Global Meal Replacement Products Market Overview

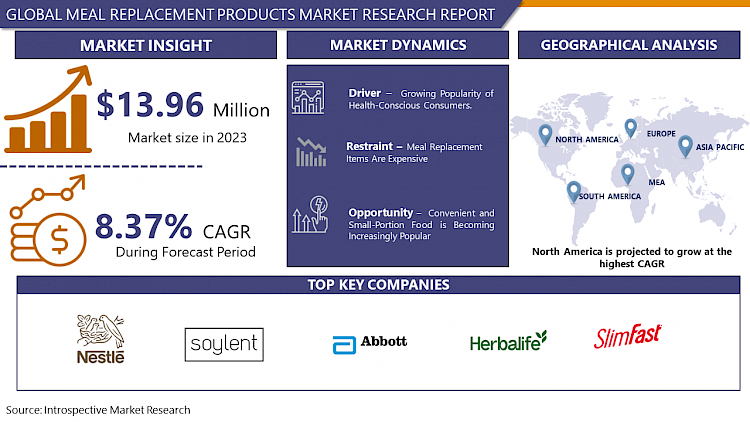

Meal Replacement Products Market size is projected to reach USD 28.78 Billion by 2032 from an estimated USD 13.96 Billion in 2023, growing at a CAGR of 8.37% globally.

A key driver is the increasing demand for convenient and controlled-portion food options. Meal replacements come in a variety of formats, from pre-made shakes and bars to ready-to-eat meals, catering to busy lifestyles and portion control needs. Another significant factor is the growing focus on health and wellness. Meal replacements often boast a balanced nutritional profile, containing essential vitamins, minerals, and protein, all conveniently packaged. This aligns perfectly with a global trend toward healthier eating habits, especially as chronic diseases become a pressing concern. Additionally, time-strapped consumers find meal replacements to be a practical solution for fitting in nutritious meals on the go.

The market also faces some hurdles. While convenience and health are attractive features, some consumers prioritize taste over nutritional value, and meal replacements can sometimes struggle to compete with the sensory satisfaction of a traditional meal. There's also a lingering perception that these products are not a complete dietary solution and may lack essential nutrients for long-term health. Manufacturers are constantly innovating to address these concerns, with a focus on improved taste profiles and formulations that provide a more comprehensive range of nutrients.

Market Dynamics and Factors for the Meal Replacement Products Market

Drivers:

Obesity And Diabetes Are Becoming More Common, And There is a Growing Popularity of Health-Conscious Consumers.

Type 2 diabetes mellitus (T2DM) is becoming more common around the world. T2DM can lead to major complications and even death if not managed properly. Diet modification is one of the most successful early-stage management methods for T2DM, but it requires patient understanding and compliance. As a result, meal replacement (MR) has grown in popularity as a technique for improving glycemic control and weight loss in T2DM patients. Diabetes is becoming more common at the same time as obesity is becoming more common. Those who are overweight or obese and have diabetes and want to lose weight confront numerous obstacles. Several recent studies, however, have shown that weight loss in diabetic individuals can be achieved using a multidisciplinary approach that includes systematic nutritional management and meal replacements (MRs). Because of their nutritional adequacy, nutritionally complete meal replacement has been demonstrated to be beneficial at the commencement of weight loss programs and for weight maintenance. Patients who use this method, however, must regularly monitor their blood glucose levels and may need to change their diabetes medications. Most commercial meal replacement is now enriched with vitamins and minerals to prevent long-term micronutrient deficit, which is prevalent in low-calorie diet regimens. They're also available in a variety of flavors and formats, which adds to their overall acceptability. Meal replacement is typically utilized as an absolute substitute for an agreed-upon amount of meals/snacks to properly commence weight loss. Furthermore, the global meal replacement industry is expected to be driven by rising awareness of healthy lifestyles. Meal replacements are becoming increasingly popular as a handy and easy way to replace regular meals with a nutritional diet.

Restraints:

Meal Replacement Items Are Expensive

Science and technology assist people in identifying foods that will assist them in managing their weight and overall health. Meal replacements are quite expensive, which may operate as a market restraint. The cost of a nutritious meal replacement is higher than the cost of a conventional meal since additional manufacturing techniques are used to boost the nutritional value of the product. The high expense of meal replacement is linked to the high cost of R&D and personalization. Consumers have moved to meal replacement products to boost their overall health as their health issues have grown and their lifestyles have changed. Meal replacement solutions are less cost-effective, which may limit market expansion.

Opportunities:

Convenient And Small-Portion Food is Becoming Increasingly Popular

Americans spend more than half of their food budget on convenience foods, according to the United States Department of Agriculture (USDA), aiming for quick and easy meals. This is driving the market examined by the growing demand for items like protein bars, energy bars, and shakes. Nutrition bars are a handy, practical, and typically healthier option for a fast on-the-go meal or snack. The industry is also driven by the availability of diverse sorts and tastes. As a result, these bars are gaining in popularity, particularly among the working class, youths, hostel dwellers, and bachelors. According to a survey performed by Welch's in 2017, 92 percent of millennials said they had been snacking instead of eating their meals. The research shows a growing customer preference for quick meals, indicating a burgeoning market for healthier, better-for-you meal replacement solutions.

Market Segmentation

Segmentation Analysis for Meal Replacement Products Market:

By Product, the powdered product segment is anticipated to register the major meal replacement market share over the forecast period. Powder products' convenience of storage and fast-paced lifestyles are projected to promote this segment's growth. With the powder packets, the manufacturers also include a free glass shaker. The availability of a wide range of flavors is expected to attract more customers who are concerned with weight loss and living a healthy lifestyle. In addition, meal replacement powders are popular because of their convenience and ease of use. Meal replacement powders are mixed into shakes and taken with water or low-calorie milk. In the future years, the increased acceptance of meal replacement powder as part of weight management will generate a good market outlook.

By Distribution Channel, the offline segment is anticipated to dominate the meal replacement market over the forecast period. Due to the presence of various formats of offline stores such as supermarkets & hypermarkets, convenience stores, specialty stores, many gym owners also sell major meal replacement products in gyms, which are anticipated to turn the demand for the offline segment in the meal replacement market.

Regional Analysis for Meal Replacement Products Market:

The meal replacement products market has seen significant growth in recent years, driven by increasing consumer demand for convenient and nutritionally balanced food options. These products, which include shakes, bars, and powders, offer a quick and easy solution for individuals with busy lifestyles who seek to maintain their health and wellness goals. The market's expansion is fueled by a growing awareness of the importance of balanced nutrition, rising health consciousness, and the increasing prevalence of lifestyle-related diseases such as obesity and diabetes. Additionally, advancements in food technology and product formulations have improved the taste and nutritional profile of meal replacement products, making them more appealing to a broader consumer base.

North America dominates the meal replacement products market, a dominance attributed to several factors. The region's high disposable income and fast-paced lifestyle have led to a greater adoption of convenient food solutions. Moreover, the strong presence of key market players, coupled with extensive marketing and promotional activities, has significantly boosted product visibility and consumer acceptance. In North America, there is also a growing trend towards health and fitness, which has propelled the demand for meal replacements as a viable alternative to traditional meals. Furthermore, the region's robust retail infrastructure, including online and offline channels, ensures widespread product availability and accessibility to consumers.

Players Covered in Meal Replacement Products Market are:

- Nestlé

- Soylent

- Abbott

- Herbalife International of America Inc.

- SlimFast

- Blue Diamond Growers

- Glanbia plc.

- General Mills Inc.

- Orgain Inc.

- Bob’s Red Mill Natural Foods

- Healthy 'N Fit International Inc.

- Kellogg NA Co.

- Encore

- PepsiCo

- Labrada.com

- Vega

- ICONIC Protein

- United States Nutrition Inc.

- MET-Rx Substrate Technology Inc.

- WorldPantry.com Inc.

- CytoSport Inc.

- OWYN

- PREMIER NUTRITION CORPORATION and other major players.

Key Industry Developments in Meal Replacement Products Market

- IN June 2022 - CTRL, the fast-growing meal replacement brand, has launched its new Meal On-The-Go Bars, marking its expansion into functional foods. The launch follows a successful friends and family funding round featuring investments from esports organization LoudGG and content creators Jimmy Here and Crispy Concords. The capital will be utilized to enhance the retail footprint, increase visibility, and expand product lines, reflecting the brand's commitment to healthier alternatives for the gaming, streaming, and digital creator community.

- In June 2021, Arla Foods Ingredients has introduced a new concept that emphasizes the versatility of whey and milk protein ingredients in the creation of on-trend meal replacements. Meal replacements have become more popular as people move away from crash diets and toward more comprehensive methods to weight loss. Over the last 10 years, the global market for such items, which include protein bars, powder shakes, and RTD beverages, has risen at a CAGR of 7%, with one in every four people now eating them at least once a week.

- In January 2020, Nestlé has declared a partnership with Burcon and Merit, two key players in the development and production of high-quality plant proteins. This collaboration will enable Nestlé to further fuel the development of nutritious and great-tasting plant-based meat and dairy substitutes with a good environmental footprint.

|

Global Meal Replacement Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.37% |

Market Size in 2032: |

USD 13.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Product

3.2 By Distribution Channel

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Meal Replacement Products Market by Product

5.1 Meal Replacement Products Market Overview Snapshot and Growth Engine

5.2 Meal Replacement Products Market Overview

5.3 Powdered Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Powdered Products: Grographic Segmentation

5.4 Ready to Drink

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Ready to Drink: Grographic Segmentation

5.5 Nutritional Bar

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Nutritional Bar: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Meal Replacement Products Market by Distribution Channel

6.1 Meal Replacement Products Market Overview Snapshot and Growth Engine

6.2 Meal Replacement Products Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Online: Grographic Segmentation

6.4 Offline

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Offline: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Meal Replacement Products Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Meal Replacement Products Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Meal Replacement Products Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 NESTLÉ

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 SOYLENT

7.4 ABBOTT

7.5 HERBALIFE INTERNATIONAL OF AMERICA INC.

7.6 SLIMFAST

7.7 BLUE DIAMOND GROWERS

7.8 GLANBIA PLC.

7.9 GENERAL MILLS INC.

7.10 ORGAIN INC.

7.11 BOB’S RED MILL NATURAL FOODS

7.12 HEALTHY 'N FIT INTERNATIONAL INC.

7.13 KELLOGG NA CO.

7.14 ENCORE

7.15 PEPSICO

7.16 LABRADA.COM

7.17 VEGA

7.18 ICONIC PROTEIN

7.19 UNITED STATES NUTRITION INC.

7.20 MET-RX SUBSTRATE TECHNOLOGY INC.

7.21 WORLDPANTRY.COM INC.

7.22 CYTOSPORT INC.

7.23 OWYN

7.24 PREMIER NUTRITION CORPORATION

7.25 OTHER MAJOR PLAYERS

Chapter 8: Global Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Product

8.2.1 Powdered Products

8.2.2 Ready to Drink

8.2.3 Nutritional Bar

8.2.4 Others

8.3 Historic and Forecasted Market Size By Distribution Channel

8.3.1 Online

8.3.2 Offline

Chapter 9: North America Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Product

9.4.1 Powdered Products

9.4.2 Ready to Drink

9.4.3 Nutritional Bar

9.4.4 Others

9.5 Historic and Forecasted Market Size By Distribution Channel

9.5.1 Online

9.5.2 Offline

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Product

10.4.1 Powdered Products

10.4.2 Ready to Drink

10.4.3 Nutritional Bar

10.4.4 Others

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Online

10.5.2 Offline

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Product

11.4.1 Powdered Products

11.4.2 Ready to Drink

11.4.3 Nutritional Bar

11.4.4 Others

11.5 Historic and Forecasted Market Size By Distribution Channel

11.5.1 Online

11.5.2 Offline

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Product

12.4.1 Powdered Products

12.4.2 Ready to Drink

12.4.3 Nutritional Bar

12.4.4 Others

12.5 Historic and Forecasted Market Size By Distribution Channel

12.5.1 Online

12.5.2 Offline

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Meal Replacement Products Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Product

13.4.1 Powdered Products

13.4.2 Ready to Drink

13.4.3 Nutritional Bar

13.4.4 Others

13.5 Historic and Forecasted Market Size By Distribution Channel

13.5.1 Online

13.5.2 Offline

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Meal Replacement Products Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.37% |

Market Size in 2032: |

USD 13.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEAL REPLACEMENT PRODUCTS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEAL REPLACEMENT PRODUCTS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEAL REPLACEMENT PRODUCTS MARKET COMPETITIVE RIVALRY

TABLE 005. MEAL REPLACEMENT PRODUCTS MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEAL REPLACEMENT PRODUCTS MARKET THREAT OF SUBSTITUTES

TABLE 007. MEAL REPLACEMENT PRODUCTS MARKET BY PRODUCT

TABLE 008. POWDERED PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 009. READY TO DRINK MARKET OVERVIEW (2016-2028)

TABLE 010. NUTRITIONAL BAR MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. MEAL REPLACEMENT PRODUCTS MARKET BY DISTRIBUTION CHANNEL

TABLE 013. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 014. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 016. NORTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 017. N MEAL REPLACEMENT PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE MEAL REPLACEMENT PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 019. EUROPE MEAL REPLACEMENT PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 020. MEAL REPLACEMENT PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC MEAL REPLACEMENT PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 022. ASIA PACIFIC MEAL REPLACEMENT PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 023. MEAL REPLACEMENT PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA MEAL REPLACEMENT PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MEAL REPLACEMENT PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 026. MEAL REPLACEMENT PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET, BY PRODUCT (2016-2028)

TABLE 028. SOUTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 029. MEAL REPLACEMENT PRODUCTS MARKET, BY COUNTRY (2016-2028)

TABLE 030. NESTLÉ: SNAPSHOT

TABLE 031. NESTLÉ: BUSINESS PERFORMANCE

TABLE 032. NESTLÉ: PRODUCT PORTFOLIO

TABLE 033. NESTLÉ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. SOYLENT: SNAPSHOT

TABLE 034. SOYLENT: BUSINESS PERFORMANCE

TABLE 035. SOYLENT: PRODUCT PORTFOLIO

TABLE 036. SOYLENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. ABBOTT: SNAPSHOT

TABLE 037. ABBOTT: BUSINESS PERFORMANCE

TABLE 038. ABBOTT: PRODUCT PORTFOLIO

TABLE 039. ABBOTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. HERBALIFE INTERNATIONAL OF AMERICA INC.: SNAPSHOT

TABLE 040. HERBALIFE INTERNATIONAL OF AMERICA INC.: BUSINESS PERFORMANCE

TABLE 041. HERBALIFE INTERNATIONAL OF AMERICA INC.: PRODUCT PORTFOLIO

TABLE 042. HERBALIFE INTERNATIONAL OF AMERICA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. SLIMFAST: SNAPSHOT

TABLE 043. SLIMFAST: BUSINESS PERFORMANCE

TABLE 044. SLIMFAST: PRODUCT PORTFOLIO

TABLE 045. SLIMFAST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BLUE DIAMOND GROWERS: SNAPSHOT

TABLE 046. BLUE DIAMOND GROWERS: BUSINESS PERFORMANCE

TABLE 047. BLUE DIAMOND GROWERS: PRODUCT PORTFOLIO

TABLE 048. BLUE DIAMOND GROWERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. GLANBIA PLC.: SNAPSHOT

TABLE 049. GLANBIA PLC.: BUSINESS PERFORMANCE

TABLE 050. GLANBIA PLC.: PRODUCT PORTFOLIO

TABLE 051. GLANBIA PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GENERAL MILLS INC.: SNAPSHOT

TABLE 052. GENERAL MILLS INC.: BUSINESS PERFORMANCE

TABLE 053. GENERAL MILLS INC.: PRODUCT PORTFOLIO

TABLE 054. GENERAL MILLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ORGAIN INC.: SNAPSHOT

TABLE 055. ORGAIN INC.: BUSINESS PERFORMANCE

TABLE 056. ORGAIN INC.: PRODUCT PORTFOLIO

TABLE 057. ORGAIN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BOB’S RED MILL NATURAL FOODS: SNAPSHOT

TABLE 058. BOB’S RED MILL NATURAL FOODS: BUSINESS PERFORMANCE

TABLE 059. BOB’S RED MILL NATURAL FOODS: PRODUCT PORTFOLIO

TABLE 060. BOB’S RED MILL NATURAL FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HEALTHY 'N FIT INTERNATIONAL INC.: SNAPSHOT

TABLE 061. HEALTHY 'N FIT INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 062. HEALTHY 'N FIT INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 063. HEALTHY 'N FIT INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. KELLOGG NA CO.: SNAPSHOT

TABLE 064. KELLOGG NA CO.: BUSINESS PERFORMANCE

TABLE 065. KELLOGG NA CO.: PRODUCT PORTFOLIO

TABLE 066. KELLOGG NA CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ENCORE: SNAPSHOT

TABLE 067. ENCORE: BUSINESS PERFORMANCE

TABLE 068. ENCORE: PRODUCT PORTFOLIO

TABLE 069. ENCORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. PEPSICO: SNAPSHOT

TABLE 070. PEPSICO: BUSINESS PERFORMANCE

TABLE 071. PEPSICO: PRODUCT PORTFOLIO

TABLE 072. PEPSICO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LABRADA.COM: SNAPSHOT

TABLE 073. LABRADA.COM: BUSINESS PERFORMANCE

TABLE 074. LABRADA.COM: PRODUCT PORTFOLIO

TABLE 075. LABRADA.COM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. VEGA: SNAPSHOT

TABLE 076. VEGA: BUSINESS PERFORMANCE

TABLE 077. VEGA: PRODUCT PORTFOLIO

TABLE 078. VEGA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ICONIC PROTEIN: SNAPSHOT

TABLE 079. ICONIC PROTEIN: BUSINESS PERFORMANCE

TABLE 080. ICONIC PROTEIN: PRODUCT PORTFOLIO

TABLE 081. ICONIC PROTEIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. UNITED STATES NUTRITION INC.: SNAPSHOT

TABLE 082. UNITED STATES NUTRITION INC.: BUSINESS PERFORMANCE

TABLE 083. UNITED STATES NUTRITION INC.: PRODUCT PORTFOLIO

TABLE 084. UNITED STATES NUTRITION INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. MET-RX SUBSTRATE TECHNOLOGY INC.: SNAPSHOT

TABLE 085. MET-RX SUBSTRATE TECHNOLOGY INC.: BUSINESS PERFORMANCE

TABLE 086. MET-RX SUBSTRATE TECHNOLOGY INC.: PRODUCT PORTFOLIO

TABLE 087. MET-RX SUBSTRATE TECHNOLOGY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. WORLDPANTRY.COM INC.: SNAPSHOT

TABLE 088. WORLDPANTRY.COM INC.: BUSINESS PERFORMANCE

TABLE 089. WORLDPANTRY.COM INC.: PRODUCT PORTFOLIO

TABLE 090. WORLDPANTRY.COM INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. CYTOSPORT INC.: SNAPSHOT

TABLE 091. CYTOSPORT INC.: BUSINESS PERFORMANCE

TABLE 092. CYTOSPORT INC.: PRODUCT PORTFOLIO

TABLE 093. CYTOSPORT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. OWYN: SNAPSHOT

TABLE 094. OWYN: BUSINESS PERFORMANCE

TABLE 095. OWYN: PRODUCT PORTFOLIO

TABLE 096. OWYN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. PREMIER NUTRITION CORPORATION: SNAPSHOT

TABLE 097. PREMIER NUTRITION CORPORATION: BUSINESS PERFORMANCE

TABLE 098. PREMIER NUTRITION CORPORATION: PRODUCT PORTFOLIO

TABLE 099. PREMIER NUTRITION CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY PRODUCT

FIGURE 012. POWDERED PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 013. READY TO DRINK MARKET OVERVIEW (2016-2028)

FIGURE 014. NUTRITIONAL BAR MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 017. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 018. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA MEAL REPLACEMENT PRODUCTS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Meal Replacement Products Market research report is 2024-2032.

Nestlé, Soylent, Abbott, Herbalife International of America Inc., SlimFast, Blue Diamond Growers, Glanbia plc., General Mills Inc., Orgain Inc., Bob’s Red Mill Natural Foods, Healthy 'N Fit International Inc., Kellogg NA Co., Encore, PepsiCo, Labrada.com, Vega, ICONIC Protein, United States Nutrition Inc., MET-Rx Substrate Technology Inc., WorldPantry.com Inc., CytoSport Inc., OWYN, PREMIER NUTRITION CORPORATION, and other major players.

The Meal Replacement Products market is segmented into Product, Distribution Channel and region. By Product, it is classified into: Powdered Products, Ready to Drink, Nutritional Bar and Others. By Distribution Channel, it is classified into: Online and Offline. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

A meal replacement is a drink, bar, soup, or other food that is meant to be used as a substitute for solid food and has controlled amounts of calories and nutrients. Some drinks are available in powdered form or as pre-mixed health shakes, which might be less expensive than solid foods with similar health benefits.

Meal Replacement Products Market size is projected to reach USD 28.78 Billion by 2032 from an estimated USD 13.96 Billion in 2023, growing at a CAGR of 8.37% globally.