Medical Billing Software Market Overview

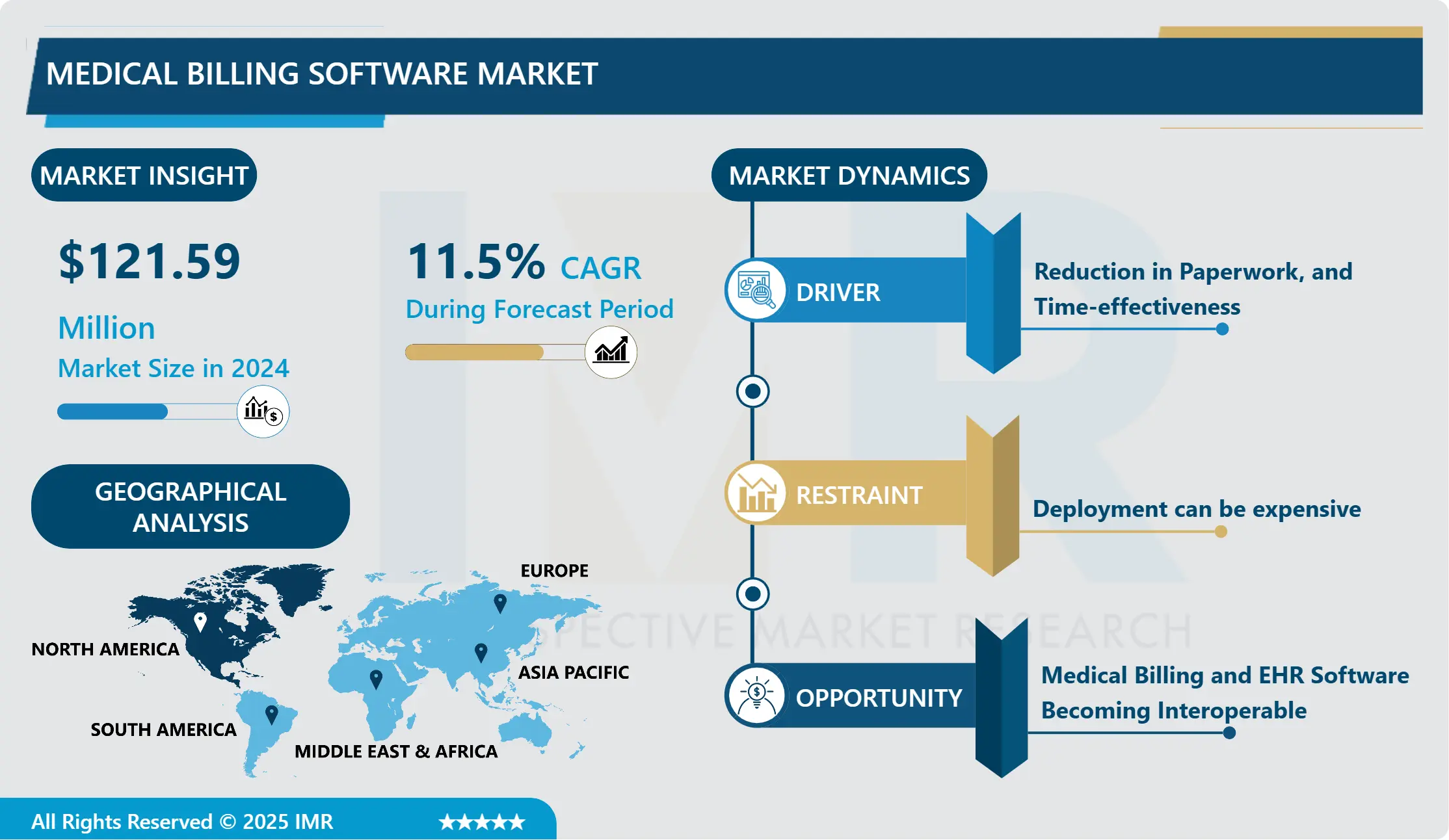

The global market for Medical Billing Software was estimated at USD 121.59 Million in 2024 and is projected to reach USD 290.47 Million by 2032, growing at a CAGR of 11.5% over the analysis period.

Customer payments are the fuel that keeps any firm running. Healthcare providers are no exception; yet, getting paid is a lengthy multi-step process with multiple regulations and players involved. While hospitals cannot make this journey any shorter, they may make it more efficient by automating billing operations. Medical billing is an important aspect of the healthcare revenue cycle since it involves getting paid for the services provided by a healthcare provider. This procedure begins before the services are even provided and includes numerous important steps. Medical billing software automates practically every aspect of the healthcare billing cycle, from scheduling a doctor's appointment to processing electronic payments. Medical software can perform a variety of functions, including appointment scheduling and management, remittance management, payment reminders, BI & reporting, patient pre-registration, medical coding support, and electronic medical claim management. The rise in the number of patients, and the growing need for effective management of health records and claims, is the major driving factor for the development of the medical billing software market in the forecasted period.

Market Dynamics And Factors For Medical Billing Software Market

Drivers:

Reduction In Paperwork, And Time-Effectiveness

All billing processes that were previously done, sent, and processed on paper can now be completed electronically. As a result, there are fewer errors and less rework. Furthermore, medical billing software significantly streamlines treatment and medication operations since most solutions allow for the filing and processing of hundreds of claims through a single interface. Switching to electronic transactions has been calculated to save healthcare providers around 1.1 million work hours each week. Purchasing and implementing medical billing software might be expensive, but the investment is worthwhile. A manual transaction costs a medical provider $6 more than an electronic transaction. The automation of billing procedures can decrease operational expenses by more than 55 percent while increasing revenue, propelling the medical billing software market to grow throughout the forecasted timeframe.

Streamline Coding

ICD (International Classification of Diseases) coding is in its tenth revision (ICD-10), and it is slowly becoming the standard, shared coding system for physicians and medical professionals. A uniform set of medical codes facilitates coding and maintains efficiencies in individual practices. On a larger scale, this classification system enables the development of a comprehensive database of codes that represent specific diseases or courses of therapy. While it is still in its initial stages, artificial intelligence (AI) technology is being utilized to streamline and automate coding and charting. AI can scan medical documents and extract key information for coding and billing. Automating the coding process saves time and reduces data entry errors, allowing records to be updated accurately thus, strengthening the development of the medical billing software market over the projected timeframe.

Restraints:

Deployment Can Be Expensive

Computerized patient billing systems may run on standard off-the-shelf hardware, but the software that powers their database-reliant structures is an investment in proprietary technology that comes at a cost. Obtaining the underlying data may involve scanning a printed document or entering in and verifying data. The combination of a server, workstations, document scanners, and networking, as well as the integration of insurance information, payment processing, and collections capabilities, can drive up the cost of a billing system to the point where it is too expensive for small practices. Moreover, the consistent cost of updating cloud-based software is also high which can also harm the adoption of medical billing software. The cloud-based billing software is also prone to cyber-attacks which can result in the loss of critical patient data thereby, hampering the adoption rate of the medical billing software market over the analysis period.

Opportunities:

Medical Billing And EHR Software Becoming Interoperable

The integration of medical billing with electronic health records (EHR) is the latest trend that offers plenty of excellent benefits for healthcare providers of all sizes. One of the main advantages is that data entry requires much less time. Manually entering data into electronic systems is both time-consuming and tedious, but when medical billing and EHR software become interoperable, users can reduce this work by eliminating the need to double enter patient data. Higher reimbursement rates are another advantage, as it allows users to enhance their first pass claim rate. When the data entry burden and the potential for typographic errors are reduced, errors that can lead to costly denials are reduced. Integrating these technologies also provides users with a centralized management solution that will take care of all practice management needs rather than bouncing back and forth between multiple platforms. Integrated and interoperable systems also facilitate communication between internal practice systems. It makes it simple to swipe or find information across all systems, eliminating the risk of human error. All the above-mentioned factors are expected to create lucrative opportunities for market players over the forecasted timeframe as more hospitals & clinics will adopt medical billing software.

Market Segmentation Analysis of Medical Billing Software Market

By System Type, the open segment is expected to lead the growth of the medical billing software market in the projected period. Unlike the closed system, an open medical billing system demonstrates the importance of a synergetic design. The patient's complete health data is transferred to more than one practice via Electronic Health Record (EHRs). This type of billing system allows providers, patients, key stakeholders, insurance payers, medical billing teams, and even third-party vendors and multiple healthcare organizations to easily access information. When viewed by several healthcare providers, EHRs contain more information than an EMR and enable editing. Open medical billing is widely opted, owing to the flexibility provided, for excellent Healthcare consisting of numerous departments.

By Deployment Type, the cloud-based segment is anticipated to have the highest share of the medical billing software market during the analysis period. Using a billing software system that operates on a cloud-based server eliminates the possibility of a loss of data. Information on cloud-based servers is securely encrypted across numerous servers, with multiple backups. Users do not have to worry about losing files due to a fire or other natural disaster, and they can deliver services offline while the Internet is down and then immediately upload saved billing information when the connection is restored.

By Functions, the claim management segment is expected to have the highest share of the medical billing software market over the analysis period. Electronic claims processing provides less room for error and allows for more efficient and faster claim submission. Resubmitting a claim takes a long time, but a solid medical billing system can accelerate the process. The best systems validate claims and claim codes before submission, alerting users to potential issues before filing the claim. AMA has indicated that by using electronic claim processing, the cost of processing can be cut from 14 % of revenue to 1 %, thereby supporting the segment's growth.

By End Users, the hospital segment is forecasted to dominate in the projected period. During the forecast period, the segment is expected to maintain its dominance. This is primarily due to the growing demand for hospital finance services. Furthermore, hospital consolidation affects the reimbursement and billing process. Hospitals in developing as well as in underdeveloped countries act as primary healthcare sources thus, the registration of patients in hospitals is more thus, supporting the expansion of the segment.

Regional Analysis of Medical Billing Software Market

The North American region is anticipated to lead the development of the medical billing software market over the forecasted timeframe. The dominance of this region is attributed to the presence of prominent key players, such as Kareo, TheraBill - WebPT, TherapyNotes, LLC, Athena Health, and Practice Fusion. Several studies conducted over the last two decades have found that administrative expenses account for approximately 15% to 25% of total the United States health care expenditures, an amount that represents an estimated $600 billion to $1 trillion per year of total national health expenditures of $3.8 trillion in 2019. The key drivers of these expenses are billing and coding fees, physician administrative activities, and insurance administrative costs. Medical billing software can help in reducing these costs and thereby decreasing the cost incurred by patients, and administration thus, boosting the adoption rate of medical billing software in this region.

The European region is expected to have the second highest share of the medical billing software market in the analysis period. The growth in this market can be attributed to the rising geriatric population and the increasing prevalence of chronic diseases. According to Eurostat, more than one in every three EU citizens aged 16 and up reported having a long-standing disease or health problem in 2019. The growing prevalence of chronic diseases is expected to increase the number of visits of individuals to healthcare facilities for a routine health checkups. This in turn will create a large amount of database and increase the number of filings for healthcare claims. Thus, to regulate healthcare claims, there has been a significant rise in the adoption rate of medical billing software in this region.

The medical billing software market in the APAC region is forecasted to develop at the highest CAGR. India, China, Australia, Japan, South Korea, and Australia are the prominent countries responsible for the growth of the market in this region. Governments in this region are investing in the medical sector to digitize the healthcare sector. For instance, the Indian government has increased its spending by 73% on public healthcare for 2021-2022. This funding will be utilized to digitize the healthcare sector as well as for other initiations started by the government. Similar initiatives by other governments are expected to attract key players to start their operations in this region thus, consolidating the expansion of the medical billing software market in the projected period.

Key Players of the Medical Billing Software Market

- AdvancedMD, Inc.

- Kareo

- WebPT

- CareCloud

- PracticeSuit

- Docpulse

- CentralReach

- AllMeds

- GE Centricity

- McKesson

- CureMD

- EverCommerce Inc.

- Other Major Players

Key Industry Development In The Medical Billing Software Market

- In February 2024, lleva, a leading provider of electronic medical records (EMR) software for behavioral health and addiction treatment, announced that it had expanded its integration with CollaborateMD, a cloud-based medical billing and practice management solution. This partnership provided Alleva customers with a seamless billing experience designed to save time and money. With Alleva's newly added Encounter Transmission Table (ETT), users could view, filter, and report on their billable service data. Additionally, demographic, insurance, and diagnosis information could be shared across platforms to facilitate claim submissions in CollaborateMD.

- In January 2024, Harris, a global vertical market software provider, expanded its Revenue Cycle Management (RCM) solutions through the acquisition of Pacific Medical Management Services, Inc. and Whittier Medical Management Associates, Inc. (PacMed). PacMed's offerings provided end-to-end RCM services for the ambulatory market, ensuring timely and optimal compensation for healthcare services. These services were designed to accelerate the posting of payments and reduce the potential denial of claims.

|

Global Medical Billing Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 121.59 Million. |

|

Forecast Period 2025-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 290.47 Million |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Function |

|

||

|

By System Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Billing Software Market by Deployment Type (2018-2032)

4.1 Medical Billing Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-Premises

Chapter 5: Medical Billing Software Market by Function (2018-2032)

5.1 Medical Billing Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Patient Pre-Registration

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Claims Management

5.5 Billing and Collection

5.6 Accounting and Financial Management

5.7 Others

Chapter 6: Medical Billing Software Market by System Type (2018-2032)

6.1 Medical Billing Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Closed

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Open

6.5 Isolated

Chapter 7: Medical Billing Software Market by End User (2018-2032)

7.1 Medical Billing Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinics

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Medical Billing Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ORACLE (US)

8.4 SAP (GERMANY)

8.5 SAS (US)

8.6 TIBCO

8.7 SOFTWARE (US)

8.8 INFORMATICA (US)

8.9 TALEND (US)

8.10 CLOUDERA (US)

8.11 RIVERSAND (US)

8.12 SYN FORCE (US)

8.13 STIBO SYSTEMS (DENMARK)

8.14 PROFISEE GROUP (US)

8.15 RELTIO (US)

8.16 SEMARCHY (US)

8.17 BROADCOM (US)

8.18 ATACCAMA (CANADA) OTHER KEY PLAYERS

Chapter 9: Global Medical Billing Software Market By Region

9.1 Overview

9.2. North America Medical Billing Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Deployment Type

9.2.4.1 Cloud

9.2.4.2 On-Premises

9.2.5 Historic and Forecasted Market Size by Function

9.2.5.1 Patient Pre-Registration

9.2.5.2 Claims Management

9.2.5.3 Billing and Collection

9.2.5.4 Accounting and Financial Management

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by System Type

9.2.6.1 Closed

9.2.6.2 Open

9.2.6.3 Isolated

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Hospitals

9.2.7.2 Clinics

9.2.7.3 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Medical Billing Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Deployment Type

9.3.4.1 Cloud

9.3.4.2 On-Premises

9.3.5 Historic and Forecasted Market Size by Function

9.3.5.1 Patient Pre-Registration

9.3.5.2 Claims Management

9.3.5.3 Billing and Collection

9.3.5.4 Accounting and Financial Management

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by System Type

9.3.6.1 Closed

9.3.6.2 Open

9.3.6.3 Isolated

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Hospitals

9.3.7.2 Clinics

9.3.7.3 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Medical Billing Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Deployment Type

9.4.4.1 Cloud

9.4.4.2 On-Premises

9.4.5 Historic and Forecasted Market Size by Function

9.4.5.1 Patient Pre-Registration

9.4.5.2 Claims Management

9.4.5.3 Billing and Collection

9.4.5.4 Accounting and Financial Management

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by System Type

9.4.6.1 Closed

9.4.6.2 Open

9.4.6.3 Isolated

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Hospitals

9.4.7.2 Clinics

9.4.7.3 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Medical Billing Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Deployment Type

9.5.4.1 Cloud

9.5.4.2 On-Premises

9.5.5 Historic and Forecasted Market Size by Function

9.5.5.1 Patient Pre-Registration

9.5.5.2 Claims Management

9.5.5.3 Billing and Collection

9.5.5.4 Accounting and Financial Management

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by System Type

9.5.6.1 Closed

9.5.6.2 Open

9.5.6.3 Isolated

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Hospitals

9.5.7.2 Clinics

9.5.7.3 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Medical Billing Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Deployment Type

9.6.4.1 Cloud

9.6.4.2 On-Premises

9.6.5 Historic and Forecasted Market Size by Function

9.6.5.1 Patient Pre-Registration

9.6.5.2 Claims Management

9.6.5.3 Billing and Collection

9.6.5.4 Accounting and Financial Management

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by System Type

9.6.6.1 Closed

9.6.6.2 Open

9.6.6.3 Isolated

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Hospitals

9.6.7.2 Clinics

9.6.7.3 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Medical Billing Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Deployment Type

9.7.4.1 Cloud

9.7.4.2 On-Premises

9.7.5 Historic and Forecasted Market Size by Function

9.7.5.1 Patient Pre-Registration

9.7.5.2 Claims Management

9.7.5.3 Billing and Collection

9.7.5.4 Accounting and Financial Management

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by System Type

9.7.6.1 Closed

9.7.6.2 Open

9.7.6.3 Isolated

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Hospitals

9.7.7.2 Clinics

9.7.7.3 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Medical Billing Software Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 121.59 Million. |

|

Forecast Period 2025-32 CAGR: |

11.5% |

Market Size in 2032: |

USD 290.47 Million |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Function |

|

||

|

By System Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||