Marine Electronics Market Synopsis

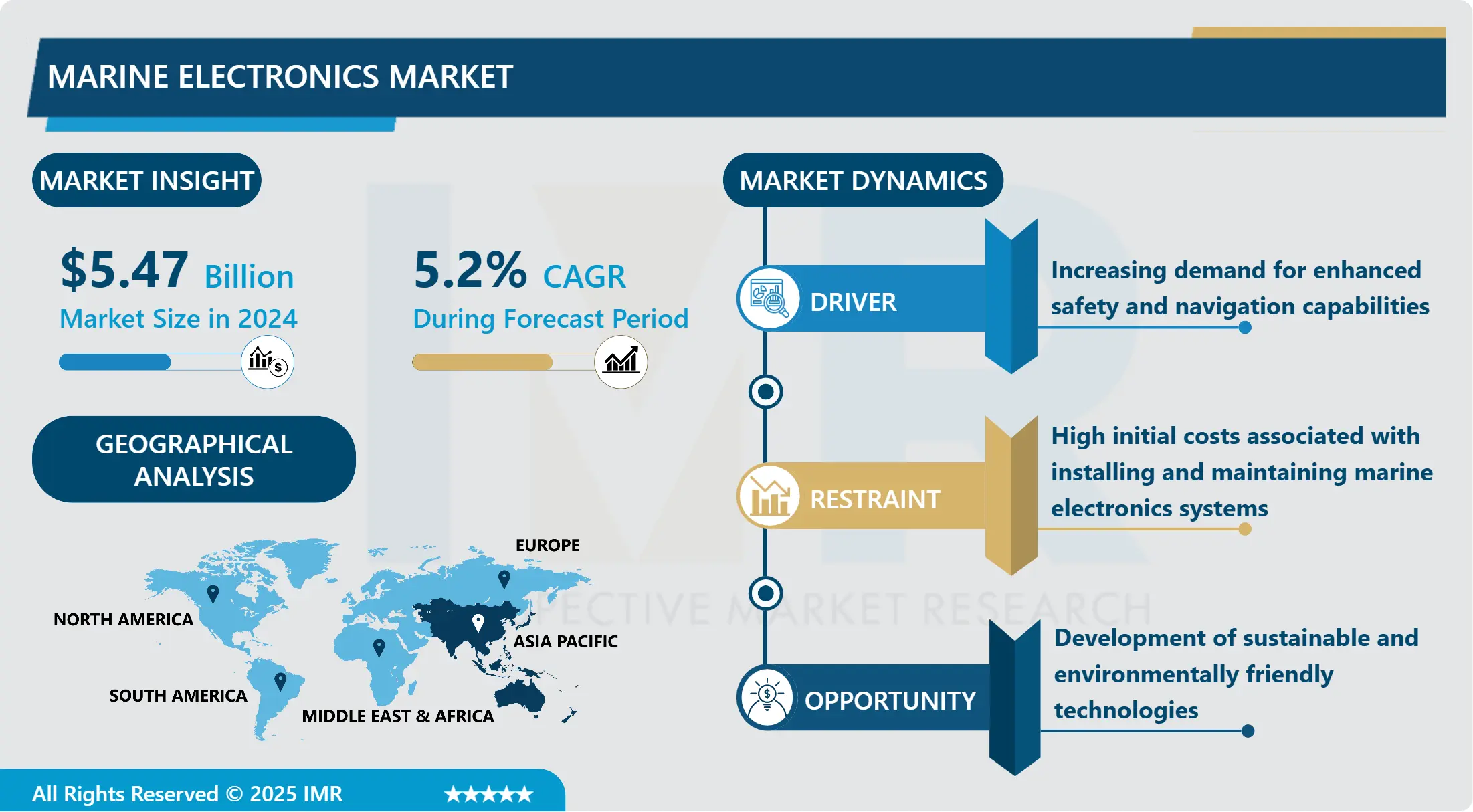

Marine Electronics Market Size Was Valued at USD 5.47 Billion in 2024, and is Projected to Reach USD 8.21 Billion by 2032, Growing at a CAGR of 5.2% From 2025-2032.

Marine electronics can be defined as the genre of electronics and electrical systems and equipment that are intended to operate in marine surroundings. These technologies are vital in navigation, communication, safety, and the overall working of boats, ships, and other vessels. The major sub categories of marine electronics encompass GPS navigational equipment, radar equipment for surveillance of nearer objects and ships, sonar equipment for underwater operations and search, marine radios for communication purposes, and electronic charting equipment for charting and planning. Marine equipment and electrical appliances are subjected to the torrents of salt water and the state of the weather; these devices are designed to weather such conditions and are safe for marine use.

Marine electronics industry covers all hard and software solutions and products designed specifically for maritime environment and usage. Already with growing use and industry of better navigation and communication in commercial shipping, recreational boating, and military applications, the market is growing. These preeminent technologies that contribute to the growth of this market are; GPS for accurate positioning and navigation, HD radar for better scene visibility, launch of electronic charting for mapping and other navigating programs.

Also, the necessity of the use of marine electronics is driven by safety requirements and the necessity to optimize operational activities on vessels. All manufacturers in this market are evaluating their products for durability and reliability in this climatic harsh environment to make changes and improvements. Fresh trends like smart shipping and self-navigation boats as well as the technology input that is being incorporated in the marine shipment are also part of the marine electronics industry’s future development.

Marine Electronics Market Trend Analysis

Marine Electronics Market Growth Driver- Integration of artificial intelligence (AI) and machine learning (ML) technologies

- A key development observed in the marine electronics industry is the complexity level of the machinery being incorporated into ships, in particular the artificial intelligence and machine learning technologies added to ships. These advancements are changing the functionality of marine electronics systems by incorporating real-time decision making, and condition monitoring of the systems thus increasing the level of automation. It is possible to calculate navigation routes, forecast weather conditions, or detect suspicious or potentially dangerous events with the help of AI and ML algorithms with the analysis of data from sensors, GPS, radar, etc. This kind of advancement is helpful not only to increase the efficiency and safety of the maritime operations but also will lead to the autonomous shipping as well as the unmanned underwater vehicle (UUV) which will give the new paradigm shift in the marine world.

Marine Electronics Market Expansion Opportunity- Development of sustainable and environmentally friendly technologies

- One of the fairly new trends that the global marine electronics industry needs to consider is the environmentally sensitive electronics. Wanting to see the maritime industry become greener, meaning using less energy, emitting less gas and producing less waste, there is a desire for the creation of new solutions on the seas. This offers the manufacturers a chance to conduct more research on machines that can be environmentally friendly and include effective techniques in marine electronics like energy-efficient propulsion systems, solar powered vessel navigation devices or even light vessel for more efficiency among others.

- In addition, there is an increasing inclination towards using new generation renewable sources of energy such as wind and the sun power in marine electronics systems that not only lower the running expenses but also respond to increasing environmentalism across the world. The companies that adopt such technologies have the potential of improving their strategic positions within the market, satisfying consumers’ needs and meeting the legal standards on the environment. Demands are shifting towards sustainable production and progress dynamically which gives new opportunities for the marine electronics industry to find new niches for the progress.

Marine Electronics Market Segment Analysis:

Marine Electronics Market Segmented on the basis of Component, Application, and Region.

By Component, Hardware segment is expected to dominate the market during the forecast period

- It will also be observed that the hardware segment holds the largest growth potential for the marine electronics market over the forecast period due to specifications of growth in technology and steep increasing needs of essential and reliable equipment for operation throughout the marine environments. Electronic devices including GPS and Radar, Sonars, Marine Radio and Communication, and Electronic Charts which are the major components that support vessel’s navigation, safety, and optimization of operations. The hardware segment on the other hand is a result of continuous advancements in the sensor technology, improved connectivity and enclosure that can stand the leakage of the marine environment.

- However, safety standards requirements and the desire for effectiveness strengthen the client’s demand for high-quality equipment in marine businesses. Because commercial and recreational boats, large and small, incorporate these advanced electronics systems into their navigation and operation, the hardware segment is anticipated to to remain the market’s force, fueling ongoing technology development and innovation.

By Application, Merchant Marine Electronics segment expected to held the largest share

- The Merchant Marine Electronics segment is anticipated to hold the largest share by application in the marine electronics market. This sector encompasses a diverse range of vessels involved in commercial shipping, including container ships, bulk carriers, tankers, and freighters. The dominance of this segment can be attributed to the increasing global trade volumes, which drive the demand for advanced navigation, communication, and safety systems to ensure efficient and secure maritime transportation. Merchant vessels rely heavily on sophisticated marine electronics such as GPS navigation systems, radar for collision avoidance, satellite communication for real-time data exchange, and integrated bridge systems for seamless operation.

- These technologies not only enhance operational efficiency and safety but also help optimize fuel consumption and reduce environmental impact, aligning with regulatory standards and industry best practices. As the global economy continues to expand, the Merchant Marine Electronics segment is poised for sustained growth, supported by ongoing technological advancements and the imperative for reliable and cost-effective maritime logistics solutions.

Marine Electronics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Several factors have been identified to influence the forecast period growth of the marine electronics in Asia Pacific, thus positioning the region as the most dominant in the market. The rapid economic development of the region especially China, Japan, South Korea and developing southeast Asian countries had led to spending spree on maritime facilities and acquisition of assets. These are coupled with growing trade events through the seas, higher per capita income increasing the tendency for leisure boating and upgrading regulatory standards to improve safety and direction.

- Also, Asia Pacific region is identified as a hub of manufacturing marine electronics industry where a lot of first tier companies are present due to strong technological proficiency and intensive R & D spending. The region’s geographical position also increases concern over the prospective localization of world transport highways, which will also increase needs for the most modern systems of ship navigation and communication. The assertion is that as industries associated with marine in Asia Pacific grow more modernized and larger than due to both the commercial and defense ends of the market, this region should keep on commanding the lion’s share of the global marine electronics market and hence determining for the worldwide marine technology of the future.

Active Key Players in the Marine Electronics Market

- ACR Electronics, Inc. (United States)

- B&G (United States)

- FLIR Systems, Inc. (United States)

- Furuno Electric Co., Ltd. (Japan)

- Garmin Ltd. (Switzerland)

- Humminbird (United States)

- Icom Inc. (Japan)

- Kongsberg Maritime AS (Norway)

- Lowrance (United States)

- Navico (Norway)

- Northrop Grumman Sperry Marine B.V. (Netherlands)

- Raymarine (United Kingdom)

- Simrad Yachting (Norway)

- Thales Group (France)

- Wärtsilä Corporation (Finland)

- Other Active Players

Key Industry Developments in the Marine Electronics Market:

- In January 2024, A new software package has been published by Cambridge Pixel, a company based in the United Kingdom, to assist instructors and students in the proper operation of marine radars. The SPx Radar Trainer is designed to facilitate the process of acquainting students with radar controls by providing a current simulation of a typical radar display, which is accompanied by schematics and 3D environment views.

|

Global Marine Electronics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.47 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 8.21 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Marine Electronics Market by Component (2018-2032)

4.1 Marine Electronics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

Chapter 5: Marine Electronics Market by Application (2018-2032)

5.1 Marine Electronics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Merchant Marine Electronics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fishing Vessel Electronics

5.5 Yacht/Recreation Boat Electronics

5.6 Military Naval Electronics

5.7 Autonomous Shipping Electronics

5.8 Smart Boat Electronics

5.9 Underwater Drone Electronics

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Marine Electronics Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ACR ELECTRONICS INC. (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 B&G (UNITED STATES)

6.4 FLIR SYSTEMS INC. (UNITED STATES)

6.5 FURUNO ELECTRIC COLTD. (JAPAN)

6.6 GARMIN LTD. (SWITZERLAND)

6.7 HUMMINBIRD (UNITED STATES)

6.8 ICOM INC. (JAPAN)

6.9 KONGSBERG MARITIME AS (NORWAY)

6.10 LOWRANCE (UNITED STATES)

6.11 NAVICO (NORWAY)

6.12 NORTHROP GRUMMAN SPERRY MARINE B.V. (NETHERLANDS)

6.13 RAYMARINE (UNITED KINGDOM)

6.14 SIMRAD YACHTING (NORWAY)

6.15 THALES GROUP (FRANCE)

6.16 WÄRTSILÄ CORPORATION (FINLAND)

6.17 OTHER ACTIVE KEY PLAYERS

Chapter 7: Global Marine Electronics Market By Region

7.1 Overview

7.2. North America Marine Electronics Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Component

7.2.4.1 Hardware

7.2.4.2 Software

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Merchant Marine Electronics

7.2.5.2 Fishing Vessel Electronics

7.2.5.3 Yacht/Recreation Boat Electronics

7.2.5.4 Military Naval Electronics

7.2.5.5 Autonomous Shipping Electronics

7.2.5.6 Smart Boat Electronics

7.2.5.7 Underwater Drone Electronics

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Marine Electronics Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Component

7.3.4.1 Hardware

7.3.4.2 Software

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Merchant Marine Electronics

7.3.5.2 Fishing Vessel Electronics

7.3.5.3 Yacht/Recreation Boat Electronics

7.3.5.4 Military Naval Electronics

7.3.5.5 Autonomous Shipping Electronics

7.3.5.6 Smart Boat Electronics

7.3.5.7 Underwater Drone Electronics

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Marine Electronics Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Component

7.4.4.1 Hardware

7.4.4.2 Software

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Merchant Marine Electronics

7.4.5.2 Fishing Vessel Electronics

7.4.5.3 Yacht/Recreation Boat Electronics

7.4.5.4 Military Naval Electronics

7.4.5.5 Autonomous Shipping Electronics

7.4.5.6 Smart Boat Electronics

7.4.5.7 Underwater Drone Electronics

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Marine Electronics Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Component

7.5.4.1 Hardware

7.5.4.2 Software

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Merchant Marine Electronics

7.5.5.2 Fishing Vessel Electronics

7.5.5.3 Yacht/Recreation Boat Electronics

7.5.5.4 Military Naval Electronics

7.5.5.5 Autonomous Shipping Electronics

7.5.5.6 Smart Boat Electronics

7.5.5.7 Underwater Drone Electronics

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Marine Electronics Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Component

7.6.4.1 Hardware

7.6.4.2 Software

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Merchant Marine Electronics

7.6.5.2 Fishing Vessel Electronics

7.6.5.3 Yacht/Recreation Boat Electronics

7.6.5.4 Military Naval Electronics

7.6.5.5 Autonomous Shipping Electronics

7.6.5.6 Smart Boat Electronics

7.6.5.7 Underwater Drone Electronics

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Marine Electronics Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Component

7.7.4.1 Hardware

7.7.4.2 Software

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Merchant Marine Electronics

7.7.5.2 Fishing Vessel Electronics

7.7.5.3 Yacht/Recreation Boat Electronics

7.7.5.4 Military Naval Electronics

7.7.5.5 Autonomous Shipping Electronics

7.7.5.6 Smart Boat Electronics

7.7.5.7 Underwater Drone Electronics

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Marine Electronics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 5.47 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.2% |

Market Size in 2032: |

USD 8.21 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||