Global Livestock Identification Market Overview

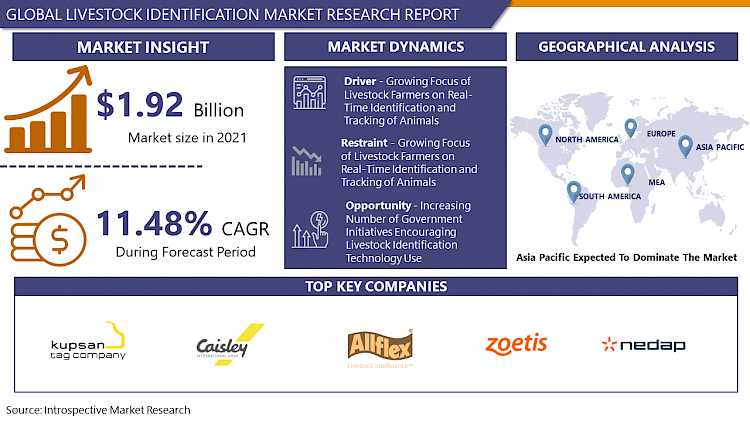

The Global Livestock Identification market was valued at USD 1.92 billion in 2021 and is expected to reach USD 4.11 billion by the year 2028, at a CAGR of 11.48%.

Livestock identification is the basis for keeping proper production records of the herd/flock. Individual livestock identification enables producers to maintain records on an animal's birth date, health history, parentage, production records, and a host of other important management information. Additionally, authentic records offer the producer sufficient information to make individual or whole herd/flock management decisions. In many instances, the producer requirement to be able to rapidly identify an animal. A successful identification system makes this task more systematic. Identification is also important to identify ownership of a certain animal or to indicate the herd/flock of origin. The requirement for the identification of stock has developed. In many situations, confirming ownership is no longer the central need.

Furthermore, identification of livestock is also required when accomplishing diagnostic procedures (e.g., testing for brucellosis) so that animals that show up serologically positive can be culled. Moreover, rising inventions in animal identity management and better support services are probably to add improvement to the overall growth of the global livestock identification market. The rapid reception of IoT and AI-empowered gadgets for powerful administration of local animals increased interest for robotization in animal cultivating, and developed focal point of ranchers on constant distinguishing proof and checking of animals are the critical turning variables for the domesticated animals' ID market.

COVID-19 Impact on Livestock Identification Market

The COVID-19 pandemic has influenced different sectors, including agriculture, manufacturing, medical, automotive, aerospace & defense, and logistics. Posterior to the current condition, the key market players are presently targeting maintaining and generating revenues to be operational. This had declined the number of events, including product introductions and their distribution in the livestock identification market in 2020. Several scheduled product releases and associated advancements have been carried over due to the spread of the virus. Nevertheless, the impact of COVID-19 is anticipated to subside over the forecast period. The market can start a moderate recovery from the end of 2021 as governments over the globe have uplifted lockdown limitations and economic activities have resumed in most regions of the globe. In the current condition, the livestock identification market is anticipated to witness significant growth as major companies operating in this market have been impacted poorly during 2020. Moreover, demand is also expected to be comparatively decreased than the last year during 2021. By the end of 2021, the demand for livestock identification devices such as smart camera systems, RFIO tags and readers, and sensors is anticipated to recover boost, and gradual recovery is anticipated from the end of 2021 while reaching normalcy by the latter half of 2022. From 2023 onwards, the Livestock Identification Market is anticipated to observe maximum growth.

Market Dynamics and Factors of the Livestock Identification Market

Drivers:

Livestock identification is another important feature of livestock farming. Traditionally, cattle were identified and monitored manually and restricted in farms by building physical fences. Nevertheless, developed technologies have made it possible to identify, track, and monitor farm livestock in real-time. Real-time developed technologies such as biometric sensors include either noninvasive or invasive sensors that identify and monitor an individual animal's health and behavior in real-time, allowing farmers to integrate this data for population-associated analysis. Real-time information from biometric sensors is processed and integrated using big data analytics systems that depend on statistical algorithms to sort through large complex data established and offer farmers relevant trending patterns and decision-making tools.

The growth in the demand for animal products, such as milk, meat, and eggs, is turning the market. Asia held approximately 40% to 45% of the global meat production. Other key manufacturers include Australia, the U.S., Brazil, and Argentina. Moreover, as per to a report by the Australian Bureau of Agriculture and Resources Economics and Sciences, China will represent about 40% of the growth in meat demand by 2050. Such factors are rising the demand for livestock identification devices.

Furthermore, there is high competition among key players, which has emphasized R&D and invention in the existing product portfolio. These key players are adopting different plans to maintain a competitive rivalry. For example, in May 2020, CowManager invented the active ear sensor technique. The company is continuously in development to support dairymen that require innovative solutions and insights into addressing the challenges. Such initiatives are expected to positively accelerate the growth.

Additionally, the expanding prevalence of zoonotic diseases is stimulating the growth of the market. This is owing to these disease spreads in the livestock can be major socioeconomic threats, resulting in production loss and interruptions of the rural economy, local markets, and international trade. Moreover, certain livestock diseases caused owing to viruses and bacteria are known to infect humans. Such factors are probably to grow the demand for the livestock identification market in the coming years.

Restraints:

Lack of awareness about the significance of livestock identification systems among ranchers and animal owners. Even though the livestock identification marketplace is crowded with various innovative technologies, consciousness among the farmers and animal owners remains considerably low, which impacts the adoption of digital equipment or gadgets for herd identification and management. Livestock identification products find usages in almost all functional aspects of poultry, cattle, and swine farms, such as feeding management, ventilation, calf management, heat stress management, behavior monitoring, milk harvesting, and reproduction management. Furthermore, farmers are often inadequate to operate these systems properly which leads to hampering the market growth over the forecast period.

Opportunities:

The growing interest for livestock identification items can be credited to the emerging number of dairy cows to satisfy the enhancing interest for dairy items, such as curd, margarine, cheddar, and yogurt, over the globe. Additionally, a flood in meat utilization over the globe has given rise to an ascent in the quantity of poultry and pig ranches. As the crowd size of dairy ranches extends, it becomes hard to distinguish and screen the group physically. The expanding group size of livestock ranches gives advancement freedoms to the livestock identification market. Livestock homesteads can be made more effective by bringing cutting-edge frameworks in massive ranches to fulfill economies of scale.

Market Segmentation

Segmentation Analysis of Livestock Identification Market:

Based on the Component Type, the market for the software segment is anticipated to increase at the maximum CAGR throughout the forecast period. Technological developments in software utilized in livestock identification and management systems and quick innovations in services are the key factors turning the market during the last few years. There is a rising demand for data analytics and maintenance and support services by livestock owners with rapid developments in livestock farming technologies. Furthermore, the use of software enables recording, retrieval, analysis, storage, and dissemination of information about a large number of cattle. These software systems also enable better management of resources and growth in the production efficiency of livestock.

Based on Animal Type, the cattle species segment is expected to register maximum market share over the forecast period. Manual identification and management of large-sized livestock farms are not only expensive but also time-consuming. In dairy farms, hardware and software solutions allow animal feeding and milking, data capture, and automatic identification, resulting in proper management and control of movements of livestock species. Due to these significances, the cattle segment is anticipated to record the largest size of the livestock identification market over the projected period.

Based on Application, the feeding management segment held the maximum market during the forecast period. There is a high demand for feeding management to identify the food intake of the animal. Moreover, the rising consciousness between the livestock owners for appropriate diet formulation for growing productivity is accelerating this application segment growth.

Regional Analysis of Livestock Identification Market:

Asia Pacific region is expected to dominate the livestock identification market during the projected period. Rapid population growth in emerging economies of the region is exerting pressure on the providers of livestock products to become more efficient and productive, thereby propelling the sales of livestock farming solutions. The growing entry of IoT-enabled livestock identification systems in animal monitoring applications also fuels the growth of this market. Factors turning the adoption of accurate livestock farming in APAC include the growing demand for livestock-related food products, increasing requirement to enhance yields with limited resources, and the rising need to protect cattle from unexpected climatic changes. Major challenges experienced by the farmers in this region are the requirements for low returns on investment, high capital, and lack of knowledge concerning the applications of livestock identification technologies.

North America region holds the significant market share owing to the latest developments of technology, coupled with the raised internet penetration, in this region. The growth can also be attributed to the raised meat utilization in this region. For example, in 2018, the list of the highest meat consumption was leading by the U.S., which is further triggering the need to defense zoonotic and foodborne diseases related to livestock animals, eventually stimulating the market growth.

Players Covered in Livestock Identification Market are:

- CAISLEY International (Germany)

- Kupsan Tag Company (Turkey)

- Afimilk (Israel)

- Livestock Improvement Corporation (New Zealand)

- Allflex (Part of Merck) (US)

- Zoetis (US)

- Leader Products (Australia)

- Nedap (Netherlands)

- Cainthus (Ireland)

- Connecterra (Netherlands)

- DeLaval (Sweden)

- Moocall (Ireland)

- Cowlar (US)

- Datamars (Switzerland)

- Others major Players.

Key Industry Developments in the Livestock Identification Market

- In February 2020, Cainthus, a Dublin-based Agri Tech company, introduced ALUS nutrition, a solution that incorporates RFIDs and cameras to monitor animal health and control feed management plans suitably.

- In December 2020, DeLaval declared its extension of the farm with a new state-of-the-art barn. The development plan incorporates a new barn for robotic milk, modernized barns for calves and heifers, and an updated visitors' area.

- In May 2021, Nedap collaborated with Waikato, a top developer, and producer of dairy technology, to build dairy farm management and animal care, assure farmers regarding proper and timely animal care, and supply cutting-edge technology explosion to dairy farmers.

|

Global Livestock Identification Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.92 Bn. |

|

Forecast Period 2022-28 CAGR: |

11.48% |

Market Size in 2028: |

USD 4.11 Bn. |

|

Segments Covered: |

By Component Type |

|

|

|

By Animal Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component Type

3.2 By Animal Type

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Livestock Identification Market by Component Type

5.1 Livestock Identification Market Overview Snapshot and Growth Engine

5.2 Livestock Identification Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Grographic Segmentation

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Grographic Segmentation

5.5 Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Services: Grographic Segmentation

Chapter 6: Livestock Identification Market by Animal Type

6.1 Livestock Identification Market Overview Snapshot and Growth Engine

6.2 Livestock Identification Market Overview

6.3 Cattle

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cattle: Grographic Segmentation

6.4 Poultry

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Poultry: Grographic Segmentation

6.5 Swine

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Swine: Grographic Segmentation

6.6 Equine

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Equine: Grographic Segmentation

6.7 Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Others: Grographic Segmentation

Chapter 7: Livestock Identification Market by Application

7.1 Livestock Identification Market Overview Snapshot and Growth Engine

7.2 Livestock Identification Market Overview

7.3 Milk Harvesting

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Milk Harvesting: Grographic Segmentation

7.4 Breeding Management

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Breeding Management: Grographic Segmentation

7.5 Feeding Management

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Feeding Management: Grographic Segmentation

7.6 Animal Health Monitoring & Comfort

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Animal Health Monitoring & Comfort: Grographic Segmentation

7.7 Heat Stress

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2016-2028F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Heat Stress: Grographic Segmentation

7.8 Behavior Monitoring

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size (2016-2028F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Behavior Monitoring: Grographic Segmentation

7.9 Others

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size (2016-2028F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Livestock Identification Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Livestock Identification Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Livestock Identification Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 CAISLEY INTERNATIONAL

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 KUPSAN TAG COMPANY

8.4 AFIMILK

8.5 LIVESTOCK IMPROVEMENT CORPORATION

8.6 ALLFLEX

8.7 ZOETIS

8.8 LEADER PRODUCTS

8.9 NEDAP

8.10 CAINTHU

8.11 CONNECTERRA

8.12 DELAVAL

8.13 MOOCALL

8.14 COWLAR

8.15 DATAMARS

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Component Type

9.2.1 Hardware

9.2.2 Software

9.2.3 Services

9.3 Historic and Forecasted Market Size By Animal Type

9.3.1 Cattle

9.3.2 Poultry

9.3.3 Swine

9.3.4 Equine

9.3.5 Others

9.4 Historic and Forecasted Market Size By Application

9.4.1 Milk Harvesting

9.4.2 Breeding Management

9.4.3 Feeding Management

9.4.4 Animal Health Monitoring & Comfort

9.4.5 Heat Stress

9.4.6 Behavior Monitoring

9.4.7 Others

Chapter 10: North America Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Component Type

10.4.1 Hardware

10.4.2 Software

10.4.3 Services

10.5 Historic and Forecasted Market Size By Animal Type

10.5.1 Cattle

10.5.2 Poultry

10.5.3 Swine

10.5.4 Equine

10.5.5 Others

10.6 Historic and Forecasted Market Size By Application

10.6.1 Milk Harvesting

10.6.2 Breeding Management

10.6.3 Feeding Management

10.6.4 Animal Health Monitoring & Comfort

10.6.5 Heat Stress

10.6.6 Behavior Monitoring

10.6.7 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component Type

11.4.1 Hardware

11.4.2 Software

11.4.3 Services

11.5 Historic and Forecasted Market Size By Animal Type

11.5.1 Cattle

11.5.2 Poultry

11.5.3 Swine

11.5.4 Equine

11.5.5 Others

11.6 Historic and Forecasted Market Size By Application

11.6.1 Milk Harvesting

11.6.2 Breeding Management

11.6.3 Feeding Management

11.6.4 Animal Health Monitoring & Comfort

11.6.5 Heat Stress

11.6.6 Behavior Monitoring

11.6.7 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component Type

12.4.1 Hardware

12.4.2 Software

12.4.3 Services

12.5 Historic and Forecasted Market Size By Animal Type

12.5.1 Cattle

12.5.2 Poultry

12.5.3 Swine

12.5.4 Equine

12.5.5 Others

12.6 Historic and Forecasted Market Size By Application

12.6.1 Milk Harvesting

12.6.2 Breeding Management

12.6.3 Feeding Management

12.6.4 Animal Health Monitoring & Comfort

12.6.5 Heat Stress

12.6.6 Behavior Monitoring

12.6.7 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component Type

13.4.1 Hardware

13.4.2 Software

13.4.3 Services

13.5 Historic and Forecasted Market Size By Animal Type

13.5.1 Cattle

13.5.2 Poultry

13.5.3 Swine

13.5.4 Equine

13.5.5 Others

13.6 Historic and Forecasted Market Size By Application

13.6.1 Milk Harvesting

13.6.2 Breeding Management

13.6.3 Feeding Management

13.6.4 Animal Health Monitoring & Comfort

13.6.5 Heat Stress

13.6.6 Behavior Monitoring

13.6.7 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Livestock Identification Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component Type

14.4.1 Hardware

14.4.2 Software

14.4.3 Services

14.5 Historic and Forecasted Market Size By Animal Type

14.5.1 Cattle

14.5.2 Poultry

14.5.3 Swine

14.5.4 Equine

14.5.5 Others

14.6 Historic and Forecasted Market Size By Application

14.6.1 Milk Harvesting

14.6.2 Breeding Management

14.6.3 Feeding Management

14.6.4 Animal Health Monitoring & Comfort

14.6.5 Heat Stress

14.6.6 Behavior Monitoring

14.6.7 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Livestock Identification Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.92 Bn. |

|

Forecast Period 2022-28 CAGR: |

11.48% |

Market Size in 2028: |

USD 4.11 Bn. |

|

Segments Covered: |

By Component Type |

|

|

|

By Animal Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LIVESTOCK IDENTIFICATION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LIVESTOCK IDENTIFICATION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LIVESTOCK IDENTIFICATION MARKET COMPETITIVE RIVALRY

TABLE 005. LIVESTOCK IDENTIFICATION MARKET THREAT OF NEW ENTRANTS

TABLE 006. LIVESTOCK IDENTIFICATION MARKET THREAT OF SUBSTITUTES

TABLE 007. LIVESTOCK IDENTIFICATION MARKET BY COMPONENT TYPE

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. LIVESTOCK IDENTIFICATION MARKET BY ANIMAL TYPE

TABLE 012. CATTLE MARKET OVERVIEW (2016-2028)

TABLE 013. POULTRY MARKET OVERVIEW (2016-2028)

TABLE 014. SWINE MARKET OVERVIEW (2016-2028)

TABLE 015. EQUINE MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. LIVESTOCK IDENTIFICATION MARKET BY APPLICATION

TABLE 018. MILK HARVESTING MARKET OVERVIEW (2016-2028)

TABLE 019. BREEDING MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 020. FEEDING MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 021. ANIMAL HEALTH MONITORING & COMFORT MARKET OVERVIEW (2016-2028)

TABLE 022. HEAT STRESS MARKET OVERVIEW (2016-2028)

TABLE 023. BEHAVIOR MONITORING MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. NORTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY COMPONENT TYPE (2016-2028)

TABLE 026. NORTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY ANIMAL TYPE (2016-2028)

TABLE 027. NORTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY APPLICATION (2016-2028)

TABLE 028. N LIVESTOCK IDENTIFICATION MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE LIVESTOCK IDENTIFICATION MARKET, BY COMPONENT TYPE (2016-2028)

TABLE 030. EUROPE LIVESTOCK IDENTIFICATION MARKET, BY ANIMAL TYPE (2016-2028)

TABLE 031. EUROPE LIVESTOCK IDENTIFICATION MARKET, BY APPLICATION (2016-2028)

TABLE 032. LIVESTOCK IDENTIFICATION MARKET, BY COUNTRY (2016-2028)

TABLE 033. ASIA PACIFIC LIVESTOCK IDENTIFICATION MARKET, BY COMPONENT TYPE (2016-2028)

TABLE 034. ASIA PACIFIC LIVESTOCK IDENTIFICATION MARKET, BY ANIMAL TYPE (2016-2028)

TABLE 035. ASIA PACIFIC LIVESTOCK IDENTIFICATION MARKET, BY APPLICATION (2016-2028)

TABLE 036. LIVESTOCK IDENTIFICATION MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA LIVESTOCK IDENTIFICATION MARKET, BY COMPONENT TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA LIVESTOCK IDENTIFICATION MARKET, BY ANIMAL TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA LIVESTOCK IDENTIFICATION MARKET, BY APPLICATION (2016-2028)

TABLE 040. LIVESTOCK IDENTIFICATION MARKET, BY COUNTRY (2016-2028)

TABLE 041. SOUTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY COMPONENT TYPE (2016-2028)

TABLE 042. SOUTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY ANIMAL TYPE (2016-2028)

TABLE 043. SOUTH AMERICA LIVESTOCK IDENTIFICATION MARKET, BY APPLICATION (2016-2028)

TABLE 044. LIVESTOCK IDENTIFICATION MARKET, BY COUNTRY (2016-2028)

TABLE 045. CAISLEY INTERNATIONAL: SNAPSHOT

TABLE 046. CAISLEY INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 047. CAISLEY INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 048. CAISLEY INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. KUPSAN TAG COMPANY: SNAPSHOT

TABLE 049. KUPSAN TAG COMPANY: BUSINESS PERFORMANCE

TABLE 050. KUPSAN TAG COMPANY: PRODUCT PORTFOLIO

TABLE 051. KUPSAN TAG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. AFIMILK: SNAPSHOT

TABLE 052. AFIMILK: BUSINESS PERFORMANCE

TABLE 053. AFIMILK: PRODUCT PORTFOLIO

TABLE 054. AFIMILK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. LIVESTOCK IMPROVEMENT CORPORATION: SNAPSHOT

TABLE 055. LIVESTOCK IMPROVEMENT CORPORATION: BUSINESS PERFORMANCE

TABLE 056. LIVESTOCK IMPROVEMENT CORPORATION: PRODUCT PORTFOLIO

TABLE 057. LIVESTOCK IMPROVEMENT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ALLFLEX: SNAPSHOT

TABLE 058. ALLFLEX: BUSINESS PERFORMANCE

TABLE 059. ALLFLEX: PRODUCT PORTFOLIO

TABLE 060. ALLFLEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ZOETIS: SNAPSHOT

TABLE 061. ZOETIS: BUSINESS PERFORMANCE

TABLE 062. ZOETIS: PRODUCT PORTFOLIO

TABLE 063. ZOETIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LEADER PRODUCTS: SNAPSHOT

TABLE 064. LEADER PRODUCTS: BUSINESS PERFORMANCE

TABLE 065. LEADER PRODUCTS: PRODUCT PORTFOLIO

TABLE 066. LEADER PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NEDAP: SNAPSHOT

TABLE 067. NEDAP: BUSINESS PERFORMANCE

TABLE 068. NEDAP: PRODUCT PORTFOLIO

TABLE 069. NEDAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. CAINTHU: SNAPSHOT

TABLE 070. CAINTHU: BUSINESS PERFORMANCE

TABLE 071. CAINTHU: PRODUCT PORTFOLIO

TABLE 072. CAINTHU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. CONNECTERRA: SNAPSHOT

TABLE 073. CONNECTERRA: BUSINESS PERFORMANCE

TABLE 074. CONNECTERRA: PRODUCT PORTFOLIO

TABLE 075. CONNECTERRA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DELAVAL: SNAPSHOT

TABLE 076. DELAVAL: BUSINESS PERFORMANCE

TABLE 077. DELAVAL: PRODUCT PORTFOLIO

TABLE 078. DELAVAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. MOOCALL: SNAPSHOT

TABLE 079. MOOCALL: BUSINESS PERFORMANCE

TABLE 080. MOOCALL: PRODUCT PORTFOLIO

TABLE 081. MOOCALL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. COWLAR: SNAPSHOT

TABLE 082. COWLAR: BUSINESS PERFORMANCE

TABLE 083. COWLAR: PRODUCT PORTFOLIO

TABLE 084. COWLAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. DATAMARS: SNAPSHOT

TABLE 085. DATAMARS: BUSINESS PERFORMANCE

TABLE 086. DATAMARS: PRODUCT PORTFOLIO

TABLE 087. DATAMARS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 088. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 089. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 090. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COMPONENT TYPE

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY ANIMAL TYPE

FIGURE 016. CATTLE MARKET OVERVIEW (2016-2028)

FIGURE 017. POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 018. SWINE MARKET OVERVIEW (2016-2028)

FIGURE 019. EQUINE MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY APPLICATION

FIGURE 022. MILK HARVESTING MARKET OVERVIEW (2016-2028)

FIGURE 023. BREEDING MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 024. FEEDING MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 025. ANIMAL HEALTH MONITORING & COMFORT MARKET OVERVIEW (2016-2028)

FIGURE 026. HEAT STRESS MARKET OVERVIEW (2016-2028)

FIGURE 027. BEHAVIOR MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. NORTH AMERICA LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. EUROPE LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. ASIA PACIFIC LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. MIDDLE EAST & AFRICA LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. SOUTH AMERICA LIVESTOCK IDENTIFICATION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Livestock Identification Market research report is 2022-2028.

DeLaval (Sweden), Allflex (Part of Merck) (US), Afimilk (Israel), Nedap (Netherlands), Livestock Improvement Corporation (New Zealand), Zoetis (US), Leader Products (Australia), Datamars (Switzerland), Kupsan Tag Company (Turkey), CAISLEY International (Germany), Cainthus (Ireland), Connecterra (Netherlands), Moocall (Ireland), and Cowlar (US)., and other major players.

The Livestock Identification Market is segmented into Component Type, Animal Type, Application, and region. By Component Type, the market is categorized into Hardware, Software, and Services. By Animal Type the market is categorized into Cattle, Poultry, Swine, Equine, and Others. By Application, the market is categorized into Milk Harvesting, Breeding Management, Feeding Management, Animal Health Monitoring & Comfort, Heat Stress, Behavior Monitoring, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Livestock identification is the basis for keeping proper production records of the herd/flock. Individual livestock identification enables producers to maintain records on an animal's birth date, health history, parentage, production records, and a host of other important management information.

The Global Livestock Identification market was valued at USD 1.92 billion in 2021 and is expected to reach USD 4.11 billion by the year 2028, at a CAGR of 11.48%.