Locomotive Market Synopsis

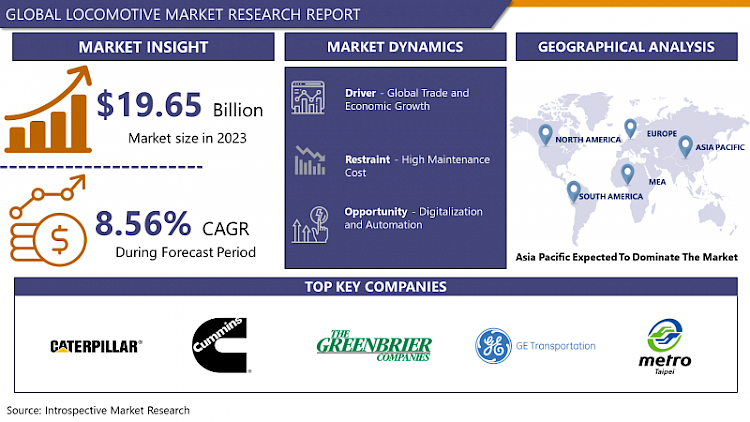

Locomotive Market Size Was Valued at USD 19.65 Billion in 2023 and is Projected to Reach USD 41.46 Billion by 2032, Growing at a CAGR of 8.56% From 2024-2032.

A locomotive is a powerful rail vehicle that provides the motive power for a train. Its primary function is to generate and transmit the mechanical force needed to move the train along the tracks. Locomotives are typically equipped with one or more engines, which can be powered by diesel, electricity, or steam.

- In the case of diesel locomotives, internal combustion engines drive electric generators that produce electricity to power electric traction motors. Electric locomotives draw power from an external source, usually overhead wires or a third rail. Steam locomotives, on the other hand, use steam produced by boiling water in a boiler to drive pistons connected to wheels.

- The design and technology of locomotives have evolved over time, with modern locomotives incorporating advanced features such as computerized control systems, improved fuel efficiency, and enhanced safety features. Locomotives play a crucial role in transportation, facilitating the movement of goods and passengers across vast rail networks worldwide.

- The locomotive market is witnessing significant growth and evolution driven by technological advancements, sustainability concerns, and increasing demand for efficient transportation solutions. With a focus on reducing emissions and improving fuel efficiency, manufacturers are increasingly investing in the development of electric and hybrid locomotives.

- Electrification of rail networks and the adoption of advanced control systems are key trends shaping the market. Additionally, emerging economies are investing in expanding their rail infrastructure, contributing to the overall growth of the locomotive market.

Locomotive Market Trend Analysis

Global Trade and Economic Growth

- The global locomotive market is intricately linked to the dynamics of global trade and economic growth. As economies expand, the demand for efficient transportation systems intensifies, making locomotives a pivotal component in facilitating the movement of goods and people. Economic growth spurs investments in infrastructure, including railways, creating a symbiotic relationship between economic development and the locomotive market.

- Global trade, characterized by the exchange of goods across borders, significantly influences the locomotive market. Locomotives play a crucial role in the transportation of bulk commodities, fostering international trade by connecting production centers to distribution networks and ports. The increasing interconnectivity of economies and the rise of global supply chains underscore the importance of reliable and efficient rail transport, further boosting the demand for locomotives.

- Moreover, environmental considerations and the emphasis on sustainable transportation solutions have led to the development of more fuel-efficient and environmentally friendly locomotives. As nations strive for energy efficiency and reduced carbon footprints, the locomotive market adapts to meet these evolving requirements, aligning with the broader goals of sustainable economic growth. In essence, the locomotive market serves as a barometer for global economic activity, reflecting the intertwined nature of trade, infrastructure development, and economic expansion.

Digitalization and Automation create an Opportunity for Locomotive Market

- Digitalization and automation present unprecedented opportunities for the locomotive market, revolutionizing the rail industry in diverse ways. The integration of digital technologies enables predictive maintenance, enhancing the reliability and efficiency of locomotives. Advanced sensors and IoT connectivity allow real-time monitoring of locomotive health, reducing downtime and improving overall operational performance.

- Automation plays a pivotal role in optimizing train operations, offering benefits such as increased safety, precision, and energy efficiency. Automated systems facilitate precise control of locomotives, ensuring smoother acceleration, braking, and navigation. Additionally, digital signalling and communication technologies enhance railway network management, enabling seamless coordination between trains and infrastructure.

- The digital transformation of the locomotive market also opens avenues for data-driven decision-making. Analyzing vast amounts of data generated by sensors and monitoring systems enables operators to make informed choices, leading to resource optimization and cost savings.

Locomotive Market Segment Analysis:

Locomotive Market Segmented on the basis of type, Motive Power and application

By Type, Rigid segment is expected to dominate the market during the forecast period

- The dominance of the rigid segment can be attributed to several factors. Rigid locomotives are renowned for their robustness and durability, making them well-suited for diverse operational environments. Their ability to withstand challenging terrains and adverse conditions positions them as preferred choices for various applications, including freight transportation and heavy-duty hauling.

- Moreover, technological advancements in rigid locomotive design have enhanced their efficiency, fuel economy, and overall performance, contributing to their widespread adoption. Industries relying on the transportation of goods and materials are increasingly turning to rigid locomotives to ensure reliable and cost-effective logistics solutions.

- Additionally, stringent safety regulations and a growing emphasis on sustainability are driving the demand for efficient and eco-friendly transportation solutions, further favouring the rigid locomotive segment. As a result, market players are investing in research and development to innovate and enhance the capabilities of rigid locomotives, solidifying their position as the dominant force in the locomotive market.

By Application, Switcher Locomotives segment held the largest share of xx% in 2022

- Switcher locomotives, also known as shunters or yard engines, play a crucial role in marshalling trains, assembling and disassembling railcars, and manoeuvring within rail yards.

- The dominance of the Switcher Locomotives segment can be attributed to its efficiency in handling short-distance movements, making it an essential component in freight yards, industrial complexes, and intermodal facilities. These locomotives are designed for flexibility, allowing them to navigate tight spaces and perform precise movements, contributing to the optimization of rail operations.

- Moreover, the Switcher Locomotives segment is characterized by its adaptability to various industries, such as manufacturing, logistics, and distribution, where the need for efficient shunting operations is paramount. As industries continue to focus on enhancing operational efficiency and reducing turnaround times, the demand for Switcher Locomotives is expected to grow, consolidating its position as the leading segment in the locomotive market.

Locomotive Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region has emerged as a dominant force in the locomotive market, showcasing remarkable growth and influence. Several factors contribute to this regional dominance. Firstly, rapid industrialization and urbanization in countries like China and India have led to an increased demand for efficient transportation systems, with locomotives playing a pivotal role in moving goods and people.

- Moreover, government initiatives and substantial investments in infrastructure development projects, including high-speed rail networks, have fueled the expansion of the locomotive market in the Asia-Pacific region. These investments aim to enhance connectivity, reduce transportation costs, and promote sustainable modes of transportation.

- Additionally, the Asia-Pacific region has witnessed advancements in technology and manufacturing capabilities, leading to the production of state-of-the-art locomotives with improved fuel efficiency, reduced emissions, and enhanced performance. This has not only met the growing demand for locomotives within the region but has also positioned Asia-Pacific as a significant player in the global locomotive market.

Locomotive Market Top Key Players:

- Caterpillar (USA)

- Cummins (USA)

- Electro-Motive Diesel (USA)

- Greenbrier Companies (USA)

- GE Transportation (USA)

- Alstom (France)

- Siemens Mobility (Germany)

- Bombardier Transportation (Germany)

- Voith Turbo Locomotive Technologies (Germany)

- Vossloh Locomotives (Germany)

- Electroputere V. I. Lenin (Romania)

- Škoda Transportation (Czech Republic)

- Transmashholding (Russia)

- National Railway Infrastructure of Ukraine (Ukraine)

- Newag (Poland)

- Stadler Rail (Switzerland)

- Pesa Bydgoszcz (Poland)

- Hitachi Rail (Japan) Hyundai Rotem (South Korea)

- Bharat Heavy Electricals Limited (BHEL) (India)

- Cressida (India)

- DLW Locomotive Works (India)

- Titagarh Wagons (India)

- Taipei Metro Corporation (Taiwan)

Key Industry Developments in the Locomotive Market:

In January 2023, Hitachi Rail signed a new framework deal with SNCF worth up to USD 81.26 million (Euro 77 million) to deliver on-board digital signaling equipment (bi-standard ERTMS/TVM) for the current generation of TGV trains (TGV-M) and existing TGV trains operating on French and European high-speed rail networks.

In October 2023, Rumo, a Brazilian freight operator, invested in hybrid locomotives from Progress Rail. This move aims to reduce the environmental impact of their freight operations by incorporating diesel-electric hybrid technology.

In May 2023, Fortescue Metals Group Work started on building the first zero-emissions capable freight locomotive in Australia. This project, led by Fortescue Future Industries, underscores the increasing focus on clean energy solutions in the locomotive sector.

|

Global Locomotive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 19.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.56 % |

Market Size in 2032: |

USD 41.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Motive Power |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LOCOMOTIVE MARKET BY TYPE (2016-2030)

- LOCOMOTIVE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RIGID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEMI-RIGID

- FLEXIBLE

- LOCOMOTIVE MARKET BY MOTIVE POWER (2016-2030)

- LOCOMOTIVE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GAS TURBINE ELECTRIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOTIVE POWERB STEAM DIESEL HYBRID

- DIESEL

- ATOMIC ELECTRIC

- STEAM

- LOCOMOTIVE MARKET BY APPLICATION (2016-2030)

- LOCOMOTIVE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FREIGHT

- SWITCHER LOCOMOTIVES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- LOCOMOTIVE Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CATERPILLAR (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CUMMINS (USA)

- ELECTRO-MOTIVE DIESEL (USA)

- GREENBRIER COMPANIES (USA)

- GE TRANSPORTATION (USA)

- ALSTOM (FRANCE)

- SIEMENS MOBILITY (GERMANY)

- BOMBARDIER TRANSPORTATION (GERMANY)

- VOITH TURBO LOCOMOTIVE TECHNOLOGIES (GERMANY)

- VOSSLOH LOCOMOTIVES (GERMANY)

- ELECTROPUTERE V. I. LENIN (ROMANIA)

- ŠKODA TRANSPORTATION (CZECH REPUBLIC)

- TRANSMASHHOLDING (RUSSIA)

- NATIONAL RAILWAY INFRASTRUCTURE OF UKRAINE (UKRAINE)

- NEWAG (POLAND)

- STADLER RAIL (SWITZERLAND)

- PESA BYDGOSZCZ (POLAND)

- HITACHI RAIL (JAPAN) HYUNDAI ROTEM (SOUTH KOREA)

- BHARAT HEAVY ELECTRICALS LIMITED (BHEL) (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL LOCOMOTIVE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Motive Power

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Locomotive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 19.65 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.56 % |

Market Size in 2032: |

USD 41.46 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Motive Power |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LOCOMOTIVE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LOCOMOTIVE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LOCOMOTIVE MARKET COMPETITIVE RIVALRY

TABLE 005. LOCOMOTIVE MARKET THREAT OF NEW ENTRANTS

TABLE 006. LOCOMOTIVE MARKET THREAT OF SUBSTITUTES

TABLE 007. LOCOMOTIVE MARKET BY TYPE

TABLE 008. RIGID MARKET OVERVIEW (2016-2028)

TABLE 009. SEMI-RIGID MARKET OVERVIEW (2016-2028)

TABLE 010. FLEXIBLERIGID MARKET OVERVIEW (2016-2028)

TABLE 011. SEMI-RIGID MARKET OVERVIEW (2016-2028)

TABLE 012. FLEXIBLE MARKET OVERVIEW (2016-2028)

TABLE 013. LOCOMOTIVE MARKET BY MOTIVE POWER

TABLE 014. GAS TURBINE ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 015. STEAM DIESEL HYBRID MARKET OVERVIEW (2016-2028)

TABLE 016. DIESEL MARKET OVERVIEW (2016-2028)

TABLE 017. ATOMIC ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 018. STEAM MARKET OVERVIEW (2016-2028)

TABLE 019. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 020. LOCOMOTIVE MARKET BY APPLICATION

TABLE 021. PASSENGER MARKET OVERVIEW (2016-2028)

TABLE 022. FREIGHT MARKET OVERVIEW (2016-2028)

TABLE 023. SWITCHER LOCOMOTIVES MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA LOCOMOTIVE MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA LOCOMOTIVE MARKET, BY MOTIVE POWER (2016-2028)

TABLE 026. NORTH AMERICA LOCOMOTIVE MARKET, BY APPLICATION (2016-2028)

TABLE 027. N LOCOMOTIVE MARKET, BY COUNTRY (2016-2028)

TABLE 028. EUROPE LOCOMOTIVE MARKET, BY TYPE (2016-2028)

TABLE 029. EUROPE LOCOMOTIVE MARKET, BY MOTIVE POWER (2016-2028)

TABLE 030. EUROPE LOCOMOTIVE MARKET, BY APPLICATION (2016-2028)

TABLE 031. LOCOMOTIVE MARKET, BY COUNTRY (2016-2028)

TABLE 032. ASIA PACIFIC LOCOMOTIVE MARKET, BY TYPE (2016-2028)

TABLE 033. ASIA PACIFIC LOCOMOTIVE MARKET, BY MOTIVE POWER (2016-2028)

TABLE 034. ASIA PACIFIC LOCOMOTIVE MARKET, BY APPLICATION (2016-2028)

TABLE 035. LOCOMOTIVE MARKET, BY COUNTRY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA LOCOMOTIVE MARKET, BY TYPE (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA LOCOMOTIVE MARKET, BY MOTIVE POWER (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA LOCOMOTIVE MARKET, BY APPLICATION (2016-2028)

TABLE 039. LOCOMOTIVE MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA LOCOMOTIVE MARKET, BY TYPE (2016-2028)

TABLE 041. SOUTH AMERICA LOCOMOTIVE MARKET, BY MOTIVE POWER (2016-2028)

TABLE 042. SOUTH AMERICA LOCOMOTIVE MARKET, BY APPLICATION (2016-2028)

TABLE 043. LOCOMOTIVE MARKET, BY COUNTRY (2016-2028)

TABLE 044. STRUKTON: SNAPSHOT

TABLE 045. STRUKTON: BUSINESS PERFORMANCE

TABLE 046. STRUKTON: PRODUCT PORTFOLIO

TABLE 047. STRUKTON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. ALSTOM: SNAPSHOT

TABLE 048. ALSTOM: BUSINESS PERFORMANCE

TABLE 049. ALSTOM: PRODUCT PORTFOLIO

TABLE 050. ALSTOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. AEG POWER SOLUTIONS B.V.: SNAPSHOT

TABLE 051. AEG POWER SOLUTIONS B.V.: BUSINESS PERFORMANCE

TABLE 052. AEG POWER SOLUTIONS B.V.: PRODUCT PORTFOLIO

TABLE 053. AEG POWER SOLUTIONS B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SIEMENS: SNAPSHOT

TABLE 054. SIEMENS: BUSINESS PERFORMANCE

TABLE 055. SIEMENS: PRODUCT PORTFOLIO

TABLE 056. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. TOSHIBA CORPORATION: SNAPSHOT

TABLE 057. TOSHIBA CORPORATION: BUSINESS PERFORMANCE

TABLE 058. TOSHIBA CORPORATION: PRODUCT PORTFOLIO

TABLE 059. TOSHIBA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CRRC: SNAPSHOT

TABLE 060. CRRC: BUSINESS PERFORMANCE

TABLE 061. CRRC: PRODUCT PORTFOLIO

TABLE 062. CRRC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. HITACHI LTD.: SNAPSHOT

TABLE 063. HITACHI LTD.: BUSINESS PERFORMANCE

TABLE 064. HITACHI LTD.: PRODUCT PORTFOLIO

TABLE 065. HITACHI LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. BOMBARDIER: SNAPSHOT

TABLE 066. BOMBARDIER: BUSINESS PERFORMANCE

TABLE 067. BOMBARDIER: PRODUCT PORTFOLIO

TABLE 068. BOMBARDIER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. BHARAT HEAVY ELECTRICALS LIMITED: SNAPSHOT

TABLE 069. BHARAT HEAVY ELECTRICALS LIMITED: BUSINESS PERFORMANCE

TABLE 070. BHARAT HEAVY ELECTRICALS LIMITED: PRODUCT PORTFOLIO

TABLE 071. BHARAT HEAVY ELECTRICALS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. WABTEC CORPORATION: SNAPSHOT

TABLE 072. WABTEC CORPORATION: BUSINESS PERFORMANCE

TABLE 073. WABTEC CORPORATION: PRODUCT PORTFOLIO

TABLE 074. WABTEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. METSO CORPORATION: SNAPSHOT

TABLE 075. METSO CORPORATION: BUSINESS PERFORMANCE

TABLE 076. METSO CORPORATION: PRODUCT PORTFOLIO

TABLE 077. METSO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. BROOKVILLE EQUIPMENT CORPORATION: SNAPSHOT

TABLE 078. BROOKVILLE EQUIPMENT CORPORATION: BUSINESS PERFORMANCE

TABLE 079. BROOKVILLE EQUIPMENT CORPORATION: PRODUCT PORTFOLIO

TABLE 080. BROOKVILLE EQUIPMENT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 081. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 082. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 083. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LOCOMOTIVE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LOCOMOTIVE MARKET OVERVIEW BY TYPE

FIGURE 012. RIGID MARKET OVERVIEW (2016-2028)

FIGURE 013. SEMI-RIGID MARKET OVERVIEW (2016-2028)

FIGURE 014. FLEXIBLERIGID MARKET OVERVIEW (2016-2028)

FIGURE 015. SEMI-RIGID MARKET OVERVIEW (2016-2028)

FIGURE 016. FLEXIBLE MARKET OVERVIEW (2016-2028)

FIGURE 017. LOCOMOTIVE MARKET OVERVIEW BY MOTIVE POWER

FIGURE 018. GAS TURBINE ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 019. STEAM DIESEL HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 020. DIESEL MARKET OVERVIEW (2016-2028)

FIGURE 021. ATOMIC ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 022. STEAM MARKET OVERVIEW (2016-2028)

FIGURE 023. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 024. LOCOMOTIVE MARKET OVERVIEW BY APPLICATION

FIGURE 025. PASSENGER MARKET OVERVIEW (2016-2028)

FIGURE 026. FREIGHT MARKET OVERVIEW (2016-2028)

FIGURE 027. SWITCHER LOCOMOTIVES MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA LOCOMOTIVE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE LOCOMOTIVE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC LOCOMOTIVE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA LOCOMOTIVE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA LOCOMOTIVE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Locomotive Market research report is 2024-2032.

Caterpillar (USA), Cummins (USA), Electro-Motive Diesel (USA), Greenbrier Companies (USA), GE Transportation (USA), Alstom (France), Siemens Mobility (Germany), Bombardier Transportation (Germany), Voith Turbo Locomotive Technologies (Germany), Vossloh Locomotives (Germany), Electroputere V. I. Lenin (Romania), Škoda Transportation (Czech Republic), Transmashholding (Russia), National Railway Infrastructure of Ukraine (Ukraine) , Newag (Poland), Stadler Rail (Switzerland), Pesa Bydgoszcz (Poland), Hitachi Rail (Japan) Hyundai Rotem (South Korea), Bharat Heavy Electricals Limited (BHEL) (India) , Cressida (India) , DLW Locomotive Works (India) , Titagarh Wagons (India) , Taipei Metro Corporation (Taiwan) and Other Major Players.

The Locomotive Market is segmented into Type, Motive Power, Application, and region. By Type, the market is categorized into Rigid, Semi-rigid, and Flexible. By Motive Power, the market is categorized into Gas Turbine Electric, Steam Diesel Hybrid, Diesel, Atomic Electric, Steam. By Application, the market is categorized into Passenger, Freight, and Switcher Locomotives. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A locomotive is a powerful rail vehicle that provides the motive power for a train. Its primary function is to generate and transmit the mechanical force needed to move the train along the tracks. Locomotives are typically equipped with one or more engines, which can be powered by diesel, electricity, or steam.

Locomotive Market Size Was Valued at USD 19.65 Billion in 2023 and is Projected to Reach USD 41.46 Billion by 2032, Growing at a CAGR of 8.56% From 2024-2032.