Liquefied Petroleum Gas (LPG) Market Overview

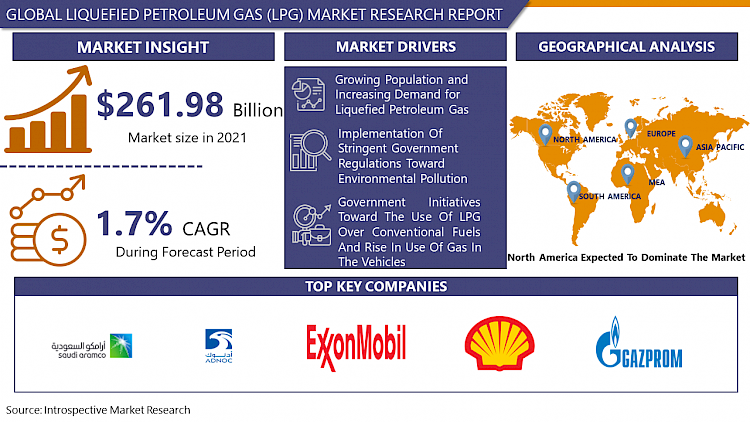

The global market for Liquefied Petroleum Gas (LPG) estimated at USD 261.98 Billion in the year 2021, is projected to reach a revised size of USD 294.79 Billion by 2028, growing at a CAGR of 1.7% over the period 2022-2028.

Liquefied petroleum gas (LPG) is also called LP gas. It is Made up from several liquid mixtures of the volatile hydrocarbon’s propene, propane, butene, and butane. It was used as a portable fuel source in 1860 and has since expanded production and consumption both domestically and industrially. Common commercial mixtures may contain ethane and ethylene as well as volatile mercaptans, an odorant added as a safety precaution. The one liter of liquid Liquefied petroleum gas expands to 270 liters of gaseous energy, allowing a lot of energy to be transported in small containers.

Although Liquefied petroleum gas is a gas at atmospheric pressure and room temperature, it can be liquefied by applying an appropriate pressure or lowering the temperature sufficiently. It can be easily condensed, packaged, stored and utilized, making it an ideal energy source for a wide range of applications. It is generally stored and distributed as a liquid and it is widely used for process and space heating, cooking and automotive propulsion. It is non-corrosive but can dissolve lubricants, certain plastics or synthetic rubbers.

Scope of the Liquefied Petroleum Gas (LPG) Market

Liquefied Petroleum Gas (LPG) Market research report contains the extensive use of secondary and primary data sources. Research process focuses on multiple factors impacting the industry such as aggressive landscape, government coverage, historical data, market present position, market trends, upcoming technologies and innovations in addition to risks, rewards, challenges and opportunities. To be able to validate market volume market, manufacturers, regional analysis, product sections and end users/applications study use Top-down and bottom-up approach.

Drivers of Liquefied Petroleum Gas (LPG) Market

Liquefied petroleum gas can be used in even the most remote areas, improving the lives of millions of citizens around the world and spurring local development. Because relatively few rural or remote areas can benefit from piped natural gas, Liquefied petroleum gas is an ideal power source for these areas, either as a primary source or in conjunction with renewable energy. These are the driving factors for growth of the market. It is also increasingly used for large-scale or small-scale power generation.

However, growing population and increasing demand for liquefied petroleum gas with vehicle exhaust has the potential to propel the growth of the market. Liquefied petroleum gas has many benefits in real life such as, Cooking, Power Generation, Energy, Health and Resources, Autogas – fuel for Liquefied petroleum gas cars and vehicles. It is also stored in pressurized cylindrical containers for use in agriculture, hospitality, construction and nautical fields.

Market Segmentation

Liquefied Petroleum Gas (LPG) Market Research report comprises of Porter's five forces analysis to do the detail study about its each segmentation like Product segmentation, End user/application segment analysis and Major key players analysis mentioned as below;

Regional Analysis

Europe and North America are expected to witness significant growth over the next few years as awareness of carbon emission reductions increases. Asia Pacific is projected to be a lucrative region for the global Liquefied petroleum gas market during the forecast period.

For cooking, large scale adoption of Liquefied petroleum gas in some regions such as Brazils uses 90%, Indonesia’s uses 75% and India’s utilizes this fuel is 45%. Our analysis will estimate the utilization of Liquefied petroleum gas is 1Bn by 2030.

Competitive Landscape and Liquefied Petroleum Gas (LPG) Market Share Analysis

Competitive analysis is the analysis of weakness and strength, marketplace expenditure, market share and market sales volume, and market trends of important players in the industry. The Liquefied Petroleum Gas (LPG) marketplace study focused on including each of the key level, secondary level and tertiary level competitors in the report. The data created by conducting the primary and secondary research. Liquefied petroleum gas report covers detail analysis of motorist, limitations and scope to new players going into the Liquefied Petroleum Gas (LPG) market.

Players Covered in Liquefied Petroleum Gas (LPG) market are :

- Saudi Aramco

- ADNOC

- BP(UK)

- KNPC

- Gazprom

- Exxon Mobil

- Shell

- Phillips66

- British Petroleum

- ADGAS

- Chevron

- China National Petroleum

- Petroleum Nasional

- Repsol

- China Gas Holdings Ltd

- FLAGA Gmbh

- Kleenheat

- Bharat Petroleum Corporation Limited

- JGC HOLDINGS CORPORATION

- Reliance Industries Limited

- Total

- Royal Dutch Shell

- Petroliam Nasional Berhad (PETRONAS)

- PetroChina Company Limited

- Petredec Pte Limited

- Qatargas Operating Company Limited

- Petrofac Limited

- Vitol

- China Petroleum & Chemical Corporation

- BP Plc. and other major players.

Among other players domestic and global, Liquefied Petroleum Gas (LPG) market share data is available for global, North America, Europe, Asia-Pacific, Middle East and Africa and South America separately. Our analysts understand competitive strengths and provide competitive analysis for each competitor separately.

|

Global Liquefied Petroleum Gas (LPG) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 261.98 Bn. |

|

Forecast Period 2022-28 CAGR: |

1.7% |

Market Size in 2028: |

USD 294.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Liquefied Petroleum Gas (LPG) Market by Type

4.1 Liquefied Petroleum Gas (LPG) Market Overview Snapshot and Growth Engine

4.2 Liquefied Petroleum Gas (LPG) Market Overview

4.3 Natural Gas Processing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Natural Gas Processing : Grographic Segmentation

4.4 Crude Oil Refining

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Crude Oil Refining: Grographic Segmentation

Chapter 5: Liquefied Petroleum Gas (LPG) Market by Source

5.1 Liquefied Petroleum Gas (LPG) Market Overview Snapshot and Growth Engine

5.2 Liquefied Petroleum Gas (LPG) Market Overview

5.3 Refinery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Refinery: Grographic Segmentation

5.4 Associated Gas

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Associated Gas: Grographic Segmentation

5.5 Non-Associated Gas

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Non-Associated Gas: Grographic Segmentation

Chapter 6: Liquefied Petroleum Gas (LPG) Market by Application

6.1 Liquefied Petroleum Gas (LPG) Market Overview Snapshot and Growth Engine

6.2 Liquefied Petroleum Gas (LPG) Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential : Grographic Segmentation

6.4 Commercial

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial : Grographic Segmentation

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial : Grographic Segmentation

6.6 Auto Fuel

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Auto Fuel : Grographic Segmentation

6.7 Refineries

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Refineries: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Liquefied Petroleum Gas (LPG) Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Liquefied Petroleum Gas (LPG) Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Liquefied Petroleum Gas (LPG) Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 SAUDI ARAMCO

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 ADNOC

7.4 BP(UK)

7.5 KNPC

7.6 GAZPROM

7.7 EXXON MOBIL

7.8 SHELL

7.9 PHILLIPS66

7.10 BRITISH PETROLEUM

7.11 ADGAS

7.12 CHEVRON

7.13 CHINA NATIONAL PETROLEUM

7.14 PETROLEUM NASIONAL

7.15 REPSOL

7.16 CHINA GAS HOLDINGS LTD

7.17 FLAGA GMBH

7.18 KLEENHEAT

7.19 BHARAT PETROLEUM CORPORATION LIMITED

7.20 JGC HOLDINGS CORPORATION

7.21 RELIANCE INDUSTRIES LIMITED

7.22 TOTAL

7.23 ROYAL DUTCH SHELL

7.24 PETROLIAM NASIONAL BERHAD (PETRONAS)

7.25 PETROCHINA COMPANY LIMITED

7.26 PETREDEC PTE LIMITED

7.27 QATARGAS OPERATING COMPANY LIMITED

7.28 PETROFAC LIMITED

7.29 VITOL

7.30 CHINA PETROLEUM & CHEMICAL CORPORATION

7.31 BP PLC.

Chapter 8: Global Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Natural Gas Processing

8.2.2 Crude Oil Refining

8.3 Historic and Forecasted Market Size By Source

8.3.1 Refinery

8.3.2 Associated Gas

8.3.3 Non-Associated Gas

8.4 Historic and Forecasted Market Size By Application

8.4.1 Residential

8.4.2 Commercial

8.4.3 Industrial

8.4.4 Auto Fuel

8.4.5 Refineries

Chapter 9: North America Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Natural Gas Processing

9.4.2 Crude Oil Refining

9.5 Historic and Forecasted Market Size By Source

9.5.1 Refinery

9.5.2 Associated Gas

9.5.3 Non-Associated Gas

9.6 Historic and Forecasted Market Size By Application

9.6.1 Residential

9.6.2 Commercial

9.6.3 Industrial

9.6.4 Auto Fuel

9.6.5 Refineries

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Natural Gas Processing

10.4.2 Crude Oil Refining

10.5 Historic and Forecasted Market Size By Source

10.5.1 Refinery

10.5.2 Associated Gas

10.5.3 Non-Associated Gas

10.6 Historic and Forecasted Market Size By Application

10.6.1 Residential

10.6.2 Commercial

10.6.3 Industrial

10.6.4 Auto Fuel

10.6.5 Refineries

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Natural Gas Processing

11.4.2 Crude Oil Refining

11.5 Historic and Forecasted Market Size By Source

11.5.1 Refinery

11.5.2 Associated Gas

11.5.3 Non-Associated Gas

11.6 Historic and Forecasted Market Size By Application

11.6.1 Residential

11.6.2 Commercial

11.6.3 Industrial

11.6.4 Auto Fuel

11.6.5 Refineries

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Natural Gas Processing

12.4.2 Crude Oil Refining

12.5 Historic and Forecasted Market Size By Source

12.5.1 Refinery

12.5.2 Associated Gas

12.5.3 Non-Associated Gas

12.6 Historic and Forecasted Market Size By Application

12.6.1 Residential

12.6.2 Commercial

12.6.3 Industrial

12.6.4 Auto Fuel

12.6.5 Refineries

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Liquefied Petroleum Gas (LPG) Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Natural Gas Processing

13.4.2 Crude Oil Refining

13.5 Historic and Forecasted Market Size By Source

13.5.1 Refinery

13.5.2 Associated Gas

13.5.3 Non-Associated Gas

13.6 Historic and Forecasted Market Size By Application

13.6.1 Residential

13.6.2 Commercial

13.6.3 Industrial

13.6.4 Auto Fuel

13.6.5 Refineries

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Liquefied Petroleum Gas (LPG) Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 261.98 Bn. |

|

Forecast Period 2022-28 CAGR: |

1.7% |

Market Size in 2028: |

USD 294.79 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. LIQUEFIED PETROLEUM GAS (LPG) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. LIQUEFIED PETROLEUM GAS (LPG) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. LIQUEFIED PETROLEUM GAS (LPG) MARKET COMPETITIVE RIVALRY

TABLE 005. LIQUEFIED PETROLEUM GAS (LPG) MARKET THREAT OF NEW ENTRANTS

TABLE 006. LIQUEFIED PETROLEUM GAS (LPG) MARKET THREAT OF SUBSTITUTES

TABLE 007. LIQUEFIED PETROLEUM GAS (LPG) MARKET BY TYPE

TABLE 008. NATURAL GAS PROCESSING MARKET OVERVIEW (2016-2028)

TABLE 009. CRUDE OIL REFINING MARKET OVERVIEW (2016-2028)

TABLE 010. LIQUEFIED PETROLEUM GAS (LPG) MARKET BY SOURCE

TABLE 011. REFINERY MARKET OVERVIEW (2016-2028)

TABLE 012. ASSOCIATED GAS MARKET OVERVIEW (2016-2028)

TABLE 013. NON-ASSOCIATED GAS MARKET OVERVIEW (2016-2028)

TABLE 014. LIQUEFIED PETROLEUM GAS (LPG) MARKET BY APPLICATION

TABLE 015. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 017. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 018. AUTO FUEL MARKET OVERVIEW (2016-2028)

TABLE 019. REFINERIES MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY SOURCE (2016-2028)

TABLE 022. NORTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY APPLICATION (2016-2028)

TABLE 023. N LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY SOURCE (2016-2028)

TABLE 026. EUROPE LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY APPLICATION (2016-2028)

TABLE 027. LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY SOURCE (2016-2028)

TABLE 030. ASIA PACIFIC LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY APPLICATION (2016-2028)

TABLE 031. LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY SOURCE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY APPLICATION (2016-2028)

TABLE 035. LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY SOURCE (2016-2028)

TABLE 038. SOUTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY APPLICATION (2016-2028)

TABLE 039. LIQUEFIED PETROLEUM GAS (LPG) MARKET, BY COUNTRY (2016-2028)

TABLE 040. SAUDI ARAMCO: SNAPSHOT

TABLE 041. SAUDI ARAMCO: BUSINESS PERFORMANCE

TABLE 042. SAUDI ARAMCO: PRODUCT PORTFOLIO

TABLE 043. SAUDI ARAMCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ADNOC: SNAPSHOT

TABLE 044. ADNOC: BUSINESS PERFORMANCE

TABLE 045. ADNOC: PRODUCT PORTFOLIO

TABLE 046. ADNOC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BP(UK): SNAPSHOT

TABLE 047. BP(UK): BUSINESS PERFORMANCE

TABLE 048. BP(UK): PRODUCT PORTFOLIO

TABLE 049. BP(UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KNPC: SNAPSHOT

TABLE 050. KNPC: BUSINESS PERFORMANCE

TABLE 051. KNPC: PRODUCT PORTFOLIO

TABLE 052. KNPC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. GAZPROM: SNAPSHOT

TABLE 053. GAZPROM: BUSINESS PERFORMANCE

TABLE 054. GAZPROM: PRODUCT PORTFOLIO

TABLE 055. GAZPROM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EXXON MOBIL: SNAPSHOT

TABLE 056. EXXON MOBIL: BUSINESS PERFORMANCE

TABLE 057. EXXON MOBIL: PRODUCT PORTFOLIO

TABLE 058. EXXON MOBIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SHELL: SNAPSHOT

TABLE 059. SHELL: BUSINESS PERFORMANCE

TABLE 060. SHELL: PRODUCT PORTFOLIO

TABLE 061. SHELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PHILLIPS66: SNAPSHOT

TABLE 062. PHILLIPS66: BUSINESS PERFORMANCE

TABLE 063. PHILLIPS66: PRODUCT PORTFOLIO

TABLE 064. PHILLIPS66: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. BRITISH PETROLEUM: SNAPSHOT

TABLE 065. BRITISH PETROLEUM: BUSINESS PERFORMANCE

TABLE 066. BRITISH PETROLEUM: PRODUCT PORTFOLIO

TABLE 067. BRITISH PETROLEUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ADGAS: SNAPSHOT

TABLE 068. ADGAS: BUSINESS PERFORMANCE

TABLE 069. ADGAS: PRODUCT PORTFOLIO

TABLE 070. ADGAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CHEVRON: SNAPSHOT

TABLE 071. CHEVRON: BUSINESS PERFORMANCE

TABLE 072. CHEVRON: PRODUCT PORTFOLIO

TABLE 073. CHEVRON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CHINA NATIONAL PETROLEUM: SNAPSHOT

TABLE 074. CHINA NATIONAL PETROLEUM: BUSINESS PERFORMANCE

TABLE 075. CHINA NATIONAL PETROLEUM: PRODUCT PORTFOLIO

TABLE 076. CHINA NATIONAL PETROLEUM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. PETROLEUM NASIONAL: SNAPSHOT

TABLE 077. PETROLEUM NASIONAL: BUSINESS PERFORMANCE

TABLE 078. PETROLEUM NASIONAL: PRODUCT PORTFOLIO

TABLE 079. PETROLEUM NASIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. REPSOL: SNAPSHOT

TABLE 080. REPSOL: BUSINESS PERFORMANCE

TABLE 081. REPSOL: PRODUCT PORTFOLIO

TABLE 082. REPSOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. CHINA GAS HOLDINGS LTD: SNAPSHOT

TABLE 083. CHINA GAS HOLDINGS LTD: BUSINESS PERFORMANCE

TABLE 084. CHINA GAS HOLDINGS LTD: PRODUCT PORTFOLIO

TABLE 085. CHINA GAS HOLDINGS LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. FLAGA GMBH: SNAPSHOT

TABLE 086. FLAGA GMBH: BUSINESS PERFORMANCE

TABLE 087. FLAGA GMBH: PRODUCT PORTFOLIO

TABLE 088. FLAGA GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. KLEENHEAT: SNAPSHOT

TABLE 089. KLEENHEAT: BUSINESS PERFORMANCE

TABLE 090. KLEENHEAT: PRODUCT PORTFOLIO

TABLE 091. KLEENHEAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. BHARAT PETROLEUM CORPORATION LIMITED: SNAPSHOT

TABLE 092. BHARAT PETROLEUM CORPORATION LIMITED: BUSINESS PERFORMANCE

TABLE 093. BHARAT PETROLEUM CORPORATION LIMITED: PRODUCT PORTFOLIO

TABLE 094. BHARAT PETROLEUM CORPORATION LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. JGC HOLDINGS CORPORATION: SNAPSHOT

TABLE 095. JGC HOLDINGS CORPORATION: BUSINESS PERFORMANCE

TABLE 096. JGC HOLDINGS CORPORATION: PRODUCT PORTFOLIO

TABLE 097. JGC HOLDINGS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. RELIANCE INDUSTRIES LIMITED: SNAPSHOT

TABLE 098. RELIANCE INDUSTRIES LIMITED: BUSINESS PERFORMANCE

TABLE 099. RELIANCE INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 100. RELIANCE INDUSTRIES LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. TOTAL: SNAPSHOT

TABLE 101. TOTAL: BUSINESS PERFORMANCE

TABLE 102. TOTAL: PRODUCT PORTFOLIO

TABLE 103. TOTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. ROYAL DUTCH SHELL: SNAPSHOT

TABLE 104. ROYAL DUTCH SHELL: BUSINESS PERFORMANCE

TABLE 105. ROYAL DUTCH SHELL: PRODUCT PORTFOLIO

TABLE 106. ROYAL DUTCH SHELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. PETROLIAM NASIONAL BERHAD (PETRONAS): SNAPSHOT

TABLE 107. PETROLIAM NASIONAL BERHAD (PETRONAS): BUSINESS PERFORMANCE

TABLE 108. PETROLIAM NASIONAL BERHAD (PETRONAS): PRODUCT PORTFOLIO

TABLE 109. PETROLIAM NASIONAL BERHAD (PETRONAS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. PETROCHINA COMPANY LIMITED: SNAPSHOT

TABLE 110. PETROCHINA COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 111. PETROCHINA COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 112. PETROCHINA COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. PETREDEC PTE LIMITED: SNAPSHOT

TABLE 113. PETREDEC PTE LIMITED: BUSINESS PERFORMANCE

TABLE 114. PETREDEC PTE LIMITED: PRODUCT PORTFOLIO

TABLE 115. PETREDEC PTE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. QATARGAS OPERATING COMPANY LIMITED: SNAPSHOT

TABLE 116. QATARGAS OPERATING COMPANY LIMITED: BUSINESS PERFORMANCE

TABLE 117. QATARGAS OPERATING COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 118. QATARGAS OPERATING COMPANY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. PETROFAC LIMITED: SNAPSHOT

TABLE 119. PETROFAC LIMITED: BUSINESS PERFORMANCE

TABLE 120. PETROFAC LIMITED: PRODUCT PORTFOLIO

TABLE 121. PETROFAC LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 121. VITOL: SNAPSHOT

TABLE 122. VITOL: BUSINESS PERFORMANCE

TABLE 123. VITOL: PRODUCT PORTFOLIO

TABLE 124. VITOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 124. CHINA PETROLEUM & CHEMICAL CORPORATION: SNAPSHOT

TABLE 125. CHINA PETROLEUM & CHEMICAL CORPORATION: BUSINESS PERFORMANCE

TABLE 126. CHINA PETROLEUM & CHEMICAL CORPORATION: PRODUCT PORTFOLIO

TABLE 127. CHINA PETROLEUM & CHEMICAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127. BP PLC.: SNAPSHOT

TABLE 128. BP PLC.: BUSINESS PERFORMANCE

TABLE 129. BP PLC.: PRODUCT PORTFOLIO

TABLE 130. BP PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY TYPE

FIGURE 012. NATURAL GAS PROCESSING MARKET OVERVIEW (2016-2028)

FIGURE 013. CRUDE OIL REFINING MARKET OVERVIEW (2016-2028)

FIGURE 014. LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY SOURCE

FIGURE 015. REFINERY MARKET OVERVIEW (2016-2028)

FIGURE 016. ASSOCIATED GAS MARKET OVERVIEW (2016-2028)

FIGURE 017. NON-ASSOCIATED GAS MARKET OVERVIEW (2016-2028)

FIGURE 018. LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY APPLICATION

FIGURE 019. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 022. AUTO FUEL MARKET OVERVIEW (2016-2028)

FIGURE 023. REFINERIES MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA LIQUEFIED PETROLEUM GAS (LPG) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Liquefied Petroleum Gas (LPG) Market research report is 2022-2028.

Saudi Aramco, ADNOC, BP(UK), KNPC, Gazprom, Exxon Mobil, Shell and other major players.

The Liquefied Petroleum Gas (LPG) Market is segmented into Type, Source, Application, and region. By Type, the market is categorized into Natural Gas Processing, Crude Oil Refining. By Source the market is categorized into Refinery, Associated Gas, Non-Associated Gas. By Application the market is categorized Residential, Commercial, Industrial, Auto Fuel, Refineries. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Liquefied petroleum gas (LPG) is also called LP gas. It is Made up from several liquid mixtures of the volatile hydrocarbon’s propene, propane, butene, and butane. It was used as a portable fuel source in 1860 and has since expanded production and consumption both domestically and industrially.

The global market for Liquefied Petroleum Gas (LPG) estimated at USD 261.98 Billion in the year 2021, is projected to reach a revised size of USD 294.79 Billion by 2028, growing at a CAGR of 1.7% over the period 2022-2028.