 2024, lleva, a leading provider of electronic medical records (EMR) software for behavioral health and addiction treatment, announced that it had expanded its integration with CollaborateMD, a cloud-based medical billing and practice management solution. This partnership provided Alleva customers with a seamless billing experience designed to save time and money. With Alleva's newly added Encounter Transmission Table (ETT), users could view, filter, and report on their billable service data. Additionally, demographic, insurance, and diagnosis information could be shared across platforms to facilitate claim submissions in CollaborateMD.

- In January 2024, Harris, a global vertical market software provider, expanded its Revenue Cycle Management (RCM) solutions through the acquisition of Pacific Medical Management Services, Inc. and Whittier Medical Management Associates, Inc. (PacMed). PacMed's offerings provided end-to-end RCM services for the ambulatory market, ensuring timely and optimal compensation for healthcare services. These services were designed to accelerate the posting of payments and reduce the potential denial of claims.

|

Global Medical Billing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2024 |

Market Size in 2023: |

USD 109.05 Million. |

|

Forecast Period 2024-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 290.47 Million |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Function |

|

||

|

By System Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Price

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Medical Billing Software Market by Type

4.1 Medical Billing Software Market Overview Snapshot and Growth Engine

4.2 Medical Billing Software Market Overview

4.3 Compliance Tracking

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Compliance Tracking: Grographic Segmentation

4.4 Claims Scrubbing

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Claims Scrubbing: Grographic Segmentation

4.5 Code & Charge Entry

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Code & Charge Entry: Grographic Segmentation

Chapter 5: Medical Billing Software Market by Application

5.1 Medical Billing Software Market Overview Snapshot and Growth Engine

5.2 Medical Billing Software Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals: Grographic Segmentation

5.4 Clinics

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Clinics: Grographic Segmentation

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Grographic Segmentation

Chapter 6: Medical Billing Software Market by Price

6.1 Medical Billing Software Market Overview Snapshot and Growth Engine

6.2 Medical Billing Software Market Overview

6.3 Monthly

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Monthly: Grographic Segmentation

6.4 One Time

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 One Time: Grographic Segmentation

6.5 Annual

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Annual: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Medical Billing Software Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Medical Billing Software Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Medical Billing Software Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 KAREO

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 BRIGHTREE

7.4 ATHENACOLLECTOR

7.5 WEBPT

7.6 PRACTICE FUSION

7.7 THERAPYNOTES

7.8 THERABILL

7.9 NEXTGEN

7.10 CHIROTOUCH

7.11 GE

7.12 POINTCLICKCARE

7.13 AZALEA HEALTH

7.14 CENTRALREACH

7.15 FACETS

7.16 DRCHRONO

7.17 NUEMD

7.18 EZ CLAIM

7.19 CHARM HEALTH

7.20 PHREESIA

7.21 ADVANCEDMD

Chapter 8: Global Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Compliance Tracking

8.2.2 Claims Scrubbing

8.2.3 Code & Charge Entry

8.3 Historic and Forecasted Market Size By Application

8.3.1 Hospitals

8.3.2 Clinics

8.3.3 Others

8.4 Historic and Forecasted Market Size By Price

8.4.1 Monthly

8.4.2 One Time

8.4.3 Annual

Chapter 9: North America Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Compliance Tracking

9.4.2 Claims Scrubbing

9.4.3 Code & Charge Entry

9.5 Historic and Forecasted Market Size By Application

9.5.1 Hospitals

9.5.2 Clinics

9.5.3 Others

9.6 Historic and Forecasted Market Size By Price

9.6.1 Monthly

9.6.2 One Time

9.6.3 Annual

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Compliance Tracking

10.4.2 Claims Scrubbing

10.4.3 Code & Charge Entry

10.5 Historic and Forecasted Market Size By Application

10.5.1 Hospitals

10.5.2 Clinics

10.5.3 Others

10.6 Historic and Forecasted Market Size By Price

10.6.1 Monthly

10.6.2 One Time

10.6.3 Annual

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Compliance Tracking

11.4.2 Claims Scrubbing

11.4.3 Code & Charge Entry

11.5 Historic and Forecasted Market Size By Application

11.5.1 Hospitals

11.5.2 Clinics

11.5.3 Others

11.6 Historic and Forecasted Market Size By Price

11.6.1 Monthly

11.6.2 One Time

11.6.3 Annual

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Compliance Tracking

12.4.2 Claims Scrubbing

12.4.3 Code & Charge Entry

12.5 Historic and Forecasted Market Size By Application

12.5.1 Hospitals

12.5.2 Clinics

12.5.3 Others

12.6 Historic and Forecasted Market Size By Price

12.6.1 Monthly

12.6.2 One Time

12.6.3 Annual

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Medical Billing Software Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Compliance Tracking

13.4.2 Claims Scrubbing

13.4.3 Code & Charge Entry

13.5 Historic and Forecasted Market Size By Application

13.5.1 Hospitals

13.5.2 Clinics

13.5.3 Others

13.6 Historic and Forecasted Market Size By Price

13.6.1 Monthly

13.6.2 One Time

13.6.3 Annual

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Medical Billing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2024 |

Market Size in 2023: |

USD 109.05 Million. |

|

Forecast Period 2024-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 290.47 Million |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Function |

|

||

|

By System Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEDICAL BILLING SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEDICAL BILLING SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEDICAL BILLING SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. MEDICAL BILLING SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEDICAL BILLING SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. MEDICAL BILLING SOFTWARE MARKET BY TYPE

TABLE 008. COMPLIANCE TRACKING MARKET OVERVIEW (2016-2028)

TABLE 009. CLAIMS SCRUBBING MARKET OVERVIEW (2016-2028)

TABLE 010. CODE & CHARGE ENTRY MARKET OVERVIEW (2016-2028)

TABLE 011. MEDICAL BILLING SOFTWARE MARKET BY APPLICATION

TABLE 012. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 013. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. MEDICAL BILLING SOFTWARE MARKET BY PRICE

TABLE 016. MONTHLY MARKET OVERVIEW (2016-2028)

TABLE 017. ONE TIME MARKET OVERVIEW (2016-2028)

TABLE 018. ANNUAL MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 021. NORTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY PRICE (2016-2028)

TABLE 022. N MEDICAL BILLING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE MEDICAL BILLING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE MEDICAL BILLING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 025. EUROPE MEDICAL BILLING SOFTWARE MARKET, BY PRICE (2016-2028)

TABLE 026. MEDICAL BILLING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC MEDICAL BILLING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC MEDICAL BILLING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 029. ASIA PACIFIC MEDICAL BILLING SOFTWARE MARKET, BY PRICE (2016-2028)

TABLE 030. MEDICAL BILLING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA MEDICAL BILLING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA MEDICAL BILLING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA MEDICAL BILLING SOFTWARE MARKET, BY PRICE (2016-2028)

TABLE 034. MEDICAL BILLING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY APPLICATION (2016-2028)

TABLE 037. SOUTH AMERICA MEDICAL BILLING SOFTWARE MARKET, BY PRICE (2016-2028)

TABLE 038. MEDICAL BILLING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 039. KAREO: SNAPSHOT

TABLE 040. KAREO: BUSINESS PERFORMANCE

TABLE 041. KAREO: PRODUCT PORTFOLIO

TABLE 042. KAREO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. BRIGHTREE: SNAPSHOT

TABLE 043. BRIGHTREE: BUSINESS PERFORMANCE

TABLE 044. BRIGHTREE: PRODUCT PORTFOLIO

TABLE 045. BRIGHTREE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ATHENACOLLECTOR: SNAPSHOT

TABLE 046. ATHENACOLLECTOR: BUSINESS PERFORMANCE

TABLE 047. ATHENACOLLECTOR: PRODUCT PORTFOLIO

TABLE 048. ATHENACOLLECTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. WEBPT: SNAPSHOT

TABLE 049. WEBPT: BUSINESS PERFORMANCE

TABLE 050. WEBPT: PRODUCT PORTFOLIO

TABLE 051. WEBPT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. PRACTICE FUSION: SNAPSHOT

TABLE 052. PRACTICE FUSION: BUSINESS PERFORMANCE

TABLE 053. PRACTICE FUSION: PRODUCT PORTFOLIO

TABLE 054. PRACTICE FUSION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. THERAPYNOTES: SNAPSHOT

TABLE 055. THERAPYNOTES: BUSINESS PERFORMANCE

TABLE 056. THERAPYNOTES: PRODUCT PORTFOLIO

TABLE 057. THERAPYNOTES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. THERABILL: SNAPSHOT

TABLE 058. THERABILL: BUSINESS PERFORMANCE

TABLE 059. THERABILL: PRODUCT PORTFOLIO

TABLE 060. THERABILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. NEXTGEN: SNAPSHOT

TABLE 061. NEXTGEN: BUSINESS PERFORMANCE

TABLE 062. NEXTGEN: PRODUCT PORTFOLIO

TABLE 063. NEXTGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. CHIROTOUCH: SNAPSHOT

TABLE 064. CHIROTOUCH: BUSINESS PERFORMANCE

TABLE 065. CHIROTOUCH: PRODUCT PORTFOLIO

TABLE 066. CHIROTOUCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. GE: SNAPSHOT

TABLE 067. GE: BUSINESS PERFORMANCE

TABLE 068. GE: PRODUCT PORTFOLIO

TABLE 069. GE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. POINTCLICKCARE: SNAPSHOT

TABLE 070. POINTCLICKCARE: BUSINESS PERFORMANCE

TABLE 071. POINTCLICKCARE: PRODUCT PORTFOLIO

TABLE 072. POINTCLICKCARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. AZALEA HEALTH: SNAPSHOT

TABLE 073. AZALEA HEALTH: BUSINESS PERFORMANCE

TABLE 074. AZALEA HEALTH: PRODUCT PORTFOLIO

TABLE 075. AZALEA HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. CENTRALREACH: SNAPSHOT

TABLE 076. CENTRALREACH: BUSINESS PERFORMANCE

TABLE 077. CENTRALREACH: PRODUCT PORTFOLIO

TABLE 078. CENTRALREACH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. FACETS: SNAPSHOT

TABLE 079. FACETS: BUSINESS PERFORMANCE

TABLE 080. FACETS: PRODUCT PORTFOLIO

TABLE 081. FACETS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. DRCHRONO: SNAPSHOT

TABLE 082. DRCHRONO: BUSINESS PERFORMANCE

TABLE 083. DRCHRONO: PRODUCT PORTFOLIO

TABLE 084. DRCHRONO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. NUEMD: SNAPSHOT

TABLE 085. NUEMD: BUSINESS PERFORMANCE

TABLE 086. NUEMD: PRODUCT PORTFOLIO

TABLE 087. NUEMD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. EZ CLAIM: SNAPSHOT

TABLE 088. EZ CLAIM: BUSINESS PERFORMANCE

TABLE 089. EZ CLAIM: PRODUCT PORTFOLIO

TABLE 090. EZ CLAIM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. CHARM HEALTH: SNAPSHOT

TABLE 091. CHARM HEALTH: BUSINESS PERFORMANCE

TABLE 092. CHARM HEALTH: PRODUCT PORTFOLIO

TABLE 093. CHARM HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. PHREESIA: SNAPSHOT

TABLE 094. PHREESIA: BUSINESS PERFORMANCE

TABLE 095. PHREESIA: PRODUCT PORTFOLIO

TABLE 096. PHREESIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ADVANCEDMD: SNAPSHOT

TABLE 097. ADVANCEDMD: BUSINESS PERFORMANCE

TABLE 098. ADVANCEDMD: PRODUCT PORTFOLIO

TABLE 099. ADVANCEDMD: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. COMPLIANCE TRACKING MARKET OVERVIEW (2016-2028)

FIGURE 013. CLAIMS SCRUBBING MARKET OVERVIEW (2016-2028)

FIGURE 014. CODE & CHARGE ENTRY MARKET OVERVIEW (2016-2028)

FIGURE 015. MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY APPLICATION

FIGURE 016. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 017. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY PRICE

FIGURE 020. MONTHLY MARKET OVERVIEW (2016-2028)

FIGURE 021. ONE TIME MARKET OVERVIEW (2016-2028)

FIGURE 022. ANNUAL MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA MEDICAL BILLING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Medical Billing Software Market research report is 2024-2032.

AdvancedMD Inc., Kareo, WebPT, CareCloud, PracticeSuit, Docpulse, CentralReach, AllMeds, GE Centricity, McKesson, CureMD, EverCommerce Inc. , Other Major Players.

The Medical Billing Software Market is segmented into Deployment Type, System Type, Function, End-Users, and region. By Deployment Type, the market is categorized into Cloud and On-Premise. By System Type, the market is categorized into Closed, Open, and Isolated. By Function, the market is categorized into Patient Pre-Registration, Claims Management, Billing and Collection, Accounting and Financial Management, and Others. By End Users, the market is categorized into Hospitals, Clinics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Medical billing software automates practically every aspect of the healthcare billing cycle, from scheduling a doctor's appointment to processing electronic payments. Medical software can perform a variety of functions, including appointment scheduling and management, remittance management, payment reminders, BI & reporting, patient pre-registration, medical coding support, and electronic medical claim management.

The global market for Medical Billing Software was estimated at USD 109.05 Million in 2023 and is projected to reach USD 290.47 Million by 2024, growing at a CAGR of 11.5% over the analysis period.