Material Testing Market Synopsis

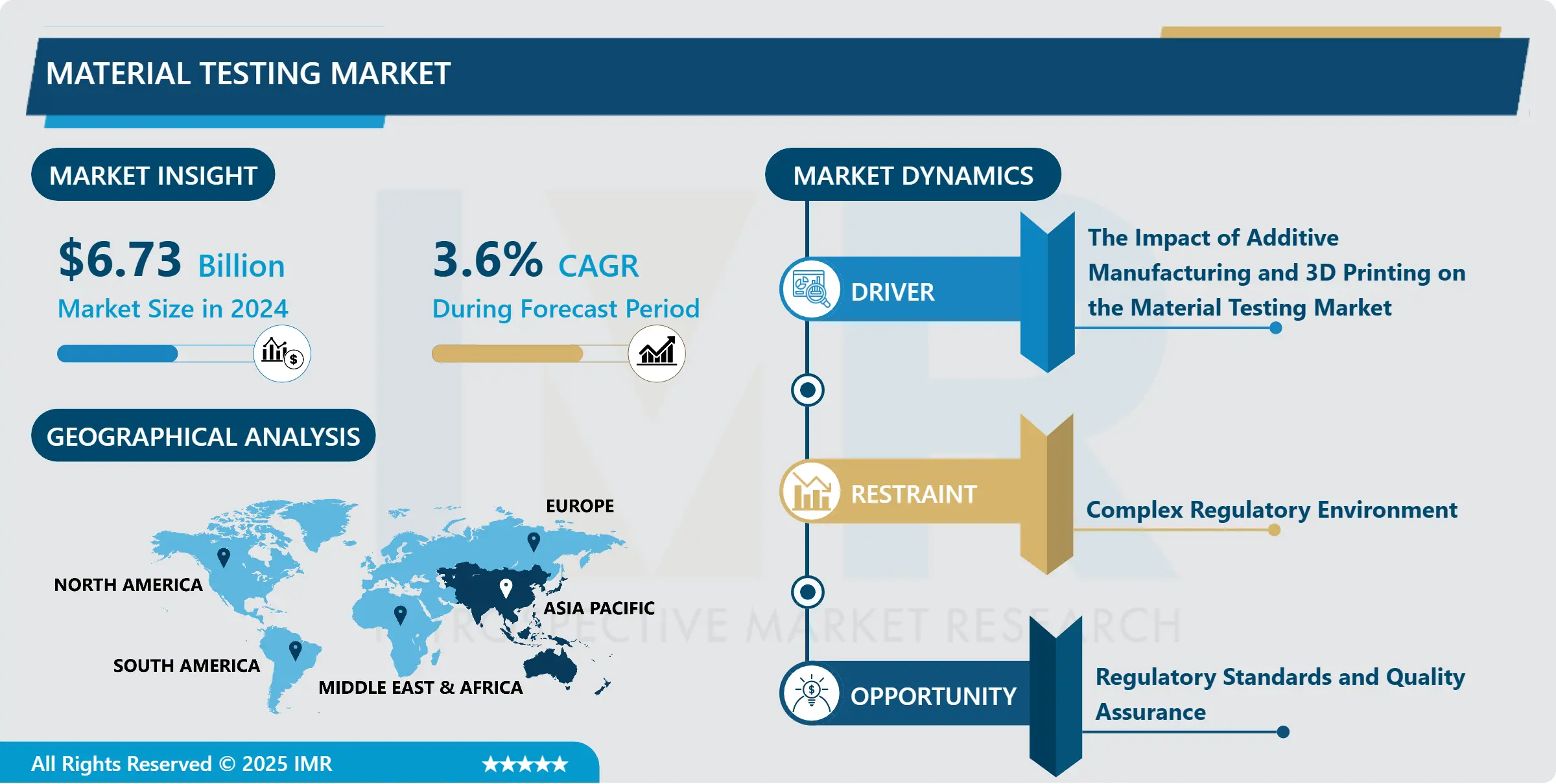

Material Testing Market Size is Valued at USD 6.73 Billion in 2024, and is Projected to Reach USD 8.94 Billion by 2032, Growing at a CAGR of 3.6% From 2025-2032.

The market for material testing includes a wide range of products and services that are used to assess the mechanical, chemical, and thermal characteristics of materials such metals, polymers, ceramics, and composites. These tests are necessary to make sure that materials fulfill the requirements and standards necessary for the various industries in which they are intended to be used, such as consumer products, automotive, aerospace, medical, and construction. The market is driven by the requirement for quality assurance, safety, regulatory compliance, and the development of new materials. It encompasses a variety of testing methods, including tensile, compressive, hardness, fatigue, impact, and thermal testing.

A vital part of several industries, including manufacturing, automotive, aerospace, and construction, is the material testing industry. The requirement to guarantee the safety, longevity, and quality of materials used in goods and constructions is driving this market. Material testing evaluates a material's performance and qualities under various circumstances using a range of methods and tools. By determining a material's mechanical, thermal, chemical, and physical characteristics, these tests assist in making sure it satisfies the necessary requirements.

The growing emphasis on quality control and safety across sectors is one of the main reasons propelling the growth of the material testing market. In order to prevent failures and accidents, government agencies and industry associations enforce strict norms and standards that necessitate thorough testing of materials. Furthermore, as a result of the quick development of technology, complex testing apparatus has been created, improving the precision and effectiveness of material testing procedures. The market is growing as a result of the use of automated and non-destructive testing techniques.

Geographically, areas like North America, Europe, and the Asia-Pacific area are seeing notable expansion in the material testing market. In particular, the Asia-Pacific area is predicted to grow rapidly because of the growing industrialization and infrastructure development in nations like China and India. Furthermore, the market is progressing due to the rising expenditures made in R&D to create innovative new testing procedures. Notwithstanding, obstacles like the exorbitant expense of sophisticated testing apparatus and the requirement for proficient professionals to manage these systems could potentially impede the expansion of the market.

In summary, the market for material testing is expected to increase significantly because to the growing need for safe and high-quality materials in a variety of industries. In the upcoming years, market participants should anticipate to find themselves in attractive prospects due to the ongoing improvements in technology and the growing awareness of the significance of material testing. In order to remain competitive and meet the changing needs of their clientele, companies in this industry are concentrating on diversifying their product offerings and allocating resources towards research & development.

Material Testing Market Trend Analysis

Material Testing Market Growth Driver- The Impact of Additive Manufacturing and 3D Printing on the Material Testing Market

- Several industries are changing as a result of additive manufacturing (AM) and 3D printing, including consumer goods, automotive, aerospace, and healthcare. Complex and specially designed components that were previously difficult or impossible to make using conventional manufacturing methods can now be created because to these technologies. There is an increasing need to make sure that the materials used in AM and 3D printing adhere to strict quality and performance standards as these techniques become more popular. In order to assess the mechanical characteristics of 3D-printed parts, such as tensile strength, hardness, and fatigue resistance, there is now a greater need for material testing. Furthermore, the layer-by-layer process of additive manufacturing presents particular difficulties such as anisotropy and porosity, which call for thorough testing and validation to guarantee that the finished goods are appropriate for the uses for which they are intended

- The demand for specialized testing tools and methods is also being driven by the development of novel materials made especially for additive manufacturing, such as biocompatible polymers, sophisticated metals, and high-performance composites. Specialized testing procedures are required to precisely evaluate the properties of these materials since they frequently display distinct features that set them apart from conventional materials. For example, interlaminar shear strength testing may be necessary for composite materials used in 3D printing, and extensive evaluations of thermal and chemical stability may be necessary for advanced alloys. The market for material testing must develop to offer the tools and procedures required as companies continue to push the limits of additive manufacturing in order to guarantee that these cutting-edge materials and procedures produce outcomes that are dependable, high-quality, and consistent. This development is essential to the industry's acceptance as well as the wider uptake of additive manufacturing technology in a variety of industries.

Material Testing Market Opportunities- Regulatory Standards and Quality Assurance

- The market for material testing is being driven in part by the increasing focus on strict regulations and quality control procedures. Stricter restrictions are being implemented by governments and international organizations more frequently to guarantee the performance, safety, and dependability of materials utilized in vital industries including healthcare, construction, automotive, and aerospace. These rules frequently include comprehensive specifications for material characteristics, testing procedures, and certification procedures. For instance, the automotive sector is subject to standards established by organizations such as the American Society for Testing and Materials (ASTM) and the International Organization for Standardization (ISO), which require stringent testing for parameters such as fatigue life, impact resistance, and tensile strength. Similar to this, the aerospace sector complies with strict regulations set forth by agencies like the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), which need extensive testing to guarantee that the materials used can endure harsh circumstances and forces.

- Manufacturers are using more sophisticated material testing methods to assure compliance and improve product quality in response to these regulatory constraints. These cutting-edge methods include automated testing equipment that offer excellent precision and reproducibility, as well as non-destructive testing (NDT), which permits the evaluation of materials without causing harm. The process of material testing is becoming more accurate and efficient as a result of the incorporation of digital technologies like machine learning and artificial intelligence (AI). Predictive analysis and real-time monitoring made possible by these technologies enable producers to spot possible problems early in the production process and make the required corrections. Furthermore, the demand for specialized testing tools and procedures is rising as businesses keep innovating and creating new materials with distinctive qualities. Investments in R&D in the material testing industry are being driven by this trend, which will result in the development of more advanced and adaptable testing systems that can satisfy the changing needs of diverse industries.

Material Testing Market Segment Analysis:

Material Testing Market Segmented based on By Type, By Material and By End-use Industry.

By Type, Servohydraulic Testing Machines segment is expected to dominate the market during the forecast period

- Servohydraulic Testing Machines are pivotal in industries like aerospace and automotive due to their capability to conduct dynamic and fatigue testing under rigorous conditions. These machines excel in simulating real-world scenarios where materials and components undergo repeated loading and stress cycles. In the aerospace sector, where safety and reliability are paramount, servohydraulic machines are essential for evaluating the durability of aircraft structures, engines, and critical components. They enable engineers to replicate complex loading patterns that aircraft encounter during flight, ensuring materials can withstand prolonged use without failure.

- Similarly, in the automotive industry, servohydraulic testing machines play a crucial role in testing vehicle components, including suspension systems, chassis frames, and engine parts. These machines simulate the stresses encountered during vehicle operation, such as road vibrations, braking forces, and impacts. By subjecting materials to these conditions, manufacturers can assess their performance, durability, and fatigue resistance, thereby improving vehicle safety and longevity. Servohydraulic systems offer precise control over force, displacement, and frequency, allowing for accurate measurement and analysis of material properties under varying stress conditions, which is vital for enhancing product reliability and meeting regulatory standards in both aerospace and automotive sectors.

By Material, Metal segment held the largest share in 2024

- Metals hold a predominant position in the material testing equipment market, primarily driven by their extensive use across key industries like automotive, aerospace, and construction. In these sectors, ensuring the structural integrity and performance of metal components under various stress conditions is critical for safety, reliability, and compliance with regulatory standards. Material testing equipment tailored for metals includes universal testing machines (UTMs) and servohydraulic testing machines, which are used to evaluate tensile strength, yield strength, ductility, and other mechanical properties essential for determining how metals behave under different loads.

- In the automotive industry, metals such as steel and aluminum are fundamental in manufacturing vehicle bodies, engine components, and structural parts. Material testing ensures that these metals meet stringent safety standards and performance requirements, including crashworthiness, durability, and fuel efficiency. Aerospace applications demand even higher standards, where metals are used in aircraft structures, engines, and landing gear. Material testing here focuses on fatigue resistance, corrosion resistance, and the ability to withstand extreme temperatures and pressures encountered during flight. The construction sector also relies heavily on metal testing to validate the strength and durability of structural elements like beams, columns, and bridges, ensuring they can withstand the loads and environmental conditions they are subjected to over their operational lifespan. Thus, the dominance of metals in material testing stems from their indispensable role in these critical industries and the need to continuously innovate and improve material performance to meet evolving technological and safety demands.

Material Testing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region's material testing market is experiencing unprecedented growth due to substantial industrial expansion and infrastructure development in key countries such as China, India, and Japan. These nations are witnessing a boom in their automotive, construction, and electronics sectors, all of which demand rigorous material testing to comply with both domestic and international standards. In China, for example, the government's focus on "Made in China 2025" emphasizes high-quality manufacturing, pushing industries to adopt advanced testing methodologies. Similarly, India's "Make in India" initiative aims to transform the country into a global manufacturing hub, thereby increasing the need for robust material testing frameworks. Japan, with its advanced technology and manufacturing prowess, continues to set high standards for material quality and testing. The widespread development of infrastructure projects, such as highways, railways, and smart cities, further drives the demand for comprehensive material testing to ensure safety and durability.

- In addition to industrial and infrastructure growth, the Asia Pacific region is benefiting from increased investments in research and development (R&D). Governments and private sectors are pouring resources into developing new materials and improving testing techniques. For instance, initiatives aimed at enhancing manufacturing quality and productivity are encouraging the adoption of automated and sophisticated material testing systems. The competitive landscape in the region, characterized by a mix of numerous local and international players, fosters a fertile ground for innovation and cost-effective solutions. Companies are continually investing in R&D to stay ahead of the curve, leading to the development of cutting-edge testing equipment and methodologies. This environment not only drives technological advancements but also makes high-quality material testing accessible to a broader range of industries. As a result, the Asia Pacific material testing market is poised for sustained growth, driven by a combination of industrial dynamism, governmental support, and a vibrant competitive ecosystem.

Active Key Players in the Material Testing Market

- Instron

- Zwick Roell

- Mts Systems

- Shimadzu

- Tinius Olsen

- Ametek

- Admet

- Hegewald & Peschke

- Applied Test Systems

- Mitutoyo

- Ta Instruments

- Torontech

- Qualitest International

- Ets Intarlaken

- Structures

- Other Active Players

|

Global Material Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.73 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 8.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Material Testing Market by Type (2018-2032)

4.1 Material Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Universal Testing Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Servohydraulic Testing Machines

4.5 Hardness Testing Equipment

4.6 Impact Testing Equipment

Chapter 5: Material Testing Market by Material (2018-2032)

5.1 Material Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastics

5.5 Rubber and Elastomer

5.6 Ceramics and Composites

5.7 Others

Chapter 6: Material Testing Market by End-User (2018-2032)

6.1 Material Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Construction

6.5 Educational institution

6.6 Medical devices

6.7 Aerospace Defense

6.8 Power

6.9 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Material Testing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 INSTRON

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ZWICK ROELL

7.4 MTS SYSTEMS

7.5 SHIMADZU

7.6 TINIUS OLSEN

7.7 AMETEK

7.8 ADMET

7.9 HEGEWALD & PESCHKE

7.10 APPLIED TEST SYSTEMS

7.11 MITUTOYO

7.12 TA INSTRUMENTS

7.13 TORONTECH

7.14 QUALITEST INTERNATIONAL

7.15 ETS INTARLAKEN

7.16 STRUCTURES

7.17 OTHER KEY PLAYERS

7.18

Chapter 8: Global Material Testing Market By Region

8.1 Overview

8.2. North America Material Testing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Universal Testing Machines

8.2.4.2 Servohydraulic Testing Machines

8.2.4.3 Hardness Testing Equipment

8.2.4.4 Impact Testing Equipment

8.2.5 Historic and Forecasted Market Size by Material

8.2.5.1 Metal

8.2.5.2 Plastics

8.2.5.3 Rubber and Elastomer

8.2.5.4 Ceramics and Composites

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Automotive

8.2.6.2 Construction

8.2.6.3 Educational institution

8.2.6.4 Medical devices

8.2.6.5 Aerospace Defense

8.2.6.6 Power

8.2.6.7 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Material Testing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Universal Testing Machines

8.3.4.2 Servohydraulic Testing Machines

8.3.4.3 Hardness Testing Equipment

8.3.4.4 Impact Testing Equipment

8.3.5 Historic and Forecasted Market Size by Material

8.3.5.1 Metal

8.3.5.2 Plastics

8.3.5.3 Rubber and Elastomer

8.3.5.4 Ceramics and Composites

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Automotive

8.3.6.2 Construction

8.3.6.3 Educational institution

8.3.6.4 Medical devices

8.3.6.5 Aerospace Defense

8.3.6.6 Power

8.3.6.7 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Material Testing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Universal Testing Machines

8.4.4.2 Servohydraulic Testing Machines

8.4.4.3 Hardness Testing Equipment

8.4.4.4 Impact Testing Equipment

8.4.5 Historic and Forecasted Market Size by Material

8.4.5.1 Metal

8.4.5.2 Plastics

8.4.5.3 Rubber and Elastomer

8.4.5.4 Ceramics and Composites

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Automotive

8.4.6.2 Construction

8.4.6.3 Educational institution

8.4.6.4 Medical devices

8.4.6.5 Aerospace Defense

8.4.6.6 Power

8.4.6.7 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Material Testing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Universal Testing Machines

8.5.4.2 Servohydraulic Testing Machines

8.5.4.3 Hardness Testing Equipment

8.5.4.4 Impact Testing Equipment

8.5.5 Historic and Forecasted Market Size by Material

8.5.5.1 Metal

8.5.5.2 Plastics

8.5.5.3 Rubber and Elastomer

8.5.5.4 Ceramics and Composites

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Automotive

8.5.6.2 Construction

8.5.6.3 Educational institution

8.5.6.4 Medical devices

8.5.6.5 Aerospace Defense

8.5.6.6 Power

8.5.6.7 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Material Testing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Universal Testing Machines

8.6.4.2 Servohydraulic Testing Machines

8.6.4.3 Hardness Testing Equipment

8.6.4.4 Impact Testing Equipment

8.6.5 Historic and Forecasted Market Size by Material

8.6.5.1 Metal

8.6.5.2 Plastics

8.6.5.3 Rubber and Elastomer

8.6.5.4 Ceramics and Composites

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Automotive

8.6.6.2 Construction

8.6.6.3 Educational institution

8.6.6.4 Medical devices

8.6.6.5 Aerospace Defense

8.6.6.6 Power

8.6.6.7 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Material Testing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Universal Testing Machines

8.7.4.2 Servohydraulic Testing Machines

8.7.4.3 Hardness Testing Equipment

8.7.4.4 Impact Testing Equipment

8.7.5 Historic and Forecasted Market Size by Material

8.7.5.1 Metal

8.7.5.2 Plastics

8.7.5.3 Rubber and Elastomer

8.7.5.4 Ceramics and Composites

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Automotive

8.7.6.2 Construction

8.7.6.3 Educational institution

8.7.6.4 Medical devices

8.7.6.5 Aerospace Defense

8.7.6.6 Power

8.7.6.7 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Material Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 6.73 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.6% |

Market Size in 2032: |

USD 8.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||