Live Streaming Software Market Synopsis

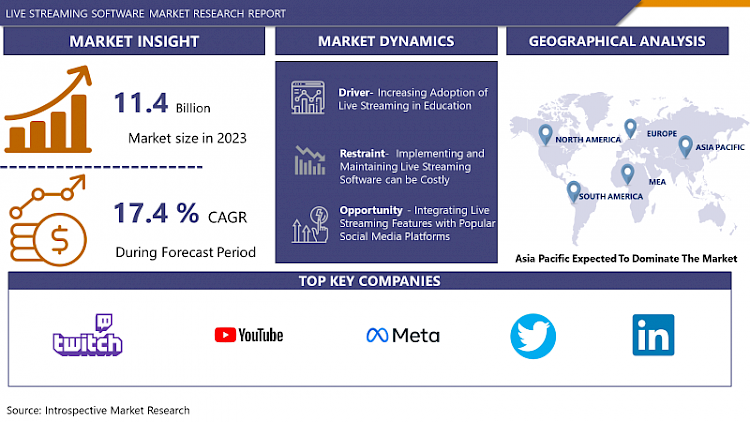

Live Streaming Software Market Size Was Valued at USD 11.4 Billion in 2023 and is Projected to Reach USD 48.3 Billion by 2032, Growing at a CAGR of 17.4% From 2024-2032.

Live streaming software enables users to broadcast live video content over the internet in real-time. It provides tools for capturing, encoding, and transmitting video and audio data to online platforms, allowing individuals and organizations to reach a wide audience for various purposes such as entertainment, gaming, education, business, and social interaction. Live streaming software often includes features for customization, audience engagement, monetization, and analytics to enhance the live streaming experience and maximize its impact.

- Live streaming software is utilized in various industries, including entertainment, gaming, education, sports, business, and spiritual events. It is used for broadcasting live events, gaming, online classes, webinars, and professional development sessions. It also enables remote learning, allowing students to attend lectures, participate in interactive discussions, and collaborate with peers and instructors in real time. Sports organizations broadcast live games, matches, tournaments, and sporting events to fans worldwide. Fitness instructors and gyms deliver virtual fitness classes, workouts, yoga sessions, and personal training sessions to clients. Businesses host virtual meetings and conferences for remote teams, clients, partners, and stakeholders.

- Companies use live streaming software to unveil new products, services, features, and updates to a global audience. Social media streaming allows creators and communities to connect, interact, and engage with their audience in real time, fostering meaningful relationships and loyalty. Religious organizations and spiritual leaders use live streaming software to broadcast religious services, ceremonies, sermons, and events to congregations and followers worldwide, enabling remote participation and engagement. Live streaming is gaining popularity in various industries, including gaming, entertainment, sports, education, and business.

- The demand for software that enables seamless live broadcasting is driven by the expansion of online entertainment, the rise of content creators, esports and gaming, remote work and virtual events, and monetization opportunities. Live streaming software caters to gamers and esports enthusiasts, providing tools for broadcasting, capturing gameplay, and engaging with audiences. Technological advancements, such as improved internet bandwidth, faster streaming protocols, and cloud-based infrastructure, have made live streaming more accessible, reliable, and affordable. The integration of live streaming features into popular social media platforms like Facebook, YouTube, Instagram, and Twitch has made live streaming more accessible to a broader audience, further driving demand for live streaming software.

Live Streaming Software Market Trend Analysis

Increasing Adoption of Live Streaming in Education

- The "Increasing Adoption of Live Streaming in Education" refers to the growing use of live streaming software in educational institutions, enabling online learning experiences. This trend is driven by the increasing demand for remote learning, particularly during the COVID-19 pandemic, which allows students to participate in real-time from anywhere with an internet connection. Live streaming offers flexibility and accessibility for both educators and students, allowing them to access educational content at their convenience.

- Live streaming software also offers scalability and cost-effectiveness for educational institutions of all sizes, as cloud-based platforms eliminate the need for expensive hardware infrastructure and technical expertise. They can accommodate varying class sizes and audience demographics, making them accessible and cost-effective for educational institutions with limited resources. It also enhances interactivity in online education by enabling real-time engagement between instructors and students through features like live chat, polls, quizzes, and interactive whiteboards.

- Studies have shown that incorporating live streaming into educational practices can lead to improved learning outcomes and student engagement. By leveraging multimedia content, live interactions, and collaborative tools, educators can create immersive and personalized learning experiences that cater to diverse learning styles and preferences. Live streaming also facilitates instant feedback and assessment, allowing instructors to adapt their teaching strategies in real time based on student responses and performance metrics.

Restraint

Implementing and Maintaining Live Streaming Software can be Costly

- The cost of implementing and maintaining live streaming software can be significant due to various factors. These include initial investment, hardware requirements, infrastructure costs, software development and customization, technical expertise, licensing and subscription fees, content delivery costs, security measures, training and support, and regular updates and maintenance. The initial cost can be significant, especially for high-quality live streaming, which may require specialized hardware. Infrastructure costs, such as servers, content delivery networks, and bandwidth, can be substantial, with cloud-based solutions offering some relief but still incurring recurring fees.

- Software development and customization can also be costly, with the complexity of the software and the extent of customization needed. Technical expertise is essential for optimal performance, security, and scalability of the live streaming infrastructure. License and subscription fees, bandwidth and content delivery costs, security measures, training and support, and regular updates and maintenance are also significant expenses. Budgeting for ongoing maintenance costs is crucial to keep the software up-to-date and compatible with evolving technologies and standards.

Opportunity

Integrating Live Streaming Features with Popular Social Media Platforms

- Live streaming software providers are leveraging the growing demand for live video content and the massive user bases of platforms like Facebook, Instagram, Twitter, YouTube, and Twitch to integrate live streaming features. This allows them to tap into the vast audience of billions of active users, enhance user engagement, streamline the broadcasting process for content creators, and increase the reach and visibility of their content. Social media platforms offer powerful tools for content discovery, recommendation, and sharing, allowing live streams to be amplified in visibility and exposure to a wider audience.

- The monetization opportunity allows creators to generate revenue directly from their live video content. However, social media platforms offer robust analytics tools that provide valuable insights into audience demographics, engagement metrics, viewer behavior, and performance analytics. By integrating live streaming features with these platforms, content creators and broadcasters can make informed decisions, refine their content strategies, and optimize their live streams for maximum impact.

Challenge

Content Piracy and Copyright Infringement

- Live streaming platforms face several challenges, including unauthorized distribution of copyrighted content, illegal re-streaming, and the presence of pirate websites and platforms. These issues can lead to copyright infringement, resulting in legal consequences for both the streamer and the platform. Live streaming platforms often lack robust content identification systems, making it difficult to prevent unauthorized streaming. Securing rights to livestream copyrighted content can be complex and costly, especially for high-profile events.

- This can result in revenue loss and reputational damage, as platforms lose revenue from advertising, subscriptions, and pay-per-view. Enforcing copyright protection can be challenging due to jurisdictional issues and resource intensity, as content piracy often crosses international borders. Enforcing copyright protection requires significant resources for monitoring, takedown requests, legal proceedings, and anti-piracy efforts, which may be burdensome for smaller content creators and rights holders.

Live Streaming Software Market Segment Analysis:

Live Streaming Software Market Segmented based on platform type, deployment mode, and end-users.

By Platform Type, Standalone Platforms segment is expected to dominate the market during the forecast period

- Standalone platforms are a type of live streaming platform that offers a range of features, including broadcasting tools, audience engagement, monetization options, and analytics. These platforms are designed to scale with the growing needs of users, allowing them to handle a wide range of streaming requirements. They also allow users to establish their branding and identity, allowing them to build communities and monetize their content directly without relying on third-party platforms.

- Standalone platforms often offer robust monetization options, such as advertising, subscriptions, donations, sponsorships, pay-per-view, and merchandise sales. They also provide dedicated customer support, tutorials, and community forums to help users get started with live streaming and troubleshoot issues. The highly competitive nature of the standalone platforms segment drives ongoing advancements in live streaming technology, user experience, and value-added services, solidifying their dominance in the market.

By Deployment Mode, Cloud-based segment held the largest share of 55% in 2023

- Cloud-based live streaming software provides scalability, accessibility, cost-effectiveness, reliability, and redundancy. It allows users to easily adjust their streaming infrastructure based on demand, enabling them to handle fluctuations in viewership and peak traffic during live events. These solutions are accessible from any location with an internet connection, making them ideal for remote teams, content creators, and event organizers. Cloud deployment eliminates the need for on-premises hardware infrastructure, reducing upfront capital expenses and ongoing operational costs.

- The platform often uses geographically distributed data centers and redundant infrastructure to ensure high availability and reliability. It can integrate with other cloud services like content delivery networks, analytics platforms, and monetization tools, enhancing workflows and monetization strategies. Cloud-based software is maintained by service providers, allowing users to focus on creating and delivering compelling live content.

Live Streaming Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is experiencing rapid growth in internet penetration due to increasing smartphone adoption, broadband infrastructure expansion, and digital literacy rates. This has led to a growing audience for live-streaming content. The region's youthful population, particularly in countries like China, India, and Indonesia, is more likely to consume digital content, making it a lucrative market for live-streaming software providers. Economic growth in many Asia Pacific countries has led to rising disposable income, making people more willing to pay for entertainment and leisure activities.

- Emerging markets with untapped potential for live-streaming software are also emerging. The region's mobile-first culture allows live-streaming software providers to reach users in remote and rural areas. The region's cultural diversity allows for localized content and culturally relevant programming. Governments in the region have actively supported the growth of the digital economy.

Live Streaming Software Market Top Key Players:

- Twitch Interactive, Inc. (US)

- YouTube (Google LLC) (US)

- Facebook Gaming (Meta Platforms, Inc.) (US)

- Twitter, Inc. (US)

- Instagram (Meta Platforms, Inc.) (US)

- LinkedIn (Microsoft Corporation) (US)

- Discord, Inc. (US)

- Snap Inc. (US)

- Periscope (Twitter, Inc.) (US)

- Vimeo, LLC (US)

- Azubu (US)

- Mixer (Microsoft Corporation) (US)

- Ustream (IBM Corporation) (US)

- Brightcove Inc. (US)

- Streamlabs (Logitech International S.A.) (US)

- Mixcloud Limited (UK)

- Dailymotion SA (France)

- DouYu International Holdings Limited (China)

- Huya Inc. (China)

- Bilibili Inc. (China)

- YY Inc. (China)

- Tencent Holdings Limited (China)

- Nimo TV (HUYA Inc.) (China)

- TikTok (ByteDance Ltd.) (China), and other major players

Key Industry Developments in the Live Streaming Software Market:

-

In April 2024, Bending Spoons announced its agreement to acquire StreamYard Top Corp, also known as Hopin. The acquisition included StreamYard, Streamable, and Superwave. StreamYard, with millions of users globally, has facilitated the live-streaming and recording of over 60 million videos. Bending Spoons confirmed the acquisition, marking a significant expansion in their technology offerings.

In March 2024, Planetcast Media Services, a media technology provider in India and Southeast Asia, announced the acquisition of Switch Media, a white-label OTT platform provider operating across Asia-Pacific, Europe, and the US. The finalized transaction transferred full control of all Switch Media's assets to Planetcast.

|

Global Live Streaming Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

11.4 Bn |

|

Forecast Period 2024-32 CAGR: |

17.4 % |

Market Size in 2032: |

48.3 Bn |

|

Segments Covered: |

By Platform Type |

|

|

|

By Deployment Mode |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LIVE STREAMING SOFTWARE MARKET BY PLATFORM TYPE (2017-2032)

- LIVE STREAMING SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STANDALONE PLATFORMS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INTEGRATED PLATFORMS

- LIVE STREAMING SOFTWARE MARKET BY DEPLOYMENT MODE (2017-2032)

- LIVE STREAMING SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD-BASED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ON-PREMISES

- LIVE STREAMING SOFTWARE MARKET BY END USER (2017-2032)

- LIVE STREAMING SOFTWARE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDIA & ENTERTAINMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BUSINESS & CORPORATE

- SPORTS

- EDUCATION

- GAMING

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Live Streaming Software Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- TWITCH INTERACTIVE, INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- YOUTUBE (GOOGLE LLC) (US)

- FACEBOOK GAMING (META PLATFORMS, INC.) (US)

- TWITTER, INC. (US)

- INSTAGRAM (META PLATFORMS, INC.) (US)

- LINKEDIN (MICROSOFT CORPORATION) (US)

- DISCORD, INC. (US)

- SNAP INC. (US)

- PERISCOPE (TWITTER, INC.) (US)

- VIMEO, LLC (US)

- AZUBU (US)

- MIXER (MICROSOFT CORPORATION) (US)

- USTREAM (IBM CORPORATION) (US)

- BRIGHTCOVE INC. (US)

- STREAMLABS (LOGITECH INTERNATIONAL S.A.) (US)

- MIXCLOUD LIMITED (UK)

- DAILYMOTION SA (FRANCE)

- DOUYU INTERNATIONAL HOLDINGS LIMITED (CHINA)

- HUYA INC. (CHINA)

- BILIBILI INC. (CHINA)

- YY INC. (CHINA)

- TENCENT HOLDINGS LIMITED (CHINA)

- NIMO TV (HUYA INC.) (CHINA)

- TIKTOK (BYTEDANCE LTD.) (CHINA)

- COMPETITIVE LANDSCAPE

- GLOBAL LIVE STREAMING SOFTWARE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Platform Type

- Historic And Forecasted Market Size By Deployment Mode

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Live Streaming Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

11.4 Bn |

|

Forecast Period 2024-32 CAGR: |

17.4 % |

Market Size in 2032: |

48.3 Bn |

|

Segments Covered: |

By Platform Type |

|

|

|

By Deployment Mode |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LIVE STREAMING SOFTWARE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LIVE STREAMING SOFTWARE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LIVE STREAMING SOFTWARE MARKET COMPETITIVE RIVALRY

TABLE 005. LIVE STREAMING SOFTWARE MARKET THREAT OF NEW ENTRANTS

TABLE 006. LIVE STREAMING SOFTWARE MARKET THREAT OF SUBSTITUTES

TABLE 007. LIVE STREAMING SOFTWARE MARKET BY TYPE

TABLE 008. PLATFORMS MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. LIVE STREAMING SOFTWARE MARKET BY END-USER

TABLE 011. ESPORT MARKET OVERVIEW (2016-2028)

TABLE 012. EVENTS MARKET OVERVIEW (2016-2028)

TABLE 013. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 014. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 015. MEDIA MARKET OVERVIEW (2016-2028)

TABLE 016. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA LIVE STREAMING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA LIVE STREAMING SOFTWARE MARKET, BY END-USER (2016-2028)

TABLE 019. N LIVE STREAMING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE LIVE STREAMING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE LIVE STREAMING SOFTWARE MARKET, BY END-USER (2016-2028)

TABLE 022. LIVE STREAMING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC LIVE STREAMING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC LIVE STREAMING SOFTWARE MARKET, BY END-USER (2016-2028)

TABLE 025. LIVE STREAMING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA LIVE STREAMING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA LIVE STREAMING SOFTWARE MARKET, BY END-USER (2016-2028)

TABLE 028. LIVE STREAMING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA LIVE STREAMING SOFTWARE MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA LIVE STREAMING SOFTWARE MARKET, BY END-USER (2016-2028)

TABLE 031. LIVE STREAMING SOFTWARE MARKET, BY COUNTRY (2016-2028)

TABLE 032. TENCENT: SNAPSHOT

TABLE 033. TENCENT: BUSINESS PERFORMANCE

TABLE 034. TENCENT: PRODUCT PORTFOLIO

TABLE 035. TENCENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ALIBABA: SNAPSHOT

TABLE 036. ALIBABA: BUSINESS PERFORMANCE

TABLE 037. ALIBABA: PRODUCT PORTFOLIO

TABLE 038. ALIBABA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. BAIDU: SNAPSHOT

TABLE 039. BAIDU: BUSINESS PERFORMANCE

TABLE 040. BAIDU: PRODUCT PORTFOLIO

TABLE 041. BAIDU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. XIAOMI: SNAPSHOT

TABLE 042. XIAOMI: BUSINESS PERFORMANCE

TABLE 043. XIAOMI: PRODUCT PORTFOLIO

TABLE 044. XIAOMI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. YOUTUBE: SNAPSHOT

TABLE 045. YOUTUBE: BUSINESS PERFORMANCE

TABLE 046. YOUTUBE: PRODUCT PORTFOLIO

TABLE 047. YOUTUBE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. FACEBOOK: SNAPSHOT

TABLE 048. FACEBOOK: BUSINESS PERFORMANCE

TABLE 049. FACEBOOK: PRODUCT PORTFOLIO

TABLE 050. FACEBOOK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. PERISCOPE: SNAPSHOT

TABLE 051. PERISCOPE: BUSINESS PERFORMANCE

TABLE 052. PERISCOPE: PRODUCT PORTFOLIO

TABLE 053. PERISCOPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 054. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 055. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 056. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LIVE STREAMING SOFTWARE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LIVE STREAMING SOFTWARE MARKET OVERVIEW BY TYPE

FIGURE 012. PLATFORMS MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. LIVE STREAMING SOFTWARE MARKET OVERVIEW BY END-USER

FIGURE 015. ESPORT MARKET OVERVIEW (2016-2028)

FIGURE 016. EVENTS MARKET OVERVIEW (2016-2028)

FIGURE 017. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 018. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 019. MEDIA MARKET OVERVIEW (2016-2028)

FIGURE 020. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA LIVE STREAMING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE LIVE STREAMING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC LIVE STREAMING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA LIVE STREAMING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA LIVE STREAMING SOFTWARE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Live Streaming Software Market research report is 2024-2032.

Twitch Interactive, Inc. (US), YouTube (Google LLC) (US), Facebook Gaming (Meta Platforms, Inc.) (US), Twitter, Inc. (US), Instagram (Meta Platforms, Inc.) (US), LinkedIn (Microsoft Corporation) (US), Discord, Inc. (US), Snap Inc. (US), Periscope (Twitter, Inc.) (US), Vimeo, LLC (US), Azubu (US), Mixer (Microsoft Corporation) (US), Ustream (IBM Corporation) (US), Brightcove Inc. (US), Streamlabs (Logitech International S.A.) (US), Mixcloud Limited (UK), Dailymotion SA (France), DouYu International Holdings Limited (China), Huya Inc. (China), Bilibili Inc. (China), YY Inc. (China), Tencent Holdings Limited (China), Nimo TV (HUYA Inc.) (China), TikTok (ByteDance Ltd.) (China) and Other Major Players.

The Live Streaming Software Market is segmented into Platform Type, Deployment Mode, End User, and region. By Platform Type, the market is categorized into Standalone Platforms and integrated Platforms. By Deployment Mode, the market is categorized into Cloud-based and on-premises. By End User, the market is categorized into Media & Entertainment, Business & Corporate, Sports, Education, Gaming. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Live Streaming Software Market refers to the industry segment focused on the development, distribution, and utilization of software solutions that enable real-time broadcasting of audio and video content over the internet. This market includes a wide range of software platforms, applications, and tools designed to facilitate live streaming across various industries and use cases, such as entertainment, gaming, sports, education, business, and social media. The market encompasses both standalone live streaming platforms and integrated features within existing social media platforms, gaming consoles, communication tools, and broadcasting software. Key players in the market offer features for encoding, transcoding, streaming management, audience engagement, monetization, analytics, and content protection, catering to the diverse needs of content creators, broadcasters, businesses, and organizations seeking to reach global audiences through live streaming.

Live Streaming Software Market Size Was Valued at USD 11.4 Billion in 2023, and is Projected to Reach USD 48.3 Billion by 2032, Growing at a CAGR of 17.4% From 2024-2032.