Liquid Fertilizer Market Synopsis

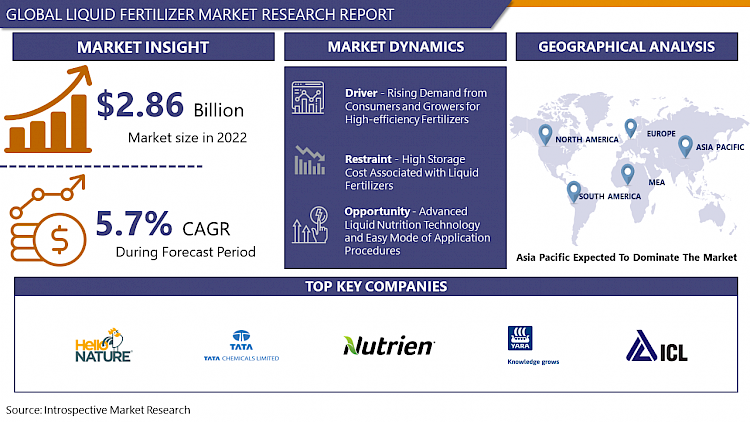

Global Liquid Fertilizer Market size is expected to grow from USD 2.86 Billion in 2022 to USD 4.46 billion by 2030, at a CAGR of 5.7% during the forecast period (2023-2030).

Liquid fertilizer is a concentrated and nutrient-rich solution designed to enrich plants and improve soil fertility. Formulated with crucial elements such as nitrogen, phosphorus, potassium, and micronutrients, it readily dissolves in water, allowing for application through irrigation or foliar spraying. Liquid fertilizers facilitate rapid absorption by plants, fostering efficient growth and development. Widely utilized in agriculture, horticulture, and gardening, these fertilizers serve to augment soil nutrient content and cater to the distinctive nutritional needs of crops.

- Liquid Fertilizers are effective extracts of soluble chemicals and powders that consist of a mixture of potassium, phosphorus, and nitrogen. They also comprise several insecticides, fungicides, weed killers as well as wetting agents, which are designed to boost plant growth. Liquid fertilizers include hydrous liquid ammonia, nitrogenous fertilizers, aqueous ammonia, concentrated solutions of ammonium nitrate and urea, ammoniates, as well as some of the complex fertilizers that are vital for soil nutrition.

- The majority of growers all across the world seek high-quality soil and nutrition in their fields during cultivation. Liquid fertilizers help farmers in increasing soil efficiency as well as enhancing overall agricultural produce. Growing demand for enhanced and efficient fertilizers, rapid adoption of sustainable methods of farming, simplicity of use, and ensuring food security are major factors that are projected to boost the market growth of liquid fertilizers over the forecasted timeframe.

Liquid Fertilizer Market Trend Analysis:

Rising Demand from Consumers and Growers for High-efficiency Fertilizers

- The growing demand from consumers for high-quality food and the development of highly effective liquid fertilizers has led to the expansion of the liquid fertilizer market over the decades. There has been observed an increase in awareness among consumers regarding food safety and security. Moreover, crop nutrition is primarily becoming important in both commercials as well as food crops owing to the vast environmental and economic considerations. As a result, fertilizers with high efficiency such as liquid fertilizers are gaining popularity. High-efficiency fertilizers are effective in saving time and labor costs, and it ensures that the crops receive nutrients in a specified amount at the right place and at the right time, by reducing minimum wastage.

- The demand for such enhanced and high-efficiency fertilizers is also rising substantially in the agriculture industry, especially in the cereals, grains, and industrial crops. This can be attributed to the emergence of low-cost polymer coating technologies as well as new urease inhibitors. Furthermore, the application of liquid fertilizers helps in decreasing the negative impact of nutrients by leaching them into the water reservoirs. Liquid fertilizer offers easy access to nutrients as it soaks directly into the soil when compared with granular forms, thereby driving market growth in the upcoming years.

Advanced Liquid Nutrition Technology and Easy Mode of Application Procedures

- Due to the increase in the global population, there is a rising global need for food, which has significantly increased the use of high-efficiency fertilizers, especially liquid fertilizers, in farming. Liquid fertilizers make a substantial contribution to total production and food security. Over the years, the demand for high-efficiency fertilizers has been significantly impacted by the desire to increase food security in the world. For instance, Greenmaster Liquid and Sportsmaster Liquid fertilizers by ICL, use innovative liquid nutrition technology and contain the company's exclusive TMax nutrient-uptake activator.

- TMax is a combination of surface-active agents (surfactants), nutrient-uptake accelerators, vitamins, and chelating agents that increases the effectiveness of fertilizer uptake. With an equally distributed application, Greenmaster Liquid provides enhanced liquid nutrition intending to maximize nutrient uptake. As a result, unlike other forms of fertilizers, liquid fertilizers are predicted to experience growth as one of the most effective fertilizers that can provide cost-effective yields under a diversity of agro-climatic conditions. The above-mentioned factors are expected to create lucrative opportunities for market players over the analysis period.

Liquid Fertilizer Market Segment Analysis:

Liquid Fertilizer Market is Segmented Based on Nutrient Type, Mode of Application, Major Compound, and Crop Type.

By Nutrient Type, Nitrogen segment is expected to dominate the market during the forecast period

- By Nutrient Type, the nitrogen segment is anticipated to lead the growth of the liquid fertilizers market. Nitrogen is the majorly consumed nutrient among all the micro and macro elements needed for the ultimate plant growth. Nitrogen is also essential in building amino acids, which further produce proteins, and performs almost every biochemical reaction performed in a plant. Inadequate nitrogen (N) availability in the field soil is a major problem that farmers face while crop cultivation. Thus, the application of additional liquid nitrogen fertilization is the ultimate solution to eradicate this problem, which further drives the segment growth.

Liquid Fertilizer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is anticipated to dominate the liquid fertilizers market over the forecasted period. The Asia Pacific is undoubtedly the largest market for liquid fertilizer owing to the rising prices of traditional fertilizers and their negative impact on environmental conditions. These have also resulted in the massive growth in the utilization of high-efficiency fertilizers such as liquid potassium fertilizers for crop production. The growing demand from consumers & growers for high-quality food, high crop yield, and advancements in automated systems for irrigation are the primary factors that drive the market growth in the Asia Pacific region. China holds the largest market share whereas Australia is estimated to grow rapidly in the upcoming years. Moreover, the rapid population growth, government initiatives, and international support to boost agricultural production are thereby estimated to generate huge growth opportunities in this region.

- The liquid fertilizers market in the North American region is expected to develop at fastest CAGR over the studied period. The growth in this region can be attributed to the presence of a diverse variety of liquid fertilizer manufacturers in this region, as well as the availability of distribution channels and manufacturing facilities. Moreover, the increasing knowledge and awareness regarding the utilization of organic liquid fertilizers, and the growing demand for high-value goods are estimated to expand the growth of liquid fertilizers in the North American region. Urea is the major liquid nitrogenous fertilizer used in this region. Further, rapid growth is been observed in the liquid micronutrient segment of the North American liquid fertilizer market owing to the growing demand for food grains and increasing soil deficiency.

Top Key Players Covered In Liquid Fertilizer Market

- The Scotts Miracle-Gro Company (US)

- Sigma AgriScience LLC (US)

- The Mosaic Company (US)

- Nutrien Ltd. (Canada)

- ILSA S.p.A. (Italy)

- Italpollina S.p.A. (Italy)

- Yara International ASA (Norway)

- EuroChem Group (Switzerland)

- Israel Chemical Ltd. (Israel)

- Tata Chemicals Ltd (India)

- Ajay Farm-Chem Private Limited (India)

- Balaji Fertilizers Private Limited (India)

- Deepak Fertilizers and Petrochemicals Corporation Limited (India)

- Bharat Fertilizer Industries Limited (India)

- Coromandel Fertilizers Limited (India), and other major players.

Key Industry Development In The Liquid Fertilizer Market:

- In January 2023, Canadian fertilizer giant Nutrien Ltd. acquired Agrochem International, a leading distributor of liquid fertilizers in Brazil, for $480 million. This move strengthens Nutrien's position in the Brazilian market and expands its reach to key agricultural regions.

- In June 2023, US fertilizer producer CF Industries announced plans to build a new $1.5 billion liquid fertilizer plant in Louisiana. This investment is expected to increase CF Industries' production capacity and meet the growing demand for liquid fertilizers in the US market.

- In July 2023, Norwegian fertilizer company Yara International acquired Compass Minerals' Plant Nutrition business for $335 million. This acquisition expands Yara's portfolio of liquid fertilizers and specialty products in North America.

|

Global Liquid Fertilizer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.86 Bn. |

|

Forecast Period 2022-30 CAGR: |

5.7% |

Market Size in 2030: |

USD 4.46 Bn. |

|

Segments Covered: |

By Nutrient Type |

|

|

|

By Mode of Application |

|

||

|

By Major Compound |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LIQUID FERTILIZER MARKET BY NUTRIENT TYPE (2016-2030)

- LIQUID FERTILIZER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NITROGEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PHOSPHORUS

- POTASSIUM

- MICRONUTRIENTS

- LIQUID FERTILIZER MARKET BY MODE OF APPLICATION (2016-2030)

- LIQUID FERTILIZER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOIL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOLIAR

- FERTIGATION

- LIQUID FERTILIZER MARKET BY MAJOR COMPOUND (2016-2030)

- LIQUID FERTILIZER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CAN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- UAN

- MAP

- DAP

- POTASSIUM NITRATE

- LIQUID FERTILIZER MARKET BY CROP TYPE (2016-2030)

- LIQUID FERTILIZER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GRAINS & CEREALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FRUITS & VEGETABLES

- OILSEEDS & PULSES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Liquid Fertilizer Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- THE SCOTTS MIRACLE-GRO COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SIGMA AGRISCIENCE LLC (US)

- THE MOSAIC COMPANY (US)

- NUTRIEN LTD. (CANADA)

- ILSA S.P.A. (ITALY)

- ITALPOLLINA S.P.A. (ITALY)

- YARA INTERNATIONAL ASA (NORWAY)

- EUROCHEM GROUP (SWITZERLAND)

- ISRAEL CHEMICAL LTD. (ISRAEL)

- TATA CHEMICALS LTD (INDIA)

- AJAY FARM-CHEM PRIVATE LIMITED (INDIA)

- BALAJI FERTILIZERS PRIVATE LIMITED (INDIA)

- DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED (INDIA)

- BHARAT FERTILIZER INDUSTRIES LIMITED (INDIA)

- COROMANDEL FERTILIZERS LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL LIQUID FERTILIZER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Nutrient Type

- Historic And Forecasted Market Size By Mode of Application

- Historic And Forecasted Market Size By Major Compound

- Historic And Forecasted Market Size By Crop Type

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Liquid Fertilizer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2.86 Bn. |

|

Forecast Period 2022-30 CAGR: |

5.7% |

Market Size in 2030: |

USD 4.46 Bn. |

|

Segments Covered: |

By Nutrient Type |

|

|

|

By Mode of Application |

|

||

|

By Major Compound |

|

||

|

By Crop Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LIQUID FERTILIZER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LIQUID FERTILIZER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LIQUID FERTILIZER MARKET COMPETITIVE RIVALRY

TABLE 005. LIQUID FERTILIZER MARKET THREAT OF NEW ENTRANTS

TABLE 006. LIQUID FERTILIZER MARKET THREAT OF SUBSTITUTES

TABLE 007. LIQUID FERTILIZER MARKET BY NUTRIENT TYPE

TABLE 008. NITROGEN MARKET OVERVIEW (2016-2028)

TABLE 009. PHOSPHORUS MARKET OVERVIEW (2016-2028)

TABLE 010. POTASSIUM MARKET OVERVIEW (2016-2028)

TABLE 011. MICRONUTRIENTS MARKET OVERVIEW (2016-2028)

TABLE 012. LIQUID FERTILIZER MARKET BY MODE OF APPLICATION

TABLE 013. SOIL MARKET OVERVIEW (2016-2028)

TABLE 014. FOLIAR MARKET OVERVIEW (2016-2028)

TABLE 015. FERTIGATION MARKET OVERVIEW (2016-2028)

TABLE 016. LIQUID FERTILIZER MARKET BY MAJOR COMPOUND

TABLE 017. CAN MARKET OVERVIEW (2016-2028)

TABLE 018. UAN MARKET OVERVIEW (2016-2028)

TABLE 019. MAP MARKET OVERVIEW (2016-2028)

TABLE 020. DAP MARKET OVERVIEW (2016-2028)

TABLE 021. POTASSIUM NITRATE MARKET OVERVIEW (2016-2028)

TABLE 022. LIQUID FERTILIZER MARKET BY CROP TYPE

TABLE 023. GRAINS & CEREALS MARKET OVERVIEW (2016-2028)

TABLE 024. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 025. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

TABLE 026. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 027. NORTH AMERICA LIQUID FERTILIZER MARKET, BY NUTRIENT TYPE (2016-2028)

TABLE 028. NORTH AMERICA LIQUID FERTILIZER MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 029. NORTH AMERICA LIQUID FERTILIZER MARKET, BY MAJOR COMPOUND (2016-2028)

TABLE 030. NORTH AMERICA LIQUID FERTILIZER MARKET, BY CROP TYPE (2016-2028)

TABLE 031. N LIQUID FERTILIZER MARKET, BY COUNTRY (2016-2028)

TABLE 032. EUROPE LIQUID FERTILIZER MARKET, BY NUTRIENT TYPE (2016-2028)

TABLE 033. EUROPE LIQUID FERTILIZER MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 034. EUROPE LIQUID FERTILIZER MARKET, BY MAJOR COMPOUND (2016-2028)

TABLE 035. EUROPE LIQUID FERTILIZER MARKET, BY CROP TYPE (2016-2028)

TABLE 036. LIQUID FERTILIZER MARKET, BY COUNTRY (2016-2028)

TABLE 037. ASIA PACIFIC LIQUID FERTILIZER MARKET, BY NUTRIENT TYPE (2016-2028)

TABLE 038. ASIA PACIFIC LIQUID FERTILIZER MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 039. ASIA PACIFIC LIQUID FERTILIZER MARKET, BY MAJOR COMPOUND (2016-2028)

TABLE 040. ASIA PACIFIC LIQUID FERTILIZER MARKET, BY CROP TYPE (2016-2028)

TABLE 041. LIQUID FERTILIZER MARKET, BY COUNTRY (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA LIQUID FERTILIZER MARKET, BY NUTRIENT TYPE (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA LIQUID FERTILIZER MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA LIQUID FERTILIZER MARKET, BY MAJOR COMPOUND (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA LIQUID FERTILIZER MARKET, BY CROP TYPE (2016-2028)

TABLE 046. LIQUID FERTILIZER MARKET, BY COUNTRY (2016-2028)

TABLE 047. SOUTH AMERICA LIQUID FERTILIZER MARKET, BY NUTRIENT TYPE (2016-2028)

TABLE 048. SOUTH AMERICA LIQUID FERTILIZER MARKET, BY MODE OF APPLICATION (2016-2028)

TABLE 049. SOUTH AMERICA LIQUID FERTILIZER MARKET, BY MAJOR COMPOUND (2016-2028)

TABLE 050. SOUTH AMERICA LIQUID FERTILIZER MARKET, BY CROP TYPE (2016-2028)

TABLE 051. LIQUID FERTILIZER MARKET, BY COUNTRY (2016-2028)

TABLE 052. ITALPOLLINA S.P.A. (ITALY): SNAPSHOT

TABLE 053. ITALPOLLINA S.P.A. (ITALY): BUSINESS PERFORMANCE

TABLE 054. ITALPOLLINA S.P.A. (ITALY): PRODUCT PORTFOLIO

TABLE 055. ITALPOLLINA S.P.A. (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TATA CHEMICALS LTD (INDIA): SNAPSHOT

TABLE 056. TATA CHEMICALS LTD (INDIA): BUSINESS PERFORMANCE

TABLE 057. TATA CHEMICALS LTD (INDIA): PRODUCT PORTFOLIO

TABLE 058. TATA CHEMICALS LTD (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. NUTRIEN LTD. (CANADA): SNAPSHOT

TABLE 059. NUTRIEN LTD. (CANADA): BUSINESS PERFORMANCE

TABLE 060. NUTRIEN LTD. (CANADA): PRODUCT PORTFOLIO

TABLE 061. NUTRIEN LTD. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. YARA INTERNATIONAL ASA (NORWAY): SNAPSHOT

TABLE 062. YARA INTERNATIONAL ASA (NORWAY): BUSINESS PERFORMANCE

TABLE 063. YARA INTERNATIONAL ASA (NORWAY): PRODUCT PORTFOLIO

TABLE 064. YARA INTERNATIONAL ASA (NORWAY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ISRAEL CHEMICAL LTD. (ISRAEL): SNAPSHOT

TABLE 065. ISRAEL CHEMICAL LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 066. ISRAEL CHEMICAL LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 067. ISRAEL CHEMICAL LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. THE MOSAIC COMPANY (US): SNAPSHOT

TABLE 068. THE MOSAIC COMPANY (US): BUSINESS PERFORMANCE

TABLE 069. THE MOSAIC COMPANY (US): PRODUCT PORTFOLIO

TABLE 070. THE MOSAIC COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. EUROCHEM GROUP (SWITZERLAND): SNAPSHOT

TABLE 071. EUROCHEM GROUP (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 072. EUROCHEM GROUP (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 073. EUROCHEM GROUP (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. THE SCOTTS MIRACLE-GRO COMPANY (US): SNAPSHOT

TABLE 074. THE SCOTTS MIRACLE-GRO COMPANY (US): BUSINESS PERFORMANCE

TABLE 075. THE SCOTTS MIRACLE-GRO COMPANY (US): PRODUCT PORTFOLIO

TABLE 076. THE SCOTTS MIRACLE-GRO COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SIGMA AGRISCIENCE LLC (US): SNAPSHOT

TABLE 077. SIGMA AGRISCIENCE LLC (US): BUSINESS PERFORMANCE

TABLE 078. SIGMA AGRISCIENCE LLC (US): PRODUCT PORTFOLIO

TABLE 079. SIGMA AGRISCIENCE LLC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. ILSA S.P.A. (ITALY): SNAPSHOT

TABLE 080. ILSA S.P.A. (ITALY): BUSINESS PERFORMANCE

TABLE 081. ILSA S.P.A. (ITALY): PRODUCT PORTFOLIO

TABLE 082. ILSA S.P.A. (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. AJAY FARM-CHEM PRIVATE LIMITED (INDIA): SNAPSHOT

TABLE 083. AJAY FARM-CHEM PRIVATE LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 084. AJAY FARM-CHEM PRIVATE LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 085. AJAY FARM-CHEM PRIVATE LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. BALAJI FERTILIZERS PRIVATE LIMITED (INDIA): SNAPSHOT

TABLE 086. BALAJI FERTILIZERS PRIVATE LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 087. BALAJI FERTILIZERS PRIVATE LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 088. BALAJI FERTILIZERS PRIVATE LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED (INDIA): SNAPSHOT

TABLE 089. DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 090. DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 091. DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. BHARAT FERTILIZER INDUSTRIES LIMITED (INDIA): SNAPSHOT

TABLE 092. BHARAT FERTILIZER INDUSTRIES LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 093. BHARAT FERTILIZER INDUSTRIES LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 094. BHARAT FERTILIZER INDUSTRIES LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. COROMANDAL FERTILIZERS LIMITED (INDIA): SNAPSHOT

TABLE 095. COROMANDAL FERTILIZERS LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 096. COROMANDAL FERTILIZERS LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 097. COROMANDAL FERTILIZERS LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 098. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 099. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 100. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LIQUID FERTILIZER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LIQUID FERTILIZER MARKET OVERVIEW BY NUTRIENT TYPE

FIGURE 012. NITROGEN MARKET OVERVIEW (2016-2028)

FIGURE 013. PHOSPHORUS MARKET OVERVIEW (2016-2028)

FIGURE 014. POTASSIUM MARKET OVERVIEW (2016-2028)

FIGURE 015. MICRONUTRIENTS MARKET OVERVIEW (2016-2028)

FIGURE 016. LIQUID FERTILIZER MARKET OVERVIEW BY MODE OF APPLICATION

FIGURE 017. SOIL MARKET OVERVIEW (2016-2028)

FIGURE 018. FOLIAR MARKET OVERVIEW (2016-2028)

FIGURE 019. FERTIGATION MARKET OVERVIEW (2016-2028)

FIGURE 020. LIQUID FERTILIZER MARKET OVERVIEW BY MAJOR COMPOUND

FIGURE 021. CAN MARKET OVERVIEW (2016-2028)

FIGURE 022. UAN MARKET OVERVIEW (2016-2028)

FIGURE 023. MAP MARKET OVERVIEW (2016-2028)

FIGURE 024. DAP MARKET OVERVIEW (2016-2028)

FIGURE 025. POTASSIUM NITRATE MARKET OVERVIEW (2016-2028)

FIGURE 026. LIQUID FERTILIZER MARKET OVERVIEW BY CROP TYPE

FIGURE 027. GRAINS & CEREALS MARKET OVERVIEW (2016-2028)

FIGURE 028. FRUITS & VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 029. OILSEEDS & PULSES MARKET OVERVIEW (2016-2028)

FIGURE 030. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 031. NORTH AMERICA LIQUID FERTILIZER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. EUROPE LIQUID FERTILIZER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. ASIA PACIFIC LIQUID FERTILIZER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. MIDDLE EAST & AFRICA LIQUID FERTILIZER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. SOUTH AMERICA LIQUID FERTILIZER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Liquid Fertilizer Market research report is 2023-2030.

The Scotts Miracle-Gro Company (US), Sigma AgriScience LLC (US), The Mosaic Company (US), Nutrien Ltd. (Canada), ILSA S.p.A. (Italy), Italpollina S.p.A. (Italy), Yara International ASA (Norway), EuroChem Group (Switzerland), Israel Chemical Ltd. (Israel), Tata Chemicals Ltd (India), Ajay Farm-Chem Private Limited (India), Balaji Fertilizers Private Limited (India), Deepak Fertilizers and Petrochemicals Corporation Limited (India), Bharat Fertilizer Industries Limited (India), Coromandel Fertilizers Limited (India), and other major players.

The Liquid Fertilizer Market is segmented into Nutrient Type, Mode of Application, Major Compound, Crop Type, and region. By Nutrient Type, the market is categorized into Nitrogen, Phosphorus, Potassium, And Micronutrients. By Mode of Application, the market is categorized into oil, Foliar, and Fertigation. By Major Compounds, the market is categorized into CAN, UAN, MAP, DAP, and Potassium Nitrate. By Crop Type, the market is categorized into Grains & Cereals, Fruits & Vegetables, Oilseeds & Pulses, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Liquid Fertilizers are effective extracts of soluble chemicals and powders that consists of a mixture of potassium, phosphorus, and nitrogen. They also comprise several insecticides, fungicides, weed killers as well as wetting agents, which are designed to boost plant growth.

Global Liquid Fertilizer Market size is expected to grow from USD 2.86 Billion in 2022 to USD 4.46 billion by 2030, at a CAGR of 5.7% during the forecast period (2023-2030).