Marshmallows Market Synopsis

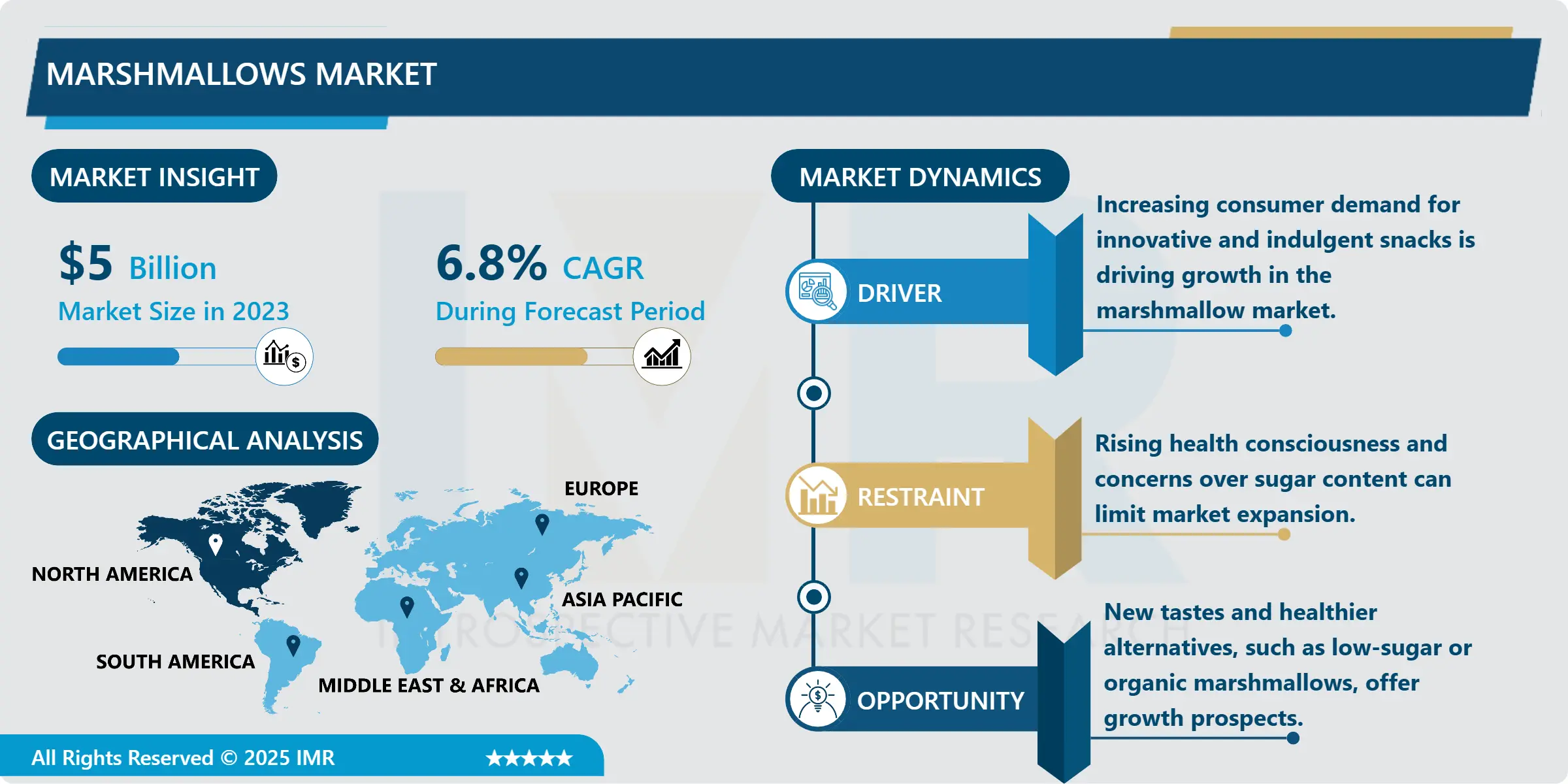

Marshmallows Market Size is Valued at USD 5.34 Billion in 2024 and is Projected to Reach USD 9.04 Billion by 2032, Growing at a CAGR of 6.8% From 2025-2032.

The marshmallow market stands out due to its growing demand, which is fueled by its adaptability in producing confectionery products, munchies, and desserts. This market encompasses a variety of products, including traditional marshmallows and specialty variations such as organic and gourmet options. Innovations in flavors and formulations, along with the increasing prevalence of marshmallow-based treats like s'mores and hot chocolate, facilitate the market's expansion. The growing consumer preference for nostalgic and comfort dishes further stimulates the market. To further stimulate market growth, key participants are emphasizing product innovation and the expansion of distribution channels to accommodate a wide range of consumer tastes and preferences.

The marshmallow market encompasses the production, distribution, and consumption of a variety of marshmallow products, including traditional marshmallows, marshmallow candies, and specialty varieties.

A variety of factors influence this market, including the increasing prevalence of novelty and gourmet marshmallow flavors, the popularity of marshmallows in baking and confectionery, and consumer preferences for sweet treats. Furthermore, seasonal demand surges, particularly during the camping and holiday seasons, influence market dynamics.

The marshmallow market has experienced growth in recent years as a result of the increasing presence of marshmallows in a variety of culinary applications and the introduction of new product offerings, such as organic and low-sugar alternatives.

In order to appeal to a wide range of consumer demographics, prominent market participants are emphasizing packaging strategies and product differentiation. Growing demand for healthier and more natural alternatives in the marshmallow segment is shaping the future landscape of the market, as health-conscious trends influence dietary choices.

Marshmallows Market Trend Analysis

Marshmallows Market Drivers- Health-Conscious Innovations

- Evolving consumer preferences and health-conscious innovations are driving significant trends in the marshmallow market. Consumers are progressively seeking healthier alternatives, and manufacturers are responding by providing options that meet this demand.

- Natural ingredients sweeten marshmallows, lowering their sugar content, and adding additional nutritional benefits like fiber and protein are among the new innovations. The objective of these health-conscious products is to provide guilt-free indulgence while simultaneously accommodating dietary requirements and preferences.

- Furthermore, the market is experiencing a significant increase in the prevalence of artisanal and gourmet marshmallows. Innovative presentations, exotic ingredients, and distinctive flavors distinguish many of these premium products, appealing to both traditional and adventurous consumers.

- The marshmallow market is adapting by incorporating nutritional advancements and investigating new and exciting flavor profiles as health trends continue to influence consumer behavior. We anticipate this market to expand and diversify further due to the dual emphasis on health and novelty.

Marshmallows Market Opportunities- Premium and Gourmet Varieties

-

The marshmallow market is experiencing a notable trend toward premium and gourmet varieties, driven by increasing consumer preference for high-quality and unique confectionery products. This shift is characterized by a growing demand for artisanal marshmallows with distinctive flavors, natural ingredients, and innovative textures.

- Crafted using organic or non-GMO ingredients, premium marshmallows often feature exotic flavors like matcha or salted caramel, appealing to health-conscious and discerning consumers. Additionally, the rise of gourmet marshmallows in specialty stores and online platforms reflects a broader trend towards personalized and luxurious snacking experiences.

- A surge in experiential consumption, where consumers seek novel and indulgent treats that offer a unique sensory experience, also supports this trend. Social media and influencer marketing, which showcase innovative uses of marshmallows in recipes and gourmet products, further fuel the market's expansion. As a result, brands are investing in premium offerings and innovative packaging to capture the attention of this evolving consumer segment and differentiate themselves in a competitive market.

Marshmallows Market Segment Analysis:

Marshmallows Market Segmented on the basis of type, Vehicle Type, and Application.

By Type, Flavored segment is expected to dominate the market during the forecast period

- Based on type, the marshmallow market divides into flavored and unflavored varieties. Specialty desserts and delights frequently incorporate flavored marshmallows, available in a variety of flavors such as vanilla, chocolate, and fruity options. This caters to the diverse preferences of consumers.

- The popularity of these flavored variants in pastry and confectionery stimulates innovation and variety within the market. Trends in culinary experimentation and seasonal promotions, which promote the development of new flavor combinations and limited edition releases, bolster the demand for flavored marshmallows.

- On the other hand, recipes that prioritize texture over flavor typically use unflavored marshmallows. Classic delights, such as s'mores and rice crispy treats, frequently contain them.

- The market for unflavored marshmallows remains consistent due to their enduring prevalence and adaptability in a variety of snack and dessert applications. Consumers' evolving tastes and the innovative culinary applications of both segments influence the marshmallow market's overall development.

By Distribution Channel, Specialty Stores segment held the largest share in 2024

- A wide variety of distribution channels characterize the marshmallow market, catering to the diverse preferences and purchasing behaviors of consumers. Supermarkets and hypermarkets continue to dominate the distribution of marshmallows, providing a diverse selection of brands and flavors in readily accessible locations.

- Premium and artisanal marshmallow options that appeal to niche markets are available at specialty stores, including gourmet food outlets and confectionary shops. Convenience stores also contribute by providing consumers with on-the-go snack options that are both convenient and fast.

- In recent years, online stores have emerged as a significant distribution channel, offering a wider selection of products, including specialty and bulk alternatives, as well as convenience. Consumers' increasing preference for online shopping and the ease of comparing prices and brands are the driving forces behind this transition to e-commerce. Collectively, these distribution channels facilitate the dynamic expansion of the marshmallow market by satisfying a wide range of consumer preferences and requirements.

Marshmallows Market Regional Insights:

North America is dominating the Global Marshmallow Market by recording the largest production and consumption of Marshmallows.

- North America dominates the global marshmallow market due to its substantial production and consumption levels. The region's robust distribution networks, high consumer demand, and well-established confectionery industry fuel this dominance.

- Popular applications such as baking, snacking, and seasonal treats substantiate marshmallows' considerable market presence in North America. Furthermore, in order to preserve their market leadership, significant organizations in the region implement sophisticated manufacturing technologies and comprehensive marketing strategies.

- Consumers' growing interest in healthier alternatives and innovative flavors is driving consistent growth in the marshmallow market. Innovations like organic and low-sugar marshmallows are stimulating consumer interest and expanding the market.

- Additionally, the proliferation of e-commerce platforms is improving market accessibility, enabling a broader consumer base and increased distribution. We anticipate the market to continue expanding as trends evolve, driven by both traditional and emerging consumer preferences.

Active Key Players in the Marshmallows Market

- Doumak Inc (US)

- Haribo GmbH (Germany)

- Hungry Harvest (US)

- H.J. Heinz Company Brands LLC (US)

- Dandies Marshmallows (US)

- Hammond's Candies (US)

- Campfire Marshmallow (US)

- Stuffed Puffs LLC (US)

- Madyson’s Marshmallow (US)

- North Mallow (US)

- Just Born Inc. (US)

- KandeeFactory (India)

- Riverdale Confectionery Industry Inc. (Philippines)

- Hsu Fu Chi international ltd. (China)

- Ananda Foods (India)

- Kroger Co. (US)

- XO Marshmallow (US), Other Active Players

|

Global Marshmallows Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2032: |

USD 9.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Marshmallows Market by Type (2018-2032)

4.1 Marshmallows Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Flavored

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Unflavored

Chapter 5: Marshmallows Market by Nature (2018-2032)

5.1 Marshmallows Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Solid Marshmallows

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Marshmallow Spread

5.5 Dehydrated Marshmallows

Chapter 6: Marshmallows Market by Distribution Channel (2018-2032)

6.1 Marshmallows Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets & Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Stores

6.5 Convenience Stores

6.6 Online Stores

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Marshmallows Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AT&T CYBERSECURITY INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 IBM CORPORATION (US)

7.4 CYGILANT INC. (US)

7.5 TATA CONSULTANCY SERVICES (INDIA)

7.6 ATOS (FRANCE)

7.7 ARCTIC WOLF NETWORKS (US)

7.8 AIRBUS CYBERSECURITY (FRANCE)

7.9 BINARY DEFENSE (US)

7.10 THALES GROUP (FRANCE)

7.11 SECUREWORKS INC. (US)

7.12 CYBERSECOP (US)

7.13 CHECK POINT SOFTWARE TECHNOLOGIES LTD. (ISRAEL)

7.14 BLACKSTRATUS INC. (US)

7.15 ESENTIRE INC. (CANADA)

7.16 VERIZON COMMUNICATION (US)

7.17 PROFICIO(US)

7.18 RADARSERVICES SMART IT-SECURITY GMBH (AUSTRIA)

7.19 NETSURION (US)

Chapter 8: Global Marshmallows Market By Region

8.1 Overview

8.2. North America Marshmallows Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Flavored

8.2.4.2 Unflavored

8.2.5 Historic and Forecasted Market Size by Nature

8.2.5.1 Solid Marshmallows

8.2.5.2 Marshmallow Spread

8.2.5.3 Dehydrated Marshmallows

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarkets & Hypermarkets

8.2.6.2 Specialty Stores

8.2.6.3 Convenience Stores

8.2.6.4 Online Stores

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Marshmallows Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Flavored

8.3.4.2 Unflavored

8.3.5 Historic and Forecasted Market Size by Nature

8.3.5.1 Solid Marshmallows

8.3.5.2 Marshmallow Spread

8.3.5.3 Dehydrated Marshmallows

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarkets & Hypermarkets

8.3.6.2 Specialty Stores

8.3.6.3 Convenience Stores

8.3.6.4 Online Stores

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Marshmallows Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Flavored

8.4.4.2 Unflavored

8.4.5 Historic and Forecasted Market Size by Nature

8.4.5.1 Solid Marshmallows

8.4.5.2 Marshmallow Spread

8.4.5.3 Dehydrated Marshmallows

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarkets & Hypermarkets

8.4.6.2 Specialty Stores

8.4.6.3 Convenience Stores

8.4.6.4 Online Stores

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Marshmallows Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Flavored

8.5.4.2 Unflavored

8.5.5 Historic and Forecasted Market Size by Nature

8.5.5.1 Solid Marshmallows

8.5.5.2 Marshmallow Spread

8.5.5.3 Dehydrated Marshmallows

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarkets & Hypermarkets

8.5.6.2 Specialty Stores

8.5.6.3 Convenience Stores

8.5.6.4 Online Stores

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Marshmallows Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Flavored

8.6.4.2 Unflavored

8.6.5 Historic and Forecasted Market Size by Nature

8.6.5.1 Solid Marshmallows

8.6.5.2 Marshmallow Spread

8.6.5.3 Dehydrated Marshmallows

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarkets & Hypermarkets

8.6.6.2 Specialty Stores

8.6.6.3 Convenience Stores

8.6.6.4 Online Stores

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Marshmallows Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Flavored

8.7.4.2 Unflavored

8.7.5 Historic and Forecasted Market Size by Nature

8.7.5.1 Solid Marshmallows

8.7.5.2 Marshmallow Spread

8.7.5.3 Dehydrated Marshmallows

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarkets & Hypermarkets

8.7.6.2 Specialty Stores

8.7.6.3 Convenience Stores

8.7.6.4 Online Stores

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Marshmallows Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8% |

Market Size in 2032: |

USD 9.04 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||