Medical Billing Outsourcing Market Synopsis

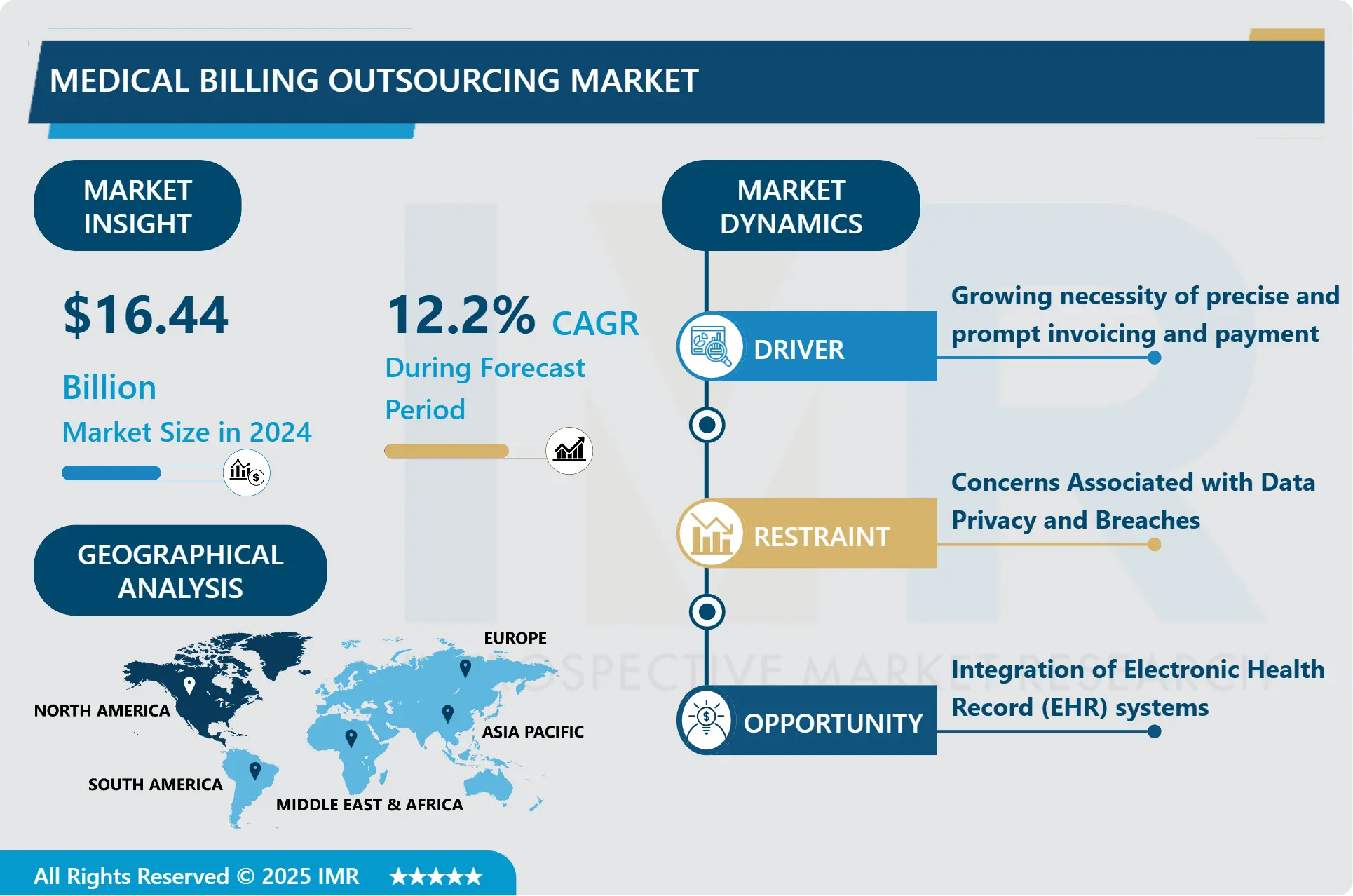

Medical Billing Outsourcing Market Size Was Valued at USD 16.44 Billion in 2024, and is Projected to Reach USD 41.3 Billion by 2032, Growing at a CAGR of 12.2% From 2025-2032.

Medical billing entails revenue cycle management otherwise known as RCM which encloses the most intricate as well as vital segments of the healthcare IT industry. It comprises the sale of medical billing outsourcing services involving organizations, sole traders, and partnerships offering the services in the market. Accommodation and transportation services, for example, are excluded because these are purchased by firms from other firms or by individuals.

Medical billing outsourcing facilitates constant cash flow, aid in cutting down the equipment and software cost, and does away with lots of employees and their expenses. Since professionals are inexperienced in working with new payment models and revenue management tools, real revenue management systems are fading from the picture. Besides, the rising popularity of billing and medical coding strategies in the management of revenue cycles is expected to fuel market growth.

The growing patient visits and hospital admissions across the globe will foster the medical billing outsourcing market growth. In addition, there is the increased need to address billing compliance, as well as the increasing trend of hospital adoption of these services that shall contribute to the growth of the market in the 2024-2034 period.

As patient volume escalated, facility revenue streams also soared, and managing billing processes became a challenge that disrupted point-of-care mechanisms. The hospital footfall has risen significantly in 2020 & 2021 and the healthcare personnel were under immense pressure, so the need for medical billing outsourcing services also surged. Therefore, outsourcing of medical billing helped medical practitioners in patient management and billing during these retrievals.

The increased business operations have caused havoc to the HCeps as the patient identification is often inaccurate, challenging to share with all staff members, and orders are often not even met. Digital order management is useful to address this problem in the sense that it has allowed for clinical and financial order data input from healthcare professionals connected to one smooth medical claims management system.

Due to diseases and pandemics that have put much pressure on the health sector several countries have been forced to embrace digitation. This is expected to increase development potential within the healthcare billing outsourcing market even more. Such aspects as the short term fluctuations and uncertainties of the legislation and regulatory framework being declared are expected to be favorable to the sector over the forecast period. However, the threat that heightens the chances of data loss and exposure may slow this industry in the future years.

Medical Billing Outsourcing Market Trend Analysis

Medical Billing Outsourcing Market Growth Driver- Rising demand for fast and accurate medical bills

- It is expected that the market will increase at a constant rate in the subsequent years because of the growing necessity of speedy and accurate medical bill for healthcare organizations. This has led to a rise in outsourcing of billing services from third parties since; handling of records and billings occupies a lot of time of the hospital staff and there is a shortage of skilled personnel for these tasks. They pointed out that complexity and stringent regulations of the health care industry and the coding system, and the overall increased cost of operating a business and contributing to rising operational costs all serve to complicate the medical billing process.

- Hospitals and private clinics have also increased the number of personnel employed to deal with the billing and administrative issues of their patients and to attend to the maintenance of facilities. Such an increase in workforce is an indication of an added pressure on healthcare providers to incur other expenses, which in turn will result in increased demand for outsourcing of medical bills. Outsourcing services are expected to propel the market forward since companies are its key clients who are looking to enhance profitability and offload the financial pressure on outsourcing companies.

Medical Billing Outsourcing Market Opportunity- Growing burden of the patient population

- The increased pressure from the patient load makes the job of the healthcare providers challenging when it comes to dealing with patients’ bills and tracking policies. The continuous rise in the number of chronic diseases like arthritis, asthma, lung infections, diabetes, heart diseases, and hypertension is the primary reason health facilities receive increasing patient visits, whether at the hospitals or private clinics across the globe.

- For instance, data collected in January 2020 has indicated that the U. S. adults have the highest rate of chronic disease- 28% of the global proportion-being in a report by The Commonwealth Fund. Moreover, as was stated in the same report, the U. S. leads the world in the proportion of adults – 40% of the total popultaion.

- This high prevalence of diseases has in turn led to the increased patient load in the hospitals and radiology clinics. Also, low penetration of latest billing software are expected to help in driving more usage of medical billing outsourcing for integrating hospital systems, reducing operational workload and improving the revenue cycle. More patient visits are being recorded in the radiology and surgical centers, thereby, enhancing the acceptance of these services in the marketplace. In addition, the requirements to learn the latest coding and billing, documentations, risk management to avoid billing mistakes, reduced the numbers of claims denial, and the balance between being financially healthy for the ASCs and hospital medical billing outsourcing are factors expected to fuel the medical billing outsourcing market forecast.

Medical Billing Outsourcing Market Segment Analysis:

Medical Billing Outsourcing Market Segmented based on Service, and End User.

By Service, middle-end services segment is expected to dominate the market during the forecast period

- On the basis of service offered, the market is divided into front-end, middle-end, and back-end services category. This element will also be even higher in the middle-end services segment which is expected to register the highest compound annual growth rate during the period under forecast. This segment is showing constant growth due to an increasing number of hospitals and surgical-centre coupled with raising awareness among healthcare establishments with middle-end services.

- In addition, the market players are employing strategies to introduce various services that can be used to streamline easy and errorless medical billing, thus developing the segment in the forecast timeframe.

By End User, hospital segment held the largest share in 2024

- By end user, the market is segmented into hospitals, physician office, others. Out of the two major end-users, the hospital segment was leading the FSH market share in 2023 and it has a high growth rate expected for the years 2024-2032. Higher share in this segment is due to more headcount visits and more use of electronic health record to search and retrieve more information on health of a particular patient and help in billing.

- However, over 2024-2032, the physicians’ office segment is expected to have a tremendously high growth rate. The segment has seen increase in the number of physicians and surgeons who are incorporating and establishing their own clinics and radiological centers and increasing their overall outsourcing of medical bill collections to third parties. These are the radiology centers, surgical centers, and the pain management centers which comes under the others segment. This segment has been estimated to be owning a better CAGR throughout the forecast period supported more usage of those billing outsourcing services.

Medical Billing Outsourcing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market in North America has produced a income of USD 8. 06 billion in 2023. The global market share is expected to be dominated by this region due to more people and establishments offering medical billing solutions in the region as well as expansion of various healthcare key players of solutions to cover the region. Additionally, the constant rise in angio developments and expenditures in medical structures, availability of a large population visiting hospitals & private clinics, and higher patient chances of getting admitted for their treatment will boost the regional market.

- Healthcare is one of the most data-driven sectors within the United States economy. Facing these developments, the industry remains very interested in the further search for effective solutions to work on the creation of a modern healthcare system and contribute to the promotion of positive changes and the evolution of patient treatment. Higher Prescribe and<|reserved_special_token_254|> demand, developing the healthcare facility in North America, and increasing hospital admissions also led to augmenting software solutions, increasing governmental efforts to support digital Health Record maintenance is anticipated to lead the market growth. In a nutshell, the development of latest technologies and their implementation in the field of healthcare is indeed coming useful in the process of growth of the United States. The increased cost of healthcare is the key driver that has led to the enhanced growth of this industry.

Active Key Players in the Medical Billing Outsourcing Market

- CareCloud Inc. (U.S.)

- R1 RCM, Inc. (U.S.)

- Experian Information Solutions, Inc. (U.S.)

- Veradigm LLC (U.S.)

- Billing Paradise (U.S.)

- 3Gen Consulting (U.S.)

- Altera Digital Health Inc. (U.K.)

- eClinicalWorks (U.S.) and Other Active Players

|

Global Medical Billing Outsourcing Market |

|||

|

Base Year: |

2025 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.2 % |

Market Size in 2032: |

USD 41.3 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Medical Billing Outsourcing Market by Service (2018-2032)

4.1 Medical Billing Outsourcing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Front-end

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Middle-end

4.5 Back-end

Chapter 5: Medical Billing Outsourcing Market by End-use (2018-2032)

5.1 Medical Billing Outsourcing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Physicians’ Office

5.5 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Medical Billing Outsourcing Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CARECLOUD INC. (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 R1 RCM INC. (U.S.)

6.4 EXPERIAN INFORMATION SOLUTIONS INC. (U.S.)

6.5 VERADIGM LLC (U.S.)

6.6 BILLING PARADISE (U.S.)

6.7 3GEN CONSULTING (U.S.)

6.8 ALTERA DIGITAL HEALTH INC. (U.K.)

6.9 ECLINICALWORKS (U.S.)

Chapter 7: Global Medical Billing Outsourcing Market By Region

7.1 Overview

7.2. North America Medical Billing Outsourcing Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Service

7.2.4.1 Front-end

7.2.4.2 Middle-end

7.2.4.3 Back-end

7.2.5 Historic and Forecasted Market Size by End-use

7.2.5.1 Hospitals

7.2.5.2 Physicians’ Office

7.2.5.3 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Medical Billing Outsourcing Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Service

7.3.4.1 Front-end

7.3.4.2 Middle-end

7.3.4.3 Back-end

7.3.5 Historic and Forecasted Market Size by End-use

7.3.5.1 Hospitals

7.3.5.2 Physicians’ Office

7.3.5.3 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Medical Billing Outsourcing Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Service

7.4.4.1 Front-end

7.4.4.2 Middle-end

7.4.4.3 Back-end

7.4.5 Historic and Forecasted Market Size by End-use

7.4.5.1 Hospitals

7.4.5.2 Physicians’ Office

7.4.5.3 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Medical Billing Outsourcing Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Service

7.5.4.1 Front-end

7.5.4.2 Middle-end

7.5.4.3 Back-end

7.5.5 Historic and Forecasted Market Size by End-use

7.5.5.1 Hospitals

7.5.5.2 Physicians’ Office

7.5.5.3 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Medical Billing Outsourcing Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Service

7.6.4.1 Front-end

7.6.4.2 Middle-end

7.6.4.3 Back-end

7.6.5 Historic and Forecasted Market Size by End-use

7.6.5.1 Hospitals

7.6.5.2 Physicians’ Office

7.6.5.3 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Medical Billing Outsourcing Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Service

7.7.4.1 Front-end

7.7.4.2 Middle-end

7.7.4.3 Back-end

7.7.5 Historic and Forecasted Market Size by End-use

7.7.5.1 Hospitals

7.7.5.2 Physicians’ Office

7.7.5.3 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Medical Billing Outsourcing Market |

|||

|

Base Year: |

2025 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 16.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.2 % |

Market Size in 2032: |

USD 41.3 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By End-use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||