Global Manufacturing Execution System Market Overview

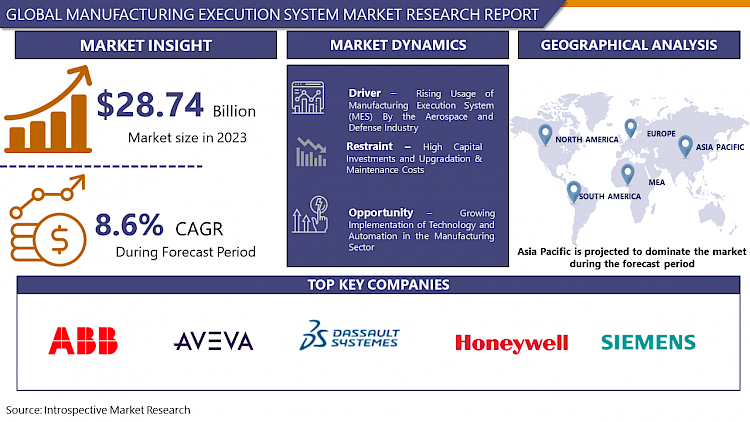

The Global Manufacturing Execution System Market size is expected to grow from USD 13.68 billion in 2023 to USD 28.74 billion by 2032, at a CAGR of 8.6 % during the forecast period (2024-2032).

The global Manufacturing Execution System (MES) market is on a robust growth trajectory, this surge is fueled by the increasing adoption of Industry 4.0 principles, which emphasize the integration of advanced technologies like Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and robotics into manufacturing processes. MES acts as the bridge between these advancements and the factory floor, creating a strong demand for the technology.

While North America currently holds the top spot in the MES market, primarily due to its strong manufacturing base, established MES vendors, and financial resources, the regional landscape is undergoing a shift. Asia Pacific, particularly, is witnessing a significant rise in MES adoption. This can be attributed to the region's rapid industrialization and government initiatives actively promoting smart manufacturing practices. Additionally, Europe, with its focus on automation and stringent regulations, is another prominent player in the global MES market.

As Industry 4.0 continues to gain traction and manufacturers strive for greater automation, efficiency, and agility, the MES market is expected to witness a sustained growth trajectory. The rising adoption of cloud-based MES solutions, offering scalability and affordability compared to traditional on-premise deployments, will further fuel this expansion. With its ability to bridge the gap between enterprise resource planning (ERP) systems and automation layers, MES is well-positioned to play a central role in the future of modern manufacturing. By providing real-time insights, optimizing production processes, and ensuring compliance, MES will serve as a key catalyst for manufacturers seeking to transform their operations and thrive in the competitive global landscape.

Market Dynamics And Key Factors For Manufacturing Execution System Market

Drivers:

Rise in new technological adoptions in the manufacturing process to increase efficiency

Manufacturers are always focusing on production cost optimization and improving production efficiency as global competition grows and business conditions change. As a result, manufacturers are turning to modern technology like manufacturing execution systems (MES) to help them optimize their processes and increase efficiency. The MES receives data from production equipment automatically and assists in scheduling, tracking, and altering production processes, as well as monitoring and controlling equipment performance based on delivery requirements. Furthermore, current developments such as the growth of Industry 4.0 and the convergence of information technology (IT) and operations technology (OT) are projected to fuel demand for MES systems throughout the projection period. The merging of information technology (IT) and operational technology (OT) systems is known as IT/OT convergence. OT systems monitor events, processes, and devices in corporate and industrial operations, whereas IT systems are utilized for data-centric computing. IT and OT convergence also refer to the integration of IT systems, such as ERP and CRM applications, with OT systems, such as Manufacturing Execution Systems (MES) and Supervisory Control and Data Acquisition (SCADA). Various firms get several benefits from process automation and business intelligence in conjunction with IT and OT to maintain regulatory compliance.

Restraints:

The transition from an existing production environment to a manufacturing execution system entails many steps that, when correctly understood, allow small and medium-sized businesses to deploy manufacturing execution systems at a low cost. The adoption of advanced factory execution systems now necessitates an appropriate software platform for the system, its connection with ERP, and data that must be shared between internal software and MES software to aid decision-making. Advanced MES solutions are too expensive for small and medium-sized businesses to deploy. They are also unaware of the advantages of modern MES solutions. These reasons are now limiting the market's growth.

Opportunities:

Manufacturing execution systems handle a variety of tasks, including managing goods and resources, scheduling, dispatching, data gathering, performance analysis, and data auditing. Manufacturing execution systems are connected with a variety of solutions, including ERP, supply chain management, warehouse management system, decision support system, business intelligence, and e-commerce, to ensure that these processes run smoothly and produce effective outcomes. Integration of factory execution systems with ERP WMS allows for the management of orders received in the warehouse. An order management system integrated with the MES solution is utilized to accurately and timely input data into the system. By making appropriate adjustments on the engineering floor, the integration of production execution systems with PLM would provide benefits such as enhanced planning and high productivity. Manufacturing execution systems are also employed in cloud-based applications, where they are connected with systems like AGV, EMS, and VMS. The ability to integrate with a large variety of systems and solutions helps manufacturing companies realize the benefits of several solutions in a single process and provide superior outcomes. It also guarantees that the tight standards governing product documentation and traceability are effectively maintained.

Challenges:

Manufacturing execution systems are difficult to establish since each system is unique to the industry and the processes involved in that sector. The three phases in the manufacturing process are implementation, staging, and transferring to the production floor. Due to the current complicated hardware infrastructure of the manufacturing or shop floor, implementation is hampered. As a result, the manufacturing execution system is unable to adapt to the environment and performs poorly, requiring many revisions throughout the installation. The process of implementing an MES takes four years on average. The complexity of the procedures needed in integrating MES with each system on a factory floor, as well as the time-consuming installation process, are two main obstacles for the industry.

Market Segmentation

Segmentation Analysis of Manufacturing Execution System Market:

By Offering, the Service segment is dominating in the Manufacturing Execution System Market. Because the post-implementation process is so critical to the functioning of industrial execution systems, the services help to increase efficiency while reducing waste and production time. In addition to the software, users may receive services from the manufacturers of industrial execution systems. Some of the post-sales services provided include installation, training, servicing, and software upgrades. The basic manufacturing execution system operations are carried out during and after implementation.

By Deployment, On-Premises dominates the Manufacturing Execution System Market. Currently, companies that are opting for premises services have multi-vertical operations in the manufacturing segment of the business. Manufacturing activities have various processes involved where certain proportion and method which required to be used and it is optimized by Manufacturing Execution System. Drug and Pharmaceutical manufacturers are the most likely user of the Manufacturing Execution System as it provides reliability and security for the process method and related data. An On-Premises system solution offers complete ownership and control over the software once it is purchased from a vendor. Currently, cloud-based solutions are more popular due to easy access and cloud technology adoption in the manufacturing sector but on premises, the software provides more security and is less venerable to cyber-attacks on live servers. Therefore, for the manufacturing sector, on-premises are the most favored solution in the market.

By End User Industry, The Pharmaceutical segment dominates in the Manufacturing Execution Systems Market. Manufacturers in the pharma industry were under a lot of pressure to continue with changing industry dynamics and adjust their processes to satisfy new needs. Manufacturing Execution Systems (MES) aid the pharmaceutical business in lowering manufacturing costs while also guaranteeing regulatory compliance. Additionally, as concerns about fraudulent medications entering the supply chain have grown, global track and trace measures have been adopted to safeguard patient safety and maintain product integrity. Manufacturers are now attempting to assure compliance with the EU Falsified Medicine Directive (EUFMD), the US Drug Supply Chain Act (DSCSA), and other universal laws by adding innovative technology and increasing resources to manage the added administrative load.

Regional Analysis of Manufacturing Execution System Market:

North America currently stands tall as the leader in the global Manufacturing Execution System (MES) market. This dominance is driven by a confluence of factors that position the region for continued growth in MES adoption.

The presence of major MES vendors like Honeywell, Oracle, Emerson, and Rockwell Automation – all headquartered in the US – is a key driver. These companies not only develop cutting-edge MES solutions but also foster a culture of innovation within the North American market. This translates to a wider variety of MES options tailored to specific industry needs, further propelling adoption.

North America boasts a long-established and robust manufacturing sector. Industries like automotive, oil & gas, and food & beverage rely heavily on efficient production processes, making MES a highly sought-after technology. As these industries continue to evolve and adapt to meet global demands, the need for advanced MES solutions will only become more critical. The strong economic position of North American countries is another crucial factor. Manufacturers here have the financial resources to invest in advanced technologies like MES. This willingness to embrace innovation allows them to optimize production processes, reduce costs, and gain a competitive edge in the global marketplace.

Players Covered In Manufacturing Execution System Market are:

- ABB Ltd. (Switzerland)

- AVEVA plc (UK)

- Dassault Systèmes (France) Honeywell International Inc. (US)

- Rockwell Automation Inc. (US)

- Siemens AG (Germany)

- SAP SE (Germany)

- General Electric Company (US)

- Oracle Corporation (US)

- Emerson Electric Co. (US)

- Werum IT Solutions GmbH (Germany) And Other Major Players.

Key Developments In Manufacturing Execution System Market

- In October 2023, Siemens Digital Industries Software and CEA-List, a technological research institute focused on smart digital systems research, formally signed a memorandum of understanding. This agreement reflects their shared dedication to collaborative research aimed at enhancing and expanding digital twin capabilities by integrating artificial intelligence (AI). The partnership also intends to investigate further integration of embedded software on virtual and hybrid platforms.

- In February 2023, AVEVA Group PLC introduced an updated version of its manufacturing execution system software to facilitate data center deployments. The latest release of the AVEVA Manufacturing Execution System (MES) aims to accelerate the standardization and extensive implementation of best practices, enhancing both operational sustainability and efficiency. By offering unified visibility, reporting, and key performance indicators (KPIs) across multiple site operations, the AVEVA Manufacturing Execution System 2023 also promotes improved supply chain resilience and agility.

- In June 2022, ABB Ltd. secured a contract to deliver the ABB Ability Manufacturing Execution System (MES) for the new production line of Asia Symbol Group. This expansion provided Asia Symbol with improved control over planning, scheduling, and ongoing efficiency and waste reduction, while also optimizing the overall production process across all lines at its Guangdong mill in China.

|

Global Manufacturing Execution System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.74 Bn. |

|

Forecast Period 2024 -32 CAGR: |

8.6% |

Market Size in 2032: |

USD 13.68 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Deployment |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Offering

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Manufacturing Execution System Market by Offering

5.1 Manufacturing Execution System Market Overview Snapshot and Growth Engine

5.2 Manufacturing Execution System Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Software: Grographic Segmentation

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Grographic Segmentation

Chapter 6: Manufacturing Execution System Market by Application

6.1 Manufacturing Execution System Market Overview Snapshot and Growth Engine

6.2 Manufacturing Execution System Market Overview

6.3 Electric Vehicle Charging

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electric Vehicle Charging: Grographic Segmentation

6.4 Smart Grid

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Smart Grid: Grographic Segmentation

6.5 Traction Locomotive

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Traction Locomotive: Grographic Segmentation

6.6 Other

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Manufacturing Execution System Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Manufacturing Execution System Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Manufacturing Execution System Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ABB LTD.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 AVEVA PLC

7.4 DASSAULT SYSTÈMES

7.5 HONEYWELL INTERNATIONAL INC.

7.6 ROCKWELL AUTOMATION INC.

7.7 SIEMENS AG

7.8 SAP SE

7.9 GENERAL ELECTRIC COMPANY

7.10 ORACLE CORPORATION

7.11 EMERSON ELECTRIC CO.

7.12 WERUM IT SOLUTIONS GMBH

7.13 OTHER MAJOR PLAYERS

Chapter 8: Global Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Offering

8.2.1 Software

8.2.2 Services

8.3 Historic and Forecasted Market Size By Application

8.3.1 Electric Vehicle Charging

8.3.2 Smart Grid

8.3.3 Traction Locomotive

8.3.4 Other

Chapter 9: North America Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Offering

9.4.1 Software

9.4.2 Services

9.5 Historic and Forecasted Market Size By Application

9.5.1 Electric Vehicle Charging

9.5.2 Smart Grid

9.5.3 Traction Locomotive

9.5.4 Other

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Offering

10.4.1 Software

10.4.2 Services

10.5 Historic and Forecasted Market Size By Application

10.5.1 Electric Vehicle Charging

10.5.2 Smart Grid

10.5.3 Traction Locomotive

10.5.4 Other

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Offering

11.4.1 Software

11.4.2 Services

11.5 Historic and Forecasted Market Size By Application

11.5.1 Electric Vehicle Charging

11.5.2 Smart Grid

11.5.3 Traction Locomotive

11.5.4 Other

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Offering

12.4.1 Software

12.4.2 Services

12.5 Historic and Forecasted Market Size By Application

12.5.1 Electric Vehicle Charging

12.5.2 Smart Grid

12.5.3 Traction Locomotive

12.5.4 Other

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Manufacturing Execution System Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Offering

13.4.1 Software

13.4.2 Services

13.5 Historic and Forecasted Market Size By Application

13.5.1 Electric Vehicle Charging

13.5.2 Smart Grid

13.5.3 Traction Locomotive

13.5.4 Other

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Manufacturing Execution System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.74 Bn. |

|

Forecast Period 2024 -32 CAGR: |

8.6% |

Market Size in 2032: |

USD 13.68 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Deployment |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MANUFACTURING EXECUTION SYSTEM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MANUFACTURING EXECUTION SYSTEM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MANUFACTURING EXECUTION SYSTEM MARKET COMPETITIVE RIVALRY

TABLE 005. MANUFACTURING EXECUTION SYSTEM MARKET THREAT OF NEW ENTRANTS

TABLE 006. MANUFACTURING EXECUTION SYSTEM MARKET THREAT OF SUBSTITUTES

TABLE 007. MANUFACTURING EXECUTION SYSTEM MARKET BY OFFERING

TABLE 008. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. MANUFACTURING EXECUTION SYSTEM MARKET BY APPLICATION

TABLE 011. ELECTRIC VEHICLE CHARGING MARKET OVERVIEW (2016-2028)

TABLE 012. SMART GRID MARKET OVERVIEW (2016-2028)

TABLE 013. TRACTION LOCOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET, BY OFFERING (2016-2028)

TABLE 016. NORTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 017. N MANUFACTURING EXECUTION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE MANUFACTURING EXECUTION SYSTEM MARKET, BY OFFERING (2016-2028)

TABLE 019. EUROPE MANUFACTURING EXECUTION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 020. MANUFACTURING EXECUTION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC MANUFACTURING EXECUTION SYSTEM MARKET, BY OFFERING (2016-2028)

TABLE 022. ASIA PACIFIC MANUFACTURING EXECUTION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 023. MANUFACTURING EXECUTION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA MANUFACTURING EXECUTION SYSTEM MARKET, BY OFFERING (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA MANUFACTURING EXECUTION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 026. MANUFACTURING EXECUTION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET, BY OFFERING (2016-2028)

TABLE 028. SOUTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET, BY APPLICATION (2016-2028)

TABLE 029. MANUFACTURING EXECUTION SYSTEM MARKET, BY COUNTRY (2016-2028)

TABLE 030. ABB LTD.: SNAPSHOT

TABLE 031. ABB LTD.: BUSINESS PERFORMANCE

TABLE 032. ABB LTD.: PRODUCT PORTFOLIO

TABLE 033. ABB LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. AVEVA PLC: SNAPSHOT

TABLE 034. AVEVA PLC: BUSINESS PERFORMANCE

TABLE 035. AVEVA PLC: PRODUCT PORTFOLIO

TABLE 036. AVEVA PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. DASSAULT SYSTÈMES: SNAPSHOT

TABLE 037. DASSAULT SYSTÈMES: BUSINESS PERFORMANCE

TABLE 038. DASSAULT SYSTÈMES: PRODUCT PORTFOLIO

TABLE 039. DASSAULT SYSTÈMES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 040. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 041. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 042. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ROCKWELL AUTOMATION INC.: SNAPSHOT

TABLE 043. ROCKWELL AUTOMATION INC.: BUSINESS PERFORMANCE

TABLE 044. ROCKWELL AUTOMATION INC.: PRODUCT PORTFOLIO

TABLE 045. ROCKWELL AUTOMATION INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SIEMENS AG: SNAPSHOT

TABLE 046. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 047. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 048. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SAP SE: SNAPSHOT

TABLE 049. SAP SE: BUSINESS PERFORMANCE

TABLE 050. SAP SE: PRODUCT PORTFOLIO

TABLE 051. SAP SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 052. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 053. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 054. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ORACLE CORPORATION: SNAPSHOT

TABLE 055. ORACLE CORPORATION: BUSINESS PERFORMANCE

TABLE 056. ORACLE CORPORATION: PRODUCT PORTFOLIO

TABLE 057. ORACLE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. EMERSON ELECTRIC CO.: SNAPSHOT

TABLE 058. EMERSON ELECTRIC CO.: BUSINESS PERFORMANCE

TABLE 059. EMERSON ELECTRIC CO.: PRODUCT PORTFOLIO

TABLE 060. EMERSON ELECTRIC CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. WERUM IT SOLUTIONS GMBH: SNAPSHOT

TABLE 061. WERUM IT SOLUTIONS GMBH: BUSINESS PERFORMANCE

TABLE 062. WERUM IT SOLUTIONS GMBH: PRODUCT PORTFOLIO

TABLE 063. WERUM IT SOLUTIONS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY OFFERING

FIGURE 012. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY APPLICATION

FIGURE 015. ELECTRIC VEHICLE CHARGING MARKET OVERVIEW (2016-2028)

FIGURE 016. SMART GRID MARKET OVERVIEW (2016-2028)

FIGURE 017. TRACTION LOCOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA MANUFACTURING EXECUTION SYSTEM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Manufacturing Execution System Market research report is 2024-2032.

ABB Ltd. (Switzerland), AVEVA plc (UK), Dassault Systèmes (France) Honeywell International Inc. (US), Rockwell Automation Inc. (US), Siemens AG (Germany), SAP SE (Germany), General Electric Company (US), Oracle Corporation (US), Emerson Electric Co. (US), Werum IT Solutions GmbH (Germany), and other major players.

The Manufacturing Execution System Market is segmented into Offering, Deployment, End-User Industry, and region. By Offering, the market is categorized into Software & Services. By Deployment, the market is categorized into Cloud & On-Premise. By End User Industry, the market is categorized into FMCG, Medical, Pharmaceutical, Chemical, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Manufacturing execution systems (MES) are critical for synchronizing processes such as manufacturing, shipping, equipment automation, and sales and planning, among other things. End-users may improve their performance, compliance, and regulatory needs throughout the business by using MES to synchronize multiple functions and give a holistic perspective to various key stakeholders.

The Global Manufacturing Execution System Market size is expected to grow from USD 13.68 billion in 2023 to USD 28.74 billion by 2032, at a CAGR of 8.6 % during the forecast period (2024-2032).