Global Machine Vision System Market Overview

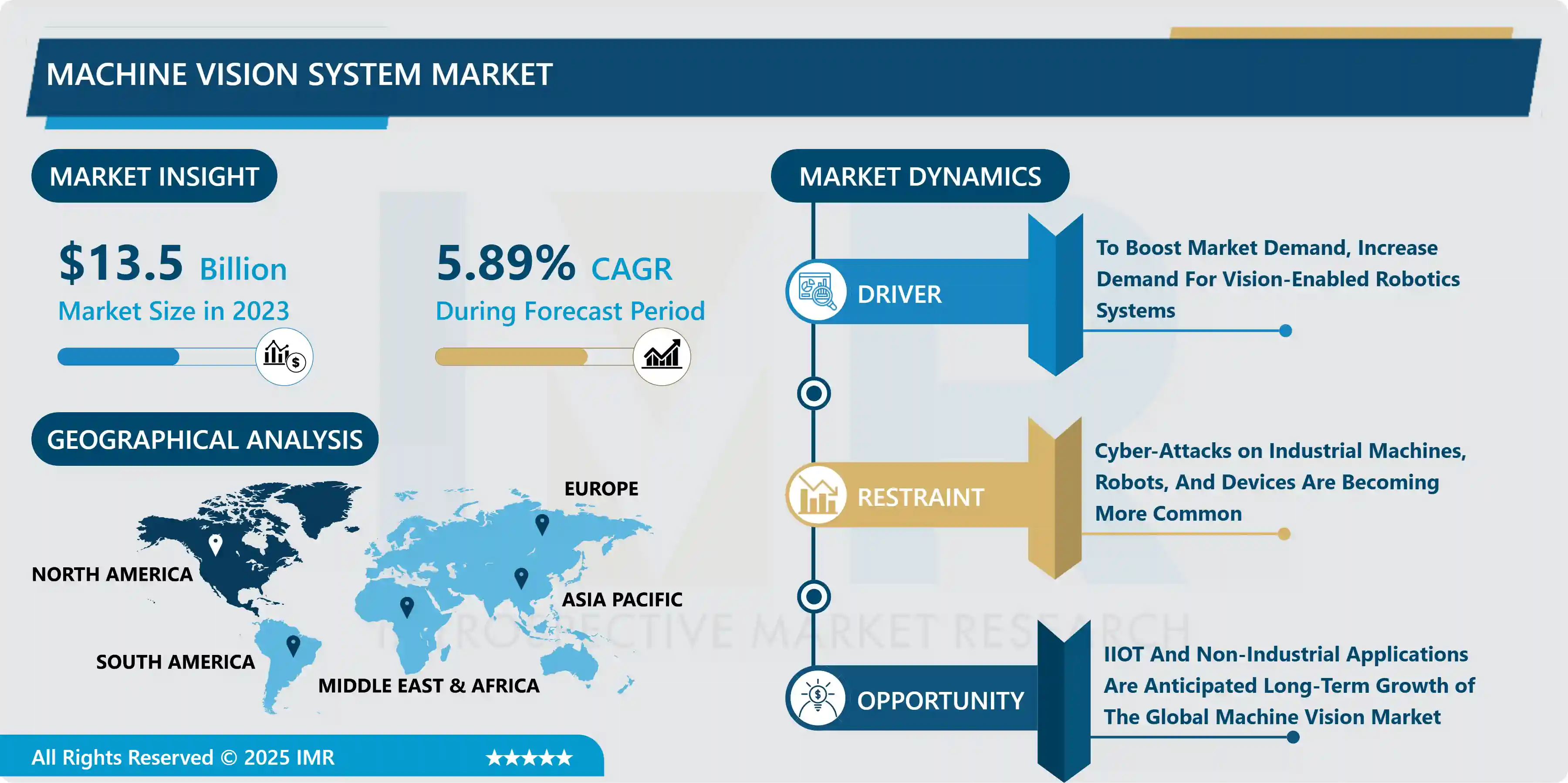

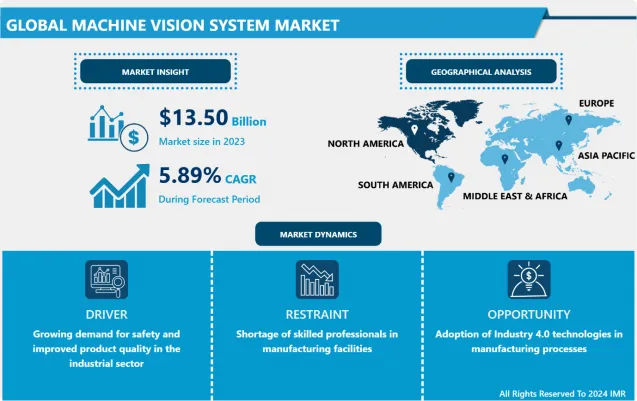

Machine Vision System Market Size Was Valued at USD 13.50 Billion in 2023, and is Projected to Reach USD 22.60 Billion by 2032, Growing at a CAGR of 5.89% From 2024-2032.

A Machine Vision System (MVS) is a component of software that allows a computer to inspect, evaluate, and recognize static or moving images. It's a branch of computer vision that's comparable to surveillance cameras but allows for automatic image capture, evaluation, and processing. A computer can recognize and assess images with the help of a machine vision system. It's similar to voice recognition technology, but instead of words, it uses visuals. Digital cameras plus back-end image processing hardware and software make up a machine vision system. The front-end camera captures photos of the environment or a focused item, which it then passes to the processing system. The recorded images are either stored or processed according to the MVS's design or requirements.

Machine vision, according to the Automated Imaging Association (AIA), includes all industrial and non-industrial applications in which a combination of hardware and software provides operational assistance to devices in the execution of their activities based on image capture and processing. Industrial computer vision employs many of the same techniques and methodologies as academic/educational and governmental/military computer vision applications, although there are some differences. In order for computer hardware and software to process, evaluate, and measure numerous attributes for decision making, machine vision systems rely on digital sensors protected inside industrial cameras with specialized optics to gather images. Machine vision systems can also make objective measurements, such as detecting the spacing between spark plugs or providing location data to help a robot align pieces in a manufacturing process.

Market Dynamics And Factors For Machine Vision System Market

Drivers:

To Boost Market Demand, Increase Demand For Vision-Enabled Robotics Systems

- This sector has recently seen a substantial shift in terms of automation and robotics technologies. Machine vision technology is becoming a crucial tool for industrial automation as a result of robotics and smart manufacturing. Similarly, the usage of industrial robots in the automotive and consumer electronics industries has increased dramatically. As a result, demand for integrated MV systems with vision-guided robot controllers has increased. By allowing robots to perceive and respond, this vision technology has increased their efficiency. In addition, the system's vision-enabled capability is useful in the pharmaceutical business, since it meticulously captures the entire process and records data for rigorous review. For example, a big player like Cognex, based in Massachusetts, is already building a name for itself in this business by producing devices and components that are equipped with advanced robotics and automation that may be used in the production process.

Restraints:

Cyber-Attacks on Industrial Machines, Robots, And Devices Are Becoming More Common

- Scanners can simply be used to survey Internet of Things (IoT) devices, allowing for easy vulnerability hacking. Usernames and passwords that are not changed from the factory defaults can act as software flaws that can be found through reverse engineering. Cyberattacks are becoming more vulnerable as people become more reliant on internet and IoT devices like AI embedded gadgets. Manufacturers can benefit from AI machine vision and automation, but they must also keep an eye on the fundamentals of cyber security. Downloading and installing the most recent software and updates, as well as educating employees on the latest cybersecurity safeguards, are all part of cyber defense.

Opportunities:

IIOT And Non-Industrial Applications Are Anticipated Long-Term Growth of The Global Machine Vision Market

- While AI and IoT are long-term development drivers, the IIoT connects production technology and information technology in today's industries to boost productivity. The IIoT mainly relies on machine vision to capture the data it requires. Furthermore, non-industrial uses of machine vision such as driverless cars, autonomous farm equipment, drone applications, intelligent traffic systems, guided surgery, and other non-industrial uses of machine vision are rapidly gaining in popularity, and often necessitate different machine vision functionality than industrial applications. These non-industrial applications of machine vision are already in use, and they could constitute a significant component of machine vision's future growth.

Segmentation Analysis of Machine Vision System Market

- By Component, software segment is anticipated to hold the maximum machine vision system market share over the forecast period. The backbone of a machine vision system's inspection aspect is software, which defines how inspection programme are executed and how quickly they may operate. Different software packages provide users with a variety of programming choices. Some software has a graphical user interface and is relatively simple to programme, whereas code-based software is more complicated but better at dealing with application-specific codes. Some programme allow you to programme using both an interface and code. One package may be more appropriate than another depending on the complexity of the codes and functions involved in a certain machine vision system.

- By Product, Over the forecast period, the PC-based machine vision system segment is likely to hold the largest share of the machine vision system market. The most popular product segment in the market was PC-based MV systems. Throughout the projected period, the category is expected to maintain its position in the worldwide market. Furthermore, over the forecast period, smart camera systems are expected to increase at a significant rate. The increase can be ascribed to the increased use of cameras in 3D sensing and imaging.

- By Application, automotive segment is expected to capture the largest machine vision system market share throughout the forecast period. Machine vision systems in the automobile industry are primarily used to increase product production and quality. In this industry, quality inspections and machine guiding are common uses for these systems. These systems detect whether parts or subassemblies are defective or not during quality control inspections. It informs the motion control equipment to accept or reject that particular component based on the feedback. Machine vision, on the other hand, improves the speed and precision of assembly robots and automated material handling equipment in machine guidance systems, which is crucial in engine chassis marriage operations. The automotive industry is on the verge of a revolution, as it transitions to autonomous vehicles in order to satisfy the expectations of a world that is becoming increasingly connected and fast-paced. The majority of automakers are substantially investing in the development of driverless vehicles. Machine vision cameras and related technology will be important in the safety of self-driving cars, assisting the vehicle in finding and recognizing potential risks as well as how to avoid them.

Regional Analysis of Machine Vision System Market

- North America is regarded as one of the world's fastest-growing revenue producers. This is due to the semiconductor industry's dominance in the region, which is a crucial segment for MV systems. Furthermore, Machine Vision System technologies are shrinking and growing smarter in order to integrate into automation applications such as autonomous vehicles, AI-driven bin picking, enhanced inspection technologies, and so on. All of this is projected to boost the region's demand for MV systems. Because North America has a competitive advantage over other regions, the United States will see the most growth. The presence of several international players in the region has contributed to this. In addition, the United States is a leader in R&D for technology development and the development of efficient engineering procedures. All of these factors contribute to the market's growth in the United States.

- In the machine vision market, Asia-Pacific is one of the most profitable regions. Countries in the Asia-Pacific region, such as China and South Korea, have some of the most extensive manufacturing facilities, where automation is increasingly used. The region is rapidly adopting robots, which is projected to have an impact on the region's machine vision industry. Favorable government actions are also projected to boost automation in the region. For example, the Chinese government's Made in China 2025 initiative encourages the utilization of R&D in factory automation and technologies, as well as investments.

- Meanwhile, Europe will experience significant growth in the following years. The extraordinary growth in technology and automation is reliant on MV systems. The demand for quality inspection and automation within industrial facilities is also predicted to be a major factor in the market's growth in the area.

- Due to the slow pace of economic development in the Middle East and Africa, the market grows at a slower rate. The region is gradually shifting away from the oil and gas industry and toward other service and manufacturing industries. As a result, there is potential for increased investment in the region's process and manufacturing industries, increasing demand for machine vision systems.

Players Covered in Machine Vision System Market are

- Omron Corporation (Japan)

- BASLER AG (Germany)

- Toshiba Corporation (Japan)

- Cognex Corporation (US)

- Texas Instruments (US)

- IDS Imaging Development Systems GmbH (Germany)

- Intel Corporation (US)

- ISRA VISION AG (Germany)

- KEYENCE Corporation of America

- MVTec Software GmbH (Germany)

- National Instruments Corporation (US)

- Omron Microscan Systems Inc. (US)

- Sony Corporation (Japan)

- Baumer Ltd. (Switzerland)

- Canon Inc. (Japan)

- Flir Systems Inc. (US)

- National Instrument Corporation (US)

- Sick AG (Germany)

Key Industry Developments In Machine Vision System Market

- In May 2023, Cognex Corporation has unveiled the Advantage 182 vision system. This cutting-edge system is specifically engineered to streamline intricate tasks such as location identification, classification, and inspection. The all-in-one solution integrates state-of-the-art machine vision capabilities, barcode reading functionality, and advanced edge learning technology. With these advanced features, the Advantage 182 enables automation across a wide range of applications, ranging from basic presence/absence detection and track-and-trace functions to meticulous alignment tasks and comprehensive color inspection

- In May 2023, Teledyne DALSA, a subsidiary of Teledyne Technologies, announce the commencement of production for its Linea 2 4k Multispectral 5GigE line scan camera. This advanced camera elevates the capabilities of vision systems with its exceptional performance and value. It incorporates a 5GigE interface, providing five times the bandwidth of the Linea GigE camera, and represents a significant leap forward in terms of speed and data transfer capabilities.

|

Machine Vision System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.50 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.89% |

Market Size in 2032: |

USD 22.60 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Machine Vision System Market by Component (2018-2032)

4.1 Machine Vision System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

Chapter 5: Machine Vision System Market by Product (2018-2032)

5.1 Machine Vision System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 PC-Based Machine Vision System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Vision Sensors & Image-Based Bar Code Readers

5.5 Vision Controllers

5.6 Standalone Vision System

5.7 Others

Chapter 6: Machine Vision System Market by Application (2018-2032)

6.1 Machine Vision System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Semiconductors

6.5 Consumer Electronics

6.6 Life Sciences

6.7 Food & Packaging

6.8 Other End-Uses

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Machine Vision System Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 HOMEDICS INCAETREX WORLDWIDE INCAETNA FELT CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALVA-AMCO PHARMACAL COMPANIES INCCHATTEM INCBLISTEX INCFOOTCARE EXPRESS INCIMPLUS LLC

7.4 JOHNSON & JOHNSON

7.5 GLAXOSMITHKLINE PLCPEDIFIX INCPROFOOT INCMIRACLE OF ALOE

7.6 SCHOLL’S WELLNESS COSPENCO MEDICAL CORPORATION

7.7 TWEEZERMAN INTERNATIONAL LLC

7.8 HRA PHARMA S.AXENNA CORPORATION AND OTHER MAJOR PLAYERS

Chapter 8: Global Machine Vision System Market By Region

8.1 Overview

8.2. North America Machine Vision System Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Component

8.2.4.1 Hardware

8.2.4.2 Software

8.2.5 Historic and Forecasted Market Size by Product

8.2.5.1 PC-Based Machine Vision System

8.2.5.2 Vision Sensors & Image-Based Bar Code Readers

8.2.5.3 Vision Controllers

8.2.5.4 Standalone Vision System

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Automotive

8.2.6.2 Semiconductors

8.2.6.3 Consumer Electronics

8.2.6.4 Life Sciences

8.2.6.5 Food & Packaging

8.2.6.6 Other End-Uses

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Machine Vision System Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Component

8.3.4.1 Hardware

8.3.4.2 Software

8.3.5 Historic and Forecasted Market Size by Product

8.3.5.1 PC-Based Machine Vision System

8.3.5.2 Vision Sensors & Image-Based Bar Code Readers

8.3.5.3 Vision Controllers

8.3.5.4 Standalone Vision System

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Automotive

8.3.6.2 Semiconductors

8.3.6.3 Consumer Electronics

8.3.6.4 Life Sciences

8.3.6.5 Food & Packaging

8.3.6.6 Other End-Uses

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Machine Vision System Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Component

8.4.4.1 Hardware

8.4.4.2 Software

8.4.5 Historic and Forecasted Market Size by Product

8.4.5.1 PC-Based Machine Vision System

8.4.5.2 Vision Sensors & Image-Based Bar Code Readers

8.4.5.3 Vision Controllers

8.4.5.4 Standalone Vision System

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Automotive

8.4.6.2 Semiconductors

8.4.6.3 Consumer Electronics

8.4.6.4 Life Sciences

8.4.6.5 Food & Packaging

8.4.6.6 Other End-Uses

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Machine Vision System Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Component

8.5.4.1 Hardware

8.5.4.2 Software

8.5.5 Historic and Forecasted Market Size by Product

8.5.5.1 PC-Based Machine Vision System

8.5.5.2 Vision Sensors & Image-Based Bar Code Readers

8.5.5.3 Vision Controllers

8.5.5.4 Standalone Vision System

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Automotive

8.5.6.2 Semiconductors

8.5.6.3 Consumer Electronics

8.5.6.4 Life Sciences

8.5.6.5 Food & Packaging

8.5.6.6 Other End-Uses

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Machine Vision System Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Component

8.6.4.1 Hardware

8.6.4.2 Software

8.6.5 Historic and Forecasted Market Size by Product

8.6.5.1 PC-Based Machine Vision System

8.6.5.2 Vision Sensors & Image-Based Bar Code Readers

8.6.5.3 Vision Controllers

8.6.5.4 Standalone Vision System

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Automotive

8.6.6.2 Semiconductors

8.6.6.3 Consumer Electronics

8.6.6.4 Life Sciences

8.6.6.5 Food & Packaging

8.6.6.6 Other End-Uses

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Machine Vision System Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Component

8.7.4.1 Hardware

8.7.4.2 Software

8.7.5 Historic and Forecasted Market Size by Product

8.7.5.1 PC-Based Machine Vision System

8.7.5.2 Vision Sensors & Image-Based Bar Code Readers

8.7.5.3 Vision Controllers

8.7.5.4 Standalone Vision System

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Automotive

8.7.6.2 Semiconductors

8.7.6.3 Consumer Electronics

8.7.6.4 Life Sciences

8.7.6.5 Food & Packaging

8.7.6.6 Other End-Uses

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Machine Vision System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.50 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.89% |

Market Size in 2032: |

USD 22.60 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||