M2M Satellite Communication Market Synopsis

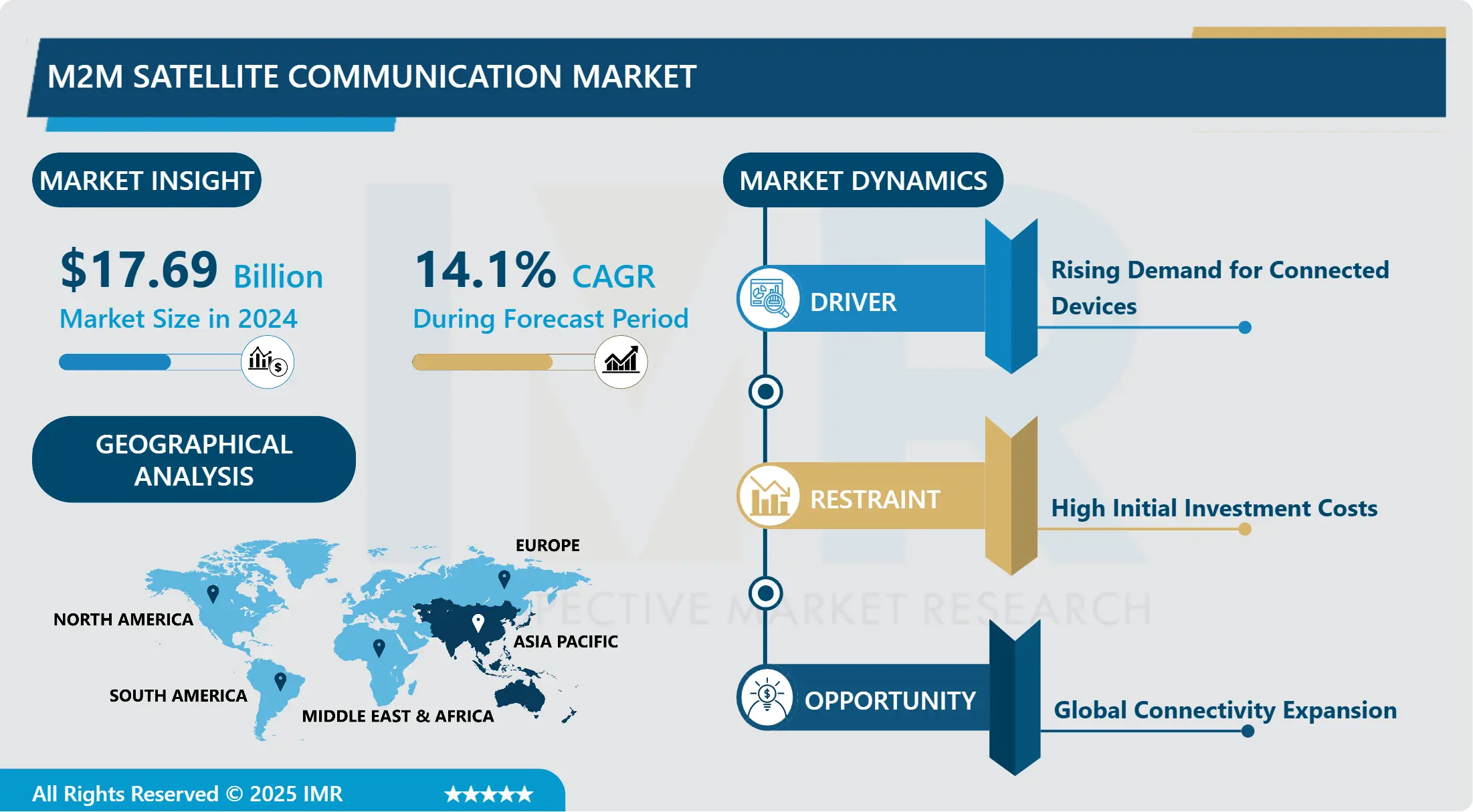

M2M Satellite Communication Market Size Was Valued at USD 17.69 Billion in 2024 and is Projected to Reach USD 50.82 Billion by 2032, Growing at a CAGR of 14.10% From 2025-2032.

M2M satellite communication is a type of technology through which two or more machines can communicate with the help of Satellite Networks and without any interference of the human. Through satellites, it enables remote devices to transmit information, receive information or instructions, and exchange data over large distances where more conventional ground-based networks are not possible. M2M satellite communication is significant in numerous fields like transportation, agriculture, environment, and disasters, especially when quick and remote data transfer along with the control signal is vital.

Global Machine-to-Machine (M2M) satellite communication market is actively involved in managing data exchange between distant and/or moving physical objects. This market has been and is expected to grow rapidly due to its constantly rising demand in the transportation, energy, agricultural, and environmental industries.

An important M2M satellite communication market enabler remains the need for dependable and pervasive communication throughout the world especially in areas where terrestrial facilities are inadequate or nonexistent. Through their coverage which is unbounded geographically, Satellites provide real-time data link and control of assets that are situated geographically from remote areas like oil rigs, ships, and even fields.

There is also rapid growth of other telecommunication technologies that have boosted the potentials of the M2M satellite communication. Development of advanced satellite elements such as miniaturization of satellite components, efficiency of satellite’s power, and data techniques made satellite-based M2M solutions reliable and economically viable. These advancement have further opened up the market even more making it easier for small business and organization to venture into the market with little cash to invest.

In addition, legal backing and other campaigns that promote globalization of markets have boosted market growth. The governments as well as the international organizations have realized that the M2M communication can greatly contribute to the improvement of business processes and safety and lessen the adverse impact on the environment in different sectors. Efforts like; spectrum authorization for use in satellite communication, and policies that encourage the use of IoT devices have expansion friendly conditions in the market.

The market of M2M satellite communication has various stakeholders ranging from the satellite operators, satellite service providers, and satellite equipment manufacturers. Satellite operators really rely on a vast structure that allows them to provide coverage of the entire globe and specialized solutions by industry. Telco’s are involved in providing complete solutions relating to enabling M2M devices through hardware connectivity and integrated software platforms that enable M2M applications to operate.

M2M satellite communication market trends just keep growing due to further innovations in satellite communication systems, web-connected IoT solutions, and its reaching applications across the emerging sectors. Other trends like utilization of AI and edge computing alongside satellite-based M2M solutions are also going to improve the solutions capabilities of offering real-time data analytics and decision making at edge of the networks.

The market for M2M satellite communication is growing fast and has been fueled by such factors as the advancement in the technologies used, favorable policies and increasing need for reliable communication in difficult terrains. With continued advancement in industries and integration of IoT products, M2M through satellite communication will continue to substantially support the connectivity and operations globally.

M2M Satellite Communication Market Trend Analysis

M2M Satellite Communication Market Growth Driver- Integration with IoT Ecosystems

- Current IoT systems have benefited from the connection of Machine-to-Machine (M2M) satellite communication, where their connectivity enhancement across the territories has improved. Compared to traditional connections to the internet, IoT devices can use satellites and various systems, which can more easily be established in fields not accessible to other types of networks. This integration makes it possible to have data transfer in real-time with the aim of improving operation, continuity, and monitoring and control over many sectors like agriculture, transportation, energy, and environmental surveillance.

- Satcom M2M helps in enhancing the IoT device’s integrated system by providing real-time transfer of information to the center for decision making and to increase the overall efficiency. Also, it guarantees constant connectivity, especially when the terrestrial networks are unavailable due to unfavourable conditions such as calamities. As more and more industries become involved in the IoT market, the compatibility between M2M satellite communication and IoT environments persists to define new trends in delivering strong solutions to connectivity issues all over the world.

M2M Satellite Communication Market Expansion Opportunity- Global Connectivity Expansion

- The Machine-to-Machine (M2M) satellite communication market is growing rapidly at the global level by dawn mainly due to the growing need for communication in the inaccessible areas of the world. M2M satellite communication is used in real-time data transfer for monitoring and controlling sectors including; agriculture, oil and gas, transport, and the monitoring of environmental factors. The major forces include the rising usage of IoT devices that demand connectivity that goes beyond the terrestrial networks.

- Satellite communication solve major problems in areas where terrestrial infrastructures are not well developed and help organizations with many applications where constant data transfer is vital for the operational and decision-making processes. High-tech trends of miniaturization in satellite systems, reduction of satellite cost, efficient hardware technology, and better data transmission rate also contribute to market growth. In addition, existing governmental efforts toward enhancing the digital networks and making more accessibility to the areas that still lacking signals are drifting the market forward, making the M2M satellite communication a breakthrough technology to reach the proposed global accessibility objectives.

M2M Satellite Communication Market Segment Analysis:

M2M Satellite Communication Market Segmented based Offering , Technology, Vertical, and Region.

By Offering, Software segment is expected to dominate the market during the forecast period

- In the context of the satellite communication of the M2M (Machine-to-Machine) industry, suppliers of equipment, software, and services are instrumental in providing solutions that support reliable transmission of communication data across far-flung regions. Hardware providers offer the satellite terminals, antennas and various necessary equipments needed to create links where normal ground infrastructure is unavailable or restricted. Software developers participate in developing strong platforms and applications that will help in data transfer, data encryption, and node management.

- It is apparent that service providers provide such essential services such as network management, fault detection and rectification, and customer support for the smooth running of M2M satellite communication systems. Altogether these services allow various industries including oil and gas, maritime industry, agriculture, and logistic to use satellite networks to monitor their operations in real-time, track their assets and increase their efficiency which in turn fuels the growth of M2M satellite communication market.

By Technology , Satellite Constellation segment held the largest share in 2024

- The M2M (Machine-to-Machine) satellite communication market is growing rapidly as technological development in mainly satellite constellation, data transmission, VSAT (Very Small Aperture Terminal) systems, AIS (Automatic Identification System), networking implementations, and satellite communication protocol. Recent advancements in technology through the establishment of satellite constellies like those by Space, OneWeb, and others make M2M communication easier, especially in the regard to reach, and are therefore easier to implement in today’s technologically advanced world. M2M technology shows enhancement in data transmission technologies that are very effective for transient M2M applications in IoT, logistics and remote M2M monitoring.

- VSAT systems play an important role in providing higher speed data transmission and communication network in places where infrastructure facility is not available. The integration of AIS boosts the maritime applications since it provides the tracking of vessels and communication through the satellite thus making their operations at the seas safer as well as more effective. New technologies in networking like security and compatibility protocols are creating efficient interfaces for integration of M2M satellite communications with other networks. Summing up, the mentioned technological progresses contribute to the M2M satellite communication market by expanding the application areas, increasing efficiency, and satisfying the constantly rising demand of the global community for interconnected and smart systems.

M2M Satellite Communication Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Geographically, over the forecast period the market of M2M satellite communication is expected to have Asia Pacific region as a dominating market. These factors include the following factors explaining the dominance of males in the industry. First, it is the constant development of technologies as well as the growing popularity of the IoT concept and solutions based on it in such countries as China, Japan, and India, which stimulate the demand for M2M satellite communication systems. These countries are ploughing lots of money into the development of infrastructure and smart city programs and these need excellent and dependable communication networks.

- Also, the increased adoption of IoT devices in automotive, healthcare, agriculture industries has a positive impact on the region’s market growth. However, the advancement in technology, governments supporting the satellite communication system for remote & rural areas will continue to bear maximum impact over the market. Geographical expanse of the Asia Pacific region and a diverse terrain facilitate the need for an effective M2M communication thereby boosting the outlook for satellite application in this region. Conclusively, due to the growth in investment in telecommunication networks and a growing significance of IoT application, Asia pacific has a distinct potential of dominating the M2M satellite communication market in the future years.

Active Key Players in the M2M Satellite Communication Market

- Marlink (France)

- Viasat (US)

- Thales (France)

- ORBCOMM (US)

- Iridium Communications (US)

- Globalstar (US)

- Orange (France)

- EchoStar (US)

- Intelsat (US)

- Rogers Communications (Canada)

- SES (Luxembourg)

- Gilat (Israel)

- Telia (Sweden)

- Kore Wireless (US)

- Honeywell (US)

- Qualcomm (US)

- Telesat (Canada)

- Wireless Logic (England)

- Outerlink Global Solutions (US)

- Nupoint Systems (Canada)

- Business comm Networks (US)

- Semtech (US)

- Yahsat (UAE)

- Other Active Players

Key Industry Developments in the M2M Satellite Communication Market

- In October 2023, the Fingy3D startup firm, managed by Mon Health's Intermed Labs, will continue to position West Virginia at the forefront of medical technology. The firm offers online purchasing of 3D-printed prosthetic fingers through Mon Health's Intermed Labs. The worldwide event received entries from 21 nations and states, with five finalists competing for a $350,000 prize.

- In September 2023, scientists at the Lawrence Livermore National Laboratory (LLNL) and Meta created a new form of 3D printed material for real-world wearable applications. These novel materials can replicate biological materials, which may have implications for the future of enhanced humanity.

|

Global M2M Satellite Communication Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 17.69 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.10% |

Market Size in 2032: |

USD 50.82 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Technology |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: M2M Satellite Communication Market by Offering (2018-2032)

4.1 M2M Satellite Communication Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardwar

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

4.5 Service

Chapter 5: M2M Satellite Communication Market by Technology (2018-2032)

5.1 M2M Satellite Communication Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Satellite Constellation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Data Transmission

5.5 VSAT

5.6 AIS

5.7 Networking

5.8 Satellite Communication Protocols

Chapter 6: M2M Satellite Communication Market by Vertical (2018-2032)

6.1 M2M Satellite Communication Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mining

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Agriculture

6.5 Energy and Utilities

6.6 Government and Public Sector

6.7 Environmental Monitoring

6.8 Disaster Management

6.9 Smart Cities Management

6.10 Automotive and Transportation

6.11 Maritime

6.12 Retail

6.13 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 M2M Satellite Communication Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MARLINK (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VIASAT (US)

7.4 THALES (FRANCE)

7.5 ORBCOMM (US)

7.6 IRIDIUM COMMUNICATIONS (US)

7.7 GLOBALSTAR (US)

7.8 ORANGE (FRANCE)

7.9 ECHOSTAR (US)

7.10 INTELSAT (US)

7.11 ROGERS COMMUNICATIONS (CANADA)

7.12 SES (LUXEMBOURG)

7.13 GILAT (ISRAEL)

7.14 TELIA (SWEDEN)

7.15 KORE WIRELESS (US)

7.16 HONEYWELL (US)

7.17 QUALCOMM (US)

7.18 TELESAT (CANADA)

7.19 WIRELESS LOGIC (ENGLAND)

7.20 OUTERLINK GLOBAL SOLUTIONS (US)

7.21 NUPOINT SYSTEMS (CANADA)

7.22 BUSINESS COMM NETWORKS (US)

7.23 SEMTECH (US)

7.24 YAHSAT(UAE)

Chapter 8: Global M2M Satellite Communication Market By Region

8.1 Overview

8.2. North America M2M Satellite Communication Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Offering

8.2.4.1 Hardwar

8.2.4.2 Software

8.2.4.3 Service

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 Satellite Constellation

8.2.5.2 Data Transmission

8.2.5.3 VSAT

8.2.5.4 AIS

8.2.5.5 Networking

8.2.5.6 Satellite Communication Protocols

8.2.6 Historic and Forecasted Market Size by Vertical

8.2.6.1 Mining

8.2.6.2 Agriculture

8.2.6.3 Energy and Utilities

8.2.6.4 Government and Public Sector

8.2.6.5 Environmental Monitoring

8.2.6.6 Disaster Management

8.2.6.7 Smart Cities Management

8.2.6.8 Automotive and Transportation

8.2.6.9 Maritime

8.2.6.10 Retail

8.2.6.11 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe M2M Satellite Communication Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Offering

8.3.4.1 Hardwar

8.3.4.2 Software

8.3.4.3 Service

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 Satellite Constellation

8.3.5.2 Data Transmission

8.3.5.3 VSAT

8.3.5.4 AIS

8.3.5.5 Networking

8.3.5.6 Satellite Communication Protocols

8.3.6 Historic and Forecasted Market Size by Vertical

8.3.6.1 Mining

8.3.6.2 Agriculture

8.3.6.3 Energy and Utilities

8.3.6.4 Government and Public Sector

8.3.6.5 Environmental Monitoring

8.3.6.6 Disaster Management

8.3.6.7 Smart Cities Management

8.3.6.8 Automotive and Transportation

8.3.6.9 Maritime

8.3.6.10 Retail

8.3.6.11 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe M2M Satellite Communication Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Offering

8.4.4.1 Hardwar

8.4.4.2 Software

8.4.4.3 Service

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 Satellite Constellation

8.4.5.2 Data Transmission

8.4.5.3 VSAT

8.4.5.4 AIS

8.4.5.5 Networking

8.4.5.6 Satellite Communication Protocols

8.4.6 Historic and Forecasted Market Size by Vertical

8.4.6.1 Mining

8.4.6.2 Agriculture

8.4.6.3 Energy and Utilities

8.4.6.4 Government and Public Sector

8.4.6.5 Environmental Monitoring

8.4.6.6 Disaster Management

8.4.6.7 Smart Cities Management

8.4.6.8 Automotive and Transportation

8.4.6.9 Maritime

8.4.6.10 Retail

8.4.6.11 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific M2M Satellite Communication Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Offering

8.5.4.1 Hardwar

8.5.4.2 Software

8.5.4.3 Service

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 Satellite Constellation

8.5.5.2 Data Transmission

8.5.5.3 VSAT

8.5.5.4 AIS

8.5.5.5 Networking

8.5.5.6 Satellite Communication Protocols

8.5.6 Historic and Forecasted Market Size by Vertical

8.5.6.1 Mining

8.5.6.2 Agriculture

8.5.6.3 Energy and Utilities

8.5.6.4 Government and Public Sector

8.5.6.5 Environmental Monitoring

8.5.6.6 Disaster Management

8.5.6.7 Smart Cities Management

8.5.6.8 Automotive and Transportation

8.5.6.9 Maritime

8.5.6.10 Retail

8.5.6.11 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa M2M Satellite Communication Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Offering

8.6.4.1 Hardwar

8.6.4.2 Software

8.6.4.3 Service

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 Satellite Constellation

8.6.5.2 Data Transmission

8.6.5.3 VSAT

8.6.5.4 AIS

8.6.5.5 Networking

8.6.5.6 Satellite Communication Protocols

8.6.6 Historic and Forecasted Market Size by Vertical

8.6.6.1 Mining

8.6.6.2 Agriculture

8.6.6.3 Energy and Utilities

8.6.6.4 Government and Public Sector

8.6.6.5 Environmental Monitoring

8.6.6.6 Disaster Management

8.6.6.7 Smart Cities Management

8.6.6.8 Automotive and Transportation

8.6.6.9 Maritime

8.6.6.10 Retail

8.6.6.11 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America M2M Satellite Communication Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Offering

8.7.4.1 Hardwar

8.7.4.2 Software

8.7.4.3 Service

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 Satellite Constellation

8.7.5.2 Data Transmission

8.7.5.3 VSAT

8.7.5.4 AIS

8.7.5.5 Networking

8.7.5.6 Satellite Communication Protocols

8.7.6 Historic and Forecasted Market Size by Vertical

8.7.6.1 Mining

8.7.6.2 Agriculture

8.7.6.3 Energy and Utilities

8.7.6.4 Government and Public Sector

8.7.6.5 Environmental Monitoring

8.7.6.6 Disaster Management

8.7.6.7 Smart Cities Management

8.7.6.8 Automotive and Transportation

8.7.6.9 Maritime

8.7.6.10 Retail

8.7.6.11 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global M2M Satellite Communication Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 17.69 Bn. |

|

Forecast Period 2025-32 CAGR: |

14.10% |

Market Size in 2032: |

USD 50.82 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Technology |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||